false

0001527702

0001527702

2024-08-06

2024-08-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): August

6, 2024

iQSTEL Inc.

(Exact name of registrant as specified in its charter)

| Nevada |

000-55984 |

45-2808620 |

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

| |

|

|

300 Aragon Avenue, Suite 375

Coral Gables, FL 33134 |

33134 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (954) 951-8191

|

________________________________________________

(Former name or former address, if changed since last

report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following provisions:

| |

[ ] |

Written communications pursuant to Rule 425 under the Securities Act (17CFR 230.425) |

| |

|

|

| |

[ ] |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

[ ] |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

[ ] |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: None.

Indicate by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934

(§240.12b-2 of this chapter).

Emerging growth company [ ]

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. [ ]

SECTION 7 – Regulation FD Disclosure

| | Item 7.01 | Regulation FD Disclosure |

iQSTEL, Inc. (the “Company”) is furnishing presentation materials

(the “Corporate Presentation”) that management intends to use, possibly with modifications, in one or more meetings from time

to time with current and potential investors. The Corporate Presentation includes an update on the Company’s current operations

and major projects, as well as information relating to the Company’s strategic plans, goals, growth initiatives and outlook, and

forecasts for future performance and industry development.

The foregoing description of the Corporate Presentation does not purport

to be complete and is qualified in its entirety by reference to the complete text of the Corporate Presentation attached as Exhibit 99.1

to this Current Report on Form 8-K.

The information contained in the Corporate Presentation is summary information

that should be considered in the context of the Company’s filings with the Securities and Exchange Commission and other public announcements

the Company may make by press release or otherwise from time to time. The Corporate Presentation speaks as of the date of this Current

Report. While the Company may elect to update the Corporate Presentation in the future to reflect events and circumstances occurring or

existing after the date of this Current Report, the Company specifically disclaims any obligation to do so.

By furnishing this Current Report on Form 8-K and furnishing the Corporate

Presentation, the Company makes no admission as to the materiality of any information in this Current Report, including without limitation

the Corporate Presentation. The Corporate Presentation contains forward-looking statements. See Page 2 of the Corporate Presentation for

a discussion of certain forward-looking statements that are included therein and the risks and uncertainties related thereto.

The information set forth in this Item 7.01 of this Report, including without

limitation the Corporate Presentation, is not deemed “filed” for purposes of Section 18 of the Securities Exchange Act of

1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended,

or the Exchange Act, except as may be expressly set forth by specific reference in such a filing.

SECTION 9 – Financial Statements and Exhibits

| |

Item 9.01 | Financial Statements and Exhibits. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

iQSTEL Inc.

/s/ Leandro Iglesias

Leandro Iglesias

Chief Executive Officer

Date August 6, 2024

iQSTEL,

Inc.

Company

- Summary

August, 2024

IMPORTANT

CAUTIONS REGARDING FORWARD-LOOKING STATEMENTS

This presentation

has been prepared by iQSTEL Inc. (“we,” “us,” “our,” “iQSTEL” or the “Company”).

This presentation does not constitute an offer of any securities for sale. Any securities offered privately will not be or have not been

registered under the Securities Act and may not be offered or sold in the United States absent registration or an applicable exemption

from registration requirements, nor shall there be any offer or sale of any securities in any state or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

The information

set forth herein does not purport to be complete or to contain all of the information you may desire. Statements contained herein are

made as of the date of this presentation unless stated otherwise, and neither this presentation, nor any sale of securities, shall under

any circumstances create an implication that the information contained herein is correct as of any time after such date or that information

will be updated or revised to reflect information that subsequently becomes available or changes occurring after the date hereof. This

presentation contains forward-looking statements. These forward-looking statements should not be used to make an investment decision.

The words ‘believe,’ ‘expect,’ ‘may,’ ‘strategy,’ ‘future,’ ‘likely,’

‘goal,’ ‘plan,’ 'estimate,' 'possible' and 'seeking' and similar expressions identify forward-looking statements,

which speak only as to the date the statement was made. All statements other than statements of historical facts included in this presentation

regarding our strategies, prospects, financial condition, operations, costs, plans and objectives are forward-looking statements.

Examples of forward-looking

statements include, among others, statements we make regarding our recent acquisitions and joint venture projects, the plans and objectives

of management for future operations, including plans relating to the development of new products or services, and our future financial

performance. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only

on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated

events and trends, the economy and other future conditions.

Because forward-looking

statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to

predict and many of which are outside of our control. Our actual results and financial condition may differ materially from those indicated

in the forward-looking statements. Therefore, you should not rely on any of these forward-looking statements. Important factors that could

cause our actual results and financial condition to differ materially from those indicated in the forward-

looking statements include,

among others, competition within the industries in which we operate, the timing, cost and success or failure of new product and service

introductions and developments, our ability to attract and retain qualified personnel, maintaining our intellectual property rights and

litigation involving intellectual property rights, legislative, regulatory and economic developments, and the other risks and uncertainties

described in the Risk Factors and in Management's Discussion and Analysis of Financial Condition and Results of Operations sections of

our most recently filed Annual Report on Form 10-K and any subsequently filed Quarterly Report(s) on Form 10-Q.

Any forward-looking

statement made by us in this presentation is based only on information currently available to us and speaks only as of the date on which

it is made. We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from

time to time, whether as a result of new information, future developments or otherwise.

Content

| I. Introduction |

5 |

| II. History and evolution |

6 |

| III. Mission |

7 |

| IV. Vision |

7 |

| V. Business Units |

8 |

| A. Core Business Enhance Telecommunications Division |

10 |

| A1. Telecommunications Subsidiaries |

11 |

| A2. Telecommunications Subsidiaries Ownership |

12 |

| A3. Telecommunications Products and Services |

12 |

| A4. Main Customers and Vendors |

14 |

| A6. IoTLabs – Proprietary Technology: IoTSmartgas |

15 |

| A7. itsBchain - Proprietary Technology: MNPA |

16 |

| B. The Fintech Division |

17 |

| C. The Electric Vehicles (EV) Division |

18 |

| D. The Artificial Intelligence (AI)-Enhanced Metaverse Division |

19 |

| VI. Revenue Growth and Diversification |

21 |

| VII. Company Business and Corporate plan |

24 |

| VIII. 2025 Time to Double Our Business Size |

25 |

| IX. Our company is quoted in OTCQX (Ticker IQST) |

25 |

| X. Successfully funds raising history |

26 |

| XI. Cap Table & Current Outstanding Debt |

27 |

| XII. Current Capital Requirements and Use of Proceeds |

28 |

| XIII. Nasdaq Uplisting |

28 |

| XIV. Management |

29 |

I.

Introduction

iQSTEL Inc. (OTCQX: IQST) (www.iQSTEL.com)

is a multinational telecommunications and technology company, incorporated in the State of Nevada, on June 24, 2011. It is an SEC reporting

company and is quoted on the OTCQX under the ticker symbol IQST. The company, if qualified, intends to uplist to a national exchange.

For the fiscal year 2023, iQSTEL

reported full-year revenue of $144.5 million. The company is on track to achieve $290 million revenue for FY-2024, averaging $700,000

per day, with an anticipated $7.5 million in gross profit and a seven-digit positive operating income for FY-2024.

iQSTEL is a global telecommunications

company serving Tier-1 global carriers, corporations, and international enterprises with high-quality communication and connectivity value-added

services. The Company is recognized as a leader in the sector, offering an extensive network of interconnections and top-tier services.

Its primary market is the United States. iQSTEL employs over 100 individuals and maintains a global commercial presence in 20 countries,

with offices in Miami, Florida; Caracas, Venezuela; Buenos Aires, Argentina; London, UK; Zürich, Switzerland; Istanbul, Turkey; and

Dubai, UAE, ensuring comprehensive 24/7 business operations.

II.

History and evolution

Our journey began in 2008, when

engineer Leandro Jose Iglesias, formerly the International Business Manager at Verizon's Venezuelan subsidiary Cantv, founded Etelix.com

USA LLC, specializing in the exchange of international voice (VoIP) services.

A significant milestone for

Etelix.com USA LLC was achieved in 2013 with its participation in the upgrade of the Maya-1 submarine cable system. During this project,

Etelix acquired 10 Gbps of international capacity between Miami and Costa Rica, subsequently reselling these services to Millicom (Tigo,

Costa Rica). This acquisition continues to generate annual revenue from the operation and maintenance of this capacity.

On June 25, 2018, PureSnax International

Inc., a publicly traded company in the United States, completed an 80% reverse merger with Etelix.com USA LLC, resulting in Etelix assuming

control of the public entity.

Following the merger, the company

was renamed iQSTEL Inc., received a new CUSIP number (46265G107) and new ticker symbol (IQST). Additionally, the Standard Industrial Classification

(SIC) code was updated to 4813, reflecting its focus on telephone communications.

From 2018

to date, iQSTEL has carried out 12 acquisitions and ventures, which are detailed in the following graph.

Notice:

The acquisition of Lynktel is in process. iQSTEL is actively conducting due diligence. While we expect to close this deal during the Q3

FY-2024, there are no assurances that the deal will close as planned.

III.

Mission

At iQSTEL,

we understand that in today's society, fulfilling the human hierarchy of needs, including physiological, safety, relationship, esteem,

and self-actualization, requires access to ubiquitous communications, the freedom of virtual banking, affordable mobility, and information

and content. We are committed to bridging these gaps and providing equal opportunities for all.

IV.

Vision

To become

a global industry leader and achieve at least $1 Billion in revenue by 2027.

V.

Business Units

iQSTEL has

4 Business Divisions delivering accessibly to the necessary tools in today's pursuit of basic human needs: Telecommunications, Fintech,

Electric Vehicles and Metaverse. Currently, most of our revenue comes from the Telecommunications Division. We intend to grow both our

Telecommunications Division as well as our other developing Divisions, expanding our product and service lines to current and future customers

with higher margin offerings.

| · | The Enhanced Telecommunications Services Division

(Communications) includes VoIP, SMS, International Fiber-Optic, Proprietary Internet of Things (IoT), and a Proprietary Mobile Number

Portability Blockchain Platform. |

| · | The Fintech Division (Financial Inclusion) includes

remittances services, top up services, Master Card Debit Card, a US Bank Account (No SSN required), and a Mobile App. |

| · | The Electric Vehicles (EV) Division (Mobility) offers

Electric Motorcycles and plans to launch a Mid Speed Car. |

| · | The Artificial Intelligence (AI)-Enhanced Metaverse

Division (information and content) includes an enriched and immersive white label proprietary AI-Enhanced Metaverse platform to access

products, services, content, entertainment, information, customer support, and more in a virtual 3D interface. |

The company

continues to grow and expand its suite of products and services both organically and through mergers and acquisitions.

Notice:

The acquisition of Lynktel is in process. iQSTEL is actively conducting due diligence. While we expect to close this deal during the Q3

FY-2024, there are no assurances that the deal will close as planned.

A.

Core Business Enhance Telecommunications Division

The International Long-Distance

traffic market size is estimated at $10.7 Billion in annual revenue, with 257 billion Minutes exchanged yearly, according to Telegeography

International Voice Report of 2023. The report estimates that Wholesale Carriers have a 72% total market share, carrying over 185 billion

Minutes per year. The Company’s current market share is around 2%. Consequently, as an International Wholesale carrier the Company

has plenty of space to grow to several times its current size, provided it can outpace competition and capture market share.

The Global A2P SMS Market

is expected to grow at a CAGR of 4.9% through the year 2030, reaching US$78 billion in 2030 from the current size of $58.01 billion, according

to Transparency Market Research. Based on these figures, the Company’s current market share is estimated at 0.2%.

With a methodical execution

of the business plan and an adequate level of capitalization, the Company believes it can maintain a steady growth rate of two-digits

year over year well beyond 2024, as it has done over the last five years.

The iQSTEL Telecommunications

Division is the cornerstone of the Company, generating over 98% of its revenue. This division comprises nine subsidiaries that provide

a diverse array of products and services tailored to operators, corporations, and small to medium-sized enterprises. With a robust global

commercial presence, the Telecommunications Division ensures comprehensive market coverage and delivers high-quality solutions across

multiple regions.

| Page 10 of 32 | August, 2024 |

| A1. | Telecommunications Subsidiaries |

Notice:

The acquisition of Lynktel is in process. iQSTEL is actively conducting due diligence. While we expect to close this deal during the Q3

FY-2024, there are no assurances that the deal will close as planned.

| Page 11 of 32 | August, 2024 |

| A2. | Telecommunications Subsidiaries Ownership |

| A3. | Telecommunications Products and Services |

The

voice (VoIP) business represents around 70% of our telecom revenue stream and the SMS business accounts for the rest. Roughly 30% of our

corporate gross profit comes from the US voice termination. The Company has implemented a professional US telecom compliance department

lead by one of our co-founders to protect our US Telecom Business and to ensure the compliance of all the FCC regulations.

By combining

the technological capabilities of these nine subsidiaries, we believe iQSTEL has brought together a complete portfolio of value-added

and enhanced services which include:

| Page 12 of 32 | August, 2024 |

Wholesale

Products:

Retail

and Corporate Services:

| Page 13 of 32 | August, 2024 |

| A4. | Main Customers and Vendors |

Our primary customers and

vendors are large operators and telecommunications companies with over 500 interconnections globally. These relationships are business-to-business

(B2B).

Our commercial strategy

relies on direct sales facilitated by our dedicated sales force. This team leverages long-standing commercial relationships to engage

with customers and vendors effectively.

Over 50% of our business

is conducted through bilateral commercial agreements (SWAPs) which establish mutual commitments to exchange calls and/or SMS between our

customers/vendors and iQSTEL.

Some of our key clients

include:

| Page 14 of 32 | August, 2024 |

| A5. | Wholesale Voice and SMS intermediation business explanation |

To illustrate iQSTEL's

core business in Voice (VoIP) and SMS wholesale intermediation, consider the following hypothetical example:

When telecommunications

operators in Spain need to send calls (VoIP) or SMS to China, rather than negotiating directly with Chinese operators, they engage with

iQSTEL. iQSTEL aggregates traffic to China not only from Spanish operators but also from other clients. This aggregation enhances iQSTEL's

negotiating power with Chinese operators, enabling it to secure better pricing. These cost advantages are then passed on to customers

in Spain like Telefonica de España (Movistar). iQSTEL earns a gross profit from managing the process.

Conversely, iQSTEL also

negotiates with Spanish operators to handle Voice (VoIP) and SMS termination in Spain, offering these services to Chinese clients and

others.

More than 50% of iQSTEL's

business is conducted through bilateral agreements involving commitments to exchange Voice and SMS traffic (SWAP deals) on a monthly or

quarterly basis.

| A6. | IoTLabs – Proprietary Technology: IoTSmartgas |

As a part of our Enhanced

Telecommunications Division, IoT Labs, LLC (www.iotlabs.mx) specializes in the development of innovative Internet of Things (IoT) solutions.

IoT Labs offers a proprietary technology suite that includes both devices and a front-end platform designed for the efficient monitoring

of liquid and gas levels in tanks of various sizes (www.iotsmartgas.com). This integrated system supports comprehensive inventory management

and facilitates the timely procurement, delivery and refill of tank contents.

Currently, IoT Labs has

implemented its solutions within the propane and liquid gas distribution sectors, marketed under the brand IoTSmartgas.com.

| Page 15 of 32 | August, 2024 |

Our product has gained

significant traction, evidenced by several received purchase orders and ongoing device tests in Panama, the Dominican Republic, and the

USA. These trials have been instrumental in identifying and addressing design improvements, particularly in enhancing device performance

under extreme humidity conditions prevalent in regions such as Latin America.

| A7. | itsBchain - Proprietary Technology: MNPA |

Under our subsidiary itsBchain

(www.itsbchain.com), we have developed a Phone Number Portability Application that facilitates number portability between cell phone providers

in just three clicks. Utilizing the advanced capabilities of blockchain technology and smart contracts, our proprietary platform is designed

to streamline the number portability process efficiently and securely between mobile carriers.

The Number Portability

Application has now reached the commercial stage, and we are actively offering this innovative solution to regulatory agencies in various

countries. We are committed to continuing our commercial efforts until we secure our first customer.

| Page 16 of 32 | August, 2024 |

B.

The Fintech Division

iQSTEL Inc.’s fintech

division and offering consists of a comprehensive Fintech ecosystem accessible through our proprietary web portal www.maxmo.vip.

This client portal and App gives clients access to a MasterCard debit card, a US bank account that does not require a social security

number (SSN), and a mobile app/wallet for tracking mobile recharges and international remittances. Our primary objective is to facilitate

and democratize access to US banking services, international remittances, US telecommunications services, and international recharges

thereby simplifying financial management and enhancing connectivity.

| Page 17 of 32 | August, 2024 |

All our fintech services are

conveniently accessible through the iQSTEL mobile money, Global Money One application and ATM services.

Currently, the Company is in

the process of redefining the final product following the release of its beta version and extensive testing with over 1,000 users.

C.

The Electric Vehicles (EV) Division

Our Electric Vehicle Division

provides environmentally friendly and cost-effective transportation options, including electric motorcycles and mid-speed electric cars

through a direct-to-consumer marketing strategy in alliance with key marketing partners. We have successfully registered the TuVolten

trademark with the European Union Intellectual Property Office and are in the process of securing TuVolten as a registered trademark in

the United States through the United States Patent and Trademark Office (USPTO). Additionally, we are pursuing E-mark certification for

our 550 Elite motorcycles.

Our team has completed

the selection of a manufacturer to produce the mid-speed electric car prototype units. The chosen model already holds E-Mark certification.

Production of the initial batch for testing purposes is planned to commence in the second half of FY-2024. This mid-speed vehicle is specifically

designed to serve as an optimal secondary family vehicle.

Notice: All the pictures

about the EV division are testing units they could change in their final version, there are no assurances that they will be produced as

planned. Even though this business line is important for iQSTEL, once we reach certain development, we plan to spin off this business

to get listed separately.

| Page 18 of 32 | August, 2024 |

iQSTEL has conducted extensive

market research for our EV Division, including:

| |

1. |

Electric Motorcycles industry in Spain,

Portugal, Venezuela, Mexico, Colombia, Panama, USA, Guatemala, and Malta. |

| |

2. |

Mid-Speed Cars industry in Spain and the

EU in general. |

| |

3. |

Current Market Size of Electric Motorcycles

(April 2022). |

| |

4. |

Comparative analysis between Dacia and TuVolten

Mid-Speed Product. |

| |

5. |

Cost structure analysis for Electric Motorcycles

and Mid-Speed Cars. |

| |

6. |

Procedure and checklist for TuVolten in

Spain. |

| |

7. |

Economy size comparison between American

countries vs. Portugal and Spain. |

| |

8. |

Procedure and checklist to obtain EU Certification

and License Plates for Electric Motorcycles and Mid-Speed Cars. |

iQSTEL has also executed

several strategic purchase agreements with Chinese manufacturers for Electric Motorcycles and Mid-Speed Cars and has produced multiple

testing batches for Electric Motorcycles. TuVolten plans to introduce its motorcycles and electric cars in Spain, Portugal, the United

States, and select Latin American countries.

D.

The Artificial Intelligence (AI)-Enhanced Metaverse Division

Our

proprietary AI-enhanced Metaverse technology platform offers a white-label solution enabling clients to engage with their end users through

an immersive and customizable experience. Accessible via web browsers on desktop computers, as well as iOS and Android devices, this platform

provides a versatile and comprehensive virtual environment.

Key

features of the platform include:

| |

• |

Digital Character Creation: Users can create and personalize their digital avatars, enhancing user engagement

and identity. |

| |

• |

Real-Time Social Interactions: Facilitates individual and group communication through robust live video streaming features,

making it ideal for hosting virtual events, webinars, or presentations. |

| |

• |

3D Environment: Incorporates spatial audio to create a 3D environment, allowing multiple audiovisual streams for a more

immersive experience. |

| |

• |

AI-Based Virtual Assistant: Enhances user interaction with setup and content deployment, including access restrictions to

improve security and exclusivity. |

The

Company plans to launch a new product this summer that leverages AI and Metaverse technology, targeting millions of potential customers

worldwide.

| Page 19 of 32 | August, 2024 |

| Page 20 of 32 | August, 2024 |

VI.

Revenue Growth and Diversification

iQSTEL's

growth strategy is built on two key components: acquisitions and organic growth.

Our

organic growth is mostly a function of integrating acquired subsidiaries into our portfolio, implementing cross-selling initiatives, and

optimizing operational costs. This strategy forms the foundation of our expansion efforts.

Our

plan now is to scale our proven revenue and profit growth strategies by levering our current growth and access to financing on better

terms. iQSTEL reported audited revenue of $13.8 million for the fiscal year 2018, its first year as a publicly listed company. By FY-2023,

the company achieved significant growth, reaching $144.5 million, a nearly tenfold growth in just five years.

Looking

ahead to fiscal year 2024, our growth strategy continues to yield successful results. The company is currently on an annual revenue run-rate

of $290 million, reflecting a remarkable year-over-year growth exceeding 100%. This projected growth is attributed to anticipated organic

expansion and revenue addition from the recent acquisition of QXTEL. It is important to note that the $290 million forecast does not include

contributions from our most recent potential acquisition of Lynk Telecom.

iQSTEL

has a history of meeting and often surpassing financial forecasts.

Organic Growth

Driving Overall Revenue Growth

While acquisitions contribute

to our revenue growth, it is the organic growth that fuels more substantial overall expansion. In FY-2022 and FY-2021, iQSTEL executed

acquisitions and reported annual revenue growth of approximately 44% each year. In 2023, without any acquisitions, the company reported

an impressive organic revenue growth of $51 million, marking a 55% increase compared to FY-2022.

The increased organic growth

in FY-2023 highlights our effective integration and proven operating synergy effectively created between our acquired targets. By incorporating

these businesses into iQSTEL's product portfolio, we drive organic growth through cross-selling and sales efficiencies, as well as cost

cutting and enhanced inventory acquisition and arbitration power.

| Page 21 of 32 | August, 2024 |

Our FY-2024 sales forecast of

$290 million reflects not only the addition of approximately $60 million from the QXTEL acquisition but also an expected $90 million in

organic revenue growth, resulting from the successful integration of acquired operations.

Given our track record of effectively

integrating acquired businesses and driving organic growth, we are confident in the soundness of our current organic growth projections.

$1

Billion Revenue Plan for 2027 ($1 Billion Plan)

Under the direction of the company’s

CFO, Alvaro Quintana, IQSTEL has developed a detailed plan to grow the company’s annual revenue to $1 billion for FY 2027. The plan

includes a detailed analysis of each subsidiary using several dynamic variables. The comprehensive plan with dynamic forecasts are available

to be presented to investment banks and institutional investors.

To simplify the $1 Billion Plan,

financial projections only entail the anticipated performance of the company’s Enhanced Telecommunications Division. Any contributions

to revenue and operating income from our Fintech, Electric Vehicle and AI-Enhanced Metaverse divisions will augment the projected $1 billion

in sales.

The $1 Billion Plan is built

primarily on the planned expansion of the company’s sales that today are primarily generated from telecommunication services. The

FY 2027 planned $1 billion in annual sales is expected to be derived from telecom services alone.

| Page 22 of 32 | August, 2024 |

The plan to grow to $1 billion

in annual sales consists of two major components:

a) Organic Growth: Approximately

half of the $1 billion in annual revenue is expected from organic sales growth generated by existing operations.

b) One Strategic Acquisition:

Approximately one quarter of the $1 billion in annual revenue is expected to be achieved through acquisition. The remaining one quarter

of the $1 billion in annual revenue is expected from organic sales growth, and synergies with IQSTEL generated by the acquired operations.

IQSTEL has targeted a specific

acquisition opportunity, described in the section “XII 2025 time to Double Our Business Size”, with the potential to

add from $200 million to $300 million in annual revenue in FY-2025. This acquisition plan includes an initiative to expand the annual

sales of the target operation to $500 million by year end FY 2027. The acquisition is being coordinated to close contemporaneously with

our intended Nasdaq uplisting and plan to raise upwards of $30m for the transaction.

Here is a detailed breakdown

of the $1 Billion Plan - Organic Growth Projections:

| Page 23 of 32 | August, 2024 |

The overall $1 Billion Plan

includes the initiatives described in the section “XI Company Business and Corporate Plan”.

Telecommunications Business

Valuation

Based on the net present value

of the company’s current and anticipated cash generation from 2024 through 2027, and the residual cash generation after 2027, we

internally calculated IQSTEL’s current business valuation to be between $158 million and $198 million. This valuation does not

include any contribution from Fintech, EV and AI-Enhanced Metaverse business divisions and the strategic acquisition described above.

VII.

Company Business and Corporate plan

The

company has a clearly defined business plan, built upon the vision we have created. We have summarized steps to execute our business and

realize our corporate plans as follows:

| A. | Transformation to Telecommunications Corporation: iQSTEL is

transitioning from a holding company to a unified corporation. This involves unifying commercial messages, simplifying brands, and reducing

departmental redundancies. |

| B. | Lynk Telecom Acquisition: We aim to complete the acquisition

of Lynk Telecom, which is expected to boost annual revenue by $20 million and increase operating income by $1 million. |

| C. | Technological Platform Consolidation: We plan to acquire or

partner with a single switching platform for all our telecom subsidiaries to improve synergies and reduce technological costs. |

| D. | Revenue Growth: Our strategy focuses on expanding both retail

and corporate business segments to increase revenue from end users, which offer higher margin contributions. |

| E. | Margin Increase: The company is improving margins within the Enhanced

Telecommunications Division through operational streamlining following acquisitions. Further margin improvements within the Enhanced Telecommunications

Division will come from the introduction of new corporate and retail services. Substantial margin increases are expected as we leverage

the Enhanced Telecommunications Division customer base to introduce higher margin products through the Fintech, EV, and AI Metaverse divisions.

|

| Page 24 of 32 | August, 2024 |

| F. | Marketing Enhancement: We plan to revamp all marketing materials

and corporate messages to align with our new corporate identity. |

| G. | Capital Raising: We intend to raise up to $10.5 million to optimize

our capital structure, leaving approximately $5 million of free cash after debt redemption. |

All these initiatives are designed

to further streamline expenses and improve operating margins. An improved operating profit in turn improves the bottom line, and in so

doing, enhances the company’s potential for an improved market valuation.

VIII.

2025 Time to Double Our Business Size

As a

culmination of the first step of our strategic acquisition strategy, and as we prepare the Company for an exchange listing, iQSTEL will

pursue the acquisition or merger with a private or public company, aiming to elevate iQSTEL to a business size of at least $500 million

in consolidated revenues per year. Upon identifying a suitable target, the company plans to raise an additional $30 million, on top of

the current capital raising plan, to complete this strategic acquisition. The amount is based on preliminary search of potential targets.

We plan

to seek financing to redeem debt, fund our operations and our growth through acquisitions. There can be no assurance that we will be successful

in raising additional funding. If we are not able to secure additional funding, the implementation of our business plan will be impaired.

IX.

Our company is quoted in OTCQX (Ticker IQST)

Since 2018, when our company

traded on OTCMarkets as a Pink Sheet stock and the year the new management took control of the company, our commitment has been to improving

corporate governance and qualifications to continue to higher quality capital markets. This dedication enabled us to achieve both QB and

QX certifications, with the QX certification obtained over two years ago.

| Page 25 of 32 | August, 2024 |

As per regulation, our company

has always been PCAOB audited, ensuring timely filing of all required documentation and disclosure. Since the end of 2022, we have been

working closely with a Nasdaq account manager to identify and address corporate governance gaps necessary for Nasdaq listing.

As of today, we have successfully

closed all governance gaps and now meet all Nasdaq requirements except the minimum share price. Key requirements achieved include:

| |

• |

Shareholders: +20,000 |

| |

• |

Stockholder Equity: > $8 million |

| |

• |

Board of Directors with a majority of independent members |

| |

• |

Audit Committee |

| |

• |

Compensation Committee |

| |

• |

Code of Ethics |

| |

• |

Annual Shareholders Meeting |

| |

• |

Annual Board Members Ratification |

| |

• |

Annual Audit Firm Ratification |

Currently, we have 183.5 million

common shares issued and 300 million authorized shares. Our management team, led by founders Leandro Jose Iglesias (CEO) and Alvaro Quintana

(CFO), are the largest shareholders, holding the equivalent of over 30 million common shares through common shares and Series B Preferred

Shares. They also control 51% of voting rights through Series A Preferred Shares, safeguarding the company against hostile takeovers.

Management believes that the

current IQST stock price does not reflect the true value of our business. We are confident that as our improved financial results become

evident, the stock price will align more closely with the value expected for a company with $290 million in revenue. While a reverse stock

split is a viable option to meet the Nasdaq minimum share price requirement, we prefer to see the stock price rise organically.

X.

Successfully funds raising history

Since

2018 the company has raised over $20 Million through different instruments such as Merchant Cash Advances, Promissory Notes, Convertible

Notes, Regulation A offerings, and registered offerings over the last 2 years.

Management believes that

having raised over $20 Million while only having a total issued and outstanding of 183.5 million common shares is a testament to management’s

absolute commitment to a responsible capital structure management strategy.

| Page 26 of 32 | August, 2024 |

XI.

Cap Table & Current Outstanding Debt

| iQSTEL, Inc |

|

| Company Ownership Cap Table |

| As of August 1, 2024 |

|

| |

|

| Common Shares |

|

| Total Authorized |

300,000,000 |

| Total Outstanding |

183,535,742 |

| Restricted |

6,514,999 |

| Free Trading Shares |

177,020,743 |

| |

|

| Preferred Shares |

|

| Authorized |

1,200,000 |

| |

|

| Preferred Series A |

|

| Authorized |

10,000 |

| Outstanding |

10,000 |

| |

|

| Preferred Series B |

|

| Authorized |

200,000 |

| Outstanding |

31,080 |

| |

|

| Preferred Series C |

|

| Authorized |

200,000 |

| Outstanding |

- |

| |

|

| Preferred Series D |

|

| Authorized |

75,000 |

| Outstanding |

- |

| Page 27 of 32 | August, 2024 |

Current

Outstanding Debt:

The

company has recently raised funds to complete the acquisition of QXTEL and to support the organic growth, following listed of the more

relevant debts summarized of the company:

| A. | $4.3 Million Convertible Note with M2B Funding, Maturity

on Q1 FY-2025, filed in the S-1 registration statement. |

| B. | $220,000 Standard Promissory Note with M2B funding,

maturity Q2 FY-2025. |

| C. | $430,000 Standard Promissory Note with 1-800 Diagonal,

Maturity along FY-2024 in monthly installments. |

| D. | $550,000 Standard Promissory Note with Samson, Maturity

along FY-2024 and Q1 FY-2025 in monthly installments. |

XII.

Current Capital Requirements and Use of Proceeds

The

intention of the company is to raise up to $10.5 Million to redeem all the debts, and have around $5 Million available to support the

M&A campaign and organic growth.

It is

important to state that the company, over the last 5 years, has built trusting and committed relationships with its debt investors. In

particular, the company has built a great relationship with our biggest investor, M2B Funding. We believe this history attests to the

potential for a smooth process with all future funders and lenders for a prompt return on investment and repayment of debts.

We have

been working with funders and lenders to structure potential financing that accomplishes our goals, and we are continually exploring options

and different instruments available in the current capital markets.

XIII.

Nasdaq Uplisting

For

the past two years, the company has been actively engaged in an information exchange with our Nasdaq analyst and FINRA. These efforts

are focused on preparing the Company for a potential uplisting to the Nasdaq stock exchange.

| Page 28 of 32 | August, 2024 |

Management Team believes that FY-2024 is the optimal

time for the Company to get listed on the NASDAQ exchange and is actively working towards this goal.

As part of the preparation for

the NASDAQ listing, the company plans to participate in key investor conferences and explore engagement with investment banks and underwriters.

These activities will complement our efforts to achieve this significant milestone within the established time frame and with exceeding

technical and financial requirements in place.

Time

to invest in IQSTEL

Under

our analysis described in the $1 Billion Plan, we estimated the current telecommunications business valuation. Our valuation model was

primarily based on estimating the net present value of our future revenue/profits based the company’s current and anticipated cash

generation from 2024 through 2027. Additionally, we’ve calculated the residual cash generation after 2027. Based on these premises,

we estimate internally IQSTEL’s current business valuation to be between $158 million and $198 million. This valuation does

not include any contribution from Fintech, EV and AI-Enhanced Metaverse business divisions and the strategic acquisition described above.

We are

a roll up company. We believe the consistent organic growth and synergies that we have achieved following acquisitions will continue to

improve our bottom line and increase shareholder value by increasing the company’s overall market valuation. We genuinely believe

our company is a good investment opportunity. We also believe our $1 Billion Plan is ideally timed with our Nasdaq uplisting initiative

XIV.

Management

Leandro

Jose Iglesias, President & CEO, Chairman of the Board

Mr. Leandro

Iglesias, with over 20 years of experience in the telecommunications industry, founded Etelix in 2008 and served as its President and

CEO until final merger and renaming to IQSTEL, Inc. Before establishing Etelix, Mr. Iglesias was the International Business Manager at

CANTV/Movilnet, the largest telecommunications provider in Venezuela, from January 2003 to July 2008, during its period under Verizon's

control. Prior to his role at CANTV/Movilnet, he served as Executive Vice President, overseeing the Latin America marketing division of

American Internet Communications from August 1998 to December 2002.

| Page 29 of 32 | August, 2024 |

Mr. Iglesias has specialized

in international long-distance traffic business, submarine cables, satellite communications, and international roaming services. He holds

an Electronic Engineering degree from Universidad Simon Bolivar, has completed the Management Program at IESA Business School, and earned

an MBA from Universidad Nororiental Gran Mariscal de Ayacucho.

Mr. Iglesias's extensive experience

and expertise in the telecom industry make him a valuable asset to our Board of Directors.

Alvaro

Quintana Cardona, CFO and Secretary of the Board

Alvaro Quintana

brings over twenty years of experience in the telecommunications industry, specializing in regulatory affairs, strategic planning, value-added

services, and international interconnection agreements. Since joining Etelix in 2013, he has served as Chief Operating Officer and Chief

Financial Officer. Prior to Etelix, Mr. Quintana was the Interconnection and Value-Added Services Manager at Digitel, a Venezuelan mobile

service provider and former subsidiary of Telecom Italia Mobile, from June 2004 to May 2013.

Mr. Quintana holds a Bachelor’s

Degree in Business Administration and a Specialist Degree in Economics from Universidad Catolica Andres Bello. Additionally, he earned

a Master’s in Telecommunications from the EOI Business School in Spain.

We believe Mr. Quintana’s

extensive experience and expertise in the telecommunications industry make him a valuable addition to our Board of Directors.

Raul

A Perez, Independent Member of the Board, and Head of Audit Committee

Mr. Perez brings over 40 years

of experience in finance, holding various positions since 1970 to our company. He currently serves as CFO of Deerbrook Family Dentistry,

PC, in Humble, Texas, a role he has held since December 1, 2014. Previously, he was a Senior Accountant at Principrin School, PC, in Houston,

Texas, from November 1, 2017, to January 31, 2019.

Throughout his career, Mr. Perez

has held numerous finance roles, including Corporate Treasurer for major corporations. He spent five years at Sudamtex of Venezuela, C.A.,

and ten years at Polar Brewery in Caracas, Venezuela. In 2000, he became a Director of the Securities and Exchange Commission of Venezuela,

overseeing the country's stock market participants. In 2004, he earned certification as a Venezuelan Investment Advisor. As an independent

contractor, he served as Corporate Compliance Officer for Activalores Casa de Bolsa, developing compliance units and manuals in accordance

with anti-money laundering laws. He also taught Corporate Finance and Managerial Accounting at the Advanced Institute of Finance (IAF)

in Caracas for five years.

| Page 30 of 32 | August, 2024 |

Mr. Perez holds a Bachelor's

degree in Accounting (1976) and an MBA in Finance (1982), providing him with comprehensive knowledge of finance and business operations.

Mr. Perez is a valuable independent

director due to his extensive education, skills, and experience in finance, as well as his regulatory expertise.

Jose Antonio

Barreto, Independent Member of the Board & Head of the Ethic Code Committee

Mr.

Barreto has been the Chief Business Development Officer at Xpectra Remote Management in Mexico since 2006. In this role, he has directed

all aspects of account development and sales efforts, targeting private and government opportunities, and developing strategic accounts

across Mexico and the LATAM region. Since 2020, he has also served as an advisor to our Board of Directors.

With over 30 years of experience

in telecommunications and technology, Mr. Barreto has led business development and operational activities, including technical, operational,

and financial analyses for several telecommunications and technology company acquisitions. Over the last 14 years, he has been a leader

in North and Central America, driving commercial processes in technology security, artificial intelligence, Internet of Things (IoT) platforms,

and cutting-edge technology solutions and software systems.

He holds a degree in Electronic

Engineering from Universidad Simón Bolivar, a Master of Science in Electrical and Computer Engineering from Rice University, and

a Master's in Telecommunications Management from Universidad Simón Bolivar and Telecom SudParis Institute.

Mr. Barreto is a valuable independent

director due to his extensive education, skills, and experience in technology companies.

Italo R. Segnini, Independent

Board of Director and Head of the Compensation Committee

From March 2020 to the present,

Mr. Segnini has served as the Global Carrier Partnership Director at Sierra Wireless. Prior to this, he was an Independent Telecom Consultant

from June 2019 to February 2020. From 2017 to 2019, he served as Director of International Carrier Business for Televisa Telecom, and

from 2012 to 2019, he was the Director of International Carrier Business for Millicom.

| Page 31 of 32 | August, 2024 |

Mr. Segnini is a seasoned professional

in the telecommunications industry with over 20 years of high-level experience at Global Tier One companies, including Telefonica, Millicom,

Televisa, and Sierra Wireless. He has extensive executive experience in various telecom areas such as Voice, A2P, SMS, Data, Roaming,

Mobility Services, B2B, MNO, MVNO, IoT, and Interconnection. He has a solid track record in international commercial negotiations, management,

sales, business development, regulatory, and operations.

Mr. Segnini holds a Juris Doctor

degree from Andres Bello Catholic University, a Master’s Degree in Telecommunications from Madrid Pontificia Comillas University,

and an MBA from IESA Business School.

Mr. Segnini is a valuable independent

director because of his extensive education, skills, and experience in the telecommunications industry.

XV.

Final Summary

iQSTEL Inc. (OTC-QX: IQST) (www.iQSTEL.com)

is a US-based, multinational publicly held company currently preparing for a listing on a national exchange with Nasdaq. In FY2023, the

company achieved $144.5 million in revenue and projects a substantial increase to $290 million in revenue with a positive operating income

forecast in the seven digits for FY2024.

The company has successfully

grown to a quarter-billion-dollar revenue company and is on track to reach its billion-dollar revenue milestone for 2027. We believe iQSTEL

is evolving into a telecommunications and technology powerhouse.

We have available upon request

the financial statements (balance sheet, P&L and cash flow) projected for the years 2024 to 2027.

For additional inquiries, please

contact: Leandro José Iglesias (CEO) and Alvaro Quintana (CFO) at investors@iqstel.com

| Page 32 of 32 | August, 2024 |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

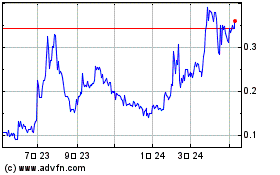

iQSTEL (QX) (USOTC:IQST)

過去 株価チャート

から 11 2024 まで 12 2024

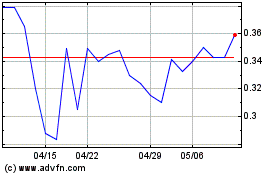

iQSTEL (QX) (USOTC:IQST)

過去 株価チャート

から 12 2023 まで 12 2024