The Idea Of Value In Crypto

2018年12月5日 - 7:11PM

ADVFN Crypto NewsWire

Summary

The idea of value has been continuously evolving in the world of

cryptocurrencies.

More and more models are being proposed that aim for better

linkage between adoption and value.

The continuing fall in cryptocurrency prices is gradually

unearthing more interesting opportunities.

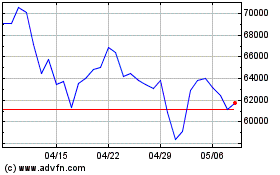

Bitcoin Close Price data by

YCharts

The crypto market has been hitting new lows over

the past year and the recent plummet in price hasn't helped.

Everything is a stark reminder of the volatility and speculative

nature of cryptocurrencies. However, that hasn't stopped progress.

Many emerging solutions are using blockchain in an interesting

manner and adoption is slowly moving forward. The landscape is

rapidly evolving and the face of crypto will quickly change over

the next few years. Current protocols are getting improvements to

address shortcomings (e.g. rootstock for BTC), while competing

technologies spring up to target crypto needs. Just this year

alone, the number of USD stable coins has been multiplying like

rabbits (e.g. Gemini dollar, Stronghold USD, USD Coin, True USD,

and several others). Meanwhile, corporations have been announcing

partnerships with private and public blockchain solutions on a

regular basis. But a question that often comes up is “What is the

value of a digital currency”?

Looking for value:

The simple answer is "value is arbitrarily

defined". In the current state, a cryptocurrency’s value is pure

speculation and is guaranteed only at the time of transaction.

While arguments based on supply and demand, scarcity, store of

value, etc. have been made, it doesn’t change the fact that there

is a general lack of intrinsic value for a significant number of

digital assets. At one point, some have tried arguing that the cost

of mining could serve as a baseline indicator of value for mineable

currencies; however, that has been shown to be false in the current

bear market, where miners have been reportedly scrapping mining rigs. Security

tokens aside, many believe that the current coins and tokens don’t

carry the same sense of ownership and/or returns that equity, loans

and other assets may offer. To address this problem, ideas from

other areas have been re-purposed to create economic models, or

tokenomics, for crypto assets. These tokenomics were meant to

theoretically craft an economic system that would create value as

adoption increased.

Generating intrinsic value:

Tokenomics are continuously evolving, and there are

interesting ideas being proposed and implemented in order to create

value. Solutions have long since expanded beyond the idea of “this

token/coin is good for smart contracts and transactions”. Moreover,

there are more and more solutions that have started pegging some

aspect of their ecosystem to fiat prices as opposed to pricing

everything solely in their native currency. Below are two high

level examples:

- A secondary stable token is paid out to node holders that

provide relevant services. The secondary token can be exchanged for

tradeable currencies at a pegged fiat price.

- Storage of data costs a given fiat value that is to be paid

using native coins. Coins are redistributed to storage nodes. Only

a single coin is used.

The first case has a clear yield that scales in

line with adoption. In contrast, the second case has a more dynamic

system, with the main token's value being affected by speculation,

adoption levels, available liquidity, and other factors. Further

elaboration would require discussing project details and provide

additional context, which is beyond the current scope. More

importantly is the fact that models are being created to give

cryptocurrencies some form of value that scales more predictably,

relatively speaking, with adoption. Identifying such systems may

lead to interesting value propositions and opportunities. However,

whether a coin is necessary or not is an entirely different issue

and will largely depend on the problem being solved.

Final remarks:

The idea of value has evolved significantly from

what it once was in the world cryptocurrency, and it’s important to

keep this in mind. Novel economical models are being defined, and

refined, to better link adoption to value. While still highly

speculative, it provides a far better idea on how value can be

generated in the long run. With the pull back in market prices over

the year, along with the recent plummet below $4,000, interesting

opportunities have been emerging. Even with solid tokenomics,

cryptocurrencies will still likely be extremely volatile, and

there’s no guarantee on which ones will survive the eventual cull,

so the risk factor is certainly worth bearing in mind. Lastly, many

seem to believe that adoption will be the next big driver of a

crypto bullrun. At that point in time, viable ecosystems with solid

economic models will likely stand out readily from the crowd.

Source:

Seeking Alpha

Bitcoin (COIN:BTCUSD)

過去 株価チャート

から 3 2024 まで 4 2024

Bitcoin (COIN:BTCUSD)

過去 株価チャート

から 4 2023 まで 4 2024