Form 8-K - Current report

2024年8月30日 - 5:52AM

Edgar (US Regulatory)

false

0001527702

0001527702

2024-08-29

2024-08-29

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): August

29, 2024

iQSTEL Inc.

(Exact name of registrant as specified in its charter)

| Nevada |

000-55984 |

45-2808620 |

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

| |

|

|

300 Aragon Avenue, Suite 375

Coral Gables, FL 33134 |

33134 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (954) 951-8191

|

________________________________________________

(Former name or former address, if changed since last

report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following provisions:

| |

[ ] |

Written communications pursuant to Rule 425 under the Securities Act (17CFR 230.425) |

| |

|

|

| |

[ ] |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

[ ] |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

[ ] |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: None.

Indicate by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934

(§240.12b-2 of this chapter).

Emerging growth company [ ]

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. [ ]

SECTION 7 – Regulation FD Disclosure

| | Item 7.01 | Regulation FD Disclosure |

iQSTEL, Inc. (the “Company”) is furnishing presentation materials

(the “Corporate Presentation”) that management intends to use, possibly with modifications, in one or more meetings from time

to time with current and potential investors. The Corporate Presentation includes an update on the Company’s current operations

and major projects, as well as information relating to the Company’s strategic plans, goals, growth initiatives and outlook, and

forecasts for future performance and industry development.

The foregoing description of the Corporate Presentation does not purport

to be complete and is qualified in its entirety by reference to the complete text of the Corporate Presentation attached as Exhibit 99.1

to this Current Report on Form 8-K.

The information contained in the Corporate Presentation is summary information

that should be considered in the context of the Company’s filings with the Securities and Exchange Commission and other public announcements

the Company may make by press release or otherwise from time to time. The Corporate Presentation speaks as of the date of this Current

Report. While the Company may elect to update the Corporate Presentation in the future to reflect events and circumstances occurring or

existing after the date of this Current Report, the Company specifically disclaims any obligation to do so.

By furnishing this Current Report on Form 8-K and furnishing the Corporate

Presentation, the Company makes no admission as to the materiality of any information in this Current Report, including without limitation

the Corporate Presentation. The Corporate Presentation contains forward-looking statements and the risks and uncertainties related thereto.

The information set forth in this Item 7.01 of this Report, including without

limitation the Corporate Presentation, is not deemed “filed” for purposes of Section 18 of the Securities Exchange Act of

1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended,

or the Exchange Act, except as may be expressly set forth by specific reference in such a filing.

SECTION 9 – Financial Statements and Exhibits

| |

Item 9.01 | Financial Statements and Exhibits. |

| |

Exhibit No. |

Description |

| |

99.1 |

Corporate Presentation |

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

iQSTEL Inc.

/s/ Leandro Iglesias

Leandro Iglesias

Chief Executive Officer

Date August 29, 2024

COMPANY

TEASER

| |

Ticker: IQST

Latest Share Price: $0.19

Market Cap: $34.87 Million

Shares Outstanding: 183,535,742

Avg Volume: 319,029

CEO: Leandro Iglesias |

|

Business:

iQSTEL Inc. (OTC: IQST) is a fast-growing technology company

offering a range of services in the telecommunications, electric vehicle (EV), fintech, and AI-enhanced metaverse industries. With headquarters

in Miami, Florida, iQSTEL operates through its various subsidiaries, targeting diverse and high-growth markets. The company’s strategy

focuses on leveraging synergies between its 11 subsidiaries to drive innovation and capture emerging opportunities. Since 2018, IQST has

overseen extensive expansion of its business, where it has grown revenues 1,500% over a five-year period to $144.5 million in FY-2023,

and completed 11 acquisitions with 1 acquisition pending.

IQST with 100 employees serves clients in more than 20 countries,

including clients in the US, Mexico, Central America, South America, Europe, Middle East, Africa, India and China. Its core business offerings

VOIP, SMS, IoT (internet of things), Blockchain platforms, and international fiber-optic connectivity between Florida and Costa Rica,

at the same time, Integrates mobile payments and MasterCard Fintech solutions, electric motorcycles, mid speed electric car, AI-Enhanced

Metaverse solutions.

|

|

Financials:

| |

Balance Sheet (as of 12/31/2023 |

|

Historical Earnings (for Years Ended) |

|

| |

Assets |

|

|

|

|

|

|

2023 |

|

2022 |

|

| |

Cash |

$ |

1,362,668 |

|

Revenues |

|

$ |

144,502,351 |

$ |

93,203,532 |

|

| |

A/R |

$ |

12,539,774 |

|

Cost of Revenues |

|

$ |

139,830,388 |

$ |

91,412,016 |

|

| |

Total Current Assets |

$ |

15,719,172 |

|

Gross Profit |

|

$ |

4,672,013 |

$ |

1,791,516 |

|

| |

Total Assets |

$ |

22,155,653 |

|

|

|

|

|

|

|

|

| |

|

|

|

|

Operating Expenses |

|

|

|

|

|

|

| |

Liabilities |

|

|

|

General & Admin |

|

$ |

4,987,516 |

$ |

4,983,176 |

|

| |

A/P |

$ |

2,966,279 |

|

Total OpEx |

|

$ |

4,987,516 |

$ |

4,983,176 |

|

| |

Other Current Liabilities |

$ |

9,993,585 |

|

|

|

|

|

|

|

|

| |

Total Liabilities |

$ |

14,109,781 |

|

EBITDA |

|

$ |

(315,503) |

$ |

(3,191,660) |

|

Investment Highlights:

| · | Revenue Growth: iQSTEL has demonstrated robust

revenue growth, with an impressive 33% CAGR over the past five years. The company reported revenue of $13.8 million in FY-2018, just reported

$144.5 million in FY-2023, and forecasted $290 million for FY-2024. |

|

| · | Diverse Revenue Streams: The company’s

multi-industry approach minimizes risk and increases resilience. iQSTEL’s ability to cross-leverage technology across segments creates

additional revenue opportunities. |

|

| · | Strategic Acquisitions: iQSTEL has executed 11

strategic acquisitions with another pending to bolster its market presence, particularly in the telecom and fintech sectors. These acquisitions

have expanded its customer base and service offerings. |

|

| · | Innovative Product Pipeline: iQSTEL is at the

forefront of innovation with its development of next-generation telecom services, EV motorcycles and mid speed car, and blockchain-based

financial products. The company’s R&D investments are expected to yield significant returns as these markets grow. |

|

Largest Customers:

| • | Telefonica

Spain |

|

|

|

|

• |

Etisalat |

| • | Telecom Italy |

|

• |

Deutsche

Telekom |

|

• |

PCCW |

| • | Vodafone |

|

• |

British

Telecom |

|

• |

Millicom |

Competitors

IQST is currently trading at a significant discount compared

to other companies, which are selling at a 0.75x revenue multiple, presenting immense potential upsides to investors.

| |

Revenues |

Share Price |

Market Cap |

Revenue Multiple |

| IQST |

$290 million** |

$0.18 |

$33 million |

0.11x |

| NUVR |

$65 million |

$7.90 |

$41 million |

0.62x |

| SURG |

$131 million |

$1.88 |

$37 million |

0.28x |

| KTEL |

$18 million |

$0.38 |

$15 million |

0.83x |

| OBLG |

$3.8 million |

$3.45 |

2.76 million |

0.72x |

**FY 2024 Run Rate

Future Plans:

| · | IQST is in the process to hire a US leading marketing

agency, to rebrand its divisions, improve its online marketing presence and increase overall shareholder value. |

|

| · | IQST will consolidate and complete ownership of different

divisions and subsidiaries in order to streamline operations and increase margins. |

|

| · | IQST will leverage its large base of telecom infrastructure to develop a platform to attract new business, increase revenues and improve margin.

|

|

The Company is planning to grow revenues to $1 billion in

annual sales by 2027, driven by two key drivers:

| · | Organic Growth: IQST estimates at least $0.5

Billion of the projected growth over the next three years will come from organic sales growth. |

|

| · | Strategic Acquisitions: The Company expects to

generate at least $250 million in additional revenue through strategic acquisitions of competitors and complimentary firms in the telecommunications

industry. An additional $250 million is expected from organic sales growth and synergies. |

|

IQST is currently in the process of completing an uplisting

to NASDAQ, with a target listing date of January 1, 2025.

Current Plan FY-2024:

| · | Rebranding and marketing plan for IQST |

| · | Consolidation of all subsidiaries with a target |

| · | $10.5 million raise in conjunction with NASDAQ listing |

Management:

| · | Leandro Iglesias – President & CEO, Chairman

of the Board |

| · | Alvaro Quintana – CFO, Director |

| · | Italo Segnini – Director |

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

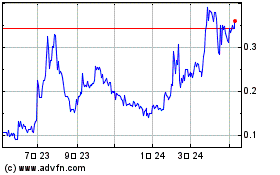

iQSTEL (QX) (USOTC:IQST)

過去 株価チャート

から 11 2024 まで 12 2024

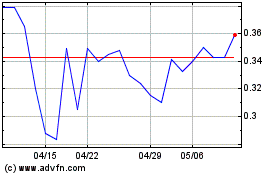

iQSTEL (QX) (USOTC:IQST)

過去 株価チャート

から 12 2023 まで 12 2024