false

FY

0001938109

00-0000000

Unlimited

Unlimited

P0Y

P0Y

P2Y

0001938109

2023-09-01

2024-08-31

0001938109

2024-08-31

0001938109

2024-12-19

0001938109

2023-06-01

2023-08-31

0001938109

2024-06-01

2024-08-31

0001938109

2023-08-31

0001938109

2022-09-01

2023-08-31

0001938109

us-gaap:CommonStockMember

2022-08-31

0001938109

us-gaap:AdditionalPaidInCapitalMember

2022-08-31

0001938109

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-08-31

0001938109

us-gaap:RetainedEarningsMember

2022-08-31

0001938109

2022-08-31

0001938109

us-gaap:CommonStockMember

2023-08-31

0001938109

us-gaap:AdditionalPaidInCapitalMember

2023-08-31

0001938109

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-08-31

0001938109

us-gaap:RetainedEarningsMember

2023-08-31

0001938109

us-gaap:CommonStockMember

2022-09-01

2023-08-31

0001938109

us-gaap:AdditionalPaidInCapitalMember

2022-09-01

2023-08-31

0001938109

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-09-01

2023-08-31

0001938109

us-gaap:RetainedEarningsMember

2022-09-01

2023-08-31

0001938109

us-gaap:CommonStockMember

2023-09-01

2024-08-31

0001938109

us-gaap:AdditionalPaidInCapitalMember

2023-09-01

2024-08-31

0001938109

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-09-01

2024-08-31

0001938109

us-gaap:RetainedEarningsMember

2023-09-01

2024-08-31

0001938109

us-gaap:CommonStockMember

2024-08-31

0001938109

us-gaap:AdditionalPaidInCapitalMember

2024-08-31

0001938109

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2024-08-31

0001938109

us-gaap:RetainedEarningsMember

2024-08-31

0001938109

2023-10-31

2023-10-31

0001938109

us-gaap:SubsequentEventMember

2024-11-14

2024-11-14

0001938109

us-gaap:SubsequentEventMember

2024-10-31

0001938109

2023-07-01

2023-07-31

0001938109

us-gaap:EquipmentMember

2024-08-31

0001938109

us-gaap:FurnitureAndFixturesMember

2024-08-31

0001938109

us-gaap:TechnologyEquipmentMember

2024-08-31

0001938109

us-gaap:LeaseholdImprovementsMember

2024-08-31

0001938109

PAPL:LaptopsMember

2024-08-31

0001938109

us-gaap:ComputerSoftwareIntangibleAssetMember

2024-08-31

0001938109

us-gaap:ComputerSoftwareIntangibleAssetMember

2024-06-30

0001938109

srt:MinimumMember

2024-08-31

0001938109

srt:MaximumMember

2024-08-31

0001938109

2021-08-31

0001938109

PAPL:CommonStockWarrantMember

2023-08-31

0001938109

PAPL:CommonStockWarrantMember

2023-09-01

2024-08-31

0001938109

PAPL:CommonStockWarrantMember

2024-08-31

0001938109

us-gaap:IPOMember

2023-11-03

0001938109

us-gaap:IPOMember

2023-11-03

2023-11-03

0001938109

2023-11-03

2023-11-03

0001938109

PAPL:WarrantLiabilityMember

2023-11-03

2023-11-03

0001938109

PAPL:WarrantLiabilityMember

2023-11-03

0001938109

2024-08-01

2024-08-31

0001938109

PAPL:EquityPurchaseAgreementMember

2024-05-10

2024-05-10

0001938109

PAPL:EquityPurchaseAgreementMember

2024-08-01

0001938109

PAPL:EquityPurchaseAgreementMember

2024-08-01

2024-08-31

0001938109

us-gaap:WarrantMember

2023-11-03

2023-11-03

0001938109

us-gaap:WarrantMember

2023-11-03

0001938109

us-gaap:WarrantMember

2024-05-10

2024-05-10

0001938109

us-gaap:WarrantMember

2024-05-10

0001938109

us-gaap:MeasurementInputSharePriceMember

us-gaap:WarrantMember

PAPL:NovemberThreeTwoThousandTwentyThreeMember

2023-11-03

0001938109

us-gaap:MeasurementInputExercisePriceMember

us-gaap:WarrantMember

PAPL:NovemberThreeTwoThousandTwentyThreeMember

2023-11-03

0001938109

us-gaap:MeasurementInputRiskFreeInterestRateMember

us-gaap:WarrantMember

PAPL:NovemberThreeTwoThousandTwentyThreeMember

2023-11-03

0001938109

us-gaap:MeasurementInputOptionVolatilityMember

us-gaap:WarrantMember

PAPL:NovemberThreeTwoThousandTwentyThreeMember

2023-11-03

0001938109

us-gaap:MeasurementInputSharePriceMember

us-gaap:WarrantMember

PAPL:NovemberThreeTwoThousandTwentyThreeMember

2024-08-31

0001938109

us-gaap:MeasurementInputExercisePriceMember

us-gaap:WarrantMember

PAPL:NovemberThreeTwoThousandTwentyThreeMember

2024-08-31

0001938109

us-gaap:MeasurementInputRiskFreeInterestRateMember

us-gaap:WarrantMember

PAPL:NovemberThreeTwoThousandTwentyThreeMember

2024-08-31

0001938109

us-gaap:MeasurementInputOptionVolatilityMember

us-gaap:WarrantMember

PAPL:NovemberThreeTwoThousandTwentyThreeMember

2024-08-31

0001938109

us-gaap:MeasurementInputSharePriceMember

us-gaap:WarrantMember

PAPL:MayTwoThousandTwentyFourMember

2024-05-31

0001938109

us-gaap:MeasurementInputExercisePriceMember

us-gaap:WarrantMember

PAPL:MayTwoThousandTwentyFourMember

2024-05-31

0001938109

us-gaap:MeasurementInputRiskFreeInterestRateMember

us-gaap:WarrantMember

PAPL:MayTwoThousandTwentyFourMember

2024-05-31

0001938109

us-gaap:MeasurementInputCreditSpreadMember

us-gaap:WarrantMember

PAPL:MayTwoThousandTwentyFourMember

2024-05-31

0001938109

us-gaap:MeasurementInputOptionVolatilityMember

us-gaap:WarrantMember

PAPL:MayTwoThousandTwentyFourMember

2024-05-31

0001938109

us-gaap:MeasurementInputSharePriceMember

us-gaap:WarrantMember

PAPL:MayTwoThousandTwentyFourMember

2024-08-31

0001938109

us-gaap:MeasurementInputExercisePriceMember

us-gaap:WarrantMember

PAPL:MayTwoThousandTwentyFourMember

2024-08-31

0001938109

us-gaap:MeasurementInputRiskFreeInterestRateMember

us-gaap:WarrantMember

PAPL:MayTwoThousandTwentyFourMember

2024-08-31

0001938109

us-gaap:MeasurementInputCreditSpreadMember

us-gaap:WarrantMember

PAPL:MayTwoThousandTwentyFourMember

2024-08-31

0001938109

us-gaap:MeasurementInputOptionVolatilityMember

us-gaap:WarrantMember

PAPL:MayTwoThousandTwentyFourMember

2024-08-31

0001938109

PAPL:WarrantLiabilityMember

2023-08-31

0001938109

PAPL:WarrantLiabilityMember

2023-09-01

2024-08-31

0001938109

PAPL:WarrantLiabilityMember

2024-08-31

0001938109

2016-09-01

2017-08-31

0001938109

2021-06-14

2021-06-14

0001938109

srt:ChiefFinancialOfficerMember

2021-11-15

0001938109

srt:ChiefFinancialOfficerMember

2021-11-15

2021-11-15

0001938109

srt:ChiefFinancialOfficerMember

2023-09-01

2024-08-31

0001938109

srt:ChiefFinancialOfficerMember

2022-09-01

2023-08-31

0001938109

us-gaap:RelatedPartyMember

2023-09-01

2024-08-31

0001938109

us-gaap:RelatedPartyMember

2022-09-01

2023-08-31

0001938109

2023-11-03

0001938109

PAPL:SubscriptionRevenueMember

2023-09-01

2024-08-31

0001938109

PAPL:SubscriptionRevenueMember

2022-09-01

2023-08-31

0001938109

PAPL:OtherRevenueMember

2023-09-01

2024-08-31

0001938109

PAPL:OtherRevenueMember

2022-09-01

2023-08-31

0001938109

PAPL:UnderwritingRevenueMember

2023-09-01

2024-08-31

0001938109

PAPL:UnderwritingRevenueMember

2022-09-01

2023-08-31

0001938109

2023-07-31

0001938109

2024-05-10

0001938109

2024-05-10

2024-05-10

0001938109

PAPL:WarrantLiabilityMember

2024-05-10

2024-05-10

0001938109

PAPL:WarrantLiabilityMember

2024-07-01

2024-07-31

0001938109

us-gaap:SubsequentEventMember

2024-10-31

2024-10-31

0001938109

us-gaap:CommonStockMember

us-gaap:SubsequentEventMember

2024-11-14

2024-11-14

0001938109

us-gaap:CommonStockMember

us-gaap:SubsequentEventMember

2024-11-14

0001938109

PAPL:PreFundedWarrantsMember

us-gaap:SubsequentEventMember

2024-11-14

2024-11-14

0001938109

PAPL:PreFundedWarrantsMember

us-gaap:SubsequentEventMember

2024-11-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K

☒

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the fiscal year ended August 31, 2024

☐

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the transition period from ______ to ______

Commission

file number 001-41738

PINEAPPLE

FINANCIAL INC.

(Exact

Name of Registrant as Specified in Its Charter)

| Canada |

|

Not

applicable |

(State or other jurisdiction

of incorporation) |

|

(I. R. S. Employer

Identification No.) |

| Unit

200, 111 Gordon Baker Road |

| North

York, Ontario M2H 3R1 |

| (Address

of principal executive offices, including ZIP code) |

| |

| (416)

669-2046 |

| (Registrant’s

telephone number, including area code) |

Securities

registered pursuant to Section 12(b) of the Exchange Act:

| Title

of each class |

|

Trading

Symbol |

|

Name

of exchange on which registered |

| Common

Shares, no par value |

|

PAPL |

|

NYSE

American |

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. Yes ☐ No ☒

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files). Yes ☒ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” “smaller

reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer |

☐ |

Accelerated

filer |

☐ |

| Non-accelerated

filer |

☒ |

Smaller

reporting company |

☒ |

| |

|

Emerging

growth company |

☒ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report. ☐

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate

by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation

received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate

by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Exchange Act) Yes ☐ No ☒

As

of August 31, 2024 (the last business day of the registrant’s most recently completed year end), the aggregate market

value of the registrant’s common shares held by non-affiliates of the registrant was approximately $4.313 million, based on the closing price

on that date as reported on the NYSE American LLC.

Number

of shares of common shares outstanding as of December 19, 2024 was 8,808,019.

Documents

Incorporated by Reference: None.

TABLE

OF CONTENTS

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

Annual Report on Form 10-K contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933,

as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”). Any statements in this Annual Report on Form 10-K about our expectations, beliefs, plans, objectives, assumptions or future

events or performance are not historical facts and are forward-looking statements. These statements are often, but not always, made through

the use of words or phrases such as “believe,” “will,” “expect,” “anticipate,” “estimate,”

“intend,” “plan” and “would.” For example, statements concerning financial condition, possible or

assumed future results of operations, growth opportunities, industry ranking, plans and objectives of management, markets for our common

stock and future management and organizational structure are all forward-looking statements. Forward-looking statements are not guarantees

of performance. They involve known and unknown risks, uncertainties and assumptions that may cause actual results, levels of activity,

performance or achievements to differ materially from any results, levels of activity, performance or achievements expressed or implied

by any forward-looking statement.

Any

forward-looking statements are qualified in their entirety by reference to the risk factors discussed throughout this Annual Report on

Form 10-K. Some of the risks, uncertainties and assumptions that could cause actual results to differ materially from estimates or projections

contained in the forward-looking statements include, but are not limited to:

| ● |

the

timing of the development of future services, |

| |

|

| ● |

projections

of revenue, earnings, capital structure and other financial items, |

| |

|

| ● |

statements

regarding the capabilities of our business operations, |

| |

|

| ● |

statements

of expected future economic performance, |

| |

|

| ● |

statements

regarding competition in our market, and |

| |

|

| ● |

assumptions

underlying statements regarding us or our business. |

The

foregoing list sets forth some, but not all, of the factors that could affect our ability to achieve results described in any forward-looking

statements. You should read this Annual Report on Form 10-K and the documents that we reference herein and have filed as exhibits to

the Annual Report on Form 10-K, completely and with the understanding that our actual future results may be materially different from

what we expect. You should assume that the information appearing in this Annual Report on Form 10-K is accurate as of the date hereof.

Because the risk factors referred to on page 17 of Annual Report on Form 10-K could cause actual results or outcomes to differ materially

from those expressed in any forward-looking statements made by us or on our behalf, you should not place undue reliance on any forward-looking

statements. Further, any forward-looking statement speaks only as of the date on which it is made, and except as required by law, we

undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement

is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible for us to

predict which factors will arise. In addition, we cannot assess the impact of each factor on our business or the extent to which any

factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

We qualify all of the information presented in this Annual Report on Form 10-K, and particularly our forward-looking statements, by these

cautionary statements.

SUMMARY

OF RISK FACTORS

Our

business is subject to numerous risks described in the section titled “Risk Factors” and elsewhere in this prospectus. The

main risks set forth below and others you should consider are discussed more fully in the section entitled “Risk Factors”

beginning on page 17, which you should read in its entirety.

● our operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations;

● public health crises such as the COVID-19 pandemic may adversely impact our business;

● the volatility of global capital markets over the past several years has generally made the raising of capital more difficult;

● risks associated with political instability and changes to the regulations governing our business operations;

● our success is largely dependent on the performance of our directors and officers, Field Agents, and employees;

● our Common Shares may be subject to significant price volatility;

● internal controls cannot provide absolute assurance with respect to the reliability of financial reporting and financial statement preparation;

● we may be unable to manage our growth;

● risks associated with security breaches;

● risks associated with software errors or defects;

● our operations depend on information technology systems; and on continuous reliable internet access;

● our business now or in the future may be adversely affected by risks outside our control;

● risks associated with the Company’s reliance on strategic partnerships;

● reputational risk, and

● risks associated with protection of intellectual property.

ITEM

1. BUSINESS

General

We are a Canadian-based mortgage technology and brokerage company that provides mortgage brokerage services and technology solutions to

Canadian mortgage agents, brokers, sub-brokers, brokerages and consumers. Through data-driven systems together with cloud-based tools,

we believe we offer competitive advantages in the Canadian mortgage industry relative to alternative mortgage broker arrangements.

We also

provide back office services, together with pre-underwriting support services (collectively the “Brokerage Services”) to Canadian

mortgage brokerages (the “Brokerages”). In connection with the provision of the Brokerage Services, we employ and engage several

licensed mortgage brokers and agents (collectively, “Field Agents”). We have a total of full-time employed staff of 55. In

addition, we also enter into affiliation agreements with certain licensed mortgage brokers (collectively, “Affiliate Brokers”

and, together with Field Agents and Brokerages, the “Users”), pursuant to which the Company and the Affiliate Broker enter

into an affiliation relationship with the intention of jointly marketing mortgage brokerage and other financial services as affiliated

entities, sometimes referred to as “white labelling”, which allows the Affiliate Broker to sell a mortgage that is branded

with its company name to its own client base.

Our services distribution and fee structure for each stream is detailed hereunder:

| |

1. |

The fee for the subscription

service revenue stream is $117 for use of our platforms by our agents to complete the mortgage deal from initiation to funding by the

lender partner and is about 3% of total gross revenue. |

| |

|

|

| |

2. |

Our pre-risk assessment services

revenue is about 1.3% of our total gross revenue and the structure for this service is $390 per deal for a mortgage funded amount of

$390,000 and over. For a mortgage funded amount under $390,000 the fee is $273. |

| |

|

|

| |

3. |

The balance of our total

gross revenue at 95% comes from our lender partner service commissions and the structure varies by rate and amount based on the season,

special promotions at that particular time, bonus applicable, funded volume, etc. The lender partners comprise of banks, trust companies,

mortgage loan companies, building societies and other lending financial institutions, including but not limited to the Bank of Nova

Scotia (Scotiabank), Manulife Bank of Canada, Toronto-Dominion Bank (TD Bank), The Mortgage Alliance Company of Canada Inc. (MCAP),

First National Financial LP, Home Trust Company, The Equitable Trust Company (Equitable Bank), ICICI Bank Canada and Desjardins Mortgage

Financing Services. |

We currently operate exclusively in Canada, specifically in the provinces

of Ontario, Newfoundland and Labrador, New Brunswick, Nova Scotia, British Columbia, Prince Edward Island, Manitoba and Alberta. We launched

our first brokerage in Ontario in November 2016. We have been approved by each of the applicable provincial mortgage regulators to operate

in 11 provinces and territories namely Alberta, British Columbia, New Brunswick, Newfoundland and Labrador, Northwest Territories, Nova

Scotia, Nunavut, Prince Edward Island, Quebec, and Yukon, and 1 provinces to follow is Saskatchewan. We launched our first brokerage office

in Alberta on July 1, 2021. We also launched our first brokerage office in Newfoundland and Labrador, Nova Scotia, New Brunswick, and

Prince Edward Island on May 4, 2022. We launched our first British Columbia brokerage office in 2024. We provide our Brokerage Services

to both residential and commercial mortgage opportunities and, in each case, through a proprietary technology called MyPineapple, as discussed

in further detail below.

MyPineapple

At

the heart of our Brokerage Services is an innovative technology system, MyPineapple, that provides real time data management and reporting,

lead generation opportunities, customer relationship management, deal processing, education and knowledge center, payroll, regulatory

compliance, data analytics, document collection and storage, automated onboarding, lender access, back office support and direct underwriting

support, all in one. MyPineapple offers network management capabilities for Users, including hundreds of qualified Field Agents, to create

an efficient marketplace for the provision of mortgage lending and insurance industry services. MyPineapple integrates directly with

Salesforce, Equifax, OneSpan, G Suite and Filogix and manages Users’ day-to-day business through automated triggers and tasks,

ensuring nothing falls through the cracks. Backed by Salesforce, pursuant to the Salesforce Agreement (defined herein), and built with

proprietary code deep data analytics, MyPineapple syncs up with Users’ calendar and emails, produces robust reporting, advanced

analytics, and real-time notifications on marketing communications, and more. MyPineapple is a sophisticated and fundamental tool for

revenue growth and relationship development. It plays a significant role in what we believe makes our Brokerage Services distinct and

cutting-edge.

MyPineapple

was created to address key issues within the mortgage brokerage industry. We built MyPineapple to create a long-term competitive advantage

relative to traditional service providers, who have comparatively high-touch, labor intensive and costly operations. We believe that,

through MyPineapple, we are able to deliver faster services and with fewer errors. Our MyPineapple platform is completely automated,

simplifying the mortgage process while providing efficiencies to and alleviating pressure on Users’ staff in completing traditional

administrative tasks, which in turn reduces the Users’ cost structure and results in increased profit margins and scalability.

MyPineapple reduces manual processes through robust quality control mechanisms, logistics management capabilities, capacity planning

tools and end-to-end transaction management. MyPineapple also includes a leading education technology platform, which enables Users to

continuously stay informed and educated on what mortgage solutions and market conditions could impact Canadian consumers.

Our

primary objectives and goals include, but are not limited to, the following:

| |

● |

Grow

our mortgage broker distribution channel to gain further market share and consumer adoption, including increasing organic (non-acquisition

related) market share and to achieve growth on the number of mortgages funded annually; |

| |

|

|

| |

● |

Become

the go-to mortgage experience platform for mortgage agents, lenders and homebuyers; |

| |

|

|

| |

● |

For

Pineapple Insurance to provide an insurance option for all our mortgage approvals; |

| |

|

|

| |

● |

To

ensure that we are providing a well-rounded and custom-tailored approach to insurance solutions that may best suit the clients’

needs; |

| |

|

|

| |

● |

To

leverage the power of our growing database and brand recognition to open further insurance opportunity channel; and |

Streamline

the insurance approval and application process for mortgage clients using technology.

Services

and Products

Brokerage

Services

The

following is a detailed description of the Brokerages Services that we offer:

| 1. |

Mortgage

Brokering: We employ and engage a number of licensed Field Agents who originate clients, provide mortgage consultation services,

advise clients on the various mortgage products offered by financial institutions in Canada, offer clients access to rate information

and mortgage options from a range of lenders, including major banks and lending institutions and assist clients in selecting the

most appropriate and effective mortgage solution for their particular needs. |

| |

|

| 2. |

Technology:

MyPineapple is a full spectrum, robust and comprehensive technology system, which allows Users to conduct their brokerage services

more effectively and efficiently. Amongst other things, MyPineapple syncs up with Users’ calendar and emails, produces robust

reporting, advanced analytics, and real-time notifications for email opens, and link clicks. MyPineapple also provides Users with

cloud storage. We also provide marketing support to Users in order to systematically manage the marketing process, segmentation and

client conversions. We ensure that all clients stay well informed with highly relevant information; it also increases the conversion

ratios and engagement metric for its Users. This provides Users the ability to focus on higher probability clients and deliver a

high level of value and service while the system manages the relationship with others. |

| |

|

| 3. |

Back

Office Support Services: Through MyPineapple, we offer our Users back office support services, including digital and automated onboarding

and set up, loan packaging and processing, digital document collection and client portals, loan maintenance activities, payroll,

lender communication, reporting requirements for regulators and business management, cloud services, expense collections, document

preparation, compliance, training, administration and marketing. |

| |

|

| 4. |

Pre-Underwriting

Support: Technology enabled and together with back-office support, we offer our Users pre-underwriting support services that establish

appropriate qualifying processes in a mortgage application, providing borrowers a digital environment ensuring mortgage agents has

the necessary data and providing borrowers with an instant pre-qualification. We use our diverse exposure to the mortgage industry

to save Users from spending valuable resources on mortgage applications that have fewer chances of reaching approval. In particular,

we offer our Users the following pre-underwriting services, aimed at speeding up the underwriting process and helping mortgage lenders

make accurate decisions: |

| |

● |

Credit

Review: We verify all information that is supplied by the client in vital loan documents and other personal information. Thereafter,

we meticulously review client credit records and tax return documents to ensure the client has the required financial stability to

make monthly payments for the mortgage. We follow checklist-based system to ensure that all the critical aspects pertaining to underwriting

are covered. |

| |

● |

Data

Validation: Our pre-underwriting support services include recording and digitizing our findings in the data validation process. By

digitizing these vital information sets about the client, we are able to establish the accuracy and speed needed to expedite the

underwriting process. |

| |

|

|

| |

● |

Fraud

Analysis and Compliance: We pride ourselves in diligently checking for identity fraud and ensuring that applications are compliant

and contain complete information. Our mortgage experts have the experience and acumen to spot missing or mala fide information. This

obviates the need for the underwriter to send client files back for incomplete information and thereby speeds up the underwriting

process. Our fraud analysis encompasses all aspects of the client file review process including running third-party reports. This

ensures the underwriter has to focus only on decision-making. |

| |

|

|

| |

● |

Appraisal

Ordering and Review: We take charge of title ordering and dispatching verified property information to the appraiser to boost the

turnaround times of the appraisal process. Once the appraisal is over, we carefully review the appraisal report to ensure that the

process has been completed in a fair and error-free manner. |

| |

|

|

| |

● |

Data

Analytics: Through MyPineapple, we are able to use data to analyze customer benefit opportunities as they become available. In particular,

MyPineapple allows us to utilize the data that has been acquired through the mortgage approval process along with real time real

estate and credit data to thereby reduce costs and overall debt process timelines. |

Insurance

Products

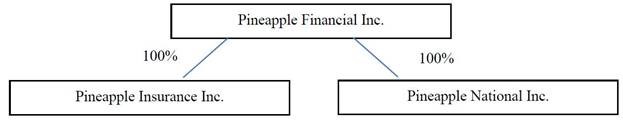

Pineapple Insurance Inc. is a wholly owned

subsidiary of Pineapple Financial Inc. This entity is to serve the insurance needs of our brand mortgage brokers and agents across

Canada. Pineapple Insurance is to act as an Managing General Agent (MGA) supported by Industrial Alliance. This entity will create

both a revenue channel and retention strategy for borrowers that live within our database. This will also allow a growth opportunity

and an overall holistic financial services opportunity for us. We are currently in the early stages of development of Pineapple

Insurance Inc. Operational infrastructure and a budget has been prepared alongside technology modifications to our MyPineapple

system in order to manage the delivery of this product. We have also created a sales and marketing plan alongside assets and

materials, which will be used for initial launch. Our next steps are staffing and human capital requirements in order to execute on

the business plan and goals of developing Pineapple Insurance.

Pineapple

Insurance provides the following services:

| |

● |

We

will complete a needs analysis on each client to ensure the most suitable product to meet both their needs and their goals. In our

product suite, we will offer term life insurance which will provide a low-cost coverage at a fixed rate of payments for a limited

period of time for the life of the mortgage. The goal of this product is to ensure that in the event of the insurer’s untimely

death with their term policy their beneficiaries will be covered in the amount of the policy during the life of the term. No insurance

will be paid to the beneficiary should the insured pass away after the end of the term or if the insured did not make the required

payments. |

| |

|

|

| |

● |

Whole

Life Insurance is a life insurance policy which is guaranteed to remain in force for the insured’s entire lifetime, provided

required premiums are paid, or to the maturity date. In addition to paying a death benefit, whole life insurance also contains a

savings component in which cash value may accumulate on a tax-advantaged basis. The policies can be leveraged as collateral or an

asset with our lenders through the Company. |

| |

● |

For

both our personal and our business clients, we offer permanent life insurance policies, which offer a death benefit and cash value.

The death benefit is money that is paid to your beneficiaries when you pass away. Cash value is a separate savings component that

you may be able to access while you are still alive. Permanent insurance can help cover the business owner for their entire life.

And unlike term insurance, it includes the potential for a cash accumulation fund. Investments in the fund are tax-preferred, including

at death when the tax-free death benefit is paid out to a named beneficiary. An additional benefit of permanent life insurance is

that allocating funds in a corporation away from taxable investments to a permanent life insurance policy can help reduce overall

annual taxable investment income. Permanent life insurance lasts from the time you buy a policy to the time you pass away, as long

as you pay the required premiums. The policies can be leveraged as collateral or an asset with our lenders through the Company. |

| |

|

|

| |

● |

Critical

Illness Insurance provides additional coverage for medical emergencies like heart attacks, strokes, or cancer. Because these emergencies

or illnesses often incur greater-than-average medical costs, these policies pay out cash to help cover those overruns where traditional

health insurance may fall short and help cover living expenses while the client recovers. These policies come at a relatively low

cost. However, the instances that they will cover are generally limited to a few illnesses or emergencies. The key element is to

ensure that the mortgagor does not fall behind in their mortgage payments. |

| |

|

|

| |

● |

Credit

Insurance is a type of life insurance that can cover the remaining amount of your loan in the event of your death. Your insurance

company will use the death benefit to pay down or pay off the remaining balance on the loan, up to a maximum amount outlined in the

certificate of insurance. The money from your death benefit will go to your creditor. The money will not go to your family or beneficiaries. |

We

offer a wide range of investment options to suit clients risk tolerance and investment preferences. A financial advisor will review and

assess the needs of each client to determine the short- and long-term goals for financial success. Such options may include segregated

funds or mutual funds for registered (registered education savings plans (RESPs), registered retirement savings plans (RRSPs), tax-free

savings accounts (TFSAs), etc.) and non-registered accounts. A segregated fund, or seg fund, is a type of investment fund administered

by Canadian insurance companies in the form of individual, variable life insurance contracts offering certain guarantees to the policyholder

such as reimbursement of capital upon death and mutual funds. As a regulatory requirement, all Canadian mortgage approvals being presented

by the mortgage broker channel must include the option for a client to consider an insurance option in an effort to protect the liability

in the case of death or disability. Pineapple Insurance Inc. will be presenting this insurance option for a client to accept or not via

the products that we have available. This will be presented to all mortgage approvals being offered via our parent company, Pineapple

Financial Inc.

As

a complementary service to our parent company, Pineapple Financial Inc., this insurance subsidiary was created to easily serve the needs

of the homeowners whose mortgages originate with us. With any mortgage product in Canada, an insurance component is a requirement, hence

the diversification and business development into insurance.

Our

insurance services identified above currently are provided by a third-party insurance company, Industrial Alliance Inc., with whom we

are affiliated as a managing general agent (MGA). We, therefore, act as an agent earning commissions from the premiums charged by the

insurance company.

We

believe the material steps for Pineapple Insurance to grow form its early stages of development are as follow:

| |

1. |

To

introduce the services offered by Industrial Alliance and to serve the Users on our platform, MyPineapple, is to market these services,

create a knowledge base for them to understand and pass on the learning to their customers, create a support structure for both Users

and Users’ customers. |

| |

|

|

| |

2. |

Set

up an internal infrastructure for the management and offering of these services i.e. hire a senior management person to manage the

operational affairs and thereafter additional personnel, as needed when the business grows. The additional personnel will be mostly

sales commissionable personnel with a retainer. |

Pineapple

Insurance officially launched in October 2024, marking a significant milestone in Pineapple Financial’s diversification strategy.

The costs anticipated for Pineapple Insurance are largely tied to marketing efforts, human capital, and platform development. Human capital

costs include a fixed expense for senior leadership, along with variable costs for additional personnel as the business scales. With

the strategic integration of Pineapple Insurance into the MyPineapple platform, our development costs are aimed at ensuring seamless

client experiences and operational efficiency. We estimate that approximately 15% of the proceeds from the shares offering will be allocated

to support the continued growth and scaling of this business vertical.

The

growth timeline for Pineapple Insurance is projected at 12 to 24 months post-launch, reflecting strong initial demand and the effectiveness

of our comprehensive go-to-market strategy. This timeline is contingent upon the effectiveness of marketing campaigns, customer adoption

of the services offered by Industrial Alliance, and the competitiveness of pricing and premiums. The early success of our launch indicates

promising customer acceptance, supported by focused efforts to educate users on product variations and benefits. These efforts are expected

to accelerate market penetration and drive sustained growth for this subsidiary.

InsurTech

MyPineapple

is a key reason for our success and has the ability to drive interested and timely insurance prospects to a replicated module that we

have built in order to streamline and manage the customer flow for insurance products. The process is designed to create a unique synchronicity

between the client obtaining a mortgage approval and insurance approval.

Combined,

the simplicity of the two platforms with its connectivity and integrations will allow Pineapple Insurance to successfully process and

approve insurance applications.

We

have also created client segmentations and retention programs to ensure that we can maximize our database of over 150,000 potential clients.

Growth

Strategy

Brokerage

Services

We

aim to gain further market share and consumer adoption by focusing on the following areas of growth:

| |

1. |

Increase

Agent Revenue From Optimized Analytics: We will continue to analyze past borrower data to determine opportunities to beneficially

re-service them in the future, potentially creating revenue generating activities and significantly enhancing the borrower experience. |

| |

|

|

| |

2. |

Added

Product Suite - Insurance. As discussed above, we are establishing an insurance channel that provides borrowers with a full suite

of insurance products, which we believe will increase revenue. |

| |

|

|

| |

3. |

National

Expansion: We expect to continue to expand our business and operations into current jurisdictions along with new provinces such as

British Colombia and Quebec. |

| |

|

|

| |

4. |

Borrower-Facing

Technology. We believe MyPineapple will be a marketplace where clients can select from a variety of mortgage products that will suit

their individual needs while tracking the progress and status of the transaction for the life of the mortgage and beyond. |

Insurance

Products

In

order to achieve our objectives and goals, Pineapple Insurance will focus on four main areas:

| |

1. |

Insurance

originations: Our files will be obtained exclusively through the Pineapple Financial referral network. This will be achieved through

technology integration where Pineapple Insurance agents are immediately notified of a mortgage approval which requires an insurance

option. Our agents will be highly trained in an effort to service the growth of our referral network. Consistency in service level

and approach is key to building our brand. |

| |

|

|

| |

2. |

Emphasizing

core values: Servicing our clients, maintaining relationships, ongoing and continued support, education and training, ongoing lines

of communication between mortgage agent and insurance agent and ensuring a smooth and efficient closing process. We expect our agents

to conduct themselves with the highest level of professionalism and carry out the fundamental and core values of Pineapple Insurance

at all times. |

| |

3. |

Hiring

and training insurance agents: We will follow and adhere to strict hiring and training policies as set out in our training manuals.

Development of education and training programs working in conjunction with our partners. Ensuring that we are consistently working

on recruiting top performing insurance agents that will be able to meet the growth and scale of the needs of the Company. |

| |

|

|

| |

4. |

Technologies

and relationship management tools: We will be replicating and customizing our robust MyPineapple system for data transfer and client

management. This will be broken into the following areas: |

| |

● |

Operational

Excellence: notifying insurance agents at the optimal time to increase conversion metrics and customer satisfaction. Integration

of client data so the process is convenient for all involved parties. Visibility of status and automations of workflow and requirements; |

| |

|

|

| |

● |

Client

Relationship Management (CRM): Advancing client relationships towards application indication, application completion and client retention;

and |

| |

|

|

| |

● |

Acquisition:

marketing funnels to leverage the overall database and identity opportunities from older missed opportunities. |

Markets

for our Services

Brokerage

Services

The

clients for our Brokerage Services include mortgage agents, brokers, sub-brokers, brokerages and consumers. Our customer activity is

intrinsically linked to the health of the real estate or commercial markets generally, particularly in Canada.

Strong

housing demand during 2020, 2021 and the first quarter of 2022 positively impacted the seasonal variations. With the onset of inflationary

pressures around the globe, not only the seasonality but the normal trends of the housing markets have declined with the increase of

interest rates. Although our business may be negatively impacted, we believe our multiple channels of revenue helps to mitigate any such

impact.

In alignment with the Canadian government’s

commitment to improving housing affordability and accessibility, several new housing measures have been introduced to support homeowners

and first-time buyers. These include enabling homeowners to refinance their mortgages to construct secondary rental suites and borrowing

up to 90% of their home’s value with a 30-year amortization period. Additionally, the mortgage insurance price limit has been increased

to $2 million, ensuring broader access to financing across Canada’s diverse housing markets.

The government has also proposed consultations on

taxing vacant land to encourage development and incentivize landowners to build homes. Collaboration with provinces, territories, and

municipalities is underway to implement these measures effectively. Starting December 15, 2024, two key rules will further aid affordability:

30-year mortgage amortizations will become available to all first-time homebuyers and buyers of new-build properties, and the price cap

for insured mortgages will rise to $1.5 million from $1 million.

Moreover, the federal government has expanded the

Canada Public Land Bank by adding 14 underused federal properties, bringing the total to 70. These properties across major cities are

slated for affordable housing developments. This initiative supports the government’s broader plan to unlock public lands for housing

and address the growing demand for homes while strengthening Canadian communities.

These measures, alongside the influx of new immigrants

and the rising demand for home renovations, refurbishments, and innovative financing solutions, create a favorable environment for Pineapple

Financial Inc. to continue expanding its offerings and capitalizing on these growth opportunities.

Insurance

Products

The

insurance market for Pineapple Insurance is focused around growth in the Canadian mortgage landscape as well as market share growth for

Pineapple Financial.

| |

● |

Real

estate investors: we are able to consolidate multiple mortgage amounts into one insurance policy to help minimize risk if an investor

has multiple properties. |

| |

|

|

| |

● |

Residential

Home purchase: with Canadian housing prices hitting all-time highs, we will help clients provide insurance to fill the gap between

their current coverage and the mortgage amount |

| |

|

|

| |

● |

Refinance:

can help clients reduce existing coverage or apply/consolidate if they require additional coverage. |

| |

|

|

| |

● |

Reverse

Mortgage: these clients can use the income from the reverse mortgage to help plan their final expense through insurance as well as

enrich their retirement years. |

| |

● |

Switch:

transferring to another lender at renewal. The insurance we offer is not tied to the lender directly and can assist clients in locking

in their rates long term when they can still qualify for insurance |

| |

|

|

| |

● |

Renovation

and construction: Clients will be able to access their cash values in their permanent insurance policies to help fund their renovations

and construction projects. If additional financing is required, we can provide the added insurance coverage needed. |

| |

|

|

| |

● |

Self-Employed:

As large numbers of Canadians move into business for themselves, we have found a great need for an insurance product that can suit

their needs since they generally do not have a company benefits plan. Income protection will also be a key component of our business

here. |

| |

|

|

| |

● |

Commercial

Mortgages: We can provide the proper insurance to clients for the right amount of coverage and timeline for one or multiple investors.

Coverages can go up to $20 million. |

| |

|

|

| |

● |

Private

Lending: Customized insurance can be provided to private lenders who may have a different set of circumstances in terms of investment

type and timeline horizon. |

| |

|

|

| |

● |

High

Risk Health & Uninsurable: We can offer guaranteed issue insurance to clients who may have declining health or were previously

declined for insurance in the past. |

Pineapple

Financial Inc. and Mortgage Market Dependency

As

of November 2024, Canada’s mortgage market continues to demonstrate resilience despite ongoing challenges. According to the Bank

of Canada, the total residential mortgage market is valued at over $1.6 trillion, driven by population growth, increasing borrower demand,

and evolving consumer sentiment. This figure excludes mortgages held by provincially regulated entities such as credit unions and mortgage

investment corporations.

Mortgage

lenders offer a broad range of products, including fixed and variable rates, varying terms, and flexible amortization periods. Recent

interest rate cuts by the Bank of Canada have rejuvenated the market, improving affordability for new buyers and creating opportunities

for existing homeowners to refinance or renew at more favorable terms. The practice of negotiating discounted rates remains prevalent,

highlighting the importance of mortgage brokers in securing competitive deals for clients.

Mortgage

brokers are critical intermediaries, leveraging their volume-based bargaining power to erode lender price discrimination and secure advantageous

rates. These professionals are provincially regulated and must meet stringent licensing and training requirements. While the barriers

to entry remain relatively low, successful brokers rely on experience, negotiating skills, and technological support to thrive in an

increasingly competitive market.

Key

trends currently influencing the market include:

| ● | Renewals

Surge: Over 30% of Canadian mortgages are expected to renew within the next 12 months,

a significant driver of market activity. |

| ● | Housing

Shortages: A growing population, combined with limited housing supply, has led to increased

pressure on the market, with demand consistently outstripping available inventory. |

| ● | Government

Policies: Recent adjustments, such as the introduction of a 30-year amortization period

for insured mortgages and incentives for affordable housing, have bolstered consumer

confidence and created new opportunities. |

| ● | Consumer

Sentiment: Improved confidence, spurred by rate cuts and stabilizing economic conditions,

has increased buyer activity despite affordability challenges. |

| ● | Technology

Adoption: Platforms like MyPineapple are transforming the brokerage landscape

by streamlining processes and providing brokers with data-driven tools to enhance efficiency

and client satisfaction. |

Industry

Growth Strategy

Our

growth strategy focuses on organic expansion, targeting increased market share through:

| 1. | Recruitment:

We have successfully recruited a significant number of Field Agents and Users,

driving a growth rate higher than many competitors. By leveraging detailed insights into

competitive models, we have tailored our value proposition to attract and retain top talent. |

| 2. | Technological

Integration: Our proprietary platform, MyPineapple, empowers brokers with tools

to increase sales volume, productivity, and efficiency. This system also supports the seamless

integration of complementary services, such as insurance products, creating additional

revenue streams and enhancing the overall client experience. |

| 3. | Policy

Alignment: By aligning our offerings with government initiatives to support housing affordability

and address shortages, we have positioned ourselves as a key player in addressing critical

market needs. |

| 4. | Focus

on Renewals and Refinances: With a large portion of the mortgage market up for renewal

in the next year, we have tailored solutions to help brokers optimize their client retention

and capitalize on refinancing opportunities. |

Our

strategy is underpinned by a commitment to delivering superior value, leveraging data and insights to support broker success, and maintaining

flexibility to adapt to evolving market conditions. This approach ensures we remain a leader in the Canadian mortgage and brokerage industry.

Recent

Development

On

May 10, 2024, the Company entered into an equity purchase agreement (the “EPA”) with Brown Stone Capital Ltd., a corporation

organized under the laws of England and Wales (the “Selling Shareholder”) pursuant to which the Company shall issue and sell

to the Selling Shareholder, from time to time as provided herein, and the Selling Shareholder shall purchase up to Fifteen Million Dollars

($15,000,000.00) of the Company’s common shares and issue 200,000 Company’s common shares as a commitment fee under the EPA

to the Selling Shareholder (collectively as the “EPA Shares”) at purchase price to be determined as per the terms and conditions

of the EPA. The Company shall have the right, but not the obligation, to direct the Selling Shareholder, by its delivery to the Selling

Shareholder of a put notice from time to time, to purchase the EPA Shares (i) in a minimum amount not less than $10,000.00 and (ii) in

a maximum amount up to the lesser of (a) $1,000,000 or (b) 150% of the average trading volume of the Company’s common shares on

the NYSE American during the five (5) Trading Days immediately preceding the respective put notice date multiplied by the lowest daily

volume weighted average price of the Company’s common shares on the NYSE American during the five (5) trading days immediately

preceding the respective put notice date. The Company’s right to issue a put notice for the EPA Shares is subject to general terms

and conditions as stipulated under the EPA, including there being an effective registration statement covering the EPA Shares.

Pursuant

to the EPA, we may issue and sell up to $15 million of Common Shares to the Selling Shareholder. The price at which we may issue and

sell shares will be 95% of the lowest daily volume weighted average price of the Company’s Common Shares on the NYSE American during

the five (5) trading days immediately preceding the respective put notice date, in each case as reported by Quotestream or other reputable

source designated by the Selling Shareholder (the “Market Price”). Assuming that (a) we issue and sell the full $15 million

of Common Shares under the EPA to the Selling Shareholder, (b) no beneficial ownership limitations, and (c) purchase price for such sales

is $0.40 or $0.50 per share, such additional issuances would represent in the aggregate approximately 37,500,000 or 30,000,000 additional

Common Shares, respectively, or approximately 81% or 77% of the total number of Common Shares outstanding as of the date hereof, after

giving effect to such issuance. If the beneficial ownership limitation is not waived, we may issue approximately 269,480 Common Shares,

or approximately 19.99% of the total number of Common Shares outstanding as of the date hereof.

The

Market Price of our Common Shares on December 13, 2024, was $0.45. Assuming this is the Market Price used as a basis for the

calculations for the put notice under the EPA, the price per share for sales to the Selling Shareholder would be $0.43 (95% of the

Market Price), and we would be able to sell 269,480 shares to the Selling Shareholder (with beneficial ownership limit), and receive

gross proceeds of $115,876 such number of shares would comprise approximately 19.99% of our issued and outstanding Common

Shares, which would result in additional dilution of our shareholders.

In

relation to the EPA Shares the Company has entered into a registration rights agreement dated May 10, 2024 (the “RRA”) with

the Selling Shareholder, requiring the Company to register the EPA Shares issued under the EPA. Pursuant to the RRA, the Company has

agreed to file one or more registration statements with the Securities and Exchange Commission covering the registration of the EPA Shares.

Concurrently,

on May 10, 2024, the Company entered into a securities purchase agreement (the “SPA” and together with the EPA and the RRA

as the “Agreements”) with the Selling Shareholder, pursuant to which the Company has agreed to sell to the Selling Shareholder

a convertible promissory note (the “Note”) in the aggregate principal amount of $300,000, with an 8% per annum interest rate

and a maturity date of twenty four (24) months from the date of the issuance. The Note is convertible into the Company’s common

shares, no par value, subject to the terms and conditions therein, and a conversion price of equal 75% of the VWAP on the trading day

immediately preceding the respective conversion date, subject to adjustment as provided in the Note. The issuance of the Note is subject

to general terms and conditions as stipulated under the SPA, including the requirement of getting shareholder approval for any issuance

of common shares beyond the beneficial ownership limit of 19.99%.

As

an incentive to buy the Note, the Company had agreed to issue warrants to purchase 1,000,000 common shares (the “2024 Warrants”),

with an exercise price of $5 per share and term of nine (9) months from the date of issuance.

As per terms of the agreement, issuer of convertible debt exercise their right and the total principal portion $300,000 plus the interest

accrued thoron $4,437 was converted into common shares by issuing 501,874 common shares.

The

equity line of credit has had no immediate impact on our business. However, it positions us to draw capital for growth initiatives as

our share price increases, enhancing our ability to fund strategic investments and operational expansions. No assurances can be given

that the stock price will increase.

Conditions

Precedent to the Right of the Company to Deliver a Put Notice

Selling

Shareholders’ obligation to accept Put Notices that are timely delivered by us under the EPA and to purchase of our Common Shares

under the EPA, are subject to satisfaction of the conditions precedent thereto set forth in the EPA, all of which are entirely outside

of Selling Shareholders’ control, which conditions include the following:

| |

● |

the

accuracy in all material respects of the representations and warranties of the Company included in the EPA as of the Put Date; |

| |

● |

the

Company having paid the cash commitment fee or issued the Commitment Shares to an account designated by Selling Shareholder; |

| |

● |

the

registration statement that includes this prospectus (and any one or more additional registration statements filed with the SEC that

include Common Shares that may be issued and sold by the Company to Selling Shareholder under the EPA) having been declared effective

under the Securities Act by the SEC, and Selling Shareholder being able to utilize this prospectus (and the prospectus included in

any one or more additional registration statements filed with the SEC under the RRA) to resell all of the Common Shares included

in this prospectus (and included in any such additional prospectuses); |

| |

● |

the

Company obtaining all permits and qualifications required by any applicable state for the offer and sale of all Common Shares issuable

pursuant to such Put Notice, or will have the availability of exemptions therefrom; |

| |

● |

the

Board of Directors approving the transactions contemplated by the EPA and RRA, which approval will remain in full force; |

| |

● |

there

will not have occurred any event and there will not exist any condition or state of facts, which makes any statement of a material

fact made in the registration statement that includes this prospectus (or in any one or more additional registration statements filed

with the SEC that include Common Shares that may be issued and sold by the Company to Selling Shareholder under the EPA) untrue or

which requires the making of any additions to or changes to the statements contained therein in order to state a material fact required

by the Securities Act to be stated therein or necessary in order to make the statements then made therein (in the case of this prospectus

or the prospectus included in any one or more additional registration statements filed with the SEC under the RRA, in the light of

the circumstances under which they were made) not misleading; |

| |

● |

the

Company performing, satisfying and complying in all material respects with all covenants, agreements and conditions required by the

EPA; |

| |

● |

the

absence of any statute, regulation, order, decree, writ, ruling or injunction by any court or governmental authority of competent

jurisdiction which prohibits the consummation of or that would materially modify or delay any of the transactions contemplated by

the EPA or the RRA; |

| |

● |

trading

in the Common Shares will not have been suspended by the SEC, Nasdaq or FINRA, the Company will not have received any final and non-appealable

notice that the listing or quotation of the Common Shares on Nasdaq will be terminated on a date certain (unless, prior to such date,

the Common Shares is listed or quoted on any other Principal Market, as such term is defined in the EPA), and there will be no suspension

of, or restriction on, accepting additional deposits of the Common Shares, electronic trading or book-entry services by The Depository

Trust Company with respect to the Common Shares; |

| |

● |

the

Company will have authorized all of the Common Shares issuable pursuant to the applicable Put Notice by all necessary corporate action

of the Company; and |

| |

● |

the

accuracy in all material respects of the representations and warranties of the Company included in the applicable Put Notice as of

the applicable Put Date. |

No

Short-Selling or Hedging by Selling Shareholder

Selling

Shareholder has agreed that none of Selling Shareholder, its sole member, any of their respective officers, or any entity managed or

controlled by Selling Shareholder or its sole member will engage in or effect, directly or indirectly, for its own account or for the

account of any other of such persons or entities, any short sales of the Common Shares or hedging transaction that establishes a net

short position in the Common Shares during the term of the EPA.

Effect

of Sales of our Common Shares under the EPA on our Shareholders

The

Commitment Shares that we issued, and the EPA Shares to be issued or sold by us, to the Selling Shareholder under the EPA that are being

registered under the Securities Act for resale by the Selling Shareholder in this offering are expected to be freely tradable. The resale

by the Selling Shareholder of a significant amount of shares registered for resale in this offering at any given time, or the perception

that these sales may occur, could cause the market price of our Common Shares to decline and to be highly volatile. Sales of our Common

Shares, if any, to the Selling Shareholder under the EPA will depend upon market conditions and other factors to be determined by us.

If

and when we do sell Common Shares to the Selling Shareholder pursuant to the EPA, after the Selling Shareholder has acquired such shares,

the Selling Shareholder may resell all, some or none of such shares at any time or from time to time in its discretion and at different

prices. As a result, investors who purchase the shares from the Selling Shareholder in this offering at different times will likely pay

different prices for those shares, and so may experience different levels of dilution, and in some cases substantial dilution, and different

outcomes in their investment results. Investors may experience a decline in the value of the shares they purchase from the Selling Shareholder

in this offering as a result of future sales made by us to the Selling Shareholder at prices lower than the prices such investors paid

for their shares in this offering. In addition, if we sell a substantial number of Common Shares to the Selling Shareholder under the

EPA, or if investors expect that we will do so, the actual sales of shares or the mere existence of our arrangement with the Selling

Shareholder may make it more difficult for us to sell equity or equity-related securities in the future at a time and at a price that

we might otherwise wish to effect such sales.

Because

the per share purchase price that the Selling Shareholder will pay for the EPA Shares in any put notice that we may elect to effect pursuant

to the EPA will be determined by reference to the VWAP during the applicable commitment period on the applicable put date for such put

notice, as of the date of this prospectus, it is not possible for us to predict the number of Common Shares that we will sell to the

Selling Shareholder under the EPA, the actual purchase price per share to be paid by the Selling Shareholder for those shares, or the

actual gross proceeds to be raised by us from those sales, if any.

As

of August 31, 2024, there were 8,425,352 Common Shares outstanding. Company has already issued 741,499 shares against

EPA out of the total 13,910,991 shares only 13,169,492 shares can further be offered. If all of the 13,169,492 shares offered

for resale by the Selling Shareholder under this prospectus were issued and outstanding, such shares would represent approximately

150% of the total number of outstanding Common Shares and approximately 249% of the total number of outstanding Common

Shares held by non-affiliates of our company, in each case as of August 31, 2024.

Although

the EPA provides that we may sell up to $15.0 million of our Common Shares to the Selling Shareholder, only 13,910,991 shares (which

includes the 200,000 Commitment Shares, for which we have not and will not receive any cash consideration) are being registered under

the Securities Act for resale by the Selling Shareholder under the registration statement that includes this prospectus. If we were to

issue and sell all of such 13,910,991 shares to the Selling Shareholder at an assumed purchase price per share of $0.97 (without taking

into account the 19.99% Exchange Cap limitation), representing the closing sale price of our Common Shares on Nasdaq on June 18, 2024,

we would only receive approximately $13.4 million in aggregate gross proceeds from the sale of such EPA Shares to the Selling Shareholder

under the EPA. Depending on the market prices of our Common Shares on the put dates on which we elect to sell such EPA Shares to the

Selling Shareholder under the EPA, we may need to register under the Securities Act additional Common Shares for resale by the Selling

Shareholder in order for us to receive aggregate proceeds equal to the Selling Shareholders’ $15.0 million maximum aggregate purchase

commitment available to us under the EPA.

If

we elect to issue and sell to the Selling Shareholder more Common Shares than the amount being registered, we must file with the SEC

one or more additional registration statements to register such additional shares, which the SEC must declare effective, in each case

before we may elect to sell any additional shares to the Selling Shareholder. For example, if the market price of our Common Shares falls

below $0.97, assuming no beneficial ownership limitations, we will be required to issue more shares than are currently being registered,

necessitating the filing of a new registration statement.

The

issuance of our Common Shares to the Selling Shareholder pursuant to the EPA will not affect the rights or privileges of our existing

shareholders, except that the economic and voting interests of each of our existing shareholders will be diluted. Although the number

of Common Shares that our existing shareholders own will not decrease, the Common Shares owned by our existing shareholder will represent

a smaller percentage of our total outstanding Common Shares after any such issuance.

The

following table sets forth the amount of gross proceeds we would receive from the Selling Shareholder from our sale of Common Shares

to the Selling Shareholder under the EPA at varying purchase prices and subject to the limitation of the number of shares being registered

at this time:

Assumed

Average

Purchase Price

Per Share | | |

Number of

Registered Shares

to be Issued if

Full Purchase(1) | | |

Percentage of

Outstanding Shares

After Giving Effect

to the Issuance to

Selling Shareholder(2) | | |

Gross Proceeds

from the Sale of

Shares to

Selling Shareholder

Under the EPA | |

| $ | 0.88 | (3) | |

| 13,169,492 | | |

| 59.93 | % | |

$ | 11,589,153 | |

| $ | 1.00 | | |

| 13,169,492 | | |

| 59.93 | % | |

$ | 13,169,492 | |

| $ | 1.50 | | |

| 13,169,492 | | |

| 59.93 | % | |

$ | 19,754,238 | |

| $ | 2.00 | | |

| 13,169,492 | | |

| 59.93 | % | |

$ | 26,338,984 | |

| $ | 2.50 | | |

| 13,169,492 | | |

| 59.93 | % | |

$ | 32,923,730 | |

| |

(1) |

Although

the EPA provides that we may sell up to $15,000,000 of our Common Shares to the Selling Shareholder, we only registered 13,910,991

shares under the registration statement that includes this prospectus, which may or may not cover all of the shares we ultimately

sell to the Selling Shareholder under the EPA. The number of shares to be issued as set forth in this column is without regard to

the Exchange Cap or Beneficial Ownership Limitation, but is limited to the actual number of shares being registered at this time. Company already issued 741,499 shares under EPA during August 2024 and this includes 200,000 Commitment Shares

we issued to the Selling Shareholder only 13,169,492 shares can further be issued. |

| |

(2) |

The

denominator is based on 8,807,019 Common Shares outstanding as of December 19, 2024 (which, for these purposes, includes the 200,000

Commitment Shares we issued to the Selling Shareholder and 541,499 shares issued during August 2024), adjusted to include the issuance of the number of shares set forth in the

adjacent column that we would have sold to the Selling Shareholder, assuming the average purchase price in the first column. The

numerator is based on the number of shares issuable under the EPA at the corresponding assumed average purchase price set forth in

the first column. |

| |

(3) |

The

closing sale price of our Common Shares on NYSE American on August 31, 2024. |

On

November 13, 2024 the Company entered into a securities purchase agreement (the “Purchase Agreement”) with an institutional

investor, pursuant to which the Company issued and sold to the investor in a registered direct offering, 382,667 (the “RD Shares”)

of the Common Shares at a price of $0.60 per share, and pre-funded warrants to purchase up to 1,284,000 Common Shares at a price of $0.5999

per share and an exercise price of $0.0001 per Common Share.

The

securities to be issued in the registered direct offering were offered pursuant to the Company’s shelf registration statement on

Form S-3 (File No. 333-282629), initially filed by the Company with the Commission on October 15, 2024, as amended on October 25, 2024,

and declared effective on October 29, 2024. The offering closed on November 14, 2024 for approximately $1.0 million in gross proceeds.

Industry

Overview

The

Canadian Mortgage and Mortgage Brokerage Industry

According

to the Bank of Canada, as of May 1, 2022, Canada’s chartered banks held over $1.523 trillion of residential mortgages

(which amount does not include mortgages held by provincially regulated entities such as credit unions or mortgage investment corporations).

Mortgage lenders typically offer a range of products, with options for fixed or variable rates, varying terms and amortization periods,

as well as differing ancillary terms for pre-payment, incentives or other matters. Interest rates are typically renegotiated every three

(3) years. While mortgage lenders post both fixed and variable interest rates at which the lender offers mortgages of varying terms,

typically most lenders are willing to negotiate interest rates lower than those posted, a practice referred to as “discounting”.

The practice began in Canada in the early 1990s and is considered the norm in today’s mortgage market. The practice of discounting

permits mortgage lenders to improve their ability to price discriminate and offer different rates to different borrowers based on their

willingness to pay. Price discrimination allows lenders to increase their profits through negotiating different rates with individual

borrowers instead of offering a blanket reduction in rates. The advent of price discrimination in the Canadian mortgage market has increased

the importance of the mortgage broker in the lending negotiation process. In return for a fee (paid by the lending institution), the

mortgage broker is typically able to negotiate a better rate than the consumer, or to efficiently reduce the time and effort required

to be applied by the consumer to achieve similar results. Mortgage brokers are provincially regulated and subject to training and licensing

requirements. See “Regulatory Environment” for details. However, there are relatively few barriers to entry in the mortgage

brokerage market. Nevertheless, the ability of a given mortgage broker to erode lender price discrimination and secure rates at the lower

end of the range at which lenders are prepared to lend is dependent upon a number of factors. While experience and negotiating ability

are relevant factors, a key factor in the potential success of a mortgage broker in securing advantageous rates is the bargaining power

of the mortgage broker, which varies directly with the volume of mortgages the broker is able to place with lenders.

Industry

Growth Strategy

Our