falseQ20001723788--12-31UnlimitedUnlimited2023 2022 2021 20200001723788bitw:InvestmentInCardanoMember2023-01-012023-12-310001723788bitw:InvestorClassMember2023-12-310001723788bitw:InvestmentInPolkadotMember2023-01-012023-12-3100017237882023-01-012023-06-300001723788us-gaap:FairValueInputsLevel2Member2023-12-310001723788bitw:InvestmentInCardanoMember2023-12-310001723788bitw:InvestmentInChainlinkMember2023-12-310001723788bitw:InvestmentInEthereumMember2024-06-300001723788bitw:InvestmentInSolanaMember2024-06-3000017237882023-01-012023-12-3100017237882023-12-310001723788us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMemberbitw:DistributedNetworksMember2024-01-012024-06-300001723788bitw:SponsorMember2023-06-300001723788bitw:InvestmentInCardanoMember2024-06-300001723788bitw:InvestmentInCardanoMember2024-01-012024-06-300001723788bitw:InvestmentInNEARProtocolMember2024-01-012024-06-300001723788bitw:InvestorClassMember2023-03-310001723788bitw:CoinbaseCustodyTrustCompanyLlcTheCustodianMember2024-06-300001723788bitw:InvestmentInEthereumMember2023-01-012023-12-310001723788bitw:CoinbaseMemberbitw:BitcoinMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2024-06-300001723788bitw:InvestmentInPolkadotMember2024-06-300001723788bitw:InvestmentInAvalancheMember2023-12-310001723788us-gaap:FairValueInputsLevel2Member2024-06-300001723788bitw:InvestmentInRippleMember2024-01-012024-06-300001723788bitw:InvestmentInChainlinkMember2024-01-012024-06-300001723788bitw:InvestmentInRippleMember2023-01-012023-12-3100017237882024-08-080001723788bitw:InvestmentInChainlinkMember2023-01-012023-12-310001723788us-gaap:FairValueInputsLevel1Member2024-06-3000017237882024-01-012024-06-300001723788bitw:InvestorClassMember2024-04-012024-06-300001723788bitw:InvestmentInPolygonMember2023-01-012023-12-310001723788bitw:InvestorClassMember2023-04-012023-06-300001723788bitw:InvestmentInBitcoinMember2024-06-300001723788bitw:CardanoMemberbitw:CoinbaseMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2024-06-300001723788bitw:ChainlinkMemberbitw:CoinbaseMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2024-06-300001723788bitw:CoinbaseMemberbitw:SolanaMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2024-06-300001723788srt:MaximumMember2023-04-172023-04-170001723788bitw:InvestmentInEthereumMember2024-01-012024-06-300001723788bitw:InvestmentInLitecoinMember2023-12-310001723788bitw:RippleMemberbitw:CoinbaseMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2024-06-300001723788bitw:CoinbaseMemberbitw:NEARProtocolMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2024-06-300001723788bitw:PolkadotMemberbitw:CoinbaseMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2024-06-300001723788bitw:InvestmentInBitcoinMember2023-12-310001723788bitw:InvestorClassMember2024-01-012024-06-300001723788bitw:InvestmentInRippleMember2024-06-300001723788bitw:InvestmentInRippleMember2023-12-310001723788bitw:InvestorClassMember2024-03-310001723788bitw:InvestmentInChainlinkMember2024-06-300001723788bitw:SponsorMemberbitw:InvestorClassMember2024-01-012024-06-300001723788bitw:InvestmentInLitecoinMember2023-01-012023-12-3100017237882020-12-092020-12-090001723788bitw:SponsorMember2024-06-3000017237882023-03-310001723788us-gaap:FairValueInputsLevel3Member2023-12-310001723788bitw:InvestmentInPolygonMember2023-12-310001723788us-gaap:FairValueInputsLevel1Member2023-12-310001723788bitw:InvestmentInSolanaMember2024-01-012024-06-300001723788bitw:SponsorMemberbitw:InvestorClassMember2023-01-012023-06-300001723788us-gaap:FairValueInputsLevel3Member2024-06-300001723788bitw:EthereumMemberbitw:CryptoMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2024-06-300001723788bitw:InvestorClassMember2023-01-012023-06-300001723788bitw:InvestorClassMember2022-12-310001723788bitw:CoinbaseMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberbitw:BitcoinCashMember2024-06-3000017237882024-06-300001723788bitw:InvestmentInAvalancheMember2023-01-012023-12-310001723788bitw:InvestmentInSolanaMember2023-01-012023-12-3100017237882022-12-310001723788bitw:InvestorClassMember2024-06-3000017237882024-03-310001723788bitw:InvestmentInNEARProtocolMember2024-06-300001723788bitw:InvestorClassMember2023-06-300001723788bitw:SponsorMember2024-01-012024-06-300001723788bitw:InvestmentInAvalancheMember2024-01-012024-06-3000017237882024-04-012024-06-300001723788bitw:InvestmentInAvalancheMember2024-06-3000017237882023-04-172023-04-170001723788bitw:InvestmentInPolkadotMember2024-01-012024-06-3000017237882023-06-300001723788bitw:InvestmentInPolkadotMember2023-12-310001723788bitw:InvestmentInBitcoinMember2023-01-012023-12-310001723788bitw:InvestmentInBitcoinCashMember2024-01-012024-06-300001723788bitw:InvestmentInSolanaMember2023-12-310001723788bitw:CoinbaseCustodyTrustCompanyLlcTheCustodianMember2023-12-310001723788bitw:CoinbaseMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberbitw:AvalancheMember2024-06-300001723788bitw:InvestmentInBitcoinCashMember2024-06-300001723788bitw:InvestmentInBitcoinMember2024-01-012024-06-300001723788bitw:InvestmentInEthereumMember2023-12-3100017237882023-04-012023-06-30xbrli:purexbrli:sharesiso4217:USD

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2024

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number 000-56270

Bitwise 10 Crypto Index Fund

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

|

Delaware |

82-3002349 |

(State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) |

250 Montgomery Street,

Suite 200

San Francisco, CA 94104

(Address of Principal Executive Offices) (Zip Code)

(415) 707-3663

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

|

|

|

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

None |

N/A |

N/A |

Securities registered pursuant to Section 12(g) of the Act: Bitwise 10 Crypto Index Fund (BITW) Shares

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

Large accelerated filer |

☐ |

Accelerated filer |

☐ |

|

|

|

|

Non-accelerated filer |

☒ |

Smaller reporting company |

☐ |

|

|

|

|

|

|

Emerging growth company |

☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Number of shares of the registrant’s common stock outstanding as of August 8, 2024: 20,241,947

Table of Contents

Statement Regarding Forward-Looking Statements

This Quarterly Report on Form 10-Q contains “forward-looking statements” with respect to the financial conditions, results of operations, plans, objectives, future performance and business of Bitwise 10 Crypto Index Fund (BITW) (the “Trust”). Statements preceded by, followed by or that include words such as “may,” “might,” “will,” “should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential” or “continue,” the negative of these terms and other similar expressions are intended to identify some of the forward-looking statements. All statements (other than statements of historical fact) included in this Quarterly Report that address activities, events or developments that will or may occur in the future, including such matters as changes in market prices and conditions, the Trust’s operations, the plans of Bitwise Investment Advisers, LLC (the “Sponsor”) and references to the Trust’s future success and other similar matters are forward-looking statements. These statements are only predictions. Actual events or results may differ materially from such statements. These statements are based upon certain assumptions and analyses the Sponsor made based on its perception of historical trends, current conditions and expected future developments, as well as other factors appropriate in the circumstances. Whether or not actual results and developments will conform to the Sponsor’s expectations and predictions, however, is subject to a number of risks and uncertainties, including, but not limited to, those described in Part II, Item 1A. Risk Factors. Forward-looking statements are made based on the Sponsor’s beliefs, estimates and opinions on the date the statements are made and neither the Trust nor the Sponsor is under a duty or undertakes an obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change, other than as required by applicable laws. Investors are therefore cautioned against relying on forward-looking statements. Factors which could have a material adverse effect on the Trust's business, financial condition or results of operations and future prospects or which could cause actual results to differ materially from the Trust's expectations include, but are not limited to:

•the extreme volatility of trading prices that many Crypto Assets, including Bitcoin, have experienced in recent periods and may continue to experience, which could have a material adverse effect on the value of the Shares of the Trust;

•the recentness of the development of Crypto Assets and the uncertain medium-to-long term value of the Shares due to a number of factors relating to the capabilities and development of Blockchain technologies and to the fundamental investment characteristics of Crypto Assets;

•the value of the Shares depending on the acceptance of Crypto Assets and Blockchain technology, a new and rapidly evolving industry;

•the unregulated nature and lack of transparency surrounding the operations of Blockchain technologies and crypto assets, which may adversely affect the value of Portfolio Crypto Assets and the Shares;

•the limited history of the Index;

•risks related to the COVID-19 outbreak, which could negatively impact the value of the Trust’s holdings and significantly disrupt its operations;

•the possibility that the Shares may trade at a price that is at, above or below the Trust’s NAV Per Share;

•regulatory changes or actions by the United States ("U.S.") Congress or any U.S. federal or state agencies that may affect the value of the Shares or restrict the use of one or more Crypto Assets, Mining activity or the operation of their networks or the markets for the Portfolio Crypto Assets in a manner that adversely affects the value of the Shares;

•changes in the policies of the U.S. Securities and Exchange Commission (the “SEC”) that could adversely impact the value of the Shares;

•the possibility that the Trust or the Sponsor could be subject to regulation as a money service business or money transmitter, which could result in extraordinary expenses to the Trust or the Sponsor and also result in decreased liquidity for the Shares;

•regulatory changes or interpretations that could obligate the Trust or the Sponsor to register and comply with new regulations, resulting in potentially extraordinary, nonrecurring expenses to the Trust;

•potential delays in mail reaching the Sponsor when sent to the Trust at its registered office;

•possible requirements for the Trust to disclose information, including information relating to investors, to regulators;

•potential conflicts of interest that may arise among the Sponsor or its affiliates and the Trust;

•the potential discontinuance of the Sponsor’s continued services, which could be detrimental to the Trust;

•the Custodian’s possible resignation or removal by the Sponsor; and

•additional risk factors discussed in Part II, Item 1A. Risk Factors and Part I, Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations of this Quarterly Report on Form 10-Q, as well as those described from time to time in our future reports filed with the SEC.

Unless otherwise stated or the context otherwise requires, the terms “we,” “our” and “us” in this Quarterly Report on Form 10-Q refer to the Sponsor acting on behalf of the Trust.

Glossary

This glossary highlights some of the industry and other terms used elsewhere in this Quarterly Report on Form 10-Q but is not a complete list of all the terms used herein. Each of the following terms has the meaning set forth below:

“Airdrops” - mean a method to promote the launch and use of new Crypto Assets by providing a small amount of such new Crypto Assets to the private wallets or exchange accounts that support the new Crypto Asset and that hold existing related Crypto Assets.

“Bitcoin” or “BTC” - means a type of Crypto Asset based on an open-source cryptographic protocol existing on the Bitcoin network, comprising one type of the Crypto Assets underlying the Trust's Shares. The native Crypto Asset for the Bitcoin network is Bitcoin.

“Blockchain” - means the public transaction ledger of a Crypto Asset’s network on which transactions are recorded.

“Consensus Algorithm” - means the algorithm at the heart of the Blockchain system that enforces the convergence of all ledgers over time.

“Crypto Assets” - means a Crypto Asset designed to work as a store or value and/or medium of exchange wherein individual Crypto Asset ownership records are stored in a ledger, a computerized database using cryptography to secure transaction records, to control the creation of additional Crypto Assets and to verify the transfer of Crypto Asset ownership.

“Crypto Asset Network” - means the online, end user to end user network hosting the public transaction ledger, known as the Blockchain, and the source code comprising the basis for the cryptographic and algorithmic protocols governing the Crypto Asset’s network.

“Crypto Asset Exchanges” - means a dealer market, a brokered market, principal to principal market or exchange market on which Crypto Assets are bought, sold, and traded.

“Custodian” - means Coinbase Custody Trust Company, LLC. On behalf of the Trust, the Custodian holds the Portfolio Crypto Assets.

“Emissions” - mean regular awards provided to holders of Crypto Assets in the form of Crypto Asset grants, and often in the form of the “gas” that powers transactions on the relevant Crypto Asset Network.

“Hard Fork” - occurs when there is a change in the set of rules governing a Blockchain that makes it more restrictive than the previous set of rules in place.

“Index” - means the Bitwise 10 Large Cap Crypto Index, the benchmark index for the Trust.

“Index Provider” - means Bitwise Index Services, LLC, an affiliate of the Trust that is controlled by the same parent entity as the Sponsor. The Index Provider administers the Index.

“Miners” - means stakeholders who help process transactions and ensure that the distributed ledgers that make up a proof of work Blockchain network stay consistent with one another.

“Mining” - means the act of solving computational puzzles through which transactions with Crypto Assets are verified and added to a proof of work Blockchain digital ledger in exchange for a Crypto Asset as a reward.

“NAV” - means net asset value.

"NAV of the Trust" - means the sum of the assets and liabilities of the Trust.

“NAV Per Share” - means the NAV of the Trust calculated on a per share basis.

“Portfolio Crypto Assets” - means the group of selected Crypto Assets that are held by the Trust.

“Shareholders” - means holders of common units of fractional undivided beneficial interest of the Trust.

EMERGING GROWTH COMPANY STATUS

The Trust is an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act (the “JOBS Act”) and, as such, may elect to comply with certain reduced reporting requirements. For as long as the Trust is an emerging growth company, unlike other public companies, it will not be required to:

•provide an auditor’s attestation report on management’s assessment of the effectiveness of its system of internal control over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act of 2002;

•comply with any new requirements adopted by the Public Company Accounting Oversight Board (“PCAOB”) requiring mandatory auditor rotation or a supplement to the auditor’s report in which the auditor would be required to provide additional information about the audit and the financial statements of the issuer;

•comply with any new audit rules adopted by the PCAOB after April 5, 2012, unless the Securities and Exchange Commission determines otherwise;

•provide certain disclosure regarding executive compensation required of larger public companies; or

•obtain shareholder approval of any golden parachute payments not previously approved.

The Trust will cease to be an “emerging growth company” upon the earliest of (i) when it has $1.235 billion or more in total annual gross revenues during its most recently completed fiscal year; (ii) when it is deemed to be a large accelerated filer under Rule 12b-2 promulgated pursuant to the Securities Exchange Act of 1934; (iii) when it has issued more than $1.0 billion of non-convertible debt over a three-year period; or (iv) the last day of the fiscal year following the fifth anniversary of its initial public offering.

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. The Trust has chosen not to “opt out” of such extended transition period, and as a result, the Trust will take advantage of such extended transition period.

Industry and Market Data

Although we are responsible for all disclosure contained in this Quarterly Report on Form 10-Q, in some cases we have relied on certain market and industry data obtained from third-party sources that we believe to be reliable. Market estimates are calculated by using independent industry publications in conjunction with our assumptions regarding the Crypto Asset industry and market. While we are not aware of any misstatements regarding any market, industry or similar data presented herein, such data involves risks and uncertainties and is subject to change based on various factors, including those discussed under the heading “Statement Regarding Forward-Looking Statements.”

PART I – FINANCIAL INFORMATION:

Item 1. Financial Statements (Unaudited)

Bitwise 10 Crypto Index Fund

(formerly known as Bitwise 10 Private Index Fund, LLC)

Financial Statements

June 30, 2024 (Unaudited) and December 31, 2023

Bitwise 10 Crypto Index Fund

Table of Contents

Bitwise 10 Crypto Index Fund

Statements of Financial Condition

June 30, 2024 (unaudited) and December 31, 2023

|

|

|

|

|

|

|

|

|

Assets |

|

June 30, 2024

(unaudited) |

|

|

December 31, 2023 |

|

Investments in Crypto Assets, at fair value (cost $306,755,187 and $314,774,926) |

|

$ |

950,574,174 |

|

|

$ |

699,798,952 |

|

Crypto Assets sold receivable |

|

|

— |

|

|

|

2,770,000 |

|

Cash |

|

|

320,114 |

|

|

|

913 |

|

Other assets |

|

|

166 |

|

|

|

263 |

|

Total Assets |

|

$ |

950,894,454 |

|

|

$ |

702,570,128 |

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

Management fee payable |

|

$ |

1,981,029 |

|

|

$ |

1,463,687 |

|

Subscriptions received in advance |

|

|

301 |

|

|

|

301 |

|

Total Liabilities |

|

|

1,981,330 |

|

|

|

1,463,988 |

|

Net Assets |

|

$ |

948,913,124 |

|

|

$ |

701,106,140 |

|

|

|

|

|

|

|

|

Net Assets consists of: |

|

|

|

|

|

|

Paid-in-capital |

|

|

427,764,344 |

|

|

|

427,764,344 |

|

Accumulated net investment gain (loss) |

|

|

(64,240,865 |

) |

|

|

(52,232,153 |

) |

Accumulated net realized gain (loss) on investments in Crypto Assets |

|

|

(58,429,342 |

) |

|

|

(59,450,077 |

) |

Net unrealized appreciation (depreciation) on investments in Crypto Assets |

|

|

643,818,987 |

|

|

|

385,024,026 |

|

Net Assets |

|

$ |

948,913,124 |

|

|

$ |

701,106,140 |

|

Shares issued and outstanding, no par value (unlimited shares

authorized) |

|

|

20,241,947 |

|

|

|

20,241,947 |

|

Net asset value per share |

|

$ |

46.88 |

|

|

$ |

34.64 |

|

See accompanying notes to financial statements (unaudited).

Bitwise 10 Crypto Index Fund

Schedules of Investments

June 30, 2024 (unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Units |

|

|

Fair Value |

|

|

Percentage of Net Assets |

|

|

Investments in Crypto Assets, at fair value * |

|

|

|

|

|

|

|

|

|

|

Bitcoin |

|

|

10,822.7163 |

|

|

$ |

648,844,683 |

|

|

|

68.38 |

|

% |

Ethereum |

|

|

66,162.3382 |

|

|

|

223,190,708 |

|

|

|

23.52 |

|

|

Solana |

|

|

244,309.7829 |

|

|

|

34,367,057 |

|

|

|

3.62 |

|

|

Ripple |

|

|

29,982,132.8127 |

|

|

|

14,175,552 |

|

|

|

1.49 |

|

|

Cardano |

|

|

19,344,814.1951 |

|

|

|

7,600,577 |

|

|

|

0.80 |

|

|

Avalanche |

|

|

215,669.2655 |

|

|

|

6,047,366 |

|

|

|

0.64 |

|

|

Polkadot |

|

|

754,077.8402 |

|

|

|

4,711,478 |

|

|

|

0.50 |

|

|

Chainlink |

|

|

317,424.5081 |

|

|

|

4,461,401 |

|

|

|

0.47 |

|

|

Bitcoin Cash |

|

|

10,861.6522 |

|

|

|

4,206,609 |

|

|

|

0.44 |

|

|

NEAR Protocol |

|

|

607,601.9414 |

|

|

|

2,968,743 |

|

|

|

0.31 |

|

|

Total investments in Crypto Assets, at fair value

(cost $306,755,187) |

|

|

|

|

$ |

950,574,174 |

|

|

|

100.18 |

|

|

Other liabilities in excess of assets |

|

|

|

|

|

(1,661,050 |

) |

|

|

(0.18 |

) |

|

Net Assets |

|

|

|

|

$ |

948,913,124 |

|

|

|

100.00 |

|

% |

December 31, 2023

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Units |

|

|

Fair Value |

|

|

Percentage of Net Assets |

|

|

Investments in Crypto Assets, at fair value * |

|

|

|

|

|

|

|

|

|

|

Bitcoin |

|

|

10,998.0429 |

|

|

$ |

462,076,062 |

|

|

|

65.91 |

|

% |

Ethereum |

|

|

67,221.7443 |

|

|

|

154,923,265 |

|

|

|

22.10 |

|

|

Solana |

|

|

239,876.3681 |

|

|

|

25,143,841 |

|

|

|

3.59 |

|

|

Ripple |

|

|

30,324,826.6436 |

|

|

|

18,825,652 |

|

|

|

2.69 |

|

|

Cardano |

|

|

19,777,360.7670 |

|

|

|

11,943,548 |

|

|

|

1.70 |

|

|

Avalanche |

|

|

195,564.0766 |

|

|

|

7,859,720 |

|

|

|

1.12 |

|

|

Polkadot |

|

|

732,019.7088 |

|

|

|

6,033,306 |

|

|

|

0.86 |

|

|

Polygon |

|

|

5,257,194.4118 |

|

|

|

5,114,199 |

|

|

|

0.73 |

|

|

Chainlink |

|

|

309,529.3045 |

|

|

|

4,803,895 |

|

|

|

0.69 |

|

|

Litecoin |

|

|

41,303.5713 |

|

|

|

3,075,464 |

|

|

|

0.44 |

|

|

Total investments in crypto assets, at fair value

(cost $314,774,926) |

|

|

|

|

$ |

699,798,952 |

|

|

|

99.81 |

|

|

Other assets in excess of liabilities |

|

|

|

|

|

1,307,188 |

|

|

|

0.19 |

|

|

Net Assets |

|

|

|

|

$ |

701,106,140 |

|

|

|

100.00 |

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* Crypto Assets do not have a singular country or geographic region, therefore country information is omitted.

See accompanying notes to financial statements (unaudited).

Bitwise 10 Crypto Index Fund

Statements of Operations (Unaudited)

For the three and six months ended June 30, 2024 and 2023

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended June 30, |

|

|

Six months ended June 30, |

|

|

|

2024

(unaudited) |

|

|

2023

(unaudited) |

|

|

2024

(unaudited) |

|

|

2023

(unaudited) |

|

Income |

|

|

|

|

|

|

|

|

|

|

|

|

Other |

|

$ |

— |

|

|

$ |

68,436 |

|

|

$ |

— |

|

|

$ |

68,436 |

|

Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

Management fee |

|

$ |

6,130,463 |

|

|

$ |

3,182,242 |

|

|

$ |

12,008,661 |

|

|

$ |

6,024,544 |

|

Transaction and other fees |

|

|

24 |

|

|

|

2,203 |

|

|

|

51 |

|

|

|

2,203 |

|

Total Expenses |

|

|

6,130,487 |

|

|

|

3,184,445 |

|

|

|

12,008,712 |

|

|

|

6,026,747 |

|

Net Investment gain (loss) |

|

|

(6,130,487 |

) |

|

|

(3,116,009 |

) |

|

|

(12,008,712 |

) |

|

|

(5,958,311 |

) |

Net realized and change in unrealized gain (loss) on investments |

|

|

|

|

|

|

|

|

|

|

|

|

Net realized gain (loss) from Crypto Assets |

|

|

(495,930 |

) |

|

|

(220,133 |

) |

|

|

1,020,735 |

|

|

|

(2,159,366 |

) |

Net change in unrealized appreciation (depreciation) from Crypto Assets |

|

|

(167,450,727 |

) |

|

|

21,961,446 |

|

|

|

258,794,961 |

|

|

|

223,022,103 |

|

Net realized and change in unrealized gain (loss) on investments |

|

|

(167,946,657 |

) |

|

|

21,741,313 |

|

|

|

259,815,696 |

|

|

|

220,862,737 |

|

Net increase (decrease) in Net Assets resulting from operations |

|

$ |

(174,077,144 |

) |

|

$ |

18,625,304 |

|

|

$ |

247,806,984 |

|

|

$ |

214,904,426 |

|

See accompanying notes to financial statements (unaudited).

Bitwise 10 Crypto Index Fund

Statements of Changes in Net Assets (Unaudited)

For the three and six months ended June 30, 2024 and 2023

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended June 30, |

|

|

Six months ended June 30, |

|

|

|

2024

(unaudited) |

|

|

2023

(unaudited) |

|

|

2024

(unaudited) |

|

|

2023

(unaudited) |

|

Increase (decrease) in net assets from operations: |

|

|

|

|

|

|

|

|

|

|

|

|

Net investment gain (loss) |

|

$ |

(6,130,487 |

) |

|

$ |

(3,116,009 |

) |

|

$ |

(12,008,712 |

) |

|

$ |

(5,958,311 |

) |

Net realized gain (loss) from Crypto Assets |

|

|

(495,930 |

) |

|

|

(220,133 |

) |

|

|

1,020,735 |

|

|

|

(2,159,366 |

) |

Net change in unrealized appreciation (depreciation) from Crypto Assets |

|

|

(167,450,727 |

) |

|

|

21,961,446 |

|

|

|

258,794,961 |

|

|

|

223,022,103 |

|

Net increase (decrease) in net assets resulting from operations |

|

|

(174,077,144 |

) |

|

|

18,625,304 |

|

|

|

247,806,984 |

|

|

|

214,904,426 |

|

Net Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

Beginning of Period |

|

|

1,122,990,268 |

|

|

|

504,435,621 |

|

|

|

701,106,140 |

|

|

|

308,156,499 |

|

End of Period |

|

$ |

948,913,124 |

|

|

$ |

523,060,925 |

|

|

$ |

948,913,124 |

|

|

$ |

523,060,925 |

|

Change in Shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

Shares outstanding at beginning of period |

|

|

20,241,947 |

|

|

|

20,241,947 |

|

|

|

20,241,947 |

|

|

|

20,241,947 |

|

Subscriptions |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Net increase (decrease) in shares |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Shares outstanding at end of period |

|

|

20,241,947 |

|

|

|

20,241,947 |

|

|

|

20,241,947 |

|

|

|

20,241,947 |

|

See accompanying notes to financial statements (unaudited).

Bitwise 10 Crypto Index Fund

Notes to Comparative Financial Statements (unaudited)

1. Organization

Bitwise 10 Crypto Index Fund (the “Trust”) is a Delaware Statutory Trust that commenced operations on November 22, 2017. The Trust’s name was changed from “Bitwise Hold 10 Private Index Fund, LLC” on September 24, 2018, and changed again from “Bitwise 10 Private Index Fund, LLC” on May 1, 2020 when it was also simultaneously converted from a Delaware Limited Liability Company to a Delaware Statutory Trust. Bitwise Investment Advisers, LLC, is the sponsor (“Sponsor”) and investment adviser of the Trust. Bitwise Asset Management, Inc, an affiliate of the Sponsor, served as the Manager before the Trust’s conversion to a Delaware Statutory Trust. Delaware Trust Company is the Trustee of the Trust, and American Stock Transfer & Trust Company is the Transfer Agent of the Trust.

On December 9, 2020, the Trust received notice that its Shares were qualified for public trading on the OTCQX U.S. Marketplace of the OTC Markets Group, Inc. (“OTCQX”). The Trust’s trading symbol on OTCQX is “BITW” and the CUSIP number for its Shares is 091749101.

The Trust’s principal investment objective is to invest in a portfolio of broad-based Crypto Assets that tracks the Bitwise 10 Large Cap Crypto Index (the “Index”), which is administered by Bitwise Index Services, LLC (the "Index Provider"), an affiliate of the Sponsor. The Trust rebalances monthly alongside the Index to stay current with changes.

All shareholders are subject to a 2.5% per annum Management Fee and are referred to as the Investor Class. Pursuant to the Agreement and Plan of Conversion executed as of May 1, 2020, the Trust converted from a Delaware Limited Liability Company to a Delaware Statutory Trust.

Theorem Fund Services, LLC (the “Administrator”) serves as the Trust’s Administrator and performs certain administrative and accounting services on behalf of the Trust.

Bitwise 10 Crypto Index Fund

Notes to Comparative Financial Statements (unaudited)

2. Significant Accounting Policies

Basis of Presentation

The financial statements are expressed in U.S. dollars and have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The Trust is an investment company and follows the specialized accounting and reporting guidance in the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC” or “Codification”) Topic 946, Financial Services—Investment Companies.

The accompanying comparative financial statements are unaudited, but in the opinion of management of the Sponsor, contain all adjustments (which include normal recurring adjustments) considered necessary to present fairly the financial position of the Trust as of June 30, 2024 and December 31, 2023 and the results of operations for the three and six months ended June 30, 2024 and 2023. These interim financial statements should be read in conjunction with the Trust’s annual report on Form 10-K for the year ended December 31, 2023. Interim period results are not necessarily indicative of results for a full-year period.

Pursuant to the Statement of Cash Flows Topic of the Codification, the Trust qualifies for an exemption from the requirement to provide a statement of cash flows and has elected not to provide a statement of cash flows.

Use of Estimates

The preparation of financial statements in accordance with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

Cash

Cash represents cash deposits held at financial institutions and Crypto Asset exchanges. Cash in a bank deposit account, at times, may exceed U.S. federally insured limits. The Trust has not experienced any losses in such accounts and does not believe it is exposed to any significant credit risk on such bank deposits.

Investments and Valuation

The Trust’s investments in Crypto Assets are stated at fair value. For a further discussion of the Trust’s calculations of valuation, please see “Calculation of Valuation” in the footnote below. Crypto Assets are generally valued using prices as reported on reputable and liquid exchanges and may utilize an average of bid and ask quotes using closing prices provided by such exchanges as of the date and time of determination ("Calculation of Valuation" below). Factors such as the recent stability of the exchange, current liquidity of the exchange, and recent price activity of an exchange will be considered in the determination of which exchanges to utilize. The time used is 4:00 pm ET which corresponds to 20:00 UTC during Daylight Savings Time and 21:00 UTC during non-Daylight Savings Time. The Sponsor’s Valuation Policy provides a listing of preferred exchanges. While some Crypto Assets are valued based on prices reported in the public markets, other Crypto Assets may be more thinly-traded or subject to irregular trading activity. Determinations on the value of certain Crypto Assets, and how to value such assets as to which limited prices or quotations are available, are based on the Sponsor’s recommendations or instructions.

Crypto Asset transactions are recorded on the trade date. Realized gains and losses from Crypto Asset transactions are determined using the identified cost method. Any change in net unrealized gain or loss is reported in the statement of operations. Commissions and other trading fees are reflected as an adjustment to cost or proceeds at the time of the transaction.

The Trust intermittently receives Airdrops of new Crypto Assets. The use of Airdrops is generally to promote the launch and use of new Crypto Assets by providing a small amount of the new Crypto Assets to the private wallets or exchange accounts of holders of existing related Crypto Assets. Airdropped Crypto Assets can have substantially different Blockchain technology that has no relation to any existing Crypto Asset, and many Airdrops may be without value. The Trust will only record receipt of Airdropped Crypto Assets if when received, the Airdropped Crypto Assets have value. Crypto Assets received from Airdrops have no cost basis and the Trust recognizes other income equal to the fair value of the new Crypto Asset received.

Bitwise 10 Crypto Index Fund

Notes to Comparative Financial Statements (unaudited)

During the three-months ended June 30, 2023, the Trust was eligible for a Flare (FLR) airdrop. The airdrop was based on the Trust’s XRP holding in its custody vault as of December 12, 2020. The Trust elected to participate in the airdrop and on April 17th, 2023, Other income resulting from the airdrop was booked into the Trust's assets. At the time of the airdrop, the result was a positive NAV increase of 0.013% bps, less than $0.00 NAV increase and $68,436 net asset increase to the Trust. On April 18th, 2023, the Trust sold the FLR and raised USD resulting in a minor loss to the Trust. The USD was used to purchase other assets in the Trust’s portfolio, since FLR wasn’t part of the Index of the Trust. The impact of this airdrop can be seen within the Statement of Operations under Other income and Net realized gain (loss) from Crypto Assets.

Calculation of Valuation

The process that the Sponsor developed for identifying a principal market (the "Principal Market"), as described in FASB ASC 820-10, which outlines the application of fair value accounting, was to begin by identifying publicly available, well established and reputable Crypto Asset exchanges selected by the Sponsor and its affiliates in their sole discretion, including, but not limited to, Binance, Bitfinex, Bitflyer, Bitstamp, Coinbase, Crypto.com, Gate.io, Gemini, HitBTC, Huobi, itBit, Kraken, KuCoin, LMAX, MEXC Global, OKX and Poloniex, and then calculating, on each valuation period, the highest volume exchange during the 60 minutes prior to 4:00 pm ET for each asset (the "Principal Market Price"). In evaluating the markets that could be considered principal markets, the Trust considered whether or not the specific markets were accessible to the Trust, either directly or through an intermediary, at the end of each period.

The following provides an overview of the Principal Market and the Principal Market Prices for Portfolio Crypto Assets that comprised the majority of the Trust’s assets for the six-month period ended June 30, 2024.

|

|

|

|

|

|

|

Crypto Asset |

|

Principal Market Price |

|

|

Principal

Market |

Bitcoin (BTC) |

|

$ |

59,952.11 |

|

|

Coinbase |

Ethereum (ETH) |

|

$ |

3,373.38 |

|

|

Crypto.com |

Solana (SOL) |

|

$ |

140.67 |

|

|

Coinbase |

Ripple (XRP) |

|

$ |

0.47 |

|

|

Coinbase |

Cardano (ADA) |

|

$ |

0.39 |

|

|

Coinbase |

Avalanche (AVAX) |

|

$ |

28.04 |

|

|

Coinbase |

Polkadot (DOT) |

|

$ |

6.25 |

|

|

Coinbase |

Chainlink (LINK) |

|

$ |

14.06 |

|

|

Coinbase |

Bitcoin Cash (BCH) |

|

$ |

387.29 |

|

|

Coinbase |

NEAR Protocol (NEAR) |

|

$ |

4.89 |

|

|

Coinbase |

3. Fair Value Measurements

The Trust carries its investments at fair value in accordance with FASB ASC Topic 820, Fair Value Measurement. Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability (i.e., the “exit price”) in an orderly transaction between market participants at the measurement date. Fair value investments are not adjusted for transaction costs.

In determining fair value, the Trust uses a single, principal market approach. A fair value hierarchy for inputs is used in measuring fair value that maximizes the use of observable inputs and minimizes the use of unobservable inputs by requiring that the most observable inputs are to be used when available. The fair value hierarchy is categorized into three levels based on the inputs as follows:

Level 1 – Valuations based on unadjusted quoted prices in active markets for identical assets or liabilities that the Trust has the ability to access.

Level 2 – Valuations based on quoted prices in markets that are not active or for which all significant inputs are observable, either directly or indirectly. These inputs may include (a) quoted prices for similar assets in active markets, (b) quoted prices for identical or similar assets in markets that are not active, (c) inputs other than quoted prices that are observable for the asset, or (d) inputs derived principally from or corroborated by observable market data by correlation or other means.

Level 3 – Valuations based on inputs that are unobservable and significant to the overall fair value measurement.

Bitwise 10 Crypto Index Fund

Notes to Comparative Financial Statements (unaudited)

The availability of valuation techniques and observable inputs can vary from investment to investment and are affected by a wide variety of factors, including the type of investment, whether the investment is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the transaction.

In certain cases, the inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, the level in the fair value hierarchy which the fair value measurement falls in its entirety is determined based on the lowest level input that is significant to the fair value measurement.

The following summarizes the Trust’s assets accounted for at fair value at June 30, 2024.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

|

Total |

|

Assets |

|

|

|

|

|

|

|

|

|

|

|

|

Investments in Crypto Assets, at fair value |

|

$ |

950,574,174 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

950,574,174 |

|

The following summarizes the Trust’s assets accounted for at fair value at December 31, 2023.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

|

Total |

|

Assets |

|

|

|

|

|

|

|

|

|

|

|

|

Investments in Crypto Assets, at fair value |

|

$ |

699,798,952 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

699,798,952 |

|

4. Risks and Uncertainties

Crypto Assets

Crypto Assets are loosely regulated and there is no central marketplace for currency exchange. Supply is determined by a computer code, not by a central bank, and prices have been extremely volatile. Crypto Asset exchanges have been closed due to fraud, failure, or security breaches. Any of the Trust’s assets that reside on an exchange that closes may be lost. At June 30, 2024, Crypto Assets of approximately $155,100 and cash of approximately $319,600 resided on exchanges. At December 31, 2023, the Trust had a $2,770,000 receivable from Crypto Assets sold and Crypto Assets of approximately $1,270,260 resided on exchanges.

Several factors may affect the price of Crypto Assets, including, but not limited to: supply and demand, investors’ expectations with respect to the rate of inflation, interest rates, currency exchange rates, or future regulatory measures (if any) that restrict the trading of Crypto Assets or the use of Crypto Assets as a form of payment. There is no assurance that Crypto Assets will maintain their long-term value in terms of purchasing power in the future, or that acceptance of Crypto Asset payments by mainstream retail merchants and commercial businesses will continue to grow.

Crypto Asset Regulation

As Crypto Assets have grown in popularity and market size, various countries and jurisdictions have begun to develop regulations governing the Crypto Assets industry. To the extent that future regulatory actions or policies limit the ability to exchange Crypto Assets or utilize them for payments, the demand for Crypto Assets will be reduced. Furthermore, regulatory actions may limit the ability of end-users to convert Crypto Assets into fiat currency (e.g., U.S. dollars) or use Crypto Assets to pay for goods and services. Such regulatory actions or policies could result in a reduction of demand, and in turn, a decline in the underlying Crypto Asset unit prices.

The effect of any future regulatory change on the Trust or Crypto Assets in general is impossible to predict, but such change could be substantial and adverse to the Trust and the value of the Trust’s investments in Crypto Assets.

Custody of Crypto Assets

Coinbase Custody Trust Company, LLC (the “Custodian”) serves as the Trust’s Custodian for Crypto Assets for which qualified custody is available. The Custodian is subject to change in the sole discretion of the Sponsor. At June 30, 2024 and December 31, 2023, Crypto Assets of approximately $950,419,100 and $698,528,691 were held by the Custodian, respectively.

Bitwise 10 Crypto Index Fund

Notes to Comparative Financial Statements (unaudited)

Crypto Asset Trading is Volatile and Speculative

Crypto Assets represent a speculative investment and involve a high degree of risk. Prices of Crypto Assets have fluctuated widely for a variety of reasons including uncertainties in government regulation and may continue to experience significant price fluctuations. If Crypto Asset markets continue to be subject to sharp fluctuations, Shareholders may experience losses as the value of the Trust’s investments decline. Even if Shareholders are able to hold their Shares in the Trust for the long-term, their Shares may never generate a profit, since Crypto Asset markets have historically experienced extended periods of flat or declining prices in addition to sharp fluctuations.

Over-the-Counter Transactions

Some of the markets in which the Trust may execute its transactions are “over-the-counter” or “interdealer” markets. The participants in such markets are typically not subject to credit evaluation and regulatory oversight as are members of “exchange-based” markets. This exposes the Trust to the risk that a counterparty will not settle a transaction in accordance with its terms and conditions because of a dispute over the terms of the contract (whether or not bona fide) or because of a credit or liquidity problem, thus causing the Trust to suffer a loss. Such “counterparty risk” is accentuated for Crypto Assets where the Trust has concentrated its transactions with a single or small group of counterparties. The Trust is not restricted from dealing with any particular counterparty or from concentrating any or all of its transactions with one counterparty. Moreover, the Trust has no internal credit function that evaluates the creditworthiness of its counterparties. The ability of the Trust to transact business with any one or number of counterparties, the lack of any meaningful and independent evaluation of such counterparty’s financial capabilities and the absence of a regulated market to facilitate settlement may increase the potential for losses by the Trust.

No FDIC or SIPC Protection

The Trust is not a banking institution or otherwise a member of the Federal Deposit Insurance Corporation (“FDIC”) or the Securities Investor Protection Corporation (“SIPC”). Accordingly, deposits or assets held by the Trust are not subject to the protections enjoyed by depositors with FDIC or SIPC member institutions. The Trust’s Crypto Asset custodians do however carry bespoke insurance policies related to the Crypto Assets over which they provide custody.

The Trust must adapt to technological change in order to secure and safeguard client accounts. While management believes they have developed an appropriate proprietary security system reasonably designed to safeguard the Trust’s Crypto Assets from theft, loss, destruction, or other issues relating to hackers and technological attack, such assessment is based upon known technology and threats. To the extent that the Trust is unable to identify and mitigate or stop new security threats, the Trust’s Crypto Assets may be subject to theft, loss, destruction, or other attack, which could have a negative impact on the performance of the Trust or result in loss of the Trust’s Crypto Assets.

Risks Associated With a Crypto Asset Majority Control

Since Crypto Assets are virtual and transactions in such currencies reside on distributed networks, governance of the underlying distributed network could be adversely altered should any individual or group obtain 51% control of the distributed network. Such control could have a significant adverse effect on either the ownership or value of the Crypto Asset.

Transaction Authentication

As of the date of these financial statements, the transfer of Crypto Assets from one party to another typically relies on an authentication process by an outside party known as a miner or validator. In exchange for compensation, the miner or validator will authenticate the transfer of the currency through the solving of a complex algorithm known as a proof of work, or will vouch for the transfer through other means, such as a proof of stake. Effective transfers of and therefore realization of Crypto Assets, and tokens are dependent on interactions from these miners or validators. In the event that there were a shortage of miners to perform this function, that shortage could have an adverse effect on either the fair value or realization of the Crypto Assets.

Other Risks

Management continues to evaluate the impact of current or anticipated military conflict, including between Russia and Ukraine, terrorism, sanctions; and other geopolitical events; as well as adverse developments in the economy, the capital markets and the Blockchain markets, including rising energy costs, inflation and interest rates, in the United States and globally; and catastrophic events such as fires, floods, earthquakes, tornadoes, hurricanes, and global health epidemics. Management has concluded that while it

Bitwise 10 Crypto Index Fund

Notes to Comparative Financial Statements (unaudited)

is reasonably possible that these events could have a negative effect on the financial performance and operations of the Trust, the specific impact is not readily determinable as of the date of the financial statements. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

5. Income Taxes

The Trust is classified as a partnership for U.S. federal income tax purposes. The Trust does not record a provision for U.S. federal, U.S. state, or local income taxes because the Shareholders report their share of the Trust’s income or loss on their income tax returns. The Trust files an income tax return in the U.S. federal jurisdiction and may file income tax returns in various U.S. states and foreign jurisdictions.

The Trust is required to determine whether its tax positions are more likely than not to be sustained on examination by the applicable taxing authority, based on the technical merits of the position. Tax positions not deemed to meet a more likely than not threshold would be recorded as a tax expense in the current year. As of June 30, 2024 and December 31, 2023, the Trust has determined that no provision for income taxes is required and no liability for unrecognized tax benefits has been recorded. The Trust does not expect that its assessment related to unrecognized tax benefits will materially change over the next 12 months. However, the Trust’s conclusions may be subject to review and adjustment at a later date based on factors including, but not limited to, the nexus of income among various tax jurisdictions; compliance with U.S. federal, U.S. state, and tax laws of jurisdictions in which the Trust operates in; and changes in the administrative practices and precedents of the relevant authorities. The Trust is required to analyze all open tax years. Open tax years are those years that are open for examination by the relevant income taxing authority. As of June 30, 2024, the 2023, 2022, 2021, and 2020 tax years remain open for examination. There were no examinations in progress at period end.

6. Shareholders’ Equity

Subscriptions

As of November 18, 2021, the Sponsor to the Trust has closed the acceptance of all subscriptions to the Bitwise 10 Crypto Index Fund, pursuant to its rights under Sections 5 and 6 of the Trust Agreement.

In-Kind Subscriptions

The Sponsor may, at its sole discretion, accept Crypto Assets (“In-Kind Investments”) in lieu of, or in addition to, cash as payment for investment in the Trust. Such In-Kind Investments are valued using the same Crypto Asset prices as per the Trust’s valuation policy at any given valuation date as of 4:00 pm ET on the date of the subscription. As of November 18, 2021, the Sponsor to the Trust has closed the acceptance of all subscriptions to the Bitwise 10 Crypto Index Fund, pursuant to its rights under Sections 5 and 6 of the Trust Agreement.

Withdrawals

In connection with the Trust seeking approval for the quotation of its Shares on OTCQX, the Trust halted the withdrawal program on October 7, 2020.

Allocation of Profits and Losses

Starting May 1, 2020, income or loss was directly allocated to the single remaining Class.

7. Related Party Transactions

The Trust considers the Sponsor, its directors and employees to be related parties of the Trust. In consideration for the management services to be provided to the Trust, the Sponsor will receive from the Trust a management fee (the “Management Fee”) payable monthly, in arrears at a rate of 2.5% per annum.

The Sponsor may, in its discretion, waive, reduce, or rebate the Management Fee with respect to any Shareholder or group of Shareholders (which group may, but need not, include all Shareholders), including affiliates of the Sponsor; provided that such waiver, reduction, or rebate shall not increase the Management Fee payable in respect of any other Shareholder.

Bitwise 10 Crypto Index Fund

Notes to Comparative Financial Statements (unaudited)

For the periods January 1, 2024 to June 30, 2024 and January 1, 2023 to June 30, 2023, the Shareholders were charged Management Fees of $12,008,661 and $6,024,544, respectively, of which $1,981,029 and $1,091,985 remained payable as of June 30, 2024 and 2023, respectively.

The Sponsor paid all expenses related to the initial offering, organization and start-up of the Trust and will not seek reimbursement for such amounts. The Sponsor is responsible for all ordinary operating expenses of the Trust, including administrative, custody, legal, audit, insurance, and other operating expenses.

8. Indemnifications

In the normal course of business, the Trust enters into contracts and agreements that contain a variety of representations and warranties and which provide general indemnifications. The Trust’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Trust that have not yet occurred. The Trust expects the risk of any future obligation under these indemnifications to be remote.

9. Financial Highlights

The following presents the financial highlights for the three and six months ended June 30, 2024 and 2023.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended

June 30, 2024 |

|

|

Three months ended

June 30, 2023 |

|

|

|

Six months ended

June 30, 2024 |

|

|

Six months ended

June 30, 2023 |

|

|

Per Share Performance |

|

Investor Class |

|

|

Investor Class |

|

|

|

Investor Class |

|

|

Investor Class |

|

|

(for a share outstanding throughout the period) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net asset value per share at beginning of period |

|

$ |

55.48 |

|

|

$ |

24.92 |

|

|

|

$ |

34.64 |

|

|

$ |

15.22 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net increase (decrease) in Net Assets resulting from operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net realized and change in unrealized gain (loss) on investments (1) |

|

|

(8.30 |

) |

|

|

1.07 |

|

|

|

|

12.83 |

|

|

|

10.91 |

|

|

Net investment gain (loss) (1) |

|

|

(0.30 |

) |

|

|

(0.15 |

) |

|

|

|

(0.59 |

) |

|

|

(0.29 |

) |

|

Net increase (decrease) in Net Assets resulting

from operations |

|

|

(8.60 |

) |

|

|

0.92 |

|

|

|

|

12.24 |

|

|

|

10.62 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net asset value per share at end of period |

|

$ |

46.88 |

|

|

$ |

25.84 |

|

|

|

$ |

46.88 |

|

|

$ |

25.84 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total return |

|

|

(15.50 |

) |

% |

|

3.69 |

|

% |

|

|

35.33 |

|

% |

|

69.78 |

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ratios to average net asset value(2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expenses |

|

|

2.51 |

|

% |

|

2.51 |

|

% |

|

|

2.51 |

|

% |

|

2.51 |

|

% |

Net investment loss |

|

|

(2.51 |

) |

% |

|

(2.45 |

) |

% |

|

|

(2.51 |

) |

% |

|

(2.48 |

) |

% |

Net Assets at end of period |

|

$ |

948,913,124 |

|

|

$ |

523,060,925 |

|

|

|

$ |

948,913,124 |

|

|

$ |

523,060,925 |

|

|

Average net assets(3) |

|

$ |

978,830,316 |

|

|

$ |

508,097,903 |

|

|

|

$ |

958,691,454 |

|

|

$ |

480,959,405 |

|

|

Portfolio turnover |

|

|

1.75 |

|

% |

|

0.96 |

|

% |

|

|

2.08 |

|

% |

|

1.55 |

|

% |

Total returns are calculated based on the change in value of a share during the period. The total return and the ratios to average net asset value are calculated for each class as a whole. An individual Shareholder’s return and ratios may vary based on the timing of capital transactions. Ratios have been annualized for the periods ended June 30, 2024 and 2023; total returns and portfolio turnover have not been annualized.

(1)Net investment loss per share is calculated by dividing the net investment loss by the average number of shares outstanding during the period. Net realized and change in unrealized gain (loss) on investments is a balancing amount necessary to reconcile the change in net asset value per share with the other per share information.

Bitwise 10 Crypto Index Fund

Notes to Comparative Financial Statements (unaudited)

(3)Based on the average of month-end net assets.

10. New Accounting Pronouncements

On September 6, 2023, the Financial Accounting Standards Board (FASB) approved a proposed accounting standards update (Intangibles – Goodwill and Other – Crypto Assets, ASU Subtopic 350-60) to improve the accounting for, and disclosure of, certain Crypto Assets. The new standard was published on December 13, 2023 and will be effective for fiscal years beginning after December 15, 2024, including interim periods within those fiscal years. The Sponsor is evaluating the potential impact the ASU may have and does not believe there will be any material impact to the Trust’s financial statements.

11. Subsequent Events

The Sponsor has evaluated subsequent events through August 8, 2024, the date the financial statements were available to be issued, and has determined that there are no subsequent events that require disclosure.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis of our financial condition and results of operations should be read together with, and is qualified in its entirety by reference to, our unaudited financial statements and related notes included elsewhere in this Form 10-Q, which have been prepared in accordance with U.S. GAAP. The following discussion may contain forward-looking statements based on current expectations that involve risks and uncertainties. Our actual results could differ materially from those discussed in these forward-looking statements as a result of various factors, including those set forth under “Part II. Item 1A. Risk Factors,” “Statement Regarding Forward-Looking Statements” or in other sections of this Form 10-Q.

Trust Overview

The Trust is a Delaware Statutory Trust that issues units of fractional undivided beneficial interest in the form of shares, which represent ownership in the Trust ("Shares"). All Shareholders of “investor class” units received 10 Shares for each unit owned prior to the corporate action date, and all Shareholders of “institutional class” units received 10.12602229 Shares for each unit owned prior to the corporate action date.

The purpose of the Trust is to make it easier for an investor to invest in the Crypto Asset market as a whole, without having to pick specific tokens, manage a portfolio, and constantly monitor ongoing news and developments. Although the Shares are not the exact equivalent of a direct investment in Crypto Assets, they provide investors with an alternative that constitutes a relatively cost-effective, professionally managed way to participate in Crypto Asset markets. The Trust holds a Portfolio of Crypto Assets, referred to as the Portfolio Crypto Assets.

In furtherance of this objective, the activities of the Trust include (i) issuing Shares in exchange for subscriptions, (ii) selling or buying Portfolio Crypto Assets in connection with monthly rebalancing, (iii) selling Portfolio Crypto Assets as necessary to cover the Management Fee (as defined below) and/or any Organizational Expenses (as defined below), (iv) causing the Sponsor to sell Portfolio Crypto Assets upon any potential future termination of the Trust, and (v) engaging in all administrative and security procedures necessary to accomplish such activities in accordance with the provisions of the Trust Agreement of Bitwise 10 Crypto Index Fund (the "Trust Agreement"), and the Custodian Agreement with the Custodian (the “Custodian Agreement").

The Trust’s principal investment objective is to invest in a Portfolio of Crypto Assets that tracks the Bitwise 10 Large Cap Crypto Index (the "Index") as closely as possible with certain exceptions determined by the Sponsor in its sole discretion. In addition, in the event the Portfolio Crypto Assets being held by the Trust present opportunities to generate returns in excess of the Index (for example, Airdrops, Emissions, forks, or similar network events) the Sponsor may also pursue these incidental opportunities on behalf of the Trust as part of the investment objective if in its sole discretion the Sponsor deems such activities to be possible and prudent. The Trust believes that it has met its principal investment objective. As of June 30, 2024, there was a correlation of 99.99% between the Portfolio Crypto Assets and the assets included in the Index. The Trust is aware that the market price of the Trust’s shares may deviate from the net asset value (“NAV”) of the shares, and the market price may at times be significantly above or below the shares’ NAV. The NAV of the Trust is calculated by summing the assets and liabilities and the NAV Per Share is calculated by dividing the total NAV by the shares outstanding. However, the Trust believes that any such deviation does not affect the Trust’s principal investment objective, as the Trust does not maintain or promote any business objectives related to the market trading price of its shares. Furthermore, under Regulation M, the Trust as issuer of the Shares is not permitted to take any actions that would seek to reconcile the NAV of the Shares and the market price of the Shares, and the Trust would not undertake business objectives that it was legally restricted from achieving.

The Trust and the Sponsor have entered into a limited, non-exclusive, revocable license agreement with Bitwise Index Services, LLC (the “Index Provider”), an affiliate of the Trust that is controlled by the same parent entity as the Sponsor, at no cost to the Trust or the Sponsor allowing the Trust to use the Index as the benchmark index for the Trust (the “License Agreement”).

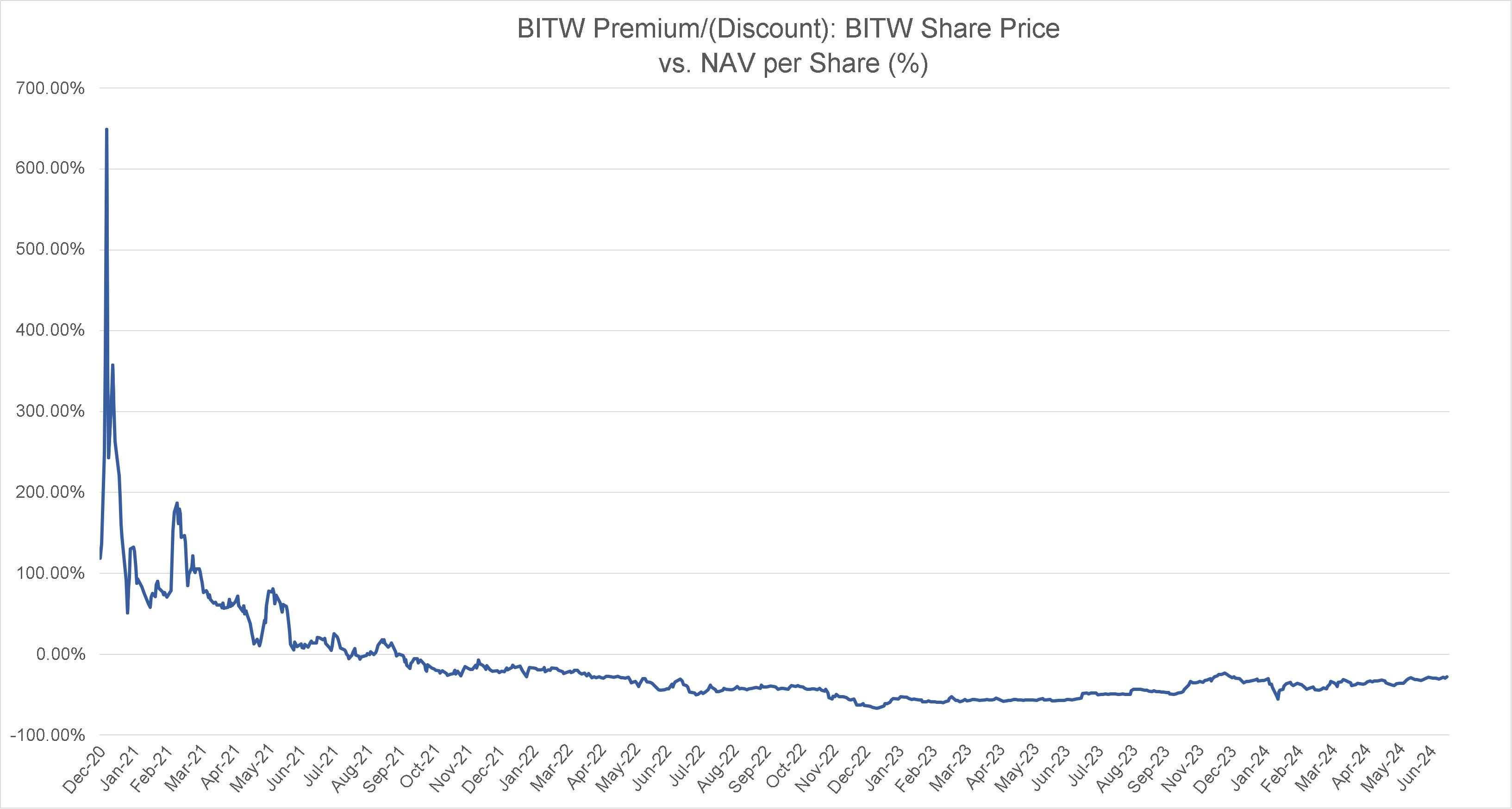

The Shares may also trade at a substantial premium over, or a substantial discount to, the NAV Per Share as a result of price volatility, trading volume and closings of the exchanges on which the Sponsor purchases Portfolio Crypto Assets on behalf of the Trust due to fraud, failure, security breaches or otherwise. As a result of the foregoing, the price of the Shares as quoted on OTCQX has varied significantly from the value of the Trust’s Portfolio Crypto Assets Per Share since the Shares were approved for quotation on December 9, 2020.

The following charts show the percentage of Premium/(Discount) of the Shares as quoted on OTCQX and the Trust’s NAV and a comparison of the NAV of the Trust vs the market price as quoted on OTCQX for the period December 10, 2020 to June 30, 2024.

From December 10, 2020 to June 30, 2024, the Shares of BITW traded at an average discount of 15.71%, based on closing prices at 4:00 pm ET, and estimated, unaudited, NAV Per Share. During that same period, the highest premium was 649.38% on December 16, 2020, and the lowest premium was 0.27% on August 4, 2021. During that same period, the highest discount was 67.80% on December 28, 2022, and the lowest discount was 0.09% on September 24, 2021. Given the lack of an ongoing redemption program and the holding period under Rule 144, there is no arbitrage mechanism to keep the Shares closely linked to the value of the Trust’s underlying holdings that may continue to have an adverse impact on investments in the Shares.

The following chart shows a comparison of the cumulative returns of the Index compared to the NAV of the Trust since inception to the period ended June 30, 2024.

Results of Operations

Financial Information for the Three and Six Months ended June 30, 2024 and 2023

The following table sets forth statements of operations data for the three and six months ended June 30, 2024 and 2023.

Statement of Operations (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended June 30, |

|

|

Six months ended June 30, |

|

|

|

2024

(unaudited) |

|

|

2023

(unaudited) |

|

|

2024

(unaudited) |

|

|

2023

(unaudited) |

|

Income |

|

|

|

|

|

|

|

|

|

|

|

|

Other |

|

$ |

— |

|

|

$ |

68,436 |

|

|

$ |

— |

|

|

$ |

68,436 |

|

Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

Management fee |

|

$ |

6,130,463 |

|

|

$ |

3,182,242 |

|

|

$ |

12,008,661 |

|

|

$ |

6,024,544 |

|

Transaction and other fees |

|

|

24 |

|

|

|

2,203 |

|

|

|

51 |

|

|

|

2,203 |

|

Total Expenses |

|

|

6,130,487 |

|

|

|

3,184,445 |

|

|

|

12,008,712 |

|

|

|

6,026,747 |

|

Net Investment gain (loss) |

|

|

(6,130,487 |

) |

|

|

(3,116,009 |

) |

|

|

(12,008,712 |

) |

|

|

(5,958,311 |

) |

Net realized and change in unrealized gain (loss) on investments |

|

|

|

|

|

|

|

|

|

|

|

|

Net realized gain (loss) from Crypto Assets |

|

|

(495,930 |

) |

|

|

(220,133 |

) |

|

|

1,020,735 |

|

|

|

(2,159,366 |

) |

Net change in unrealized appreciation (depreciation) from Crypto Assets |

|

|

(167,450,727 |

) |

|

|

21,961,446 |

|

|

|

258,794,961 |

|

|

|

223,022,103 |

|

Net realized and change in unrealized gain (loss) on investments |

|

|

(167,946,657 |

) |

|

|

21,741,313 |

|

|

|

259,815,696 |

|

|

|

220,862,737 |

|

Net increase (decrease) in Net Assets resulting from operations |

|

$ |

(174,077,144 |

) |

|

$ |

18,625,304 |

|

|

$ |

247,806,984 |

|

|

$ |

214,904,426 |

|

Comparison of the six-month periods ended June 30, 2024 and 2023

The following provides a discussion of the material items that impacted the Trust’s financial condition during the applicable period:

Management fees

The Sponsor charges the Trust a Management Fee payable monthly, in arrears, in an amount equal to 2.5% per annum (1/12th of 2.5% per month) of the net asset value of the Trust’s assets at the end of each month. Management fees for the six months ended

June 30, 2024 were $12,008,661 compared to management fees for the six months ended June 30, 2023 of $6,024,544. These changes were due to an increase in the Trust’s net asset value due to an increase in the value of the Portfolio Crypto Assets held by the Trust as a result of the fair market value of the Assets (see “Schedules of Investments” below).

Net realized gain (loss) from Crypto Assets

Net realized gain from Crypto Assets for the six months ended June 30, 2024 was $1,020,735 compared to net realized loss from Crypto Assets for the six months ended June 30, 2023 of $2,159,366. These changes were due to fluctuations in the value of the Portfolio Crypto Assets.