false0000897448AMARIN CORP PLCUK00-000000000008974482024-07-252024-07-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): July 25, 2024

Amarin Corporation plc

(Exact name of registrant as specified in its charter)

|

|

|

|

|

England and Wales |

|

0-21392 |

|

Not applicable |

(State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

|

|

|

Iconic Offices, The Greenway, Block C Ardilaun Court, 112-114 St Stephens Green, Dublin 2, Ireland |

|

Not applicable |

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: + 353 (0) 1 6699 020

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading

Symbol |

|

Name of each exchange

on which registered |

American Depositary Shares (ADS(s)), each ADS representing the right to receive one (1) Ordinary Share of Amarin Corporation plc |

|

AMRN |

|

NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

As previously disclosed, on June 3, 2024, Amarin Corporation plc (the “Company”) announced that Aaron Berg was appointed to the role of President and Chief Executive Officer (and principal executive officer) of the Company, effective June 4, 2024 (the “CEO Start Date”). In addition, Mr. Berg was also appointed as a member of the Company’s board of directors (the “Board”), effective as of the CEO Start Date.

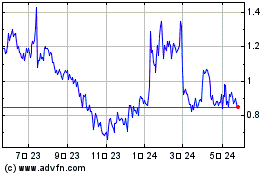

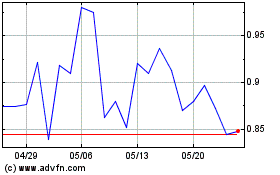

In connection with his appointment as President and Chief Executive Officer, Mr. Berg entered into an employment agreement with the Company, dated July 25, 2024 (the “CEO Employment Agreement”), which provides that, effective as of the CEO Start Date, Mr. Berg’s annual base salary will be $700,000 and he will have the potential to earn cash incentive compensation as determined in the sole discretion of the Board or the Remuneration Committee of the Board. In connection with his appointment, Mr. Berg will be granted a performance-based stock option to purchase 5,000,000 shares (the “Option Award”) pursuant to the Amarin Corporation plc 2020 Stock Incentive Plan, as amended (the “Plan”) and the form of Option Award agreement attached to the CEO Employment Agreement (the “Option Award Agreement”). The Option Award is earned based upon the achievement of share price hurdles ranging from $1.25 to $10.00 and the earned option shares are subject to five months of further time-based vesting once a share price hurdle has been achieved. For each share price hurdle to be achieved, the volume weighted average price of the shares over a 60 calendar-day period must equal or exceed the applicable share price hurdle. The Option Award will have an exercise price equal to the closing price of the Company’s American Depository Shares on the NASDAQ Capital Market on the date of grant, which is expected to be August 1, 2024. The Option Award is subject to acceleration and a clawback in certain circumstances in accordance with the terms of the Option Award Agreement. Pursuant to the CEO Employment Agreement, Mr. Berg has also agreed to purchase $100,000 worth of the Company’s shares using his personal funds.

The CEO Employment Agreement provides that, if Mr. Berg’s employment is terminated by the Company without cause or if Mr. Berg resigns for good reason, in either case outside of the Change in Control Period (as defined below), Mr. Berg will be eligible to receive the following severance benefits, subject to his execution and the effectiveness of a separation agreement, including, among other things, a general release of claims in favor of the Company (the “Separation Agreement”): (i) an amount equal to 18 months of his base salary, to be paid in equal installments over the course of 18 months following the date of termination, (ii) an amount equal to 0.975 times his base salary, to be paid in a lump sum, and (iii) subject to Mr. Berg’s copayment of premium amounts at the applicable active employees’ rate and proper election to continue COBRA health coverage, payment of the portion of the premiums equal to the amount that the Company would have paid to provide health insurance to Mr. Berg had he remained employed until the earliest of (A) 18 months following termination, (B) Mr. Berg’s eligibility for group medical plan benefits under any other employer’s group medical plan or (C) the end of Mr. Berg’s COBRA health continuation period (the “COBRA Coverage”). The CEO Employment Agreement also provides that if Mr. Berg’s employment is terminated by the Company without cause or Mr. Berg resigns for good reason in either case within the 24-month period following a change in control (the “Change in Control Period”), Mr. Berg will be eligible to receive the following severance benefits, subject to his execution and the effectiveness of a Separation Agreement: (i) an amount equal to 3.3 times his base salary, to be paid in a lump sum, and (ii) the COBRA Coverage.

The foregoing descriptions of the CEO Employment Agreement and the Option Award are only summaries and are qualified in their entirety by reference to the CEO Employment Agreement and the Option Award Agreement, which are filed as Exhibits 10.1 and 10.2, respectively, and are incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

*Certain confidential portions omitted via redaction from this Exhibit.

* * *

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Date: July 29, 2024 |

|

|

|

Amarin Corporation plc |

|

|

|

|

|

|

|

|

By: |

|

/s/ Jonathan Provoost |

|

|

|

|

|

|

Jonathan Provoost |

|

|

|

|

|

|

Executive Vice President, Chief Legal & Compliance Officer & Secretary |

Exhibit 10.1

EMPLOYMENT AGREEMENT

This Employment Agreement (“Agreement”) is made as of this 25 day of July, 2024 (the “Effective Date”), between Amarin Corporation plc, (the “Company”) and Aaron D. Berg (the “Executive”).

Payments and benefits to the Executive under this Agreement may be satisfied by a subsidiary or affiliate of the Company.

WHEREAS, the Company desires to continue to employ the Executive and the Executive desires to continue to be employed by the Company, on the terms and conditions contained herein.

NOW, THEREFORE, in consideration of the mutual covenants and agreements herein contained and other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the parties agree as follows:

(a)Term. The Company shall employ the Executive and the Executive shall be employed by the Company pursuant to this Agreement commencing as of June 4, 2024 and continuing until such employment is terminated in accordance with the provisions hereof (the “Term”). The Executive’s employment with the Company shall be “at will,” meaning that the Executive’s employment may be terminated by the Company or the Executive at any time and for any reason subject to the terms of this Agreement.

(b)Position and Duties. The Executive shall serve as the President and Chief Executive Officer (“CEO”) of the Company and shall have such powers and duties as may from time to time be prescribed by the Company’s Board of Directors (the “Board”). In addition, the Company shall cause the Executive to be nominated for election to the Board and to be recommended to the shareholders for election to the Board as long as the Executive remains the CEO; provided that the Executive shall be deemed to have resigned from the Board and from any related positions upon ceasing to serve as CEO for any reason. The Executive shall devote the Executive’s full working time and efforts to the business and affairs of the Company. Notwithstanding the foregoing, the Executive may serve on other boards of directors, with the reasonable approval of the Board, or engage in religious, charitable or other community activities as long as such services and activities do not interfere with the Executive’s performance of the Executive’s duties to the Company. In addition to the Executive’s role as CEO, the Executive acknowledges and agrees that he may be required, without additional compensation, to perform duties for certain affiliated entities of the Company, including, without limitation, Amarin Pharma, Inc., and to accept any reasonable office or position with any such affiliate as the Board may require, including, but not limited to, service as an officer or director of any such affiliate, provided, however, that such duties and obligations to the Company’s affiliates do not unduly burden or interfere with the Executive’s performance as CEO of the Company. The Company shall maintain a director and officer policy (“D&O Policy”) and the Executive shall be covered under the Company’s D&O policy.

2.Location. The Executive’s principal place of employment will be the Company’s

U.S headquarters, which are currently located in Bridgewater, New Jersey, but the Executive

understands that he will be required to travel frequently for business, including to the Company’s Irish headquarters, which are currently located in Dublin, Ireland, as well as to other locations in Europe and other parts of the world. Any change to the location of the Executive’s principal place of employment must be approved in advance by the Board. The Executive shall be reimbursed for all business travel, subject to the Company’s policies and procedures then in effect and established

by the Company for its U.S. executives.

3.Compensation and Related Matters.

(a)Base Salary. The Executive’s initial base salary shall be paid at the rate of

$700,000 per year. The Executive’s base salary shall be subject to periodic review by the Board or the Remuneration Committee of the Board (the “Remuneration Committee”). The Remuneration Committee may increase but not decrease the Executive’s Base Salary. The base salary in effect at any given time is referred to herein as “Base Salary.” The Base Salary shall be payable in a manner that is consistent with the Company’s usual payroll practices for its executive officers.

(b)Incentive Compensation. The Executive shall be eligible to receive cash incentive compensation as determined by the Board or the Remuneration Committee from time to time. The actual amount of the Executive’s cash incentive compensation, if any, shall be determined in the sole discretion of the Board or the Remuneration Committee, and may be further subject to the terms of any applicable incentive compensation plan that may be in effect from time to time. Except as may be provided by the Board or the Remuneration Committee, or as may otherwise be set forth in the applicable incentive compensation plan or this Agreement, the Executive must be employed by the Company on the date such cash incentive compensation is paid in order to earn or receive any cash incentive compensation.

(c)Expenses. The Executive shall be entitled to receive prompt reimbursement for all reasonable expenses (including, for the avoidance of doubt, all reasonable travel expenses incurred consistent with the policies and procedures then in effect and established by the Company for its U.S. executives) incurred by the Executive during the Term in performing services hereunder, in accordance with the policies and procedures then in effect and established by the Company for its U.S. executives.

(d)Other Benefits. The Executive shall be eligible to participate in or receive benefits under the Company’s employee benefit plans in effect from time to time, subject to the terms of such plans.

(e)Paid Time Off. The Executive shall be entitled to take paid time off in accordance with the Company’s applicable paid time off policy for its U.S. executives, as may be in effect from time to time.

(f)Equity. In connection with the commencement of the Executive’s employment as CEO and subject to the approval of the Board or the Remuneration Committee, the Company shall grant the Executive a stock option to purchase Five Million (5,000,000) of the Company’s Ordinary Shares or American Depositary Shares, representing ordinary shares of the Company, issued under the Company’s American Depositary Receipt facility (“Shares”), subject to performance-based vesting terms as set forth in the award agreement attached hereto as Exhibit

A under the Amarin Corporation plc 2020 Stock Incentive Plan (the “Plan” and, together with the award agreement, the “Equity Documents”) and with an exercise price per share equal to the closing price of a Share on the Nasdaq Global Market on the date of grant (or if no closing market price is reported for such date, the closing market price on the immediately preceding date for which a closing market price is reported) (the “Option”).

(g)Equity Commitment. The Executive desires to evidence his commitment and support for the Company by purchasing equity in the Company, without any present intention to transfer or otherwise transact in such equity, and the Company desires to accommodate this commitment. As such, promptly following the Executive’s and the Company’s execution of this Agreement (and in any event promptly following the start of the Company’s next open trading

window under its insider trading policy and special trading procedures for insiders), the Executive will purchase for cash approximately $100,000 of American Depository Shares of the Company in an open market transaction at market pricing.

4.Termination. The Executive’s employment hereunder may be terminated without any breach of this Agreement under the following circumstances:

(a)Death. The Executive’s employment hereunder shall terminate upon death.

(b)Disability. The Company may terminate the Executive’s employment if the Executive is disabled and unable to perform or expected to be unable to perform the essential functions of the Executive’s then existing position or positions under this Agreement with or without reasonable accommodation for a period of 180 days (which need not be consecutive) in any 12-month period. If any question shall arise as to whether during any period the Executive is disabled so as to be unable to perform the essential functions of the Executive’s then existing position or positions with or without reasonable accommodation, the Executive may, and at the request of the Company shall, submit to the Company a certification in reasonable detail by a physician selected by the Company to whom the Executive or the Executive’s guardian has no reasonable objection as to whether the Executive is so disabled or how long such disability is expected to continue, and such certification shall for the purposes of this Agreement be conclusive of the issue. The Executive shall cooperate with any reasonable request of the physician in connection with such certification. If such question shall arise and the Executive shall fail to submit such certification, the Company’s determination of such issue shall be binding on the Executive. Nothing in this Section 4(b) shall be construed to waive the Executive’s rights, if any, under existing law including, without limitation, the Family and Medical Leave Act of 1993, 29 U.S.C.

§2601 et seq. and the Americans with Disabilities Act, 42 U.S.C. §12101 et seq.

(c)Termination by the Company for Cause. The Company may terminate the Executive’s employment hereunder for Cause. For purposes of this Agreement, “Cause” means and shall be limited to: (i) conduct constituting an act of material misconduct in connection with the performance of the Executive’s duties, including, without limitation, misappropriation of funds or property of the Company other than the occasional, customary and de minimis use of Company property for personal purposes; (ii) the commission by the Executive of (A) any felony; or (B) a misdemeanor involving moral turpitude, deceit, dishonesty or fraud; (iii) any conduct of the Executive that would reasonably be expected to result in material injury or material reputational harm to the Company or any of its subsidiaries and affiliates if the Executive was retained; (iv)

prior to a Change of Control, the Executive’s continued non-performance; (v) a breach by the Executive of any of the material provisions of any agreement between the Executive and the Company, including, without limitation, any agreement relating to non-disclosure, non- competition or assignment of inventions; and (vi) a material violation by the Executive of the Company’s written policies or procedures provided that, other than in the case of noncurable events, the Executive shall be provided written notice and fifteen (15) days to cure.

(d)Termination by the Company without Cause. The Company may terminate the Executive’s employment hereunder at any time without Cause. Any termination by the Company of the Executive’s employment under this Agreement which does not constitute a termination for Cause under Section 4(c) and does not result from the death or disability of the Executive under Section 4(a) or (b) shall be deemed a termination without Cause.

(e)Termination by the Executive. The Executive may terminate employment hereunder at any time for any reason, including but not limited to, Good Reason. For purposes of this Agreement, “Good Reason” shall mean that the Executive has completed all steps of the Good Reason Process (hereinafter defined) following the occurrence of any of the following events without the Executive’s consent (each, a “Good Reason Condition”):

(i)a material diminution in the Executive’s responsibilities, authority

or duties;

(ii)a material diminution in the Executive’s Base Salary except for

across-the-board salary reductions based on the Company’s financial performance similarly affecting all or substantially all C-level and executive/senior management employees of the Company (for clarity, 5% or more diminution shall be deemed material);

(iii)a requirement by the Company that the Executive change the principal location where the Executive is required to provide services for the Company (not including business travel and short-term assignments) by more than 50 miles; or

(iv)a material breach of this Agreement by the Company. The “Good Reason Process” consists of the following steps:

(i)the Executive reasonably determines in good faith that a Good Reason Condition has occurred;

(ii)the Executive notifies the Company in writing of the first occurrence of the Good Reason Condition within 30 days of the first occurrence of such condition;

(iii)notwithstanding such efforts, the Good Reason Condition continues to exist at the end of the Cure Period; and

(iv)the Executive terminates employment within 30 days after the end of the Cure Period.

The Company shall have 30 days (“Cure Period”) from delivery of the Executive’s notice of the existence of a Good Reason Condition to cure such breached Good Reason Condition. If the Company cures the Good Reason Condition during the Cure Period, Good Reason shall be deemed not to have occurred.

5.Matters Related to Termination.

(a)Notice of Termination. Except for termination as specified in Section 4(a), any termination of the Executive’s employment by the Company or any such termination by the Executive shall be communicated by written Notice of Termination to the other party hereto. For purposes of this Agreement, a “Notice of Termination” shall mean a notice that indicates the specific termination provision in this Agreement relied upon.

(b)Date of Termination. “Date of Termination” shall mean: (i) if the Executive’s employment is terminated by death, the date of death; (ii) if the Executive’s employment is terminated on account of disability under Section 4(b) or by the Company for Cause under Section 4(c), the date on which Notice of Termination is given, provided, however, that the Company has, prior to the issuance of the Notice of Termination pursuant to Section 4(c), delivered written notice and provided the Executive with an opportunity to cure and such breach has not been cured within such 30 day cure period; (iii) if the Executive’s employment is terminated by the Company without Cause under Section 4(d), the date on which a Notice of Termination is given or the date otherwise specified by the Company in the Notice of Termination; (iv) if the Executive’s employment is terminated by the Executive under Section 4(e) other than for Good Reason, 30 days after the date on which a Notice of Termination is given; and (v) if the Executive’s employment is terminated by the Executive under Section 4(e) for Good Reason, the date on which a Notice of Termination is given after the end of the Cure Period. Notwithstanding the foregoing, in the event that the Executive gives a Notice of Termination to the Company, the Company may unilaterally accelerate the Date of Termination and such acceleration shall not result in a termination by the Company for

purposes of this Agreement.

(c)Accrued Obligations. If the Executive’s employment with the Company is terminated for any reason, the Company shall pay or provide to the Executive (or to the Executive’s authorized representative or estate) (i) any Base Salary earned through the Date of Termination and, if applicable, any accrued but unused vacation through the Date of Termination; (ii) unpaid expense reimbursements (subject to, and in accordance with, Section 3(c) of this Agreement); and

(iii) any vested benefits the Executive may have under any employee benefit plan of the Company through the Date of Termination, which vested benefits shall be paid and/or provided in accordance with the terms of such employee benefit plans (collectively, the “Accrued Obligations”).

(d)Resignation of All Other Positions. To the extent applicable, the Executive shall be deemed to have resigned from all officer and board member positions that the Executive holds with the Company or any of its subsidiaries and affiliates upon the termination of the Executive’s employment for any reason. The Executive shall execute any documents in reasonable form as may be requested to confirm or effectuate any such resignations.

6.Severance Pay and Benefits Upon Termination by the Company without Cause or by the Executive for Good Reason Outside the Change of Control Period. If the Executive’s

employment is terminated by the Company without Cause as provided in Section 4(d), or the Executive terminates employment for Good Reason as provided in Section 4(e), in each case outside of the Change of Control Period (as defined below), then, in addition to the Accrued Obligations, and subject to (i) the Executive signing a separation agreement and release in a form and manner reasonably satisfactory to the Company, which shall include, without limitation, a general release of claims against the Company and all related persons and entities that shall not release the Executive’s rights under this Agreement or the Award Agreement, a reaffirmation of all of the Executive’s Continuing Obligations (as defined below), and, in the Company’s sole discretion, a one-year post-employment noncompetition agreement, and shall provide that if the Executive breaches any of the Continuing Obligations, all payments of the Severance Amount shall immediately cease (the “Separation Agreement”), and (ii) the Separation Agreement becoming irrevocable, all within 60 days after the Date of Termination (or such shorter period as set forth in the Separation Agreement):

(a)the Company shall pay the Executive an amount equal to the sum of 18 months of the Executive’s Base Salary (the “Severance Amount”); and

(b)the Company shall pay the Executive a lump sum in cash in an amount equal to .975 times the Executive’s Base Salary; and

(c)subject to the Executive’s copayment of premium amounts at the applicable active employees’ rate and the Executive’s proper election to receive benefits under the Consolidated Omnibus Budget Reconciliation Act of 1985, as amended (“COBRA”), the Company shall pay to the group health plan provider or the COBRA provider a monthly payment equal to the monthly employer contribution that the Company would have made to provide health insurance to the Executive if the Executive had remained employed by the Company until the earliest of (A) the 18-month anniversary of the Date of Termination; (B) the date that the Executive becomes eligible for group medical plan benefits under any other employer’s group medical plan; or (C) the cessation of the Executive’s health continuation rights under COBRA; provided, however, that if the Company determines that it cannot pay such amounts to the group health plan provider or the COBRA provider (if applicable) without potentially violating applicable law (including, without limitation, Section 2716 of the Public Health Service Act), then the Company shall convert such payments to payroll payments directly to the Executive for the time period specified above. Such payments to the Executive shall be subject to tax-related deductions and withholdings and paid on the Company’s regular payroll dates.

The amounts payable under this Section 6, to the extent taxable, shall be paid out in substantially equal installments in accordance with the Company’s payroll practice over 18 months commencing within 60 days after the Date of Termination; provided, however, that if the 60-day period begins in one calendar year and ends in a second calendar year, such payments, to the extent they qualify as “non-qualified deferred compensation” within the meaning of Section 409A of the Internal Revenue Code of 1986, as amended (the “Code”), shall begin to be paid in the second calendar year by the last day of such 60-day period; provided, further, that the initial payment shall include a catch-up payment to cover amounts retroactive to the day immediately following the Date of Termination. Each payment pursuant to this Agreement is intended to constitute a separate payment for purposes of Treasury Regulation Section 1.409A-2(b)(2).

7.Severance Pay and Benefits Upon Termination by the Company without Cause or by the Executive for Good Reason within the Change of Control Period. The provisions of this Section 7 shall apply in lieu of, and expressly supersede, the provisions of Section 6 if (i) the Executive’s employment is terminated either (a) by the Company without Cause as provided in Section 4(d), or (b) by the Executive for Good Reason as provided in Section 4(e), and (ii) the Date of Termination is within the Change of Control Period. These provisions shall terminate and be of no further force or effect after the Change of Control Period.

(a)If the Executive’s employment is terminated by the Company without Cause as provided in Section 4(d) or the Executive terminates employment for Good Reason as provided in Section 4(e) and in each case the Date of Termination occurs within the Change of Control Period, then, in addition to the Accrued Obligations, and subject to the signing of the Separation Agreement by the Executive and the Separation Agreement becoming fully effective, all within the time frame set forth in the Separation Agreement but in no event more than 60 days after the Date of Termination:

(i)the Company shall pay the Executive a lump sum in cash in an amount equal to 3.3 times the Executive’s Base Salary; and

(ii)subject to the Executive’s copayment of premium amounts at the applicable active employees’ rate and the Executive’s proper election to receive benefits under COBRA, the Company shall pay to the group health plan provider or the COBRA provider a monthly payment equal to the monthly employer contribution that the Company would have made to provide health insurance to the Executive if the Executive had remained employed by the Company until the earliest of (A) the 18-month anniversary of the Date of Termination; (B) the date that the Executive becomes eligible for group medical plan benefits under any other employer’s group medical plan; or (C) the cessation of the Executive’s health continuation rights under COBRA; provided, however, that if the Company determines that it cannot pay such amounts to the group health plan provider or the COBRA provider (if applicable) without potentially violating applicable law (including, without limitation, Section 2716 of the Public Health Service Act), then the Company shall convert such payments to payroll payments directly to the Executive for the time period specified above. Such payments to the Executive shall be subject to tax- related deductions and withholdings and paid on the Company’s regular payroll dates.

The amounts payable under this Section 7(a), to the extent taxable, shall be paid or commence to be paid within 60 days after the Date of Termination; provided, however, that if the 60-day period begins in one calendar year and ends in a second calendar year, such payments to the extent they qualify as “non-qualified deferred compensation” within the meaning of Section 409A of the Code, shall be paid or commence to be paid in the second calendar year by the last day of such 60- day period.

(b)Additional Limitation.

(i)Anything in this Agreement to the contrary notwithstanding, in the event that the amount of any compensation, payment or distribution by the Company to or for the benefit of the Executive, whether paid or payable or distributed or distributable

pursuant to the terms of this Agreement or otherwise, calculated in a manner consistent with Section 280G of the Code, and the applicable regulations thereunder (the “Aggregate Payments”), would be subject to the excise tax imposed by Section 4999 of the Code, then the Aggregate Payments shall be reduced (but not below zero) so that the sum of all of the Aggregate Payments shall be $1.00 less than the amount at which the Executive becomes subject to the excise tax imposed by Section 4999 of the Code; provided that such reduction shall only occur if it would result in the Executive receiving a higher After Tax Amount (as defined below) than the Executive would receive if the Aggregate Payments were not subject to such reduction. In such event, the Aggregate Payments shall be reduced in the following order, in each case, in reverse chronological order beginning with the Aggregate Payments that are to be paid the furthest in time from consummation of the transaction that is subject to Section 280G of the Code: (1) cash payments not subject to Section 409A of the Code; (2) cash payments subject to Section 409A of the Code; (3) equity-based payments and acceleration; and (4) non-cash forms of benefits; provided that in the case of all the foregoing Aggregate Payments all amounts or payments that are not subject to calculation under Treas. Reg. §1.280G-1, Q&A-24(b) or (c) shall be reduced before any amounts that are subject to calculation under Treas. Reg. §1.280G-1, Q&A- 24(b) or (c).

(ii)For purposes of this Section 7(b), the “After Tax Amount” means the amount of the Aggregate Payments less all federal, state, and local income, excise and employment taxes imposed on the Executive as a result of the Executive’s receipt of the Aggregate Payments. For purposes of determining the After Tax Amount, the Executive shall be deemed to pay federal income taxes at the highest marginal rate of federal income taxation applicable to individuals for the calendar year in which the determination is to be made, and state and local income taxes at the highest marginal rates of individual taxation in each applicable state and locality, net of the maximum reduction in federal income taxes that could be obtained from deduction of such state and local taxes.

(iii)The determination as to whether a reduction in the Aggregate Payments shall be made pursuant to Section 7(b)(i) shall be made by a nationally recognized accounting firm selected by the Company (the “Accounting Firm”), which shall provide detailed supporting calculations both to the Company and the Executive within 15 business days of the Date of Termination, if applicable, or at such earlier time as is reasonably requested by the Company or the Executive. Any determination by the Accounting Firm shall be binding upon the Company and the Executive.

(c)Definitions. For purposes of this Agreement:

(i)“Change of Control” shall have the meaning set forth in the Plan, but only to the extent such events constitute a “change in the ownership or effective control” of the Company or a “change in the ownership of a substantial portion of the Company’s assets” for purposes of Section 409A of the Code.

(ii)“Change of Control Period” shall mean the period beginning on the date of the first event constituting a Change of Control and ending on the 24-month anniversary of the first event constituting a Change of Control.

(a)Anything in this Agreement to the contrary notwithstanding, if at the time of the Executive’s separation from service within the meaning of Section 409A of the Code, the Company determines that the Executive is a “specified employee” within the meaning of Section

409A(a)(2)(B)(i) of the Code, then to the extent any payment or benefit that the Executive becomes entitled to under this Agreement or otherwise on account of the Executive’s separation from service would be considered deferred compensation otherwise subject to the 20% additional tax imposed pursuant to Section 409A(a) of the Code as a result of the application of Section 409A(a)(2)(B)(i) of the Code, such payment shall not be payable and such benefit shall not be provided until the date that is the earlier of (A) six months and one day after the Executive’s separation from service, or (B) the Executive’s death. If any such delayed cash payment is otherwise payable on an installment basis, the first payment shall include a catch-up payment covering amounts that would otherwise have been paid during the six-month period but for the application of this provision, and the balance of the installments shall be payable in accordance with their original schedule.

(b)All in-kind benefits provided and expenses eligible for reimbursement under this Agreement shall be provided by the Company or incurred by the Executive during the time periods set forth in this Agreement. All reimbursements shall be paid as soon as administratively practicable, but in no event shall any reimbursement be paid after the last day of the taxable year following the taxable year in which the expense was incurred. The amount of in- kind benefits provided or reimbursable expenses incurred in one taxable year shall not affect the in-kind benefits to be provided or the expenses eligible for reimbursement in any other taxable year (except for any lifetime or other aggregate limitation applicable to medical expenses). Such right to reimbursement or in-kind benefits is not subject to liquidation or exchange for another benefit.

(c)To the extent that any payment or benefit described in this Agreement constitutes “non-qualified deferred compensation” under Section 409A of the Code, and to the extent that such payment or benefit is payable upon the Executive’s termination of employment, then such payments or benefits shall be payable only upon the Executive’s “separation from service.” The determination of whether and when a separation from service has occurred shall be made in accordance with the presumptions set forth in Treasury Regulation Section 1.409A-1(h).

(d)The parties intend that this Agreement will be administered in accordance with Section 409A of the Code. To the extent that any provision of this Agreement is ambiguous as to its compliance with Section 409A of the Code, the provision shall be read in such a manner so that all payments hereunder comply with or are exempt from Section 409A of the Code. Each payment pursuant to this Agreement is intended to constitute a separate payment for purposes of Treasury Regulation Section 1.409A-2(b)(2). The parties agree that this Agreement may be amended, as reasonably requested by either party, and as may be necessary to fully comply with Section 409A of the Code and all related rules and regulations in order to preserve the payments and benefits provided hereunder without additional cost to either party.

(e)The Company makes no representation or warranty and shall have no liability to the Executive or any other person if any provisions of this Agreement are determined

to constitute deferred compensation subject to Section 409A of the Code but do not satisfy an exemption from, or the conditions of, such Section.

9.Reverse Stock Split. The provisions of Section 4(c) of the Plan shall apply to the Executive’s outstanding stock options and other equity-based awards if there is a reverse stock split of the Company’s stock as follows:

(a)The number of shares subject to any outstanding stock options held by the Executive shall be reduced proportionately to reflect the reverse stock split and the exercise price of such stock option shall be increased proportionately to reflect the reverse stock split.

(b)Any other outstanding equity-based awards held by the Executive shall be adjusted in a manner consistent with the adjustments described above in order to prevent dilution

or enlargement of the benefits or potential benefits intended to be provided pursuant to such awards.

(c)The Company shall notify the Executive in writing (including electronically by updating the details of the Executive’s equity-based awards through Shareworks or such other online platform then used by the Company) of the adjustments made to the Executive’s equity- based awards pursuant to Section 4(c) of the Plan within a reasonable time following the effective date of the reverse stock split.

10.Continuing Obligations.

(a)Restrictive Covenants Agreement. As a condition of employment, the Executive acknowledges his continuing obligations under the Nondisclosure, Developments and Noncompetition Agreement dated November 19, 2012, which, among other things, prohibits disclosure of any confidential or proprietary information of the Company (the “Restrictive Covenants Agreement”). A copy of the Restrictive Covenants Agreement is attached hereto as Exhibit B, and the terms are incorporated by reference as material terms of this Agreement. For purposes of this Agreement, the obligations in this Section 10 and those that arise in the Restrictive Covenants Agreement and any other agreement relating to confidentiality, assignment of inventions, or other restrictive covenants shall collectively be referred to as the “Continuing Obligations.” For the avoidance of doubt, all restrictive covenants obligations are supplemental to one another, and in the event of any conflict between restrictive covenants obligations, the most restrictive provision that is enforceable shall govern.

(b)Third-Party Agreements and Rights. The Executive hereby confirms that the Executive is not bound by the terms of any agreement with any previous employer or other party which restricts in any way the Executive’s use or disclosure of information, other than confidentiality restrictions (if any), or the Executive’s engagement in any business. The Executive represents to the Company that the Executive’s execution of this Agreement, the Executive’s employment with the Company and the performance of the Executive’s proposed duties for the Company will not violate any obligations the Executive may have to any such previous employer or other party. In the Executive’s work for the Company, the Executive will not disclose or make use of any information in violation of any agreements with or rights of any such previous employer or other party, and the Executive will not bring to the premises of the Company any copies or other

tangible embodiments of non-public information belonging to or obtained from any such previous employment or other party.

(c)Litigation and Regulatory Cooperation. During and after the Executive’s employment, the Executive shall reasonably cooperate with the Company in (i) the defense or prosecution of any claims or actions now in existence or which may be brought in the future against or on behalf of the Company which relate to events or occurrences that transpired while the Executive was employed by the Company, and (ii) the investigation, whether internal or external, of any matters about which the Company believes the Executive may have knowledge or information. The Executive’s reasonable cooperation in connection with such claims, actions or investigations shall include, but not be limited to, being available to meet with counsel to answer questions or to prepare for discovery or trial and to act as a witness on behalf of the Company at mutually convenient times. During and after the Executive’s employment, the Executive also shall reasonably cooperate with the Company in connection with any investigation or review of any federal, state or local regulatory authority as any such investigation or review relates to events or occurrences that transpired while the Executive was employed by the Company. The Company shall reimburse the Executive for any reasonable costs, expenses and out-of-pocket expenses incurred in connection with the Executive’s performance of obligations pursuant to this Section 10(c), including, without limitation, to the extent the Board determines in its reasonable good faith discretion that, under the circumstances at hand, it would be reasonable and prudent for the

Executive to engage independent counsel, the Company will reimburse the Executive’s reasonable attorney fees.

(d)Relief. The Executive agrees that it would be difficult to measure any damages caused to the Company which might result from any breach by the Executive of the Continuing Obligations, and that in any event money damages would be an inadequate remedy for any such breach. Accordingly, the Executive agrees that if the Executive breaches, or proposes to breach, any portion of the Continuing Obligations, the Company shall be entitled, in addition to all other remedies that it may have, to an injunction or other appropriate equitable relief to restrain any such breach without showing or proving any actual damage to the Company.

11.Consent to Jurisdiction. The parties hereby consent to the jurisdiction of the state and federal courts of the State of New Jersey. Accordingly, with respect to any such court action, the Executive (a) submits to the exclusive personal jurisdiction of such courts; (b) consents to service of process; and (c) waives any other requirement (whether imposed by statute, rule of court, or otherwise) with respect to personal jurisdiction or service of process.

12.Integration. This Agreement, together with the Equity Documents and the Restrictive Covenants Agreement, constitutes the entire agreement between the parties with respect to the subject matter hereof and supersedes all prior agreements between the parties concerning such subject matter, including, but not limited to, the Executive’s employment agreement with the Company dated as of April 20, 2018.

13.Withholding; Tax Effect. All payments made by the Company to the Executive under this Agreement shall be net of any tax or other amounts required to be withheld by the Company under applicable law. Nothing in this Agreement shall be construed to require the

Company to make any payments to compensate the Executive for any adverse tax effect associated with any payments or benefits or for any deduction or withholding from any payment or benefit.

14.Assignment; Successors and Assigns. Neither the Executive nor the Company may make any assignment of this Agreement or any interest in it, by operation of law or otherwise, without the prior written consent of the other; provided, however, that the Company shall require any successor (whether direct or indirect and whether by purchase, lease, merger, consolidation, liquidation or otherwise) to all or substantially all of the Company’s business and/or assets of the Company expressly to assume and agree to perform this Agreement to the same extent that the Company would be required to perform it if no succession had taken place; provided, further that if the Executive remains employed or becomes employed by the Company, the purchaser or any of their affiliates in connection with any such transaction, then the Executive shall not be entitled to any payments, benefits or vesting pursuant to Section 6 or pursuant to Section 7 of this Agreement solely as a result of such transaction. This Agreement shall inure to the benefit of and be binding upon the Executive and the Company, and each of the Executive’s and the Company’s respective successors, executors, administrators, heirs and permitted assigns. In the event of the Executive’s death after the Executive’s termination of employment but prior to the completion by the Company of all payments due to the Executive under this Agreement, the Company shall continue such payments to the Executive’s beneficiary designated in writing to the Company prior to the Executive’s death (or to the Executive’s estate, if the Executive fails to make such designation).

15.Enforceability. If any portion or provision of this Agreement (including, without limitation, any portion or provision of any section of this Agreement) shall to any extent be declared illegal or unenforceable by a court of competent jurisdiction, then the remainder of this Agreement, or the application of such portion or provision in circumstances other than those as to which it is so declared illegal or unenforceable, shall not be affected thereby, and each portion and

provision of this Agreement shall be valid and enforceable to the fullest extent permitted by law.

16.Survival. The provisions of this Agreement shall survive the termination of this Agreement and/or the termination of the Executive’s employment to the extent necessary to effectuate the terms contained herein.

17.Waiver. No waiver of any provision hereof shall be effective unless made in writing and signed by the waiving party. The failure of any party to require the performance of any term or obligation of this Agreement, or the waiver by any party of any breach of this Agreement, shall not prevent any subsequent enforcement of such term or obligation or be deemed a waiver of any subsequent breach.

18.Notices. Any notices, requests, demands and other communications provided for by this Agreement shall be sufficient only if in writing and delivered in person or sent by a nationally recognized overnight courier service or by registered or certified mail, postage prepaid, return receipt requested, to the Executive at the last address the Executive has filed in writing with the Company or, in the case of the Company, at its main offices in the United States, attention of the Board.

19.Amendment. This Agreement may be amended or modified only by a written instrument signed by the Executive and by a duly authorized representative of the Company.

20.Effect on Other Plans and Agreements. An election by the Executive to resign for Good Reason under the provisions of this Agreement shall not be deemed a voluntary termination of employment by the Executive for the purpose of interpreting the provisions of any of the Company’s benefit plans, programs or policies. Nothing in this Agreement shall be construed to limit the rights of the Executive under the Company’s benefit plans, programs or policies except that the Executive shall have no rights to any severance benefits under any Company severance pay plan, offer letter or otherwise, including, without limitation, under the Company’s Executive Severance and Change of Control Plan. Notwithstanding anything to the contrary in this Agreement, all severance pay and benefits provided to the Executive pursuant to Section 6 or Section 7 of this Agreement (as applicable) shall be reduced and/or offset by any amounts or benefits paid to the Executive to satisfy the federal Worker Adjustment and Retraining Notification (WARN) Act, 29 U.S.C. § 2101 et seq., as amended, and any applicable state plant or facility closing or mass layoff law (whether as damages, as payment of salary or other wages during an applicable notice period or otherwise). In the event that the Executive is party to an agreement with the Company providing for payments or benefits under such plan or agreement and under this Agreement, the terms of this Agreement shall govern and the Executive may receive payment under this Agreement only and not both. Further, Section 6 and Section 7 of this Agreement are mutually exclusive and in no event shall the Executive be entitled to payments or benefits pursuant to both Section 6 and Section 7 of this Agreement.

21.Governing Law. This is a New Jersey contract and shall be construed under and be governed in all respects by the laws of the State of New Jersey without giving effect to the conflict of laws principles thereof. With respect to any disputes concerning federal law, such disputes shall be determined in accordance with the law as it would be interpreted and applied by the United States Court of Appeals for the Third Circuit.

22.Counterparts. This Agreement may be executed in any number of counterparts, each of which when so executed and delivered shall be taken to be an original; but such counterparts shall together constitute one and the same document.

IN WITNESS WHEREOF, the parties have executed this Agreement effective on the Effective Date.

AMARIN CORPORATION PLC

By: /s/ Odysseas Kostas Name: Odysseas Kostas

Its: Director

AARON D. BERG

/s/ Aaron Berg

Aaron D. Berg

Exhibit 10.2

Exhibit A

AWARD AGREEMENT

CERTAIN CONFIDENTIAL PORTIONS OF THIS EXHIBIT HAVE BEEN OMITTED AND REPLACED WITH  . SUCH IDENTIFED INFORMATION HAS BEEN EXCLUDED FROM THIS EXHIBIT BECAUSE IT IS (I) NOT MATERIAL AND (II) OF THE TYPE THAT THE REGISTRANT TREATS AS PRIVATE OR CONFIDENTIAL

. SUCH IDENTIFED INFORMATION HAS BEEN EXCLUDED FROM THIS EXHIBIT BECAUSE IT IS (I) NOT MATERIAL AND (II) OF THE TYPE THAT THE REGISTRANT TREATS AS PRIVATE OR CONFIDENTIAL

AMARIN CORPORATION plc 2020 STOCK INCENTIVE PLAN AWARD AGREEMENT

This AWARD AGREEMENT (the “Agreement”) is entered into and made effective between Amarin Corporation plc (the “Company”) and (the “Optionee”). The Company hereby grants to the Optionee a Non-Qualified Stock Option (the “Option”) to purchase the number of shares set forth below. Capitalized terms used and not defined herein shall have the meanings set forth in the Amarin Corporation plc 2020 Stock Incentive Plan, as amended (the “Plan”), which is incorporated by this reference in its entirety.

1.Number of Ordinary Shares Underlying the Option: 5,000,000 (the “Option Shares”)

2.Per Share Exercise Price: $[] if left blank the “Per Share Exercise Price” shall be closing price on the Grant Date of the Shares on the National Association of Securities Dealers Automatic Quotation System (“Nasdaq”) (provided that such Per Share Exercise Price shall not be less than the par value of a Share at any time, currently £0.50)

3.Grant Date: August 1, 2024

4.Expiration Date: August 1, 2034

5.Performance Period: The nine calendar-year period commencing on the Grant Date and Ending on August 1, 2033.

6.Date Option Shares Become Exercisable (Vesting): This Award is subject to both a performance-based vesting condition (the “Performance Vesting Condition”) and a time-based vesting condition (the “Time Condition”), as described in Paragraph 6(a) and Paragraph 6(b) below. Except as otherwise provided in Paragraph 6(c) and Paragraph 6(d) below, both the Performance Vesting Condition and Time Condition must be satisfied before the Expiration Date before the Option Shares will be deemed vested and exercisable.

a.Performance Vesting. Subject to Paragraph 6(c) below, the number of Option Shares set forth in the Option Table below shall be deemed to have satisfied the Performance Vesting Condition on the date that the Board or the Committee confirms that there has been a Share Price Hurdle Achievement (as defined below) (such date, the “Performance Date”), subject to the Optionee’s Continuous Status as an Employee or Consultant through the applicable Performance Date. “Share Price Hurdle” means each dollar figure set forth in the Option Table below. “Share Price Hurdle Achievement” means that the trailing 60-Day VWAP of the Shares during the Performance Period equals or exceeds the applicable Share Price Hurdle. “60-Day VWAP” means the volume weighted average price of the Shares over a period of 60 calendar days. The Board or Committee shall confirm Share Price Hurdle Achievement as soon as reasonably practicable but no less frequently than quarterly during the Performance Period and within 30 days after the end of

the Performance Period. The Performance Vesting Condition shall be deemed satisfied on the Performance Date for the applicable Share Price Hurdle

Achievement. To the extent any portion of Option Shares has not satisfied the Performance Vesting Condition on or prior to the last day of the Performance Period, such portion shall expire and be of no further force or effect as 12:01 a.m. on the day following the end of the Performance Period. In no event may more than 100% of the Option Shares be deemed to have satisfied the Performance Vesting Condition.

OPTION TABLE

|

|

|

“Share Price Hurdle” |

|

Number of Option Shares That Satisfy the Performance Vesting Condition |

$1.25 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$10.00 |

|

|

b.Time Condition. Subject to Paragraphs 6(c) and 6(d) below, any Option Shares for which the Performance Vesting Condition has been satisfied shall satisfy the Time Condition and shall be vested and exercisable on the earlier of the (i) date that is five months following the Performance Date for such Option Shares, subject to the Optionee’s Continuous Status as an Employee or Consultant through such date or

(ii) the termination of the Optionee’s Continuous Status as an Employee or Consultant by reason the Optionee’s death or permanent or total disability. For the avoidance of doubt, and notwithstanding anything else contained herein or in the Employment Agreement (as defined below) to the contrary, in the event of Optionee’s death or disability, the Option Shares for which the Performance Vesting Condition has been achieved shall automatically satisfy the Time Condition and become vested and exercisable by the Executive or his estate.

c.Change of Control. Notwithstanding anything to the contrary in the Plan or in the Employment Agreement between the Company and the Executive, dated as of July 25, 2024 (the “Employment Agreement”):

i.if either (A) a Change of Control occurs prior to end of the Performance Period, subject to the Optionee’s Continuous Status as an Employee or Consultant through the Change of Control or, (B) the Optionee’s Continuous Status as an Employee or Consultant is terminated by the Company without Cause (as defined in the Employment Agreement) or by the Optionee for Good Reason (as defined in the Employment Agreement) (in either case an “Involuntary Termination”) and such Involuntary Termination occurs within three months prior to the Change of Control (a “Pre-Change of Control Involuntary Termination”), and subject to the Optionee signing a Separation Agreement (as defined in the Employment

Agreement) and the Separation Agreement becoming irrevocable, all within

60 days after the Date of Termination (as defined in the Employment Agreement) (or such shorter period as set forth in the Separation Agreement) (the “Separation Agreement Condition”), then the Performance Vesting Condition shall be deemed satisfied for all unvested Option Shares (i.e., all Share Price Hurdles shall be deemed achieved) as of immediately prior to the effective time of the Change of Control.

ii.If this Option is not assumed, substituted or continued by the Company or its successor entity in such Change of Control, subject to the Optionee’s Continuous Status as an Employee or Consultant through (i) the Change of Control or (ii) a Pre-Change of Control Involuntary Termination and subject to the Separation Agreement Condition, the Time Condition shall be deemed to be fully satisfied as of immediately prior to the effective time of the Change of Control.

iii.If this Option is assumed, substituted or continued by the Company or its successor entity in a Change of Control, the Time Condition shall be deemed to be satisfied upon the earlier of (i) the date that is 12 months following the consummation of the Change of Control and (ii) an Involuntary Termination, subject to the Separation Agreement Condition.

iv.In the event of an Involuntary Termination, the then unvested Option Shares will be held in abeyance to the extent necessary to effectuate the provisions in this Section 6(c) and 6(d) below.

d.Termination Without Cause or for Good Reason Prior to a Change of Control. Notwithstanding anything to the contrary in the Plan or in the Employment Agreement, in the event of an Involuntary Termination that occurs at any time more than three months prior to a Change of Control, subject to the Separation Agreement Condition, (i) the number of Option Shares that would have been deemed to have satisfied the Performance Vesting Condition if the next unachieved Share Price Hurdle had been achieved shall be deemed to satisfy the Performance Vesting Condition and (ii) the Time Condition for any Option Shares for which the Share Price Hurdle has been achieved or deemed achieved pursuant to this Paragraph 6(d) shall immediately accelerate and become fully vested and exercisable as of the later of the Date of Termination and the effectiveness of the Separation Agreement.1

7.Terms of this Award Agreement: In the event of a conflict between the provisions of this Agreement and the Plan, except in relation to Paragraphs 6, 8 and 9 of this Agreement (which

1 For example, in the event of a termination by the Company without Cause or by the Optionee for Good Reason, if the Performance Vesting Condition has been achieved for both the $ and the $2. Share Price Hurdles as of the Date of the Termination, an additional

and the $2. Share Price Hurdles as of the Date of the Termination, an additional  Option Shares (those attributable to the $

Option Shares (those attributable to the $ Share Price Hurdle) shall be deemed to satisfy the Performance Vesting Condition.

Share Price Hurdle) shall be deemed to satisfy the Performance Vesting Condition.

terms of this Agreement shall prevail), the provisions of the Plan shall prevail. A copy of the Plan is provided herewith.

8.Non-transferable: This Option shall not be transferable by the Optionee other than by will or the laws of descent and distribution, and the Option shall be exercisable, during the Optionee’s lifetime, only by the Optionee.

9.Forfeiture; Recovery of Compensation:

a.This Agreement and the Option shall be subject to reduction, cancellation, forfeiture or recoupment to the extent necessary to comply with (i) any clawback, forfeiture or other similar policy adopted by the Board or Committee and as in effect from time to time (the “Clawback Policy”); and (ii) applicable law and the Optionee agrees that the Optionee shall take all required action to enable such reduction, cancellation, forfeiture or recoupment. The Optionee further agrees that

(i) all Incentive-Based Compensation (as defined in the Clawback Policy) received by the Optionee after the effective date of the Clawback Policy is subject to recovery pursuant to the Clawback Policy and (ii) the Optionee is not entitled to indemnification for any Erroneously Awarded Compensation (as defined in the Clawback Policy) or for any claim or losses arising out of or in any way related to Erroneously Awarded Compensation recovered pursuant to the Clawback Policy and, to the extent any agreement or organizational document purports to provide otherwise, the Optionee hereby irrevocably agrees to forego such indemnification.

b.Notwithstanding anything in the Plan to the contrary, if the Company terminates the Optionee’s Continuous Status as an Employee or Consultant for Cause, then any portion of this Option outstanding on such date (whether vested or unvested) shall terminate immediately and be of no further force and effect; provided, however, for the avoidance of doubt, any Option Shares that have vested and been exercised and are held by the Optionee as of the Date of Termination shall not terminate.

c.If, within 30 days after the termination of the Optionee’s Continuous Status as an Employee or Consultant, the Board or the Committee has reasonable evidence to conclude that the Optionee breached the nondisclosure or confidentiality terms of the Nondisclosure, Developments and Noncompetition Agreement, then any portion of this Option outstanding on such date (whether vested or unvested) shall terminate immediately and be of no further force and effect. If a court of competent jurisdiction (the “Court”) enters an order concluding that the Optionee breached the nondisclosure or confidentiality terms of the Nondisclosure, Developments and Noncompetition Agreement then, in addition to all other legal and equitable remedies for such breach, the Optionee agrees to pay the Company a sum equal to the Net Proceeds realized by the Optionee during the one-year period preceding the date the Company reasonably concluded that the Optionee breached the Nondisclosure, Developments and Noncompetition Agreement (the “Net Proceeds Payment”), provided the Court will determine actual monetary damages to the Company as a result of Optionee’s breach (the “Monetary Damages Amount”)

and to the extent that the Monetary Damages Amount exceeds the Net Proceeds Payment (the “Delta”), the Optionee shall be liable for the Net Proceeds Payment and the Delta. For the avoidance of doubt, in no event shall the Optionee be liable for monetary damages under this Section 9(c) greater than the Monetary Damages Amount.

d.For purposes of this Agreement, “Net Proceeds” means the full amount of any proceeds realized by the Optionee from the exercise of all or any portion of this Option Shares or the sale of any Option Shares, net of the amount of any brokerage commission relating to such sale and after deduction of the exercise price paid by the Optionee with respect to such Option Shares.

By accepting this Agreement, the Optionee agrees to all of the terms and conditions described herein and in the Plan (including any applicable local law addendum).

AMARIN CORPORATION plc OPTIONEE

By: /s/ Signature: Refer to Shareworks for acceptance.

Name: Tom Reilly Name:

Title: Exec. VP, CFO & Head of Global HR

Exhibit B

NONDISCLOSURE, DEVELOPMENTS AND NONCOMPETITION AGREEMENT

NONDISCLOSURE, DEVELOPMENTS AND NONCOMPETITION AGREEMENT

I, the undersigned Employee, enter into this Nondisclosure, Developments and Noncompetition Agreement (the "Agreement'')with Amarin Pharma Inc. (along 'with its parents, subsidiaries, affiliates, related entities and their respective predecessors, successors and assigns, the “Company'') as a condition of my employment with the Company and for other good and sufficient consideration. I hereby agree with the Company as follows:

1.Proprietary Information. I agree that all information, whether or not in writing, concerning the Company's business, technology, business relationships or financial affairs which the Company has not released to the general public (collectively, "Proprietary Information") is and will be the exclusive property of the Company. By way of illustration Proprietary Information may include information or material which has not been made generally available to the public, such as: (a) corporate information, including plans, strategies, methods, policies, resolutions, negotiations or litigation; (b) marketing information, including strategies, methods, customer identities or other information about customers, prospect identities or other information about prospects, or market analyses or projections; (c) financial information, including cost and performance data, debt arrangements, equity structure, investors and holdings, purchasing and sales data and price lists, tax-related agreements and strategies; and (d) operational and technological information, including plans, specifications, manuals, forms, templates, software, designs, methods, procedures, formulas, discoveries, inventions, trade secrets, improvements; concepts and ideas; (e) personnel information, including personnel lists, reporting or organizational structure, resumes, personnel data, compensation structure, performance evaluations and termination arrangements; and (f) development and market development information, including clinical trial information, unpublished pre-clinical and clinical results, identity of clinical sites, certain payer contract information. Proprietary Information also includes information received in confidence by the Company from its customers, clinical sites, payors, contractors, or suppliers or other third parties.

2.Recognition of Company's Rights. I will not, at any time, without the Company’s prior written permission, either during or after my employment with the Company, disclose any Proprietary Information to anyone outside of the Company, or use or permit to be used any Proprietary Information for any purpose other than the performance of my duties as an employee of the Company. I will cooperate with the Company and use my best efforts to prevent the unauthorized disclosure of all Proprietary Information. I will deliver to the Company all copies of Proprietary Information in my possession or control upon the earlier of a request by the Company or the termination of my employment with the Company.

3.Rights of Others. I understand that the Company is now and may hereafter be subject to non-disclosure or confidentiality agreements with third persons which require the Company to protect or refrain from use of proprietary information. I agree to be bound by the terms of such agreements in the event I have access to such proprietary information.

4.Avoidance of Conflict of Interest. While an employee of the Company; I will not engage in any other business activity that conflicts with my duties to the Company.

5.Developments. I represent that I have made and that I will make full and prompt disclosure to the Company of all inventions, discoveries. designs, developments, methods, modifications, improvements, processes, databases, computer programs, techniques, trade secrets, graphics or images, audio or visual works, Educational Materials and other works of authorship (collectively "Developments"), whether or not patentable or copyrightable, that are created, made, conceived or reduced to practice by me (alone or jointly with others) or under my direction during the period of my employment with the Company. I acknowledge that all work performed by me is on a "work for hire" basis, and I hereby do assign and transfer and, to the extent any such assignment cannot be made at present, will assign and transfer, to the Company and its successors and assigns all my right, title and interest in all Developments that (a) relate to the business of the Company or any customer of or supplier to the Company or any of the products or services being researched, developed, manufactured or sold by the Company or which may be used with such products or services; or (b) result from tasks assigned to me by the Company; or (c) result from the use of premises or personal property (whether tangible or intangible) owned, leased or contracted for by the Company ("Company-Related Developments"), and all related patents, patent applications, trademarks and trademark applications, copyrights and copyright applications, and other intellectual property rights in all countries and territories worldwide and under any

international conventions (''Intellectual Property Rights").

To preclude any possible uncertainty, I have set forth on Exhibit A attached hereto a complete list of Developments that I have, alone or jointly with others, conceived, developed or reduced to practice prior to the commencement of my employment with the Company that I consider to be my property or the property of third parties and that I wish to have excluded from the scope of this Agreement ("Prior Inventions"). I have also listed on Exhibit A all patents and patent applications in which I am named as an inventor, other than those which have been assigned to the Company ("Other Patent Rights"). If no such disclosure is attached; I represent that there are no Prior Inventions or Other Patent Rights. If in the course of my employment with the Company, I incorporate a Prior Invention into a Company product, process or machine or other work done for the Company, I hereby grant to the Company a nonexclusive, royalty-free, irrevocable, worldwide license (with the full right to sublicense) to make, have made, modify, use and sell such Prior Invention. Notwithstanding the foregoing, I will not incorporate, or permit to be incorporated, Prior Inventions in any Company-Related Development without the Company's prior written consent

This Agreement does not obligate me to assign to the Company any Development which, in the sole judgment of the Company, reasonably exercised, is developed entirely on my own time and does not relate to the business efforts or research and development efforts in which, during the period of my employment with the Company, the Company actually is engaged or reasonably would be engaged, and does not result from the use of premises or equipment owned or leased by the Company. However, I will also promptly disclose to the Company any such Developments for the purpose of determining whether they qualify for such exclusion. I understand that to the extent this Agreement is required to be construed in accordance with the laws of any state which precludes a requirement in an employee agreement to assign certain classes of inventions made by an employee, this paragraph 5 will be interpreted not to apply to any invention which a court rules and/or the Company agrees falls within such classes. I also hereby waive all claims to any moral rights or other special rights which l may have or accrue in any Company-Related Developments.

6.Documents and Other Materials; I will keep and maintain adequate and current records of all Proprietary Information and Company-Related Developments developed by me during my employment with the Company, which records will be available to and remain the sole property of the Company at au times,

All files, letters, notes, memoranda, reports, records, data, charts, quotations and proposals, specification sheets, Educational Materials or other written, photographic or other tangible material containing Proprietary Information, whether created by me or others, which come into my custody or possession, are the exclusive property of the Company to be used by me only in the performance of my duties for the Company. Any property situated on the Company's premises and owned by the Company, including without limitation computers, disks and other storage media, filing cabinets or other work areas, is subject to inspection by the Company at any time with or without notice. ln the event of the termination of my employment with the Company for any reason, I will deliver to the Company all tangible material containing Proprietary Information, and other materials of any nature pertaining to the Proprietary Information of the Company and to my work, and will not take or keep in my possession any of the foregoing or any copies.

7.Enforcement of Intellectual Property Rights. I will cooperate fully with the Company both during and after my employment with the Company, with respect to the procurement, maintenance and enforcement of Intellectual Property Rights in Company-Related Developments. I will sign all papers, including without limitation copyright applications, patent applications, declarations, oaths, assignments of priority rights, and powers of attorney, which the Company may deem necessary or desirable in order to protect its rights and interests in any Company-Related Development. If the Company is unable, after reasonable effort to secure my signature on any such papers, I hereby irrevocably designate and appoint each officer of the Company as my agent and attorney-in-fact to execute any such papers on my behalf, and to take any and all actions as the Company may deem necessary or desirable in order to protect its rights and interests in any Company-Related Development.

8.Non-Competition and Non-Solicitation. In order to protect the Company's Proprietary Information and good will, during my employment and for a period of twelve (12) months following the termination of

my employment for any reason (the "Restricted Period;), I will not directly or indirectly, whether as owner, partner, shareholder, director, manager, consultant, agent, employee, co-venturer or otherwise, engage, participate or invest in any business activity anywhere in the world that develops, manufactures or markets any products, or services that the Company or its affiliates, has under development or that are the subject of active planning at any time during my employment including, without limitation, a business that provides or has active plans to provide products and/or services in the area of lipid management; provided that this shall not prohibit any possible investment in publicly traded stock of a company representing less than one percent of the stock of such company. In addition; during the Restricted Period, I will not, directly or indirectly, in any manner, other than for the benefit of the Company, (a) call upon, solicit, divert, take away; accept or conduct any business from or with any of the customers or prospective customers of the Company or any of its suppliers, and/or (b) solicit, entice, attempt to persuade any other employee or consultant of the Company to leave the Company for any reason or otherwise participate in or facilitate the hire, directly or through another entity, of any person who is employed or engaged by the Company or who was employed or engaged by the Company within six months of any attempt to hire such person. I acknowledge and agree that if I violate any of the provisions of this paragraph 8, the running of the Restricted Period will be extended by the time during which I engage in such violation(s).

9.Prior Agreements. I hereby represent that, except as I have fully disclosed previously in writing to the Company, I am not bound by the terms of any agreement with any previous employer or other party to refrain from using or disclosing any trade secret or confidential or proprietary information in the course of my employment with the Company or to refrain from competing, directly or indirectly, with the business of such previous employer or any other party. I further represent that my performance of all the terms of this Agreement as an employee of the Company does not and will not breach any agreement to keep in confidence proprietary information, knowledge or data acquired by me in confidence or in trust prior to my employment with the Company. I will not disclose to the Company or induce the Company to use any confidential or proprietary information or material belonging to any previous employer or others.

10.Remedies Upon Breach. I understand that the restrictions contained in this Agreement are necessary for the protection of the business and goodwi1l of the Company and I consider them to be reasonable for such purpose. Any breach of this Agreement is likely to cause the Company substantial and irrevocable damage and therefore, in the event of such breach, the Company, in addition to such other remedies which may be available, will be entitled to specific performance and other injunctive relief. If I violate this Agreement, in addition to all other remedies available to the Company at law, in equity, and under contract, I agree that I shall be obligated to pay all the Company's costs of enforcement of this Agreement, including attorneys' fees and expenses.