UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of October 2024

Commission File Number: 001-14642

ING Groep N.V.

(Translation of registrant's name into English)

Bijlmerdreef 106

1102 CT Amsterdam

The Netherlands

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F [ X ] Form 40-F [ ]

On October 31, 2024, the Registrant issued a press release, a copy of which is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

(c) Exhibit 99.1. Press release dated October 31, 2024

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | ING Groep N.V. |

| | | (Registrant) |

| | | |

| | | |

| Date: October 31, 2024 | | /s/ Raymond Vermeulen |

| | | Raymond Vermeulen |

| | | Head of Media Relations & Issue Management |

| | | |

Exhibit 99.1

ING posts 3Q2024 net result of €1,880 million, supported by commercial growth and strong income 3Q2024 profit before tax of €2,668 million with a four - quarter rolling average return on equity of 13.8% • Resilient net interest income, supported by volume growth in lending and deposits • Fee income increasing 11% year - on - year, surpassing €1 billion, with significant growth in both Retail and Wholesale Banking • Increase of 189,000 mobile primary customers and strong growth in mortgages • €2.5 billion distribution announced as we continue to align our capital to our target level CEO statement “In the third quarter of 2024, we have again delivered strong results and are executing well on our strategy to accelerate growth, increase impact and deliver value for all stakeholders,” said Steven van Rijswijk, CEO of ING. “We have grown our customer base and taken important steps in our climate action approach. Our good commercial momentum has led to robust income growth, specifically in fee income. We have also seen increased lending and deposit volumes and resilient margins. “Fee income has continued to increase in line with our ambition to diversify our income and surpassed € 1 billion for the first time . Fee income from retail investment products has continued to rise, reflecting an increase in assets under management and customer trading activity . Wholesale Banking has in particular benefited from higher deal flow in Global Capital Markets . “In Retail Banking, performance was supported by strong core lending growth of €6 billion, mainly in residential mortgages across all Retail markets. Our market share of new mortgage production has increased significantly in the Netherlands, as our quick processing of digital applications and our flexible operations helped us in a very competitive market. This is a clear example of how we increase impact and deliver value for customers. “Wholesale Banking income was resilient, supported by volume growth in lending and deposits in addition to strong results in Payments & Cash Management and Financial Markets. Our Capital Markets Advisory business continues to grow following investments to further build on our expertise. We aim to optimise our capital efficiency and during this quarter we have significantly reduced our risk - weighted assets (RWA) in Wholesale Banking. “Expenses have risen 2 % from the last quarter as we invest in growing our business . Risk costs were € 336 million, in line with our through - the - cycle - average . Our four - quarter rolling return on equity came out at 13 . 8 % and our CET 1 ratio increased to 14 . 3 % , driven by our strong profitability and lower RWA . “We continue to take steps to converge our CET1 capital ratio to our target level of around 12.5%. The share buyback programme announced in May 2024 has been completed and we today announce a next distribution of €2.5 billion, which will have a pro forma impact of 76 basis points on our CET1 ratio. Operating at the right level of capital is in the best interest of all our stakeholders and allows us to support customers and the economy in the countries we operate in. “In September, we have published our Climate Progress Update 2024, which shares our sharpened approach to client engagement, our updated energy policy and the latest on our Terra approach. We aim to make an impact by working with clients on their transitions to net zero while financing the technologies and solutions needed for a sustainable future. “We are well positioned to continue to execute our strategy and grow our business, and I would like to thank our customers for their loyalty and our employees for their contributions to our excellent third - quarter performance.” Investor enquiries E: investor.relations@ing.com Press enquiries T: +31 (0)20 576 5000 E: media.relations@ing.com Analyst call 31 October 2024 at 9:00 am CET +31 20 708 5074 (NL) +44 330 551 0202 (UK) (Registration required via invitation) Live audio webcast at www.ing.com Media call 31 October 2024 at 11:00 am CET +31 20 708 5073 (NL) +44 330 551 0200 (UK) (Quote ING Media Call when prompted by the operator) Live audio webcast at www.ing.com Press release ING Corporate Communications Amsterdam, 31 October 2024

Business Highlights Net core lending growth €8.5 bln in 3Q2024 Net core deposits growth €2.9 bln in 3Q2024 Net result €1,880 mln - 5% vs 3Q2023 Fee income €1,009 mln +11% vs 3Q2023 CET1 ratio 14.3% +0.3% vs 2Q2024 Return on equity (4 - qtr rolling avg) 13.8% - 0.2% vs 2Q2024 Superior value for customers NPS score: Ranked #1 in 5 of 10 retail markets Mobile primary customers 1) : +189,000 in 3Q2024 We aim to deliver superior value to our customers, including offering a seamless digital experience and simplifying customers’ journeys. The number of our mobile primary customers — primary customers with a mobile interaction through our app or website — grew by 189,000 to reach 13.9 million, out of a total of more than 39 million customers. Mobile primary customers now make up 88% of our total of 15.8 million primary customers. Germany, Türkiye and Romania were particularly strong in mobile primary customer growth. In the Netherlands, we gained significant market share in mortgages as our quick processing of digital applications and our flexible operations helped us optimally benefit in a dynamic and competitive environment. This also resulted in a higher net promoter score from intermediaries. Our strong technology foundations enable us to scale our digital capabilities across our markets. For example, this quarter we have launched our shared app foundation, called ‘OneApp’, to Business Banking customers in Germany, following earlier rollouts in the Netherlands and Belgium. We’re working on expanding it to other countries as well. We’re also scaling our fraud prevention capabilities to keep our customers safe and secure. Our ‘Look who’s calling’ feature in the mobile app allows customers to check whether a call is in fact from an ING employee. It was first introduced in the Netherlands and has now been expanded to Italy and Poland and other countries will follow. Sustainability Volume mobilised 2) : €85.3 bln in 9M2024 vs €73.9 bln in 9M2023 Sustainability deals supported by ING: 565 in 9M2024 vs 507 in 9M2023 We aim to put sustainability at the heart of what we do. This quarter, we have published our Climate Progress Update 2024, which outlines the important steps we’ve taken to sharpen the way we engage with clients on their transition towards net zero. It also includes our progress on steering the most carbon - intensive sectors in our loan portfolio towards global climate goals — our ‘Terra’ approach. We continue to support homeowners in retrofitting their homes to make them more energy - efficient, and to offer sustainable mortgages for homes that qualify. Importantly, we have announced new steps in our policy for energy financing. We have stopped all new general financing to ‘pure - play’ upstream oil & gas companies that continue to develop new fields. In addition, driven by guidance from the International Energy Agency, we will stop providing new financing for new LNG export terminals after 2025. We believe that we can make the most impact by financing the technologies and solutions needed for a low - carbon economy. Our sustainable volume mobilised increased by 15% to €85.3 billion year - to - date as we continue to support our corporate clients in their transition. For example, ING acted as sole sustainability coordinator for the upsized refinancing of a syndicated €2 billion revolving credit facility linked to ESG goals for Henkel, owner of consumer brands like Pritt glue and Syoss hair care. We also supported the transition in the transportation sector with a $150 million facility to develop a portfolio of contracted EV charging depots in the US with Voltera, a company that aims to help solve the EV infrastructure challenge and scale zero - emission transportation. Society is transitioning to a low - carbon economy. So are our clients, and so is ING. We finance a lot of sustainable activities, but we still finance more that’s not. See how we’re progressing at ing.com/climate. 1) Includes private individuals only 2) See our Annual Report for definition ING Press Release 3Q2024 2

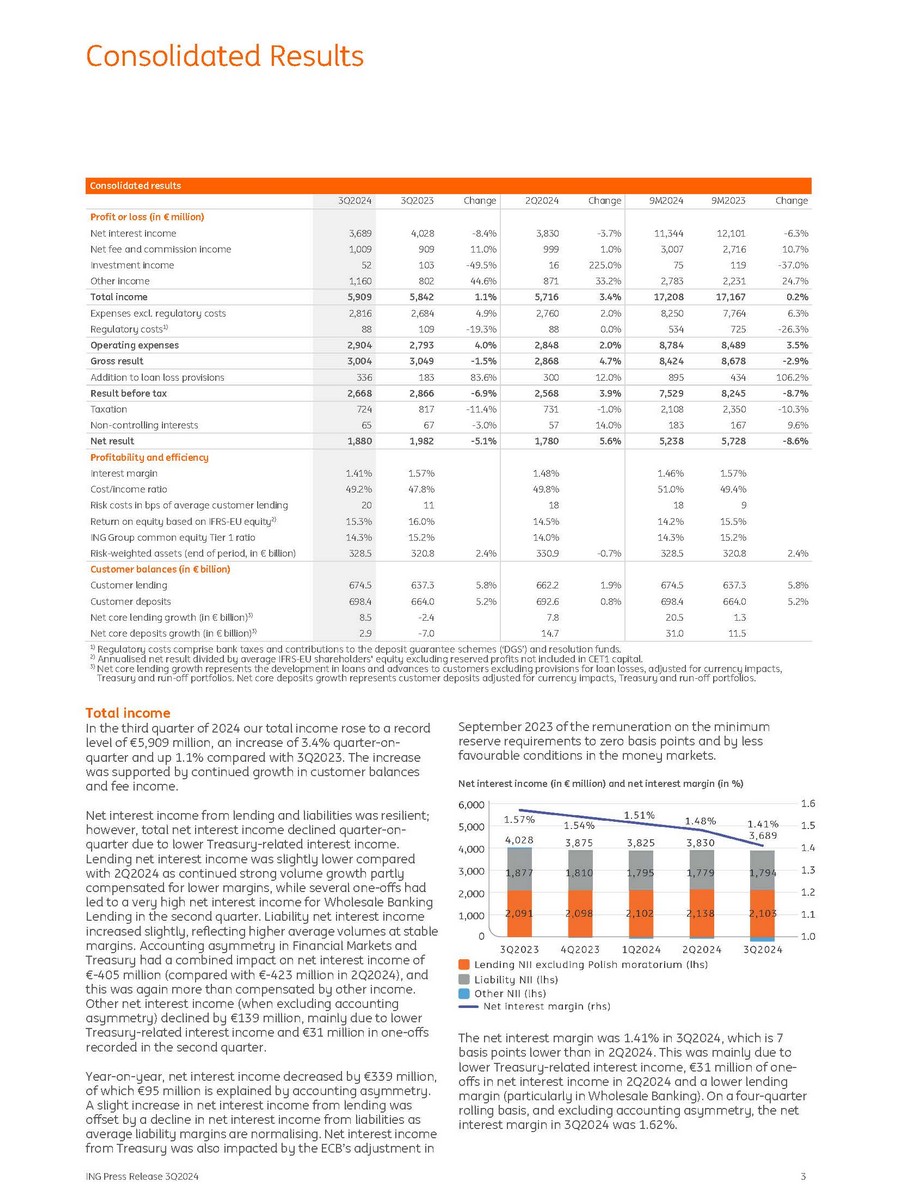

Consolidated Results Change 9M2023 9M2024 Change 2Q2024 Change 3Q2023 3Q2024 Profit or loss (in € million) - 6.3% 12,101 11,344 - 3.7% 3,830 - 8.4% 4,028 3,689 Net interest income 10.7% 2,716 3,007 1.0% 999 11.0% 909 1,009 Net fee and commission income - 37.0% 119 75 225.0% 16 - 49.5% 103 52 Investment income 24.7% 2,231 2,783 33.2% 871 44.6% 802 1,160 Other income 0.2% 17,167 17,208 3.4% 5,716 1.1% 5,842 5,909 Total income 6.3% 7,764 8,250 2.0% 2,760 4.9% 2,684 2,816 Expenses excl. regulatory costs - 26.3% 725 534 0.0% 88 - 19.3% 109 88 Regulatory costs 1) 3.5% 8,489 8,784 2.0% 2,848 4.0% 2,793 2,904 Operating expenses - 2.9% 8,678 8,424 4.7% 2,868 - 1.5% 3,049 3,004 Gross result 106.2% 434 895 12.0% 300 83.6% 183 336 Addition to loan loss provisions - 8.7% 8,245 7,529 3.9% 2,568 - 6.9% 2,866 2,668 Result before tax - 10.3% 2,350 2,108 - 1.0% 731 - 11.4% 817 724 Taxation 9.6% 167 183 14.0% 57 - 3.0% 67 65 Non - controlling interests - 8.6% 5,728 5,238 5.6% 1,780 - 5.1% 1,982 1,880 Net result Profitability and efficiency 1.57% 1.46% 1.48% 1.57% 1.41% Interest margin 49.4% 51.0% 49.8% 47.8% 49.2% Cost/income ratio 9 18 18 11 20 Risk costs in bps of average customer lending 15.5% 14.2% 14.5% 16.0% 15.3% Return on equity based on IFRS - EU equity 2) 15.2% 14.3% 14.0% 15.2% 14.3% ING Group common equity Tier 1 ratio 2.4% 320.8 328.5 - 0.7% 330.9 2.4% 320.8 328.5 Risk - weighted assets (end of period, in € billion) Customer balances (in € billion) 5.8% 637.3 674.5 1.9% 662.2 5.8% 637.3 674.5 Customer lending 5.2% 664.0 698.4 0.8% 692.6 5.2% 664.0 698.4 Customer deposits 1.3 20.5 7.8 - 2.4 8.5 Net core lending growth (in € billion) 3) 11.5 31.0 14.7 - 7.0 2.9 Net core deposits growth (in € billion) 3) ING Press Release 3Q2024 3 1) Regulatory costs comprise bank taxes and contributions to the deposit guarantee schemes (‘DGS’) and resolution funds. 2) Annualised net result divided by average IFRS - EU shareholders' equity excluding reserved profits not included in CET1 capital. 3) Net core lending growth represents the development in loans and advances to customers excluding provisions for loan losses, adjusted for currency impacts, Treasury and run - off portfolios. Net core deposits growth represents customer deposits adjusted for currency impacts, Treasury and run - off portfolios. Total income In the third quarter of 2024 our total income rose to a record level of €5,909 million, an increase of 3.4% quarter - on - quarter and up 1.1% compared with 3Q2023. The increase was supported by continued growth in customer balances and fee income. Net interest income from lending and liabilities was resilient; however, total net interest income declined quarter - on - quarter due to lower Treasury - related interest income. Lending net interest income was slightly lower compared with 2Q2024 as continued strong volume growth partly compensated for lower margins, while several one - offs had led to a very high net interest income for Wholesale Banking Lending in the second quarter. Liability net interest income increased slightly, reflecting higher average volumes at stable margins. Accounting asymmetry in Financial Markets and Treasury had a combined impact on net interest income of € - 405 million (compared with € - 423 million in 2Q2024), and this was again more than compensated by other income. Other net interest income (when excluding accounting asymmetry) declined by €139 million, mainly due to lower Treasury - related interest income and €31 million in one - offs recorded in the second quarter. Year - on - year, net interest income decreased by €339 million, of which €95 million is explained by accounting asymmetry. A slight increase in net interest income from lending was offset by a decline in net interest income from liabilities as average liability margins are normalising. Net interest income from Treasury was also impacted by the ECB’s adjustment in September 2023 of the remuneration on the minimum reserve requirements to zero basis points and by less favourable conditions in the money markets. Net interest income (in € million) and net interest margin (in %) The net interest margin was 1.41% in 3Q2024, which is 7 basis points lower than in 2Q2024. This was mainly due to lower Treasury - related interest income, €31 million of one - offs in net interest income in 2Q2024 and a lower lending margin (particularly in Wholesale Banking). On a four - quarter rolling basis, and excluding accounting asymmetry, the net interest margin in 3Q2024 was 1.62%. Consolidated results

Consolidated Results In the third quarter of 2024, we grew our loan book in both Retail and Wholesale Banking. In Retail Banking, where we continue to expand our customer base, net core lending growth (which is the increase in customer lending adjusted for currency impacts and excluding movements in Treasury and in run - off portfolios) was €6.4 billion. In addition to increasing our residential mortgages portfolio (by €5.7 billion, spread across all countries), we also grew our consumer lending and business lending books. Wholesale Banking recorded net core lending growth of €2.1 billion, thanks to an increase in Lending and Financial Markets, partly offset by our ongoing efforts to optimise capital usage. ING Press Release 3Q2024 4 Also, our deposit base further increased in the third quarter of 2024. Net core deposits growth (which excludes FX impacts and movements in Treasury deposits) was €2.9 billion, to which Retail Banking contributed €1.0 billion. We continued to grow outside the eurozone and recorded a €5.5 billion inflow in Belgium following a successful promotional campaign. This was partially offset by a seasonal outflow (as customers spent part of their holiday allowance as received in 2Q2024) and by an anticipated net outflow in Germany after the end of a promotional campaign. Wholesale Banking recorded net core deposits growth of €1.8 billion, mainly reflecting further targeted growth in deposit volumes for Payments & Cash Management and in Money Markets. With a total net fee and commission income of over €1 billion in the quarter, we are on track to generate €4 billion of fee income this year. Fee income increased 11% year - on - year, with strong growth in both Retail Banking and Wholesale Banking. In Retail Banking, the increase was driven by higher fees from investment products (reflecting growth in assets under management and in the number of trades) as well as an increase in daily banking fees (reflecting a higher number of mobile primary customers and updated pricing for payment packages). The increase in fee income for Wholesale Banking was mainly attributable to a higher deal flow in Global Capital Markets and in Corporate Finance. Sequentially, fee income rose 1.0%. This was driven by higher fees in Retail Banking from daily banking services and investment products. Investment income in 3Q2024 included a €101 million annual dividend from our stake in the Bank of Beijing (up from €98 million a year ago), which was partly offset by realised losses on the sale of debt securities. Other income increased strongly year - on - year, mainly due to the positive offsetting effect of accounting asymmetry in Financial Markets, as well as to a smaller IAS 29 impact (reflecting lower inflation in Türkiye). Furthermore, in 3Q2024 we recorded €77 million as our share in the one - off profit of an associate in Belgium, while other income in 3Q2023 had included a €61 million gain from the release of reserves in Financial Markets. Sequentially, other income rose by €289 million; this was mainly due to the aforementioned gain on a sale as well as to a sharp increase in other income for Treasury. Operating expenses Total operating expenses were € 2 , 904 million, including € 88 million of regulatory costs and € 24 million of incidental cost items . Expenses excluding regulatory costs and incidental items amounted to €2,792 million and rose 9.0% year - on - year, mainly attributable to the impact of inflation on staff expenses and the implementation of the ‘Danske Bank’ ruling on VAT in the Netherlands. This was combined with higher investments in business growth, particularly in the Retail Other countries. Sequentially, the growth in expenses excluding regulatory costs and incidental items was 2.7%. Operating expenses (in € million) Regulatory costs were €88 million in 3Q2024. This amount was stable sequentially but lower year - on - year because the Dutch deposit guarantee fund has already reached its target level this year. Incidental expense items in 3Q2024 amounted to €24 million, reflecting €21 million of restructuring costs for Retail Belgium and €3 million of hyperinflation accounting impacts on expenses in Türkiye (due to accounting requirements of IAS 29). This €24 million of incidental cost items in 3Q2024 compares with €122 million of incidental items in 3Q2023 and €41 million in 2Q2024. Addition to loan loss provisions Net additions to loan loss provisions amounted to €336 million. This is equivalent to 20 basis points of average customer lending, equal to our through - the - cycle average. Total net additions to Stage 3 provisions in 3Q2024 were €453 million and mainly related to individual Stage 3 provisioning. This was largely connected to a few new and existing Stage 3 files in Wholesale Banking. Total Stage 1 and 2 risk costs were € - 117 million. This mainly reflected a partial release of the management overlays that had initially been created to cover the potential impact of higher inflation and rising interest rates on customers’ ability to pay, combined with some model updates in Retail Banking.

Consolidated Results Addition to loan loss provisions (in € million) ING Press Release 3Q2024 5 Risk costs for Retail Banking were € 145 million, or 12 basis points of average customer lending, and mainly related to Germany and Belgium . Wholesale Banking recorded € 191 million of risk costs, or 40 basis points of average customer lending . Net result The net result in 3Q2024 was €1,880 million compared with €1,982 million in 3Q2023 and €1,780 million in the previous quarter. The effective tax rate in 3Q2024 was 27.1% compared with 28.5% in both comparable quarters. For the full year 2024, we expect an effective tax rate of 28%. Return on equity ING Group (in %) ING’s continued strong performance was reflected in a 15.3% return on equity in the third quarter. On a four - quarter rolling average basis, the return on equity remained high at 13.8%. ING’s return on equity is calculated using average IFRS - EU shareholders' equity after excluding 'reserved profit not included in CET1 capital', which amounted to €1,559 million at the end of 3Q2024. This reflects 50% of the resilient net profit in the first nine months of 2024, which has been reserved for distribution in line with our policy, minus the interim dividend over 2024 that was paid in August. Resilient net profit is defined as net profit adjusted for significant items that are not linked to the normal course of business. In line with this definition, and consistent with previous quarters, the impact of hyperinflation accounting has been excluded. Therefore, resilient net profit was €36 million higher than net profit in 3Q2024. 2024 Outlook 1) Based on current assumptions and scenarios, we expect a total income in 2024 of >€22.5 billion (including €4 billion of fee income) and a cost/income ratio of ~53%. For 2024, a return on equity is expected of >13%. The CET1 ratio is expected to converge towards our ~12.5% target by 2025. 1) The targets, outlook and trends discussed in this 2024 Outlook section are forward - looking statements that are based on management’s current expectations and are subject to change, including as a result of the factors described under the section entitled ‘Important Legal Information’ in this document. ING assumes no obligation to publicly update or revise these forward - looking statements, whether as a result of new information or for any other reason.

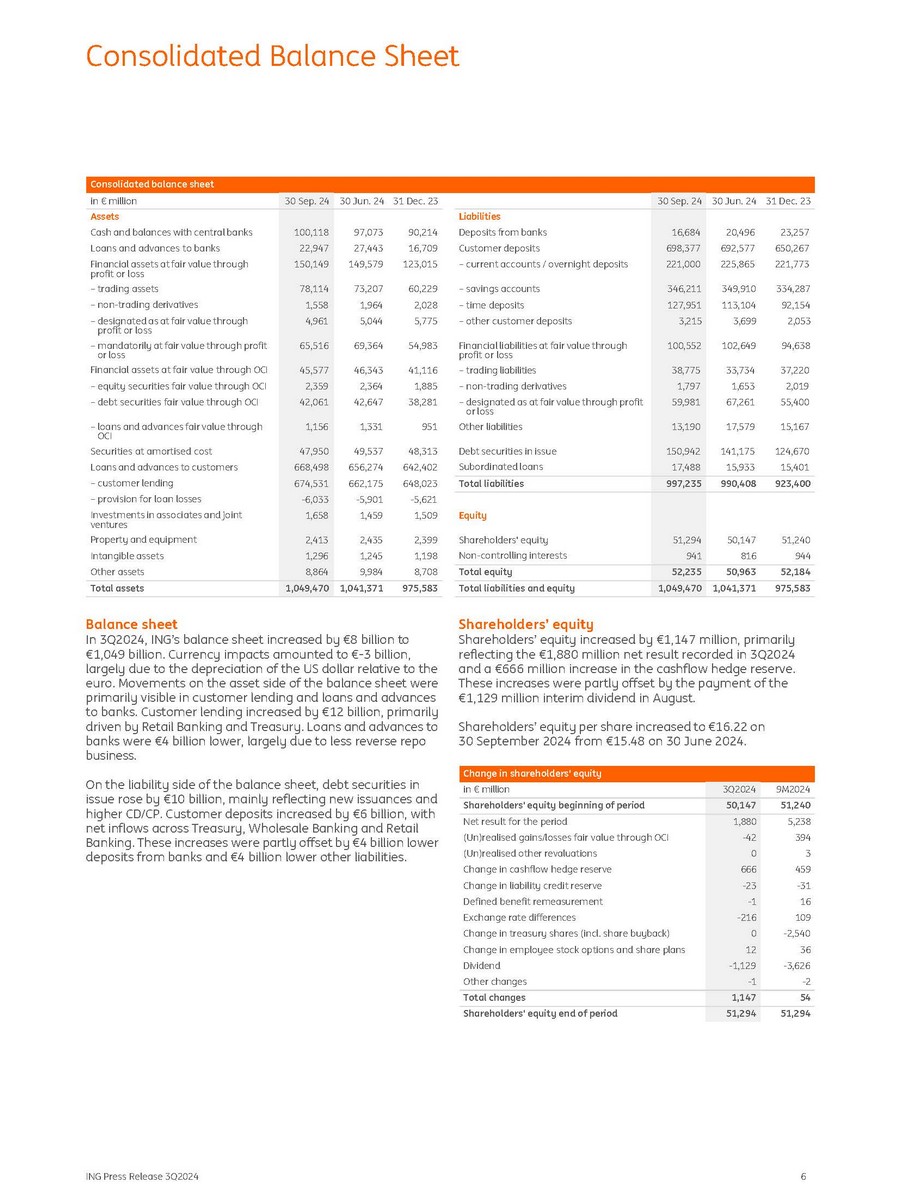

ING Press Release 3Q2024 6 Consolidated Balance Sheet Consolidated balance sheet 31 Dec. 23 30 Jun. 24 30 Sep. 24 30 Jun. 24 31 Dec. 23 30 Sep. 24 in € million 23,257 650,267 221,773 334,287 92,154 2,053 94,638 37,220 2,019 55,400 15,167 124,670 15,401 20,496 692,577 225,865 349,910 113,104 3,699 102,649 33,734 1,653 67,261 17,579 141,175 15,933 16,684 698,377 221,000 346,211 127,951 3,215 100,552 38,775 1,797 59,981 13,190 150,942 17,488 Liabilities Deposits from banks Customer deposits – current accounts / overnight deposits – savings accounts – time deposits – other customer deposits Financial liabilities at fair value through profit or loss – trading liabilities – non - trading derivatives – designated as at fair value through profit or loss Other liabilities Debt securities in issue Subordinated loans 97,073 90,214 27,443 16,709 149,579 123,015 73,207 60,229 1,964 2,028 5,044 5,775 69,364 54,983 46,343 41,116 2,364 1,885 42,647 38,281 1,331 951 49,537 48,313 656,274 642,402 662,175 648,023 - 5,901 - 5,621 1,459 1,509 2,435 2,399 1,245 1,198 9,984 8,708 100,118 22,947 150,149 78,114 1,558 4,961 65,516 45,577 2,359 42,061 1,156 47,950 668,498 674,531 - 6,033 1,658 2,413 1,296 8,864 Assets Cash and balances with central banks Loans and advances to banks Financial assets at fair value through profit or loss – trading assets – non - trading derivatives – designated as at fair value through profit or loss – mandatorily at fair value through profit or loss Financial assets at fair value through OCI – equity securities fair value through OCI – debt securities fair value through OCI – loans and advances fair value through OCI Securities at amortised cost Loans and advances to customers – customer lending – provision for loan losses Investments in associates and joint ventures Property and equipment Intangible assets Other assets 923,400 990,408 997,235 Total liabilities 51,240 944 50,147 816 51,294 941 Equity Shareholders' equity Non - controlling interests 52,184 50,963 52,235 Total equity 975,583 1,041,371 1,049,470 Total liabilities and equity 1,041,371 975,583 1,049,470 Total assets Balance sheet In 3Q2024, ING’s balance sheet increased by €8 billion to €1,049 billion. Currency impacts amounted to € - 3 billion, largely due to the depreciation of the US dollar relative to the euro. Movements on the asset side of the balance sheet were primarily visible in customer lending and loans and advances to banks. Customer lending increased by €12 billion, primarily driven by Retail Banking and Treasury. Loans and advances to banks were €4 billion lower, largely due to less reverse repo business. On the liability side of the balance sheet, debt securities in issue rose by €10 billion, mainly reflecting new issuances and higher CD/CP. Customer deposits increased by €6 billion, with net inflows across Treasury, Wholesale Banking and Retail Banking. These increases were partly offset by €4 billion lower deposits from banks and €4 billion lower other liabilities. Shareholders’ equity Shareholders’ equity increased by € 1 , 147 million, primarily reflecting the € 1 , 880 million net result recorded in 3 Q 2024 and a € 666 million increase in the cashflow hedge reserve . These increases were partly offset by the payment of the € 1 , 129 million interim dividend in August . Shareholders’ equity per share increased to €16.22 on 30 September 2024 from €15.48 on 30 June 2024. Change in shareholders’ equity 9M2024 3Q2024 in € million 51,240 50,147 Shareholders' equity beginning of period 5,238 1,880 Net result for the period 394 - 42 (Un)realised gains/losses fair value through OCI 3 0 (Un)realised other revaluations 459 666 Change in cashflow hedge reserve - 31 - 23 Change in liability credit reserve 16 - 1 Defined benefit remeasurement 109 - 216 Exchange rate differences - 2,540 0 Change in treasury shares (incl. share buyback) 36 12 Change in employee stock options and share plans - 3,626 - 1,129 Dividend - 2 - 1 Other changes 54 1,147 Total changes 51,294 51,294 Shareholders' equity end of period

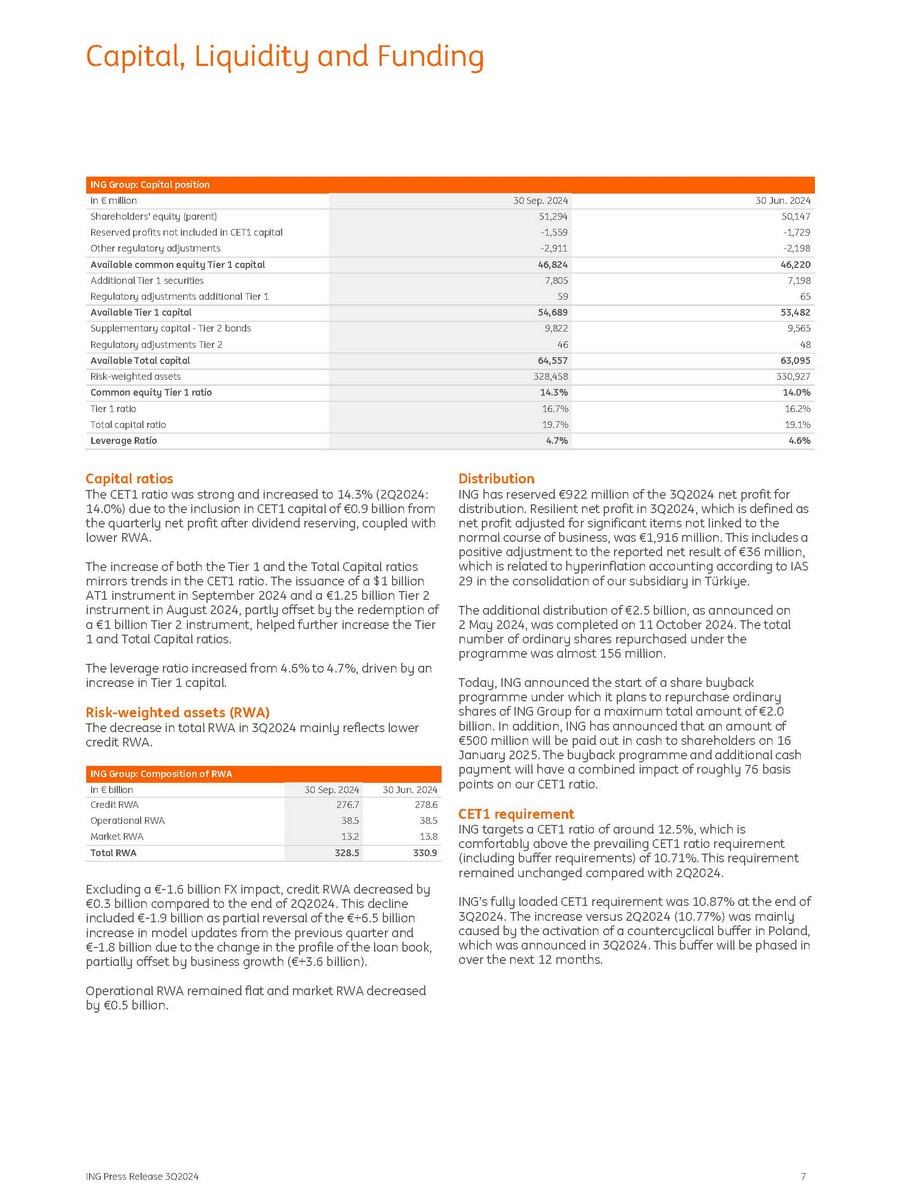

ING Press Release 3Q2024 7 Capital, Liquidity and Funding ING Group: Capital position 30 Jun. 2024 30 Sep. 2024 in € million 50,147 51,294 Shareholders' equity (parent) - 1,729 - 1,559 Reserved profits not included in CET1 capital - 2,198 - 2,911 Other regulatory adjustments 46,220 46,824 Available common equity Tier 1 capital 7,198 7,805 Additional Tier 1 securities 65 59 Regulatory adjustments additional Tier 1 53,482 54,689 Available Tier 1 capital 9,565 9,822 Supplementary capital - Tier 2 bonds 48 46 Regulatory adjustments Tier 2 63,095 64,557 Available Total capital 330,927 328,458 Risk - weighted assets 14.0% 14.3% Common equity Tier 1 ratio 16.2% 16.7% Tier 1 ratio 19.1% 19.7% Total capital ratio 4.6% 4.7% Leverage Ratio Capital ratios The CET1 ratio was strong and increased to 14.3% (2Q2024: 14.0%) due to the inclusion in CET1 capital of €0.9 billion from the quarterly net profit after dividend reserving, coupled with lower RWA. The increase of both the Tier 1 and the Total Capital ratios mirrors trends in the CET1 ratio. The issuance of a $1 billion AT1 instrument in September 2024 and a €1.25 billion Tier 2 instrument in August 2024, partly offset by the redemption of a €1 billion Tier 2 instrument, helped further increase the Tier 1 and Total Capital ratios. The leverage ratio increased from 4.6% to 4.7%, driven by an increase in Tier 1 capital. Risk - weighted assets (RWA) The decrease in total RWA in 3Q2024 mainly reflects lower credit RWA. ING Group: Composition of RWA 30 Jun. 2024 30 Sep. 2024 in € billion 278.6 276.7 Credit RWA 38.5 38.5 Operational RWA 13.8 13.2 Market RWA 330.9 328.5 Total RWA Excluding a € - 1.6 billion FX impact, credit RWA decreased by €0.3 billion compared to the end of 2Q2024. This decline included € - 1.9 billion as partial reversal of the €+6.5 billion increase in model updates from the previous quarter and € - 1.8 billion due to the change in the profile of the loan book, partially offset by business growth (€+3.6 billion). Operational RWA remained flat and market RWA decreased by €0.5 billion. Distribution ING has reserved €922 million of the 3Q2024 net profit for distribution. Resilient net profit in 3Q2024, which is defined as net profit adjusted for significant items not linked to the normal course of business, was €1,916 million. This includes a positive adjustment to the reported net result of €36 million, which is related to hyperinflation accounting according to IAS 29 in the consolidation of our subsidiary in Türkiye. The additional distribution of €2.5 billion, as announced on 2 May 2024, was completed on 11 October 2024. The total number of ordinary shares repurchased under the programme was almost 156 million. Today, ING announced the start of a share buyback programme under which it plans to repurchase ordinary shares of ING Group for a maximum total amount of €2.0 billion. In addition, ING has announced that an amount of €500 million will be paid out in cash to shareholders on 16 January 2025. The buyback programme and additional cash payment will have a combined impact of roughly 76 basis points on our CET1 ratio. CET1 requirement ING targets a CET1 ratio of around 12.5%, which is comfortably above the prevailing CET1 ratio requirement (including buffer requirements) of 10.71%. This requirement remained unchanged compared with 2Q2024. ING’s fully loaded CET1 requirement was 10.87% at the end of 3Q2024. The increase versus 2Q2024 (10.77%) was mainly caused by the activation of a countercyclical buffer in Poland, which was announced in 3Q2024. This buffer will be phased in over the next 12 months.

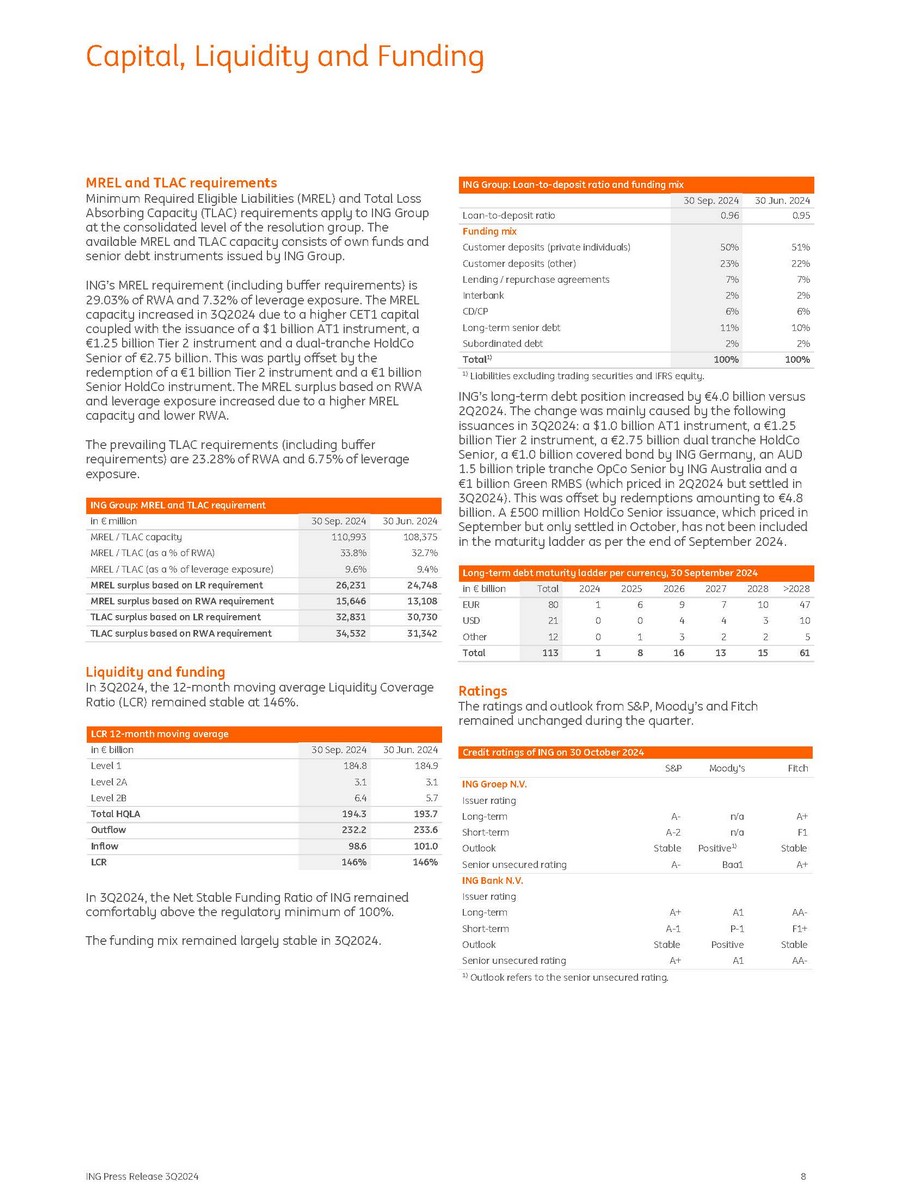

Capital, Liquidity and Funding MREL and TLAC requirements Minimum Required Eligible Liabilities (MREL) and Total Loss Absorbing Capacity (TLAC) requirements apply to ING Group at the consolidated level of the resolution group. The available MREL and TLAC capacity consists of own funds and senior debt instruments issued by ING Group. ING’s MREL requirement (including buffer requirements) is 29 . 03 % of RWA and 7 . 32 % of leverage exposure . The MREL capacity increased in 3 Q 2024 due to a higher CET 1 capital coupled with the issuance of a $ 1 billion AT 1 instrument, a €1.25 billion Tier 2 instrument and a dual - tranche HoldCo Senior of €2.75 billion. This was partly offset by the redemption of a €1 billion Tier 2 instrument and a €1 billion Senior HoldCo instrument. The MREL surplus based on RWA and leverage exposure increased due to a higher MREL capacity and lower RWA. The prevailing TLAC requirements (including buffer requirements) are 23.28% of RWA and 6.75% of leverage exposure. ING Group: MREL and TLAC requirement 30 Jun. 2024 30 Sep. 2024 in € million 108,375 110,993 MREL / TLAC capacity 32.7% 33.8% MREL / TLAC (as a % of RWA) 9.4% 9.6% MREL / TLAC (as a % of leverage exposure) 24,748 26,231 MREL surplus based on LR requirement 13,108 15,646 MREL surplus based on RWA requirement 30,730 32,831 TLAC surplus based on LR requirement 31,342 34,532 TLAC surplus based on RWA requirement Liquidity and funding In 3Q2024, the 12 - month moving average Liquidity Coverage Ratio (LCR) remained stable at 146%. ING Group: Loan - to - deposit ratio and funding mix 30 Jun. 2024 30 Sep. 2024 0.95 0.96 Loan - to - deposit ratio Funding mix 51% 50% Customer deposits (private individuals) 22% 23% Customer deposits (other) 7% 7% Lending / repurchase agreements 2% 2% Interbank 6% 6% CD/CP 10% 11% Long - term senior debt 2% 2% Subordinated debt 100% 100% Total 1) 1) Liabilities excluding trading securities and IFRS equity. ING’s long - term debt position increased by €4.0 billion versus 2Q2024. The change was mainly caused by the following issuances in 3Q2024: a $1.0 billion AT1 instrument, a €1.25 billion Tier 2 instrument, a €2.75 billion dual tranche HoldCo Senior, a €1.0 billion covered bond by ING Germany, an AUD 1.5 billion triple tranche OpCo Senior by ING Australia and a €1 billion Green RMBS (which priced in 2Q2024 but settled in 3Q2024). This was offset by redemptions amounting to €4.8 billion. A £500 million HoldCo Senior issuance, which priced in September but only settled in October, has not been included in the maturity ladder as per the end of September 2024. Long - term debt maturity ladder per currency, 30 September 2024 >2028 2028 2027 2026 2025 2024 Total in € billion 47 10 7 9 6 1 80 EUR 10 3 4 4 0 0 21 USD 5 2 2 3 1 0 12 Other 61 15 13 16 8 1 113 Total Ratings The ratings and outlook from S&P, Moody’s and Fitch remained unchanged during the quarter. Credit ratings of ING on 30 October 2024 S&P Moody's Fitch In 3Q2024, the Net Stable Funding Ratio of ING remained comfortably above the regulatory minimum of 100%. The funding mix remained largely stable in 3Q2024. ING Groep N.V. Issuer rating Long - term Short - term Outlook Senior unsecured rating A - n/a A - 2 n/a Stable Positive 1) A - Baa1 A+ F1 Stable A+ ING Bank N . V . Issuer rating Long - term Short - term Outlook Senior unsecured rating A+ A - 1 Stable A+ A1 P - 1 Positive A1 AA - F1+ Stable AA - 1) Outlook refers to the senior unsecured rating. LCR 12 - month moving average 30 Jun. 2024 30 Sep. 2024 in € billion 184.9 184.8 Level 1 3.1 3.1 Level 2A 5.7 6.4 Level 2B 193.7 194.3 Total HQLA 233.6 232.2 Outflow 101.0 98.6 Inflow 146% 146% LCR ING Press Release 3Q2024 8

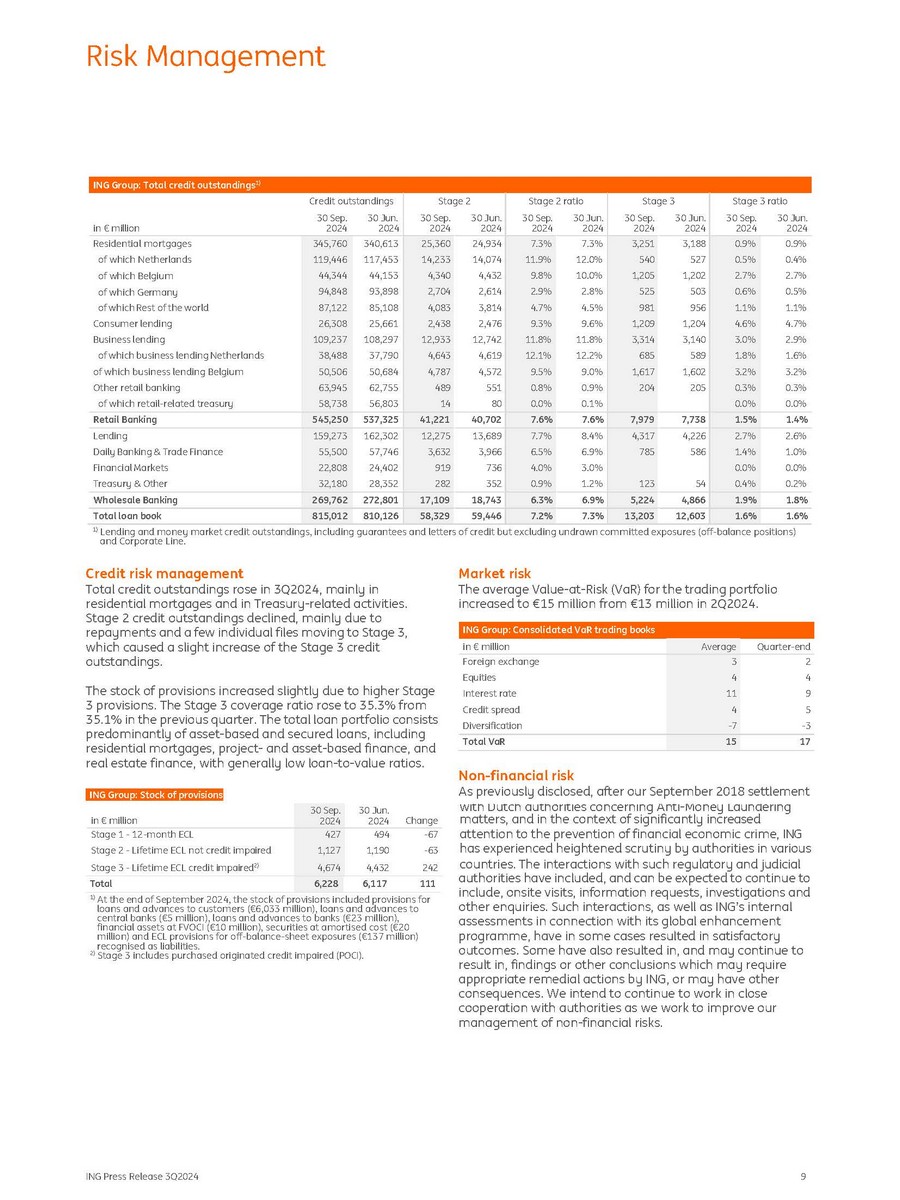

Risk Management ING Group: Total credit outstandings 1) Stage 3 ratio 30 Sep. 30 Jun. 2024 2024 Stage 3 30 Sep. 30 Jun. 2024 2024 Stage 2 ratio 30 Sep. 30 Jun. 2024 2024 Stage 2 30 Sep. 30 Jun. 2024 2024 Credit outstandings 30 Sep. 30 Jun. in € million 2024 2024 0.9% 0.4% 2.7% 0.5% 1.1% 4.7% 2.9% 1.6% 3.2% 0.3% 0.0% 0.9% 0.5% 2.7% 0.6% 1.1% 4.6% 3.0% 1.8% 3.2% 0.3% 0.0% 3,188 527 1,202 503 956 1,204 3,140 589 1,602 205 3,251 540 1,205 525 981 1,209 3,314 685 1,617 204 7.3% 12.0% 10.0% 2.8% 4.5% 9.6% 11.8% 12.2% 9.0% 0.9% 0.1% 7.3% 11.9% 9.8% 2.9% 4.7% 9.3% 11.8% 12.1% 9.5% 0.8% 0.0% 24,934 14,074 4,432 2,614 3,814 2,476 12,742 4,619 4,572 551 80 25,360 14,233 4,340 2,704 4,083 2,438 12,933 4,643 4,787 489 14 340,613 117,453 44,153 93,898 85,108 25,661 108,297 37,790 50,684 62,755 56,803 345,760 119,446 44,344 94,848 87,122 26,308 109,237 38,488 50,506 63,945 58,738 Residential mortgages of which Netherlands of which Belgium of which Germany of which Rest of the world Consumer lending Business lending of which business lending Netherlands of which business lending Belgium Other retail banking of which retail - related treasury 1.4% 1.5% 7,738 7,979 7.6% 7.6% 40,702 41,221 537,325 545,250 Retail Banking 2.6% 1.0% 0.0% 0.2% 2.7% 1.4% 0.0% 0.4% 4,226 586 54 4,317 785 123 8.4% 6.9% 3.0% 1.2% 7.7% 6.5% 4.0% 0.9% 13,689 3,966 736 352 12,275 3,632 919 282 162,302 57,746 24,402 28,352 159,273 55,500 22,808 32,180 Lending Daily Banking & Trade Finance Financial Markets Treasury & Other 1.8% 1.9% 4,866 5,224 6.9% 6.3% 18,743 17,109 272,801 269,762 Wholesale Banking 1.6% 1.6% 12,603 13,203 7.3% 7.2% 59,446 58,329 810,126 815,012 Total loan book 1) Lending and money market credit outstandings, including guarantees and letters of credit but excluding undrawn committed exposures (off - balance positions) and Corporate Line. Credit risk management Total credit outstandings rose in 3Q2024, mainly in residential mortgages and in Treasury - related activities. Stage 2 credit outstandings declined, mainly due to repayments and a few individual files moving to Stage 3, which caused a slight increase of the Stage 3 credit outstandings. Market risk The average Value - at - Risk (VaR) for the trading portfolio increased to €15 million from €13 million in 2Q2024. ING Group: Consolidated VaR trading books Quarter - end Average in € million 2 3 Foreign exchange 4 4 Equities 9 11 Interest rate 5 4 Credit spread - 3 - 7 Diversification 17 15 Total VaR The stock of provisions increased slightly due to higher Stage 3 provisions. The Stage 3 coverage ratio rose to 35.3% from 35.1% in the previous quarter. The total loan portfolio consists predominantly of asset - based and secured loans, including residential mortgages, project - and asset - based finance, and real estate finance, with generally low loan - to - value ratios. Non - financial risk recognised as liabilities. 2) 1) At the end of September 2024, the stock of provisions included provisions for loans and advances to customers (€6,033 million), loans and advances to central banks (€5 million), loans and advances to banks (€23 million), financial assets at FVOCI (€10 million), securities at amortised cost (€20 million) and ECL provisions for off - balance - sheet exposures (€137 million) Stage 3 includes purchased originated credit impaired (POCI). other enquiries. Such interactions, as well as ING’s internal assessments in connection with its global enhancement programme, have in some cases resulted in satisfactory outcomes. Some have also resulted in, and may continue to result in, findings or other conclusions which may require appropriate remedial actions by ING, or may have other consequences. We intend to continue to work in close cooperation with authorities as we work to improve our management of non - financial risks. As previously disclosed, after our September 2018 settlement with Dutch authorities concerning Anti - Money Laundering matters, and in the context of significantly increased Change 30 Jun. 2024 30 Sep. 2024 ING Group: Stock of provisions in € million attention to the prevention of financial economic crime, ING - 67 494 427 Stage 1 - 12 - month ECL has experienced heightened scrutiny by authorities in various - 63 1,190 1,127 Stage 2 - Lifetime ECL not credit impaired countries. The interactions with such regulatory and judicial authorities have included, and can be expected to continue to include, onsite visits, information requests, investigations and 242 111 4,432 6,117 4,674 6,228 Stage 3 - Lifetime ECL credit impaired 2) Total ING Press Release 3Q2024 9

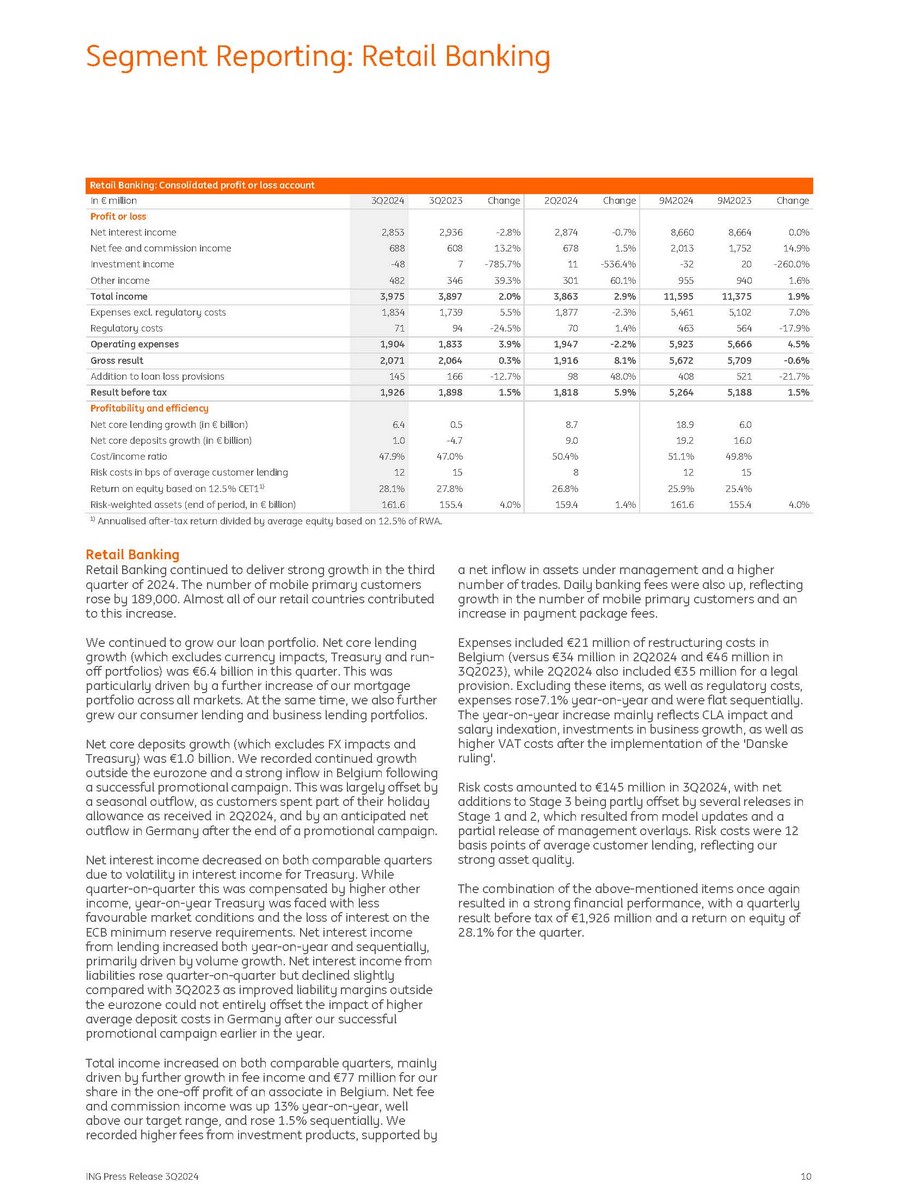

ING Press Release 3Q2024 10 Segment Reporting: Retail Banking Change 9M2023 9M2024 Change 2Q2024 Change 3Q2023 3Q2024 In € million Profit or loss 0.0% 8,664 8,660 - 0.7% 2,874 - 2.8% 2,936 2,853 Net interest income 14.9% 1,752 2,013 1.5% 678 13.2% 608 688 Net fee and commission income - 260.0% 20 - 32 - 536.4% 11 - 785.7% 7 - 48 Investment income 1.6% 940 955 60.1% 301 39.3% 346 482 Other income 1.9% 11,375 11,595 2.9% 3,863 2.0% 3,897 3,975 Total income 7.0% 5,102 5,461 - 2.3% 1,877 5.5% 1,739 1,834 Expenses excl. regulatory costs - 17.9% 564 463 1.4% 70 - 24.5% 94 71 Regulatory costs 4.5% 5,666 5,923 - 2.2% 1,947 3.9% 1,833 1,904 Operating expenses - 0.6% 5,709 5,672 8.1% 1,916 0.3% 2,064 2,071 Gross result - 21.7% 521 408 48.0% 98 - 12.7% 166 145 Addition to loan loss provisions 1.5% 5,188 5,264 5.9% 1,818 1.5% 1,898 1,926 Result before tax Profitability and efficiency 6.0 18.9 8.7 0.5 6.4 Net core lending growth (in € billion) 16.0 19.2 9.0 - 4.7 1.0 Net core deposits growth (in € billion) 49.8% 51.1% 50.4% 47.0% 47.9% Cost/income ratio 15 12 8 15 12 Risk costs in bps of average customer lending 25.4% 25.9% 26.8% 27.8% 28.1% Return on equity based on 12.5% CET1 1) 4.0% 155.4 161.6 1.4% 159.4 4.0% 155.4 161.6 Risk - weighted assets (end of period, in € billion) 1) Annualised after - tax return divided by average equity based on 12.5% of RWA. Retail Banking Retail Banking continued to deliver strong growth in the third quarter of 2024. The number of mobile primary customers rose by 189,000. Almost all of our retail countries contributed to this increase. We continued to grow our loan portfolio. Net core lending growth (which excludes currency impacts, Treasury and run - off portfolios) was €6.4 billion in this quarter. This was particularly driven by a further increase of our mortgage portfolio across all markets. At the same time, we also further grew our consumer lending and business lending portfolios. Net core deposits growth (which excludes FX impacts and Treasury) was €1.0 billion. We recorded continued growth outside the eurozone and a strong inflow in Belgium following a successful promotional campaign. This was largely offset by a seasonal outflow, as customers spent part of their holiday allowance as received in 2Q2024, and by an anticipated net outflow in Germany after the end of a promotional campaign. Net interest income decreased on both comparable quarters due to volatility in interest income for Treasury. While quarter - on - quarter this was compensated by higher other income, year - on - year Treasury was faced with less favourable market conditions and the loss of interest on the ECB minimum reserve requirements. Net interest income from lending increased both year - on - year and sequentially, primarily driven by volume growth. Net interest income from liabilities rose quarter - on - quarter but declined slightly compared with 3Q2023 as improved liability margins outside the eurozone could not entirely offset the impact of higher average deposit costs in Germany after our successful promotional campaign earlier in the year. Total income increased on both comparable quarters, mainly driven by further growth in fee income and €77 million for our share in the one - off profit of an associate in Belgium. Net fee and commission income was up 13% year - on - year, well above our target range, and rose 1.5% sequentially. We recorded higher fees from investment products, supported by a net inflow in assets under management and a higher number of trades. Daily banking fees were also up, reflecting growth in the number of mobile primary customers and an increase in payment package fees. Expenses included €21 million of restructuring costs in Belgium (versus €34 million in 2Q2024 and €46 million in 3Q2023), while 2Q2024 also included €35 million for a legal provision. Excluding these items, as well as regulatory costs, expenses rose7.1% year - on - year and were flat sequentially. The year - on - year increase mainly reflects CLA impact and salary indexation, investments in business growth, as well as higher VAT costs after the implementation of the 'Danske ruling'. Risk costs amounted to €145 million in 3Q2024, with net additions to Stage 3 being partly offset by several releases in Stage 1 and 2, which resulted from model updates and a partial release of management overlays. Risk costs were 12 basis points of average customer lending, reflecting our strong asset quality. The combination of the above - mentioned items once again resulted in a strong financial performance, with a quarterly result before tax of € 1 , 926 million and a return on equity of 28 . 1 % for the quarter . Retail Banking: Consolidated profit or loss account

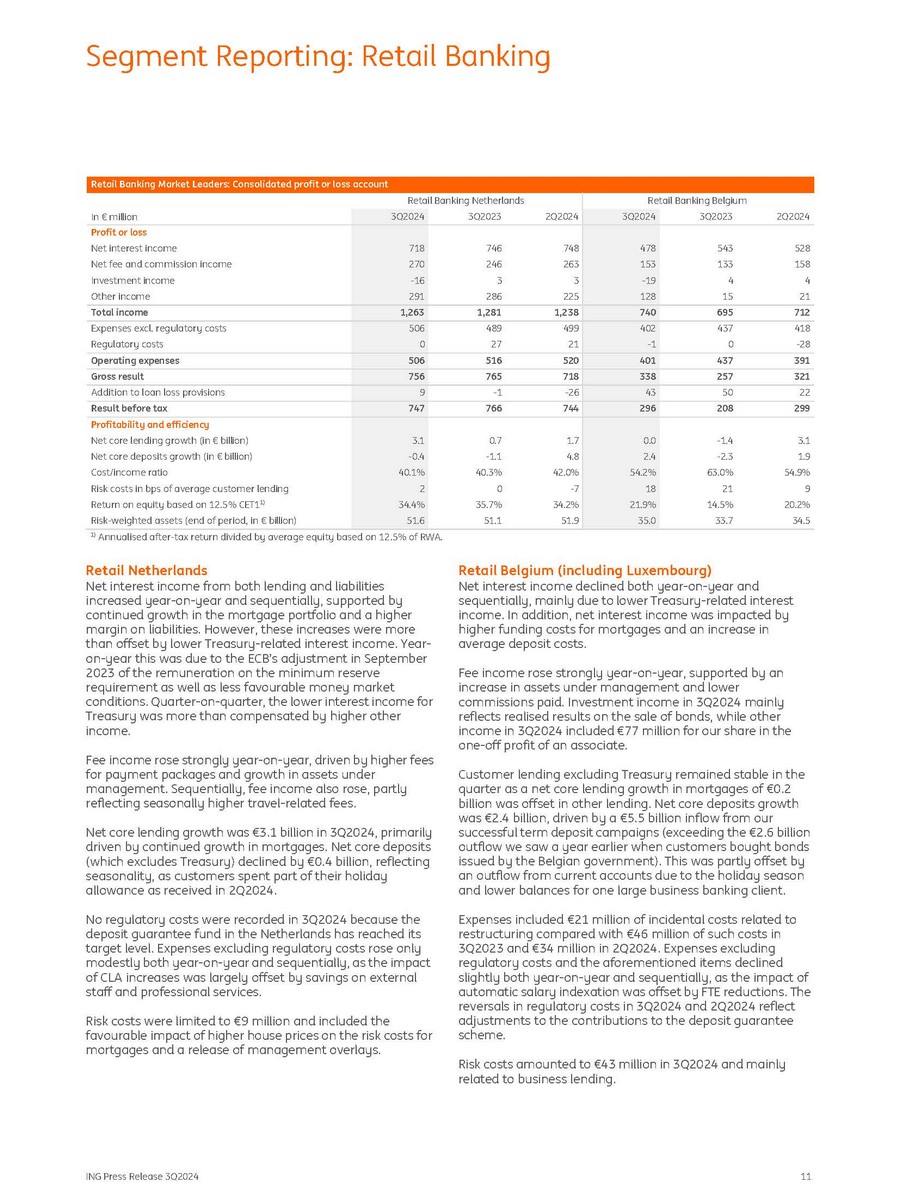

ING Press Release 3Q2024 11 Segment Reporting: Retail Banking Retail Banking Market Leaders: Consolidated profit or loss account Retail Banking Belgium Retail Banking Netherlands 2Q2024 3Q2023 3Q2024 2Q2024 3Q2023 3Q2024 In € million Profit or loss 528 543 478 748 746 718 Net interest income 158 133 153 263 246 270 Net fee and commission income 4 4 - 19 3 3 - 16 Investment income 21 15 128 225 286 291 Other income 712 695 740 1,238 1,281 1,263 Total income 418 437 402 499 489 506 Expenses excl. regulatory costs - 28 0 - 1 21 27 0 Regulatory costs 391 437 401 520 516 506 Operating expenses 321 257 338 718 765 756 Gross result 22 50 43 - 26 - 1 9 Addition to loan loss provisions 299 208 296 744 766 747 Result before tax Profitability and efficiency 3.1 - 1.4 0.0 1.7 0.7 3.1 Net core lending growth (in € billion) 1.9 - 2.3 2.4 4.8 - 1.1 - 0.4 Net core deposits growth (in € billion) 54.9% 63.0% 54.2% 42.0% 40.3% 40.1% Cost/income ratio 9 21 18 - 7 0 2 Risk costs in bps of average customer lending 20.2% 14.5% 21.9% 34.2% 35.7% 34.4% Return on equity based on 12.5% CET1 1) 34.5 33.7 35.0 51.9 51.1 51.6 Risk - weighted assets (end of period, in € billion) 1) Annualised after - tax return divided by average equity based on 12.5% of RWA. Retail Netherlands Net interest income from both lending and liabilities increased year - on - year and sequentially, supported by continued growth in the mortgage portfolio and a higher margin on liabilities. However, these increases were more than offset by lower Treasury - related interest income. Year - on - year this was due to the ECB’s adjustment in September 2023 of the remuneration on the minimum reserve requirement as well as less favourable money market conditions. Quarter - on - quarter, the lower interest income for Treasury was more than compensated by higher other income. Fee income rose strongly year - on - year, driven by higher fees for payment packages and growth in assets under management. Sequentially, fee income also rose, partly reflecting seasonally higher travel - related fees. Net core lending growth was €3.1 billion in 3Q2024, primarily driven by continued growth in mortgages. Net core deposits (which excludes Treasury) declined by €0.4 billion, reflecting seasonality, as customers spent part of their holiday allowance as received in 2Q2024. No regulatory costs were recorded in 3Q2024 because the deposit guarantee fund in the Netherlands has reached its target level. Expenses excluding regulatory costs rose only modestly both year - on - year and sequentially, as the impact of CLA increases was largely offset by savings on external staff and professional services. Risk costs were limited to €9 million and included the favourable impact of higher house prices on the risk costs for mortgages and a release of management overlays. Retail Belgium (including Luxembourg) Net interest income declined both year - on - year and sequentially, mainly due to lower Treasury - related interest income. In addition, net interest income was impacted by higher funding costs for mortgages and an increase in average deposit costs. Fee income rose strongly year - on - year, supported by an increase in assets under management and lower commissions paid. Investment income in 3Q2024 mainly reflects realised results on the sale of bonds, while other income in 3Q2024 included €77 million for our share in the one - off profit of an associate. Customer lending excluding Treasury remained stable in the quarter as a net core lending growth in mortgages of €0.2 billion was offset in other lending. Net core deposits growth was €2.4 billion, driven by a €5.5 billion inflow from our successful term deposit campaigns (exceeding the €2.6 billion outflow we saw a year earlier when customers bought bonds issued by the Belgian government). This was partly offset by an outflow from current accounts due to the holiday season and lower balances for one large business banking client. Expenses included €21 million of incidental costs related to restructuring compared with €46 million of such costs in 3Q2023 and €34 million in 2Q2024. Expenses excluding regulatory costs and the aforementioned items declined slightly both year - on - year and sequentially, as the impact of automatic salary indexation was offset by FTE reductions. The reversals in regulatory costs in 3Q2024 and 2Q2024 reflect adjustments to the contributions to the deposit guarantee scheme. Risk costs amounted to €43 million in 3Q2024 and mainly related to business lending.

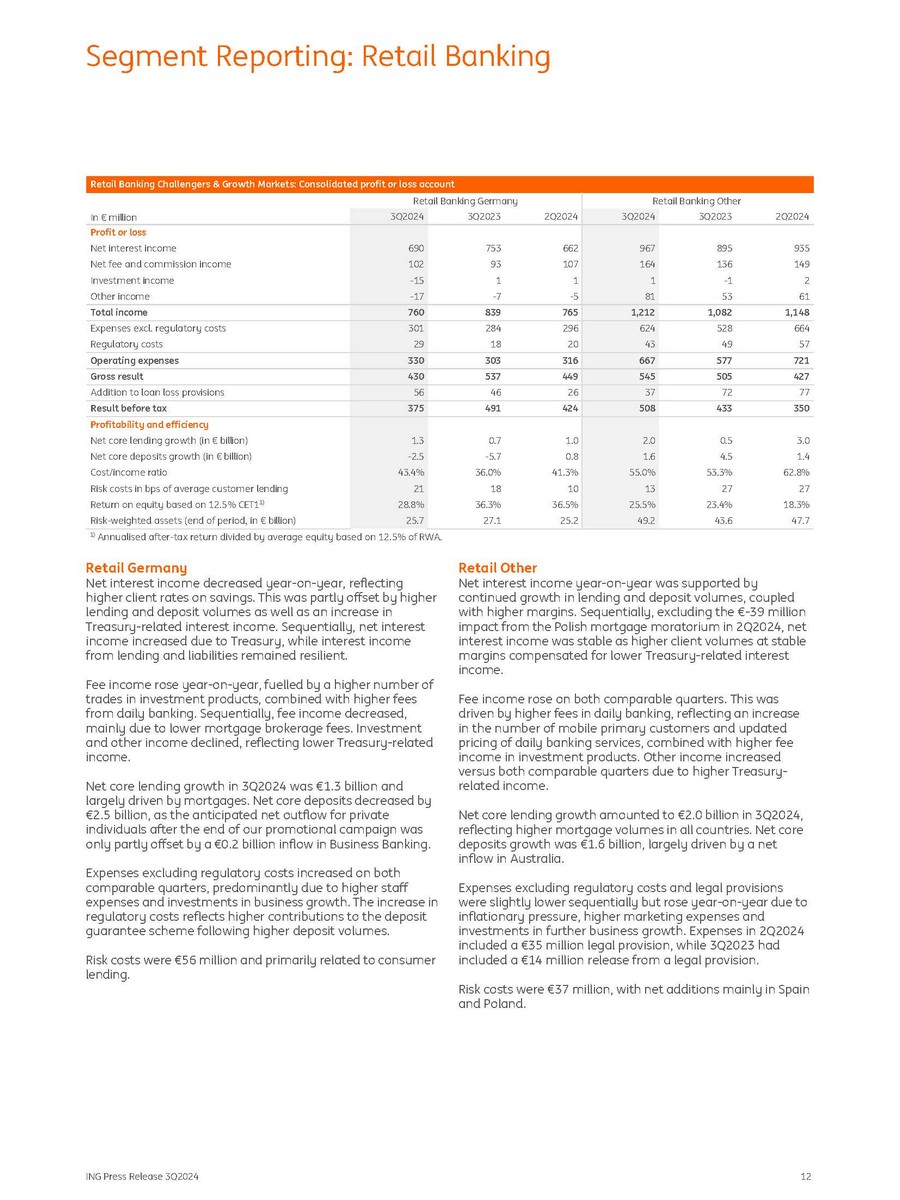

ING Press Release 3Q2024 12 Segment Reporting: Retail Banking Retail Banking Challengers & Growth Markets: Consolidated profit or loss account Retail Banking Other Retail Banking Germany 2Q2024 3Q2023 3Q2024 2Q2024 3Q2023 3Q2024 In € million Profit or loss 935 895 967 662 753 690 Net interest income 149 136 164 107 93 102 Net fee and commission income 2 - 1 1 1 1 - 15 Investment income 61 53 81 - 5 - 7 - 17 Other income 1,148 1,082 1,212 765 839 760 Total income 664 528 624 296 284 301 Expenses excl. regulatory costs 57 49 43 20 18 29 Regulatory costs 721 577 667 316 303 330 Operating expenses 427 505 545 449 537 430 Gross result 77 72 37 26 46 56 Addition to loan loss provisions 350 433 508 424 491 375 Result before tax Profitability and efficiency 3.0 0.5 2.0 1.0 0.7 1.3 Net core lending growth (in € billion) 1.4 4.5 1.6 0.8 - 5.7 - 2.5 Net core deposits growth (in € billion) 62.8% 53.3% 55.0% 41.3% 36.0% 43.4% Cost/income ratio 27 27 13 10 18 21 Risk costs in bps of average customer lending 18.3% 23.4% 25.5% 36.5% 36.3% 28.8% Return on equity based on 12.5% CET1 1) 47.7 43.6 49.2 25.2 27.1 25.7 Risk - weighted assets (end of period, in € billion) 1) Annualised after - tax return divided by average equity based on 12.5% of RWA. Retail Germany Net interest income decreased year - on - year, reflecting higher client rates on savings. This was partly offset by higher lending and deposit volumes as well as an increase in Treasury - related interest income. Sequentially, net interest income increased due to Treasury, while interest income from lending and liabilities remained resilient. Fee income rose year - on - year, fuelled by a higher number of trades in investment products, combined with higher fees from daily banking. Sequentially, fee income decreased, mainly due to lower mortgage brokerage fees. Investment and other income declined, reflecting lower Treasury - related income. Net core lending growth in 3Q2024 was €1.3 billion and largely driven by mortgages. Net core deposits decreased by €2.5 billion, as the anticipated net outflow for private individuals after the end of our promotional campaign was only partly offset by a €0.2 billion inflow in Business Banking. Expenses excluding regulatory costs increased on both comparable quarters, predominantly due to higher staff expenses and investments in business growth. The increase in regulatory costs reflects higher contributions to the deposit guarantee scheme following higher deposit volumes. Risk costs were €56 million and primarily related to consumer lending. Retail Other Net interest income year - on - year was supported by continued growth in lending and deposit volumes, coupled with higher margins. Sequentially, excluding the € - 39 million impact from the Polish mortgage moratorium in 2Q2024, net interest income was stable as higher client volumes at stable margins compensated for lower Treasury - related interest income. Fee income rose on both comparable quarters. This was driven by higher fees in daily banking, reflecting an increase in the number of mobile primary customers and updated pricing of daily banking services, combined with higher fee income in investment products. Other income increased versus both comparable quarters due to higher Treasury - related income. Net core lending growth amounted to €2.0 billion in 3Q2024, reflecting higher mortgage volumes in all countries. Net core deposits growth was €1.6 billion, largely driven by a net inflow in Australia. Expenses excluding regulatory costs and legal provisions were slightly lower sequentially but rose year - on - year due to inflationary pressure, higher marketing expenses and investments in further business growth. Expenses in 2Q2024 included a €35 million legal provision, while 3Q2023 had included a €14 million release from a legal provision. Risk costs were €37 million, with net additions mainly in Spain and Poland.

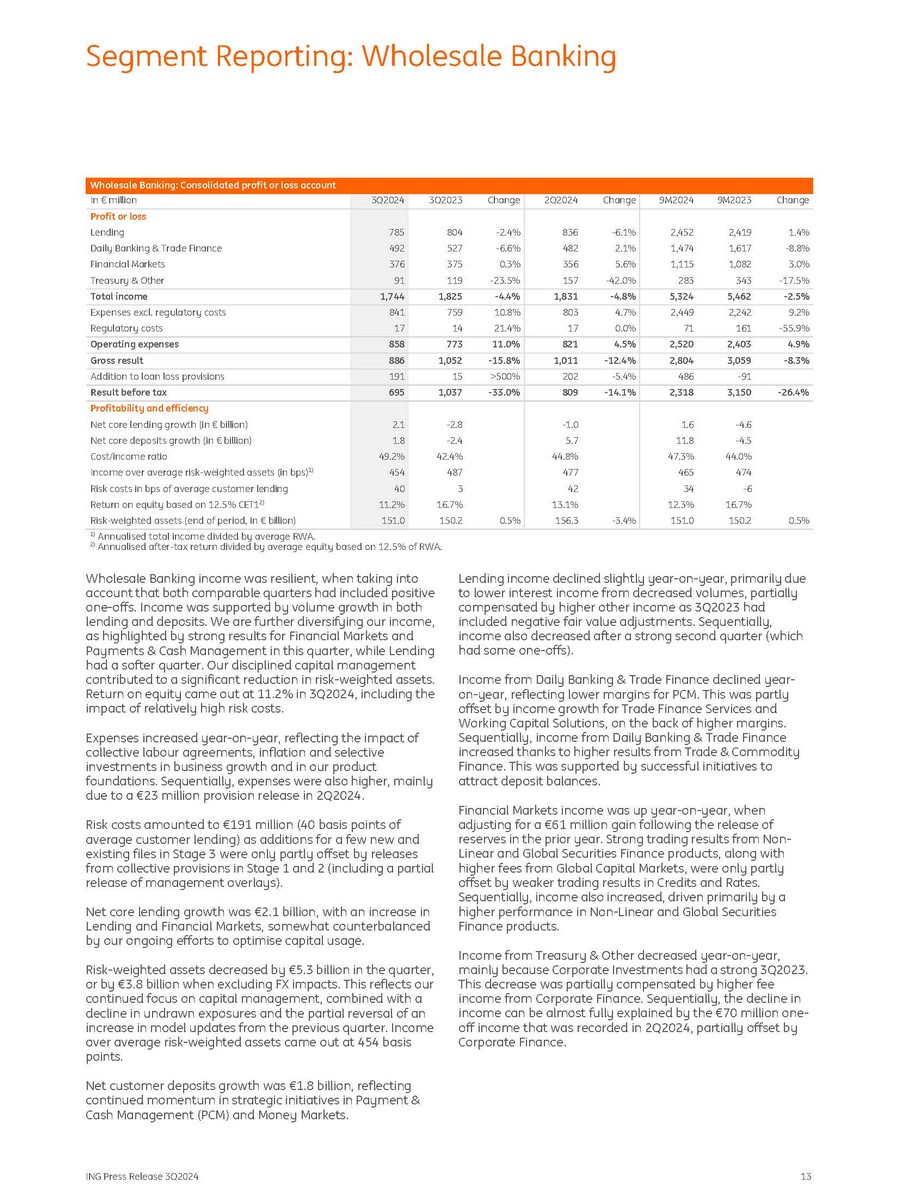

ING Press Release 3Q2024 13 Segment Reporting: Wholesale Banking Change 9M2023 9M2024 Change 2Q2024 Change 3Q2023 3Q2024 In € million Profit or loss 1.4% 2,419 2,452 - 6.1% 836 - 2.4% 804 785 Lending - 8.8% 1,617 1,474 2.1% 482 - 6.6% 527 492 Daily Banking & Trade Finance 3.0% 1,082 1,115 5.6% 356 0.3% 375 376 Financial Markets - 17.5% 343 283 - 42.0% 157 - 23.5% 119 91 Treasury & Other - 2.5% 5,462 5,324 - 4.8% 1,831 - 4.4% 1,825 1,744 Total income 9.2% 2,242 2,449 4.7% 803 10.8% 759 841 Expenses excl. regulatory costs - 55.9% 161 71 0.0% 17 21.4% 14 17 Regulatory costs 4.9% 2,403 2,520 4.5% 821 11.0% 773 858 Operating expenses - 8.3% 3,059 2,804 - 12.4% 1,011 - 15.8% 1,052 886 Gross result - 91 486 - 5.4% 202 >500% 15 191 Addition to loan loss provisions - 26.4% 3,150 2,318 - 14.1% 809 - 33.0% 1,037 695 Result before tax Profitability and efficiency - 4.6 1.6 - 1.0 - 2.8 2.1 Net core lending growth (in € billion) - 4.5 11.8 5.7 - 2.4 1.8 Net core deposits growth (in € billion) 44.0% 47.3% 44.8% 42.4% 49.2% Cost/income ratio 474 465 477 487 454 Income over average risk - weighted assets (in bps) 1) - 6 34 42 3 40 Risk costs in bps of average customer lending 16.7% 12.3% 13.1% 16.7% 11.2% Return on equity based on 12.5% CET1 2) 0.5% 150.2 151.0 - 3.4% 156.3 0.5% 150.2 151.0 Risk - weighted assets (end of period, in € billion) 1) Annualised total income divided by average RWA. 2) Annualised after - tax return divided by average equity based on 12.5% of RWA. Wholesale Banking income was resilient, when taking into account that both comparable quarters had included positive one - offs. Income was supported by volume growth in both lending and deposits. We are further diversifying our income, as highlighted by strong results for Financial Markets and Payments & Cash Management in this quarter, while Lending had a softer quarter. Our disciplined capital management contributed to a significant reduction in risk - weighted assets. Return on equity came out at 11.2% in 3Q2024, including the impact of relatively high risk costs. Expenses increased year - on - year, reflecting the impact of collective labour agreements, inflation and selective investments in business growth and in our product foundations. Sequentially, expenses were also higher, mainly due to a €23 million provision release in 2Q2024. Risk costs amounted to €191 million (40 basis points of average customer lending) as additions for a few new and existing files in Stage 3 were only partly offset by releases from collective provisions in Stage 1 and 2 (including a partial release of management overlays). Net core lending growth was € 2 . 1 billion, with an increase in Lending and Financial Markets, somewhat counterbalanced by our ongoing efforts to optimise capital usage . Risk - weighted assets decreased by €5.3 billion in the quarter, or by €3.8 billion when excluding FX impacts. This reflects our continued focus on capital management, combined with a decline in undrawn exposures and the partial reversal of an increase in model updates from the previous quarter. Income over average risk - weighted assets came out at 454 basis points. Net customer deposits growth was €1.8 billion, reflecting continued momentum in strategic initiatives in Payment & Cash Management (PCM) and Money Markets. Lending income declined slightly year - on - year, primarily due to lower interest income from decreased volumes, partially compensated by higher other income as 3Q2023 had included negative fair value adjustments. Sequentially, income also decreased after a strong second quarter (which had some one - offs). Income from Daily Banking & Trade Finance declined year - on - year, reflecting lower margins for PCM. This was partly offset by income growth for Trade Finance Services and Working Capital Solutions, on the back of higher margins. Sequentially, income from Daily Banking & Trade Finance increased thanks to higher results from Trade & Commodity Finance. This was supported by successful initiatives to attract deposit balances. Financial Markets income was up year - on - year, when adjusting for a €61 million gain following the release of reserves in the prior year. Strong trading results from Non - Linear and Global Securities Finance products, along with higher fees from Global Capital Markets, were only partly offset by weaker trading results in Credits and Rates. Sequentially, income also increased, driven primarily by a higher performance in Non - Linear and Global Securities Finance products. Income from Treasury & Other decreased year - on - year, mainly because Corporate Investments had a strong 3Q2023. This decrease was partially compensated by higher fee income from Corporate Finance. Sequentially, the decline in income can be almost fully explained by the €70 million one - off income that was recorded in 2Q2024, partially offset by Corporate Finance. Wholesale Banking: Consolidated profit or loss account

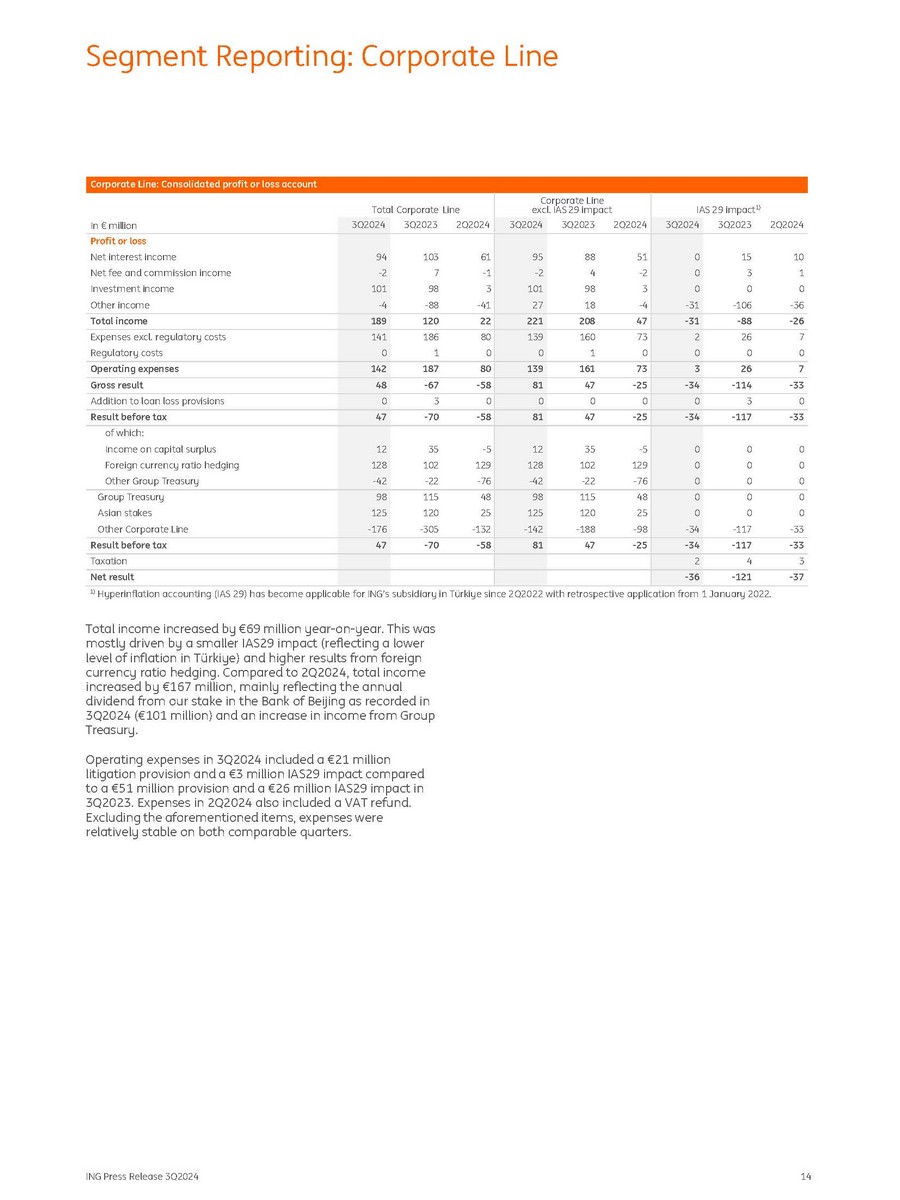

Segment Reporting: Corporate Line Corporate Line: Consolidated profit or loss account IAS 29 impact 1) Corporate Line excl. IAS 29 impact Line 2Q2024 Corporate 3Q2023 Total 3Q2024 In € million 2Q2024 3Q2023 3Q2024 2Q2024 3Q2023 3Q2024 Profit or loss 10 15 0 51 88 95 61 103 94 Net interest income 1 3 0 - 2 4 - 2 - 1 7 - 2 Net fee and commission income 0 0 0 3 98 101 3 98 101 Investment income - 36 - 106 - 31 - 4 18 27 - 41 - 88 - 4 Other income - 26 - 88 - 31 47 208 221 22 120 189 Total income 7 26 2 73 160 139 80 186 141 Expenses excl. regulatory costs 0 0 0 0 1 0 0 1 0 Regulatory costs 7 26 3 73 161 139 80 187 142 Operating expenses - 33 - 114 - 34 - 25 47 81 - 58 - 67 48 Gross result 0 3 0 0 0 0 0 3 0 Addition to loan loss provisions - 33 - 117 - 34 - 25 47 81 - 58 - 70 47 Result before tax of which: 0 0 0 - 5 35 12 - 5 35 12 Income on capital surplus 0 0 0 129 102 128 129 102 128 Foreign currency ratio hedging 0 0 0 - 76 - 22 - 42 - 76 - 22 - 42 Other Group Treasury 0 0 0 48 115 98 48 115 98 Group Treasury 0 0 0 25 120 125 25 120 125 Asian stakes - 33 - 117 - 34 - 98 - 188 - 142 - 132 - 305 - 176 Other Corporate Line - 33 - 117 - 34 - 25 47 81 - 58 - 70 47 Result before tax 3 4 2 Taxation - 37 - 121 - 36 Net result ING Press Release 3Q2024 14 1) Hyperinflation accounting (IAS 29) has become applicable for ING’s subsidiary in Türkiye since 2Q2022 with retrospective application from 1 January 2022. Total income increased by €69 million year - on - year. This was mostly driven by a smaller IAS29 impact (reflecting a lower level of inflation in Türkiye) and higher results from foreign currency ratio hedging. Compared to 2Q2024, total income increased by €167 million, mainly reflecting the annual dividend from our stake in the Bank of Beijing as recorded in 3Q2024 (€101 million) and an increase in income from Group Treasury. Operating expenses in 3Q2024 included a €21 million litigation provision and a €3 million IAS29 impact compared to a €51 million provision and a €26 million IAS29 impact in 3Q2023. Expenses in 2Q2024 also included a VAT refund. Excluding the aforementioned items, expenses were relatively stable on both comparable quarters.

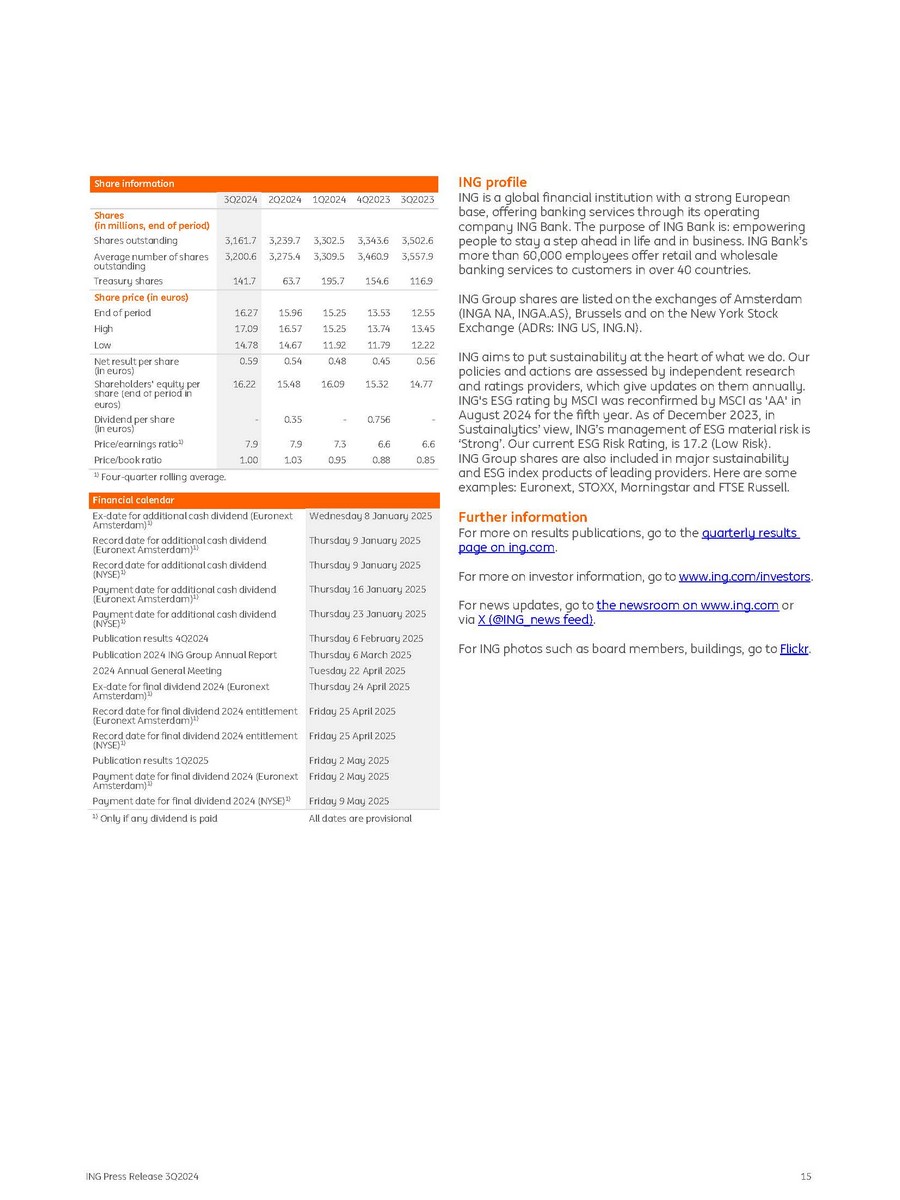

ING Press Release 3Q2024 15 Share information 3Q2023 4Q2023 1Q2024 2Q2024 3Q2024 3,502.6 3,557.9 116.9 3,343.6 3,460.9 154.6 3,302.5 3,309.5 195.7 3,239.7 3,275.4 63.7 3,161.7 3,200.6 141.7 Shares (in millions, end of period) Shares outstanding Average number of shares outstanding Treasury shares Share price (in euros) 12.55 13.53 15.25 15.96 16.27 End of period 13.45 13.74 15.25 16.57 17.09 High 12.22 11.79 11.92 14.67 14.78 Low 0.56 0.45 0.48 0.54 0.59 Net result per share (in euros) 14.77 15.32 16.09 15.48 16.22 Shareholders' equity per share (end of period in euros) - 0.756 - 0.35 - Dividend per share (in euros) 6.6 6.6 7.3 7.9 7.9 Price/earnings ratio 1) 0.85 0.88 0.95 1.03 1.00 Price/book ratio 1) Four - quarter rolling average. Financial calendar Wednesday 8 January 2025 Ex - date for additional cash dividend (Euronext Amsterdam) 1) Thursday 9 January 2025 Record date for additional cash dividend (Euronext Amsterdam) 1) Thursday 9 January 2025 Record date for additional cash dividend (NYSE) 1) Thursday 16 January 2025 Payment date for additional cash dividend (Euronext Amsterdam) 1) Thursday 23 January 2025 Payment date for additional cash dividend (NYSE) 1) Thursday 6 February 2025 Publication results 4Q2024 Thursday 6 March 2025 Publication 2024 ING Group Annual Report Tuesday 22 April 2025 2024 Annual General Meeting Thursday 24 April 2025 Ex - date for final dividend 2024 (Euronext Amsterdam) 1) Friday 25 April 2025 Record date for final dividend 2024 entitlement (Euronext Amsterdam) 1) Friday 25 April 2025 Record date for final dividend 2024 entitlement (NYSE) 1) Friday 2 May 2025 Publication results 1Q2025 Friday 2 May 2025 Payment date for final dividend 2024 (Euronext Amsterdam) 1) Friday 9 May 2025 Payment date for final dividend 2024 (NYSE) 1) 1) Only if any dividend is paid All dates are provisional ING profile ING is a global financial institution with a strong European base, offering banking services through its operating company ING Bank. The purpose of ING Bank is: empowering people to stay a step ahead in life and in business. ING Bank’s more than 60,000 employees offer retail and wholesale banking services to customers in over 40 countries. ING Group shares are listed on the exchanges of Amsterdam (INGA NA, INGA.AS), Brussels and on the New York Stock Exchange (ADRs: ING US, ING.N). ING aims to put sustainability at the heart of what we do. Our policies and actions are assessed by independent research and ratings providers, which give updates on them annually. ING's ESG rating by MSCI was reconfirmed by MSCI as 'AA' in August 2024 for the fifth year. As of December 2023, in Sustainalytics’ view, ING’s management of ESG material risk is ‘Strong’. Our current ESG Risk Rating, is 17.2 (Low Risk). ING Group shares are also included in major sustainability and ESG index products of leading providers. Here are some examples: Euronext, STOXX, Morningstar and FTSE Russell. Further information For more on results publications, go to the quarterly results page on ing.com . For more on investor information, go to www.ing.com/investors . For news updates, go to the newsroom on www.ing.com or via X (@ING_news feed) . For ING photos such as board members, buildings, go to Flickr .

ING Press Release 3Q2024 16 Important legal information Elements of this press release contain or may contain information about ING Groep N . V . and/ or ING Bank N . V . within the meaning of Article 7 ( 1 ) to ( 4 ) of EU Regulation No 596 / 2014 (‘Market Abuse Regulation’) . ING Group’s annual accounts are prepared in accordance with International Financial Reporting Standards as adopted by the European Union (‘IFRS - EU’). In preparing the financial information in this document, except as described otherwise, the same accounting principles are applied as in the 2023 ING Group consolidated annual accounts. All figures in this document are unaudited. Small differences are possible in the tables due to rounding. Certain of the statements contained herein are not historical facts, including, without limitation, certain statements made of future expectations and other forward - looking statements that are based on management’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. Actual results, performance or events may differ materially from those in such statements due to a number of factors, including, without limitation: (1) changes in general economic conditions and customer behaviour, in particular economic conditions in ING’s core markets, including changes affecting currency exchange rates and the regional and global economic impact of the invasion of Russia into Ukraine and related international response measures (2) changes affecting interest rate levels (3) any default of a major market participant and related market disruption (4) changes in performance of financial markets, including in Europe and developing markets (5) fiscal uncertainty in Europe and the United States (6) discontinuation of or changes in ‘benchmark’ indices (7) inflation and deflation in our principal markets (8) changes in conditions in the credit and capital markets generally, including changes in borrower and counterparty creditworthiness (9) failures of banks falling under the scope of state compensation schemes (10) non - compliance with or changes in laws and regulations, including those concerning financial services, financial economic crimes and tax laws, and the interpretation and application thereof (11) geopolitical risks, political instabilities and policies and actions of governmental and regulatory authorities, including in connection with the invasion of Russia into Ukraine and the related international response measures (12) legal and regulatory risks in certain countries with less developed legal and regulatory frameworks (13) prudential supervision and regulations, including in relation to stress tests and regulatory restrictions on dividends and distributions (also among members of the group) (14) ING’s ability to meet minimum capital and other prudential regulatory requirements (15) changes in regulation of US commodities and derivatives businesses of ING and its customers (16) application of bank recovery and resolution regimes, including write down and conversion powers in relation to our securities (17) outcome of current and future litigation, enforcement proceedings, investigations or other regulatory actions, including claims by customers or stakeholders who feel misled or treated unfairly, and other conduct issues (18) changes in tax laws and regulations and risks of non - compliance or investigation in connection with tax laws, including FATCA (19) operational and IT risks, such as system disruptions or failures, breaches of security, cyber - attacks, human error, changes in operational practices or inadequate controls including in respect of third parties with which we do business and including any risks as a result of incomplete, inaccurate, or otherwise flawed outputs from the algorithms and data sets utilized in artificial intelligence (20) risks and challenges related to cybercrime including the effects of cyberattacks and changes in legislation and regulation related to cybersecurity and data privacy, including such risks and challenges as a consequence of the use of emerging technologies, such as advanced forms of artificial intelligence and quantum computing (21) changes in general competitive factors, including ability to increase or maintain market share (22) inability to protect our intellectual property and infringement claims by third parties (23) inability of counterparties to meet financial obligations or ability to enforce rights against such counterparties (24) changes in credit ratings (25) business, operational, regulatory, reputation, transition and other risks and challenges in connection with climate change and ESG - related matters, including data gathering and reporting (26) inability to attract and retain key personnel (27) future liabilities under defined benefit retirement plans (28) failure to manage business risks, including in connection with use of models, use of derivatives, or maintaining appropriate policies and guidelines (29) changes in capital and credit markets, including interbank funding, as well as customer deposits, which provide the liquidity and capital required to fund our operations, and (30) the other risks and uncertainties detailed in the most recent annual report of ING Groep N.V. (including the Risk Factors contained therein) and ING’s more recent disclosures, including press releases, which are available on www.ING.com. This document may contain ESG - related material that has been prepared by ING on the basis of publicly available information, internally developed data and other third - party sources believed to be reliable. ING has not sought to independently verify information obtained from public and third - party sources and makes no representations or warranties as to accuracy, completeness, reasonableness or reliability of such information. Materiality, as used in the context of ESG, is distinct from, and should not be confused with, such term as defined in the Market Abuse Regulation or as defined for Securities and Exchange Commission (‘SEC’) reporting purposes. Any issues identified as material for purposes of ESG in this document are therefore not necessarily material as defined in the Market Abuse Regulation or for SEC reporting purposes. In addition, there is currently no single, globally recognized set of accepted definitions in assessing whether activities are “green” or “sustainable.” Without limiting any of the statements contained herein, we make no representation or warranty as to whether any of our securities constitutes a green or sustainable security or conforms to present or future investor expectations or objectives for green or sustainable investing. For information on characteristics of a security, use of proceeds, a description of applicable project(s) and/or any other relevant information, please reference the offering documents for such security. This document may contain inactive textual addresses to internet websites operated by us and third parties. Reference to such websites is made for information purposes only, and information found at such websites is not incorporated by reference into this document. ING does not make any representation or warranty with respect to the accuracy or completeness of, or take any responsibility for, any information found at any websites operated by third parties. ING specifically disclaims any liability with respect to any information found at websites operated by third parties. ING cannot guarantee that websites operated by third parties remain available following the publication of this document, or that any information found at such websites will not change following the filing of this document. Many of those factors are beyond ING’s control. Any forward - looking statements made by or on behalf of ING speak only as of the date they are made, and ING assumes no obligation to publicly update or revise any forward - looking statements, whether as a result of new information or for any other reason. This document does not constitute an offer to sell, or a solicitation of an offer to purchase, any securities in the United States or any other jurisdiction.

Ing Groep NV (PK) (USOTC:INGVF)

過去 株価チャート

から 10 2024 まで 11 2024

Ing Groep NV (PK) (USOTC:INGVF)

過去 株価チャート

から 11 2023 まで 11 2024