DRWN – Potential

Acquisition Candidate HIPAA Compliant Blockchain Collaboration with

Oracle Corporation

Miami, FL -- April 3, 2018

-- InvestorsHub NewsWire -- EmergingGrowth.com, a leading

independent small cap media portal with an extensive history of

providing unparalleled content for the Emerging Growth markets and

companies, reports on Quantum Medical (OTC

Pink: DRWN).

Highlights:

First HIPAA Compliant

Blockchain Technology

Collaboration with Oracle

(NYSE:

ORCL)

Potential Acquisition

Candidate

Ricky Bernard, President of Quantum

Medical commented: “With Oracle’s collaboration with

development and their Blockchain Cloud Service, we can accelerate

revenue, create new revenue streams, and reduce cost and risk by

securely extending medical blockchain business applications and

processes while speeding up transactions across our partner

ecosystem.”

DRWN may

not be at these levels much longer.

See the Press Release and more on Quantum

Medical (OTC

Pink: DRWN) on EmergingGrowth.com

http://emerginggrowth.com/?s=DRWN

The U.S. healthcare sector is estimated to have spent $100 billion on IT in 2017,

underlining the increasingly central role that tech plays in the

healthcare sector. Though the increased digitization of healthcare

has its merits—such as improved data management—it also exposes

clinics, medical suppliers, health insurers and other players in

the sector to the growing threat of cybercrime.

Healthcare networks hold massive volumes of accurate, comprehensive

and up-to-date financial, medical and personal information of

millions of Americans. As a result, healthcare data is

significantly richer in value than data from retail and financial

services, making the sector more attractive to hackers. According

to a report on Reuters, medical

data is worth 10 times more on the black market than credit card

data.

Back in 2014, Community Health Systems Inc. (NYSE: CYH ), one of the largest

providers of general hospital healthcare services in the U.S., was

infiltrated by alleged Chinese hackers in a breach that compromised

4.5 million medical records.

Although CYH hired cybersecurity experts from

a FireEye (NASDAQ: FEYE) affiliated company to look

into the matter, the bigger question that went unanswered was

whether smaller healthcare players with leaner cybersecurity

budgets silently suffer more damaging breaches. This question is

difficult to answer with precision, but Ricky Bernard, the CEO of

Quantum Medical Transport (OTC

PINK: DRWN) believes the threat of data breaches in healthcare

is steadily increasing for big and small players alike.

“Now more than ever, there is a need to pioneer more effective and

lasting solutions that enhance data protection in healthcare,”

added Mr. Bernard, who spoke exclusively to EmergingGrowth.com.

Quantum Medical Transport is a profitable medical technology and

transportation public company based in Texas. The company grossed

$1.31 million in annual operating revenue as of December 31, 2017,

compared to $1.2 million the same period the previous year. “Over

the past decade, our revenues have historically been in the

$1.0-$1.3 million range” said Bernard. The company also recently

closed its acquisition of United

Ambulance LLC, strengthening its position in the medical

transportation market.

However, Bernard says that the company’s recent successful

acquisition and healthy topline aren’t its biggest accomplishments

yet—rather, its bold foray into medical blockchain technology

is.

Medical blockchain is a game-changer

The company recently embarked on developing a medical blockchain

platform called QuantH, which aims to provide a subscription based

secure encryption data sharing (Health Information Data Exchange)

service to the $3 trillion healthcare sector. The company is

currently raising $50 million in

capital through the sale of tokens to accredited investors via a

private placement.

QuantH will be the first HIPAA compliant medical blockchain

platform. The Health Insurance Portability and Accountability Act

(HIPAA) sets the standard for protecting sensitive patient data.

HIPAA compliance will therefore give QuantH mainstream acceptance

in the healthcare sector, something Bernard believes will

significantly boost subscriptions to QuantH.

“We are pioneering blockchain-as-a-service in the healthcare sector

and expect QuantH to enhance data protection and introduce new

levels of efficiency in healthcare data management,” he noted. “In

view of our HIPAA compliance, and the pressing need for more

effective ways to secure healthcare data, we expect positive market

reception,” he continued.

The company already has a robust B2B network of healthcare sector

players in Texas that it regularly engages with technology in the

course of offering its transport services. This increases the

likelihood that it will successfully upsell its QuantH subscription

service to existing players in its Texas network, giving it

sufficient momentum to later fan out to other geographies across

the country.

“I am optimistic about the number of subscriptions as demand for a

more secure way of sharing and managing healthcare data is at an

all-time high. Medical blockchain has been identified as a game

changer, but there has been no HIPAA compliant blockchain to date.

We are breaking new ground with our HIPAA compliant blockchain,

something that competitively positions us to gain market

leadership,” said Bernard.

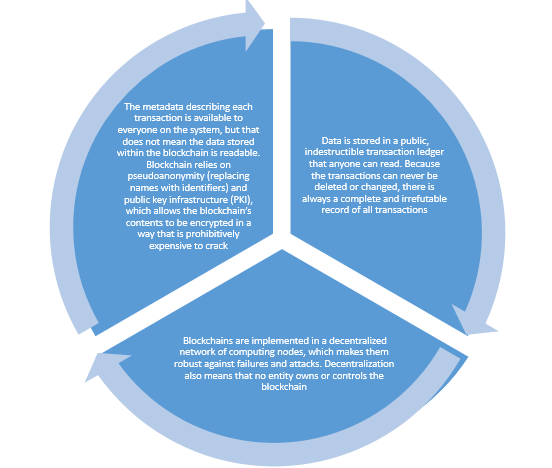

Medical blockchain is viewed as a game-changer in the healthcare

sector due to its ability to enhance data protection in a way

cybersecurity companies have not been able to do. Blockchain

decentralizes data storage, making the data available to all

players in the health system in a timely manner. This streamlines

data sharing, lowers data management costs and improves overall

service delivery.

Likewise, data on blockchain cannot be changed once it has been

recorded. This boosts transparency, which is an important

ingredient in healthcare. Most importantly, data on blockchain is

encrypted and the real identities of parties on the ledger are

replaced with unique identifiers, eliminating the risk of linking

information on the ledger back to individuals such as patients and

institutions such as clinics.

3 key reasons why blockchain is ideal for healthcare

data protection

Owing to its merits, blockchain is gaining more acceptance in the

healthcare sector. According to a recent study by IBM, 56%

of surveyed healthcare executives have solid plans to implement a

commercial blockchain solution by 2020. DRWN is therefore an early

mover in a fast-growing space.

An article in the MIT Technology

review notes that decentralized databases (blockchain) promise

to revolutionize medical records, but not until the healthcare

industry buys into the idea. HIPAA compliance is what will allow

QuantH to get that much needed buy-in from the healthcare industry,

underlining its massive commercial viability. This commercial

viability is perhaps the core reason why QuantH has already aroused

the interest of some of the largest tech companies on the planet,

despite still being in the development stage.

Largest tech companies interested

DRWN announced in the final week of

March that it had been invited by Oracle Corporation (NYSE:

ORCL) to participate in the Oracle

Blockchain Cloud Platform Beta program to support the development

QuantH. This signals that the company’s blockchain technology is

gaining traction—so much so that Oracle believes it has the

potential to become commercially viable and is actively supporting

its development.

It is instructive to note that Oracle’s cloud-based integration

platform is the largest provider to banks and supply chain vendors

for the transfer of information. It can easily handle the large

amounts of data involved in the transmission of medical

records.

The support from Oracle is the latest indicator yet that QuantH has

tremendous commercial potential—a factor that will substantially

increase potential returns for accredited investors who participate

in the $50 million Initial Coin Offering (ICO). Commercial

viability also heightens the chance that, after going live, QuantH

will sign up a significant number of subscribers across the health

sector.

“I am confident of two things: first, based on the

amazing momentum we have garnered during the development phase, we

will be able to raise the $50 million through the ICO. Second, upon

commercial launch, we will be able to steadily expand our

subscription base for our blockchain-as-a-service platform,” said

Bernard.

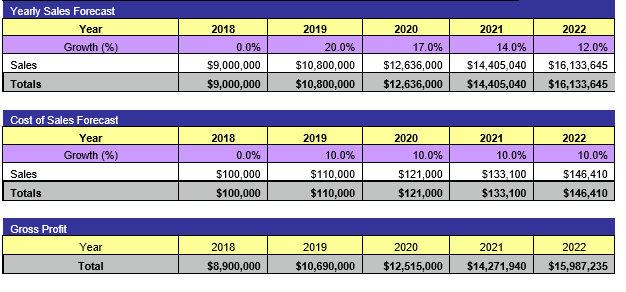

According to the 100 page prospectus for the ICO, which is available on the company’s

website, annual subscription revenue for the

blockchain-as-a-service platform could hit $9 million in 2018 and

grow consistently at a double digit rate to $16.13 million in 2022.

Through this period, annual cost of sales will not exceed $150,000

in any given year, delivering incredible returns for ICO investors

and the company at large. These projections are based upon a

successful $50 million capital raise in the ICO, which is plausible

given the traction that QuantH is gaining, including support from

big players such as Oracle.

Financial projections for QuantH; Source: ICO

Prospectus

According to Bernard, the successful rollout of QuantH will secure

the company income that will not only support organic growth across

the whole business with a view to growing current profitability,

but also support mergers and acquisitions in the electronic health

records (EHR) space.

“We see a lot of synergies between our new strategic direction in

medical tech and existing companies in EHR. Once income from our

QuantH blockchain-as-a-service platform is sustainable, we will

explore mergers and acquisitions in the EHR space,” he said.

The outlook for DRWN is bullish in light of the increasing

likelihood that QuantH will have a successful commercial rollout

that will help power the company’s broader objective of

consolidating its position in medical tech through both organic

growth and acquisitions of EHR players.

Tables could turn

However, there is a likelihood that the tables could turn. Although

the company is exploring acquisitions in the EHR space, it could

actually end up being the one acquired by a larger player. The

hunter could become the hunted.

DRWN is a potential acquisition target for two reasons. Firstly,

because of the commercial viability of its HIPAA compliant

blockchain technology, especially now that Oracle is supporting its

development. Secondly, because of its track record as a revenue

generating and profitable company with an established track record

in the healthcare sector that spans over a decade.

To expound on the second point, it is instructive to note that most

of the companies currently getting into blockchain are completely

new entrants. These are development stage companies with no sales

and little-known top executives. While some are legitimate, others

have been flagged down by regulators, who have warned investors

that they lack solid fundamentals and could be using blockchain as

nothing more than a buzzword. These are not the qualities that

typically make a company an acquisition target.

In contrast, DRWN is well established, profitable and properly

governed—going by its historical performance and publicly available

audited results. The fact that it is participating in the Oracle

Blockchain Cloud Platform Beta program further demonstrates that it

has both the in-house talent and polished corporate reputation

needed to be an acquisition target. It makes greater sense for

large caps interested in medical blockchain to buy DRWN than the

dozens of untested players mushrooming in the blockchain space. –

Further, it’s easier to acquire the technology than to reinvent

it.

Conclusion

When a new technology such as blockchain gains mainstream

acceptance, the historical market entry strategy by large caps has

predominantly been the acquisition of promising emerging growth

companies that have existing familiarity with the technology.

This positions DRWN very competitively as it puts it on the radar

of deal hungry large caps, especially now that has an existing

working relationship with Oracle. Based on this working

relationship, Oracle could very well end up being a potential

suitor in future.

Alternatively, the support from Oracle could also serve to whet the

appetite of other big players such as IBM (NYSE: IBM) and General Electric (NYSE:

GE), which both have vested

interests in blockchain and healthcare, respectively. IBM has

produced a tremendous body of research on blockchain and currently

has several blockchain patents under its belt, while GE has

previously said that it is looking “very actively” into blockchain in

light of its potential to protect the integrity of medical

data.

DRWN’s current market cap of less than $5 million grossly

underrepresents the company’s underlying value. It is a potential

acquisition target pioneering a HIPAA compliant medical blockchain

platform that is commercially viable. It also has healthy

financials and is generating $1 million plus in sales without its

game-changing block-chain-as-a-service platform. Overall, sales

could grow fivefold in the first of year of the service. Once all

these factors are priced into the stock, the uptrend could be

historic.

DRWN may

not be at these levels much longer.

See the Press Release and more on Quantum

Medical (OTC Pink: DRWN) on EmergingGrowth.com

http://emerginggrowth.com/?s=DRWN

Other Companies in the news and featured on

EmergingGrowth.com

Creative Medical Technology, Inc.

Shares of Creative Medical Technology, Inc. (OTCQB:

CELZ) seem to have seen their day. Shares have been

declining since its initial, almost 600% run last week. We’ll

see how its product fairs at the International Urology Conference

in May. It may be its only saving grace.

Have a look at Quantum Medical, (OTC

Pink: DRWN). Now working in collaboration with

Oracle.

Quantum Medical, Inc.’s (OTC Pink: DRWN) QuantH,

its own proprietary medical blockchain technology is currently in

development and will launch as the first HIPAA (Health Insurance

Portability and Accountability Act) compliant blockchain

technology.

Therapy Cells, Inc.

Stop sign company Therapy Cells, Inc. (OTC:

TCEL) went from dormant to almost a billion shares in 6.5

hours. There has been no news or financial disclosures posted

on OTC Markets since early 2015. Shares traded up 500%

brefore giving back ½ at the close. If a deal is not

announced soon, it may very well, just go back to sleep.

Keep an eye on Quantum Medical, (OTC

Pink: DRWN). Their announcement of a collaboration with

Oracle could be just what the doctor ordered.

Worldflix, Inc.

Shares of Worldflix, Inc. (OTC

Pink: WRFX) have been trading well since its announcement of

securing a cryptocurrency platform. Moreover, shares have

up-ticked each of the last 8 sessions despite market

conditions. Candlesticks yesterday however indicated its

first downturn. Might be time to take some funds off the

table and enjoy the fruits of your 350% gains.

We could be looking at much larger

returns for Quantum Medical, (OTC

Pink: DRWN) with Oracle Corporation’s (NYSE: ORCL)

collaboration with development of their HIPAA compliant QuanH,

HIPAA Compliant Medical Blockchain Technology?

About

EmergingGrowth.com

EmergingGrowth.com is a leading

independent small cap media portal with an extensive history of

providing unparalleled content for the Emerging Growth markets and

companies. Through its evolution, EmergingGrowth.com found a

niche in identifying companies that can be overlooked by the

markets due to, among other reasons, trading price or market

capitalization. We look for strong management, innovation,

strategy, execution, and the overall potential for long- term

growth. Aside from being a trusted resource for the Emerging

Growth info-seekers, we are well known for discovering undervalued

companies and bringing them to the attention of the investment

community. Through our parent Company, we also have the

ability to facilitate road shows to present your products and

services to the most influential investment banks in the

space.

All information contained

herein as well as on the EmergingGrowth.com website is obtained

from sources believed to be reliable but not guaranteed to be

accurate or all-inclusive. All material is for informational

purposes only, is only the opinion of EmergingGrowth.com and should

not be construed as an offer or solicitation to buy or sell

securities. The information may include certain forward-looking

statements, which may be affected by unforeseen circumstances and /

or certain risks. This report is not without bias.

EmergingGrowth.com has motivation by means of either self-marketing

or EmergingGrowth.com has been compensated by or for a company or

companies discussed in this article. Full details about which can

be found in our full disclosure, which can be found

here, http://emerginggrowth.com/5647386697-3 Please consult an investment professional

before investing in anything viewed within. When EmergingGrowth.com

is long shares it will sell those shares. In addition, please make

sure you read and understand the Terms of Use, Privacy Policy and

the Disclosure posted on the EmergingGrowth.com website.

CONTACT:

Company: EmergingGrowth.com - http://www.EmergingGrowth.com

Contact

Email: info@EmergingGrowth.com

SOURCE: EmergingGrowth.com

A Clean Slate (CE) (USOTC:DRWN)

過去 株価チャート

から 11 2024 まで 12 2024

A Clean Slate (CE) (USOTC:DRWN)

過去 株価チャート

から 12 2023 まで 12 2024