| 40

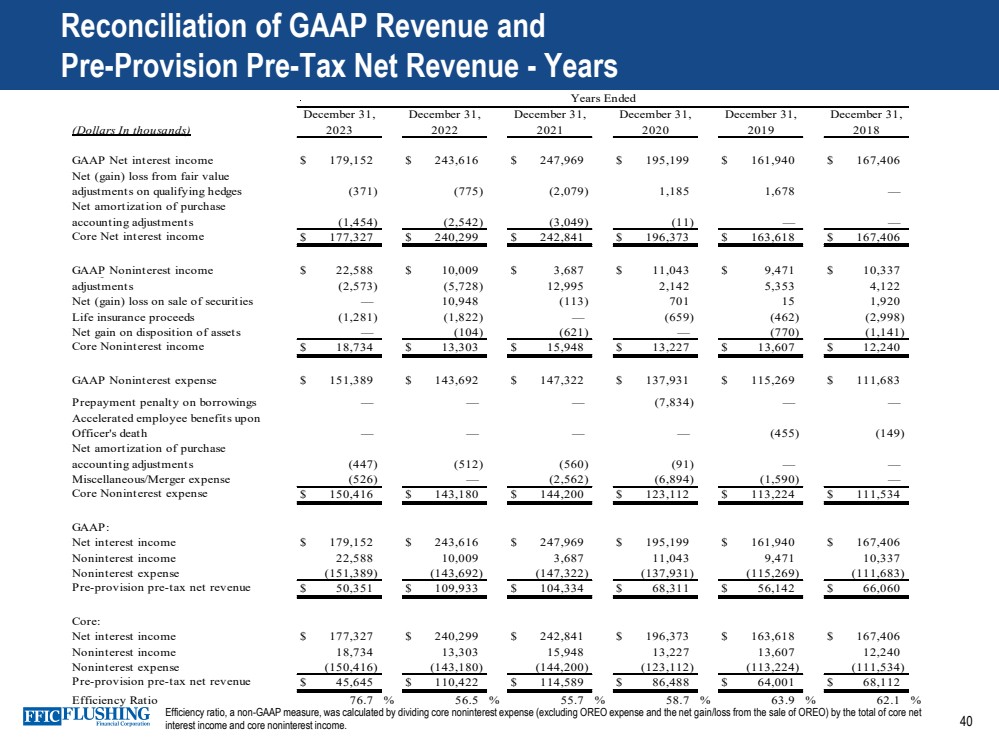

Reconciliation of GAAP Revenue and

Pre-Provision Pre-Tax Net Revenue - Years

Efficiency ratio, a non-GAAP measure, was calculated by dividing core noninterest expense (excluding OREO expense and the net gain/loss from the sale of OREO) by the total of core net

interest income and core noninterest income.

(Dollars In thousands)

GAAP Net interest income $ 179,152 $ 243,616 $ 247,969 $ 195,199 $ 161,940 $ 167,406

Net (gain) loss from fair value

adjustments on qualifying hedges (371) (775) (2,079) 1,185 1,678 —

Net amortization of purchase

accounting adjustments (1,454) (2,542) (3,049) (11) — —

Core Net interest income $ 177,327 $ 240,299 $ 242,841 $ 196,373 $ 163,618 $ 167,406

GAAP Noninterest income Net (gain) loss from fair value $ 22,588 $ 10,009 $ 3,687 $ 11,043 $ 9,471 $ 10,337

adjustments (2,573) (5,728) 12,995 2,142 5,353 4,122

Net (gain) loss on sale of securities — 10,948 (113) 701 1 5 1,920

Life insurance proceeds (1,281) (1,822) — (659) (462) (2,998)

Net gain on disposition of assets — (104) (621) — (770) (1,141)

Core Noninterest income $ 18,734 $ 13,303 $ 15,948 $ 13,227 $ 13,607 $ 12,240

GAAP Noninterest expense $ 151,389 $ 143,692 $ 147,322 $ 137,931 $ 115,269 $ 111,683

Prepayment penalty on borrowings — — — (7,834) — —

Accelerated employee benefits upon

Officer's death — — — — (455) (149)

Net amortization of purchase

accounting adjustments (447) (512) (560) (91) — —

Miscellaneous/Merger expense (526) — (2,562) (6,894) (1,590) —

Core Noninterest expense $ 150,416 $ 143,180 $ 144,200 $ 123,112 $ 113,224 $ 111,534

GAAP:

Net interest income $ 179,152 $ 243,616 $ 247,969 $ 195,199 $ 161,940 $ 167,406

Noninterest income 22,588 10,009 3,687 11,043 9,471 10,337

Noninterest expense (151,389) (143,692) (147,322) (137,931) (115,269) (111,683)

Pre-provision pre-tax net revenue $ 50,351 $ 109,933 $ 104,334 $ 68,311 $ 56,142 $ 66,060

Core:

Net interest income $ 177,327 $ 240,299 $ 242,841 $ 196,373 $ 163,618 $ 167,406

Noninterest income 18,734 13,303 15,948 13,227 13,607 12,240

Noninterest expense (150,416) (143,180) (144,200) (123,112) (113,224) (111,534)

Pre-provision pre-tax net revenue $ 45,645 $ 110,422 $ 114,589 $ 86,488 $ 64,001 $ 68,112

Efficiency Ratio 76.7 % 56.5 % 55.7 % 58.7 % 63.9 % 62.1 %

December 31,

2019

December 31,

2018

Years Ended

December 31,

2020

December 31,

2023

December 31,

2022

December 31,

2021 |