Bitcoin Investors Accumulate Almost $1 Billion In BTC As Exchange Reserves Falls Towards New Lows

2024年10月11日 - 2:00AM

NEWSBTC

Although the Bitcoin price faces challenges in breaking out

significantly from its support level of $60,000, recent on-chain

data reveals a fascinating shift in sentiment among Bitcoin

enthusiasts. Despite the ongoing price corrections, it appears that

long-term holders remain undeterred. In fact, about 15,917 BTC,

valued at approximately $987 million, has been withdrawn from

various cryptocurrency exchanges over the past week. Bitcoin Exits

Crypto Exchanges In Droves According to a previous report by

NewsBTC, Bitcoin’s recent dip to $60,000 can largely be attributed

to the actions of short-term holders. On-chain data reveals that

this particular group of traders decided to exit their positions

after Bitcoin’s performance failed to meet expectations in early

October, further intensifying the selling pressure. However,

long-term holders have taken full advantage of this increased

selling pressure. Rather than follow the short-term market

sentiment, many long-term investors seized the opportunity to add

more Bitcoin to their portfolios. Related Reading: Crypto Analyst

Predicts Massive 8,400% Rise For XRP Price To $44, Calls It

‘Conservative’ As data would have it, long-term holders seem to

have capitalized on the selling pressure, with many of them taking

the opportunity to add to their holdings. According to on-chain

data highlighted by crypto analyst Ali Martinez, the Bitcoin

reserves on cryptocurrency exchanges have been in a steady decline

since October 3. On that day, the total Bitcoin balance across

exchanges stood at 2.5825 million BTC. What’s notable is that this

figure was a result of several consecutive days of BTC inflows to

exchanges, beginning on September 28 and continuing until October

3. During this time, the price of Bitcoin fell from $66,230 to

$60,047, marking a decrease of about 9.3% as many traders sold on

exchanges. However, in an interesting turn of events, long-term

holders have seen this influx of BTC into exchanges as an

opportunity to acquire more tokens. As a result, there has been a

consistent decline in the total Bitcoin balance on exchanges since

October 3. Numbers show that 15,917 BTC were withdrawn from

exchanges between October 3 and the time of writing, bringing the

total Bitcoin exchange reserve to about 2.5667 million BTC. What

Does This Mean For Bitcoin? The outflow of BTC from exchanges is

generally seen as positive for the cryptocurrency’s price moving

forward, as it reduces the amount of BTC available for sale. During

this outflow period, Bitcoin retested the $64,000 price level on

October 7. However, it has since reversed and is approaching the

$60,000 price floor again. Related Reading: Standard Chartered

Analysts Says Ethereum Price Will Reach $10,000 If This Happens As

of the time of writing, Bitcoin is trading at $60,912, marking a

2.1% decline over the past 24 hours. This dip shows the importance

of long-term holders and bullish investors continuing to accumulate

BTC from exchanges. The onus now is on long-term holders to keep

accumulating Bitcoin from exchanges in order to help prevent

further price declines. Featured image created with Dall.E, chart

from Tradingview.com

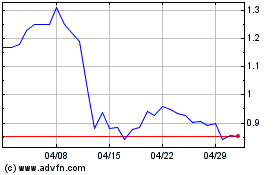

Flow (COIN:FLOWUSD)

過去 株価チャート

から 10 2024 まで 11 2024

Flow (COIN:FLOWUSD)

過去 株価チャート

から 11 2023 まで 11 2024