Second XRP ETF Filing Hits The Market, How Did The XRP Price Respond?

2024年10月11日 - 5:00AM

NEWSBTC

The crypto ETF market is expanding at an alarming rate, with news

of a second XRP Exchange Traded Fund (ETF) filing spreading across

the space. Canary Capital, a boutique Sydney investment and

corporate advisory firm has just filed an XRP ETF, following

Bitwise’s lead. With the new ETF filing, the price of XRP could see

a possible change in the future. Canary Capital Files New XRP

ETF On Tuesday, October 8, Canary Capital submitted an official S-1

filing for an XRP ETF with the United States Securities and

Exchange Commission (SEC). This filing comes just after Bitwise,

another top asset management company filed for an ETF on September

30, marking the first ever XRP–based ETF in the crypto

market. Related Reading: Dogecoin Vs. Bitcoin: Gauging The

Performances Of Two Crypto Giants This Cycle According to Canary

Capital’s new filing, the Trust’s investment goal is to provide

direct exposure to the value of XRP, enabling investors to access

this cryptocurrency’s market through a brokerage account. Through

this method, Canary Capital intends to limit the potential barriers

to accessing the market and reduce the risks involved in acquiring

and holding XRP. Canary Capital has also stated that it aims

to track the performance of XRP in the market, as measured by the

Trust’s Pricing Benchmark. This pricing benchmark will utilize a

similar methodology to the real-time price of the Chicago

Mercantile Exchange (CME) CF Ripple index. While divulging

the objectives and risk factors associated with an XRP ETF, Canary

Capital failed to disclose the identity of the custodian for its

potential XRP ETF. The investment management company also did not

provide details on the ticker to be used for its XRP ETF, however,

revealed that the Trustee for the investment product would be the

Delaware Trust company. Despite the optimism Canary Capital’s

new XRP ETF filing has generated in the crypto community, both its

application and Bitwise’s still require approval from the SEC

before they can launch in the market. Presently, the

likelihood of a swift approval appears low, considering Ripple’s

ongoing legal battle with the regulator. Earlier this month, the US

SEC submitted a new appeal to challenge the court’s July 2023

ruling that programmatic sales of XRP are not considered

securities. XRP Price Falls As Regulatory Uncertainty Clouds

Optimism Despite Canary Capital’s new XRP ETF filing, the price of

XRP has been on a downward trend, showing no signs of moving out of

bearish momentum trends. CoinMarketCap’s data shows that XRP has

fallen by 0.72% in the last 24 hours and another 0.79% over the

past week. Related Reading: Bitcoin Price Fails At MA-200, Is

A Crash To $52,000 Coming? The cryptocurrency has been in the red

for the past few weeks, only seeing slight gains when market

conditions turn significantly favorable. With the new XRP ETF, many

would expect the XRP price to rally, as anticipation for the

investment product builds in the crypto space. However, XRP is

still consolidating around the $0.5 mark, even experiencing a

decrease in its 24-hour trading volume. It is clear that

XRP’s bullish momentum has been completely overshadowed by

regulatory uncertainty and negative sentiment. Despite this, many

in the XRP community continue to maintain a positive outlook,

expecting the price of XRP to break out to the upside soon.

Featured image created with Dall.E, chart from Tradingview.com

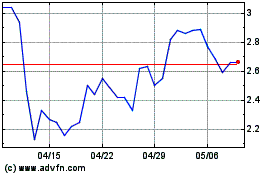

Optimism (COIN:OPUSD)

過去 株価チャート

から 10 2024 まで 11 2024

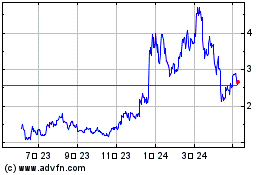

Optimism (COIN:OPUSD)

過去 株価チャート

から 11 2023 まで 11 2024