false000082922400008292242024-07-302024-07-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 30, 2024

Starbucks Corporation

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Washington | 000-20322 | 91-1325671 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

2401 Utah Avenue South, Seattle, Washington 98134

(Address of principal executive offices) (Zip Code)

(206) 447-1575

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | | | | |

| ☐ | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | |

| ☐ | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | |

| ☐ | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | |

| ☐ | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title | Trading Symbol | Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | SBUX | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Selection 13(a) of the Exchange Act. o

Item 2.02Results of Operations and Financial Condition.

On July 30, 2024, Starbucks Corporation issued a press release announcing its financial results for the quarter ended June 30, 2024. A copy of the press release is attached as Exhibit 99.1.

Item 9.01Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 104 | | Cover Page Interactive Data File (formatted as inline XBRL) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | |

| | STARBUCKS CORPORATION |

| | | |

| Dated: | July 30, 2024 | | | |

| | By: | /s/ Rachel Ruggeri |

| | | Rachel Ruggeri |

| | | executive vice president, chief financial officer |

Exhibit 99.1

Starbucks Reports Q3 Fiscal 2024 Results

Q3 Consolidated Net Revenues of $9.1 Billion, Down 1%; Up 1% in Constant Currency; Up 6% Over Q2

Q3 GAAP and Non-GAAP EPS of $0.93; Action Plans Partially Offset Continued Headwinds

Q3 Active U.S. Starbucks® Rewards Membership Totals 33.8 Million, Up 7% Over Prior Year and Up 3% Over Q2

SEATTLE; July 30, 2024 – Starbucks Corporation (Nasdaq: SBUX) today reported financial results for its 13-week fiscal third quarter ended June 30, 2024. GAAP results in fiscal 2024 and fiscal 2023 include items that are excluded from non-GAAP results. Please refer to the reconciliation of GAAP measures to non-GAAP measures at the end of this release for more information.

Q3 Fiscal 2024 Highlights

•Global comparable store sales declined 3%, driven by a 5% decline in comparable transactions, partially offset by a 2% increase in average ticket

◦North America comparable store sales declined 2%, driven by a 6% decline in comparable transactions, partially offset by a 3% increase in average ticket; U.S. comparable store sales declined 2%, driven by a 6% decline in comparable transactions, partially offset by a 4% increase in average ticket

◦International comparable store sales declined 7%, driven by a 4% decline in average ticket and a 3% decline in comparable transactions; China comparable store sales declined 14%, driven by a 7% decline in both average ticket and comparable transactions

•The company opened 526 net new stores in Q3, ending the period with 39,477 stores: 52% company-operated and 48% licensed

◦At the end of Q3, stores in the U.S. and China comprised 61% of the company’s global portfolio, with 16,730 and 7,306 stores in the U.S. and China, respectively

•Consolidated net revenues declined 1% to $9.1 billion, or a 1% increase on a constant currency basis

•GAAP operating margin contracted 60 basis points year-over-year to 16.7%, primarily driven by increased promotional activity, investments in store partner wages and benefits, and deleverage. This contraction was partially offset by pricing and in-store operational efficiencies.

◦Non-GAAP operating margin contracted 70 basis points year-over-year to 16.7% on a constant currency basis

•GAAP earnings per share of $0.93 declined 6% over prior year

◦Non-GAAP earnings per share of $0.93 declined 7% over prior year, or declined 6% on a constant currency basis

•Starbucks Rewards loyalty program 90-day active members in the U.S. totaled 33.8 million, up 7% year-over-year

“Our three-part action plan is beginning to work and driving operational improvements that we expect to improve financial performance,” commented Laxman Narasimhan, chief executive officer. “Our growing culture of focused innovation and relentless execution continues to enhance our capabilities, while helping return the business to sustainable growth,” Narasimhan added.

“Our efficiency efforts, which are tracking ahead of expectations, partially offset investments associated with the cautious consumer environment,” commented Rachel Ruggeri, chief financial officer. “Collectively, our disciplined approach enables us to preserve both balance sheet strength and flexibility, positioning us to successfully navigate through the current macroeconomic environment,” Ruggeri added.

Q3 North America Segment Results | | | | | | | | | | | | | | | | | |

| | | | | |

| Quarter Ended | | Change (%) |

| ($ in millions) | Jun 30, 2024 | | Jul 2, 2023 | |

| | | | | |

Change in Comparable Store Sales (1) | (2)% | | 7% | | |

| Change in Transactions | (6)% | | 1% | | |

| Change in Ticket | 3% | | 6% | | |

| Store Count | 18,198 | | 17,592 | | 3% |

| Revenues | $6,816.7 | | $6,737.8 | | 1% |

| Operating Income | $1,432.7 | | $1,463.9 | | (2)% |

| Operating Margin | 21.0% | | 21.7% | | (70) bps |

|

(1) Includes only Starbucks® company-operated stores open 13 months or longer. Comparable store sales exclude the effects of fluctuations in foreign currency exchange rates and Siren Retail stores. Stores that are temporarily closed or operating at reduced hours remain in comparable store sales while stores identified for permanent closure have been removed. |

Net revenues for the North America segment increased 1% over Q3 FY23 to $6.8 billion in Q3 FY24, primarily driven by net new company-operated store growth of 5% over the past 12 months, as well as growth in our licensed store business. This increase was partially offset by a 2% decline in comparable store sales, driven by a 6% decline in comparable transactions, partially offset by a 3% increase in average ticket.

Operating income decreased to $1.4 billion in Q3 FY24 compared to $1.5 billion in Q3 FY23. Operating margin of 21.0% contracted from 21.7% in the prior year, primarily driven by investments in store partner wages and benefits, increased promotional activity, and deleverage. This contraction was partially offset by pricing and in-store operational efficiencies.

Q3 International Segment Results | | | | | | | | | | | | | | | | | |

| | | | | |

| Quarter Ended | | Change (%) |

| ($ in millions) | Jun 30, 2024 | | Jul 2, 2023 | |

| | | | | |

Change in Comparable Store Sales (1) | (7)% | | 24% | | |

| Change in Transactions | (3)% | | 21% | | |

| Change in Ticket | (4)% | | 2% | | |

| Store Count | 21,279 | | 19,630 | | 8% |

| Revenues | $1,842.1 | | $1,972.9 | | (7)% |

| Operating Income | $287.5 | | $374.5 | | (23)% |

| Operating Margin | 15.6% | | 19.0% | | (340) bps |

|

(1) Includes only Starbucks® company-operated stores open 13 months or longer. Comparable store sales exclude the effects of fluctuations in foreign currency exchange rates and Siren Retail stores. Stores that are temporarily closed or operating at reduced hours remain in comparable store sales while stores identified for permanent closure have been removed. |

Net revenues for the International segment declined 7% over Q3 FY23 to $1.8 billion in Q3 FY24, primarily driven by an approximate 5% unfavorable impact from foreign currency translation and a 7% decline in comparable store sales, driven by a 4% decline in average ticket and 3% decline in comparable transactions. Another factor was lower product and equipment sales to, and royalty revenues from, our licensees. This decline was partially offset by net new company-operated store growth of 11% over the past 12 months.

Operating income decreased to $287.5 million in Q3 FY24 compared to $374.5 million in Q3 FY23. Operating margin of 15.6% contracted from 19.0% in the prior year, primarily driven by promotional activities, investments in store partner wages and benefits, and strategic investments. This contraction was partially offset by in-store operational efficiencies.

Q3 Channel Development Segment Results | | | | | | | | | | | | | | | | | |

| | | | | |

| Quarter Ended | | Change (%) |

| ($ in millions) | Jun 30, 2024 | | Jul 2, 2023 | |

| | | | | |

| Revenues | $438.3 | | $448.8 | | (2)% |

| Operating Income | $235.2 | | $208.0 | | 13% |

| Operating Margin | 53.7% | | 46.3% | | 740 bps |

Net revenues for the Channel Development segment declined 2% over Q3 FY23 to $438.3 million in Q3 FY24, primarily due to a decline in revenue in the Global Coffee Alliance, from SKU optimization and following the sale of Seattle's Best Coffee brand in the prior year. This decline was partially offset by an increase in global ready-to-drink revenue.

Operating income increased to $235.2 million in Q3 FY24 compared to $208.0 million in Q3 FY23. Operating margin of 53.7% expanded from 46.3% in the prior year, primarily due to sales mix shift, lower product costs related to the Global Coffee Alliance, and strength in our North American Coffee Partnership joint venture income.

Fiscal 2024 Financial Targets

The company will discuss fiscal year 2024 financial targets during its Q3 FY24 earnings conference call starting today at 2:00 p.m. Pacific Time. These items can be accessed on the company's Investor Relations website during and after the call. The company uses its website as a tool to disclose important information about the company and comply with its disclosure obligations under Regulation Fair Disclosure.

Company Update

1.In May, the company announced new commitments to further support LGBTQIA2+ partners and communities, including an expanded partnership with the National Center for Transgender Equality, providing transgender, non-binary, and gender non-conforming partners support for name and gender marker changes.

2.In May, Satya Nadella resigned from the company's Board of Directors (the “Board”), stating, "I have the utmost confidence in Laxman and our senior leadership team. Their unwavering commitment and strategic acumen assure me that Starbucks is in capable hands, poised for a future filled with innovation and success." Following his departure, the size of the Board was reduced to ten members.

3.In June, the company announced a partnership with Grubhub, rolling out Starbucks Delivery with Grubhub in select U.S. markets, with the goal of national availability in all 50 states by August 2024. Offering customers the convenience of ordering from Starbucks through three leading delivery platforms, Starbucks Delivery is expected to approach $1 billion in U.S. revenue this fiscal year, doubling in just two years and continuing to be a growing part of our business.

4.In June, the company announced Starbucks Studios. This new initiative will produce original entertainment and amplify stories to advance further our company mission to foster human connection and joy, elevating the brand experience.

5.In June, the company launched loyalty partnerships with Marriott Bonvoy and Hilton Honors, in the U.S. and China, respectively. The partnerships allow Starbucks® Rewards members the ability to link accounts and unlock exclusive benefits for travel and coffee, as well as earn additional benefits, creating more value for our members and support program growth.

6.The Board of Directors declared a cash dividend of $0.57 per share, payable on August 30, 2024, to shareholders of record on August 16, 2024. The company had 57 consecutive quarters of dividend payouts with CAGR of approximately 20% over that time period, demonstrating the company's commitment to consistent value creation for shareholders.

Conference Call

Starbucks will hold a conference call today at 2:00 p.m. Pacific Time, which will be hosted by Laxman Narasimhan, ceo, and Rachel Ruggeri, cfo. The call will be webcast and can be accessed at http://investor.starbucks.com. A replay of the webcast will be available until end of day Friday, September 13, 2024.

About Starbucks

Since 1971, Starbucks Coffee Company has been committed to ethically sourcing and roasting high-quality arabica coffee. Today, with more than 39,000 stores worldwide, the company is the premier roaster and retailer of specialty coffee in the world. Through our unwavering commitment to excellence and our guiding principles, we bring the unique Starbucks Experience to life for every customer through every cup. To share in the experience, please visit us in our stores or online at stories.starbucks.com or www.starbucks.com.

Forward-Looking Statements

Certain statements contained herein and in our investor conference call related to these results are “forward-looking” statements within the meaning of applicable securities laws and regulations. Generally, these statements can be

identified by the use of words such as “aim,” “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “feel,” “forecast,” “intend,” “may,” “outlook,” “plan,” “potential,” “predict,” “project,” “seek,” “should,” “will,” “would,” and similar expressions intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. By their nature, forward-looking statements involve risks, uncertainties, and other factors (many beyond our control) that could cause our actual results to differ materially from our historical experience or from our current expectations or projections. Our forward-looking statements, and the risks and uncertainties related thereto, include, but are not limited to, those described under the “Risk Factors” and “Management's Discussion and Analysis of Financial Condition and Results of Operations” sections of the company’s most recently filed periodic reports on Form 10-K and Form 10-Q and in other filings with the SEC, as well as:

•our ability to preserve, grow, and leverage our brands, including the risk of negative responses by consumers (such as boycotts or negative publicity campaigns) or governmental actors (such as retaliatory legislative treatment) who object to certain actions taken or not taken by the Company, which responses could adversely affect our brand value;

•the acceptance of the company’s products and changes in consumer preferences, consumption, or spending behavior and our ability to anticipate or react to them; shifts in demographic or health and wellness trends; or unfavorable consumer reaction to new products, platforms, reformulations, or other innovations;

•our anticipated operating expenses, including our anticipated total capital expenditures;

•the costs associated with, and the successful execution and effects of, our existing and any future business opportunities, expansions, initiatives, strategies, investments, and plans, including our Triple Shot Reinvention with Two Pumps Plan;

•the impacts of partner investments and changes in the availability and cost of labor including any union organizing efforts and our responses to such efforts;

•the ability of our business partners, suppliers and third-party providers to fulfill their responsibilities and commitments;

•higher costs, lower quality, or unavailability of coffee, dairy, cocoa, energy, water, raw materials, or product ingredients;

•the impact of adverse weather conditions or natural disasters;

•the impact of significant increases in logistics costs;

•a worsening in the terms and conditions upon which we engage with our manufacturers and source suppliers, whether resulting from broader local or global conditions, or dynamics specific to our relationships with such parties;

•unfavorable global or regional economic conditions and related economic slowdowns or recessions, low consumer confidence, high unemployment, weak credit or capital markets, budget deficits, burdensome government debt, austerity measures, higher interest rates, higher taxes, political instability, higher inflation, or deflation;

•inherent risks of operating a global business including geopolitical instability, local labor policies and conditions, including labor strikes and work stoppages, protectionist trade policies, or economic or trade sanctions, and compliance with local trade practices and other regulations;

•failure to attract or retain key executive or partner talent or successfully transition executives;

•the potential negative effects of incidents involving food or beverage-borne illnesses, tampering, adulteration, contamination or mislabeling;

•negative publicity related to our company, products, brands, marketing, executive leadership, partners, board of directors, founder, operations, business performance, expansions, initiatives, strategies, investments, plans, or prospects;

•potential negative effects of a material breach, failure, or corruption of our information technology systems or those of our direct and indirect business partners, suppliers or third-party providers, or failure to comply with data protection laws;

•our environmental, community, and farmer promises and any reaction related thereto, such as the rise in opposition to “ESG” and inclusion and diversity efforts;

•risks associated with acquisitions, dispositions, business partnerships, or investments – such as acquisition integration, termination difficulties or costs, or impairment in recorded value;

•the impact of foreign currency translation, particularly a stronger U.S. dollar;

•the impact of substantial competition from new entrants, consolidations by competitors, and other competitive activities, such as pricing actions (including price reductions, promotions, discounting, couponing, or free goods), marketing, category expansion, product introductions, or entry or expansion in our geographic markets;

•the impact of changes in U.S. tax law and related guidance and regulations that may be implemented, including on tax rates;

•the impact of health epidemics, pandemics, or other public health events on our business and financial results, and the risk of negative economic impacts and related regulatory measures or voluntary actions that may be put in place, including restrictions on business operations or social distancing requirements, and the duration and efficacy of such restrictions;

•failure to comply with anti-corruption laws, trade sanctions and restrictions, or similar laws or regulations; and

•the impact of significant legal disputes and proceedings, or government investigations.

In addition, many of the foregoing risks and uncertainties are, or could be, exacerbated by any worsening of the global business and economic environment. A forward-looking statement is neither a prediction nor a guarantee of future events or circumstances, and those future events or circumstances may not occur. You should not place undue reliance on the forward-looking statements, which speak only as of the date of this report. We are under no obligation to update or alter any forward-looking statements, whether as a result of new information, future events, or otherwise.

Key Metrics

The company's financial results and long-term growth model will continue to be driven by new store openings, comparable store sales growth and operating margin management. We believe these key operating metrics are useful to investors because management uses these metrics to assess the growth of our business and the effectiveness of our marketing and operational strategies.

Contacts:

| | | | | | | | |

| Starbucks Contact, Investor Relations: | | Starbucks Contact, Media: |

| Tiffany Willis | | Emily Albright |

| investorrelations@starbucks.com | | press@starbucks.com |

STARBUCKS CORPORATION

CONSOLIDATED STATEMENTS OF EARNINGS

(unaudited, in millions, except per share data) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended | | Quarter Ended |

| Jun 30,

2024 | | Jul 2,

2023 | | %

Change | | Jun 30,

2024 | | Jul 2,

2023 |

|

| | | | | | | As a % of total net revenues |

| Net revenues: | | | | | | | | | |

| Company-operated stores | $ | 7,516.0 | | | $ | 7,556.7 | | | (0.5) | % | | 82.5 | % | | 82.4 | % |

| Licensed stores | 1,129.0 | | | 1,136.2 | | | (0.6) | | | 12.4 | | | 12.4 | |

| Other | 468.9 | | | 475.4 | | | (1.4) | | | 5.1 | | | 5.2 | |

| Total net revenues | 9,113.9 | | | 9,168.3 | | | (0.6) | | | 100.0 | | | 100.0 | |

| Product and distribution costs | 2,740.9 | | | 2,864.2 | | | (4.3) | | | 30.1 | | | 31.2 | |

| Store operating expenses | 3,829.1 | | | 3,697.6 | | | 3.6 | | | 42.0 | | | 40.3 | |

| Other operating expenses | 143.9 | | | 138.7 | | | 3.7 | | | 1.6 | | | 1.5 | |

| Depreciation and amortization expenses | 380.4 | | | 342.2 | | | 11.2 | | | 4.2 | | | 3.7 | |

| General and administrative expenses | 576.0 | | | 604.3 | | | (4.7) | | | 6.3 | | | 6.6 | |

| Restructuring and impairments | — | | | 7.1 | | | nm | | — | | | 0.1 | |

| | | | | | | | | |

| Total operating expenses | 7,670.3 | | | 7,654.1 | | | 0.2 | | | 84.2 | | | 83.5 | |

| Income from equity investees | 73.9 | | | 69.7 | | | 6.0 | | | 0.8 | | | 0.8 | |

| | | | | | | | | |

| Operating income | 1,517.5 | | | 1,583.9 | | | (4.2) | | | 16.7 | | | 17.3 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Interest income and other, net | 28.1 | | | 21.3 | | | 31.9 | | | 0.3 | | | 0.2 | |

| Interest expense | (141.3) | | | (140.9) | | | 0.3 | | | (1.6) | | | (1.5) | |

| Earnings before income taxes | 1,404.3 | | | 1,464.3 | | | (4.1) | | | 15.4 | | | 16.0 | |

| Income tax expense | 348.6 | | | 322.4 | | | 8.1 | | | 3.8 | | | 3.5 | |

| Net earnings including noncontrolling interests | 1,055.7 | | | 1,141.9 | | | (7.5) | | | 11.6 | | | 12.5 | |

| Net earnings attributable to noncontrolling interests | 0.9 | | | 0.2 | | | 350.0 | | | 0.0 | | | 0.0 | |

| Net earnings attributable to Starbucks | $ | 1,054.8 | | | $ | 1,141.7 | | | (7.6) | | | 11.6 | % | | 12.5 | % |

| Net earnings per common share - diluted | $ | 0.93 | | | $ | 0.99 | | | (6.1) | % | | | | |

| Weighted avg. shares outstanding - diluted | 1,135.8 | | | 1,150.5 | | | | | | | |

| Cash dividends declared per share | $ | 0.57 | | | $ | 0.53 | | | | | | | |

| Supplemental Ratios: | | | | | | | | | |

| Store operating expenses as a % of company-operated store revenues | | | | 50.9 | % | | 48.9 | % |

| | | | | | |

| Effective tax rate including noncontrolling interests | | | | 24.8 | % | | 22.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Quarters Ended | | Three Quarters Ended |

| Jun 30,

2024 | | Jul 2,

2023 | | %

Change | | Jun 30,

2024 | | Jul 2,

2023 |

|

| | | | | | | As a % of total net revenues |

| Net revenues: | | | | | | | | | |

| Company-operated stores | $ | 22,323.8 | | | $ | 21,782.4 | | | 2.5 | % | | 82.4 | % | | 81.9 | % |

| Licensed stores | 3,375.7 | | | 3,325.2 | | | 1.5 | | | 12.5 | | | 12.5 | |

| Other | 1,402.8 | | | 1,494.4 | | | (6.1) | | | 5.2 | | | 5.6 | |

| Total net revenues | 27,102.3 | | | 26,602.0 | | | 1.9 | | | 100.0 | | | 100.0 | |

| Product and distribution costs | 8,370.2 | | | 8,476.1 | | | (1.2) | | | 30.9 | | | 31.9 | |

| Store operating expenses | 11,404.7 | | | 10,998.9 | | | 3.7 | | | 42.1 | | | 41.3 | |

| Other operating expenses | 427.1 | | | 394.1 | | | 8.4 | | | 1.6 | | | 1.5 | |

| Depreciation and amortization expenses | 1,117.6 | | | 1,011.2 | | | 10.5 | | | 4.1 | | | 3.8 | |

| General and administrative expenses | 1,878.6 | | | 1,805.6 | | | 4.0 | | | 6.9 | | | 6.8 | |

| Restructuring and impairments | — | | | 21.8 | | | nm | | — | | | 0.1 | |

| | | | | | | | | |

| Total operating expenses | 23,198.2 | | | 22,707.7 | | | 2.2 | | | 85.6 | | | 85.4 | |

| Income from equity investees | 197.8 | | | 179.0 | | | 10.5 | | | 0.7 | | | 0.7 | |

| Gain from sale of assets | — | | | 91.3 | | | nm | | — | | | 0.3 | |

| Operating income | 4,101.9 | | | 4,164.6 | | | (1.5) | | | 15.1 | | | 15.7 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Interest income and other, net | 96.0 | | | 51.1 | | | 87.9 | | | 0.4 | | | 0.2 | |

| Interest expense | (422.0) | | | (406.9) | | | 3.7 | | | (1.6) | | | (1.5) | |

| Earnings before income taxes | 3,775.9 | | | 3,808.8 | | | (0.9) | | | 13.9 | | | 14.3 | |

| Income tax expense | 923.2 | | | 903.4 | | | 2.2 | | | 3.4 | | | 3.4 | |

| Net earnings including noncontrolling interests | 2,852.7 | | | 2,905.4 | | | (1.8) | | | 10.5 | | | 10.9 | |

| Net earnings attributable to noncontrolling interests | 1.0 | | | 0.2 | | | 400.0 | | | 0.0 | | | 0.0 | |

| Net earnings attributable to Starbucks | $ | 2,851.7 | | | $ | 2,905.2 | | | (1.8) | | | 10.5 | % | | 10.9 | % |

| Net earnings per common share - diluted | $ | 2.51 | | | $ | 2.52 | | | (0.4) | % | | | | |

| Weighted avg. shares outstanding - diluted | 1,137.3 | | | 1,152.0 | | | | | | | |

| Cash dividends declared per share | $ | 1.71 | | | $ | 1.59 | | | | | | | |

| Supplemental Ratios: | | | | | | | | | |

| Store operating expenses as a % of company-operated store revenues | | | | 51.1 | % | | 50.5 | % |

| | | | | | |

| Effective tax rate including noncontrolling interests | | | | 24.4 | % | | 23.7 | % |

Segment Results (in millions)

North America | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Jun 30,

2024 | | Jul 2,

2023 | | % Change | | Jun 30,

2024 | | Jul 2,

2023 |

|

| Quarter Ended | | | | | | | As a % of North America

total net revenues |

| Net revenues: | | | | | | | | | |

| Company-operated stores | $ | 6,135.0 | | | $ | 6,080.6 | | | 0.9 | % | | 90.0 | % | | 90.2 | % |

| Licensed stores | 681.3 | | | 655.8 | | | 3.9 | | | 10.0 | | | 9.7 | |

| Other | 0.4 | | | 1.4 | | | (71.4) | | | 0.0 | | | 0.0 | |

| Total net revenues | 6,816.7 | | | 6,737.8 | | | 1.2 | | | 100.0 | | | 100.0 | |

| Product and distribution costs | 1,831.9 | | | 1,885.4 | | | (2.8) | | | 26.9 | | | 28.0 | |

| Store operating expenses | 3,131.1 | | | 2,990.1 | | | 4.7 | | | 45.9 | | | 44.4 | |

| Other operating expenses | 69.5 | | | 67.8 | | | 2.5 | | | 1.0 | | | 1.0 | |

| Depreciation and amortization expenses | 266.6 | | | 230.4 | | | 15.7 | | | 3.9 | | | 3.4 | |

| General and administrative expenses | 84.9 | | | 93.1 | | | (8.8) | | | 1.2 | | | 1.4 | |

| Restructuring and impairments | — | | | 7.1 | | | nm | | — | | | 0.1 | |

| Total operating expenses | 5,384.0 | | | 5,273.9 | | | 2.1 | | | 79.0 | | | 78.3 | |

| | | | | | | | | |

| Operating income | $ | 1,432.7 | | | $ | 1,463.9 | | | (2.1) | % | | 21.0 | % | | 21.7 | % |

| Supplemental Ratio: | | | | | | | | | |

| Store operating expenses as a % of company-operated store revenues | | | | 51.0 | % | | 49.2 | % |

| | | | | | |

| | | | | | | | | |

| Three Quarters Ended | | | | | | | | | |

| | | | | | | | | |

|

| | | | | | |

| Net revenues: | | | | | | | | | |

| Company-operated stores | $ | 18,240.7 | | | $ | 17,693.9 | | | 3.1 | % | | 89.8 | % | | 90.0 | % |

| Licensed stores | 2,074.1 | | | 1,973.2 | | | 5.1 | | | 10.2 | | | 10.0 | |

| Other | 2.8 | | | 2.6 | | | 7.7 | | | 0.0 | | | 0.0 | |

| Total net revenues | 20,317.6 | | | 19,669.7 | | | 3.3 | | | 100.0 | | | 100.0 | |

| Product and distribution costs | 5,623.5 | | | 5,624.7 | | | — | | | 27.7 | | | 28.6 | |

| Store operating expenses | 9,316.2 | | | 8,973.2 | | | 3.8 | | | 45.9 | | | 45.6 | |

| Other operating expenses | 214.0 | | | 196.7 | | | 8.8 | | | 1.1 | | | 1.0 | |

| Depreciation and amortization expenses | 774.2 | | | 673.5 | | | 15.0 | | | 3.8 | | | 3.4 | |

| General and administrative expenses | 287.9 | | | 286.6 | | | 0.5 | | | 1.4 | | | 1.5 | |

| Restructuring and impairments | — | | | 20.7 | | | nm | | — | | | 0.1 | |

| Total operating expenses | 16,215.8 | | | 15,775.4 | | | 2.8 | | | 79.8 | | | 80.2 | |

| | | | | | | | | |

| Operating income | $ | 4,101.8 | | | $ | 3,894.3 | | | 5.3 | % | | 20.2 | % | | 19.8 | % |

| Supplemental Ratio: | | | | | | | | | |

| Store operating expenses as a % of company-operated store revenues | | | | 51.1 | % | | 50.7 | % |

| | | | | | |

International | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Jun 30,

2024 | | Jul 2,

2023 | | % Change | | Jun 30,

2024 | | Jul 2,

2023 |

|

| Quarter Ended | | | | | | | As a % of International total net revenues |

| Net revenues: | | | | | | | | | |

| Company-operated stores | $ | 1,381.0 | | | $ | 1,476.1 | | | (6.4) | % | | 75.0 | % | | 74.8 | % |

| Licensed stores | 447.7 | | | 480.4 | | | (6.8) | | | 24.3 | | | 24.3 | |

| Other | 13.4 | | | 16.4 | | | (18.3) | | | 0.7 | | | 0.8 | |

| Total net revenues | 1,842.1 | | | 1,972.9 | | | (6.6) | | | 100.0 | | | 100.0 | |

| Product and distribution costs | 637.1 | | | 677.3 | | | (5.9) | | | 34.6 | | | 34.3 | |

| Store operating expenses | 698.0 | | | 707.5 | | | (1.3) | | | 37.9 | | | 35.9 | |

| Other operating expenses | 58.8 | | | 54.3 | | | 8.3 | | | 3.2 | | | 2.8 | |

| Depreciation and amortization expenses | 82.7 | | | 83.1 | | | (0.5) | | | 4.5 | | | 4.2 | |

| General and administrative expenses | 80.5 | | | 77.0 | | | 4.5 | | | 4.4 | | | 3.9 | |

| | | | | | | | | |

| Total operating expenses | 1,557.1 | | | 1,599.2 | | | (2.6) | | | 84.5 | | | 81.1 | |

| Income from equity investees | 2.5 | | | 0.8 | | | 212.5 | | | 0.1 | | | 0.0 | |

| Operating income | $ | 287.5 | | | $ | 374.5 | | | (23.2) | % | | 15.6 | % | | 19.0 | % |

| Supplemental Ratio: | | | | | | | | | |

| Store operating expenses as a % of company-operated store revenues | | | | 50.5 | % | | 47.9 | % |

| | | | | | | | | |

| Three Quarters Ended | | | | | | | | | |

| | | | | | |

| | | | | | | | | |

|

| | | | | | |

| Net revenues: | | | | | | | | | |

| Company-operated stores | $ | 4,083.1 | | | $ | 4,088.5 | | | (0.1) | % | | 75.0 | % | | 74.2 | % |

| Licensed stores | 1,301.6 | | | 1,352.0 | | | (3.7) | | | 23.9 | | | 24.5 | |

| Other | 60.9 | | | 67.3 | | | (9.5) | | | 1.1 | | | 1.2 | |

| Total net revenues | 5,445.6 | | | 5,507.8 | | | (1.1) | | | 100.0 | | | 100.0 | |

| Product and distribution costs | 1,923.5 | | | 1,903.8 | | | 1.0 | | | 35.3 | | | 34.6 | |

| Store operating expenses | 2,088.5 | | | 2,025.7 | | | 3.1 | | | 38.4 | | | 36.8 | |

| Other operating expenses | 168.8 | | | 155.0 | | | 8.9 | | | 3.1 | | | 2.8 | |

| Depreciation and amortization expenses | 251.0 | | | 250.8 | | | 0.1 | | | 4.6 | | | 4.6 | |

| General and administrative expenses | 253.9 | | | 244.9 | | | 3.7 | | | 4.7 | | | 4.4 | |

| | | | | | | | | |

| Total operating expenses | 4,685.7 | | | 4,580.2 | | | 2.3 | | | 86.0 | | | 83.2 | |

| Income from equity investees | 2.9 | | | 2.0 | | | 45.0 | | | 0.1 | | | 0.0 | |

| Operating income | $ | 762.8 | | | $ | 929.6 | | | (17.9) | % | | 14.0 | % | | 16.9 | % |

| Supplemental Ratio: | | | | | | | | | |

| Store operating expenses as a % of company-operated store revenues | | | | 51.1 | % | | 49.5 | % |

| | | | | | |

Channel Development | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Jun 30,

2024 | | Jul 2,

2023 | | % Change | | Jun 30,

2024 | | Jul 2,

2023 |

|

| Quarter Ended | | | | | | | As a % of

Channel Development

total net revenues |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Net revenues | $ | 438.3 | | | $ | 448.8 | | | (2.3) | % | | | | |

| Product and distribution costs | 257.7 | | | 293.0 | | | (12.0) | | | 58.8 | % | | 65.3 | % |

| Other operating expenses | 15.2 | | | 14.8 | | | 2.7 | | | 3.5 | | | 3.3 | |

| Depreciation and amortization expenses | — | | | 0.0 | | | nm | | — | | | 0.0 | |

| General and administrative expenses | 1.6 | | | 1.9 | | | (15.8) | | | 0.4 | | | 0.4 | |

| Total operating expenses | 274.5 | | | 309.7 | | | (11.4) | | | 62.6 | | | 69.0 | |

| Income from equity investees | 71.4 | | | 68.9 | | | 3.6 | | | 16.3 | | | 15.4 | |

| | | | | | | | | |

| Operating income | $ | 235.2 | | | $ | 208.0 | | | 13.1 | % | | 53.7 | % | | 46.3 | % |

| | | | | | | | | |

| Three Quarters Ended | | | | | | | | | |

| | | | | | | | | |

|

| | | | | | |

| Net revenues | $ | 1,304.5 | | | $ | 1,407.7 | | | (7.3) | % | | | | |

| Product and distribution costs | 789.3 | | | 932.7 | | | (15.4) | | | 60.5 | % | | 66.3 | % |

| Other operating expenses | 43.2 | | | 40.6 | | | 6.4 | | | 3.3 | | | 2.9 | |

| Depreciation and amortization expenses | — | | | 0.1 | | | nm | | — | | | 0.0 | |

| General and administrative expenses | 5.7 | | | 6.2 | | | (8.1) | | | 0.4 | | | 0.4 | |

| Total operating expenses | 838.2 | | | 979.6 | | | (14.4) | | | 64.3 | | | 69.6 | |

| Income from equity investees | 194.9 | | | 177.0 | | | 10.1 | | | 14.9 | | | 12.6 | |

| Gain from sale of assets | — | | | 91.3 | | | nm | | — | | | 6.5 | |

| Operating income | $ | 661.2 | | | $ | 696.4 | | | (5.1) | % | | 50.7 | % | | 49.5 | % |

Corporate and Other

| | | | | | | | | | | | | | | | | |

| Jun 30,

2024 | | Jul 2,

2023 | | %

Change |

| |

| Quarter Ended | | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Net revenues | $ | 16.8 | | | $ | 8.8 | | | 90.9 | % |

| Product and distribution costs | 14.2 | | | 8.5 | | | 67.1 | |

| | | | | |

| Other operating expenses | 0.4 | | | 1.8 | | | (77.8) | |

| Depreciation and amortization expenses | 31.1 | | | 28.7 | | | 8.4 | |

| General and administrative expenses | 409.0 | | | 432.3 | | | (5.4) | |

| | | | | |

| Total operating expenses | 454.7 | | | 471.3 | | | (3.5) | |

| Operating loss | $ | (437.9) | | | $ | (462.5) | | | (5.3) | % |

| | | | | |

| Three Quarters Ended | | | | | |

| | | | | |

| |

| | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Net revenues | $ | 34.6 | | | $ | 16.8 | | | 106.0 | % |

| Product and distribution costs | 33.9 | | | 14.9 | | | 127.5 | |

| | | | | |

| Other operating expenses | 1.1 | | | 1.8 | | | (38.9) | |

| Depreciation and amortization expenses | 92.4 | | | 86.8 | | | 6.5 | |

| General and administrative expenses | 1,331.1 | | | 1,267.9 | | | 5.0 | |

| Restructuring and impairments | — | | | 1.1 | | | nm |

| Total operating expenses | 1,458.5 | | | 1,372.5 | | | 6.3 | |

| | | | | |

| Operating loss | $ | (1,423.9) | | | $ | (1,355.7) | | | 5.0 | % |

STARBUCKS CORPORATION

CONSOLIDATED BALANCE SHEETS

(unaudited, in millions, except per share data)

| | | | | | | | | | | |

| Jun 30,

2024 | | Oct 1,

2023 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 3,179.1 | | | $ | 3,551.5 | |

| Short-term investments | 212.3 | | | 401.5 | |

| Accounts receivable, net | 1,146.0 | | | 1,184.1 | |

| Inventories | 1,854.7 | | | 1,806.4 | |

| Prepaid expenses and other current assets | 415.8 | | | 359.9 | |

| Total current assets | 6,807.9 | | | 7,303.4 | |

| Long-term investments | 274.8 | | | 247.4 | |

| Equity investments | 456.1 | | | 439.9 | |

| Property, plant and equipment, net | 8,080.3 | | | 7,387.1 | |

| Operating lease, right-of-use asset | 8,808.1 | | | 8,412.6 | |

| Deferred income taxes, net | 1,701.6 | | | 1,769.8 | |

| Other long-term assets | 693.7 | | | 546.5 | |

| Other intangible assets | 105.7 | | | 120.5 | |

| Goodwill | 3,183.6 | | | 3,218.3 | |

| TOTAL ASSETS | $ | 30,111.8 | | | $ | 29,445.5 | |

| LIABILITIES AND SHAREHOLDERS' EQUITY/(DEFICIT) | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 1,586.3 | | | $ | 1,544.3 | |

| Accrued liabilities | 2,081.5 | | | 2,145.1 | |

| Accrued payroll and benefits | 708.4 | | | 828.3 | |

| Current portion of operating lease liability | 1,419.2 | | | 1,275.3 | |

| Stored value card liability and current portion of deferred revenue | 1,831.0 | | | 1,700.2 | |

| Short-term debt | 23.1 | | | 33.5 | |

| Current portion of long-term debt | — | | | 1,818.6 | |

| Total current liabilities | 7,649.5 | | | 9,345.3 | |

| Long-term debt | 15,551.4 | | | 13,547.6 | |

| Operating lease liability | 8,298.1 | | | 7,924.8 | |

| Deferred revenue | 6,011.0 | | | 6,101.8 | |

| Other long-term liabilities | 539.2 | | | 513.8 | |

| Total liabilities | 38,049.2 | | | 37,433.3 | |

| Shareholders’ deficit: | | | |

Common stock ($0.001 par value) — authorized, 2,400.0 shares; issued and outstanding, 1,133.1 and 1,142.6 shares, respectively | 1.1 | | | 1.1 | |

| Additional paid-in capital | 223.0 | | | 38.1 | |

| Retained deficit | (7,561.5) | | | (7,255.8) | |

| Accumulated other comprehensive income/(loss) | (608.0) | | | (778.2) | |

| Total shareholders’ deficit | (7,945.4) | | | (7,994.8) | |

| Noncontrolling interests | 8.0 | | | 7.0 | |

| Total deficit | (7,937.4) | | | (7,987.8) | |

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY/(DEFICIT) | $ | 30,111.8 | | | $ | 29,445.5 | |

| | | |

STARBUCKS CORPORATION

CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited, in millions)

| | | | | | | | | | | | | | | |

| | | Three Quarters Ended |

| | | Jun 30,

2024 | | Jul 2,

2023 | | |

| OPERATING ACTIVITIES: | | | | | | | |

| Net earnings including noncontrolling interests | | | $ | 2,852.7 | | | $ | 2,905.4 | | | |

| Adjustments to reconcile net earnings to net cash provided by operating activities: | | | | | | | |

| Depreciation and amortization | | | 1,191.0 | | | 1,073.8 | | | |

| Deferred income taxes, net | | | 16.6 | | | (30.2) | | | |

| Income earned from equity method investees | | | (201.5) | | | (182.7) | | | |

| Distributions received from equity method investees | | | 220.5 | | | 146.6 | | | |

| Gain on sale of assets | | | — | | | (91.3) | | | |

| | | | | | | |

| Stock-based compensation | | | 236.6 | | | 228.5 | | | |

| Non-cash lease costs | | | 1,082.6 | | | 998.4 | | | |

| Loss on retirement and impairment of assets | | | 62.9 | | | 79.1 | | | |

| Other | | | 20.2 | | | 22.8 | | | |

| Cash provided by/(used in) changes in operating assets and liabilities: | | | | | | | |

| Accounts receivable | | | 44.7 | | | 44.3 | | | |

| Inventories | | | (53.4) | | | 194.5 | | | |

| Income taxes payable | | | (50.7) | | | 48.0 | | | |

| Accounts payable | | | 61.7 | | | 47.3 | | | |

| Deferred revenue | | | 51.6 | | | (8.2) | | | |

| Operating lease liability | | | (1,049.7) | | | (1,056.1) | | | |

| Other operating assets and liabilities | | | 74.2 | | | (356.5) | | | |

| Net cash provided by operating activities | | | 4,560.0 | | | 4,063.7 | | | |

| INVESTING ACTIVITIES: | | | | | | | |

| Purchases of investments | | | (545.6) | | | (357.1) | | | |

| Sales of investments | | | 0.5 | | | 2.0 | | | |

| Maturities and calls of investments | | | 731.8 | | | 515.0 | | | |

| Additions to property, plant and equipment | | | (1,979.3) | | | (1,634.1) | | | |

| Proceeds from sale of assets | | | — | | | 110.0 | | | |

| | | | | | | |

| Other | | | (56.9) | | | (42.0) | | | |

| Net cash used in investing activities | | | (1,849.5) | | | (1,406.2) | | | |

| FINANCING ACTIVITIES: | | | | | | | |

| Net (payments)/proceeds from issuance of commercial paper | | | — | | | (175.0) | | | |

| Net proceeds from issuance of short-term debt | | | 118.3 | | | 83.7 | | | |

| Repayments of short-term debt | | | (127.0) | | | (46.7) | | | |

| Net proceeds from issuance of long-term debt | | | 1,995.3 | | | 1,497.8 | | | |

| Repayments of long-term debt | | | (1,825.1) | | | (1,000.0) | | | |

| Proceeds from issuance of common stock | | | 79.2 | | | 149.4 | | | |

| Cash dividends paid | | | (1,939.0) | | | (1,824.8) | | | |

| Repurchase of common stock | | | (1,266.7) | | | (699.3) | | | |

| Minimum tax withholdings on share-based awards | | | (98.1) | | | (87.0) | | | |

| Other | | | (10.6) | | | (11.0) | | | |

| Net cash used in financing activities | | | (3,073.7) | | | (2,112.9) | | | |

| Effect of exchange rate changes on cash and cash equivalents | | | (9.2) | | | (6.0) | | | |

| Net increase/(decrease) in cash and cash equivalents | | | (372.4) | | | 538.6 | | | |

| CASH AND CASH EQUIVALENTS: | | | | | | | |

| Beginning of period | | | 3,551.5 | | | 2,818.4 | | | |

| End of period | | | $ | 3,179.1 | | | $ | 3,357.0 | | | |

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: | | | | | | | |

| Cash paid during the period for: | | | | | | | |

| Interest, net of capitalized interest | | | $ | 373.9 | | | $ | 369.6 | | | |

| Income taxes | | | $ | 1,079.9 | | | $ | 939.8 | | | |

Supplemental Information

The following supplemental information is provided for historical and comparative purposes.

U.S. Supplemental Data | | | | | | | | | | | | | | | | | |

| Quarter Ended | | Change (%) |

| ($ in millions) | Jun 30, 2024 | | Jul 2, 2023 | |

| | | | | |

| Revenues | $6,366.8 | | $6,272.3 | | 2% |

Change in Comparable Store Sales (1) | (2)% | | 7% | | |

| Change in Transactions | (6)% | | 1% | | |

| Change in Ticket | 4% | | 6% | | |

| Store Count | 16,730 | | 16,144 | | 4% |

(1)Includes only Starbucks® company-operated stores open 13 months or longer. Comparable store sales exclude Siren Retail stores. Stores that are temporarily closed or operating at reduced hours remain in comparable store sales while stores identified for permanent closure have been removed. |

|

China Supplemental Data | | | | | | | | | | | | | | | | | |

| Quarter Ended | | Change (%) |

| ($ in millions) | Jun 30, 2024 | | Jul 2, 2023 | |

| | | | | |

| Revenues | $733.8 | | $821.9 | | (11)% |

Change in Comparable Store Sales (1) | (14)% | | 46% | | |

| Change in Transactions | (7)% | | 48% | | |

| Change in Ticket | (7)% | | (1)% | | |

| Store Count | 7,306 | | 6,480 | | 13% |

(1)Includes only Starbucks® company-operated stores open 13 months or longer. Comparable store sales exclude the effects of fluctuations in foreign currency exchange rates and Siren Retail stores. Stores that are temporarily closed or operating at reduced hours remain in comparable store sales while stores identified for permanent closure have been removed. |

Store Data

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Net stores opened/(closed) and transferred during the period | | | | |

| Quarter Ended | | Three Quarters Ended | | Stores open as of |

| Jun 30,

2024 | | Jul 2,

2023 | | Jun 30,

2024 | | Jul 2,

2023 | | Jun 30,

2024 | | Jul 2,

2023 |

| North America: | | | | | | | | | | | |

| Company-operated stores | 113 | | | 105 | | | 312 | | | 236 | | | 10,940 | | | 10,452 | |

| Licensed stores | 20 | | | 5 | | | 76 | | | 61 | | | 7,258 | | | 7,140 | |

| Total North America | 133 | | | 110 | | | 388 | | | 297 | | | 18,198 | | | 17,592 | |

| International: | | | | | | | | | | | |

| Company-operated stores | 244 | | | 272 | | | 562 | | | 543 | | | 9,526 | | | 8,580 | |

| Licensed stores | 149 | | | 206 | | | 489 | | | 671 | | | 11,753 | | | 11,050 | |

| Total International | 393 | | | 478 | | | 1,051 | | | 1,214 | | | 21,279 | | | 19,630 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Total Company | 526 | | | 588 | | | 1,439 | | | 1,511 | | | 39,477 | | | 37,222 | |

|

Non-GAAP Disclosure

In addition to the GAAP results provided in this release, the company provides certain non-GAAP financial measures that are not in accordance with, or alternatives for, generally accepted accounting principles in the United States (GAAP). When provided to investors, our non-GAAP financial measures of non-GAAP general and administrative expenses (G&A), non-GAAP operating income, non-GAAP operating income growth (loss), non-GAAP operating margin, non-GAAP effective tax rate and non-GAAP earnings per share exclude the below-listed items and their related tax impacts, as management does not believe they contribute to a meaningful evaluation of the company’s future operating performance or comparisons to the company's past operating performance. The GAAP measures most directly comparable to non-GAAP G&A, non-GAAP operating income, non-GAAP operating income growth (loss), non-GAAP operating margin, non-GAAP effective tax rate and non-GAAP earnings per share are G&A, operating income, operating income growth (loss), operating margin, effective tax rate and diluted net earnings per share, respectively.

| | | | | |

| Non-GAAP Exclusion | Rationale |

| |

| |

| Restructuring and impairment costs | Management excludes restructuring and impairment costs for reasons discussed above. These expenses are anticipated to be completed within a finite period of time. |

| |

| |

| |

| |

| |

| |

| |

| |

The Company also presents constant currency information to provide a framework for assessing how our underlying businesses performed excluding the effect of foreign currency rate fluctuations. To present the constant currency information, current period results for entities reporting in currencies other than United States dollars are converted into United States dollars using the average monthly exchange rates from the comparative period rather than the actual exchange rates in effect during the respective periods, excluding related hedging activities. We believe the presentation of results on a constant currency basis in addition to GAAP results helps users better understand our performance, because it excludes the effects of foreign currency volatility that are not indicative of our underlying operating results.

Non-GAAP G&A, non-GAAP operating income, non-GAAP operating income growth (loss), non-GAAP operating margin, non-GAAP effective tax rate, non-GAAP earnings per share and constant currency may have limitations as analytical tools. These measures should not be considered in isolation or as a substitute for analysis of the company’s results as reported under GAAP. Other companies may calculate these non-GAAP financial measures differently than the company does, limiting the usefulness of those measures for comparative purposes.

STARBUCKS CORPORATION

NET REVENUE CONSTANT CURRENCY RECONCILIATION

(unaudited, in millions)

| | | | | |

| Quarter Ended |

| Consolidated |

Revenue for the quarter ended Jul 2, 2023 as reported (GAAP) | $ | 9,168.3 | |

Revenue for the quarter ended Jun 30, 2024 as reported (GAAP) | $ | 9,113.9 | |

| Change (%) | (0.6) | % |

| Constant Currency Impact (%) | 1.2 | % |

| Change in Constant Currency (%) | 0.6 | % |

| |

| |

|

| |

| |

| |

| |

| |

STARBUCKS CORPORATION

RECONCILIATION OF SELECTED GAAP MEASURES TO NON-GAAP MEASURES

(unaudited, in millions, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended | | | | |

| Consolidated | Jun 30,

2024 | | Jul 2,

2023 | | Change | Constant Currency Impact | Change in Constant Currency |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Operating income, as reported (GAAP) | $ | 1,517.5 | | | $ | 1,583.9 | | | (4.2)% | | |

Restructuring and impairment costs (1) | — | | | 7.1 | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Non-GAAP operating income | $ | 1,517.5 | | | $ | 1,591.0 | | | (4.6)% | 1.5% | (3.1)% |

| | | | | | | |

| Operating margin, as reported (GAAP) | 16.7 | % | | 17.3 | % | | (60) bps | | |

Restructuring and impairment costs (1) | — | | | 0.1 | | | | | |

| | | | | | | |

| | | | | | | |

| Non-GAAP operating margin | 16.7 | % | | 17.4 | % | | (70) bps | — bps | (70) bps |

| | | | | | | |

| Diluted net earnings per share, as reported (GAAP) | $ | 0.93 | | | $ | 0.99 | | | (6.1)% | | |

Restructuring and impairment costs (1) | — | | | 0.01 | | | | | |

| | | | | | | |

| | | | | | | |

Income tax effect on Non-GAAP adjustments (2) | — | | | 0.00 | | | | | |

| Non-GAAP EPS | $ | 0.93 | | | $ | 1.00 | | | (7.0)% | 1.0% | (6.0)% |

| | | | | | | |

| | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

(1)Represents costs associated with our restructuring efforts.

(2)Adjustments were determined based on the nature of the underlying items and their relevant jurisdictional tax rates.

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

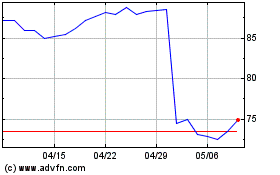

Starbucks (NASDAQ:SBUX)

過去 株価チャート

から 7 2024 まで 7 2024

Starbucks (NASDAQ:SBUX)

過去 株価チャート

から 7 2023 まで 7 2024