UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of July 2024

Commission File Number: 001-41085

SNOW LAKE RESOURCES LTD.

(Translation of registrant's name into English)

242 Hargrave Street, #1700

Winnipeg, Manitoba R3C 0V1 Canada

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

☒ Form 20-F ☐ Form 40-F

Indicate by check mark if the Registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the Registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

SNOW LAKE RESOURCES LTD. |

| |

(Registrant) |

| |

|

|

| Date: July 24, 2024 |

By |

/s/ Kyle Nazareth

|

| |

|

|

| |

|

Kyle Nazareth |

| |

|

Chief Financial Officer |

EXHIBIT INDEX

Snow Lake Provides an Update

on the Black Lake Uranium Project

Winnipeg, Manitoba, Canada, July 24, 2024 - Snow Lake Resources Ltd., d/b/a Snow Lake Energy (NASDAQ: LITM) ("Snow Lake" or the "Company") is pleased to provide an update on its Black Lake Uranium Project, located in the Athabasca Basin, Saskatchewan, Canada.

CEO Remarks

"We are pleased to have completed our acquisition of the option to acquire a 100% interest in the Black Lake Uranium Project" commented Frank Wheatley, CEO of Snow Lake. He continued: "With permits expected shortly, we can now begin to schedule in earnest our exploration program, and expect to initiate the program with an airborne survey of the entire project area. In addition, we can now give the green light to our exploration crews to begin preparation to mobilize to the field for initial prospecting and ground geophysics, focusing on areas of known uranium mineralization."

Black Lake Uranium Project

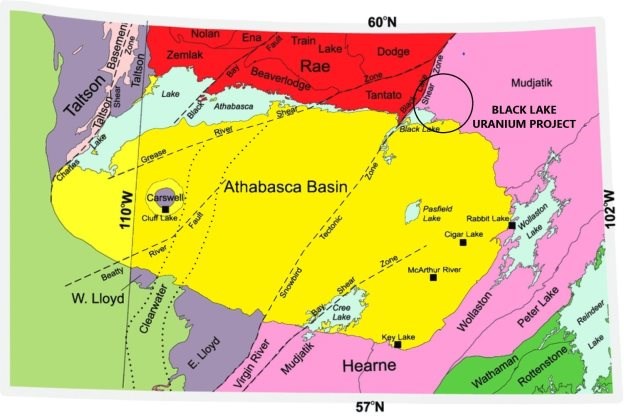

The Black Lake Uranium Project is located in the northeastern Athabasca Basin, Saskatchewan. Uranium mineralization was discovered in 1950 and exploration was conducted intermittently by a number of companies during the 1950's and 1970's.

The Black Lake Uranium Project (the "Project") is considered to be an exploration stage project with historical, non-modern mining code compliant uranium resources, that would also benefit from modern exploration techniques and technology for uranium exploration.

2024 Exploration Program

Snow Lake has designed a multi-phase exploration program for 2024 for the Project. Phase 1 of the program consists of obtaining, compiling, digitizing and reviewing all historical exploration data on the Project, which includes:

- all historical exploration data, plans, maps, geological reports, survey reports and assessment reports from prior companies' exploration programs in the 1950's and 1970's;

- all previous geologic, radiometric, and scintillometer surveys;

- assay results from prior diamond drilling programs on the Higginson Lake, Charlebois Lake and Spreckly Lake project areas.

Obtaining and compiling all historical data has greatly facilitated designing a detailed exploration program using the latest geophysical technology to both verify known uranium mineralization on the Project, as well as to identify new targets for further exploration.

Phase 1 is now complete and Phase 2, consisting of an airborne survey over the entire Project area, is currently being scheduled. Survey results will assist in identifying targets for field work in Phase 3.

Phase 3 will consist of initial prospecting and mapping, and a suite of ground geophysics, to refine the results of the airborne survey and assist in locating high-value drill targets. This phase of the program will focus on areas of know mineralization on the Project.

Phase 4 will consist of a program of diamond drilling, which is intended to be a program of up to 2,000 meters of diamond drilling, spread over approximately 10 holes of approximately 200 meters each, dependent upon appropriate drill target identification from Phase 3 of the program. Based upon successful drilling, the objective of the 2024 work program would be to produce an initial SK-1300 compliant mineral resource estimate.

Geological Setting- Black Lake Uranium Project

In the Black Lake Uranium Project, uranium mineralization occurs in the local geology consisting of a series of pegmatitic and migmatitic rocks, conformably intermixed with metasedimentary units overlying a granitic gneiss basement. These pegmatitic and migmatitic rocks are found to be locally mineralized with uranium-bearing minerals.

The bedrock in the Black Lake area is composed of an ancient Precambrian sedimentary assemblage now folded and fractured and highly metamorphosed by the later granitic intrusive masses. The sedimentary assemblage is thoroughly recrystallized, generally pronounced banded and most are strongly gneissoid or schistose. Pegmatites and related migmatites are closely related and mineralogically similar to the granite but formed later. They form as dykes and sills and are spatially related to the granite - granite gneiss contact with the metasediments. The area is structurally complex.

Black Lake, and the surrounding area, is known for its uranium and to a lesser extent molybdenum mineralization in pegmatites and migmatite which occurs as lens like, and possibly en-echelon type bodies within dykes and sills. Radioactivity can be traced continuously along strike over several kilometers. Radioactive minerals of most of the mineralized pegmatites and migmatites are primary accessory constituents; however, some are sheared, while others are injected via hydrothermal solutions.

Figure 1 - Regional Geology of the Athabasca Basin

Historical Exploration

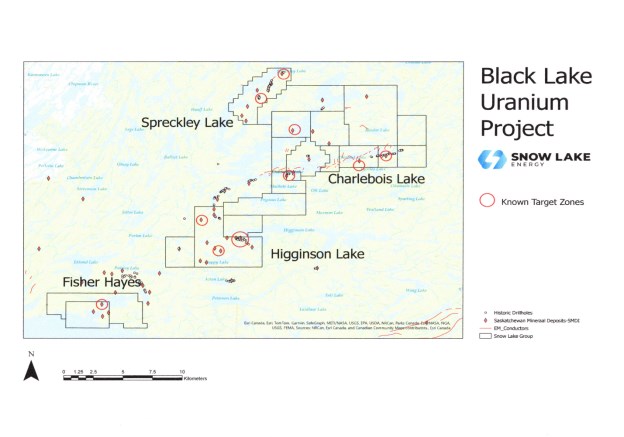

The Black Lake Uranium Project underwent significant exploration during the 1950's and 1970's by several companies. The historic programs focused on Higginson Lake and Charlebois Lake and confirmed 28 historic uranium showings. Prior work included a variety of geophysical, geochemical and drilling programs. A total of 13 SMDI (Saskatchewan Mineral Deposit Index) sites have been recorded on the Higginson Lake Project. The Charlebois Project has extensive uranium showings and in addition to mapping, surveying, trenching and several shallow drill holes completed during the 1950's.

Fisher Hayes and Spreckley Lake were also subject to scintillometer surveys, trenching and diamond drilling during the 1950's. Historic trench sampling results from the 1950's indicate up to 1.57% U3O8.

All historical exploration results referred to in this press release are from publicly available information and represent results from exploration work conducted by parties other than Snow Lake. Snow Lake does not have any of the original data, samples, drill core, assay reports, nor does it have any information such as the identity of the assay lab, assay procedures, or QAQC procedures. Snow Lake makes no representation or warranty as to the existence, description or accuracy of any historical exploration work or data on the Project. Snow Lake would have to conduct extensive exploration work, including prospecting, sampling, drilling, and assaying in order to confirm the existence of uranium mineralization on the Project. Any historical exploration results referred to in this press release have not been determined in accordance with the modern mining code requirements for disclosing exploration results.

Mining Claims

The Black Lake Uranium Project consists of 20 mining claims covering 18,908 hectares and is divided into the following four project areas: Higginson Lake, Charlebois Lake, Fisher Hayes and Spreckley Lake, as set out in Figure 2.

Figure 2 - Black Lake Uranium Project

Option to Acquire 100% Interest in the Black Lake Uranium Project

Snow Lake, through its recently acquired wholly owned subsidiary Global Uranium Acquisition Corp Pty Ltd ("Global"), is a party to a mineral property option agreement (the "Option Agreement") with Doctors Investment Group Ltd., a private British Columbia company, pursuant to which Global has the sole and exclusive right to earn a 100% undivided interest in the mineral claims comprising the Project. Details of the acquisition of Global and the Option Agreement is set out in Schedule A attached hereto.

Saskatchewan, Canada

Saskatchewan was the second-largest global producer of uranium in 2022 and accounted for 15% of the world's primary uranium production1, and was ranked as the 3rd overall jurisdiction for mining investment according to the Fraser Institute's 2023 annual survey2. Saskatchewan also hosts the world's largest, highest grade uranium deposits, and is the source of almost a quarter of the world's uranium supply for electrical generation.3

Uranium Market

The only significant commercial use for U3O8 is as a fuel for nuclear power plants for the generation of electricity4. Nuclear energy underpins the three major global trends of: 1) electrification; 2) decarbonization; and 3) energy security. Global demand for electricity is estimated to grow by approximately 50% by 2040 and is accompanied by calls to triple global nuclear capacity by 20505. Nuclear energy provides clean, non-CO2 emissions, and low-cost energy, with greater generating capacity per footprint than other fuel sources.

Geopolitical Events

Geopolitical events continue to shape the global uranium market, including the ongoing Russian invasion of Ukraine, political instability in Niger, and the United States passing a series of laws banning the importation of Russian uranium and facilitating American nuclear energy leadership. These events continue to influence and drive the global energy mix and policy, with renewed focus on nuclear power as a means of ensuring energy security.

United States - Legislation to Enhance Energy Security

In the past two months, the United States has passed two significant pieces of legislation designed to advance clean energy, enhance energy security and independence, and to revive an aging nuclear energy industry at home and bolster cutting-edge technologies abroad.

The Prohibiting Russian Uranium Imports Act

On May 13, 2024, President Biden signed into law The Prohibiting Russian Uranium Imports Act (the "Import Ban"), a move which the White House has called "a national security priority". The Import Ban bans the import of enriched uranium produced in Russia or by Russian entities and is designed to enhance the United States' energy security by reducing its dependence on Russia for nuclear fuels. It also unlocks funding to support domestic uranium production. Russia is currently the largest foreign supplier of enriched uranium to the United States, according to US Energy Department data.

1 World Nuclear Association (WNA) data.

2 Fraser Institute Annual Survey of Mining Companies 2023

3 Government of Saskatchewan

5 World Nuclear Association

The ADVANCE Act

On July 9, 2024, President Biden signed into law the Accelerating Deployment of Versatile, Advanced Nuclear for Clean Energy (ADVANCE) Act (the "Nuclear Energy Law"), which is designed to reestablish the United States as the global leader in nuclear energy in the twenty-first century. The Nuclear Energy Law strengthens the United States' energy security, as well as expanding nuclear power as a clean, reliable power source designed to remain a major part of the United States future energy mix, meeting their climate goals and ensuring their energy independence.

Nuclear Power's Critical Role in the Energy Transition

Nuclear power plays a critical role in the energy transition, as it is widely stated that there is no path to net zero carbon without nuclear power. At COP 28, a total of 22 countries agreed to target tripling nuclear capacity by 2050 as countries focus on energy security and affordability. Nuclear power programs continue to expand, with 440 operating reactors in 31 countries, and with 60 reactors under construction in 18 countries6.

Uranium Supply, Demand and Pricing

Supply: Geopolitical events continue to disrupt the global uranium supply chain. A combination of low prices over the past decade, underinvestment in uranium projects and nuclear power, mine closures, challenges in re-starting idled uranium mines, and the COVID19 pandemic, have all contributed to a reduction in the global supply of uranium. More recently, uranium producers, developers, and physical uranium holding companies have continued to buy physical uranium, putting further strain on the uranium supply chain.

Demand: Demand for uranium is being driven by the increasing focus on nuclear power as a component part of net zero, a policy shift to include nuclear power as clean energy, and the number of nuclear reactors in operation and under construction.

As noted above, with 440 operating reactors in 31 countries, and with 60 reactors under construction in 18 countries, total uncovered uranium requirements are more than 500 million pounds through 2030. The World Nuclear Association's Nuclear Fuel Report (2023)7 shows a 28% increase in uranium demand over 2023 - 2030, with a 51% increase in uranium demand for the decade 2031 - 2040, providing plenty of scope for growth in nuclear capacity in a world focused on carbon emissions. Demand for uranium is forecast to outstrip uranium supply over the next decade.

6 World Nuclear Association

7 World Nuclear Association

Prices: As a result, prices of uranium have recovered from their lows over the past decade and briefly exceeded USD$100 per pound U3O8 in January 2024, with current prices around USD$85 per pound U3O8.

Positive for Uranium Exploration and Development

Snow Lake is of the view that the combination of supply and demand factors, against the backdrop of the search for solutions to decarbonization and managing global geopolitical risks, is very positive for uranium exploration over the next decade.

Clean Energy Opportunities

As Snow Lake continues its transition to a clean energy company, it continues to review North American opportunities in the clean energy space, in an effort to identify additional sources of clean energy that have the potential to be commercialized, that would contribute to net zero, that would complement its current portfolio of uranium and lithium projects and have the potential to create shareholder value.

Qualified Person Statement

Ronald Scott, PhD, PGeo, is the Chief Geoscientist of Snow Lake Resources, and is a Qualified Person as defined by the SEC's S-K 1300 rules for Snow Lake's Canadian and Namibian exploration projects and has sufficient experience relevant to the type of deposits under evaluation and has reviewed and approved the technical information in this release.

About Snow Lake Resources Ltd.

Snow Lake Resources Ltd., d/b/a Snow Lake Energy, is a Canadian clean energy exploration company listed on NASDAQ: LITM with a global portfolio of clean energy mineral projects comprised of two uranium projects and two hard rock lithium projects. The Black Lake Uranium Project is an exploration stage project located in the Athabasca Basin, Saskatchewan and the Engo Valley Uranium Project is an exploration stage project located in the Skeleton Coast of Namibia. The Shatford Lake Lithium Project is an exploration stage project located adjacent to the Tanco lithium mine in Southern Manitoba, and the Snow Lake Lithium™ Project is an exploration stage project located in the Snow Lake region of Northern Manitoba.

The current focus of the Company is advancing the exploration of its two uranium projects to supply the minerals and resources needed for the clean energy transition, while exploration activities on its two lithium projects will remain limited until such time as the lithium market recovers from its current depressed levels. Learn more at www.snowlakeenergy.com.

Forward-Looking Statements: This press release contains "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934 and the "safe harbor" provisions under the Private Securities Litigation Reform Act of 1995 that are subject to substantial risks and uncertainties. All statements, other than statements of historical fact, contained in this press release are forward-looking statements, including without limitation statements with regard to Snow Lake Resources Ltd. We base these forward-looking statements on our expectations and projections about future events, which we derive from the information currently available to us. Forward-looking statements contained in this press release may be identified by the use of words such as "anticipate," "believe," "contemplate," "could," "estimate," "expect," "intend," "seek," "may," "might," "plan," "potential," "predict," "project," "target," "aim," "should," "will," "would," or the negative of these words or other similar expressions, although not all forward-looking statements contain these words. Forward-looking statements are based on Snow Lake Resources Ltd.'s current expectations and are subject to inherent uncertainties, risks and assumptions that are difficult to predict. Further, certain forward-looking statements are based on assumptions as to future events that may not prove to be accurate. Some of these risks and uncertainties are described more fully in the section titled "Risk Factors" in our registration statements and annual reports filed with the Securities and Exchange Commission. Forward-looking statements contained in this announcement are made as of this date, and Snow Lake Resources Ltd. undertakes no duty to update such information except as required under applicable law.

Contact and Information

Frank Wheatley, CEO

+1 (604) 562-1916

|

Investor Relations

Investors:

ir@snowlakelithium.com

Website:

www.snowlakeenergy.com

|

Follow us on Social Media

Twitter:

www.twitter.com/SnowLakeEnergy

LinkedIn:

www.linkedin.com/company/snow-lake-energy |

Schedule A

Black Lake Uranium Project

Option to Earn a 100% Interest in the Black Lake Uranium Project

Snow Lake, through its recently acquired wholly owned subsidiary, Global Uranium Acquisition Corp (Pty) Ltd ("Global"), is a party to a mineral property option agreement (the "Option Agreement") with Doctors Investment Group Ltd. ("Doctors"), a private British Columbia company, pursuant to which Global can earn a 100% interest in the Black Lake Uranium Project.

Doctors is currently the sole registered and beneficial owner of 100% of the right, title and interest in the mineral claims comprising the Black Lake Uranium Project.

Acquisition of Global

Snow Lake acquired Global in consideration of:

a) Initial Cash Payment: Payment to Global by Snow Lake of the amount of CAD$50,000 in cash, which amount represents the amount paid by Global to Doctors in accordance with Section 3.2 (i) of the Option Agreement;

b) Initial Issuance of Snow Lake Shares: Allotting and issuing to the shareholders of Global, an aggregate of 1,000,000 fully paid and non-assessable common shares of Snow Lake (the "Initial Snow Lake Shares"); and

c) Milestone Payment of Snow Lake Shares: Allotting and issuing an aggregate of 1,000,000 fully paid and non-assessable common shares of Snow Lake (the "Milestone Snow Lake Shares"), in the event an SK-1300 compliant technical report determines that there is a uranium mineral resource on the Black Lake Uranium Project of a minimum of 10 million pounds U3O8 with a minimum average grade of 500 ppm U3O8 per tonne.

Option Agreement

The Option Agreement provides that Global can earn a 100% interest in the Black Lake Uranium Project as follows:

a) Cash Payments. Payment by Global to Doctors of the following amounts in cash:

i) CAD$50,000 within 2 days of signing the Option Agreement (which amount has been paid).

ii) CAD$150,000 within 30 days of signing the Option Agreement (which amount has been paid).

iii) CAD$250,000 on or before the first anniversary of signing the Option Agreement;

iv) CAD$350,000 on or before the second anniversary of signing the Option Agreement;

v) CAD$400,000 on or before the third anniversary of signing the Option Agreement; and

vi) CAD$600,000 on or before the fourth anniversary of signing the Option Agreement; and

b) Exploration Expenditures. Global incurring the following exploration expenditures on the Black Lake Uranium Project:

i) CAD$500,000 in exploration expenditures on or before the first anniversary of the signing of the Option Agreement;

ii) CAD$500,000 in exploration expenditures on or before the first anniversary of the signing of the Option Agreement; and

iii) CAD$1,000,000 in exploration expenditures on or before the first anniversary of the signing of the Option Agreement.

Global has the right under the Option Agreement to accelerate both cash payments and/or the exploration expenditures prescribed under the Option Agreement.

Snow Lake Resources (NASDAQ:LITM)

過去 株価チャート

から 10 2024 まで 11 2024

Snow Lake Resources (NASDAQ:LITM)

過去 株価チャート

から 11 2023 まで 11 2024