Ripple Acquires Crypto Custody Firm Metaco In $250 Million Deal

2023年5月18日 - 6:30AM

NEWSBTC

US-based cryptocurrency company Ripple has recently announced its

acquisition of Metaco. Metaco is a Swiss-based crypto custody firm

and the deal, valued at $250 million, marks Ripple’s foray into the

acquisition space. Metaco specializes in developing cutting-edge

technology that enables financial institutions to securely store

and effectively manage digital assets. Some of its notable clients

comprise Citi, BNP Paribas, and the digital asset arm of Societe

Generale. Related Reading: Polkadot Latest Update Fuels

Anticipation Of Higher Price For DOT After the acquisition, Ripple

will become the exclusive shareholder of Metaco. It will, however,

allow the company to retain its independent brand identity and

continue its operations uninterrupted. Nevertheless, this

acquisition holds significant importance for Ripple. Its own

cryptocurrency, XRP, currently ranks as the sixth largest in the

world based on market capitalization. Ripple expressed that this

acquisition will serve as a catalyst for expanding its

institutional offering. Additionally, this will also strengthen its

position in the cryptocurrency market. By integrating Metaco’s

expertise and technology, Ripple aims to enhance its capabilities

in providing secure storage and management solutions for digital

assets. Investor Caution Has Been Growing Regarding Crypto Asset

Storage Following a decline in cryptocurrency prices in 2022 along

with notable collapses of major crypto firms like the U.S. exchange

FTX, investor enthusiasm for crypto assets has waned. A critical

factor contributing to this shift in sentiment is the growing

alertness among investors regarding the storage of crypto assets.

Several crypto platforms had frozen their withdrawals resulting in

significant losses for investors. This has prompted them to choose

and prioritize secure storage solutions to store their digital

assets. Anticipating a surge in demand from institutional

investors, Ripple CEO Brad Garlinghouse expressed his expectation

for an upswing in the need for crypto custody services. He also

stated: By focusing on the infrastructure … you’re not really

subject to the same gyrations of the crypto winters. If ultimately

you’re solving a clear problem at scale for these customers,

there’s going to be demand there. Amidst the intensifying

enforcement actions by US regulators against crypto firms, CEO Brad

Garlinghouse highlighted the added appeal of Metaco, being based in

Switzerland and having a workforce comprised of non-US employees.

Garlinghouse emphasized that the regulatory landscape in markets

outside the United States offers greater and better clarity. This

enables companies to make sound and informed investments. Related

Reading: Decentraland (MANA) Leads Crypto Market Gains, Here’s Why

He noted that these transparent and well-defined rules in other

jurisdictions have been responsible for creating an environment

conducive to business growth and innovation. Following its recent

private financing round, Ripple was valued at $15 billion even

though the company had encountered a significant level of

regulatory ambiguity. The uncertainty escalated when the Securities

and Exchange Commission (SEC) filed a lawsuit against the company

and two of its executives, alleging the sale of unregistered

securities. This legal action has further added to the regulatory

challenges faced by the crypto giant. Featured Image From, Charts

From TradingView.com

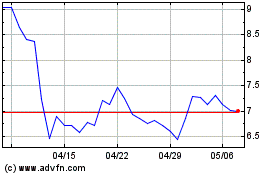

Polkadot (COIN:DOTUSD)

過去 株価チャート

から 3 2024 まで 4 2024

Polkadot (COIN:DOTUSD)

過去 株価チャート

から 4 2023 まで 4 2024