0001068689

false

Q2

--12-31

57,883

57883

0001068689

2023-01-01

2023-06-30

0001068689

2023-08-14

0001068689

2023-06-30

0001068689

2022-12-31

0001068689

us-gaap:RelatedPartyMember

2023-06-30

0001068689

us-gaap:RelatedPartyMember

2022-12-31

0001068689

us-gaap:SeriesAPreferredStockMember

2023-06-30

0001068689

us-gaap:SeriesAPreferredStockMember

2022-12-31

0001068689

us-gaap:SeriesBPreferredStockMember

2023-06-30

0001068689

us-gaap:SeriesBPreferredStockMember

2022-12-31

0001068689

2023-04-01

2023-06-30

0001068689

2022-04-01

2022-06-30

0001068689

2022-01-01

2022-06-30

0001068689

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2022-12-31

0001068689

us-gaap:CommonStockMember

2022-12-31

0001068689

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001068689

us-gaap:RetainedEarningsMember

2022-12-31

0001068689

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2023-03-31

0001068689

us-gaap:CommonStockMember

2023-03-31

0001068689

us-gaap:AdditionalPaidInCapitalMember

2023-03-31

0001068689

us-gaap:RetainedEarningsMember

2023-03-31

0001068689

2023-03-31

0001068689

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2021-12-31

0001068689

us-gaap:CommonStockMember

2021-12-31

0001068689

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0001068689

us-gaap:RetainedEarningsMember

2021-12-31

0001068689

2021-12-31

0001068689

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2022-03-31

0001068689

us-gaap:CommonStockMember

2022-03-31

0001068689

us-gaap:AdditionalPaidInCapitalMember

2022-03-31

0001068689

us-gaap:RetainedEarningsMember

2022-03-31

0001068689

2022-03-31

0001068689

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2023-01-01

2023-06-30

0001068689

us-gaap:CommonStockMember

2023-01-01

2023-06-30

0001068689

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-06-30

0001068689

us-gaap:RetainedEarningsMember

2023-01-01

2023-06-30

0001068689

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2023-04-01

2023-06-30

0001068689

us-gaap:CommonStockMember

2023-04-01

2023-06-30

0001068689

us-gaap:AdditionalPaidInCapitalMember

2023-04-01

2023-06-30

0001068689

us-gaap:RetainedEarningsMember

2023-04-01

2023-06-30

0001068689

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2022-01-01

2022-06-30

0001068689

us-gaap:CommonStockMember

2022-01-01

2022-06-30

0001068689

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-06-30

0001068689

us-gaap:RetainedEarningsMember

2022-01-01

2022-06-30

0001068689

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2022-04-01

2022-06-30

0001068689

us-gaap:CommonStockMember

2022-04-01

2022-06-30

0001068689

us-gaap:AdditionalPaidInCapitalMember

2022-04-01

2022-06-30

0001068689

us-gaap:RetainedEarningsMember

2022-04-01

2022-06-30

0001068689

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2023-06-30

0001068689

us-gaap:CommonStockMember

2023-06-30

0001068689

us-gaap:AdditionalPaidInCapitalMember

2023-06-30

0001068689

us-gaap:RetainedEarningsMember

2023-06-30

0001068689

us-gaap:PreferredStockMember

us-gaap:SeriesAPreferredStockMember

2022-06-30

0001068689

us-gaap:CommonStockMember

2022-06-30

0001068689

us-gaap:AdditionalPaidInCapitalMember

2022-06-30

0001068689

us-gaap:RetainedEarningsMember

2022-06-30

0001068689

2022-06-30

0001068689

ATDS:AssetPurchaseAgreementMember

ATDS:CenturionHoldingsILLCMember

2022-01-18

2022-01-19

0001068689

ATDS:AssetPurchaseAgreementMember

ATDS:CenturionHoldingsILLCMember

ATDS:PromissoryNoteMember

2022-01-19

0001068689

ATDS:AssetPurchaseAgreementMember

ATDS:CenturionHoldingsILLCMember

2022-01-19

0001068689

ATDS:AssetPurchaseAgreementMember

ATDS:CenturionHoldingsILLCMember

2022-04-20

0001068689

2022-01-02

0001068689

us-gaap:SeriesAPreferredStockMember

2023-01-01

2023-06-30

0001068689

us-gaap:SeriesAPreferredStockMember

2022-01-01

2022-06-30

0001068689

ATDS:StockOptionsMember

2023-01-01

2023-06-30

0001068689

ATDS:StockOptionsMember

2022-01-01

2022-06-30

0001068689

us-gaap:WarrantMember

2023-01-01

2023-06-30

0001068689

us-gaap:WarrantMember

2022-01-01

2022-06-30

0001068689

us-gaap:FurnitureAndFixturesMember

2023-06-30

0001068689

us-gaap:FurnitureAndFixturesMember

2022-12-31

0001068689

us-gaap:ComputerEquipmentMember

2023-06-30

0001068689

us-gaap:ComputerEquipmentMember

2022-12-31

0001068689

us-gaap:GeneralAndAdministrativeExpenseMember

2023-01-01

2023-06-30

0001068689

us-gaap:GeneralAndAdministrativeExpenseMember

2022-01-01

2022-06-30

0001068689

ATDS:WordpressGDPRRightsMember

2023-06-30

0001068689

ATDS:WordpressGDPRRightsMember

2022-12-31

0001068689

ATDS:ARALOCMember

2023-06-30

0001068689

ATDS:ARALOCMember

2022-12-31

0001068689

ATDS:ArcMailLicenseMember

2023-06-30

0001068689

ATDS:ArcMailLicenseMember

2022-12-31

0001068689

ATDS:DataExpressMember

2023-06-30

0001068689

ATDS:DataExpressMember

2022-12-31

0001068689

ATDS:FileFacetsMember

2023-06-30

0001068689

ATDS:FileFacetsMember

2022-12-31

0001068689

ATDS:IntellyWPMember

2023-06-30

0001068689

ATDS:IntellyWPMember

2022-12-31

0001068689

ATDS:ResilientNetworkSystemsMember

2023-06-30

0001068689

ATDS:ResilientNetworkSystemsMember

2022-12-31

0001068689

2022-01-01

2022-12-31

0001068689

us-gaap:ConvertibleNotesPayableMember

ATDS:IssuedInFiscalYearTwoThousandAndTwentyMember

2023-06-30

0001068689

us-gaap:ConvertibleNotesPayableMember

ATDS:IssuedInFiscalYearTwoThousandAndTwentyMember

2022-12-31

0001068689

us-gaap:ConvertibleNotesPayableMember

ATDS:IssuedInFiscalYearTwoThousandAndTwentyOneMember

2023-06-30

0001068689

us-gaap:ConvertibleNotesPayableMember

ATDS:IssuedInFiscalYearTwoThousandAndTwentyOneMember

2022-12-31

0001068689

us-gaap:ConvertibleNotesPayableMember

ATDS:IssuedInFiscalYearTwoThousandAndTwentyTwoMember

2023-06-30

0001068689

us-gaap:ConvertibleNotesPayableMember

ATDS:IssuedInFiscalYearTwoThousandAndTwentyTwoMember

2022-12-31

0001068689

us-gaap:ConvertibleNotesPayableMember

ATDS:IssuedInFiscalYearTwoThousandAndTwentyThreeMember

2023-06-30

0001068689

us-gaap:ConvertibleNotesPayableMember

ATDS:IssuedInFiscalYearTwoThousandAndTwentyThreeMember

2022-12-31

0001068689

us-gaap:ConvertibleNotesPayableMember

2023-06-30

0001068689

us-gaap:ConvertibleNotesPayableMember

2022-12-31

0001068689

us-gaap:ConvertibleNotesPayableMember

2023-01-01

2023-06-30

0001068689

us-gaap:ConvertibleNotesPayableMember

2022-01-01

2022-12-31

0001068689

us-gaap:ConvertibleNotesPayableMember

2022-01-01

2022-06-30

0001068689

ATDS:PromissoryNotesIssuedInFiscalYearTwoThousandAndTwentyMember

2020-12-31

0001068689

ATDS:PromissoryNotesIssuedInFiscalYearTwoThousandAndTwentyMember

2020-01-01

2020-12-31

0001068689

ATDS:PromissoryNotesIssuedInFiscalYearTwoThousandAndTwentyOneMember

2021-12-31

0001068689

ATDS:PromissoryNotesIssuedInFiscalYearTwoThousandAndTwentyOneMember

2021-01-01

2021-12-31

0001068689

srt:MinimumMember

ATDS:PromissoryNotesIssuedInFiscalYearTwoThousandAndTwentyOneMember

2021-01-01

2021-12-31

0001068689

srt:MaximumMember

ATDS:PromissoryNotesIssuedInFiscalYearTwoThousandAndTwentyOneMember

2021-01-01

2021-12-31

0001068689

srt:MinimumMember

ATDS:PromissoryNotesIssuedInFiscalYearTwoThousandAndTwentyOneMember

2021-12-31

0001068689

srt:MaximumMember

ATDS:PromissoryNotesIssuedInFiscalYearTwoThousandAndTwentyOneMember

2021-12-31

0001068689

2022-10-19

0001068689

ATDS:PromissoryNotesIssuedInFiscalYearTwoThousandAndTwentyOneMember

2023-06-30

0001068689

ATDS:TwoThousandTwentyOneConvertibleNotesMember

2021-01-01

2021-12-31

0001068689

ATDS:TwoThousandTwentyOneConvertibleNotesMember

2021-12-31

0001068689

ATDS:TwoThousandTwentyOneConvertibleNotesMember

srt:MinimumMember

2021-12-31

0001068689

ATDS:TwoThousandTwentyOneConvertibleNotesMember

srt:MaximumMember

2021-12-31

0001068689

ATDS:TwoThousandTwentyOneConvertibleNotesMember

2023-01-01

2023-06-30

0001068689

ATDS:PromissoryNotesIssuedInFiscalYearTwoThousandAndTwentyTwoMember

2022-01-01

2022-12-31

0001068689

ATDS:PromissoryNotesIssuedInFiscalYearTwoThousandAndTwentyTwoMember

srt:MinimumMember

2022-01-01

2022-12-31

0001068689

ATDS:PromissoryNotesIssuedInFiscalYearTwoThousandAndTwentyTwoMember

srt:MaximumMember

2022-01-01

2022-12-31

0001068689

ATDS:PromissoryNotesIssuedInFiscalYearTwoThousandAndTwentyTwoMember

srt:MinimumMember

2022-12-31

0001068689

ATDS:PromissoryNotesIssuedInFiscalYearTwoThousandAndTwentyTwoMember

srt:MaximumMember

2022-12-31

0001068689

ATDS:NoteExchangeAgreementMember

2023-06-30

0001068689

ATDS:NoteExchangeAgreementMember

ATDS:WestlandPropertiesLLCMember

2023-06-30

0001068689

ATDS:NoteExchangeAgreementMember

2023-01-01

2023-06-30

0001068689

srt:RevisionOfPriorPeriodAccountingStandardsUpdateAdjustmentMember

us-gaap:AccountingStandardsUpdate202006Member

2022-01-01

0001068689

ATDS:PromissoryNotesIssuedInFiscalYearTwoThousandAndTwentyTwoMember

2023-01-01

2023-06-30

0001068689

ATDS:PromissoryNotesIssuedInFiscalYearTwoThousandAndTwentyOneMember

2023-01-01

2023-06-30

0001068689

ATDS:PromissoryNotesIssuedInFiscalYearTwoThousandAndTwentyTwoMember

srt:MinimumMember

2023-01-01

2023-06-30

0001068689

ATDS:PromissoryNotesIssuedInFiscalYearTwoThousandAndTwentyTwoMember

srt:MaximumMember

2023-01-01

2023-06-30

0001068689

ATDS:PromissoryNotesIssuedInFiscalYearTwoThousandAndTwentyTwoMember

srt:MinimumMember

2023-06-30

0001068689

ATDS:PromissoryNotesIssuedInFiscalYearTwoThousandAndTwentyTwoMember

srt:MaximumMember

2023-06-30

0001068689

us-gaap:MeasurementInputExpectedTermMember

us-gaap:FairValueMeasurementsRecurringMember

2022-12-31

0001068689

us-gaap:MeasurementInputPriceVolatilityMember

us-gaap:FairValueMeasurementsRecurringMember

2022-12-31

0001068689

us-gaap:MeasurementInputExpectedDividendRateMember

us-gaap:FairValueMeasurementsRecurringMember

2023-06-30

0001068689

us-gaap:MeasurementInputExpectedDividendRateMember

us-gaap:FairValueMeasurementsRecurringMember

2022-12-31

0001068689

us-gaap:MeasurementInputRiskFreeInterestRateMember

2022-12-31

0001068689

ATDS:EconomicInjuryDisasterLoanOriginatedInMay2020Member

2023-06-30

0001068689

ATDS:EconomicInjuryDisasterLoanOriginatedInMay2020Member

2022-12-31

0001068689

ATDS:EconomicInjuryDisasterLoanOriginatedInMay2020Member

2023-01-01

2023-06-30

0001068689

ATDS:PromissoryNoteOriginatedInSeptember2020Member

2023-06-30

0001068689

ATDS:PromissoryNoteOriginatedInSeptember2020Member

2022-12-31

0001068689

ATDS:PromissoryNoteOriginatedInSeptember2020Member

2023-01-01

2023-06-30

0001068689

ATDS:PromissoryNoteOriginatedInDecember2020Member

2023-06-30

0001068689

ATDS:PromissoryNoteOriginatedInDecember2020Member

2022-12-31

0001068689

ATDS:PromissoryNoteOriginatedInDecember2020Member

2023-01-01

2023-06-30

0001068689

ATDS:PromissoryNoteOriginatedInJanuary2021Member

2023-06-30

0001068689

ATDS:PromissoryNoteOriginatedInJanuary2021Member

2022-12-31

0001068689

ATDS:PromissoryNoteOriginatedInJanuary2021Member

2023-01-01

2023-06-30

0001068689

ATDS:PromissoryNoteOriginatedInFebruary2021Member

2023-06-30

0001068689

ATDS:PromissoryNoteOriginatedInFebruary2021Member

2022-12-31

0001068689

ATDS:PromissoryNoteOriginatedInFebruary2021Member

2023-01-01

2023-06-30

0001068689

ATDS:PromissoryNoteOriginatedInApril2021Member

2023-06-30

0001068689

ATDS:PromissoryNoteOriginatedInApril2021Member

2022-12-31

0001068689

ATDS:PromissoryNoteOriginatedInApril2021Member

2023-01-01

2023-06-30

0001068689

ATDS:PromissoryNoteOriginatedInJuly2021Member

2023-06-30

0001068689

ATDS:PromissoryNoteOriginatedInJuly2021Member

2022-12-31

0001068689

ATDS:PromissoryNoteOriginatedInJuly2021Member

2023-01-01

2023-06-30

0001068689

ATDS:PromissoryNoteOriginatedInSeptember2021Member

2023-06-30

0001068689

ATDS:PromissoryNoteOriginatedInSeptember2021Member

2022-12-31

0001068689

ATDS:PromissoryNoteOriginatedInSeptember2021Member

2023-01-01

2023-06-30

0001068689

ATDS:PromissoryNoteOriginatedInApril2022OneMember

2023-06-30

0001068689

ATDS:PromissoryNoteOriginatedInApril2022OneMember

2022-12-31

0001068689

ATDS:PromissoryNoteOriginatedInApril2022OneMember

2023-01-01

2023-06-30

0001068689

ATDS:PromissoryNoteOriginatedInApril2022TwoMember

2023-06-30

0001068689

ATDS:PromissoryNoteOriginatedInApril2022TwoMember

2022-12-31

0001068689

ATDS:PromissoryNoteOriginatedInApril2022TwoMember

2023-01-01

2023-06-30

0001068689

ATDS:PromissoryNoteOriginatedInJune2022OneMember

2023-06-30

0001068689

ATDS:PromissoryNoteOriginatedInJune2022OneMember

2022-12-31

0001068689

ATDS:PromissoryNoteOriginatedInJune2022OneMember

2023-01-01

2023-06-30

0001068689

ATDS:PromissoryNoteOriginatedInJuly2022Member

2023-06-30

0001068689

ATDS:PromissoryNoteOriginatedInJuly2022Member

2022-12-31

0001068689

ATDS:PromissoryNoteOriginatedInJuly2022Member

2023-01-01

2023-06-30

0001068689

ATDS:PromissoryNoteOriginatedInJuly2022TwoMember

2023-06-30

0001068689

ATDS:PromissoryNoteOriginatedInJuly2022TwoMember

2022-12-31

0001068689

ATDS:PromissoryNoteOriginatedInJuly2022TwoMember

2023-01-01

2023-06-30

0001068689

ATDS:PromissoryNoteOriginatedInAugust2022Member

2023-06-30

0001068689

ATDS:PromissoryNoteOriginatedInAugust2022Member

2022-12-31

0001068689

ATDS:PromissoryNoteOriginatedInAugust2022Member

2023-01-01

2023-06-30

0001068689

ATDS:PromissoryNoteOriginatedInOctober2022Member

2023-06-30

0001068689

ATDS:PromissoryNoteOriginatedInOctober2022Member

2022-12-31

0001068689

ATDS:PromissoryNoteOriginatedInOctober2022Member

2023-01-01

2023-06-30

0001068689

ATDS:PromissoryNoteOriginatedInJanuary2023Member

2023-06-30

0001068689

ATDS:PromissoryNoteOriginatedInJanuary2023Member

2022-12-31

0001068689

ATDS:PromissoryNoteOriginatedInJanuary2023Member

2023-01-01

2023-06-30

0001068689

ATDS:PromissoryNoteOriginatedInMarch2023Member

2023-06-30

0001068689

ATDS:PromissoryNoteOriginatedInMarch2023Member

2022-12-31

0001068689

ATDS:PromissoryNoteOriginatedInMarch2023Member

2023-01-01

2023-06-30

0001068689

ATDS:PromissoryNoteOriginatedInMarch2023TwoMember

2023-06-30

0001068689

ATDS:PromissoryNoteOriginatedInMarch2023TwoMember

2022-12-31

0001068689

ATDS:PromissoryNoteOriginatedInMarch2023TwoMember

2023-01-01

2023-06-30

0001068689

ATDS:PromissoryNoteOriginatedInApril2023Member

2023-06-30

0001068689

ATDS:PromissoryNoteOriginatedInApril2023Member

2022-12-31

0001068689

ATDS:PromissoryNoteOriginatedInApril2023Member

2023-01-01

2023-06-30

0001068689

ATDS:PromissoryNoteOriginatedInApril2023TwoMember

2023-06-30

0001068689

ATDS:PromissoryNoteOriginatedInApril2023TwoMember

2022-12-31

0001068689

ATDS:PromissoryNoteOriginatedInApril2023TwoMember

2023-01-01

2023-06-30

0001068689

ATDS:PromissoryNoteOriginatedInMay2023Member

2023-06-30

0001068689

ATDS:PromissoryNoteOriginatedInMay2023Member

2022-12-31

0001068689

ATDS:PromissoryNoteOriginatedInMay2023Member

2023-01-01

2023-06-30

0001068689

us-gaap:NotesPayableOtherPayablesMember

2023-01-01

2023-06-30

0001068689

us-gaap:NotesPayableOtherPayablesMember

2022-01-01

2022-06-30

0001068689

us-gaap:SeriesBPreferredStockMember

2023-01-01

2023-06-30

0001068689

ATDS:WarrantOneMember

2023-06-30

0001068689

ATDS:WarrantTwoMember

2023-06-30

0001068689

ATDS:WarrantThreeMember

2023-06-30

0001068689

ATDS:WarrantFourMember

2023-06-30

0001068689

ATDS:WarrantFiveMember

2023-06-30

0001068689

ATDS:WarrantSixMember

2023-06-30

0001068689

ATDS:WarrantSevenMember

2023-06-30

0001068689

ATDS:StockOptionsMember

2023-01-01

2023-06-30

0001068689

ATDS:StockOptionsMember

srt:MaximumMember

2023-01-01

2023-06-30

0001068689

ATDS:StockOptionsMember

2023-06-30

0001068689

ATDS:StockOptionsMember

2022-12-31

0001068689

ATDS:EmployeesConsultantsAndAdvisorsMember

2022-12-31

0001068689

ATDS:EmployeesConsultantsAndAdvisorsMember

2023-01-01

2023-06-30

0001068689

ATDS:EmployeesConsultantsAndAdvisorsMember

2023-06-30

0001068689

us-gaap:RestrictedStockMember

2022-12-31

0001068689

us-gaap:RestrictedStockMember

2023-01-01

2023-06-30

0001068689

us-gaap:RestrictedStockMember

2023-06-30

0001068689

ATDS:RestrictedStockAwardsMember

2023-01-01

2023-06-30

0001068689

ATDS:RestrictedStockAwardsMember

2022-01-01

2022-12-31

0001068689

srt:ChiefExecutiveOfficerMember

2023-01-01

2023-06-30

0001068689

srt:ChiefFinancialOfficerMember

2023-01-01

2023-06-30

0001068689

ATDS:RootVenturesLLCMember

us-gaap:SubsequentEventMember

2023-07-07

2023-07-07

0001068689

ATDS:RootVenturesLLCMember

us-gaap:SubsequentEventMember

2023-07-07

0001068689

us-gaap:SubsequentEventMember

ATDS:PurchaseAgreementMember

ATDS:InvestorOneMember

2023-07-06

0001068689

us-gaap:SubsequentEventMember

ATDS:PurchaseAgreementMember

ATDS:InvestorTwoMember

2023-07-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

ATDS:Number

xbrli:pure

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-Q

(Mark

One)

☒

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934.

For

the quarterly period ended June 30, 2023

OR

☐

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the transition period from ________ to ________

Commission

File Number: 000-30542

DATA443

RISK MITIGATION, INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

86-0914051 |

(State

of

incorporation) |

|

(I.R.S.

Employer

Identification

No.) |

| |

|

|

4000

Sancar Way, Suite 400

Research

Triangle Park, North Carolina |

|

27709 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

(919)

858-6542

(Registrant’s

telephone number, including area code)

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of Each Class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| N/A |

|

N/A |

|

N/A |

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and, (2)

has been subject to such filing requirements for the past 90 days.

Yes

☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files).

Yes

☒ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”,

“smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer ☐ |

Accelerated

filer ☐ |

| Non-accelerated

filer ☒ |

Smaller

reporting company ☒ |

| |

Emerging

growth company ☒ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes

☐ No ☒

The

outstanding number of shares of common stock as of August 14, 2023 was 61,413,168.

DATA443

RISK MITIGATION, INC.

FORM

10-Q

TABLE

OF CONTENTS

PART

I

FINANCIAL

INFORMATION

| ITEM

1. |

FINANCIAL

STATEMENTS |

DATA443

RISK MITIGATION, INC.

CONDENSED

CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

| | |

June 30, | | |

December 31, | |

| | |

2023 | | |

2022 | |

| Assets | |

| | | |

| | |

| Current assets | |

| | | |

| | |

| Cash | |

$ | 15,904 | | |

$ | 1,712 | |

| Accounts receivable, net | |

| 3,147 | | |

| 31,978 | |

| Prepaid expense and other current assets | |

| 273,159 | | |

| 91,204 | |

| Total current assets | |

| 292,210 | | |

| 124,894 | |

| | |

| | | |

| | |

| Property and equipment, net | |

| 503,242 | | |

| 427,031 | |

| Operating lease right-of-use assets, net | |

| 249,796 | | |

| 405,148 | |

| Advance payment for acquisition | |

| 2,726,188 | | |

| 2,726,188 | |

| Intellectual property, net of accumulated amortization | |

| 204,997 | | |

| 454,331 | |

| Deposits | |

| 45,673 | | |

| 45,673 | |

| Total Assets | |

$ | 4,022,106 | | |

$ | 4,183,265 | |

| | |

| | | |

| | |

| Liabilities and Stockholders’ Deficit | |

| | | |

| | |

| Current Liabilities | |

| | | |

| | |

| | |

| | | |

| | |

| Accounts payable and accrued liabilities | |

| 2,221,000 | | |

| 1,031,931 | |

| Deferred revenue | |

| 1,814,620 | | |

| 1,704,249 | |

| Interest payable | |

| 616,593 | | |

| 478,712 | |

| Notes payable, net of unamortized discount | |

| 2,267,658 | | |

| 918,785 | |

| Convertible notes payable, net of unamortized discount | |

| 2,721,171 | | |

| 4,134,155 | |

| Due to a related party | |

| 320,488 | | |

| 112,062 | |

| Operating lease liability | |

| 338,818 | | |

| 213,831 | |

| Finance lease liability | |

| - | | |

| 10,341 | |

| Total Current Liabilities | |

| 10,300,348 | | |

| 8,604,066 | |

| | |

| | | |

| | |

| Notes payable, net of unamortized discount - non-current | |

| 1,605,855 | | |

| 3,104,573 | |

| Convertible notes payable, net of unamortized discount - non-current | |

| 97,946 | | |

| 97,946 | |

| Deferred revenues - non-current | |

| 515,000 | | |

| 788,902 | |

| Operating lease liability - non-current | |

| - | | |

| 354,631 | |

| | |

| | | |

| | |

| Total Liabilities | |

| 12,519,149 | | |

| 12,950,118 | |

| | |

| | | |

| | |

| Commitments and Contingencies | |

| - | | |

| - | |

| | |

| | | |

| | |

| Stockholders’ Deficit | |

| | | |

| | |

| Series A Preferred Stock, 150,000

shares designated; $0.001

par value; 149,892

shares issued and outstanding, respectively | |

| 150 | | |

| 150 | |

| Series B Preferred Stock, 80,000 designated; $10 par value; 0 shares issued and outstanding | |

| - | | |

| - | |

| Preferred stock, value | |

| | | |

| | |

| Common stock: 500,000,000 authorized; $0.001 par value 59,363,988 and 2,615,737 shares issued and outstanding as of June 30, 2023 and December 31, 2022, respectively | |

|

59,360

| | |

| 2,611 | |

| Additional paid in capital | |

| 43,503,928 | | |

| 42,642,514 | |

| Accumulated deficit | |

| (52,060,481 | ) | |

| (51,412,128 | ) |

| Total Stockholders’ Deficit | |

| (8,497,043 | ) | |

| (8,766,853 | ) |

| Total Liabilities and Stockholders’ Deficit | |

$ | 4,022,106 | | |

$ | 4,183,265 | |

See

the accompanying notes, which are an integral part of these unaudited condensed consolidated financial statements.

DATA443

RISK MITIGATION, INC.

CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED)

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

Three Months Ended | | |

Six Months Ended | |

| | |

June 30, | | |

June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

| | |

| | |

| | |

| |

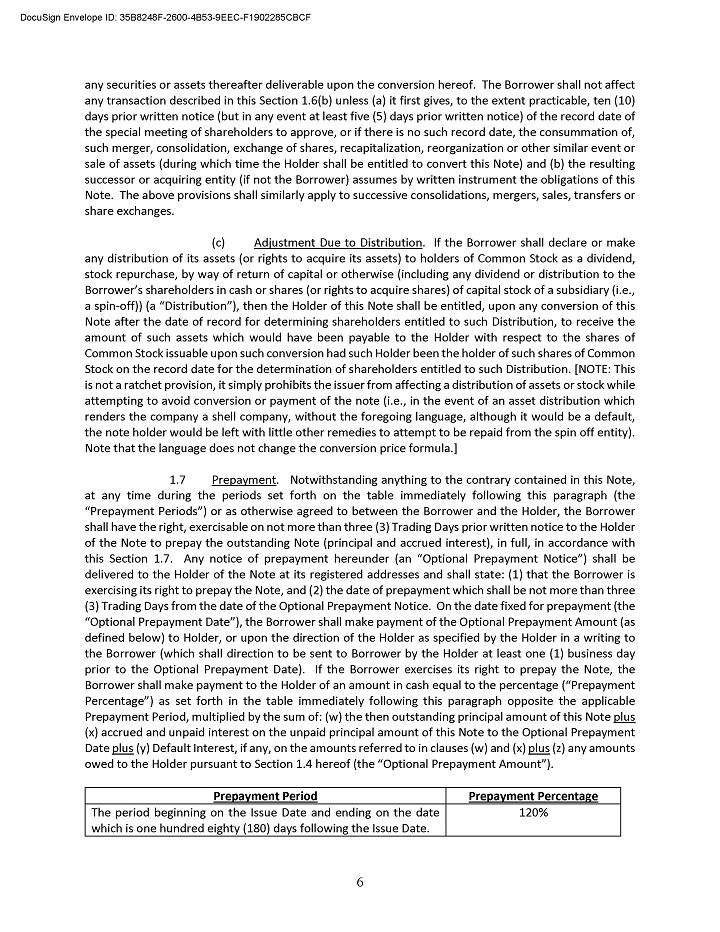

| Revenue | |

$ | 619,040 | | |

$ | 750,989 | | |

$ | 1,998,846 | | |

$ | 1,363,505 | |

| Cost of revenue | |

| 244,881 | | |

| 78,593 | | |

| 453,863 | | |

| 278,272 | |

| Gross profit | |

| 374,159 | | |

| 672,396 | | |

| 1,544,983 | | |

| 1,085,233 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses | |

| | | |

| | | |

| | | |

| | |

| General and administrative | |

| 1,635,499 | | |

| 2,116,220 | | |

| 3,036,308 | | |

| 3,089,782 | |

| Sales and marketing | |

| 64,379 | | |

| 59,635 | | |

| 96,553 | | |

| 180,030 | |

| Total operating expenses | |

| 1,699,878 | | |

| 2,175,855 | | |

| 3,132,861 | | |

| 3,269,812 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from operations | |

| (1,325,719 | ) | |

| (1,503,459 | ) | |

| (1,587,878 | ) | |

| (2,184,579 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other income (expense) | |

| | | |

| | | |

| | | |

| | |

| Interest expense | |

| (3,488,822 | ) | |

| (942,753 | ) | |

| (3,964,556 | ) | |

| (2,037,069 | ) |

| Gain (loss) on settlement of debt | |

| 4,904,081 | | |

| - | | |

| 4,904,081 | | |

| - | |

| Change in fair value of derivative liability | |

| - | | |

| - | | |

| - | | |

| (57,883 | ) |

| Total other expense | |

| 1,415,259 | | |

| (942,753 | ) | |

| 939,525 | | |

| (2,094,952 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Provision for income taxes | |

| - | | |

| - | | |

| - | | |

| - | |

| Net income/(loss) | |

$ | 89,540 | | |

$ | (2,446,212 | ) | |

$ | (648,353 | ) | |

$ | (4,279,531 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Dividend on Series B Preferred Stock | |

| - | | |

| - | | |

| - | | |

| (104,631 | ) |

| Net income/(loss) attributable to common stockholders | |

$ |

89,540 | | |

$ | (2,446,212 | ) | |

$ | (648,353 | ) | |

$ | (4,384,162 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted income/(loss) per Common Share | |

$ | 0.00 | | |

$ | (25.10 | ) | |

$ | (0.04 | ) | |

$ | (9.62 | ) |

| Basic and diluted weighted average number of common shares outstanding | |

| 28,510,444 | | |

| 97,477 | | |

| 16,334,701 | | |

| 444,824 | |

See

the accompanying notes, which are an integral part of these unaudited condensed consolidated financial statements.

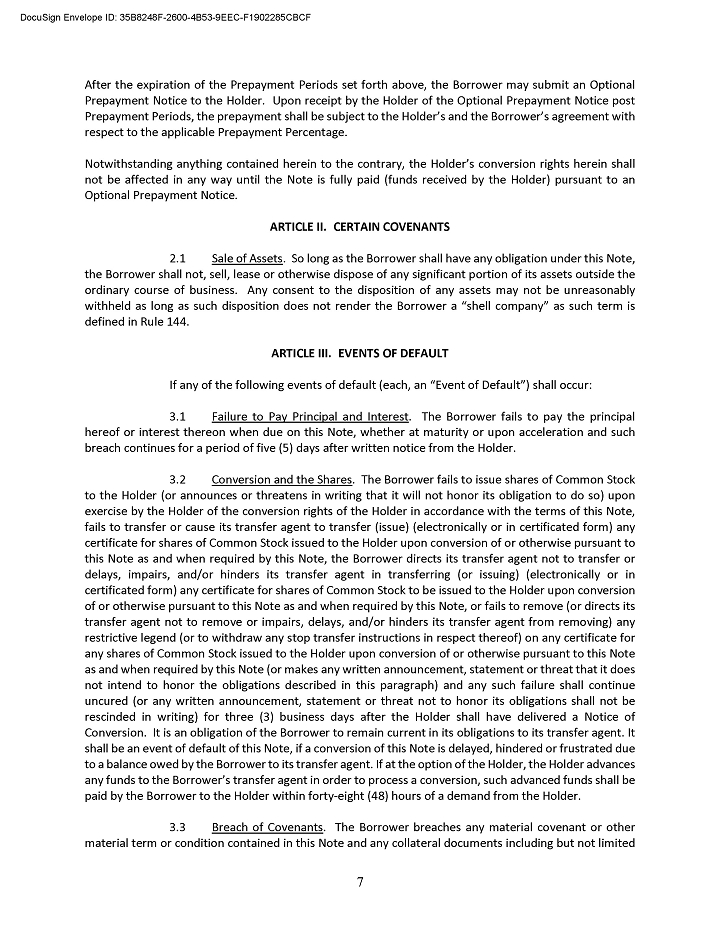

DATA443

RISK MITIGATION, INC.

CONDENSED

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ DEFICIT

(UNAUDITED)

Six

Months Ended June 30, 2023

| |

|

Shares |

|

|

Amount |

|

|

Shares |

|

|

Amount |

|

|

Capital |

|

|

Deficit |

|

|

Deficit |

|

| |

|

Series

A |

|

|

|

|

|

|

|

|

Additional |

|

|

|

|

|

Total |

|

| |

|

Preferred

Stock |

|

|

Common

stock |

|

|

Paid

in |

|

|

Accumulated |

|

|

Stockholders’ |

|

| |

|

Shares |

|

|

Amount |

|

|

Shares |

|

|

Amount |

|

|

Capital |

|

|

Deficit |

|

|

Deficit |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance

- December 31, 2022 |

|

|

149,892 |

|

|

$ |

150 |

|

|

|

2,615,737 |

|

|

$ |

2,611 |

|

|

$ |

42,642,514 |

|

|

$ |

(51,412,128 |

) |

|

$ |

(8,766,853 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Subscription of stock for cash |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

20,000 |

|

|

|

- |

|

|

|

20,000 |

|

| Common

stock issued for conversion of debt |

|

|

- |

|

|

|

- |

|

|

|

10,807,823 |

|

|

|

10,808 |

|

|

|

321,784 |

|

|

|

- |

|

|

|

332,592 |

|

| Common stock issued for adjustment to PPM investors |

|

|

- |

|

|

|

- |

|

|

|

45,619,000 |

|

|

|

45,619 |

|

|

|

(45,619 |

) |

|

|

- |

|

|

|

- |

|

| Stock-based

compensation |

|

|

- |

|

|

|

- |

|

|

|

321,428 |

|

|

|

322 |

|

|

|

565,249 |

|

|

|

- |

|

|

|

565,571 |

|

| Net

loss |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(648,353 |

) |

|

|

(648,353 |

) |

| Balance

– June 30, 2023 |

|

|

149,892 |

|

|

$ |

150 |

|

|

|

59,363,988 |

|

|

$ |

59,360 |

|

|

$ |

43,503,928 |

|

|

$ |

(52,060,481 |

) |

|

$ |

(8,497,043 |

) |

Three

Months Ended June 30, 2023

| | |

Series A | | |

| | |

| | |

Additional | | |

| | |

Total | |

| | |

Preferred Stock | | |

Common stock | | |

Paid in | | |

Accumulated | | |

Stockholders’ | |

| | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Capital | | |

Deficit | | |

Deficit | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Balance - March 31, 2023 | |

| 149,892 | | |

$ | 150 | | |

| 6,746,764 | | |

$ | 6,742 | | |

$ | 42,982,226 | | |

$ | (52,150,021 | ) | |

$ | (9,160,903 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Subscription of stock for cash | |

| - | | |

| - | | |

| - | | |

| - | | |

| 20,000 | | |

| - | | |

| 20,000 | |

| Common stock issued for conversion of debt | |

| - | | |

| - | | |

| 6,676,796 | | |

| 6,677 | | |

| 95,926 | | |

| - | | |

| 102,603 | |

| Common stock issued for adjustment to PPM investors | |

| - | | |

| - | | |

| 45,619,000 | | |

| 45,619 | | |

| (45,619 | ) | |

| - | | |

| - | |

| Stock-based compensation | |

| - | | |

| - | | |

| 321,428 | | |

| 322 | | |

| 451,395 | | |

| - | | |

| 451,717 | |

| Net income | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 89,540 | | |

| 89,540 | |

| Balance – June 30, 2023 | |

| 149,892 | | |

$ | 150 | | |

| 59,363,988 | | |

$ | 59,360 | | |

$ | 43,503,928 | | |

$ | (52,060,481 | ) | |

$ | (8,497,043 | ) |

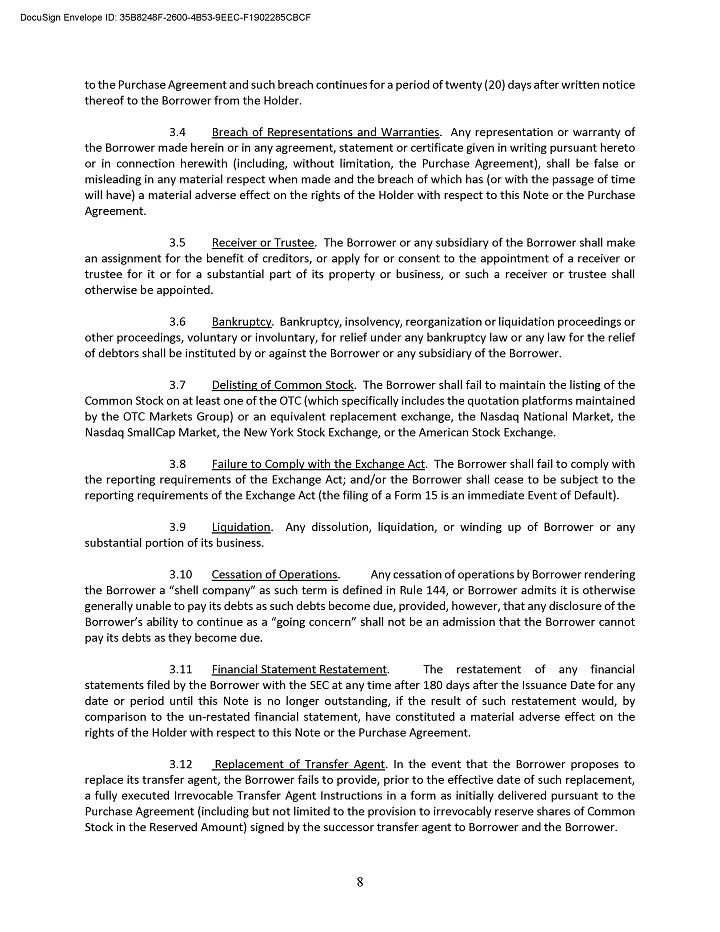

Six

Months Ended June 30, 2022

| | |

Series A | | |

| | |

| | |

Additional | | |

| | |

Total | |

| | |

Preferred Stock | | |

Common Stock | | |

Paid in | | |

Accumulated | | |

Stockholders’ | |

| | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Capital | | |

Deficit | | |

Deficit | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Balance - December 31, 2021 | |

| 150,000 | | |

$ | 150 | | |

| 122,044 | | |

$ | 122 | | |

$ | 37,810,380 | | |

$ | (42,033,887 | ) | |

$ | (4,223,235 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Cumulative-effect adjustment from adoption of ASU 2020-06 | |

| - | | |

| - | | |

| - | | |

| - | | |

| (517,500 | ) | |

| 439,857 | | |

| (77,643 | ) |

| Common stock issued for acquisition of Centurion assets | |

| - | | |

| - | | |

| 380,952 | | |

| 381 | | |

| 2,475,807 | | |

| - | | |

| 2,476,188 | |

| Common stock issued for conversion of preferred stock | |

| (108 | ) | |

| - | | |

| 108,000 | | |

| 108 | | |

| (108 | ) | |

| | | |

| - | |

| Common stock issued for conversion of debt | |

| - | | |

| - | | |

| 165,273 | | |

| 165 | | |

| 29,160 | | |

| - | | |

| 29,325 | |

| Common stock issued in conjunction with convertible notes | |

| - | | |

| - | | |

| 18,170 | | |

| 18 | | |

| 140,918 | | |

| - | | |

| 140,936 | |

| Common stock issued for exercised cashless warrant | |

| - | | |

| - | | |

| 6,631 | | |

| 7 | | |

| (7 | ) | |

| - | | |

| - | |

| Common stock issued for service | |

| - | | |

| - | | |

| 153,491 | | |

| 153 | | |

| 844,048 | | |

| - | | |

| 844,201 | |

| Resolution of derivative liability upon exercise of warrant | |

| - | | |

| - | | |

| | | |

| - | | |

| 57,883 | | |

| - | | |

| 57,883 | |

| Warrant issued in conjunction with debts | |

| - | | |

| - | | |

| | | |

| - | | |

| 47,628 | | |

| - | | |

| 47,628 | |

| Stock-based compensation | |

| - | | |

| - | | |

| | | |

| - | | |

| (45,511 | ) | |

| - | | |

| (45,511 | ) |

| Net loss | |

| - | | |

| - | | |

| | | |

| - | | |

| - | | |

| (4,384,162 | ) | |

| (4,384,162 | ) |

| Balance - June 30, 2022 | |

| 149,892 | | |

$ | 150 | | |

| 954,561 | | |

$ | 954 | | |

$ | 40,842,698 | | |

$ | (45,978,192 | ) | |

$ | (5,134,390 | ) |

See

the accompanying notes, which are an integral part of these unaudited condensed consolidated financial statements.

Three

months ended June 30, 2022

| | |

Series A | | |

| | |

| | |

Additional | | |

| | |

Total | |

| | |

Preferred Stock | | |

Common Stock | | |

Paid in | | |

Accumulated | | |

Stockholders’ | |

| | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Capital | | |

Deficit | | |

Deficit | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Balance - March 31, 2022 | |

| 150,000 | | |

$ | 150 | | |

| 148,367 | | |

$ | 148 | | |

$ | 37,353,357 | | |

$ | (43,531,980 | ) | |

$ | (6,178,325 | ) |

| Balance | |

| 150,000 | | |

$ | 150 | | |

| 148,367 | | |

$ | 148 | | |

$ | 37,353,357 | | |

$ | (43,531,980 | ) | |

$ | (6,178,325 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Common stock issued for acquisition of Centurion assets | |

| - | | |

| - | | |

| 380,952 | | |

| 381 | | |

| 2,475,807 | | |

| - | | |

| 2,476,188 | |

| Common stock issued for conversion of preferred stock | |

| (108 | ) | |

| - | | |

| 108,000 | | |

| 108 | | |

| (108 | ) | |

| - | | |

| - | |

| Common stock issued for conversion of debt | |

| - | | |

| - | | |

| 151,200 | | |

| 151 | | |

| 1,361 | | |

| - | | |

| 1,512 | |

| Common stock issued for service | |

| - | | |

| - | | |

| 153,491 | | |

| 153 | | |

| 844,048 | | |

| - | | |

| 844,201 | |

| Common stock issued in conjunction with convertible notes | |

| - | | |

| - | | |

| 12,551 | | |

| 13 | | |

| 78,431 | | |

| - | | |

| 78,444 | |

| Warrant issued in conjunction with debts | |

| - | | |

| - | | |

| - | | |

| - | | |

| 47,628 | | |

| - | | |

| 47,628 | |

| Stock-based compensation | |

| - | | |

| - | | |

| - | | |

| - | | |

| 42,174 | | |

| - | | |

| 42,174 | |

| Adjustment of reverse stock split | |

| - | | |

| - | | |

| | | |

| | | |

| | | |

| - | | |

| - | |

| Net loss | |

| - | | |

| - | | |

| | | |

| | | |

| | | |

| (2,446,212 | ) | |

| (2,446,212 | ) |

| Net

income (loss) | |

| - | | |

| - | | |

| | | |

| | | |

| | | |

| (2,446,212 | ) | |

| (2,446,212 | ) |

| Balance - June 30, 2022 | |

| 149,892 | | |

| 150 | | |

| 954,561 | | |

| 954 | | |

| 40,842,698 | | |

| (45,978,192 | ) | |

| (5,134,390 | ) |

| Balance | |

| 149,892 | | |

| 150 | | |

| 954,561 | | |

| 954 | | |

| 40,842,698 | | |

| (45,978,192 | ) | |

| (5,134,390 | ) |

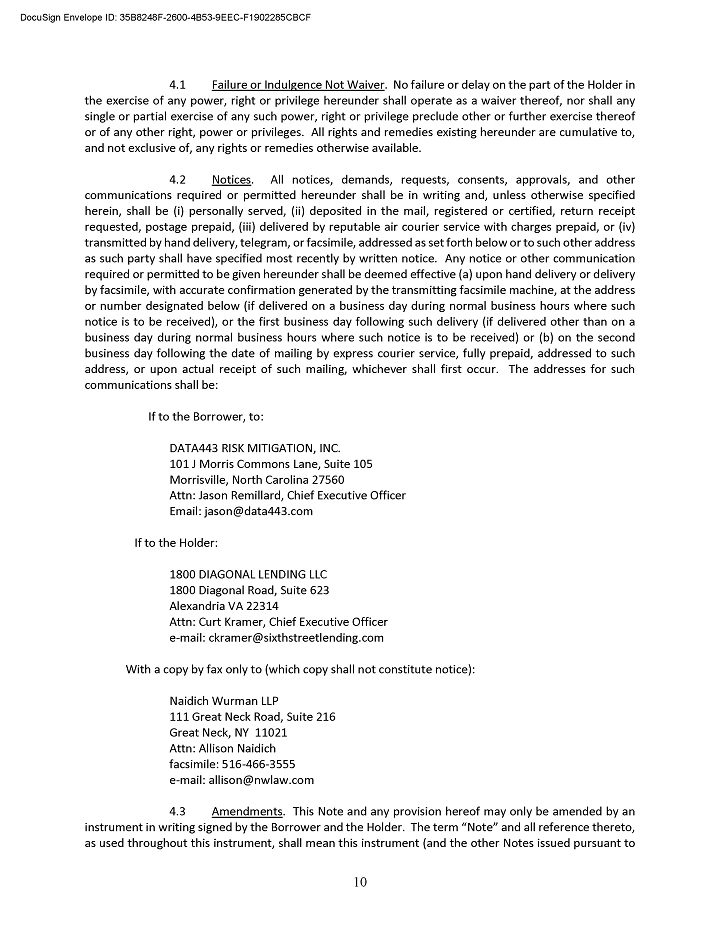

DATA443

RISK MITIGATION, INC.

CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

| | |

2023 | | |

2022 | |

| | |

Six Months Ended | |

| | |

June 30, | |

| | |

2023 | | |

2022 | |

| | |

| | |

| |

| CASH FLOWS FROM OPERATING ACTIVITIES: | |

| | | |

| | |

| | |

| | | |

| | |

| Net loss | |

$ | (648,353 | ) | |

$ | (4,279,531 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Change in fair value of derivative liability | |

| - | | |

| 57,883 | |

| Gain on settlement of debt | |

| (4,904,081 | ) | |

| - | |

| Stock-based compensation expense | |

| 565,571 | | |

| 798,690 | |

| Depreciation and amortization | |

| 340,550 | | |

| 540,714 | |

| Amortization of debt discount | |

| 625,783 | | |

| 1,549,752 | |

| Lease liability amortization | |

| (74,292 | ) | |

| (14,958 | ) |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Accounts receivable | |

| 28,831 | | |

| (209,938 | ) |

| Prepaid expenses and other assets | |

| (181,955 | ) | |

| 42,852 | |

| Accounts payable and accrued liabilities | |

| 1,189,069 | | |

| 308,642 | |

| Deferred revenue | |

| (163,531 | ) | |

| 973,992 | |

| Accrued interest | |

| 3,398,326 | | |

| 105,577 | |

| Deposit | |

| - | | |

| 10,414 | |

| Net Cash provided by/(used in) Operating Activities | |

| 175,918 | | |

| (115,911 | ) |

| | |

| | | |

| | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | |

| | | |

| | |

| Advance payment for acquisition | |

| - | | |

| (250,000 | ) |

| Purchase of property and equipment | |

| (167,427 | ) | |

| (96,960 | ) |

| Net Cash used in Investing Activities | |

| (167,427 | ) | |

| (346,960 | ) |

| | |

| | | |

| | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | |

| | | |

| | |

| Bank overdraft | |

| - | | |

| 3,781 | |

| Proceeds from issuance of convertible notes payable | |

| 564,070 | | |

| 1,207,800 | |

| Repayment of convertible notes payable | |

| (146,663 | ) | |

| (758,346 | ) |

| Proceeds from stock subscription | |

| 20,000 | | |

| - | |

| Proceeds from issuance of Series B Preferred Stock | |

| - | | |

| 75,000 | |

| Redemption of Series B Preferred Stock | |

| - | | |

| (487,730 | ) |

| Finance lease payments | |

| (10,341 | ) | |

| (41,195 | ) |

| Proceeds from issuance of notes payable | |

| 417,427 | | |

| 1,186,453 | |

| Repayment of notes payable | |

| (1,047,218 | ) | |

| (1,957,492 | ) |

| Proceeds from related parties | |

| 229,426 | | |

| 116,238 | |

| Repayment to related parties | |

| (21,000 | ) | |

| (86,571 | ) |

| Net Cash provided by/(used in) Financing Activities | |

| 5,701 | | |

| (742,062 | ) |

| | |

| | | |

| | |

| Net change in cash | |

| 14,192 | | |

| (1,204,933 | ) |

| Cash, beginning of period | |

| 1,712 | | |

| 1,204,933 | |

| Cash, end of period | |

$ | 15,904 | | |

$ | - | |

| | |

| | | |

| | |

| Supplemental cash flow information | |

| | | |

| | |

| Cash paid for interest | |

$ | 408,160 | | |

$ | 344,867 | |

| | |

| | | |

| | |

| Non-cash Investing and Financing transactions: | |

| | | |

| | |

| Common stock issued for exercised cashless warrant | |

$ | - | | |

$ | 7 | |

| Settlement of convertible notes payable through issuance of common stock | |

$ | 332,592 | | |

$ | 27,812 | |

| Common stock issued in conjunction with convertible note | |

$ | - | | |

$ | 62,493 | |

| Resolution of derivative liability upon exercise of warrant | |

$ | - | | |

$ | 57,883 | |

| Settlement of convertible notes payable through issuance of preferred common stock | |

$ | - | | |

$ | 65,600 | |

| Note payable issued for settlement of License fee payable | |

$ | - | | |

$ | 77,643 | |

See

the accompanying notes, which are an integral part of these unaudited condensed consolidated financial statements.

DATA443

RISK MITIGATION, INC.

NOTES

TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NOTE

1: SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Description

of Business

Data443

Risk Mitigation, Inc. (the “Company”) was incorporated as a Nevada corporation on May 4, 1998. On October 15, 2019, the Company

changed its name from LandStar, Inc. to Data443 Risk Mitigation, Inc. within the state of Nevada.

The

Company delivers solutions and capabilities that businesses can use in conjunction with their use of established cloud vendors such as

Microsoft® Azure, Google® Cloud Platform (GCP) and Amazon® Web Services (AWS), as well as with on-premises databases and

database applications with virtualization platforms, such as those hosted or configured using VMWare®, Citrix® and Oracle®

clouds/products).

Advance

Payment for Acquisition

On

January 19, 2022, we entered into an Asset Purchase Agreement with Centurion Holdings I, LLC (“Centurion”) to acquire the

intellectual property rights and certain assets collectively known as Centurion SmartShield Home and SmartShield Enterprise, patented

technology that protects and recovers devices in the event of ransomware attacks. The total purchase price of $3,400,000 consists of:

(i) a $250,000 cash payment at closing; (ii) a $2,900,000 promissory note issued by Data443 in favor of Centurion (“Centurion Note”);

and (iii) $250,000 in the form of a contingent payment. The Centurion Note matures January 19, 2027 but provides that Data443’s

repayment obligation would accelerate on the occurrence of certain events. One of those events was a financing event that did not occur

within the originally anticipated timeframe. If that event had occurred, then Data443’s repayment obligation would have been to

repay the balance of the outstanding principal and interest as follows: (i) $500,000 of the then-outstanding amount due in cash; and

(ii) the remaining balance, at Data443’s option, in Common stock or a combination of Common stock and cash, with the number of

shares of Common stock to be determined according to a specified formula. In April 2022, Data443 and Centurion agreed that, even though

the trigger for this acceleration event did not occur, Data443 would issue shares of Common stock to Centurion in an amount then-equivalent

to $2,400,000, as partial repayment of the obligation due under the Centurion Note. The number of shares of Common stock Data443 issued

to Centurion on April 20, 2022, was 380,952. Because Data443 still has some repayment obligations to fulfill under the Centurion Note,

as of the filing date of these financial statements, the acquisition that is the subject of the Centurion Asset Purchase Agreement is

still not completed, and is expected to be completed in 2023.

Basis

of Presentation

These

unaudited condensed consolidated financial statements have been prepared in accordance with rules and regulations of the Securities and

Exchange Commission (“SEC”) and generally accepted accounting principles in the United States of America (“GAAP”)

for interim financial information and with the instructions to Form 10-Q and Regulation S-X. Accordingly, the unaudited condensed consolidated

financial statements do not include all of the information and footnotes required by generally accepted accounting principles for complete

financial statements. In the opinion of management, we have included all adjustments considered necessary for a fair presentation and

such adjustments are of a normal recurring nature. These unaudited condensed consolidated financial statements should be read in conjunction

with the consolidated financial statements for the year ended December 31, 2022 and notes thereto and other pertinent information contained

in our Form 10-K as filed with the SEC on February 24, 2023. The results of operations for the six months ended June 30, 2023, are not

necessarily indicative of the results to be expected for the full fiscal year ending December 31, 2023.

Basis

of Consolidation

The

accompanying unaudited consolidated financial statements as of June 30, 2023 include our accounts and those of our wholly-owned subsidiary,

Data 443 Risk Mitigation, Inc., a North Carolina operating company. These unaudited consolidated financial statements have been prepared

on the accrual basis of accounting in accordance with US GAAP. All inter company balances and transactions have been eliminated in consolidation.

Reclassifications

Certain prior year amounts have been reclassified

to conform to the current period presentation. These reclassifications had no impact on the net earnings (loss) or and financial position.

Accounts

Receivable

Trade

receivables are generally recorded at the invoice amount mostly for a one-year period, net of an allowance for bad debt. For the three

months ended June 30, 2023, and June 30, 2022, we recorded bad debt expense of $0 and $0, respectively

Stock-Based

Compensation

Employees

– We account for stock-based compensation under the fair value method which requires all such compensation to employees,

including the grant of employee stock options, to be calculated based on its fair value at the measurement date (generally the grant

date), and recognized in the consolidated statement of operations over the requisite service period.

Nonemployees

- Under the requirements of the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update

(“ASU”) 2018-07, Compensation-Stock Compensation (Topic 718): Improvements to Nonemployee Stock-Based Payment Accounting

(“ASU 2018-07”), we account for stock-based compensation to non-employees under the fair value method which requires all

such compensation to be calculated based on the fair value at the measurement date (generally the grant date), and recognized in the

statement of operations over the requisite service period.

We

recorded approximately $565,571 in stock-based compensation expense for the six months ended June 30, 2023, compared to $798,690

in stock-based compensation expense for the six months ended June 30, 2022. Determining the appropriate fair value model and the

related assumptions requires judgment. During the three months ended June 30, 2023, the fair value of each option grant was estimated

using a Black-Scholes option-pricing model. The expected volatility represents the historical volatility of our publicly traded common

stock. Due to limited historical data, we calculate the expected life based on the mid-point between the vesting date and the contractual

term which is in accordance with the simplified method. The expected term for options granted to nonemployees is the contractual life.

The risk-free interest rate is based on a treasury instrument whose term is consistent with the expected life of stock options. We have

not paid and do not anticipate paying cash dividends on our shares of Common stock; therefore, the expected dividend yield is assumed

to be zero.

Contingencies

We

account for contingent liabilities in accordance with Accounting Standards Codification (“ASC”) Topic 450, Contingencies.

This standard requires management to assess potential contingent liabilities that may exist as of the date of the financial statements

to determine the probability and amount of loss that may have occurred, which inherently involves an exercise of judgment. If the assessment

of a contingency indicates that it is probable that a material loss has been incurred and the amount of the liability can be estimated,

then the estimated liability would be accrued in our financial statements. If the assessment indicates that a potential material loss

contingency is not probable but is reasonably possible, or is probable but cannot be estimated, then the nature of the contingent liability,

and an estimate of the range of possible losses, if determinable and material, would be disclosed in our financial statements. For loss

contingencies considered remote, we generally would neither accrue any estimated liability nor disclose the nature of the contingent

liability in our financial statements. Management has assessed potential contingent liabilities as of June 30, 2023, and based on that

assessment, there are no probable or possible loss contingencies requiring accrual or establishment of a reserve.

Basic

and Diluted Net Loss Per Common Share

Basic

earnings per share (“EPS”) is computed based on the weighted average number of shares of common stock outstanding during

the period. Diluted EPS is computed based on the weighted average number of shares of common stock plus the effect of dilutive potential

common shares outstanding during the period using the treasury stock method and as if converted method. Dilutive potential common shares

include outstanding stock options, warrant and convertible notes.

For

the six months ended June 30, 2023 and 2022, respectively, the following common stock equivalents were excluded from the computation

of diluted net loss per share as the result of the computation was anti-dilutive:

SCHEDULE

OF ANTI-DILUTIVE BASIC AND DILUTED EARNINGS PER SHARE

| | |

2023 | | |

2022 | |

| | |

Six Months Ended | |

| | |

June 30, | |

| | |

2023 | | |

2022 | |

| | |

(Shares) | | |

(Shares) | |

| Series A Preferred Stock | |

| 149,892,000 | | |

| 149,892,000 | |

| Stock options | |

| 2,838,067 | | |

| 1,029 | |

| Warrants | |

| 158,441 | | |

| 158,441 | |

| Total | |

| 152,888,508 | | |

| 150,051,470 | |

Recently

Adopted Accounting Guidance

In

August 2020, the FASB issued ASU 2020-06, ASC Subtopic 470-20 “Debt—Debt with Conversion and Other Options” and ASC

subtopic 815-40 “Hedging—Contracts in Entity’s Own Equity” (“Standard”). The Standard reduced the

number of accounting models available for convertible debt instruments and convertible preferred stock. Pursuant to the Standard, convertible

debt instruments that continue to be subject to separation models are (1) those with embedded conversion features that are not clearly

and closely related to the host contract, that meet the definition of a derivative, and that do not qualify for a scope exception from

derivative accounting; and (2) convertible debt instruments issued with substantial premiums for which the premiums are recorded as paid

in capital. The Standard is effective for fiscal years beginning after December 15, 2021, including interim periods within those fiscal

years. Due to adoption of this Standard on January 1, 2022, we recognized a cumulative effect adjustment to increase the opening retained

earnings as of January 1, 2022 by $439,857.

To

compute the transition adjustment for a convertible instrument under both the modified retrospective and full retrospective methods,

entities need to recompute the basis of that instrument at transition (i.e., the beginning of year of adoption for the modified retrospective

method or the beginning of earliest year presented for the full retrospective method) as if the conversion option had not been separated.

The Company use the modified retrospective method to adjust.

Recently

Issued Accounting Pronouncements

The

Company has considered all other recently issued accounting pronouncements and does not believe the adoption of such pronouncements will

have a material impact on its consolidated financial statements.

NOTE

2: LIQUIDITY AND GOING CONCERN

The

accompanying financial statements have been prepared assuming that we will continue as a going concern. As reflected in the financial

statements, we have incurred significant current period losses of $648,353

for the six months ended June 30, 2023 and we

have negative working capital of $10,008,138 and

an accumulated deficit $52,060,481

as of June 30, 2023. We have relied upon loans and issuances

of our equity to fund our operations. These conditions, among others, raise substantial doubt about our ability to continue as a going

concern. Management’s plans regarding these matters, include raising additional debt or equity financing, the terms of which might

not be acceptable. The accompanying financial statements do not include any adjustments that might result from the outcome of this uncertainty.

NOTE

3: PROPERTY AND EQUIPMENT

The

following table summarizes the components of our property and equipment as of the dates presented:

SUMMARY

OF COMPONENTS OF PROPERTY AND EQUIPMENT

| | |

June 30, | | |

December 31, | |

| | |

2023 | | |

2022 | |

| Furniture and Fixtures | |

$ | 6,103 | | |

$ | 6,103 | |

| Computer Equipment | |

| 1,035,097 | | |

| 867,670 | |

| Property and equipment, gross | |

| 1,041,200 | | |

| 873,773 | |

| Accumulated depreciation | |

| (537,958 | ) | |

| (446,742 | ) |

| Property and equipment, net of accumulated depreciation | |

$ | 503,242 | | |

$ | 427,031 | |

Depreciation

expense for the six months ended June 30, 2023 and 2022, was $91,216 and $80,170, respectively.

During

the six months ended June 30, 2023 and 2022, we purchased property and equipment of $167,427 and $96,960, respectively.

NOTE

4: INTELLECTUAL PROPERTY

The

following table summarizes the components of our intellectual property as of the dates presented:

SCHEDULE

OF INTELLECTUAL PROPERTY

| | |

June 30,

2023 | | |

December 31,

2022 | |

| Intellectual property: | |

| | | |

| | |

| WordPress® GDPR rights | |

$ | 46,800 | | |

$ | 46,800 | |

| ARALOC® | |

| 1,850,000 | | |

| 1,850,000 | |

| ArcMail® | |

| 1,445,000 | | |

| 1,445,000 | |

| DataExpress® | |

| 1,388,051 | | |

| 1,388,051 | |

| FileFacets® | |

| 135,000 | | |

| 135,000 | |

| IntellyWP™ | |

| 60,000 | | |

| 60,000 | |

| Resilient Network Systems | |

| 305,000 | | |

| 305,000 | |

| Intellectual property | |

| 5,229,851 | | |

| 5,229,851 | |

| Accumulated amortization | |

| (5,024,854 | ) | |

| (4,775,520 | ) |

| Intellectual property, net of accumulated amortization | |

$ | 204,997 | | |

$ | 454,331 | |

We

recognized amortization expense of $249,334 and $460,544 for the six months ended June 30,

2023, and 2022, respectively.

Based

on the carrying value of definite-lived intangible assets as of June 30, 2023, we estimate our amortization expense for the next five

years will be as follows:

SCHEDULE

OF FUTURE AMORTIZATION EXPENSE OF INTANGIBLE ASSETS

| | |

Amortization | |

| | |

Expense | |

| Year ended December 31, | |

| |

| 2023 (excluding the six months ended June 30, 2023) | |

$ | 162,247 | |

| 2024 | |

| 27,000 | |

| 2025 | |

| 15,750 | |

| Thereafter | |

| - | |

| Total | |

$ | 204,997 | |

NOTE

5: ACCOUNTS PAYABLE AND ACCRUED LIABILITIES

The

following table summarizes the components of our accounts payable and accrued liabilities as of the dates presented:

SUMMARY

OF ACCOUNTS PAYABLE AND ACCRUED LIABILITIES

| | |

June 30, | | |

December 31, | |

| | |

2023 | | |

2022 | |

| Accounts payable | |

$ | 1,370,015 | | |

$ | 427,553 | |

| Credit cards | |

| 72,374 | | |

| 50,302 | |

| Accrued liabilities | |

| 778,611 | | |

| 554,076 | |

| Balance, end of year | |

$ | 2,221,000 | | |

$ | 1,031,931 | |

NOTE

6: DEFERRED REVENUE

For

the six months ended June 30, 2023 and as of December 31, 2022, changes in deferred revenue were as follows:

SUMMARY

OF CHANGES IN DEFERRED REVENUE

| | |

June 30, | | |

December 31, | |

| | |

2023 | | |

2022 | |

| Balance, beginning of period | |

$ | 2,493,151 | | |

$ | 1,608,596 | |

| Deferral of revenue | |

| 1,186,955 | | |

| 3,511,678 | |

| Recognition of deferred revenue | |

| (1,350,486 | ) | |

| (2,627,123 | ) |

| Balance, end of period | |

$ | 2,329,620 | | |

$ | 2,493,151 | |

As

of June 30, 2023 and December 31, 2022, deferred revenue is classified as follows:

SUMMARY

OF DEFERRED REVENUE

| | |

June 30, | | |

December 31, | |

| | |

2023 | | |

2022 | |

| Current | |

$ | 1,814,620 | | |

$ | 1,704,249 | |

| Non-current | |

| 515,000 | | |

| 788,902 | |

| Balance, end of year | |

$ | 2,329,620 | | |

$ | 2,493,151 | |

NOTE

7: LEASES

Operating

lease

We

have two noncancelable operating leases for office facilities, one that we entered into January 2019 and that expires January 10, 2024

and another that we entered into in April 2022 and that expires April 30, 2024. Each operating lease has a renewal option and a rent

escalation clause. In the summer of 2022, we relocated to the expanded square footage of the premises that are the subject of the April

2022 lease to support our growing operations, and entered into a commission agreement with the landlord of the building to sublet the

premises that are the subject of the January 2019 lease.

We

recognized total lease expense of approximately $146,994 and

$83,339 for the six

months ended June 30, 2023 and 2022, respectively, primarily related to operating lease costs paid to lessors from operating cash

flows. As of June 30, 2023 and December 31, 2022, we recorded a security deposit of $33,467.

At

June 30, 2023, future minimum lease payments under operating leases that have initial noncancelable lease terms in excess of one year

were as follows:

SCHEDULE

OF FUTURE MINIMUM LEASE PAYMENTS UNDER OPERATING LEASES

| | |

Total | |

| Year Ended December 31, | |

| | |

| 2023 (excluding the six months ended June 30, 2023) | |

| 242,379 | |

| 2024 | |

| 121,406 | |

| Thereafter | |

| - | |

| Total lease payment | |

| 363,785 | |

| Less: Imputed interest | |

| (24,967 | ) |

| Operating lease liabilities | |

| 338,818 | |

| | |

| | |

| Operating lease liability - current | |

| 338,818 | |

| Operating lease liability - non-current | |

$ | - | |

The

following summarizes other supplemental information about our operating leases as of June 30, 2023:

SCHEDULE

OF OTHER SUPPLEMENTAL INFORMATION UNDER OPERATING LEASE

| Weighted average discount rate | |

| 8 | % |

| Weighted average remaining lease term (years) | |

| .70 | |

Financing

leases

We

do not have any financing leases as June 30, 2023 and $10,341 as of December 31, 2022.

NOTE

8: CONVERTIBLE NOTES PAYABLE

Convertible

notes payable consists of the following:

SCHEDULE

OF CONVERTIBLE NOTES PAYABLE

| | |

June 30, | | |

December 31, | |

| | |

2023 | | |

2022 | |

| Convertible Notes - Issued in fiscal year 2020 | |

| 97,946 | | |

| 97,946 | |

| Convertible Notes - Issued in fiscal year 2021 | |

| 414,690 | | |

| 600,400 | |

| Convertible Notes - Issued in fiscal year 2022 | |

| 1,891,083 | | |

| 3,710,440 | |

| Convertible Notes - Issued in fiscal year 2023 | |

| 534,454 | | |

| - | |

| Convertible notes payable, Gross | |

| 2,938,173 | | |

| 4,408,786 | |

| Less debt discount and debt issuance cost | |

| (119,056 | ) | |

| (176,685 | ) |

| Convertible notes payable | |

| 2,819,117 | | |

| 4,232,101 | |

| Less current portion of convertible notes payable | |

| 2,721,171 | | |

| 4,134,155 | |

| Long-term convertible notes payable | |

$ | 97,946 | | |

$ | 97,946 | |

During

the six months ended June 30, 2023 and the year ended December 31, 2022, we recognized interest expense of $3,964,556

and $374,938,

respectively, and amortization of debt discount expense of $145,837

and $636,010,

respectively. During the six months ended June 30, 2022 we recognized interest expense of $346,348 and amortization of debt discount,

included in interest expense of $625,783.

Conversion

During

the six months ended June 30, 2023, we converted notes with principal amounts and accrued interest of $332,592 into 10,807,823 shares

of common stock.

Convertible

notes payable consists of the following:

Promissory

Notes - Issued in fiscal year 2020

In

2020, we issued convertible promissory notes with principal amounts totaling $100,000. The 2020 Promissory Notes have the following key

provisions:

| |

● |

Terms

60 months. |

| |

|

|

| |

● |

Annual

interest rates of 5%. |

| |

|

|

| |

● |

Conversion

price fixed at $0.01. |

Promissory

Notes - Issued in fiscal year 2021

In

2021, we issued convertible promissory notes with principal amounts totaling $1,696,999, which resulted in cash proceeds of $1,482,000

after financing fees of $214,999 were deducted. The 2021 Convertible Notes have the following key provisions:

| |

● |

Terms

ranging from 90 days to 12 months. |

| |

|

|

| |

● |

Annual

interest rates of 5% to 12%. |

| |

|

|

| |

● |

Convertible

at the option of the holders after varying dates. |

| |

|

|

| |

● |

Conversion

price based on a formula corresponding to a discount (39% discount) off the average closing price or lowest trading price of our

Common stock for the 20 prior trading days including the day on which a notice of conversion is received. |

| |

|

|

| |

● |

The

Mast Hill Fund, LLC convertible promissory note matured on October 19, 2022. The default annual interest rate of 16% becomes the

effective interest rate on the past due principal and interest. As of June 30, 2023 the note had a principle balance of $414,690

and accrued interest of $39,822. The note is currently in default. |

The

2021 Convertible Notes also were associated with the following:

| |

● |

The

issuance of 1,414 shares of Common stock valued at $133,663. |

| |

|

|

| |

● |

The

issuance of 117,992 warrants to purchase shares of Common stock with an exercise price a range from $7.44 to 36.00. The term in which

the warrants can be exercised is 5 years from issue date. (Note 12) |

During

the six months ended June 30, 2023, in connection with the 2021 Convertible Notes, we repaid principal in the amount of $38,490 and

interest expense of $39,822.

Promissory

Notes - Issued in fiscal year 2022

During

the year ended December 31, 2022, we issued convertible promissory notes with principal amounts totaling $2,120,575, which resulted in

cash proceeds of $1,857,800 after deducting a financing fee of $262,775. The 2022 Convertible Notes have the following key provisions:

| |

● |

Terms

ranging from 3 to 12 months. |

| |

|

|

| |

● |

Annual

interest rates of 9% to 20%. |

| |

|

|

| |

● |

Convertible

at the option of the holders after varying dates. |

| |

|

|

| |

● |

Conversion

price based on a formula corresponding to a discount (20% or 39% discount) off the lowest trading price of our Common stock for the

20 prior trading days including the day on which a notice of conversion is received, although one of the 2022 Convertible Notes establishes

a fixed conversion price of $4.50 per share. |

| |

|

|

| |

● |

554,464

shares of common stock valued at $473,691 issued in conjunction with convertible notes. |

| |

|

|

| |

● |

On June 30, 2023, the Company entered into a Note Exchange

Agreement (the “Note Exchange Agreement”) with Westland Properties LLC (the “Noteholder”), pursuant to which

the Company agreed with Westland Properties LLC to exchange one outstanding note with a total outstanding balance of $5,398,299

for a new note with an aggregate value of $665,000

(the “New Note”). The

New Note matures on June 1, 2024, and calls for payments of (i) $115,000 on or prior to July 25, 2023, (ii) nine monthly payments to

the noteholder in the amount of $38,889 each, with the first payment beginning September 1, 2023 and (iii) $200,000 on the earlier

of (a) three business days following the Company’s successful listing on any of the NYSE American, the Nasdaq Capital Market,

the Nasdaq Global Market, the Nasdaq Global Select Market or the New York Stock Exchange or (b) the receipt of not less than

$4,000,000 in funding from a single transaction. If the conditions for payment of the above $200,000 are not met, but the Company

raises capital in excess of $500,000 in a single closing, then 25% of any capital raised in such closing shall be used to satisfy

the $200,000 payment. The Company followed ASC470 Trouble Debt Restructuring, to record a gain

on settlement of debt for $4,904,081. |

In

connection with the adoption of ASU 2020-06 on January 1, 2022, we reclassified $517,500, previously allocated to the conversion feature,

from additional paid-in capital to convertible notes on our balance sheet. The reclassification was recorded to combine the two legacy

units of account into a single instrument classified as a liability. As of January 1, 2022, we also recognized a cumulative effect adjustment

of $439,857 to accumulated deficit on our balance sheet, that was primarily driven by the derecognition of interest expense related to

the accretion of the debt discount as required under the legacy accounting guidance. Under ASU 2020-06, we will no longer incur non-cash

interest expense related to the accretion of the debt discount associated with the embedded conversion option.

Promissory

Notes - Issued in fiscal year 2023

During

the six months ended June 30, 2023, we issued convertible promissory notes with principal amounts totaling $637,858, which resulted in

cash proceeds of $520,000 after deducting a financing fee of $117,858. The 2023 Convertible Notes have the following key provisions:

| |

● |

Terms

ranging from 9 to 12 months. |

| |

|

|

| |

● |

Annual

interest rates of 9% to 20%. |

| |

|

|

| |

● |

Convertible

at the option of the holders after varying dates. |

| |

|

|

| |

● |

Conversion

price based on a formula corresponding to a discount (20% or 30% discount) off the lowest trading price of our Common stock for the

20 prior trading days including the day on which a notice of conversion is received, although one of the 2023 Convertible Notes establishes

a fixed conversion price of $.50 per share. |

| |

|

|

| |

● |

As of the six months ended June 30, 2023, there were no derivative liabilities. |

NOTE

9: DERIVATIVE LIABILITIES

We

analyzed the conversion option of convertible notes for derivative accounting consideration under ASC 815, Derivatives and Hedging, and

hedging, and determined that the instrument should be classified as a liability since the conversion option becomes effective at issuance

resulting in there being no explicit limit to the number of shares to be delivered upon settlement of the above conversion options.

ASC

815 requires we assess the fair market value of derivative liability at the end of each reporting period and recognize any change in