As

filed with the Securities and Exchange Commission on May 30, 2024

Registration

No. 333-239264

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

POST-EFFECTIVE

AMENDMENT NO. 5 TO

FORM

F-1

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

AETERNA

ZENTARIS INC.

(Exact

name of Registrant as specified in its charter)

Not

Applicable

(Translation

of Registrant’s name into English)

| Canada |

|

2834 |

|

Not

Applicable |

(State

or other jurisdiction of

incorporation or organization) |

|

(Primary

Standard Industrial

Classification

Code Number)

|

|

(I.R.S.

Employer

Identification Number) |

c/o

Norton Rose Fulbright Canada, LLP,

222 Bay Street, Suite 3000,

PO Box 53, Toronto ON M5K 1E7, Canada

(Address,

including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Klaus

Paulini, PhD

President

and Chief Executive Officer

Aeterna

Zentaris Inc.

c/o Norton Rose Fulbright Canada, LLP,

222

Bay Street, Suite 3000,

PO

Box 53, Toronto ON M5K 1E7, Canada

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies

to:

Janet

Grove, Esq.

Trevor

Zeyl, Esq.

Norton

Rose Fulbright Canada LLP

222

Bay Street, Suite 3000, P.O. Box 53,

Toronto

ON M5K 1E7

Canada

(416) 216-4792 |

|

Scott

Saks,

Esq.

Norton Rose Fulbright US LLP

1301 Avenue of the Americas

New York, New York 10019-6022

United

States

(212) 318-3151 |

Approximate

date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under

the Securities Act of 1933, check the following box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please

check the following box and list the Securities Act registration statement number of the earlier effective registration statement

for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list

the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list

the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging

growth company ☐

If

an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards†

provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

†

The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards

Board to its Accounting Standards Codification after April 5, 2012.

The

Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective

in accordance with Section 8(c) of the Securities Act or until this post-effective amendment number 5 to the registration

statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to Section 8(c) of the

Securities Act, may determine.

EXPLANATORY

NOTE

Aeterna

Zentaris Inc., a corporation incorporated under the laws of Canada (“Aeterna Zentaris”, “we”, “us”,

the “Company” or the “Registrant”) filed a registration statement with the Securities and Exchange Commission

(the “SEC”) on Form F-1 (Registration number 333-239264) which was declared effective by the SEC on July 1, 2020 (the “Form

F-1”).

On

March 27, 2024, the Registrant filed its Annual Report on Form 20-F for the year ended December 31, 2023 (File No. 001-38064) (the “Form

20-F”) with the SEC.

As

previously announced, on December 14, 2023 Aeterna Zentaris and Ceapro Inc. (“Ceapro”) entered into an Arrangement Agreement

(as amended by the Amendment Agreement, dated January 16, 2024, and as may be further amended, supplemented or otherwise modified from

time to time, the “Arrangement Agreement”), pursuant to which Aeterna Zentaris and Ceapro undertook a business combination

transaction (the “Arrangement”). Pursuant to the Arrangement Agreement, and subject to the terms and conditions therein,

Aeterna Zentaris will acquire all of the issued and outstanding common shares in the capital of Ceapro in a company-approved Plan of

Arrangement (the “Plan of Arrangement”) under the Canada Business Corporations Act such that Ceapro will become a wholly-owned

subsidiary of Aeterna Zentaris and Aeterna Zentaris will continue the operations of Aeterna Zentaris and Ceapro on a combined basis (the

“Combined Company”).

On

May 15, 2024, the Registrant furnished a Report on Form 6-K (the “May 15 Form 6-K”) with the SEC that included certain updated

information relating to the Plan of Arrangement, Ceapro (including its consolidated financial statements for the year ended December

31, 2023) and the Combined Company (including unaudited pro forma combined consolidated financial information of the Combined Company).

This

Post-Effective Amendment No. 5 (the “Post-Effective Amendment No. 5”) to the Form F-1 is being filed by the Registrant

(i) to incorporate by reference into the Form F-1, the Form 20-F, the May 15 Form 6-K and certain other Reports on Form

6-K submitted by the Registrant with the SEC as indicated in the prospectus included in the Form F-1 under the heading “Documents

Incorporated by Reference” and (ii) to include certain other information in the Form F-1. The information contained on any

websites referenced in the Form 20-F, the May 15 Form 6-K and any other report or document incorporated by reference into this Form F-1,

including any exhibits thereto, are not incorporated by reference or deemed to be a part of this Form F-1.

On

May 3, 2024, Aeterna Zentaris’ 4:1 share consolidation (or reverse stock split) (the “Share Consolidation”) of Aeterna

Zentaris’ common shares (the “Common Shares”) became effective on the basis of one post-Share Consolidation Common

Share for every four pre-Share Consolidation Common Shares and the Common Shares commenced trading on a post-Share Consolidation basis

on the Toronto Stock Exchange (“TSX”) and the NASDAQ Capital Markets (“Nasdaq”) at the opening of trading on

such date. Unless otherwise indicated, all references to numbers of our Common Shares, including the Common Shares issuable upon exercise

of warrants offered pursuant to the prospectus included in the Form F-1, and all outstanding convertible securities, including the warrants

exercisable for the Common Shares offered by the prospectus included in the Form F-1, have been adjusted to reflect the Share Consolidation

as if it had already occurred.

This

Post-Effective Amendment No. 5 contains an updated prospectus relating to the offer and sale of the Registrant’s Common

Shares issuable upon the exercise of warrants registered under the Form F-1.

All

filing fees payable in connection with the registration of the securities registered by the Form F-1 were paid by the Registrant

at the time of the initial filing of the Form F-1.

The

information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement

filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is

not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT

TO COMPLETION, DATED May 30, 2024

PRELIMINARY

PROSPECTUS

56,211

Common Shares

Issuable

upon Exercise of Warrants

Aeterna

Zentaris Inc.

We

are offering up to 56,211 of our common shares, no par value per share (“Common Shares”), which are issuable upon

the exercise of warrants (each a “Common Warrant”) at an exercise price per whole Common Share of $45.00. The Common

Warrants were initially offered and sold by us pursuant to a prospectus dated July 1, 2020 as part of a public offering of Common

Shares, Common Warrants and certain other warrants to purchase Common Shares. Such prospectus also covered the offer and sale by us of

the Common Shares underlying the Common Warrants. No securities are being offered pursuant to this prospectus other than the Common Shares

that will be issued upon the exercise of the Common Warrants.

In

order to obtain the Common Shares offered hereby, holders of Common Warrants must pay the applicable exercise price per whole

Common Share. The Common Warrants were exercisable upon issuance,

and will expire on July 7, 2025. Each Common Share (including Common Shares underlying the Common Warrants) offered under

this prospectus has associated with it one right to purchase a Common Share under our Rights Plan (as defined herein). Please

see the section entitled “Description of Common Warrants” in this prospectus for a more detailed discussion.

We will receive proceeds from the exercise of the Common Warrants but not from the sale of the underlying Common Shares.

Our

Common Shares are listed on both the NASDAQ Capital Market (“NASDAQ”) and on the Toronto Stock Exchange (“TSX”)

under the symbol “AEZS”. On May 29, 2024, the last reported sales price of our Common Shares on NASDAQ was $10.25

per share and on TSX was C$13.90 per share.

NEITHER

THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR

PASSED UPON THE ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Investing

in our securities involves a high degree of risk. Before making any decision to invest in our securities, you should carefully consider

the information disclosed under “Risk Factors” beginning on page 14 of this Prospectus, as well as those risk factors

contained or incorporated by reference into this Prospectus.

The

securities offered by this prospectus have not been qualified in Canada and may not be offered or sold in Canada except pursuant

to a Canadian prospectus or an exemption from the prospectus requirements under applicable Canadian securities laws. The Company

has not filed and does not intend to file a Canadian prospectus in connection with the securities offered by this prospectus.

The

date of this Prospectus is , 2024

TABLE

OF CONTENTS

PLAN

OF ARRANGEMENT

As previously announced, on

December 14, 2023 Aeterna Zentaris and Ceapro Inc. (“Ceapro”) entered into an Arrangement Agreement (as amended by the Amendment

Agreement, dated January 16, 2024, and as may be further amended, supplemented or otherwise modified from time to time, the “Arrangement

Agreement”), pursuant to which Aeterna Zentaris and Ceapro undertook a business combination transaction (the “Arrangement”).

Pursuant to the Arrangement Agreement, and subject to the terms and conditions therein, Aeterna Zentaris will acquire all of the issued

and outstanding common shares in the capital of Ceapro in a company-approved Plan of Arrangement (the “Plan of Arrangement”)

under the Canada Business Corporations Act such that Ceapro will become a wholly-owned subsidiary of Aeterna Zentaris and Aeterna Zentaris

will continue the operations of Aeterna Zentaris and Ceapro on a combined basis (the “Combined Company”).

In connection with the Plan

of Arrangement, we are issuing 633,583 warrants (“Aeterna Zentaris New Warrants”) to all of the holders (the “Shareholders”)

of our Common Shares and all of the holders (the “Aeterna Warrant Holders”) of our outstanding warrants to purchase Common

Shares (“Aeterna Zentaris Adjusted Warrants”), including the warrants exercisable for the Common Shares offered by this prospectus, as of the close of business on May 30, 2024. The Aeterna Zentaris New Warrants are expected to be distributed on

or about May 31, 2024, and the transaction is expected to close on or about June 3, 2024.

We filed a separate Registration Statement on Form F-1 (File No. 333-277115) with the SEC for the registration under the U.S. Securities

Act of 1933, as amended (the “Securities Act”), of the Aeterna Zentaris New Warrants and the Common Shares issuable upon

exercise thereof being offered in the Plan of Arrangement.

We are also issuing in the

Plan of Arrangement (i) up to 1,847,719 Common Shares (the “Aeterna Plan Shares”) to the holders of Ceapro’s outstanding

common shares (“Ceapro Shares”), and (ii) replacement options (the “Replacement Options”) exercisable for up

to 67,929 Common Shares in exchange for outstanding options (vested and unvested) to purchase Ceapro common shares that Ceapro issued

pursuant to its employee plans (“Ceapro Options”), in a transaction exempt from the registration requirements of the Securities

Act pursuant to Section 3(a)(10) thereof.

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement on Form F-1 that we filed with the SEC under the Securities Act of 1933, as amended,

or the Securities Act. This prospectus does not contain all of the information included in the registration statement. For further

information, we refer you to the registration statement, including its exhibits, filed with the SEC. Statements contained in this

prospectus about the contents of any document are not necessarily complete. If SEC rules require that a document be filed as an

exhibit to the registration statement, please see such document for a complete description of these matters.

The SEC allows us to “incorporate by reference”

information into this prospectus and the registration statement of which this prospectus is a part, which means that we can disclose

important information to you by referring you to another document filed separately with the SEC. The information incorporated by reference

is deemed to be part of this prospectus, except for any information superseded by information contained directly in this prospectus,

any accompanying prospectus supplement, any subsequently filed document deemed incorporated by reference or any free writing prospectus

prepared by or on behalf of us. This prospectus incorporates by reference the Annual Report on Form 20-F for the year ended December

31, 2023 we filed with the SEC on March 27, 2024, the Report on Form 6-K we furnished with the SEC on May 15, 2024 as well as certain

additional Reports on Form 6-K we have furnished and filed with the SEC.

References in this prospectus to the “Form

20-F” are to our Annual Report on Form 20-F for the year ended December 31, 2023 (File No. 001-38064) we filed with the SEC on

March 27, 2024, which is incorporated herein by reference.

References in this prospectus to the “May

15 Form 6-K” are to the Report on Form 6-K we furnished with the SEC that included certain updated information relating to the

Plan of Arrangement, Ceapro (including its consolidated financial statements for the year ended December 31, 2023) and the Combined Company

(including unaudited pro forma combined consolidated financial information of the Combined Company), which is also incorporated herein

by reference.

The full list of documents incorporated by reference into this prospectus

and the registration statement of which this prospectus is a part are identified under the headings “Documents Incorporated by

Reference.” Before purchasing any securities, you should carefully read this prospectus in its entirety, together with the additional

information described under the headings, “Documents Incorporated by Reference” and “Where You Can Find Additional

Information” in this prospectus.

This

prospectus does not constitute an offer to sell, or a solicitation of an offer to purchase, the securities offered by this prospectus

in any jurisdiction or in any circumstances where it is unlawful to make such offer or solicitation. We have not done anything that would permit this offering or possession or distribution of this prospectus

in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves

about and to observe any restrictions relating to this offering and the distribution of this prospectus.

You

should rely only on the information contained or incorporated by reference in this prospectus. We have not authorized anyone to provide

information different from that contained, or incorporated by reference, in this prospectus, any amendment or supplement to

this prospectus or in any free writing prospectus prepared by us or on our behalf. If anyone provides you with different or inconsistent

information, you should not rely on it. When you make a decision about whether to invest in our securities, you should not rely upon any information other

than the information included or incorporated by reference in this prospectus and any free writing prospectus prepared by us or on our

behalf.

You

should assume that the information contained in this prospectus and the documents incorporated by reference herein is accurate only as

of their respective dates. Our business, financial condition, results of operations and prospects may have changed since those dates.

If any statement in a document incorporated by reference in this prospectus is inconsistent with a statement in a document incorporated

by reference in this prospectus with a later date or a statement set forth directly in this prospectus, the statement in the document

incorporated by reference with the later date or the statement set forth directly in this prospectus, as the case may be, modifies or

supersedes the earlier statement. If any statement in this prospectus or incorporated by reference in this prospectus is inconsistent

with a statement in another document having a later date—for example, a prospectus supplement filed after the date of this prospectus—the

statement in the document having the later date modifies or supersedes the earlier statement.

Except as otherwise indicated,

the information concerning Ceapro contained and incorporated by reference in this prospectus is based solely on information provided

to Aeterna Zentaris by Ceapro or is taken from, or is based upon, publicly available information. Information concerning Ceapro should

be read together with, and is qualified by, the documents and information related to Ceapro incorporated by reference herein. In the

Arrangement Agreement, Ceapro provided a covenant to ensure that no information provided by it in connection with this prospectus will

include any misrepresentation or omit to state a material fact required to be stated in this prospectus in order to make such information

not misleading in light of the circumstances in which it is disclosed. Although we have no knowledge that would indicate that any of

the information provided by Ceapro is untrue or incomplete, neither we nor any of our officers or directors assumes any responsibility

for the failure by Ceapro to disclose facts or events which may have occurred or may affect the completeness or accuracy of such information

but which are unknown to us. We have no knowledge of any material information concerning Ceapro that has not been generally disclosed.

In this prospectus, unless

otherwise indicated, references to “we”, “us”, “our”, “Aeterna Zentaris” the “Corporation”

or the “Company” are to Aeterna Zentaris Inc., a Canadian corporation, and its consolidated subsidiaries, prior to consummation

of the Plan of Arrangement, unless it is clear that such terms refer only to Aeterna Zentaris Inc. excluding its subsidiaries.

In this prospectus, unless

otherwise indicated, references to “Ceapro” are to Ceapro Inc., a corporation existing under the federal laws of Canada,

and its consolidated subsidiaries, prior to consummation of the Plan of Arrangement, unless it is clear that such terms refer only to

Ceapro Inc. excluding its subsidiaries.

In this prospectus, unless

otherwise indicated, references to the “Combined Company” are to Aeterna Zentaris, and its consolidated subsidiaries, after

the completion of the Plan of Arrangement, unless it is clear that such terms refer only to Aeterna Zentaris, excluding its subsidiaries,

after the completion of the Plan of Arrangement.

The

financial statements included in or incorporated by reference into this prospectus have been prepared in accordance with International

Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS”), and thus may not be comparable to financial statements

of United States (“U.S.”) companies.

Certain information presented

in this prospectus, including certain documents incorporated by reference herein, may include non-IFRS measures that are used by us as

indicators of financial performance. These financial measures do not have standardized meanings prescribed under IFRS and our computation

may differ from similarly-named computations as reported by other entities and, accordingly, may not be comparable. These financial measures

should not be considered as an alternative to, or more meaningful than, measures of financial performance as determined in accordance

with IFRS as an indicator of performance. We believe these measures may be useful supplemental information to assist investors in assessing

our operational performance and our ability to generate cash through operations. The non-IFRS measures also provide investors with insight

into our decision making as we use these non-IFRS measures to make financial, strategic and operating decisions.

Unless

otherwise stated, currency amounts in this prospectus are stated in United States dollars, or “$” or “US$”.

All references to “C$” are to Canadian dollars.

Aeterna Zentaris’ historical

financial statements are presented in US dollars and Ceapro’s historical financial statements are presented in Canadian dollars.

Unless otherwise indicated, all monetary information included or incorporated by reference in this prospectus related to Aeterna Zentaris

is presented in US dollars and all monetary information included or incorporated by reference in this prospectus related to Ceapro is

presented in Canadian dollars.

The unaudited pro forma condensed consolidated financial information of the Combined Company included or incorporated

by reference in this prospectus is presented in Canadian dollars. Aeterna Zentaris’ financial statements were translated from US

dollars to Canadian dollars in the unaudited pro forma condensed consolidated statement of financial position of the Combined Company

as at December 31, 2023 at a spot exchange rate of C$1.3495 = US$1.00. Aeterna Zentaris’ financial statements were translated from

US dollars to Canadian dollars in the statement of loss of the Combined Company at the average exchange rate of C$1.3495 = US$1.00 for

the year ended December 31, 2023.

It has not yet been determined

which currency the Combined Company’s financial statements will be presented if the Plan of Arrangement is consummated.

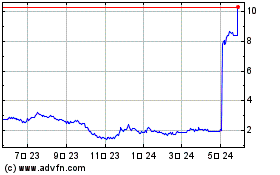

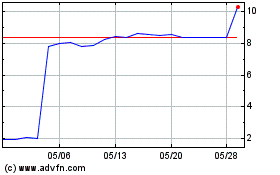

On May 3, 2024, Aeterna Zentaris’

4:1 share consolidation (or reverse stock split) (the “Share Consolidation”) of Aeterna Zentaris’ common shares (the

“Common Shares”) became effective on the basis of one post-Share Consolidation Common Share for every four pre-Share Consolidation

Common Shares and the Common Shares commenced trading on a post-Share Consolidation basis on the TSX and NASDAQ at the opening of trading

on such date. Unless otherwise indicated, all references to numbers of our Common Shares, including the Common Shares issuable upon exercise

of warrants offered pursuant to the prospectus included in the Form F-1, and all outstanding convertible securities, including the warrants

exercisable for the Common Shares offered by the prospectus included in the Form F-1, have been adjusted to reflect the Share Consolidation

as if it had already occurred.

PROSPECTUS

SUMMARY

This

summary highlights selected information about us, Ceapro, the Plan of Arrangement, this offering and information contained in

greater detail elsewhere in this prospectus and in the documents incorporated by reference herein. This summary is not complete and does

not contain all of the information that you should consider before investing in our securities. You should carefully read and consider

this entire prospectus and the documents, and information incorporated by reference into this prospectus, including the financial statements

and related notes of Aeterna Zentaris and Ceapro, the unaudited pro forma combined consolidated financial statements and “Risk

Factors,” before making an investment decision. If you invest in our securities, you are assuming a high degree of risk.

Aeterna

Zentaris

Aeterna

Zentaris is a specialty biopharmaceutical company commercializing and developing therapeutics and diagnostic tests. The Company’s

lead product, Macrilen® (macimorelin), is the first and only FDA and EMA approved oral test indicated for

the diagnosis of patients with AGHD. Macimorelin is currently marketed under the tradename Ghryvelin™ in the European

Economic Area and under the tradename “Macimorelin 60 mg granules for oral suspension in sachet” in the UK through an exclusive

licensing agreement with Atnahs Pharma UK Ltd. (“Pharmanovia”). Aeterna Zentaris’ several other license and

commercialization partners are also seeking approval for commercialization of macimorelin in Israel and the Palestinian Authority, the

Republic of Korea, Turkey and several non-European Union Balkan countries. Aeterna Zentaris is actively pursuing business development

opportunities for the commercialization of macimorelin in North America, Asia and the rest of the world. We are also leveraging

the clinical success and compelling safety profile of macimorelin to develop the compound for the diagnosis of CGHD, an area of

significant unmet need.

Aeterna

Zentaris is also dedicated to the development of therapeutic assets and has established a pre-clinical pipeline to potentially address

unmet medical needs across a number of indications, with a focus on rare or orphan, including neuromyelitis optica spectrum disorder

and Parkinson’s disease, chronic hypoparathyroidism and ALS (Lou Gehrig’s Disease).

Corporate

Information

Aeterna

Zentaris was incorporated on September 12, 1990

under the CBCA and continues to be governed by the CBCA. Our registered address is located at 222 Bay St., Suite 3000,

Toronto, Ontario, Canada M5K 1E7 c/o Norton Rose Fulbright Canada LLP and we operate another office located at 315 Sigma

Drive, Summerville, South Carolina 29486; our telephone number is +1 (843) 900-3223 and our website is www.zentaris.com.

None of the documents or information found on our website shall be deemed to be included in or incorporated by reference into this prospectus,

unless such document is specifically incorporated herein by reference as provided under “Documents Incorporated by Reference.” For additional information with respect to Aeterna

Zentaris please refer to the Form 20-F, which is incorporated herein by reference.

In May 2004, we changed our

name to Aeterna Zentaris Inc. On July 15, 2022, we completed the 25-to-1 2022 share consolidation (reverse stock split) and, previously,

on November 17, 2015, we also completed a 100-to-1 share consolidation (reverse stock split). Our Common Shares commenced trading on

a consolidated and adjusted basis on both the NASDAQ and the TSX on November 20, 2015. We completed a 4-to-1 Share Consolidation for

our Common Shares on May 3, 2024, prior to the issuance of the Aeterna Zentaris New Warrants and the consummation of the Plan of Arrangement.

We

currently have three wholly-owned direct and indirect subsidiaries: Aeterna Zentaris GmbH (“AEZS Germany”),

based in Frankfurt am Main, Germany and incorporated under the laws of Germany; Zentaris IVF GmbH, a direct wholly-owned

subsidiary of AEZS Germany based in Frankfurt am Main, Germany and incorporated under the laws of Germany; and Aeterna

Zentaris, Inc., an entity incorporated in the State of Delaware with an office in the Charleston, South Carolina area in

the U.S.

Plan

of Arrangement with Ceapro

On December 14, 2023, Aeterna Zentaris entered

into the Arrangement Agreement with Ceapro, pursuant to which Aeterna Zentaris and Ceapro agreed that, subject to the terms and conditions

set forth in the Arrangement Agreement, including approvals from the TSXV, TSX and NASDAQ described below, on the Effective Date Aeterna

Zentaris will acquire 100 percent of the Ceapro Shares pursuant to a company-approved plan of arrangement under the Canada Business Corporations

Act (the “CBCA”) such that Ceapro will become a wholly-owned subsidiary of Aeterna Zentaris and Aeterna Zentaris will continue

the operations of Aeterna Zentaris and Ceapro on a combined basis (the “Arrangement”). The terms of the Arrangement Agreement

were the result of arm’s length negotiations between Aeterna Zentaris and Ceapro and their respective advisors.

If completed, the Plan of Arrangement will result

in Aeterna Zentaris acquiring all of the issued and outstanding Ceapro Shares on the Effective Date, and Ceapro will become a wholly-owned

subsidiary of Aeterna Zentaris and Aeterna Zentaris will continue the operations of Aeterna Zentaris and Ceapro on a combined basis.

On the Effective Date, existing Shareholders

and former Ceapro Shareholders would own approximately 50% of the outstanding Common Shares assuming the exercise of all of the Aeterna

Zentaris New Warrants and based on the number of Common Shares and Ceapro Shares issued and outstanding as of market close on December

13, 2023, the day prior to the execution of the Arrangement Agreement. For further information regarding the Combined Company, see section

entitled “Information Concerning the Combined Company”.

Aeterna Zentaris has applied to list all of

its Common Shares issuable upon the exercise of the Aeterna Zentaris New Warrants on the TSX and has filed an initial listing application

with the NASDAQ for the continued listing of its Common Shares on NASDAQ as the exchange has determined that the Plan of Arrangement

constitutes a “change of control” under its rules and regulations. The parties intend to rely upon the exemption from the

registration requirements of the U.S. Securities Act pursuant to Section 3(a)(10) thereof and applicable state securities laws with respect

to the issuance of the Consideration Shares and the Replacement Options pursuant to the Plan of Arrangement.

Following closing, Aeterna Zentaris and Ceapro

have agreed to use their commercially reasonable efforts to delist the Ceapro Shares from the TSXV promptly following the Effective Date.

Aeterna Zentaris and Ceapro also intend to apply for a decision for Ceapro to cease to be a reporting issuer under the Securities Laws

of each jurisdiction of Canada in which it is a reporting issuer, if permitted by applicable Laws.

The Arrangement Agreement contains customary

representations and warranties and is subject to customary conditions to closing and other restrictive covenants, including, but not

limited to, the following:

| |

● |

Directors

and Officers: Upon the occurrence of the Plan of Arrangement, effective as of the Effective Date, certain directors of

Aeterna Zentaris will resign, the number of director seats on the Aeterna Zentaris Board will be increased and nominees of Ceapro

will be appointed to fill such vacancies on the Aeterna Zentaris Board, to the extent permitted by law. Furthermore, Aeterna Zentaris

will appoint a new Chief Executive Officer as of the Effective Date. |

| |

|

|

| |

● |

Non-Solicitation:

Subject to certain exceptions, neither party will solicit or assist in the initiation of proposals that could result in an Acquisition

Proposal by a third-party. |

| |

|

|

| |

● |

Notification

of Proposals: A Party that receives an acquisition solicitation has to notify the other Party within 24 hours of its receipt

of such solicitation and must provide certain information and details relating to such acquisition solicitation. |

| |

|

|

| |

● |

Superior

Proposal: Notwithstanding other restrictions contained in the Plan of Arrangement, in the event a Party receives a superior

proposal from a third-party, such Party may, subject to compliance with the terms of the Plan of Arrangement, enter into a definitive

agreement with a party providing for an Acquisition Proposal so long as such Acquisition Proposal constitutes a Superior Proposal. |

| |

|

|

| |

● |

Termination

of Arrangement Agreement: The parties may terminate the Arrangement Agreement upon the occurrence of certain conditions,

and in any event, if the Effective Date has not occurred on or before June 14, 2024. |

| |

|

|

| |

● |

Termination

Fees: Upon the occurrence of certain termination events pursuant to the terms of the Arrangement Agreement, Aeterna Zentaris

shall be entitled to a fee of US$500,000 to be paid by Ceapro within the time(s) specified in the Arrangement Agreement in respect

to each termination event. |

For additional information with respect to the

representations and warranties, conditions to closing and other terms in the Plan of Arrangement please refer to the section entitled

“The Plan of Arrangement – Principal Terms of the Plan of Arrangement” and to the Arrangement Agreement incorporated

by reference as Exhibit 2.1 to the registration statement of which this prospectus forms a part.

On December 14, 2023, each of the directors

and officers of Aeterna Zentaris and Ceapro entered into lock-up agreements, the forms of which is attached to the Arrangement Agreement,

pursuant to which, among other things, they have agreed to vote in favor of the Arrangement Agreement. On March 12, 2024, the shareholders

of both Aeterna Zentaris and Ceapro approved the Plan of Arrangement, and on March 28, 2024, the Court of King’s Bench of Alberta

issued its final order approving the Plan of Arrangement. No Ceapro Shareholders exercised their Dissent Rights in connection with the

Plan of Arrangement.

Reasons

for the Plan of Arrangement

In reaching its conclusions and formulating

its recommendation, the Aeterna Zentaris Board (excluding the Aeterna Zentaris Non-Participating Director) reviewed a significant amount

of technical, financial and operational information relating to Ceapro and Aeterna Zentaris and considered a number of factors and reasons,

including those listed below. The following is a summary of the principal reasons for the unanimous determination of the Aeterna Zentaris

Board that the Plan of Arrangement is in the best interests of Aeterna Zentaris and the unanimous recommendation of the Aeterna Zentaris

Board (excluding the Aeterna Zentaris Non-Participating Director) that Shareholders vote in favor of the Issuance Resolution.

| |

● |

Greater

potential for stable cashflow to support R&D of potentially higher return pharmaceutical products. Ceapro currently

generates revenues from two main active ingredients, oat beta glucan and avenanthramides, extracted and purified using its proprietary

technology. Cash from these products are planned to be used along with Aeterna Zentaris’ revenue from the commercialization

or licensing of the macimorelin product to support the development of the Combined Company’s roster of high potential-return

products, ideally creating growing and sustainable revenue for the Combined Company and our combined investors. |

| |

|

|

| |

● |

Greater

diversification of commercial and development product pipeline lowers risk. The Combined Company is expected to benefit

from an extensive and diversified pipeline of innovative products in development, including Ceapro’s quicker to market biotechnology

products and Aeterna Zentaris’ potentially higher return, but longer-horizon, products. With this pipeline rejuvenation, the

Combined Company is anticipated to boast: |

| |

|

(i) |

more products in the pipeline that are closer to potential

commercialization; |

| |

|

|

|

| |

|

(ii) |

an enhanced ability to strategically focus financial

and company resources in a manner that provides the most value to the Combined Company and shareholders; and |

| |

|

|

|

| |

|

(iii) |

a more compelling value proposition and lower risk profile. |

| |

● |

Expanded

pharmaceutical research and development capabilities. Both Aeterna Zentaris and Ceapro bring deep expertise and knowledge

that are expected to play a key role in advancing the Combined Company and development pipeline. The Combined Company will have the

infrastructure to support development activities and potentially offer improved efficiencies, in addition to cost savings. The Combined

Company, we will also have an expanded development pipeline of products which we are committed to prioritizing as we evaluate what

will provide the best overall potential for the Combined Company, shareholders and consumers. |

| |

|

|

| |

● |

Compelling

North American + European combination. Ceapro has an operational presence in North America, which addresses another strategic

consideration for Aeterna Zentaris, a Canadian company on North American markets but whose current operational footprint is largely

European. While we expect to continue to maintain some presence in Europe, we believe Aeterna Zentaris needs to re-focus operations

within the North American biotechnology market. We believe that combining with Ceapro, a company with an established presence in

North America, provides better exposure to potential new investors, business development opportunities and talent. |

| |

|

|

| |

● |

Expertise

and efficiencies. Both companies have expertise that can build upon each other, which is expected to result in a stronger

Combined Company. For example, Aeterna Zentaris is adept at navigating the conduct of human clinical trials and the crucial regulatory

approval process required to bring pharmaceutical products to market. The Combined Company plans to leverage this expertise with

the higher value pharmaceutical opportunities being advanced by Ceapro for its active ingredients and technologies. |

| |

● |

Raymond

James Fairness Opinion. The Aeterna Zentaris Strategic Committee and the Aeterna Zentaris Board received an opinion from

Raymond James dated December 14, 2023, as to the fairness to the Shareholders, from a financial point of view, of the consideration

to be paid by Aeterna Zentaris under the Plan of Arrangement, based upon and subject to the assumptions, limitations and qualifications

set forth therein. A complete copy of the Raymond James Fairness Opinion is included as Annex D to this prospectus. |

| |

|

|

| |

● |

Dual-listing

expected to improve trading volume and capital market profile. Shareholders of Aeterna Zentaris and Ceapro Shareholders

will share in future value creation, with existing shareholders of Aeterna and Ceapro, assuming the exercise of the Aeterna Zentaris

New Warrants, to each own approximately 50% of the Combined Company, respectively. The dual NASDAQ and TSX listing is expected to

provide additional volume and an improved capital market profile for the Combined Company. |

| |

|

|

| |

● |

Strengthened

combined balance sheet. The Combined Company will be well-capitalized to support ongoing commercial operations while strategically

investing in product research and development to advance differentiated, innovative products. |

| |

|

|

| |

● |

Bolsters

financial strength and capital markets profile. The pro forma cash balance of the Combined Company as at December 31,

2023 of C$51.4 million, with increased public float, liquidity, and access to capital, is expected to provide Aeterna Zentaris with

greater capacity to pursue further growth and return capital to Shareholders. |

| |

|

|

| |

● |

Accretive

transaction. The Plan of Arrangement is expected to deliver cash flow per share and net asset value per share accretion

to Aeterna Zentaris. |

| |

|

|

| |

● |

Management

strength and integration. Aeterna Zentaris will benefit from the integration of business leadership with extensive experience,

bringing together the proven strengths and capabilities and focus on delivering increased value to shareholders. The Combined Company

will also provide a platform to recruit qualified successors at both the management and board levels that will drive the success

of the Combined Company. |

| |

|

|

| |

● |

Synergies.

The complementary nature of Ceapro’s and Aeterna Zentaris’ combined asset base is expected to provide significant

upside, increased diversification, less risk and the potential for improved efficiencies. The Combined Company would also be able

to exploit any overlap in administrative functions and expenses that result from the Plan of Arrangement. The Combined Company is

expected to be a long-term sustainable business, which is optimally positioned to deliver value to shareholders as the biopharma

sector recovers from its current trough. |

Effect

of the Issuance Resolution

Upon completion of the Plan of Arrangement,

Aeterna Zentaris expects to issue the following Consideration Shares, Replacement Options and Aeterna Zentaris New Warrants:

| Purpose | |

Number of Common Shares | | |

Percent

of Common Shares of Combined Company(4) | |

| Consideration Shares to Ceapro Shareholders(1)

| |

| 1,847,719 | | |

| 50.00 | % |

| Common Shares upon exercise of Replacement Options(2)

| |

| 67,929 | | |

| 1.84 | |

| Common Shares upon exercise of Aeterna Zentaris New Warrants(3) | |

| 633,583 | | |

| 17.15 | % |

Notes:

| (1) |

Reflects that no Ceapro Shareholders exercised their

Dissent Rights and that there are 78,293,177 Ceapro Shares issued and outstanding. |

| (2) |

Includes both vested and unvested Replacement Options

and assumes that there are 2,878,666 Ceapro Options (vested and unvested) issued and outstanding immediately prior to the completion

of the Plan of Arrangement. |

| (3) |

Assumes that there are 1,213,969 Common Shares and 114,405

Aeterna Zentaris Adjusted Warrants issued and outstanding immediately prior to the completion of the Plan of Arrangement. |

| (4) |

Assumes that there are 3,695,271 Common Shares of the

Combined Company issued and outstanding immediately upon the completion of the Plan of Arrangement after going effect to the Share

Consolidation, including the exercise of all the Aeterna Zentaris New Warrants (but excluding the exercise of the Replacement Options). |

As set forth below, Shareholders and former

Ceapro Shareholders are each expected to own approximately 50% of the issued and outstanding Common Shares of the Combined Company immediately

following completion of the Plan of Arrangement, assuming the exercise of all of the Aeterna Zentaris New Warrants and based on the number

of Common Shares and Ceapro Shares issued and outstanding as of market close on December 31, 2023, in each case after giving effect to

the Share Consolidation. See section entitled “Information Concerning the Combined Company”.

| | |

Number of Common Shares | | |

Percent

of Common Shares of Combined Company(4) | |

| Common Shares held by current Shareholders(1)

| |

| 1,213,969 | | |

| 32.85 | % |

| Common Shares upon exercise of Aeterna Zentaris New Warrants to be held by

current Shareholders and current holders of Aeterna Zentaris Adjusted Warrants(1)(2) | |

| 633,583 | | |

| 17.15 | % |

| Total: | |

| 1,847,552 | | |

| 50.00 | % |

| Consideration Shares to be held by Ceapro Shareholders(3)

| |

| 1,847,719 | | |

| 50.00 | % |

Notes:

| (1) |

Assumes that there are 1,213,969 Common Shares issued

and outstanding immediately prior to the completion of the Plan of Arrangement. |

| (2) |

Assumes that there are 114,405 Aeterna Zentaris Adjusted

Warrants issued and outstanding immediately prior to the completion of the Plan of Arrangement. |

| (3) |

Reflects that no Ceapro Shareholders exercised their

Dissent Rights and that there are 78,293,177 Ceapro Shares issued and outstanding prior to the Share Consolidation. |

| (4) |

Assumes that there are 3,695,271 Common Shares of the

Combined Company issued and outstanding immediately upon the completion of the Plan of Arrangement, including the exercise of all

the Aeterna Zentaris New Warrants (but excluding the exercise of the Replacement Options). |

Ceapro

Ceapro is a Canadian biopharmaceutical company

involved in the development and commercialization of “active ingredients” derived from oats and other renewable plant resources

for healthcare and cosmetic industries.

Over the last decade, Ceapro’s development

projects have focused on its expertise in oats and developing new innovative natural health care products to address global needs. However,

in order to exploit these opportunities, numerous challenges must be overcome, including securing adequate and quality feedstock, developing

proper formulations, achieving manufacturing scale-up, and completing scientific testing. Ceapro’s dedicated team is constantly

focused on overcoming these challenges to stay profitable and ahead of competitors by successfully fine-tuning and implementing proprietary

enabling technologies.

Ceapro has one reportable operating segment

and revenue stream, being the operations relating to the active ingredient product technology industry. The active ingredient product

technology industry involves the development of proprietary extraction technologies and the application of these technologies to the

production and development and commercialization of active ingredients derived from oats and other renewable plant resources for the

healthcare and cosmetic industries.

Ceapro’s products include:

| |

● |

a commercial line of natural active ingredients, including

oat beta glucan, avenanthramides (colloidal oat extract), oat powder, oat oil, oat peptides and lupin peptides, which are marketed

to the personal care, cosmetic, medical and animal health industries through Ceapro’s distribution partners and direct sales; |

| |

|

|

| |

● |

a commercial line of natural anti-aging skincare products,

utilizing active ingredients including oat beta glucan and avenanthramides, which are marketed to the cosmeceuticals market through

Ceapro’s wholly-owned subsidiary, Juvente DC Inc.; and |

| |

|

|

| |

● |

veterinary therapeutic products, including an oat shampoo,

an ear cleanser and a dermal complex/conditioner, which are manufactured and marketed to veterinarians in Japan and Asia. |

Other products and technologies are currently

in the research and development or pre-commercial stage. These include:

| |

● |

a potential platform using Ceapro’s beta glucan

formulations to deliver compounds used for treatments in both the personal and healthcare sectors; |

| |

|

|

| |

● |

a variety of novel enabling technologies including Pressurized

Gas eXpanded drying technology which is currently being tested on oat and yeast beta glucan but may have application for multiple

classes of compounds; and |

| |

|

|

| |

● |

the development of new technologies to increase the

content of avenanthramides to high levels to enable new innovative products to be introduced to new markets including functional

foods, nutraceuticals and botanical drugs. High levels of avenanthramides enable the production of powder formulation for the potential

commercialization of products such as enriched oat flour as a functional food and the production of pills and/or tablets as a potential

botanical drug. |

For additional information with respect to Ceapro

and its business, please refer to the section entitled “Information About Ceapro” in this prospectus and in the public filings

available on Ceapro’s issuer profile on SEDAR+ at www.sedarplus.ca.

Combined

Company

Overview

On completion of the Plan of Arrangement, (i)

Aeterna Zentaris will acquire all of the issued and outstanding Ceapro Shares and Ceapro will become a wholly-owned subsidiary of Aeterna

Zentaris, and (ii) each of the current Shareholders, as a group, and the Ceapro Shareholders, as a group, are expected to own approximately

50% of the issued and outstanding Common Shares assuming the exercise of the Aeterna Zentaris New Warrants and based on the number of

Common Shares and Ceapro Shares expected to be issued and outstanding prior to the consummation of the Plan of Arrangement. As a result,

all of the assets of Ceapro will become indirectly held by the Combined Company.

Name

and Corporate Status

Following the Plan of Arrangement, Aeterna Zentaris

(the Combined Company) will continue to exist under the CBCA, and Ceapro will continue to exist under the CBCA.

Upon the closing of the Plan of Arrangement,

the Combined Company will initially continue under the name “Aeterna Zentaris Inc.” and the Common Shares (including the

Consideration Shares issued pursuant to the Plan of Arrangement and the Common Shares issued upon conversion of the Aeterna Zentaris

New Warrants following the Plan of Arrangement) are expected to continue to be listed for trading on the TSX and the NASDAQ initially

under the symbol “AEZS”.

Although the Arrangement Agreement originally

contemplated that the name of Aeterna Zentaris be immediately changed upon the closing of the Plan of Arrangement and that approval of

such name change be sought from the Shareholders at the Meeting, Aeterna Zentaris and Ceapro have since decided that it would be preferable

that, as part of the integration efforts to be undertaken following closing, the board of directors of the Combined Company (the Combined

Company Board) will finalize the selection of a new name for the Combined Company, which will be presented to the shareholders of the

Combined Company at the next annual general meeting, which is expected to be held in the months following closing.

The Combined Company will be a reporting issuer

in all of the provinces of Canada and will file reports with the SEC under Section 13(a) of the U.S. Securities Exchange Act of 1934.

Anticipated

Corporate Structure

The corporate chart below sets forth the Combined

Company’s subsidiaries, each of which will be wholly-owned, and the jurisdiction of incorporation of each entity.

Description

of the Combined Company

The Combined Company will combine Ceapro’s

business relating to the development and commercialization of natural products for the personal care, cosmetic, human and animal health

industries using proprietary technology and natural renewable resources, and to the development of innovative products, technologies

and delivery systems with Aeterna Zentaris’ business relating to the development and commercialization of therapeutics and diagnostic

tests.

The Combined Company is expected to have the

following characteristics:

| |

● |

Diversified

commercial and development product pipeline. The Combined Company will benefit from an extensive and diversified pipeline

of innovative products in development, including Ceapro’s quicker to market biotechnology products and Aeterna Zentaris’

potentially higher return, but longer-horizon, products. With this pipeline rejuvenation, the Combined Company is anticipated to

boast: |

| |

|

○ |

more products in the pipeline that are closer to potential

commercialization; |

| |

|

|

|

| |

|

○ |

an enhanced ability to strategically focus financial

and company resources in a manner that provides the most value to the Combined Company and shareholders; and |

| |

|

|

|

| |

|

○ |

a more compelling value proposition and lower risk profile. |

| |

● |

Expanded

pharmaceutical research and development capabilities. The Combined Company will have the established pharmaceutical

research and development capabilities of both Aeterna Zentaris and Ceapro, as well as infrastructure to support development activities

and potentially offer improved efficiencies in addition to cost savings. |

| |

|

|

| |

● |

Greater

potential for stable cashflow to support R&D of potentially higher return pharmaceutical products. Ceapro currently

generates revenues from two main active ingredients, oat beta glucan and avenanthramides, extracted and purified using its proprietary

technology. Cash flow from these products are planned to be used along with Aeterna Zentaris’ revenue from the commercialization

or licensing of Aeterna Zentaris’ macimorelin product to support the development of the Combined Company’s roster of

high potential-return products, ideally creating growing and sustainable revenue for the Combined Company and our combined investors. |

| |

|

|

| |

● |

Stronger

financial position and flexibility. The Combined Company will have increased financial flexibility with enhanced free

cash flow and a strengthened balance sheet, with approximately C$51.4 million in unrestricted cash as of December 31, 2023 on a pro

forma basis. |

| |

|

|

| |

● |

Strengthened

expertise and efficiencies. Both Aeterna Zentaris and Ceapro have expertise that can build upon each other, which

is expected to result in a stronger Combined Company. For example, Aeterna Zentaris is adept at navigating the conduct of human clinical

trials and the crucial regulatory approval process required to bring pharmaceutical products to market. The Combined Company plans

to leverage this expertise with the higher value pharmaceutical opportunities being advanced by Ceapro for its active ingredients

and technologies. |

| |

|

|

| |

● |

North

American + European operations. Ceapro has an operational presence in North America, while Aeterna Zentaris is a Canadian

company that trades on North American markets but whose current operational footprint is largely European. |

The business of the Combined Company and information

relating to the Combined Company will be that of Aeterna Zentaris and Ceapro generally and as disclosed elsewhere in this prospectus,

including, but not limited to, as further described in the section entitled “Information Concerning Ceapro” herein.

The head office of the Combined Company will

be situated at 222 Bay St., Suite 3000, Toronto, Ontario, Canada M5K 1E7 c/o Norton Rose Fulbright Canada LLP.

The Combined Company will have its registered

office located at 222 Bay St., Suite 3000, Toronto, Ontario, Canada M5K 1E7 c/o Norton Rose Fulbright Canada LLP.

Description

of Share Capital

The authorized share capital of the Combined

Company will continue to be as described in section entitled “Information Concerning Aeterna Zentaris” and the rights and

restrictions of the Common Shares will remain unchanged.

Combined

Company Shareholders and Principal Shareholders

The issued share capital of the Combined Company

will change as a result of the consummation of the Plan of Arrangement to reflect the issuance of the Common Shares contemplated in the

Plan of Arrangement. Based on the outstanding securities of Ceapro as of December 31, 2023, and giving effect to the Share Consolidation,

it is expected that Aeterna Zentaris will issue up to a maximum of 2,549,231 Common Shares in connection with the Plan of Arrangement

(including the Consideration Shares and the Common Shares issuable upon exercise of the Replacement Options and the Aeterna Zentaris

New Warrants). If no outstanding Ceapro Options have been exercised prior to the Effective Time, and giving effect to the Share Consolidation,

67,929 Common Shares are expected to be reserved for issuance upon the exercise of the Replacement Options (vested and unvested) and

633,583 Common Shares are expected to be reserved for issuance upon the exercise of the Aeterna Zentaris New Warrants.

On completion of the Plan of Arrangement, assuming

that the current number of Common Shares and Ceapro Shares outstanding does not change from the date hereof and excluding the exercise

of any Aeterna Zentaris New Warrants, it is expected that there will be 3,061,688 Common Shares issued and outstanding. Up to a maximum

of 829,267 Common Shares will be issuable upon the exercise of outstanding convertible securities of Aeterna Zentaris, including, without

limitation, the Replacement Options and the Aeterna Zentaris New Warrants to be issued pursuant to the Plan of Arrangement. On completion

of the Plan of Arrangement, assuming that the current number of convertible securities of Aeterna Zentaris and Ceapro does not change

from the respective dates of the information provided herein, and giving effect to the Share Consolidation, it is expected that the total

number of Common Shares issued and outstanding will be 3,890,955 on a fully-diluted basis.

To the knowledge of the directors and executive

officers of Aeterna Zentaris as of the date of this prospectus, no person will beneficially own, or control or direct, directly or indirectly,

voting securities of Aeterna Zentaris carrying 10% or more of the voting rights attached to the Common Shares following completion of

the Plan of Arrangement.

Estimated

Available Funds and Principal Purposes

Based on the consolidated financial statements

of Aeterna Zentaris and Ceapro, respectively, as of December 31, 2023, Aeterna Zentaris had estimated working capital of approximately

C$42 million and Ceapro had estimated working capital of approximately C$13 million. Based on the unaudited pro forma combined consolidated

financial information of the Combined Company as of December 31, 2023 set forth herein, the Combined Company would have estimated working

capital of approximately C$52.2 million upon completion of the Plan of Arrangement.

Aeterna Zentaris has historically had negative

cash flow from operating activities and has historically incurred net losses but, based on current operations, the Combined Company expects

to meet its cash needs for the twelve-month period following the date hereof. To the extent that the Combined Company has negative operating

cash flows in future periods, it may need to deploy a portion of its existing working capital to fund such negative cash flows or raise

additional funds through the issuance of additional equity securities, loan financing or other means. There is no assurance that additional

capital or other types of financing will be available if needed or that these financings will be on terms at least as favorable to the

Combined Company as those previously obtained, or at all. See section entitled “Risk Factors”.

Pro-Forma

Consolidated Capitalization

The following table sets forth the capitalization

of the Combined Company on an actual basis (without giving effect to the Share Consolidation) and on a pro forma basis after giving effect

to this offering, the Share Consolidation and the Plan of Arrangement.

| | |

As at December 31, 2023 | |

| | |

Actual | | |

As Adjusted | | |

As Adjusted | |

| (unaudited) (in thousands, except share data) | |

(in US $, except

share data) | | |

(in US $, except

share data) | | |

(in C$, except

share data) | |

| | |

| | |

| | |

| |

| Number of Common Shares issued and outstanding | |

| 4,855,876 | | |

| 3,117,899 | | |

| 3,117,899 | |

| | |

| | | |

| | | |

| | |

| Cash and cash equivalents | |

| 34,016 | | |

| 41,385 | | |

| 54,736 | |

| | |

| | | |

| | | |

| | |

| Warrant liability | |

| - | | |

| 19 | | |

| 25 | |

| Deferred share unit liability | |

| - | | |

| 386 | | |

| 511 | |

| Total non-current liabilities | |

| 14,280 | | |

| 15,681 | | |

| 20,739 | |

| Shareholders’ equity: | |

| | | |

| | | |

| | |

| Share capital | |

| 293,410 | | |

| 29,666 | | |

| 39,236 | |

| Warrants | |

| 5,085 | | |

| - | | |

| - | |

| Contributed surplus | |

| 90,710 | | |

| 3,768 | | |

| 4,984 | |

| Retained earnings (deficit) | |

| (369,831 | ) | |

| 8,281 | | |

| 10,954 | |

| Accumulated other comprehensive income | |

| (1,178 | ) | |

| - | | |

| - | |

| Total capitalization | |

| 32,476 | | |

| 57,801 | | |

| 76,449 | |

The number of our Common Shares outstanding before this offering is based on 4,855,876 shares outstanding as of December 31, 2023 (without giving effect to the Share

Consolidation), and excludes as of such date:

| ● |

457,648 Common Shares issuable upon the exercise of

the Aeterna Zentaris Adjusted Warrants at a weighted average exercise price of $21.76 per share; |

| ● |

53,400 Common Shares issuable upon the exercise of outstanding

employee stock options (vested and unvested) at a weighted average exercise price of $12.51 per share; and |

| ● |

303,250 Common Shares reserved for future issuance under

our 2018 Long-Term Incentive Plan dated March 27, 2018. |

The number of our Common Shares that will be

outstanding immediately after this offering and the Plan of Arrangement is based on 1,213,969 shares outstanding as of December 31, 2023

(as adjusted for the Share Consolidation), and excludes as of such date:

| ● |

58,195 Common Shares issuable upon the exercise of

the Aeterna Zentaris Adjusted Warrants at a weighted average exercise price of $103.76 per share; |

| ● |

13,350 Common Shares issuable upon the exercise of outstanding

Aeterna Zentaris employee stock options (vested and unvested) at a weighted average exercise price of $50.05 per share; |

| ● |

218,512 Common Shares reserved for future issuance under

our 2018 Long-Term Incentive Plan dated March 27, 2018; |

| ● |

67,929 Common Shares issuable upon the exercise of outstanding

Replacement Options (vested and unvested) to be issued to Ceapro’s employees in the Plan of Arrangement in exchange for the

Ceapro Options (vested and unvested); and |

| ● |

633,583 Common Shares issuable upon the exercise of

Aeterna Zentaris New Warrants to be issued to investors at an exercise price of $0.01 per share. |

Directors

and Executive Officers

Following completion of the Plan of Arrangement,

the Combined Company Board will be comprised of eight (8) directors. The directors of Combined Company will hold office until the next

annual general meeting of Shareholders or until their respective successors have been duly elected or appointed, unless his or her office

is vacated earlier in accordance with the articles of the Combined Company (being the articles of Aeterna Zentaris) or within the provisions

of the CBCA.

Management of the Combined Company is expected

to include executives from both Ceapro and Aeterna Zentaris. Gilles Gagnon, Ceapro’s current Chief Executive Officer, and Giuliano

La Fratta, Aeterna Zentaris’ current Chief Financial Officer, will lead the Combined Company’s business following completion

of the Plan of Arrangement as President and Chief Executive Officer and Senior Vice President and Chief Financial Officer, respectively.

Upon closing of the Plan of Arrangement and as a component of near-term integration efforts, it is expected that the Combined Company

Board will assess the composition of the Combined Company’s executive officer team (aside from the President and Chief Executive

Officer and Senior Vice President and Chief Financial Officer) to determine which Ceapro and which Aeterna Zentaris executive officers

will hold roles as executive officers of the Combined Company. Additional changes to the Combined Company Board and executive officers

of the Combined Company may follow over the short, medium, and long-term as integration efforts progress and the Combined Company is

in a better position to assess needs and recruit successors.

As of the Effective Date and assuming the exercise

in full of the Aeterna Zentaris New Warrants, the Combined Company’s directors, President and Chief Executive Officer and Senior

Vice President and Chief Financial Officer are expected to collectively hold 47,147 Common Shares (representing 1.28% of the total issued

and outstanding Common Shares) as a group.

Other

Recent Developments

Aeterna

Zentaris

Macimorelin

Commercialization Program

On March 15, 2023, with the Company’s

consent, Consilient Health Limited (“Consilient” or “CH”) entered into an assignment agreement with Pharmanovia

to transfer the current licensing agreement for the commercialization of macimorelin in the European Economic Area and the United Kingdom

to Pharmanovia, as well as the current supply agreement pursuant to which the Company agreed to provide the licensed product. Also on

March 15, 2023, the Company and Pharmanovia entered into an amendment agreement, pursuant to which the Company provided its acknowledgement

and consent to the assignment agreement and agreed to certain amended terms which do not materially differ from the previous license

and supply agreement with CH. To date, we have received total pricing milestone payments from CH of US$0.5 million (€0.5 million)

relating to Ghryvelin™/Macimorelin 60 mg approved list prices in the United Kingdom, Germany and Spain. We shipped initial batches

of macimorelin (Ghryvelin™/Macimorelin 60 mg) to Consilient in the first quarter of 2022. Consilient launched the product meanwhile

in the United Kingdom, Sweden, Denmark, Finland, Germany and Austria. More EU countries are expected to follow pending re-imbursement

negotiations. On April 19, 2022, we announced that the European Patent Office had issued a patent providing intellectual property protection

of macimorelin in 27 countries within the European Union as well as additional European non-EU countries, such as the UK and Turkey,

for macimorelin for use to diagnose growth hormone deficiency (“GHD”) in adults. In the meantime, the related Patent Cooperation

Treaty patent application has been granted in Canada, Japan, South Korea, Eurasia and New Zealand.

On May 9, 2023, the United States Patent and

Trademark Office issued patent US11,644,474 to the Company protecting the use of macimorelin for the diagnosis of GHD in pediatrics.

Pipeline

Expansion Opportunities

Please see Item 5 “Operating and Financial

Review and Prospects” in the Form 20-F which is incorporated by reference herein for a summary of Aeterna Zentaris pipeline of

expansion opportunities including:

| |

● |

AIM

Biologicals: Targeted, highly specific autoimmunity modifying therapeutics for the potential treatment of neuromyelitis

optica spectrum disorder (NMOSD) and Parkinson’s disease. |

| |

|

|

| |

● |

AEZS-150

– Delayed Clearance Parathyroid Hormone Fusion Polypeptides: Potential treatment for chronic hypoparathyroidism |

| |

|

|

| |

● |

AEZS-130

– Macimorelin Pre-Clinical Program |

Ceapro

Over the three years preceding 2023, Ceapro’s

financial results have reflected an average year over year sales growth of 13.7% from C$15.1 million in 2020 to C$17.2 million in 2021

and C$18.8 million in 2022, with respective net profit of C$1.9 million, C$3.4 million, and C$4.4million. As a sales breakdown, Avenanthramides

represents 60-65%, oat beta glucan 15-20% and oat oil 10-15%. 90% of these sales are made through Symrise AG, a global supplier of fragrances,

flavors, food nutrition, and cosmetic ingredients, with whom Ceapro has renewed on March 10, 2022 a supply and distribution agreement

with this long-time partner (the “Symrise Agreement”). The Symrise Agreement includes 11 exclusive customers, with Johnson

and Johnson (“J&J”) representing approximately 50% of Ceapro’s business. On September 28, 2022, J&J announced

Kenvue as the name for a new company to be formed from the planned spin-off of their consumer division. Kenvue started to be publicly

traded on May 4, 2023 and became fully independent on August 23, 2023. Ceapro’s results for the year ending on December 31, 2023

were significantly impacted by this planned spin-off, showing a sales decline of approximately 49% from C$18.8 million in 2022 to C$9.6

million in 2023. Given statements made on July 20, 2023 in a press release announcing the first financial results of Kenvue, it appears

that Kenvue has put emphasis on improving supply chain productivity and benefitted from some stock piling from the previous year. On

August 25, 2023, Ceapro announced the signing of an amendment to the Symrise Agreement. Pursuant to the amendment, Ceapro has extended

the term of the agreement for two years to December 31, 2026. The extended agreement also includes the potential to launch a new formulation

of oat beta glucan mostly targeting the Chinese market. Symrise is currently assessing samples of Ceapro’s new powder formulation

of oat beta glucan.

Ceapro fully completed a transition to its new

state of the art manufacturing site at the end of 2020. Since then, Ceapro has produced and shipped an average of 300 metric tons of

active ingredients per year. Given new technologies being developed at large scale, Ceapro believes that it is well-positioned to significantly

increase its production capacity and offer additional products like yeast beta glucan and alginate for the nutraceutical sector.

THE

OFFERING

This

summary highlights information presented in greater detail elsewhere in this prospectus. This summary is not complete and does

not contain all the information you should consider before investing in our Common Shares. You should carefully read this entire

prospectus before investing in our Common Shares including “Risk Factors,” our consolidated financial statements and

the documents incorporated herein.

| Issuer |

|

Aeterna

Zentaris Inc. |

| |

|

|

| Securities

offered |

|

Up

to 56,211 of our common shares, no par value per share (“Common Shares”), which are issuable upon the exercise

of warrants (each a “Common Warrant”) at an exercise price per whole Common Share of $45.00. Each Common Share

(including Common Shares underlying the Common Warrants) offered under this prospectus has associated with it one right to purchase

a Common Share under our Rights Plan (as defined herein). Please see the section entitled “Description of Common Warrants”

in this prospectus for a more detailed discussion. |

| |

|

|

| Description

of Common Warrants |

|

The

Common Warrants were exercisable upon issuance and expire July 7, 2025. The Common Warrants have an exercise price of $45.00

per share. |

| |

|

|

| Use

of proceeds |

|

We

will receive proceeds from the exercise of the Common Warrants but not from the sale of the underlying Common Shares. We

intend to use any proceeds from the exercise of the Common Warrants for general corporate purposes, which includes, among other purposes,

the investigation of further therapeutic uses of Macrilen™ (macimorelin), the expansion of pipeline development activities,

the further expansion of commercialization of macimorelin in available territories, the funding of a pediatric clinical trial in

the E.U. and U.S. for macimorelin, for trials costs in excess of amounts funded through the Novo Amendment through its termination

in May 2023, and the investigation of further therapeutic uses of macimorelin. See “Use of Proceeds.” |

| |

|

|

| NASDAQ Capital Market and TSX symbol |

|

We have applied

for our Common Shares following consummation of the Plan of Arrangement, including the Common shares issuable upon exercise of all outstanding Common Warrants, to continue to be

listed on the NASDAQ and the TSX initially under the symbol “AEZS.” It is a condition

to the Plan of Arrangement for our Common Shares following consummation of the Plan of Arrangement

to be approved for continued listing on the NASDAQ and TSX.

The Common

Warrants are not listed on the NASDAQ, the TSX or any other securities exchange or recognized

trading system. |

| |

|

|

| Limitations

on beneficial ownership |

|

Subject

to certain limitations and exceptions, a holder (together with its affiliates) may not exercise any portion of a Common Warrant

to the extent that the holder would beneficially own more than 4.99% (or, at the election of the purchaser, 9.99%) of the

outstanding Common Shares immediately after exercise of such Common Warrant, except that upon at least 61 days’ prior

notice from the holder to us, the holder may increase the amount of ownership of outstanding stock after exercising the holder’s

Common Warrants up to 9.99% of the number of Common Shares outstanding immediately after giving effect to the exercise. |

| |

|

|

| Risk

factors |

|

An

investment in our Common Shares involves a high degree of risk. Please refer to “Risk Factors” in this prospectus,

Item 3. “Key Information – Risk Factors” contained in the Form 20-F, incorporated by reference herein,

“Risk Factors” in the May 15 Form 6-K, incorporated by reference herein, and the other information included or incorporated by reference in this prospectus for a discussion of factors you should carefully

consider before investing in our Common Shares. |

| |

|

|

| Dividend

Policy |

|

We