false

2024-12-03

0001852353

Dakota Gold Corp.

0001852353

2024-12-03

2024-12-03

0001852353

exch:XASE

dc:CommonStockParValueZeroPointZeroZeroOnePerShareMember

2024-12-03

2024-12-03

0001852353

exch:XASE

dc:WarrantsEachWarrantExercisableForOneShareOfTheRegistrantThreeNinesCommonStockAtAnExercisePriceOfTwoPointZeroEightMember

2024-12-03

2024-12-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

December 3, 2024

DAKOTA GOLD CORP.

(Exact name of registrant as specified in its charter)

|

Delaware

|

001-41349

|

85-3475290

|

| (State or other jurisdiction |

(Commission |

(IRS Employer |

| of incorporation) |

File Number) |

Identification No.) |

106 Glendale Drive, Suite A,

Lead, South Dakota, United States

57754

(Address of principal executive offices) (ZIP Code)

Registrant’s telephone number, including area code: (605) 906-8363

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbols |

|

Name of each exchange on which registered |

|

Common Stock, par value $0.001 per share

|

|

DC

|

|

NYSE American LLC

|

|

Warrants, each warrant exercisable for one share of the Registrant's common stock at an exercise price of $2.08

|

|

DC.WS

|

|

NYSE American LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b -2 of this chapter).

Emerging growth company ☑

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation FD Disclosure.

On December 3, 2024, Dakota Gold Corp. (the "Company") issued a press release providing certain project updates. A copy of the press release is furnished as Exhibit 99.1 hereto and is incorporated herein by reference.

The information set forth in this Item 7.01, including the information set forth in Exhibit 99.1, is being furnished and shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 8.01. Other Events.

At-the-Market Offering Update

On October 21, 2022, the Company entered into an Equity Distribution Agreement (the "Distribution Agreement") with BMO Capital Markets Corp. and Canaccord Genuity LLC. As of the date of this Current Report on Form 8-K, the Company has sold shares of its common stock ("Common Stock") pursuant to a prospectus supplement for gross proceeds of approximately $29.5 million under the Distribution Agreement. The Company intends to file an amendment to the prospectus supplement to increase the dollar amount of Common Stock available to be sold pursuant to the Distribution Agreement to $50 million on or about December 12, 2024.

This Current Report on Form 8-K shall not constitute an offer to sell or the solicitation of an offer to buy the securities discussed herein, nor shall there be any sale of such securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

DAKOTA GOLD CORP.

/s/ Shawn Campbell

Name: Shawn Campbell

Title: Chief Financial Officer

Date: December 3, 2024

| December 3, 2024 |

News Release 24-22 |

Dakota Gold step-out drilling nearly doubles the strike length of

modeled Homestake Mine-style gold mineralization at Maitland

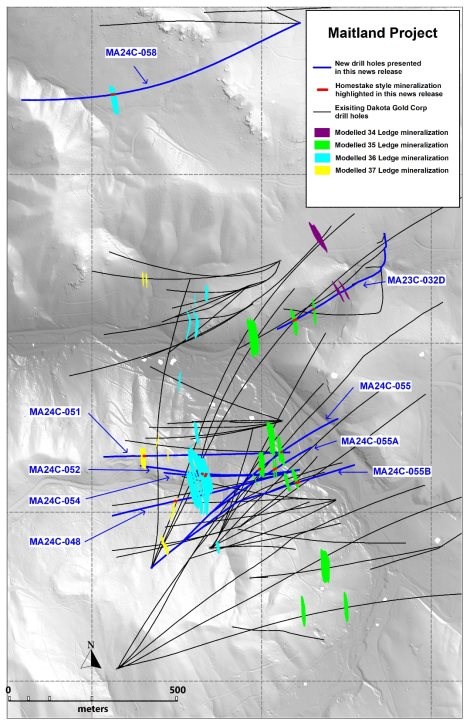

LEAD, SOUTH DAKOTA - Dakota Gold Corp. (NYSE American: DC) ("Dakota Gold" or the "Company") is pleased to announce that step-out drilling north of the JB Gold Zone has nearly doubled the known strike-length of the Homestake iron-formation hosted gold mineralization at the Maitland Gold Project ("Maitland").

Dakota Gold's 2024 Maitland drill program has delineated four distinct ledges, each of which has yielded high-grade Homestake Mine-style gold intercepts analogous to the gold mineralization found in the "West Ledge" system that produced approximately 6 million ounces of gold at the historic Homestake Mine. To date, the Company's program at Maitland has generated 49 intercepts from 73 holes at an average grade of 10.11 grams per tonne gold (g/t Au) over an average thickness of 3.8 meters.

While the modeling of the Maitland gold system had previously appeared to share a similar sized footprint with the West Ledge system of the Homestake Mine, this step-out drilling has substantially extended the mineralization northward, with the system still open to further expansion to the north, south and at depth.

Significant Highlights (See Table 1):

- Step-out drill hole MA24C-058 intersected 28.10 g/t Au over 0.8 meters. MA24C-058 is located 710 meters northwest of the JB Gold Zone discovery drill hole MA23C-017, nearly doubling the length of the known mineralization.

- Other highlighted JB Gold Zone intercepts:

- MA23C-032D intersecting - 14.45 g/t Au over 1.8 meters

- MA24C-051 intersecting - 8.93 g/t Au over 3.5 meters

- MA24C-055 intersecting - 11.50 g/t Au over 1.6 meters

- With the inclusion of step-out drill hole MA24C-058, the length of all mineralized ledges in the Maitland area to date is 1,646 meters long. The ledges remain open along strike and to depth.

Jerry Aberle, Chief Operating Officer commented, "The results of our drill programs at Maitland have demonstrated beyond doubt that the same mineralizing fluids that produced the Homestake Mine are repeatable and have mineralized the exact same host rocks at Maitland. Those of us that worked at the Homestake Mine or were engaged in Homestake's exploration of the corridor extending north of the mine have waited a long time for the opportunity to prove that these Homestake Mine-style deposits are repeatable. We've now demonstrated that with our results to date, and we've only just begun." Aberle continued, "With all of the Homestake data and our first-hand knowledge of that data, Dakota Gold's technical team worked up a number of solid targets within the corridor and ranked them. We chose to start our corridor program at Maitland in early 2022, and this first program has exceeded every expectation I could have had for sustained consistent results. And, we have multiple targets to the north at Blind Gold and to the south at the North Drift Discovery yet to test."

James Berry, Vice President Exploration of Dakota Gold, said, "My experience as an exploration and underground geologist working 10 years at the Homestake Mine informs my belief that the Maitland drill results identifying Ledges 34, 35, 36 and 37 are analogous to the West Ledges of the Homestake Mine. From the drill core, we are seeing steeply plunging or reclined mineralization and comparable grades and thicknesses. The Maitland mineralization is shallower than the West Ledges of the Homestake Mine which produced more than 6 million ounces of gold. The Homestake Mine is the world's largest banded iron formation hosted gold deposit and similar gold systems include Orla's Musselwhite and B2's Back River deposits. The one unique characteristic of the Maitland mineralization is it is close to infrastructure and a 15 minute drive from our head office. As we wrap up our 2024 drill program at Maitland for the year, we will be refining our modelling of the ledges and analyzing the results to create a follow up drill program for the 2025 year that will target shallower intercepts."

Table 1. Released Drill Results (Metric / Imperial)1,2

|

Hole #

|

From

|

To

|

Depth

|

Interval3

|

Gold

|

From

|

To

|

Depth

|

Interval3

|

Gold

|

Mineral

Type

|

g x m

|

|

m

|

m

|

m

|

m

|

g/t

|

ft

|

ft

|

ft

|

ft

|

oz/ton

|

|

|

MA23C-032D

|

1176.4

|

1179.8

|

1135

|

3.4

|

6.20

|

3859.6

|

3870.7

|

3723

|

11.1

|

0.181

|

pꞒ

|

21

|

|

|

1224.3

|

1227.9

|

1182

|

3.6

|

5.51

|

4016.8

|

4028.6

|

3877

|

11.8

|

0.161

|

pꞒ

|

20

|

|

|

1569.4

|

1571.2

|

1484

|

1.8

|

14.45

|

5148.8

|

5154.8

|

4870

|

6

|

0.421

|

pꞒ

|

26

|

|

MA24C-048

|

458.4

|

459.9

|

306

|

1.6

|

8.85

|

1503.9

|

1509.0

|

1004

|

5.1

|

0.258

|

pꞒ

|

14

|

|

MA24C-051

|

568.2

|

571.7

|

436

|

3.5

|

8.93

|

1864.3

|

1875.8

|

1431

|

11.5

|

0.261

|

pꞒ

|

31

|

|

MA24C-052

|

578.9

|

581.9

|

527

|

3.0

|

2.92

|

1899.2

|

1909.2

|

1730

|

10.0

|

0.085

|

pꞒ

|

9

|

|

|

602.0

|

603.3

|

552

|

1.3

|

9.90

|

1975

|

1979.2

|

1812

|

4.2

|

0.289

|

pꞒ

|

13

|

|

MA24C-054

|

656.5

|

658.2

|

613

|

1.6

|

6.98

|

2153.9

|

2159.3

|

2012

|

5.4

|

0.203

|

pꞒ

|

11

|

|

MA24C-055

|

733.9

|

735.5

|

487

|

1.6

|

11.50

|

2407.8

|

2412.9

|

1598

|

5.1

|

0.335

|

pꞒ

|

18

|

|

|

848.3

|

852.0

|

551

|

3.7

|

3.78

|

2783.2

|

2795.3

|

1809

|

12.1

|

0.110

|

pꞒ

|

14

|

|

MA24C-055A

|

801.7

|

802.4

|

542

|

0.6

|

4.25

|

2630.4

|

2632.4

|

1779

|

2.0

|

0.124

|

pꞒ

|

3

|

|

|

811.7

|

812.3

|

549

|

0.5

|

4.79

|

2663.2

|

2665.0

|

1801

|

1.8

|

0.140

|

pꞒ

|

3

|

|

MA24C-055B

|

919.9

|

924.3

|

659

|

4.4

|

3.57

|

3018.1

|

3032.5

|

2163

|

14.4

|

0.104

|

pꞒ

|

16

|

|

|

930.2

|

933.6

|

666

|

3.4

|

2.95

|

3051.8

|

3062.9

|

2184

|

11.1

|

0.086

|

pꞒ

|

10

|

|

MA24C-058

|

828.4

|

829.1

|

501

|

0.8

|

28.10

|

2717.7

|

2720.3

|

1645

|

2.6

|

0.820

|

pꞒ

|

22

|

|

|

833.5

|

834.9

|

504

|

1.4

|

6.48

|

2734.6

|

2739.3

|

1652

|

4.7

|

0.189

|

pꞒ

|

9

|

|

|

837.5

|

840.1

|

506

|

2.6

|

4.55

|

2747.7

|

2756.3

|

1660

|

8.6

|

0.133

|

pꞒ

|

12

|

1. The table may contain rounding errors.

2. Abbreviations in the table include ounces per ton ("oz/ton"); grams per tonne ("g/t"); feet ("ft"); meter ("m"); and Precambrian mineralization ("pꞒ").

3. True Thickness Unknown

Figure 1. Dakota Gold plan view map with Highlighted Maitland, JB Gold Zone Drill Holes.

Maitland Gold Project

The Maitland Gold Project hosts the JB Gold Zone, which has returned highlight intercepts including drill hole MA23C-038 which intersected 25.03 g/t Au over 4.4 meters. Maitland is 3 miles along strike of the historic Homestake Mine. The JB Gold Zone discovery is analogous to the West Ledges at the Homestake Mine that produced over 6 million ounces at a grade of 7.7 g/t Au. Dakota Gold has completed its 2024 Maitland drill program and is assessing results that will inform the 2025 follow up drill program where we have significant potential to continue to expand the footprint of the high-grade gold discovered to date.

Richmond Hill Oxide Heap Leach Gold Project

Regarding Dakota Gold's other focus area, the Richmond Hill Oxide Heap Leach Gold Project, based on the current defined oxide resource and additional significant drill hole intercepts encountered in the current drill campaign, Dakota has contracted with M3, RESPEC, IMC and Woods Processing to undertake the necessary engineering and metallurgical studies currently in progress to advance from the Initial Assessment with Cash Flow (IACF) to initiating a full feasibility in Q2 2025. Concurrently the Company is undertaking baseline environmental studies that will inform future permitting requirements. With regards Richmond Hill, it is analogous to the adjacent Wharf Mine of Coeur Mining which is expected to generate over $100 million in free cash flow in 2024 from approximately 90,000 ounces of gold. The Richmond Hill Oxide Heap Leach Gold Project is located on private land with certain existing permits and we believe with anticipated updated amendments, we can advance the project expeditiously through development and into production. Our financial proposal for up to $300 million for a development opportunity with Orion Mine Finance, our major shareholder announced on October 12, 2023, provides Dakota Gold with the financial pathway to a commercial gold operation.

About Dakota Gold Corp.

Dakota Gold is building on the legacy of the 145 year old Homestake Gold Mining District by advancing the Richmond Hill Oxide Heap Leach Gold Project and outlining a high-grade underground gold resource at the Maitland Gold Project located on private land in South Dakota.

Subscribe to Dakota Gold's e-mail list at www.dakotagoldcorp.com to receive the latest news and other Company updates.

Shareholder and Investor Inquiries

For more information, please contact:

Dr. Robert Quartermain

Co-Chair, Director, President and Chief Executive Officer

Tel: +1 778-655-9638

Dr. Stephen O'Rourke

Co-Chair, Director and Managing Director

Tel: +1 605-717-2540

Carling Gaze

VP of Investor Relations and Corporate Communications

Tel: +1 605-679-7429

Email: info@dakotagoldcorp.com

Qualified Person and S-K 1300 Disclosure

James M. Berry, a Registered Member of SME and Vice President of Exploration of Dakota Gold Corp., is the Company's designated qualified person for this news release as defined in Subpart 1300 - Disclosure by Registrants Engaged in Mining Operations of Regulation S-K and has reviewed and approved its scientific and technical content.

The ranges of potential tonnage and grade (or quality) disclosed above in respect of the Maitland Gold Project are conceptual in nature and could change as the proposed exploration activities are completed. There has been insufficient exploration of the Maitland Gold Project to allow for an estimate of a mineral resource and it is uncertain if further exploration will result in the estimation of a mineral resource. The disclosure above in respect of the Maitland Gold Project therefore does not represent, and should not be construed to be, an estimate of a mineral resource or mineral reserve.

Quality Assurance/Quality Control consists of regular insertion of certified reference materials, duplicate samples, and blanks into the sample stream. Samples are submitted to the ALS Geochemistry sample preparation facility in Winnipeg, Manitoba. Gold and multi-element analyses are performed at the ALS Geochemistry laboratory in Vancouver, British Columbia. ALS Minerals is an ISO/IEC 17025:2017 accredited lab. Check samples are submitted to Bureau Veritas, Vancouver B.C. as an umpire laboratory. Assay results are reviewed, and discrepancies are investigated prior to incorporation into the Company database.

Forward-Looking Statements

This communication contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. When used in this news release, the words "plan," "target," "anticipate," "believe," "estimate," "intend," "potential," "will" and "expect" and similar expressions are intended to identify such forward-looking statements. Any express or implied statements contained in this announcement that are not statements of historical fact may be deemed to be forward-looking statements, including, without limitation: the continuity of geology, correctness of models and assumptions, or magnitude of resource potential regarding Maitland, the JB Gold Zone, or the Unionville Zone; our expectations regarding the drilling to be completed in 2024 and 2025; our expectations for the improvement and growth of the mineral resources; the grade potential of the drilling completed after the effective date of the Initial Assessment; the timing for the updated S-K 1300 Initial Assessments to be released in 2025 or thereafter; and our overall expectation for the possibility of near-term production at the Richmond Hill project. These forward-looking statements are based on assumptions and expectations that may not be realized and are inherently subject to numerous risks and uncertainties, which could cause actual results to differ materially from these statements. These risks and uncertainties include, among others: the execution and timing of our planned exploration activities; our use and evaluation of historic data; our ability to achieve our strategic goals; the state of the economy and financial markets generally and the effect on our industry; and the market for our common stock. The foregoing list is not exhaustive. For additional information regarding factors that may cause actual results to differ materially from those indicated in our forward-looking statements, we refer you to the risk factors included in Item 1A of the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2023, as updated by annual, quarterly and current reports that we file with the SEC, which are available at www.sec.gov. We caution investors not to place undue reliance on the forward-looking statements contained in this communication. These statements speak only as of the date of this communication, and we undertake no obligation to update or revise these statements, whether as a result of new information, future events or otherwise, except as may be required by law. We do not give any assurance that we will achieve our expectations.

v3.24.3

Document and Entity Information Document

|

Dec. 03, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Creation Date |

Dec. 03, 2024

|

| Document Period End Date |

Dec. 03, 2024

|

| Amendment Flag |

false

|

| Entity Registrant Name |

Dakota Gold Corp.

|

| Entity Address, Address Line One |

106 Glendale Drive, Suite A,

|

| Entity Address, City or Town |

Lead

|

| Entity Address, State or Province |

SD

|

| Entity Address, Country |

US

|

| Entity Address, Postal Zip Code |

57754

|

| Entity Incorporation, State Country Name |

DE

|

| City Area Code |

605

|

| Local Phone Number |

906-8363

|

| Entity File Number |

001-41349

|

| Entity Central Index Key |

0001852353

|

| Entity Emerging Growth Company |

true

|

| Entity Tax Identification Number |

85-3475290

|

| Entity Ex Transition Period |

false

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| NYSE MKT LLC [Member] | Common Stock, par value $0.001 per share [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

DC

|

| Security Exchange Name |

NYSEAMER

|

| NYSE MKT LLC [Member] | Warrants, each warrant exercisable for one share of the Registrant's common stock at an exercise price of $2.08 [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Warrants, each warrant exercisable for one share of the Registrant's common stock at an exercise price of $2.08

|

| Trading Symbol |

DC.WS

|

| Security Exchange Name |

NYSEAMER

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe date the document was made available and submitted, in YYYY-MM-DD format. The date of submission, date of acceptance by the recipient, and the document effective date are all potentially different.

| Name: |

dei_DocumentCreationDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

dei_EntityListingsExchangeAxis=exch_XASE |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=dc_CommonStockParValueZeroPointZeroZeroOnePerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=dc_WarrantsEachWarrantExercisableForOneShareOfTheRegistrantThreeNinesCommonStockAtAnExercisePriceOfTwoPointZeroEightMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

Dakota Gold (AMEX:DC)

過去 株価チャート

から 12 2024 まで 1 2025

Dakota Gold (AMEX:DC)

過去 株価チャート

から 1 2024 まで 1 2025