UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities

Exchange Act of 1934

| Filed by the Registrant |

☑ |

| Filed by a Party other than the Registrant |

☐ |

Check the appropriate box:

☑ Preliminary

Proxy Statement

☐

Confidential, for Use of the Commission only (as permitted by Rule 14a-6(e)(2))

☐ Definitive

Proxy Statement

☐ Definitive

Additional Materials

☐ Soliciting

Material Pursuant to §240.14a-12

DOLPHIN ENTERTAINMENT, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other

Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| |

|

| ☑ |

No fee required. |

| ☐ |

Fee paid previously with preliminary materials: |

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a–6(i)(1) and 0–11 |

————————————————————————————

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

————————————————————————————

_____________, 2024

Dear Shareholder:

It is my pleasure to invite you

to attend the annual meeting of shareholders (the “Annual Meeting”) of Dolphin Entertainment, Inc., a Florida corporation

(the “Company”). The Annual Meeting will be held on September 24, 2024 at 10:00 a.m. Eastern Daylight Time at 200 South

Biscayne Boulevard, 39th Floor, Miami, Florida 33131.

We are pleased to inform you that

instead of a paper or electronic copy of our proxy materials, most of our shareholders will be mailed a Notice of Internet Availability

of Proxy Materials (“Notice of Internet Availability”) on or about August __, 2024. The Notice of Internet Availability

contains instructions on how to access proxy materials and how to submit your proxy over the Internet. The Notice of Internet Availability

also contains instructions on how to request a paper copy of our proxy materials, if desired. All shareholders who do not receive a Notice

of Internet Availability, or who have not consented to receive their proxy materials electronically by email, will be mailed a paper copy

of the proxy materials. Furnishing proxy materials over the Internet allows us to provide our shareholders with the information they need

in a timely manner, while reducing the environmental impact and lowering the costs of printing and distributing our proxy materials.

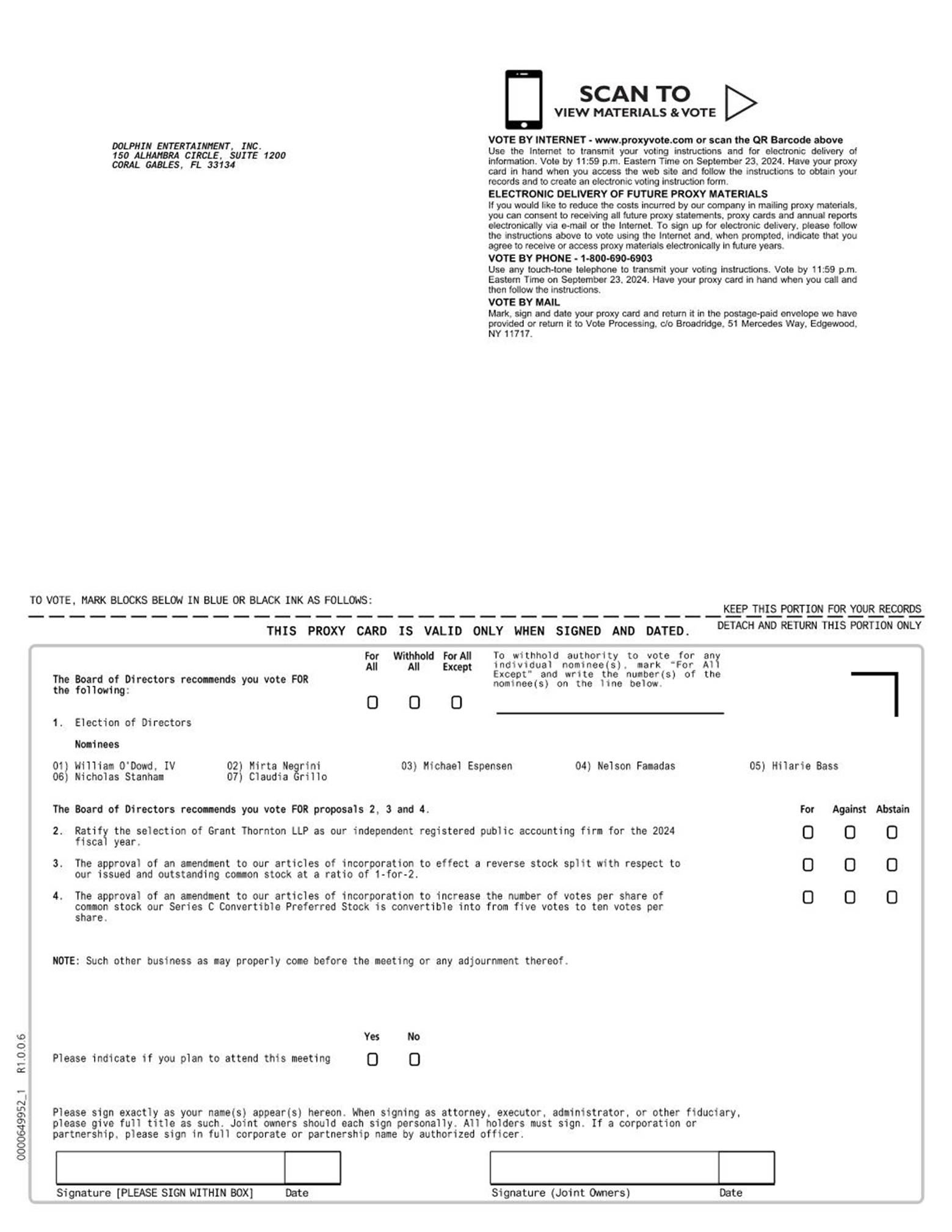

The Annual Meeting will be held for the following purposes:

| |

1. |

To elect seven directors to hold office until the 2025 annual meeting of shareholders or until their respective successors are duly elected and qualified; |

| |

2. |

To ratify the appointment of Grant Thornton LLP as the Company’s independent registered public accountants for the fiscal year ending December 31, 2024; |

| |

3. |

To approve an amendment to the Company’s Amended and Restated Articles of Incorporation to effect a reverse stock split with respect to the Company’s issued and outstanding common stock at a ratio of 1-for-2; and |

| |

4. |

To approve an amendment to the Company’s Amended and Restated Articles of Incorporation to increase the number of votes per share of common stock that the Series C Convertible Preferred Stock (the “Series C”) is convertible into from five votes per share to ten votes per share. |

The Company’s Board of Directors recommends

that you vote in favor of proposals 1, 2, 3, and 4.

Only shareholders of record as of the close of business

on July 29, 2024 may attend and vote at the Annual Meeting.

WHETHER OR NOT YOU EXPECT TO BE PRESENT AT THE MEETING,

PLEASE VOTE YOUR SHARES, SO THAT A QUORUM WILL BE PRESENT AND A MAXIMUM NUMBER OF SHARES MAY BE VOTED. IT IS IMPORTANT AND IN YOUR INTEREST

FOR YOU TO VOTE. WE ENCOURAGE YOU TO VOTE YOUR PROXY BY MAILING IN YOUR ENCLOSED PROXY CARD IN THE ENCLOSED POSTAGE PAID ENVELOPE, OR

VOTE ONLINE OR OVER THE TELEPHONE ACCORDING TO THE INSTRUCTIONS IN THE PROXY CARD.

THE PROXY IS REVOCABLE AT ANY TIME PRIOR TO ITS

USE.

| |

|

| |

BY ORDER OF THE BOARD OF DIRECTORS |

| |

|

| |

|

| |

William O’Dowd, IV |

| |

Chief Executive Officer |

————————————————————————————

TABLE OF CONTENTS

————————————————————————————

DOLPHIN ENTERTAINMENT, INC.

150 Alhambra Circle, Suite 1200

Coral Gables, Florida 33134

————————————————————————————

PROXY STATEMENT

————————————————————————————

Proxy Statement for Annual Meeting of Shareholders

to be held on September 24, 2024

You are receiving this proxy statement

because as of July 29, 2024 (the “Record Date”), you owned shares of common stock of Dolphin Entertainment, Inc., a

Florida corporation (referred to as “we”, “us” or the “Company”), entitling you

to vote at the Annual Meeting. Our Board of Directors (the “Board”) is soliciting proxies from shareholders as of the

Record Date who wish to vote at the meeting. By use of a proxy, you can vote even if you do not attend the Annual Meeting. This proxy

statement describes the matters on which you are being asked to vote and provides information on those matters so that you can make an

informed decision.

————————————————————————————

QUESTIONS AND ANSWERS ABOUT OUR

ANNUAL MEETING

————————————————————————————

Q: When and where will the Annual

Meeting take place?

A: The Annual Meeting will be held on September 24,

2024 at 10:00 a.m., EDT, at 200 South Biscayne Blvd., 39th Floor, Miami, FL 33131.

Q: Who may vote at the Annual

Meeting?

A: Only holders of record of shares of our common

stock at the close of business on July 29, 2024 (the “Record Date”), are entitled to notice of and to vote at the Annual

Meeting or any adjournment or postponement of the Annual Meeting. On the Record Date, we had 22,119,016 shares of our common stock outstanding

and entitled to be voted at the Annual Meeting.

Q: How many votes do I have?

A: You may cast one vote for each share of our common

stock held by you as of the Record Date on all matters presented at the Annual Meeting. Holders of our common stock do not possess cumulative

voting rights.

Q: How do I vote?

A: If you are a shareholder of record as of the Record

Date, you may vote:

| |

· |

via Internet at www.proxyvote.com (see your proxy card for additional instructions); |

| |

|

|

| |

· |

by telephone at 1-800-690-6903; |

| |

|

|

| |

· |

by mail, by signing and returning the proxy card provided; or |

| |

|

|

| |

· |

in person during the Annual Meeting. |

If your shares are held in “street name,”

meaning that they are held of record by your brokerage firm, bank, broker-dealer or other nominee, then you will receive voting instructions

from the holder of record. You must follow those instructions in order for your shares to be voted. Your broker is required to vote your

shares in accordance with your instructions. If your shares are held by an intermediary and you intend to vote your shares in person at

the Annual Meeting, please bring with you evidence of your ownership as of the record date (such as a recent brokerage statement showing

your ownership of the shares as of the record date or a letter from the broker or nominee confirming such ownership), and a form of personal

photo identification.

Q: What is the difference between

a shareholder of record and a beneficial owner?

A: If your shares are registered directly in your

name with our transfer agent, Nevada Agency and Transfer Company, then you are considered the “shareholder of record” with

respect to those shares.

If your shares are held in street name by a brokerage

firm, bank, trustee or other agent, which we refer to as a nominee, then you are considered the “beneficial owner” of the

shares held in street name. As the beneficial owner, you have the right to direct your nominee on how to vote your shares by following

the instructions provided to you by your nominee.

Q: What constitutes a quorum, and why is a quorum

required?

A: We are required to have a quorum of shareholders

present to conduct business at the Annual Meeting. The presence at the Annual Meeting, in person or by proxy, of the holders of a majority

of our shares of common stock entitled to vote as of the record date will constitute a quorum, permitting us to conduct the business of

the Annual Meeting. Proxies received but marked as “ABSTAIN” or “WITHHOLD”, if any, and broker non-votes (described

below), if applicable, will be included in the calculation of the number of shares considered to be present at the Annual Meeting for

quorum purposes. If a quorum is not present, we will be required to reconvene the Annual Meeting at a later date.

Q: What am I being asked to

vote on?

A: At the Annual Meeting you will be asked to vote

on the following four proposals. Our Board recommendation for each of these proposals is set forth below.

| |

|

| Proposal |

Board Recommendation |

| 1. |

Election of Directors |

FOR each director nominee |

| 2. |

To ratify the appointment of Grant Thornton LLP (“GT”) as our independent registered public accounting firm for the year ending December 31, 2024 |

FOR |

| 3. |

To approve an amendment to the Company’s Amended and Restated Articles of Incorporation to effect a reverse stock split with respect to the Company’s issued and outstanding common stock at a ratio of 1-for-2 |

FOR |

| 4. |

To approve an amendment to the Company’s Amended and Restated Articles of Incorporation to increase the number of votes per share of common stock that the Series C Convertible Preferred Stock (the “Series C”) is convertible into from five votes per share to ten votes per share |

FOR |

Q: What happens if additional

matters are presented at the Annual Meeting?

A: Other than the items of business described in this

proxy statement, we are not aware of any other business to be acted upon at the Annual Meeting. If you grant a proxy, the proxy holders,

William O’Dowd, IV and Mirta Negrini, will have the discretion to vote your shares on any additional matters properly presented

for a vote at the meeting in accordance with Florida law and our Bylaws.

Q: How many votes are needed

to approve each proposal?

| |

|

| Proposal |

Description of Votes Needed |

| 1. |

Election of Directors |

The seven nominees for election as directors will be elected by a “plurality” of the votes cast at the Annual Meeting. This means that the seven nominees who receive the highest number of “FOR” votes will be elected as the directors to serve until the next annual meeting of shareholders or until their respective successors are duly elected and qualified. Abstentions and broker non-votes (as described below) will not have any effect on the election of directors. |

| 2. |

Ratification of our appointment of GT as our independent registered public accounting firm |

Ratification of our appointment of GT as our independent registered public accounting firm for the year ending December 31, 2024 will be approved if the number of votes cast “FOR” the proposal exceeds the number of votes cast “AGAINST” the proposal. Abstentions and broker non-votes will not have any effect on whether this proposal is approved. The ratification of accountants is a routine proposal on which a broker or other nominee is generally empowered to vote in the absence of voting instructions from the beneficial owner. |

| 3. |

Reverse Stock Split |

The amendment of our Articles of Incorporation will be considered approved if a majority of the votes entitled to be cast on the amendment cast votes “FOR” the proposal. You may vote “FOR,” “AGAINST,” or “ABSTAIN” on this proposal. This proposal is a routine proposal on which a broker or other nominee is generally empowered to vote in the absence of voting instructions from the beneficial owner. Abstentions and broker non-votes will have the same effect as votes against the proposal. |

| 4. |

Series C Vote Increase |

The amendment of our Articles of Incorporation will be considered approved if a majority of the votes entitled to be cast on the amendment cast votes “FOR” the proposal. You may vote “FOR,” “AGAINST,” or “ABSTAIN” on this proposal. Abstentions and broker non-votes will have the same effect as votes against the proposal. |

Q: What if I sign and return

my proxy without making any selections?

A: If you sign and return your proxy without making

any selections, your shares will be voted “FOR” the director nominees in Proposal 1 and “FOR” ratification of

the appointment of GT in Proposal 2, “FOR” the reverse stock split in Proposal 3, and “FOR” the Series C Vote

Increase in Proposal 4. If other matters properly come before the meeting, the proxy holders will have the authority to vote on those

matters for you at the proxy holders’ discretion.

Q: What if I am a beneficial

shareholder and I do not give the nominee voting instructions?

A: If you are a beneficial shareholder and your shares

are held in street name with a broker, the broker has the authority to vote shares for which you do not provide voting instructions only

with respect to certain “routine” matters. A broker non-vote occurs when a nominee who holds shares for a beneficial owner

does not vote on a particular matter because the nominee does not have discretionary voting authority for that matter and has not received

instructions from the beneficial owner of the shares. Broker non-votes are included in the calculation of the number of votes considered

to be present at the Annual Meeting for purposes of determining the presence of a quorum but are not counted as votes cast with respect

to a matter on which the nominee has expressly not voted. Proposals 1 and 4 are deemed to be “non-routine” matters, and as

a result, your broker or nominee may not vote your shares on Proposals 1 and 4 in the absence of your instruction. Proposals 2 and 3 are

considered to be “routine” matters, and as a result, your broker or nominee may vote your shares in its discretion either

for or against Proposals 2 and 3 even in the absence of your instruction. If you are a beneficial owner and want to ensure that all of

the shares you beneficially own are voted for or against Proposals 2 and 3, you must give your broker or nominee specific instructions

to do so.

The table below sets forth, for each proposal on the ballot, whether a

broker can exercise discretion and vote your shares absent your instructions and if not, the impact of such broker non-vote on the approval

of the proposal.

| Proposal |

|

Can Brokers Vote

Absent Instructions? |

|

Impact of

Broker Non-Vote |

| 1. |

Election of Directors |

|

No |

|

No effect |

| 2. |

Ratification of GT as our independent registered public accounting firm |

|

Yes |

|

No effect |

| 3. |

Reverse Stock Split |

|

Yes |

|

Same as vote against |

| 4. |

Series C Vote Increase |

|

No |

|

Same as vote against |

Q: Are there any appraisal rights

or dissenters’ rights?

A: Under the Florida Business Corporation Act, our

shareholders are not entitled to dissenters’ rights or appraisal rights with respect to any of the proposals.

Q: Can I change my vote after

I have delivered my proxy?

A: Yes. If you are a shareholder of record, you may

revoke your proxy at any time before its exercise at the Annual Meeting by:

| |

· |

delivering written notice to Mirta A. Negrini at Dolphin Entertainment, Inc., 150 Alhambra Circle, Suite 1200, Coral Gables, FL 33134; |

| |

|

|

| |

· |

properly submitting a proxy with a later date (which may be done by Internet, telephone or mail); or |

| |

|

|

| |

· |

attending the Annual Meeting and voting in person. |

If you are a beneficial shareholder, you must contact

your nominee to change your vote or obtain a proxy to vote your shares if you wish to cast your vote in person at the Annual Meeting.

Q: What does it mean if I receive

more than one proxy card?

A: If you receive more than one proxy card, it means

that you hold shares of common stock in more than one account. To ensure that all your shares are voted, sign and return each proxy card.

Alternatively, if you vote by Internet or telephone, you will need to vote once for each proxy card you receive.

Q: Who can attend the Annual

Meeting?

A: Only shareholders of record as of the Record Date,

individuals holding a valid proxy from a record holder and our invited guests may attend the Annual Meeting.

Q: If I plan to attend the Annual

Meeting, should I still vote by proxy?

A: Yes. Casting your vote in advance does not affect

your right to attend the Annual Meeting.

Q: Where can I find voting results

of the Annual Meeting?

A: We will announce the results for the proposals

voted upon at the Annual Meeting and publish final detailed voting results in a Form 8-K filed within four business days after the Annual

Meeting.

Q: Who should I call with other

questions?

A: If you have additional questions about this proxy

statement or the Annual Meeting or would like additional copies of this proxy statement or the enclosures herein, please contact: Dolphin

Entertainment, Inc., 150 Alhambra Circle, Suite 1200, Coral Gables, Florida 33134, Attention: Mirta A. Negrini, Telephone: (305) 774-0407.

————————————————————————————

PROPOSAL 1—ELECTION OF DIRECTORS

————————————————————————————

Under our Bylaws, each of

our directors is elected for a term expiring at the next annual meeting of shareholders following his or her election or until his or

her successor is duly elected and qualified. The Board is currently comprised of seven (7) directors. Our current directors are William

O’Dowd, IV, Michael Espensen, Nelson Famadas, Mirta A. Negrini, Anthony Leo, Nicholas Stanham and Claudia Grillo. Our Board has

nominated six of the current directors for re-election and Hilarie Bass for election at the Annual Meeting.

Our directors standing for election,

their age, positions held, and duration of such, are as follows:

| |

|

|

|

|

|

|

| Name |

|

Position |

|

Age |

|

First appointed |

| William O’Dowd, IV |

|

Chief Executive Officer, Chairman, President |

|

55 |

|

Chief Executive Officer and Chairman: June 2008; President: 1996 |

| Mirta A. Negrini |

|

Chief Financial Officer, Chief Operating Officer, Director |

|

60 |

|

Chief Financial Officer and Chief Operating Officer: October 2013; Director: December 2014 |

| Michael Espensen |

|

Director |

|

74 |

|

June 2008 |

| Nelson Famadas |

|

Director |

|

51 |

|

December 2014 |

| Hilarie Bass |

|

N/A |

|

69 |

|

N/A |

| Nicholas Stanham, Esq. |

|

Director |

|

56 |

|

December 2014 |

| Claudia Grillo |

|

Director |

|

65 |

|

June 2019 |

Business Experience

The following is a brief account

of the education and business experience of directors and executive officers during at least the past five years, indicating their principal

occupation during the period, and the name and principal business of the organization by which they were employed.

William O’Dowd, IV. Mr. O’Dowd

has served as our Chief Executive Officer and Chairman of our Board since June 2008. Mr. O’Dowd founded Dolphin Entertainment, LLC

in 1996 and has served as its President since that date. Mr. O’Dowd enjoys a solid reputation as an Emmy-nominated producer, international

distributor, and financier of quality entertainment content. Some of Mr. O’Dowd’s notable credits include: Executive Producer

of Nickelodeon’s hit series, Zoey 101 (Primetime Emmy Award-nominated); Executive Producer of Raising Expectations, starring Molly

Ringwald and Jason Priestley (winner of 2017’s KidScreen Award for Best Global Kids Show); Producer of the feature film Max Steel

(based on a top-selling Mattel action figure in Latin America); and, in the digital arena, Executive Producer of H+, which premiered on

YouTube and won multiple Streamy Awards.

Mr. O’Dowd has served on the Leadership Council

of United Way Worldwide since its inception in 2012, as well as on the Board of Directors of United Way United Kingdom since its inception

in 2014, and has previously served on the Board of Directors of the Miami-Dade County Public School System Foundation, among other charities.

Furthermore, Mr. O’Dowd has taught one course a year as an adjunct professor at the University of Miami School of Communication

for over twenty-five years.

Qualifications. The Board nominated Mr. O’Dowd

to serve as a director because of his current and prior senior executive and management experience at our Company and his significant

industry experience, including having founded Dolphin Entertainment LLC, a leading entertainment company specializing in children’s

and young adult’s live-action programming.

Mirta A. Negrini. Ms. Negrini has served on

our Board since December 2014 and as our Chief Financial and Operating Officer since October 2013. Ms. Negrini has over thirty years of

experience in both private and public accounting. Immediately prior to joining us, she served since 1996 as a named partner in Gilman

& Negrini, P.A., an accounting firm of which we were a client. Prior to that, Ms. Negrini worked at several multinational corporations,

and she began her career at Arthur Andersen LLP in 1986. Ms. Negrini serves on the Board of Directors of St. Brendan High School and on

the Finance Committee of the Board of Directors of RCMA. She is a Certified Public Accountant licensed in the State of Florida.

Qualifications. The Board nominated Ms. Negrini to serve as a director

because of her significant accounting experience gained as a named partner at an accounting firm and her current experience as a senior

executive at our Company.

Michael Espensen. Mr.

Espensen has served on our Board since June 2008. From 2009 to 2014, Mr. Espensen served as Chief Executive Officer of Keraplast Technologies,

LLC, a private multimillion-dollar commercial-stage biotechnology company, from where he retired. From 2009 to present, Mr. Espensen has

also served as Chairman of the Board of Keraplast. While serving as Chief Executive Officer, Mr. Espensen was responsible for overseeing

and approving Keraplast’s annual budgets and financial statements. Mr. Espensen is also a producer and investor in family entertainment

for television and feature films. Between 2006 and 2009, Mr. Espensen was Executive or Co-Executive Producer of twelve made-for-television

movies targeting children and family audiences. As Executive Producer, he approved production budgets and then closely monitored actual

spending to ensure that productions were not over budget. Mr. Espensen has also been a real estate developer and investor for over thirty

years.

Qualifications. The Board

nominated Mr. Espensen to serve as a director because of his business management and financial oversight experience both as the current

Chairman and former Chief Executive Officer of a multimillion-dollar company and as a former Executive Producer in the made-for-television

movie industry, as well as his valuable knowledge of our industry.

Nelson Famadas. Mr. Famadas

has served on our Board since December 2014. He is Managing Partner and Chief Operating Officer of Carver Road Capital, a hospitality

private equity fund. Previously, he owned and served as President of Cien, a Hispanic marketing firm. Prior to Cien from 2011 to 2015,

Mr. Famadas served as Senior Vice President of National Latino Broadcasting (“NLB”), an independent Hispanic media

company that owns and operates two satellite radio channels on SiriusXM. From 2010 to 2012, Mr. Famadas served as our Chief Operating

Officer, where he was responsible for daily operations including public filings and investor relations. From

2002 through 2010, he served as President of Gables Holding Corp., a real estate development company based in Puerto Rico. Mr.

Famadas began his career at MTV Networks, specifically MTV Latin America, ultimately serving as New Business Development Manager. From

1995 through 2001, he co-founded and managed Astracanada Productions, a television production company that catered mostly to the Hispanic

audience, creating over 1,300 hours of programming. As Executive Producer, he received a Suncoast EMMY in 1997 for Entertainment Series

for A Oscuras Pero Encendidos. Mr. Famadas has over 20 years of experience in television and radio production, programming, operations,

sales and marketing.

Qualifications. The Board

nominated Mr. Famadas to serve as a director because of his significant prior management experience as a co-founder and former manager

of a television production company and senior vice president of a broadcasting firm, as well as his current management experience with

a marketing firm.

Hilarie Bass. Until December

2018, Hilarie Bass was president of Greenberg Traurig, a leading global law firm with more than 2000 attorneys and 40 offices worldwide.

Prior to being president of the law firm, she served as Chair of the 600 member Litigation Department for eight years. A trial lawyer

for more than 30 years, Hilarie litigated business disputes involving $100’s of millions for Fortune 100 companies in both jury

and non-jury trials. Her expertise as a trial lawyer was recognized by her invitation to be a member of the American College of Trial

lawyers. Hilarie has served as president of the American Bar Association, as Chair of the University of Miami Board of Trustees, and as

Chair of the Board of United Way of Miami Dade. She currently is a member of the UHealth Board of Directors, the Board of the ABA Retirement

Fund and the American Bar Endowment. Hilarie serves as president of the Bass Institute for Diversity and Inclusion, an entity she created

in 2019, along with the Bass Foundation. In her role at the Institute, she has spoken around the world on issues of gender parity, women’s

leadership, and the retention and elevation of women in the corporate context.

Qualifications. The Board nominated Ms. Bass

to serve as a director because of her experience as the president of a leading global law firm as well as her management experience at

that firm.

Nicholas Stanham, Esq.

Mr. Stanham has served on our Board since December 2014. Mr. Stanham is a founding partner of R&S International Law Group, LLP in

Miami, Florida, which was founded in January 2008. His practice is focused primarily on real estate and corporate structuring for high

net worth individuals. Mr. Stanham has over 25 years of experience in real estate purchases and sales of residential and commercial properties.

Since 2004, Mr. Stanham has been a member of the Christopher Columbus High School board of directors. In addition, he serves as a director

of ReachingU, a foundation that promotes initiatives and supports organizations that offer educational opportunities to Uruguayans living

in poverty.

Qualifications. The Board nominated Mr. Stanham

to serve as a director because of his experience as a founding partner at a law firm as well as his business management experience at

that firm.

Claudia Grillo. Ms. Grillo

has served on our Board since June of 2019. Ms. Grillo has served as Associate Vice President of Strategic Philanthropy for the University

of Miami since April of 2018. Prior to joining the University of Miami, Ms. Grillo served as the Chief Operating Officer at the United

Way of Miami-Dade where she was responsible for securing gifts from individuals, families and corporations. She has been an active member

of the South Florida community through her involvement as a board member of the International Women’s Forum, The Children’s

Trust and Achieve Miami.

Qualifications. The Board nominated Ms. Grillo to serve a director

because of her experience serving as Chief Operating Officer of an organization.

Vote Required for Approval

The election of directors requires

the approval of a plurality of the votes present in person or represented by proxy and entitled to be cast at the Meeting. Abstentions

and broker non-votes will have no effect on Proposal 1.

Recommendation of the Board of Directors

Our Board recommends a vote “FOR”

each of the director nominees.

————————————————————————————

CORPORATE GOVERNANCE

————————————————————————————

Board Leadership Structure and

Role in Risk Oversight

Our Board has not adopted a formal

policy regarding the need to separate or combine the offices of Chairman of the Board and Chief Executive Officer and instead our Board

remains free to make this determination in a manner it deems most appropriate for our Company. Currently, we combine the positions of

Chief Executive Officer and Chairman of the Board. We believe that the combined role of Chief Executive Officer and Chairman of the Board

promotes strategy development and execution. Mr. O’Dowd currently serves as Chief Executive Officer and Chairman of the Board. We

believe Mr. O’Dowd is suited to serve both roles, because he is the director most familiar with our business and industry, and most

capable of effectively identifying strategic priorities and leading the discussion and execution of strategy. Currently, our Board does

not perform a risk oversight function.

Meetings

During 2023, our Board held a

total of four meetings. Each incumbent director attended at least 75% of the aggregate of (1) the total number of meetings of our Board

during the period in which he or she was a director and (2) 75% of the total number of meetings of all committees on which he served during

the period in which he was a director. It is the policy of our Board to encourage its members to attend our annual meeting of shareholders.

Family Relationships

There are no family relationships

between any director or executive officer.

Involvement in Certain Legal Proceedings

There are no material proceedings

to which any director or executive officer or any associate of any such director or officer is a party adverse to our Company or has a

material interest adverse to our Company.

No director or executive officer

has been involved in any of the following events during the past ten years:

1. any bankruptcy petition filed

by or against any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within

two years prior to that time;

2. any conviction in a criminal

proceeding or being subject to a pending criminal proceeding (excluding traffic violations and other minor offences);

3. being subject to any order,

judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily

enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities or banking activities;

4. being found by a court of competent

jurisdiction (in a civil action), the Securities and Exchange Commission or the Commodity Futures Trading Commission to have violated

a federal or state securities or commodities law, and the judgment has not been reversed, suspended, or vacated;

5. being the subject of, or a

party to, any federal or state judicial or administrative order, judgment, decree, or finding, not subsequently reversed, suspended or

vacated, relating to an alleged violation of: (i) any federal or state securities or commodities law or regulation; or (ii) any law or

regulation respecting financial institutions or insurance companies including, but not limited to, a temporary or permanent injunction,

order of disgorgement or restitution, civil money penalty or temporary or permanent cease- and- desist order, or removal or prohibition

order; or (iii) any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or

6. being the subject of, or a

party to, any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory organization (as defined in Section

3(a)(26) of the Exchange Act), any registered entity (as defined in Section 1(a)(29) of the Commodity Exchange Act), or any equivalent

exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member.

Delinquent Section 16(a) Reports

Under Section 16(a) of the Exchange

Act (“Section 16(a)”), our executive officers, directors, and persons who own more than 10% of a registered class of

the Company’s equity securities are required to file with the Securities and Exchange Commission initial statements of beneficial

ownership, reports of changes in ownership and annual reports concerning their ownership of our common stock and other equity securities,

on Forms 3, 4 and 5 respectively. Executive officers, directors, and persons who own more than 10% of a registered class of the Company’s

equity securities are required by Securities and Exchange Commission regulations to furnish us with copies of all Section 16(a) reports

that they file.

Based solely on the copies of

such reports and amendments thereto received by us, or written representations that no filings were required, we believe that all Section

16(a) filing requirements applicable to our executive officers and directors and 10% shareholders were met for the year ended December

31, 2023, except for a Form 3 for NSL Ventures LLC, a more than 10% shareholder in the year ended December 31, 2023, that was not filed.

Code of Ethics

Our Board has adopted a Code of

Ethics for Senior Financial Officers (our “Code of Ethics”). Our Code of Ethics sets forth standards of conduct applicable

to our Chief Executive Officer and our Chief Financial and Operating Officer to promote honest and ethical conduct, proper disclosure

in our periodic filings, and compliance with applicable laws, rules and regulations. In addition, our Board adopted a Code of Conduct

for Directors, Officers and Employees (“Code of Conduct”). Our Code of Ethics and Code of Conduct are available to

view at our website, www.dolphinentertainment.com by clicking on Investor Relations. We intend to provide disclosure of any amendments

or waivers of our Code of Ethics on our website within four business days following the date of the amendment or waiver.

Board Committees

Our Board currently has a standing

Audit Committee and Compensation Committee. Each of the Board’s committees operates under a written charter adopted by our Board

which addresses the purpose, duties and responsibilities of such committee. A current copy of each committee charter can be found on our

website at www.dolphinentertainment.com by clicking on Investor Relations. Information contained on or accessible through our website

is not part of, and is not incorporated by reference in, this Proxy Statement.

Audit Committee

and Audit Committee Financial Experts

The Audit Committee consists of

Messrs. Famadas, Stanham and Espensen, who serves as Chairman. In 2023, the Audit Committee held four meetings. All members of the Audit

Committee were present at each meeting.

Among its responsibilities, the

Audit Committee assists the Board in overseeing: our accounting and financial reporting practices and policies; systems of internal controls

over financial reporting; the integrity of our consolidated financial statements and the independent audit thereof; our compliance with

legal and regulatory requirements; and the performance of our independent registered public accounting firm and assessment of the auditor’s

qualifications and independence.

In addition, the Audit Committee

selects and appoints our independent registered public accounting firm and reviews and approves related party transactions. The Audit

Committee Chairman reports on Audit Committee actions and recommendations at Board meetings. The Audit Committee may, in its discretion,

delegate its duties and responsibilities to a subcommittee of the Audit Committee as it deems appropriate. Our Board has determined that

each member of the Audit Committee meets the independence requirements under Nasdaq’s listing standards and the enhanced independence

standards for audit committee members required by the SEC. In addition, our Board has determined that Mr. Espensen meets the requirements

of an audit committee financial expert under the rules of the SEC and Nasdaq.

Director

Nominations

Our Board currently does not have

a standing nominating committee or committee performing similar functions. In accordance with Nasdaq rules, a majority of the Board’s

independent directors recommend director nominees for selection by the Board. Our Board believes that our independent directors can satisfactorily

carry out the responsibility of properly selecting, approving and recommending director nominees without the formation of a standing nominating

committee. The directors who participate in the consideration and recommendation of director nominees are those independent directors

of the Board identified herein. As there is no standing nominating committee, we do not have a nominating committee charter in place.

The Board will also consider director

candidates recommended for nomination by our shareholders during such times as it is seeking proposed nominees to stand for election at

the next annual meeting of shareholders (or, if applicable, a special meeting of shareholders). All shareholder nominations and recommendations

for nominations to the Board must be addressed to the Chairman of the Audit Committee who will submit such nominations to the Board. Our

Board currently does not have a written policy with regard to the nomination process, or a formal policy with respect to the consideration

of director candidates. In addition, we have not formally established any specific, minimum qualifications that must be met or skills

that are necessary for directors to possess. In general, in identifying and evaluating nominees for director, the Board considers educational

background, diversity of professional experience, knowledge of our businesses, integrity, professional reputation, independence, and the

ability to represent the best interests of our shareholders. The Board will evaluate the suitability of potential candidates nominated

by shareholders in the same manner as other candidates recommended to the Board.

Compensation

Committee

The Compensation Committee consists

of Messrs. Stanham and Famadas, who serves as Chairman. In 2023, the Compensation Committee held one meeting, which both members attended.

Among its responsibilities, the

Compensation Committee: establishes salaries, incentives and other forms of compensation for executive officers and directors; reviews

and approves any proposed employment agreement with any executive officer and any proposed modification or amendment thereof; and maintains

and administers our equity incentive plan.

The Compensation Committee Chairman

reports on Compensation Committee actions and recommendations at Board meetings. The Compensation Committee has the authority to engage

the services of outside legal or other experts and advisors as it determines in its sole discretion; however, in 2023 the Compensation

Committee did not engage an independent compensation consultant because it did not believe one was necessary. Our Chief Executive Officer

may recommend compensation levels for executive officers (other than his own) to the Compensation Committee. The Compensation Committee

may form and delegate authority to subcommittees as appropriate and in accordance with applicable law, regulation and the Nasdaq rules.

————————————————————————————

EXECUTIVE COMPENSATION

————————————————————————————

Our executive compensation program

is designed to balance the goals of attracting and retaining talented executives who are motivated to achieve our annual and long-term

strategic goals while keeping the program affordable and appropriately aligned with shareholder interests. We believe that our executive

compensation program accomplishes these goals in a way that is consistent with our purpose and core values and the long-term interests

of the Company and its shareholders.

The following table sets forth

information concerning all cash and non-cash compensation awarded to, and earned by or paid to (i) all individuals serving as the Company’s

principal executive officers or acting in a similar capacity during the last two completed fiscal years, regardless of compensation level,

and (ii) the Company’s two most highly compensated executive officers other than the principal executive officer serving at the

end of the last two completed fiscal years (collectively, the “Named Executive Officers”).

Summary Compensation Table

| Name and Principal Position | |

Year | | |

Salary ($) | | |

Equity(1) Awards ($) | | |

Bonus ($) | | |

All Other Compensation ($) | | |

Total ($) | |

| William O’Dowd, IV, | |

| 2023 | | |

| 400,000 | | |

| — | | |

| — | | |

| 282,880 | (2) | |

| 682,880 | |

| Chairman and Chief Executive Officer | |

| 2022 | | |

| 400,000 | | |

| 1,951 | | |

| — | | |

| 282,878 | (3) | |

| 684,829 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Mirta A. Negrini, | |

| 2023 | | |

| 300,000 | | |

| — | | |

| — | | |

| — | | |

| 300,000 | |

| Chief Financial and Operating Officer | |

| 2022 | | |

| 300,000 | | |

| 1,951 | | |

| — | | |

| — | | |

| 301,951 | |

———————

| |

(1) |

Equity awards comprise 296 restricted stock units granted and vested in 2022 and no option awards. |

| |

(2) |

This amount includes life insurance in the amount of $20,380 and interest accrued on accrued and unpaid compensation in the amount of $262,500 (see Certain Relationship and Related Transactions). This amount does not include interest payments on promissory notes from related party transactions. |

| |

(3) |

This amount includes life insurance in the amount of $20,380 and interest accrued on accrued and unpaid compensation in the amount of $262,498 (see Certain Relationship and Related Transactions). This amount does not include interest payments on promissory notes from related party transactions. |

Employment Arrangements

Mirta A. Negrini. On October

21, 2013, we appointed Ms. Negrini as our Chief Financial and Operating Officer. The terms of Ms. Negrini’s employment arrangement

do not provide for any payments in connection with her resignation, retirement or other termination, or a change in control, or a change

in her responsibilities following a change in control. On March 1, 2024, the Compensation Committee of the Board approved an increase

in the base salary of Ms. Negrini from $300,000 to $325,000 per year. The increase was effective February 1, 2024.

Outstanding Equity Awards at Fiscal

Year-End

None of the Named Executive Officers

in the table above had any outstanding equity awards as of December 31, 2023 and December 31, 2022.

Director Compensation

During the year ended December

31, 2023, we did not pay compensation to any of our directors in connection with their service on our Board.

Information Concerning Executive

Officers

Biographical information with

respect to our current executive officers, Mr. O’Dowd and Ms. Negrini, is set forth above under “Proposal 1—Election

of Directors.”

2023 Pay versus Performance Table

and Supporting Narrative

The following table and supporting

narrative contain information regarding “compensation actually paid” to our named executive officers and the relationship

to company performance.

| Year |

|

Summary Compensation Table Total for PEO ($)(1) |

|

|

Compensation Actually Paid to PEO ($)(1) |

|

Average Summary Compensation Table Total for Non-PEO Named Executive Officers ($)(2) |

|

|

Average Compensation Actually Paid to Non-PEO Named Executive Officers ($)(2) |

|

|

Value of $100 fixed investment

_____________

Total Shareholder Return ($) |

|

|

Net Income ($mm) |

|

| 2023 |

|

$682,880 |

|

|

|

$682,880 |

|

$300,000 |

|

|

|

$300,000 |

|

|

|

$50 |

|

|

|

($22) |

|

| 2022 |

|

$684,829 |

|

|

|

$683,831 |

|

$301,951 |

|

|

|

$300,953 |

|

|

|

$53 |

|

|

|

($5) |

|

| 2021 |

|

$682,880 |

|

|

|

$682,880 |

|

$300,000 |

|

|

|

$300,000 |

|

|

|

$251 |

|

|

|

($6) |

|

| (1) | Reflects compensation for our Chief Executive Officer, William O’Dowd, IV, who served as our Principal Executive Officer (PEO)

in 2021, 2022 and 2023. |

| (2) | Reflects compensation for Mirta A. Negrini in 2021, 2022 and 2023, as shown in the Summary Compensation Table for each respective

year. |

| |

|

PEO – William O’Dowd, IV |

|

|

|

Other NEO Average |

| Adjustments |

|

2023 |

|

|

|

2022 |

2021 |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2021 |

|

| Summary Compensation Table Total |

|

$682,880 |

|

|

|

$684,829 |

$682,880 |

|

|

|

$300,000 |

|

|

|

$301,951 |

|

|

|

$300,000 |

|

| Deduction for amounts reported in “Equity Awards” column in the SCT for applicable FY |

|

$0 |

|

|

|

($1,951) |

$0 |

|

|

|

$0 |

|

|

|

($1,951) |

|

|

|

$0 |

|

| Addition of fair value at vesting date, of equity awards granted during the FY that vested during the FY |

|

$0 |

|

|

|

$953 |

$0 |

|

|

|

$0 |

|

|

|

$953 |

|

|

|

$0 |

|

| Compensation Actually Paid |

|

$682,880 |

|

|

|

$683,831 |

$682,880 |

|

|

|

$300,000 |

|

|

|

$300,953 |

|

|

|

$300,000 |

|

To calculate “compensation actually paid”

for our PEO and other NEOs the following adjustments were made to Summary Compensation Table total pay.

The equity awards included above comprise of restricted

share units granted in 2022. Measurement date equity fair values are calculated with assumptions derived on a basis consistent with those

used for grant date fair value purposes. Restricted stock units are valued based on the stock price on the relevant measurement date.

Compensation Actually Paid Versus Company Performance

The following charts provide a clear, visual description

of the relationships between “compensation actually paid to our PEO, and the average for our non-PEO NEO, to aspects of our financial

performance.

————————————————————————————

PROPOSAL 2—RATIFICATION OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

————————————————————————————

Introduction

The Audit Committee has appointed

Grant Thornton LLP (“GT”) to serve as our independent registered public accounting firm for the 2024 fiscal year. GT

has served as our independent registered public accounting firm since June 3, 2022. In connection with the appointment of GT, the Audit

Committee annually reviews and negotiates the terms of the engagement letter entered into with GT. This letter sets forth important terms

regarding the scope of the engagement, associated fees, payment terms and responsibilities of each party.

The Audit Committee believes that

the continued retention of GT as our independent registered public accounting firm is in the best interest of us and our shareholders,

and we are asking our shareholders to ratify the appointment of GT as our independent registered public accounting firm for 2024. Although

shareholder ratification of the selection and appointment of our independent registered public accounting firm is not required by our

Bylaws or otherwise, we are submitting such appointment to our shareholders for ratification because we value our shareholders’

views on our independent registered public accounting firm and as a matter of good corporate governance. The Audit Committee will consider

the outcome of our shareholders’ vote in connection with the Audit Committee’s appointment of our independent registered public

accounting firm in the next fiscal year but is not bound by the shareholders’ vote. Even if the selection is ratified, the Audit

Committee may, in its discretion, direct the appointment of a different independent registered public accounting firm at any time if it

determines that a change would be in the best interests of us and our shareholders.

We expect a representative of

GT to attend the Annual Meeting. The representative will have an opportunity to make a statement if he or she desires and will be available

to respond to appropriate questions.

Fees Paid to Our Independent Registered

Public Accounting Firm

The following table sets

forth the aggregate fees billed or expected to be billed to our Company for professional services rendered by our independent registered

public accounting firm, Grant Thornton LLP, for the fiscal years ended December 31, 2023 and December 31, 2022.

| |

|

Year Ended

12/31/2023 |

|

|

Year Ended

12/31/2022 |

|

| Audit Fees(1) |

|

$ |

771,750 |

|

|

$ |

776,000 |

|

| Audit-Related Fees(2) |

|

$ |

126,000 |

|

|

|

— |

|

| Tax Fees |

|

|

— |

|

|

|

— |

|

| All Other Fees |

|

|

— |

|

|

|

— |

|

| Total |

|

$ |

897,750 |

|

|

$ |

776,000 |

|

———————

| |

(1) |

Audit Fees— this category consists of fees billed or expected to be billed for professional services rendered for the audits of our financial statements, reviews of our interim financial statements included in quarterly reports, services performed in connection with regular filings with the Securities and Exchange Commission and other services that are normally provided by our independent registered public accounting firm for the fiscal years ended December 31, 2023 and December 31, 2022. |

| |

(2) |

Audit Related Fees - this category consists of fees billed or expected to be billed for audit related services performed by the independent registered public accounting firm that are not required by statute or regulation for the registrant itself. During the year ended December 31, 2023, these fees were related to the audits of Special Projects Media, LLC. |

Policy on Pre-Approval by Audit

Committee of Services Performed by Independent Registered Public Accounting Firm

The Audit Committee reviews, and

in its sole discretion pre-approves, our independent auditors’ annual engagement letter including proposed fees and all auditing

services provided by the independent auditors. Accordingly, our Audit Committee approved all services rendered by our independent registered

public accounting firm, Grant Thornton LLP, during fiscal year 2023, as described above. Our Audit Committee and Board has considered

the nature and amount of fees billed or expected to be billed by Grant Thornton LLP and believes that the provision of services for activities

unrelated to the audit was compatible with maintaining Grant Thornton LLP’s independence.

The Audit Committee has not implemented

a policy or procedure which delegates the authority to approve, or pre-approve, audit or permitted non-audit services to be performed

by Grant Thornton LLP. Our Board may not engage the independent auditors to perform the non-audit services proscribed by law or regulation.

Audit Committee Report

The Audit Committee oversees our accounting and financial

reporting processes on behalf of the Board. Management has primary responsibility for our financial statements, financial reporting process

and internal controls over financial reporting. The independent auditors are responsible for performing an independent audit of our financial

statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). The Audit Committee’s

responsibility is to select the independent auditors and monitor and oversee our accounting and financial reporting processes, including

our internal controls over financial reporting, and the audits of our financial statements.

In 2023, the Audit Committee met

and held discussions with management and the independent auditors. In the discussions related to our financial statements for fiscal year

2023, management represented to the Audit Committee that such financial statements were prepared in accordance with U.S. generally accepted

accounting principles. The Audit Committee reviewed and discussed with management the financial statements for fiscal year 2023. In fulfilling

its responsibilities, the Audit Committee discussed with the independent auditors those matters required to be discussed by the applicable

requirements of the Public Company Accounting Oversight Board (the “PCAOB”) and the Securities and Exchange Commission. In

addition, the Audit Committee received from the independent auditors the written disclosures and letter required by applicable requirements

of the PCAOB regarding the independent auditor’s communications with the Audit Committee concerning independence, and the Audit

Committee discussed with the independent auditors that firm’s independence.

Based upon the Audit Committee’s

discussions with management and the independent auditors and the Audit Committee’s review of the representations of management and

the written disclosures and letter of the independent auditors provided to the Audit Committee, the Audit Committee recommended to the

Board that the audited consolidated financial statements for the year ended December 31, 2023 be included in our 2023 annual report on

Form 10-K, for filing with the SEC.

The Audit Committee:

Michael Espensen

Nelson Famadas

Nicholas Stanham

The immediately preceding report

of the Audit Committee does not constitute soliciting material and should not be deemed filed or incorporated by reference into any of

previous filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent

that we specifically incorporate such report by reference.

Vote Required for Approval

Proposal 2 shall be approved if

a majority of votes present in person or represented by proxy and entitled to be cast are cast in favor of such action. Since Proposal

2 is considered a routine matter, brokers will have discretionary voting on this matter if they do not receive instructions Abstentions

and broker non-votes will not be treated as votes cast and will have no impact on Proposal 2.

Recommendation of the Board of

Directors

Our Board recommends a vote “FOR”

ratification of the appointment of GT as our independent registered public accounting firm for the year ending December 31, 2024.

PROPOSAL 3—APPROVAL OF AN

AMENDMENT TO THE ARTICLES OF INCORPORATION TO EFFECT REVERSE STOCK SPLIT

On July 29, 2024, our Board approved,

and directed that there be submitted to our shareholders for approval, a proposed amendment to the Articles of Incorporation to effect

a reverse stock split with respect to our issued and outstanding common stock (the “Reverse Stock Split”), to be effected

at such time and date, if at all, as determined by the Board in its sole discretion.

Effecting the Reverse Stock Split

requires that our Articles of Incorporation be amended. The text of the proposed amendment is set forth in Annex A to

this proxy statement and is incorporated by reference herein. By approving this proposal, shareholders would give the Board the authority,

but not the obligation, to file the Amendment to effect the Reverse Stock Split and full discretion to approve the ratio at

which shares of common stock will be reclassified with a ratio of 1-for-2. The amendment, once filed, will be effective upon the filing

of such amendment to the Articles of Incorporation in the form attached as Annex A with the Secretary of State of Florida with

such filing to occur, if at all, at the sole discretion of the Board.

Although the Reverse Stock Split

will not have any dilutive effect on our shareholders, the proportion of shares owned by our shareholders relative to the number of shares

authorized for issuance will decrease because the Reverse Stock Split does not change our current authorized number of shares of Common

Stock of 200,000,000. The remaining authorized shares of common stock may be used for various purposes, as described below. In order to

support our projected need for additional flexibility to raise capital as necessary, the Board believes that the number of authorized

shares of Common Stock should be maintained at 200,000,000.

Reasons for the Reverse Stock Split

The Board believes it would be

prudent and advisable to have the additional authorized shares of common stock available to provide additional flexibility regarding the

potential use of shares of Common Stock for business and financial purposes in the future. Having an increased number of authorized but

unissued shares of Common Stock would allow us to take prompt action with respect to corporate opportunities that develop, without the

delay and expense of convening a special meeting of shareholders for the purpose of approving an increase in our authorized shares.

The additional shares could be

used for various purposes without further shareholder approval. These purposes may include: (i) raising capital, if we have an appropriate

opportunity, through offerings of Common Stock or securities that are convertible into Common Stock; (ii) expanding our business through

potential strategic transactions, including mergers, acquisitions, and other business combinations or acquisitions of new technologies

or products; (iii) establishing strategic relationships with other companies; (iv) exchanges of Common Stock or securities that are convertible

into Common Stock for other outstanding securities; (v) providing equity incentives to attract and retain employees, officers or directors;

and (vi) other purposes. We do not currently have any plans, proposals or arrangements to issue any of the newly available authorized

shares for any purposes.

In addition, we believe that the

low per share market price of our common stock impairs its marketability to and acceptance by institutional investors and other members

of the investing public and could create a negative impression of the Company. Theoretically, decreasing the number of shares of common

stock outstanding should not, by itself, affect the marketability of the shares, the type of investor who would be interested in acquiring

them, or our reputation in the financial community. In practice, however, many investors, brokerage firms and market makers consider low-priced

stocks as unduly speculative in nature and, as a matter of policy, avoid investment and trading in such stocks. Moreover, the analysts

at many brokerage firms do not monitor the trading activity or otherwise provide coverage of lower priced stocks. The presence of these

factors may be adversely affecting, and may continue to adversely affect, not only the pricing of our common stock but also its trading

liquidity. In addition, these factors may affect our ability to raise additional capital through the sale of stock.

Potential Effects of the Reverse

Stock Split

By approving this proposal, shareholders

will approve the combination of two (2) shares of common stock into one (1) share. Except for de minimus adjustments that may result

from the treatment of fractional shares as described below, the Reverse Stock Split will not have any dilutive effect on our shareholders

since each shareholder would hold the same percentage of our common stock outstanding immediately following the Reverse Stock Split as

such shareholder held immediately prior to the Reverse Stock Split. The relative voting and other rights that accompany the shares of

common stock would not be affected by the Reverse Stock Split. The Reverse Stock Split, without the concurrent decrease of the authorized

shares of common stock, will give our Board authority to issue additional shares than it would have been able to issue before the Reverse

Stock Split from time to time without delay or further action by the shareholders except as may be required by applicable law or the rules

of the Nasdaq Capital Market.

Although our Board believes that

the decrease in the number of shares of our common stock outstanding as a consequence of the Reverse Stock Split and any consequent increase

in the market price of our common stock could encourage interest in our common stock and possibly promote greater liquidity for our shareholders,

such liquidity could also be adversely affected by the reduced number of shares outstanding after the Reverse Stock Split.

The Reverse Stock Split will

be effected simultaneously for all issued and outstanding shares of common stock and the exchange ratio will be the same for all issued

and outstanding shares of common stock. The Reverse Stock Split will affect all of our shareholders uniformly and will not affect

any shareholder’s percentage ownership interests in the Company, except for immaterial adjustments that may result from the

treatment of fractional shares. Common stock issued pursuant to the Reverse Stock Split will remain fully paid and non-assessable.

The Reverse Stock Split will not affect the Company’s continuing obligations under the periodic reporting requirements

of the Securities Exchange Act. Following the Reverse Stock Split, our common stock will continue to be listed on The Nasdaq

Capital Market, under the symbol “DLPN,” although it would receive a new CUSIP number.

Upon effectiveness of the Reverse

Stock Split, the number of authorized shares of common stock that are not issued or outstanding will increase substantially, because the

proposed amendment will not reduce the number of authorized shares, while it will reduce the number of outstanding shares by a factor

of two (2). This will increase the number of shareholders who hold less than a “round lot,” or 100 shares. This has two

disadvantages. First, the Exchange requires that we have a certain number of round lot shareholders to continue to be listed. Second,

the transaction costs to shareholders selling “odd lots” are typically higher on a per share basis. Consequently, the Reverse

Stock Split could increase the transaction costs to existing shareholders in the event they wish to sell all or a portion of their position.

The shares that are authorized

but unissued after the Reverse Stock Split will be available for issuance, and, if we issue these shares, the ownership interest

of holders of our common stock may be diluted. The number of shares of our common stock that may be purchased upon exercise of outstanding

options or other securities convertible into, or exercisable or exchangeable for, shares of our common stock, and the exercise or conversion

prices for these securities, will also be ratably adjusted in accordance with their terms upon effectiveness. We may issue such shares

to raise capital and/or as consideration in acquiring other businesses or establishing strategic relationships with other companies. Such

acquisitions or strategic relationships may be effected using shares of common stock or other securities convertible into common stock

and/or by using capital that may need to be raised by selling such securities.

Implementation of the Reverse Stock

Split

Following shareholder approval

of this proposal, the Reverse Stock Split would be implemented, if at all, by the filing of the amendment to the Articles of Incorporation

with the Secretary of State of the State of Florida (such time of filing, the “Effective Time”). Upon the filing of

the amendment, without further action on our part or our shareholders, the outstanding shares of common stock held by shareholders of

record as of the Effective Time would be converted into a lesser number of shares of common stock based on a Reverse Stock Split ratio

as determined by the Board. However, at any time prior to the effectiveness of the filing of the Amendment with the Secretary of State

of the State of the State of Florida, the Board reserves the right to abandon this proposal and to not file the amendment, even if approved

by the shareholders of the Corporation, if the Board, in its discretion, determines that such amendment is no longer in the best interests

of the Corporation or its shareholders.

Effect on Authorized but Unissued

Shares of Capital Stock

Currently, we are authorized to

issue up to a total of 200,000,000 shares of common stock, of which 22,119,016 shares were issued and outstanding as of the Record Date,

and 10,000,000 shares of preferred stock, of which 50,000 were issued and outstanding as of the Record Date. The Reverse Stock Split,

if approved and effected, will not have any effect on the authorized number of shares of our common stock or preferred stock.

Fractional Shares

No fractional shares will be issued

in connection with the Reverse Stock Split. Instead, the fractional shares of common stock created as a result of the Reverse Stock

Split shall be rounded up to the next whole number such that in lieu of fractional shares, each shareholder who would have otherwise been

entitled to receive a fractional share of common stock shall instead receive a whole share of common stock as a result of the Reverse

Stock Split. Each holder of common stock will hold the same percentage of the outstanding common stock immediately following the Reverse

Stock Split as that shareholder did immediately before the Reverse Stock Split, except for adjustments due to fractional

shares.

Certificated Shares

If a Reverse Stock Split is effectuated,

shareholders holding certificated shares (i.e., shares represented by one or more physical share certificates) will receive a transmittal

letter from the Company’s transfer agent promptly after the effectiveness of a Reverse Stock Split. The transmittal letter will

be accompanied by instructions specifying how shareholders holding certificated shares can exchange certificates representing the pre-split

shares for a statement of holding.

Beginning after the effectiveness

of the Reverse Stock Split, each certificate representing pre-split shares will be deemed for all corporate purposes to evidence ownership

of post-split common stock.

SHAREHOLDERS SHOULD NOT DESTROY

ANY PRE-SPLIT STOCK CERTIFICATE AND SHOULD NOT SUBMIT ANY CERTIFICATES UNTIL THEY ARE REQUESTED TO DO SO.

Accounting Matters

As of the Effective Time, the

stated capital attributable to common stock on our balance sheet will be reduced proportionately based on the Reverse Stock Split ratio

(including a retroactive adjustment of prior periods), and the additional paid-in capital account will be credited with the amount by

which the stated capital is reduced. Reported per share net income or loss will be higher because there will be fewer shares of our common

stock outstanding.

United States Federal Income

Tax Consequences of the Reverse Stock Split

The following summary describes

certain material U.S. federal income tax consequences of the Reverse Stock Split to holders of our common stock. This summary addresses

the tax consequences only to a beneficial owner of our common stock that is a citizen or individual resident of the United States, a corporation

organized in or under the laws of the United States or any state thereof or the District of Columbia or otherwise subject to U.S. federal

income taxation on a net income basis in respect of our common stock (a “U.S. holder”). This summary does not address

all of the tax consequences that may be relevant to any particular shareholder, including tax considerations that arise from rules of

general application to all taxpayers or to certain classes of taxpayers or that are generally assumed to be known by investors. This summary

also does not address the tax consequences to persons that may be subject to special treatment under U.S. federal income tax law or persons

that do not hold our common stock as “capital assets” (generally, property held for investment). This summary is based on

the provisions of the Internal Revenue Code of 1986, as amended, U.S. Treasury regulations, administrative rulings and judicial authority,

all as in effect as of the date hereof. Subsequent developments in U.S. federal income tax law, including changes in law or differing

interpretations, which may be applied retroactively, could have a material effect on the U.S. federal income tax consequences of the Reverse

Stock Split. Each shareholder should consult his, her or its own tax advisor regarding the U.S. federal, state, local and foreign

income and other tax consequences of the Reverse Stock Split.

If a partnership (or other entity

classified as a partnership for U.S. federal income tax purposes) is the beneficial owner of our common stock, the U.S. federal income

tax treatment of a partner in the partnership will generally depend on the status of the partner and the activities of the partnership.

Partnerships that hold our common stock, and partners in such partnerships, should consult their own tax advisors regarding the U.S. federal

income tax consequences of the Reverse Stock Split.

The Reverse Stock Split should

be treated as a recapitalization for U.S. federal income tax purposes. Therefore, no gain or loss should be recognized by a U.S. holder

upon the Reverse Stock Split. Accordingly, the aggregate tax basis in the common stock received pursuant to the Reverse Stock Split should

equal the aggregate tax basis in the common stock surrendered and the holding period for the common stock received should include the

holding period for the common stock surrendered.

Risks Associated with the Reverse

Stock Split

We cannot predict whether the Reverse

Stock Split will increase the market price for our common stock. The history of similar stock split combinations for companies in

like circumstances is varied, and the market price of our common stock will also be based on our performance and other factors, some of

which are unrelated to the number of shares outstanding. Further, there are a number of risks associated with the Reverse Stock Split,

including:

| · | The market price per share of our shares of common stock post-Reverse Stock Split may not remain

in excess of the $1.00 minimum bid price per share as required by Nasdaq, or the Company may fail to meet the other requirements for continued

listing on Nasdaq, resulting in the delisting of our common stock. |

| · | Although the Board believes that a higher stock price may help generate the interest of new investors,

the Reverse Stock Split may not result in a per-share price that will successfully attract certain types of investors and

such resulting share price may not satisfy the investing guidelines of institutional investors or investment funds. Further, other factors,

such as our financial results, market conditions and the market perception of our business, may adversely affect the interest of new investors

in the shares of our common stock. As a result, the trading liquidity of the shares of our common stock may not improve as a result of

the Reverse Stock Split and there can be no assurance that the Reverse Stock Split, if completed, will result in the intended

benefits. |

| · | The Reverse Stock Split could be viewed negatively by the market and other factors, such as

those described above, may adversely affect the market price of the shares of our common stock. Consequently, the market price per share

post-Reverse Stock Split may not increase in proportion to the reduction of the number of shares of our common stock outstanding

before the implementation of the Reverse Stock Split. Accordingly, the total market capitalization of our shares of common stock

after the Reverse Stock Split may be lower than the total market capitalization before the Reverse Stock Split. Any reduction

in total market capitalization as the result of the Reverse Stock Split may make it more difficult for us to meet the Nasdaq

Listing Rule regarding minimum value of listed securities, which could result in our shares of common stock being delisted from The Nasdaq

Capital Market. |

| · | As mentioned above, the Reverse Stock Split may result in some shareholders owning “odd

lots” of less than 100 shares of common stock. Odd lot shares may be more difficult to sell, and brokerage commissions and

other costs of transactions in odd lots are generally somewhat higher than the costs of transactions in “round lots” of even

multiples of 100 shares. |

Vote Required for Approval

Proposal 3 shall be approved if

a majority of votes entitled to be cast are cast in favor of such action. Since Proposal 3 is considered a routine matter, brokers will

have discretionary voting on this matter if they do not receive instructions. Abstentions and broker non-votes will have the same effect

as votes against Proposal 3.

Recommendation of the Board of

Directors

The Board recommends a vote “FOR”

the proposal to amend the Articles of Incorporation to effect the Reverse Stock Split.

PROPOSAL 4—APPROVAL OF AN

AMENDMENT TO THE ARTICLES OF INCORPORATION TO INCREASE THE NUMBER OF VOTES UNDERLYING THE SERIES C CONVERTIBLE PREFERRED STOCK

————————————————————————————

On July 29, 2024, our Board approved,

and directed that there be submitted to our shareholders for approval, a proposed amendment to the terms of the Series C Convertible Preferred

Stock (the “Series C”) included in our Articles of Incorporation to increase the number of votes per share of common

stock the Series C is convertible into from five votes per share to ten votes per share. The text of the proposed amendment is set forth