false2024Q20001166003December 31http://fasb.org/us-gaap/2024#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2024#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2024#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2024#OtherAssetsNoncurrentxbrli:sharesiso4217:USDiso4217:USDxbrli:sharesxpo:service_centeriso4217:EURxbrli:purexpo:segmentxpo:claimant00011660032024-01-012024-06-3000011660032024-07-2600011660032024-06-3000011660032023-12-3100011660032024-04-012024-06-3000011660032023-04-012023-06-3000011660032023-01-012023-06-3000011660032022-12-3100011660032023-06-300001166003us-gaap:CommonStockMember2024-03-310001166003us-gaap:AdditionalPaidInCapitalMember2024-03-310001166003us-gaap:RetainedEarningsMember2024-03-310001166003us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-3100011660032024-03-310001166003us-gaap:RetainedEarningsMember2024-04-012024-06-300001166003us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-04-012024-06-300001166003us-gaap:CommonStockMember2024-04-012024-06-300001166003us-gaap:AdditionalPaidInCapitalMember2024-04-012024-06-300001166003us-gaap:CommonStockMember2024-06-300001166003us-gaap:AdditionalPaidInCapitalMember2024-06-300001166003us-gaap:RetainedEarningsMember2024-06-300001166003us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-06-300001166003us-gaap:CommonStockMember2023-12-310001166003us-gaap:AdditionalPaidInCapitalMember2023-12-310001166003us-gaap:RetainedEarningsMember2023-12-310001166003us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001166003us-gaap:RetainedEarningsMember2024-01-012024-06-300001166003us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-06-300001166003us-gaap:CommonStockMember2024-01-012024-06-300001166003us-gaap:AdditionalPaidInCapitalMember2024-01-012024-06-300001166003us-gaap:CommonStockMember2023-03-310001166003us-gaap:AdditionalPaidInCapitalMember2023-03-310001166003us-gaap:RetainedEarningsMember2023-03-310001166003us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-3100011660032023-03-310001166003us-gaap:RetainedEarningsMember2023-04-012023-06-300001166003us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-300001166003us-gaap:CommonStockMember2023-04-012023-06-300001166003us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300001166003us-gaap:CommonStockMember2023-06-300001166003us-gaap:AdditionalPaidInCapitalMember2023-06-300001166003us-gaap:RetainedEarningsMember2023-06-300001166003us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300001166003us-gaap:CommonStockMember2022-12-310001166003us-gaap:AdditionalPaidInCapitalMember2022-12-310001166003us-gaap:RetainedEarningsMember2022-12-310001166003us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001166003us-gaap:RetainedEarningsMember2023-01-012023-06-300001166003us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-06-300001166003us-gaap:CommonStockMember2023-01-012023-06-300001166003us-gaap:AdditionalPaidInCapitalMember2023-01-012023-06-300001166003xpo:YellowAssetAcquisitionMember2023-12-012023-12-310001166003xpo:PrimarilyConsistingOfLandAndBuildingsMemberxpo:YellowAssetAcquisitionMember2023-12-012023-12-310001166003xpo:YellowAssetAcquisitionMemberxpo:AssumedExistingLeasesMember2023-12-012023-12-310001166003srt:AffiliatedEntityMemberxpo:XPOCollectionsDesignatedActivityCompanyLimitedMemberxpo:TradeReceivablesSecuritizationProgramTwoMember2024-06-300001166003us-gaap:CarryingReportedAmountFairValueDisclosureMember2024-06-300001166003us-gaap:FairValueInputsLevel1Member2024-06-300001166003us-gaap:CarryingReportedAmountFairValueDisclosureMember2023-12-310001166003us-gaap:FairValueInputsLevel1Member2023-12-310001166003xpo:NorthAmericanLTLMemberus-gaap:OperatingSegmentsMember2024-04-012024-06-300001166003xpo:NorthAmericanLTLMemberus-gaap:OperatingSegmentsMember2023-04-012023-06-300001166003xpo:NorthAmericanLTLMemberus-gaap:OperatingSegmentsMember2024-01-012024-06-300001166003xpo:NorthAmericanLTLMemberus-gaap:OperatingSegmentsMember2023-01-012023-06-300001166003xpo:EuropeanTransportationMemberus-gaap:OperatingSegmentsMember2024-04-012024-06-300001166003xpo:EuropeanTransportationMemberus-gaap:OperatingSegmentsMember2023-04-012023-06-300001166003xpo:EuropeanTransportationMemberus-gaap:OperatingSegmentsMember2024-01-012024-06-300001166003xpo:EuropeanTransportationMemberus-gaap:OperatingSegmentsMember2023-01-012023-06-300001166003us-gaap:CorporateNonSegmentMember2024-04-012024-06-300001166003us-gaap:CorporateNonSegmentMember2023-04-012023-06-300001166003us-gaap:CorporateNonSegmentMember2024-01-012024-06-300001166003us-gaap:CorporateNonSegmentMember2023-01-012023-06-300001166003xpo:NorthAmericanLTLMembercountry:USus-gaap:OperatingSegmentsMember2024-04-012024-06-300001166003xpo:EuropeanTransportationMembercountry:USus-gaap:OperatingSegmentsMember2024-04-012024-06-300001166003country:US2024-04-012024-06-300001166003xpo:NorthAmericanLTLMemberxpo:NorthAmericaExcludingUnitedStatesMemberus-gaap:OperatingSegmentsMember2024-04-012024-06-300001166003xpo:EuropeanTransportationMemberxpo:NorthAmericaExcludingUnitedStatesMemberus-gaap:OperatingSegmentsMember2024-04-012024-06-300001166003xpo:NorthAmericaExcludingUnitedStatesMember2024-04-012024-06-300001166003country:FRxpo:NorthAmericanLTLMemberus-gaap:OperatingSegmentsMember2024-04-012024-06-300001166003country:FRxpo:EuropeanTransportationMemberus-gaap:OperatingSegmentsMember2024-04-012024-06-300001166003country:FR2024-04-012024-06-300001166003xpo:NorthAmericanLTLMemberus-gaap:OperatingSegmentsMembercountry:GB2024-04-012024-06-300001166003xpo:EuropeanTransportationMemberus-gaap:OperatingSegmentsMembercountry:GB2024-04-012024-06-300001166003country:GB2024-04-012024-06-300001166003xpo:EuropeExcludingFranceAndUnitedKingdomMemberxpo:NorthAmericanLTLMemberus-gaap:OperatingSegmentsMember2024-04-012024-06-300001166003xpo:EuropeExcludingFranceAndUnitedKingdomMemberxpo:EuropeanTransportationMemberus-gaap:OperatingSegmentsMember2024-04-012024-06-300001166003xpo:EuropeExcludingFranceAndUnitedKingdomMember2024-04-012024-06-300001166003xpo:NorthAmericanLTLMembercountry:USus-gaap:OperatingSegmentsMember2023-04-012023-06-300001166003xpo:EuropeanTransportationMembercountry:USus-gaap:OperatingSegmentsMember2023-04-012023-06-300001166003country:US2023-04-012023-06-300001166003xpo:NorthAmericanLTLMemberxpo:NorthAmericaExcludingUnitedStatesMemberus-gaap:OperatingSegmentsMember2023-04-012023-06-300001166003xpo:EuropeanTransportationMemberxpo:NorthAmericaExcludingUnitedStatesMemberus-gaap:OperatingSegmentsMember2023-04-012023-06-300001166003xpo:NorthAmericaExcludingUnitedStatesMember2023-04-012023-06-300001166003country:FRxpo:NorthAmericanLTLMemberus-gaap:OperatingSegmentsMember2023-04-012023-06-300001166003country:FRxpo:EuropeanTransportationMemberus-gaap:OperatingSegmentsMember2023-04-012023-06-300001166003country:FR2023-04-012023-06-300001166003xpo:NorthAmericanLTLMemberus-gaap:OperatingSegmentsMembercountry:GB2023-04-012023-06-300001166003xpo:EuropeanTransportationMemberus-gaap:OperatingSegmentsMembercountry:GB2023-04-012023-06-300001166003country:GB2023-04-012023-06-300001166003xpo:EuropeExcludingFranceAndUnitedKingdomMemberxpo:NorthAmericanLTLMemberus-gaap:OperatingSegmentsMember2023-04-012023-06-300001166003xpo:EuropeExcludingFranceAndUnitedKingdomMemberxpo:EuropeanTransportationMemberus-gaap:OperatingSegmentsMember2023-04-012023-06-300001166003xpo:EuropeExcludingFranceAndUnitedKingdomMember2023-04-012023-06-300001166003xpo:NorthAmericanLTLMembercountry:USus-gaap:OperatingSegmentsMember2024-01-012024-06-300001166003xpo:EuropeanTransportationMembercountry:USus-gaap:OperatingSegmentsMember2024-01-012024-06-300001166003country:US2024-01-012024-06-300001166003xpo:NorthAmericanLTLMemberxpo:NorthAmericaExcludingUnitedStatesMemberus-gaap:OperatingSegmentsMember2024-01-012024-06-300001166003xpo:EuropeanTransportationMemberxpo:NorthAmericaExcludingUnitedStatesMemberus-gaap:OperatingSegmentsMember2024-01-012024-06-300001166003xpo:NorthAmericaExcludingUnitedStatesMember2024-01-012024-06-300001166003country:FRxpo:NorthAmericanLTLMemberus-gaap:OperatingSegmentsMember2024-01-012024-06-300001166003country:FRxpo:EuropeanTransportationMemberus-gaap:OperatingSegmentsMember2024-01-012024-06-300001166003country:FR2024-01-012024-06-300001166003xpo:NorthAmericanLTLMemberus-gaap:OperatingSegmentsMembercountry:GB2024-01-012024-06-300001166003xpo:EuropeanTransportationMemberus-gaap:OperatingSegmentsMembercountry:GB2024-01-012024-06-300001166003country:GB2024-01-012024-06-300001166003xpo:EuropeExcludingFranceAndUnitedKingdomMemberxpo:NorthAmericanLTLMemberus-gaap:OperatingSegmentsMember2024-01-012024-06-300001166003xpo:EuropeExcludingFranceAndUnitedKingdomMemberxpo:EuropeanTransportationMemberus-gaap:OperatingSegmentsMember2024-01-012024-06-300001166003xpo:EuropeExcludingFranceAndUnitedKingdomMember2024-01-012024-06-300001166003xpo:NorthAmericanLTLMembercountry:USus-gaap:OperatingSegmentsMember2023-01-012023-06-300001166003xpo:EuropeanTransportationMembercountry:USus-gaap:OperatingSegmentsMember2023-01-012023-06-300001166003country:US2023-01-012023-06-300001166003xpo:NorthAmericanLTLMemberxpo:NorthAmericaExcludingUnitedStatesMemberus-gaap:OperatingSegmentsMember2023-01-012023-06-300001166003xpo:EuropeanTransportationMemberxpo:NorthAmericaExcludingUnitedStatesMemberus-gaap:OperatingSegmentsMember2023-01-012023-06-300001166003xpo:NorthAmericaExcludingUnitedStatesMember2023-01-012023-06-300001166003country:FRxpo:NorthAmericanLTLMemberus-gaap:OperatingSegmentsMember2023-01-012023-06-300001166003country:FRxpo:EuropeanTransportationMemberus-gaap:OperatingSegmentsMember2023-01-012023-06-300001166003country:FR2023-01-012023-06-300001166003xpo:NorthAmericanLTLMemberus-gaap:OperatingSegmentsMembercountry:GB2023-01-012023-06-300001166003xpo:EuropeanTransportationMemberus-gaap:OperatingSegmentsMembercountry:GB2023-01-012023-06-300001166003country:GB2023-01-012023-06-300001166003xpo:EuropeExcludingFranceAndUnitedKingdomMemberxpo:NorthAmericanLTLMemberus-gaap:OperatingSegmentsMember2023-01-012023-06-300001166003xpo:EuropeExcludingFranceAndUnitedKingdomMemberxpo:EuropeanTransportationMemberus-gaap:OperatingSegmentsMember2023-01-012023-06-300001166003xpo:EuropeExcludingFranceAndUnitedKingdomMember2023-01-012023-06-300001166003us-gaap:EmployeeSeveranceMemberxpo:NorthAmericanIntermodalOperationMemberus-gaap:OperatingSegmentsMember2023-12-310001166003us-gaap:EmployeeSeveranceMemberxpo:NorthAmericanIntermodalOperationMemberus-gaap:OperatingSegmentsMember2024-01-012024-06-300001166003us-gaap:EmployeeSeveranceMemberxpo:NorthAmericanIntermodalOperationMemberus-gaap:OperatingSegmentsMember2024-06-300001166003us-gaap:EmployeeSeveranceMemberxpo:EuropeanTransportationMemberus-gaap:OperatingSegmentsMember2023-12-310001166003us-gaap:EmployeeSeveranceMemberxpo:EuropeanTransportationMemberus-gaap:OperatingSegmentsMember2024-01-012024-06-300001166003us-gaap:EmployeeSeveranceMemberxpo:EuropeanTransportationMemberus-gaap:OperatingSegmentsMember2024-06-300001166003us-gaap:EmployeeSeveranceMemberus-gaap:CorporateNonSegmentMember2023-12-310001166003us-gaap:EmployeeSeveranceMemberus-gaap:CorporateNonSegmentMember2024-01-012024-06-300001166003us-gaap:EmployeeSeveranceMemberus-gaap:CorporateNonSegmentMember2024-06-300001166003xpo:NorthAmericanIntermodalOperationMemberus-gaap:OperatingSegmentsMember2024-01-012024-06-300001166003xpo:OtherCurrentAssetsandOtherCurrentLiabilitiesMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CurrencySwapMember2024-06-300001166003us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueInputsLevel2Memberus-gaap:OtherCurrentAssetsMemberus-gaap:CurrencySwapMember2024-06-300001166003us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherCurrentLiabilitiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CurrencySwapMember2024-06-300001166003xpo:OtherLongTermAssetsandOtherLongTermLiabilitiesMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CurrencySwapMember2024-06-300001166003us-gaap:OtherNoncurrentAssetsMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CurrencySwapMember2024-06-300001166003us-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CurrencySwapMember2024-06-300001166003xpo:OtherCurrentAssetsandOtherCurrentLiabilitiesMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueInputsLevel2Memberus-gaap:InterestRateSwapMember2024-06-300001166003us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueInputsLevel2Memberus-gaap:OtherCurrentAssetsMemberus-gaap:InterestRateSwapMember2024-06-300001166003us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherCurrentLiabilitiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:InterestRateSwapMember2024-06-300001166003us-gaap:FairValueInputsLevel2Member2024-06-300001166003xpo:OtherCurrentAssetsandOtherCurrentLiabilitiesMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CurrencySwapMember2023-12-310001166003us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueInputsLevel2Memberus-gaap:OtherCurrentAssetsMemberus-gaap:CurrencySwapMember2023-12-310001166003us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherCurrentLiabilitiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CurrencySwapMember2023-12-310001166003xpo:OtherCurrentAssetsandOtherCurrentLiabilitiesMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueInputsLevel2Memberus-gaap:InterestRateSwapMember2023-12-310001166003us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueInputsLevel2Memberus-gaap:OtherCurrentAssetsMemberus-gaap:InterestRateSwapMember2023-12-310001166003us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherCurrentLiabilitiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:InterestRateSwapMember2023-12-310001166003xpo:OtherLongTermAssetsandOtherLongTermLiabilitiesMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueInputsLevel2Memberus-gaap:InterestRateSwapMember2023-12-310001166003us-gaap:OtherNoncurrentAssetsMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueInputsLevel2Memberus-gaap:InterestRateSwapMember2023-12-310001166003us-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueInputsLevel2Memberus-gaap:InterestRateSwapMember2023-12-310001166003us-gaap:FairValueInputsLevel2Member2023-12-310001166003us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateSwapMember2024-04-012024-06-300001166003us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateSwapMember2023-04-012023-06-300001166003us-gaap:DesignatedAsHedgingInstrumentMemberxpo:NetInvestmentHedgeMember2024-04-012024-06-300001166003us-gaap:DesignatedAsHedgingInstrumentMemberxpo:NetInvestmentHedgeMember2023-04-012023-06-300001166003us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateSwapMember2024-01-012024-06-300001166003us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateSwapMember2023-01-012023-06-300001166003us-gaap:DesignatedAsHedgingInstrumentMemberxpo:NetInvestmentHedgeMember2024-01-012024-06-300001166003us-gaap:DesignatedAsHedgingInstrumentMemberxpo:NetInvestmentHedgeMember2023-01-012023-06-300001166003xpo:NewTermLoanFacilityMember2024-06-300001166003us-gaap:CarryingReportedAmountFairValueDisclosureMemberxpo:NewTermLoanFacilityMember2024-06-300001166003xpo:NewTermLoanFacilityMember2023-12-310001166003us-gaap:CarryingReportedAmountFairValueDisclosureMemberxpo:NewTermLoanFacilityMember2023-12-310001166003xpo:SeniorSecuredNotesDue2028Member2024-06-300001166003xpo:SeniorSecuredNotesDue2028Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2024-06-300001166003xpo:SeniorSecuredNotesDue2028Member2023-12-310001166003xpo:SeniorSecuredNotesDue2028Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2023-12-310001166003xpo:SeniorNotesDue2031Member2024-06-300001166003us-gaap:CarryingReportedAmountFairValueDisclosureMemberxpo:SeniorNotesDue2031Member2024-06-300001166003xpo:SeniorNotesDue2031Member2023-12-310001166003us-gaap:CarryingReportedAmountFairValueDisclosureMemberxpo:SeniorNotesDue2031Member2023-12-310001166003xpo:A7.125SeniorNotesDue2032Member2024-06-300001166003us-gaap:CarryingReportedAmountFairValueDisclosureMemberxpo:A7.125SeniorNotesDue2032Member2024-06-300001166003xpo:A7.125SeniorNotesDue2032Member2023-12-310001166003us-gaap:CarryingReportedAmountFairValueDisclosureMemberxpo:A7.125SeniorNotesDue2032Member2023-12-310001166003xpo:SeniorDebenturesDue2034Member2024-06-300001166003us-gaap:CarryingReportedAmountFairValueDisclosureMemberxpo:SeniorDebenturesDue2034Member2024-06-300001166003xpo:SeniorDebenturesDue2034Member2023-12-310001166003us-gaap:CarryingReportedAmountFairValueDisclosureMemberxpo:SeniorDebenturesDue2034Member2023-12-310001166003xpo:AssetFinanceDebtMember2024-06-300001166003us-gaap:CarryingReportedAmountFairValueDisclosureMemberxpo:AssetFinanceDebtMember2024-06-300001166003xpo:AssetFinanceDebtMember2023-12-310001166003us-gaap:CarryingReportedAmountFairValueDisclosureMemberxpo:AssetFinanceDebtMember2023-12-310001166003us-gaap:RevolvingCreditFacilityMemberxpo:ABLFacilityMember2024-06-300001166003xpo:UncommittedSecuredLetterOfCreditFacilityMember2024-06-300001166003us-gaap:SecuredDebtMemberxpo:NewTermLoanFacilityMember2015-12-310001166003us-gaap:SecuredDebtMemberxpo:NewTermLoanFacilityMember2016-12-310001166003us-gaap:SecuredDebtMemberxpo:NewTermLoanFacilityMember2023-06-300001166003xpo:NewTermLoanFacilityMember2023-06-300001166003us-gaap:SecuredDebtMemberxpo:NewTermLoanFacilityMember2023-04-012023-06-300001166003us-gaap:SecuredDebtMemberxpo:NewTermLoanFacilityMember2023-10-012023-12-310001166003us-gaap:SecuredDebtMemberxpo:TermLoanTrancheTwoMember2024-06-300001166003xpo:SeniorSecuredNotesDue2028Memberus-gaap:SeniorNotesMember2023-06-300001166003xpo:SeniorNotesDue2031Memberus-gaap:SeniorNotesMember2023-06-300001166003us-gaap:ForeignCountryMember2024-04-012024-06-300001166003xpo:InsuranceContributionLitigationMember2012-04-012012-04-300001166003xpo:CaliforniaEnvironmentalMattersMember2024-04-012024-04-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________________

Form 10-Q

___________________________________________

(Mark One)

| | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2024

or

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from____________to____________

Commission File Number: 001-32172

_______________________________________________________

XPO, Inc.

(Exact name of registrant as specified in its charter)

_______________________________________________________

| | | | | | | | | | | |

| Delaware | | 03-0450326 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

| Five American Lane | | |

| Greenwich, | CT | | 06831 |

| (Address of principal executive offices) | | (Zip Code) |

(855) 976-6951

(Registrant’s telephone number, including area code)

______________________________________________________________________________________________________________

N/A

______________________________________________________________________________________________________________

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

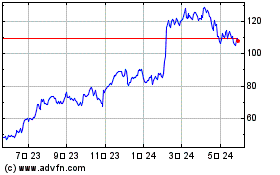

| Common stock, par value $0.001 per share | | XPO | | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | | ☒ | | Accelerated filer | | ☐ |

| | | | | | |

| Non-accelerated filer | | ☐ | | Smaller reporting company | | ☐ |

| | | | | | |

| | | | Emerging growth company | | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of July 26, 2024, there were 116,392,944 shares of the registrant’s common stock, par value $0.001 per share, outstanding.

XPO, Inc.

Quarterly Report on Form 10-Q

For the Quarterly Period Ended June 30, 2024

Table of Contents

Part I—Financial Information

Item 1. Financial Statements.

XPO, Inc.

Condensed Consolidated Balance Sheets

(Unaudited)

| | | | | | | | | | | | | | |

| | June 30, | | December 31, |

| (In millions, except per share data) | | 2024 | | 2023 |

| ASSETS | | | | |

| Current assets | | | | |

| Cash and cash equivalents | | $ | 250 | | | $ | 412 | |

Accounts receivable, net of allowances of $45 and $45, respectively | | 1,088 | | | 973 | |

| Other current assets | | 210 | | | 208 | |

| | | | |

| Total current assets | | 1,548 | | | 1,593 | |

| Long-term assets | | | | |

Property and equipment, net of $1,954 and $1,853 in accumulated depreciation, respectively | | 3,305 | | | 3,075 | |

| Operating lease assets | | 742 | | | 708 | |

| Goodwill | | 1,481 | | | 1,498 | |

Identifiable intangible assets, net of $476 and $452 in accumulated amortization, respectively | | 392 | | | 422 | |

| Other long-term assets | | 262 | | | 196 | |

| | | | |

| Total long-term assets | | 6,182 | | | 5,899 | |

| Total assets | | $ | 7,729 | | | $ | 7,492 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | |

| Current liabilities | | | | |

| Accounts payable | | $ | 477 | | | $ | 532 | |

| Accrued expenses | | 772 | | | 775 | |

| Short-term borrowings and current maturities of long-term debt | | 64 | | | 69 | |

| Short-term operating lease liabilities | | 129 | | | 121 | |

| Other current liabilities | | 99 | | | 93 | |

| | | | |

| Total current liabilities | | 1,542 | | | 1,590 | |

| Long-term liabilities | | | | |

| Long-term debt | | 3,330 | | | 3,335 | |

| Deferred tax liability | | 364 | | | 337 | |

| Employee benefit obligations | | 88 | | | 91 | |

| Long-term operating lease liabilities | | 613 | | | 588 | |

| Other long-term liabilities | | 294 | | | 285 | |

| | | | |

| Total long-term liabilities | | 4,688 | | | 4,636 | |

| Stockholders’ equity | | | | |

| | | | |

Common stock, $0.001 par value; 300 shares authorized; 116 shares issued and outstanding as of June 30, 2024 and December 31, 2023, respectively | | — | | | — | |

| Additional paid-in capital | | 1,322 | | | 1,298 | |

| Retained earnings | | 402 | | | 185 | |

| Accumulated other comprehensive loss | | (225) | | | (217) | |

| | | | |

| | | | |

| Total equity | | 1,499 | | | 1,266 | |

| Total liabilities and equity | | $ | 7,729 | | | $ | 7,492 | |

Amounts may not add due to rounding.

See accompanying notes to condensed consolidated financial statements.

XPO, Inc.

Condensed Consolidated Statements of Income

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| (In millions, except per share data) | | 2024 | | 2023 | | 2024 | | 2023 |

| Revenue | | $ | 2,079 | | | $ | 1,917 | | | $ | 4,097 | | | $ | 3,824 | |

| Salaries, wages and employee benefits | | 854 | | | 783 | | | 1,688 | | | 1,545 | |

| Purchased transportation | | 436 | | | 444 | | | 874 | | | 901 | |

| Fuel, operating expenses and supplies | | 402 | | | 390 | | | 814 | | | 817 | |

| Operating taxes and licenses | | 21 | | | 15 | | | 40 | | | 30 | |

| Insurance and claims | | 33 | | | 46 | | | 71 | | | 90 | |

| Gains on sales of property and equipment | | (4) | | | (2) | | | (5) | | | (5) | |

| Depreciation and amortization expense | | 122 | | | 107 | | | 239 | | | 208 | |

| | | | | | | | |

| Transaction and integration costs | | 12 | | | 17 | | | 26 | | | 39 | |

| Restructuring costs | | 6 | | | 10 | | | 14 | | | 34 | |

| Operating income | | 197 | | | 107 | | | 335 | | | 165 | |

| Other income | | (6) | | | (3) | | | (16) | | | (8) | |

| Debt extinguishment loss | | — | | | 23 | | | — | | | 23 | |

| Interest expense | | 56 | | | 43 | | | 114 | | | 85 | |

| Income from continuing operations before income tax provision | | 147 | | | 44 | | | 237 | | | 65 | |

| Income tax provision (benefit) | | (3) | | | 13 | | | 20 | | | 17 | |

| Income from continuing operations | | 150 | | | 31 | | | 217 | | | 48 | |

| Income (loss) from discontinued operations, net of taxes | | — | | | 2 | | | — | | | (1) | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Net income | | $ | 150 | | | $ | 33 | | | $ | 217 | | | $ | 47 | |

| | | | | | | | |

| Net income (loss) | | | | | | | | |

| Continuing operations | | $ | 150 | | | $ | 31 | | | $ | 217 | | | $ | 48 | |

| Discontinued operations | | — | | | 2 | | | — | | | (1) | |

| Net income | | $ | 150 | | | $ | 33 | | | $ | 217 | | | $ | 47 | |

| | | | | | | | |

| Earnings (loss) per share data | | | | | | | | |

| Basic earnings per share from continuing operations | | $ | 1.29 | | | $ | 0.27 | | | $ | 1.87 | | | $ | 0.42 | |

| Basic earnings (loss) per share from discontinued operations | | — | | | 0.01 | | | — | | | (0.01) | |

| Basic earnings per share | | $ | 1.29 | | | $ | 0.28 | | | $ | 1.87 | | | $ | 0.41 | |

| Diluted earnings per share from continuing operations | | $ | 1.25 | | | $ | 0.27 | | | $ | 1.81 | | | $ | 0.41 | |

| Diluted earnings (loss) per share from discontinued operations | | — | | | 0.01 | | | — | | | (0.01) | |

| Diluted earnings per share | | $ | 1.25 | | | $ | 0.28 | | | $ | 1.81 | | | $ | 0.40 | |

| | | | | | | | |

| Weighted-average common shares outstanding | | | | | | | | |

| Basic weighted-average common shares outstanding | | 116 | | | 116 | | | 116 | | | 116 | |

| Diluted weighted-average common shares outstanding | | 120 | | | 118 | | | 120 | | | 117 | |

Amounts may not add due to rounding.

See accompanying notes to condensed consolidated financial statements.

XPO, Inc.

Condensed Consolidated Statements of Comprehensive Income

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| (In millions) | | 2024 | | 2023 | | 2024 | | 2023 |

| Net income | | $ | 150 | | | $ | 33 | | | $ | 217 | | | $ | 47 | |

| | | | | | | | |

| Other comprehensive income (loss), net of tax | | | | | | | | |

Foreign currency translation gain (loss), net of tax effect of $(4), $2, $(7) and $10 | | $ | (3) | | | $ | 14 | | | $ | (9) | | | $ | 27 | |

Unrealized gain on financial assets/liabilities designated as hedging instruments, net of tax effect of $(1), $—, $(1) and $1 | | — | | | 1 | | | 1 | | | 3 | |

| | | | | | | | |

| Other comprehensive income (loss) | | (3) | | | 15 | | | (8) | | | 30 | |

| | | | | | | | |

| | | | | | | | |

| Comprehensive income | | $ | 147 | | | $ | 48 | | | $ | 209 | | | $ | 77 | |

Amounts may not add due to rounding.

See accompanying notes to condensed consolidated financial statements.

XPO, Inc.

Condensed Consolidated Statements of Cash Flows

(Unaudited) | | | | | | | | | | | | | | |

| | Six Months Ended June 30, |

| (In millions) | | 2024 | | 2023 |

| Cash flows from operating activities of continuing operations | | | | |

| Net income | | $ | 217 | | | $ | 47 | |

| Loss from discontinued operations, net of taxes | | — | | | (1) | |

| Income from continuing operations | | 217 | | | 48 | |

Adjustments to reconcile income from continuing operations to net cash from operating activities | | | | |

| Depreciation and amortization | | 239 | | | 208 | |

| Stock compensation expense | | 42 | | | 41 | |

| Accretion of debt | | 5 | | | 7 | |

| Deferred tax expense (benefit) | | 25 | | | (6) | |

| | | | |

| | | | |

| Gains on sales of property and equipment | | (5) | | | (5) | |

| Other | | 6 | | | 39 | |

| Changes in assets and liabilities | | | | |

| Accounts receivable | | (135) | | | (64) | |

| Other assets | | (67) | | | (31) | |

| Accounts payable | | 14 | | | (57) | |

| Accrued expenses and other liabilities | | 13 | | | 27 | |

| Net cash provided by operating activities from continuing operations | | 355 | | | 207 | |

| Cash flows from investing activities of continuing operations | | | | |

| | | | |

| Payment for purchases of property and equipment | | (496) | | | (355) | |

| Proceeds from sale of property and equipment | | 13 | | | 13 | |

| | | | |

| | | | |

| Net cash used in investing activities from continuing operations | | (483) | | | (342) | |

| Cash flows from financing activities of continuing operations | | | | |

| Proceeds from issuance of debt | | — | | | 1,977 | |

| | | | |

| Repurchase of debt | | — | | | (2,003) | |

| | | | |

| | | | |

| Repayment of debt and finance leases | | (39) | | | (35) | |

| Payment for debt issuance costs | | (4) | | | (15) | |

| | | | |

| | | | |

| Change in bank overdrafts | | 27 | | | 51 | |

| Payment for tax withholdings for restricted shares | | (17) | | | (12) | |

| | | | |

| Other | | (1) | | | 1 | |

| Net cash used in financing activities from continuing operations | | (35) | | | (36) | |

| | | | |

| Cash flows from discontinued operations | | | | |

| Operating activities of discontinued operations | | — | | | (8) | |

| Investing activities of discontinued operations | | — | | | 1 | |

| | | | |

| Net cash used in discontinued operations | | — | | | (7) | |

| Effect of exchange rates on cash, cash equivalents and restricted cash | | — | | | 5 | |

| Net decrease in cash, cash equivalents and restricted cash | | (162) | | | (173) | |

| Cash, cash equivalents and restricted cash, beginning of period | | 419 | | | 470 | |

| Cash, cash equivalents and restricted cash, end of period | | $ | 256 | | | $ | 297 | |

| | | | |

| | | | |

| Supplemental disclosure of cash flow information | | | | |

| | | | |

| Leased assets obtained in exchange for new operating lease liabilities | | $ | 144 | | | $ | 46 | |

| Leased assets obtained in exchange for new finance lease liabilities | | 31 | | | 36 | |

| Cash paid for interest | | 101 | | | 90 | |

| Cash paid for income taxes | | 32 | | | 18 | |

Amounts may not add due to rounding.

See accompanying notes to condensed consolidated financial statements.

XPO, Inc.

Condensed Consolidated Statements of Changes in Equity

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Common Stock | | | | | | | | | | | | |

| (Shares in thousands, dollars in millions) | | | | | | Shares | | Amount | | Additional Paid-In Capital | | Retained Earnings | | Accumulated Other

Comprehensive Loss | | | | | | Total Equity |

| Balance as of March 31, 2024 | | | | | | 116,312 | | | $ | — | | | $ | 1,302 | | | $ | 252 | | | $ | (222) | | | | | | | $ | 1,332 | |

| Net income | | | | | | — | | | — | | | — | | | 150 | | | — | | | | | | | 150 | |

| Other comprehensive loss | | | | | | — | | | — | | | — | | | — | | | (3) | | | | | | | (3) | |

| | | | | | | | | | | | | | | | | | | | |

Exercise and vesting of stock compensation awards | | | | | | 32 | | | — | | | — | | | — | | | — | | | | | | | — | |

Tax withholdings related to vesting of stock compensation awards | | | | | | — | | | — | | | (3) | | | — | | | — | | | | | | | (3) | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Stock compensation expense | | | | | | — | | | — | | | 23 | | | — | | | — | | | | | | | 23 | |

| | | | | | | | | | | | | | | | | | | | |

| Balance as of June 30, 2024 | | | | | | 116,344 | | | $ | — | | | $ | 1,322 | | | $ | 402 | | | $ | (225) | | | | | | | $ | 1,499 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | Common Stock | | | | | | | | | | | | |

| (Shares in thousands, dollars in millions) | | | | | | Shares | | Amount | | Additional Paid-In Capital | | Retained Earnings | | Accumulated Other

Comprehensive Loss | | | | | | Total Equity |

| Balance as of December 31, 2023 | | | | | | 116,073 | | | $ | — | | | $ | 1,298 | | | $ | 185 | | | $ | (217) | | | | | | | $ | 1,266 | |

| Net income | | | | | | — | | | — | | | — | | | 217 | | | — | | | | | | | 217 | |

| Other comprehensive loss | | | | | | — | | | — | | | — | | | — | | | (8) | | | | | | | (8) | |

| | | | | | | | | | | | | | | | | | | | |

Exercise and vesting of stock compensation awards | | | | | | 271 | | | — | | | — | | | — | | | — | | | | | | | — | |

Tax withholdings related to vesting of stock compensation awards | | | | | | — | | | — | | | (18) | | | — | | | — | | | | | | | (18) | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Stock compensation expense | | | | | | — | | | — | | | 42 | | | — | | | — | | | | | | | 42 | |

| | | | | | | | | | | | | | | | | | | | |

| Balance as of June 30, 2024 | | | | | | 116,344 | | | $ | — | | | $ | 1,322 | | | $ | 402 | | | $ | (225) | | | | | | | $ | 1,499 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Common Stock | | | | | | | | | | | | |

| (Shares in thousands, dollars in millions) | | | | | | Shares | | Amount | | Additional Paid-In Capital | | Retained Earnings | | Accumulated Other

Comprehensive Loss | | | | | | Total Equity |

| Balance as of March 31, 2023 | | | | | | 115,750 | | | $ | — | | | $ | 1,252 | | | $ | 10 | | | $ | (207) | | | | | | | $ | 1,055 | |

| Net income | | | | | | — | | | — | | | — | | | 33 | | | — | | | | | | | 33 | |

| Other comprehensive loss | | | | | | — | | | — | | | — | | | — | | | 15 | | | | | | | 15 | |

| | | | | | | | | | | | | | | | | | | | |

Exercise and vesting of stock compensation awards | | | | | | 189 | | | — | | | — | | | — | | | — | | | | | | | — | |

Tax withholdings related to vesting of stock compensation awards | | | | | | — | | | — | | | (4) | | | — | | | — | | | | | | | (4) | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Stock compensation expense | | | | | | — | | | — | | | 19 | | | — | | | — | | | | | | | 19 | |

Other | | | | | | — | | | — | | | 1 | | | — | | | — | | | | | | | 1 | |

| Balance as of June 30, 2023 | | | | | | 115,939 | | | $ | — | | | $ | 1,268 | | | $ | 43 | | | $ | (192) | | | | | | | $ | 1,119 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Common Stock | | | | | | | | | | | | |

| (Shares in thousands, dollars in millions) | | | | | | Shares | | Amount | | Additional Paid-In Capital | | Retained Earnings (Accumulated Deficit) | | Accumulated Other

Comprehensive Loss | | | | | | Total Equity |

| Balance as of December 31, 2022 | | | | | | 115,435 | | | $ | — | | | $ | 1,238 | | | $ | (4) | | | $ | (222) | | | | | | | $ | 1,012 | |

| Net income | | | | | | — | | | — | | | — | | | 47 | | | — | | | | | | | 47 | |

| Other comprehensive income | | | | | | — | | | — | | | — | | | — | | | 30 | | | | | | | 30 | |

| | | | | | | | | | | | | | | | | | | | |

Exercise and vesting of stock compensation awards | | | | | | 504 | | | — | | | — | | | — | | | — | | | | | | | — | |

Tax withholdings related to vesting of stock compensation awards | | | | | | — | | | — | | | (12) | | | — | | | — | | | | | | | (12) | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Stock compensation expense | | | | | | — | | | — | | | 41 | | | — | | | — | | | | | | | 41 | |

| Other | | | | | | — | | | — | | | 1 | | | — | | | — | | | | | | | 1 | |

| Balance as of June 30, 2023 | | | | | | 115,939 | | | $ | — | | | $ | 1,268 | | | $ | 43 | | | $ | (192) | | | | | | | $ | 1,119 | |

Amounts may not add due to rounding.

See accompanying notes to condensed consolidated financial statements.

XPO, Inc.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

1. Organization, Description of Business and Basis of Presentation

XPO, Inc., together with its subsidiaries (“XPO,” “we” or the “Company”), is a leading provider of freight transportation services. We use our proprietary technology to move goods efficiently through our customers’ supply chains in North America and Europe. See Note 2—Segment Reporting for additional information on our operations.

Strategic Developments

In December 2023, we acquired 28 less-than-truckload (“LTL”) service centers in the U.S. previously operated by Yellow Corporation. In connection with this transaction, we purchased 26 of the service centers and assumed existing leases for the other two locations. This strategic acquisition of assets aligns with our commitment to invest in expanding our LTL network capacity.

Our Board of Directors has previously authorized the divestiture of our European business. There can be no assurance that the divestiture will occur, or of the terms or timing of a transaction.

Basis of Presentation

We prepared our Condensed Consolidated Financial Statements in accordance with U.S. generally accepted accounting principles (“GAAP”) and on the same basis as the accounting policies described in our Annual Report on Form 10-K for the year ended December 31, 2023 (the “2023 Form 10-K”). The interim reporting requirements of Form 10-Q allow certain information and note disclosures normally included in annual consolidated financial statements to be condensed or omitted. These Condensed Consolidated Financial Statements should be read in conjunction with the 2023 Form 10-K.

The Condensed Consolidated Financial Statements are not audited but reflect all adjustments that are of a normal recurring nature and are necessary for a fair presentation of the financial condition, operating results and cash flows for the interim periods presented. Operating results for the three and six months ended June 30, 2024 are not necessarily indicative of the results that may be expected for the year ending December 31, 2024.

The historical results of operations and financial positions of RXO, Inc., GXO Logistics, Inc. and our intermodal operation are presented as discontinued operations and, as such, have been excluded from both continuing operations and segment results for all periods presented.

Within the Condensed Consolidated Financial Statements and associated notes, certain amounts may not add due to the use of rounded numbers. Percentages presented are calculated from the underlying numbers in millions.

Restricted Cash

As of June 30, 2024 and December 31, 2023, our restricted cash included in Other long-term assets on our Condensed Consolidated Balance Sheets was $6 million and $7 million, respectively.

Trade Receivables Securitization and Factoring Programs

We sell certain of our trade accounts receivable on a non-recourse basis to third-party financial institutions under factoring agreements. We also sell trade accounts receivable under a securitization program for our European Transportation business. We use trade receivables securitization and factoring programs to help manage our cash flows and offset the impact of extended payment terms for some of our customers.

The maximum amount of net cash proceeds available at any one time under our securitization program, inclusive of any unsecured borrowings, is €200 million (approximately $214 million as of June 30, 2024). As of June 30, 2024, €6 million (approximately $6 million) was available under the program. The weighted average interest rate was 5.36% as of June 30, 2024. The program expires in July 2026.

Information related to the trade receivables sold was as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| (In millions) | | 2024 | | 2023 | | 2024 | | 2023 |

| Securitization programs | | | | | | | | |

Receivables sold in period | | $ | 449 | | | $ | 470 | | | $ | 899 | | | $ | 910 | |

Cash consideration | | 449 | | | 470 | | | 899 | | | 910 | |

| | | | | | | | |

| Factoring programs | | | | | | | | |

Receivables sold in period | | 20 | | | 34 | | | 41 | | | 58 | |

Cash consideration | | 20 | | | 34 | | | 41 | | | 58 | |

Fair Value Measurements

Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The levels of inputs used to measure fair value are:

•Level 1—Quoted prices for identical instruments in active markets;

•Level 2—Quoted prices for similar instruments in active markets; quoted prices for identical or similar instruments in markets that are not active; and model-derived valuations in which all significant inputs are observable in active markets; and

•Level 3—Valuations based on inputs that are unobservable, generally utilizing pricing models or other valuation techniques that reflect management’s judgment and estimates.

We base our fair value estimates on market assumptions and available information. The carrying values of cash and cash equivalents, accounts receivable, accounts payable, accrued expenses and current maturities of long-term debt approximated their fair values as of June 30, 2024 and December 31, 2023 due to their short-term nature and/or being receivable or payable on demand. The Level 1 cash equivalents include money market funds valued using quoted prices in active markets and a cash deposit for the securitization program. For information on the fair value hierarchy of our derivative instruments, see Note 5—Derivative Instruments and for information on financial liabilities, see Note 6—Debt.

The fair value hierarchy of cash equivalents was as follows:

| | | | | | | | | | | | | | | | | | | | |

| (In millions) | | Carrying Value | | Fair Value | | Level 1 |

| June 30, 2024 | | $ | 208 | | | $ | 208 | | | $ | 208 | |

| December 31, 2023 | | 369 | | | 369 | | | 369 | |

Accounting Pronouncements Issued but Not Yet Effective

In December 2023, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2023-09, “Income Taxes (Topic 740): Improvements to Income Tax Disclosures.” The ASU modifies income tax disclosures by requiring (i) consistent categories and greater disaggregation of information in the rate reconciliations and (ii) the disclosure of income taxes paid disaggregated by jurisdiction, among other requirements. This ASU is effective for annual periods beginning in 2025, and should be applied on a prospective basis, with the option to apply retrospectively. Early adoption is permitted. We are currently evaluating the impact of the new standard, which is limited to financial statement disclosures.

In November 2023, the FASB issued ASU 2023-07, “Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures.” The amendments in the ASU increase reportable segment disclosure requirements primarily through enhanced disclosures about significant segment expenses. In addition, the amendments enhance interim disclosure requirements, clarify circumstances in which an entity can disclose multiple segment measures of profit and loss, and provide new segment disclosure requirements for entities with a single reportable segment, among other disclosure requirements. This ASU is effective on a retrospective basis for annual periods beginning in 2024, and for interim periods beginning January 1, 2025. Early adoption is permitted. We are currently evaluating the impact of the new standard, which is limited to financial statement disclosures.

2. Segment Reporting

We are organized into two reportable segments: North American LTL, the largest component of our business, and European Transportation.

In our North American LTL segment, we provide shippers with geographic density and day-definite domestic and cross-border services to the U.S., as well as Mexico, Canada and the Caribbean. Our North American LTL segment also includes the results of our trailer manufacturing operations.

In our European Transportation segment, we serve an extensive base of customers within the consumer, trade and industrial markets. We offer dedicated truckload, LTL, truck brokerage, managed transportation, last mile, freight forwarding, warehousing and multimodal solutions, such as road-rail and road-short sea combinations.

Corporate includes corporate headquarters costs for executive officers and certain legal and financial functions, and other costs and credits not attributed to our reportable segments.

Our chief operating decision maker (“CODM”) regularly reviews financial information at the operating segment level to allocate resources to the segments and to assess their performance. We include items directly attributable to a segment, and those that can be allocated on a reasonable basis, in segment results reported to the CODM. We do not provide asset information by segment to the CODM. Our CODM evaluates segment profit (loss) based on adjusted earnings before interest, taxes, depreciation and amortization (“Adjusted EBITDA”), which we define as income from continuing operations before debt extinguishment loss, interest expense, income tax provision (benefit), depreciation and amortization expense, transaction and integration costs, restructuring costs and other adjustments. Segment Adjusted EBITDA includes an allocation of corporate costs.

Selected financial data for our segments is as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| (in millions) | | 2024 | | 2023 | | 2024 | | 2023 |

| Revenue | | | | | | | | |

| North American LTL | | $ | 1,272 | | | $ | 1,136 | | | $ | 2,493 | | | $ | 2,256 | |

| European Transportation | | 808 | | | 781 | | | 1,605 | | | 1,568 | |

| Total | | $ | 2,079 | | | $ | 1,917 | | | $ | 4,097 | | | $ | 3,824 | |

| | | | | | | | |

| Adjusted EBITDA | | | | | | | | |

| North American LTL | | $ | 297 | | | $ | 208 | | | $ | 551 | | | $ | 390 | |

| European Transportation | | 49 | | | 46 | | | 87 | | | 83 | |

| Corporate | | (3) | | | (10) | | | (8) | | | (19) | |

| Total Adjusted EBITDA | | 343 | | | 244 | | | 631 | | | 454 | |

| Less: | | | | | | | | |

| Debt extinguishment loss | | — | | | 23 | | | — | | | 23 | |

| Interest expense | | 56 | | | 43 | | | 114 | | | 85 | |

| Income tax provision (benefit) | | (3) | | | 13 | | | 20 | | | 17 | |

| Depreciation and amortization expense | | 122 | | | 107 | | | 239 | | | 208 | |

| | | | | | | | |

| | | | | | | | |

Transaction and integration costs (1) | | 12 | | | 17 | | | 26 | | | 39 | |

Restructuring costs (2) | | 6 | | | 10 | | | 14 | | | 34 | |

| | | | | | | | |

| Income from continuing operations | | $ | 150 | | | $ | 31 | | | $ | 217 | | | $ | 48 | |

| | | | | | | | |

| Depreciation and amortization expense | | | | | | | | |

| North American LTL | | $ | 86 | | | 71 | | | $ | 168 | | | $ | 139 | |

| European Transportation | | 35 | | | 33 | | | 70 | | | 65 | |

| Corporate | | 1 | | | 3 | | | 2 | | | 4 | |

| Total | | $ | 122 | | | $ | 107 | | | $ | 239 | | | $ | 208 | |

(1) Transaction and integration costs for the periods ended June 30, 2024 and June 30, 2023 are primarily comprised of stock-based compensation for certain employees related to strategic initiatives, while the 2023 periods also include retention awards for certain employees related to strategic initiatives. Transaction and integration costs for the three months ended June 30, 2024 and 2023 include $1 million and $0 million, respectively, related to our European Transportation segment, and $11 million and $17 million, respectively, related to Corporate. Transaction and integration costs for the six months ended June 30, 2024 and 2023 include $1 million and $0 million, respectively, related to our North American LTL segment, $1 million and $1 million, respectively, related to our European Transportation segment, and $24 million and $38 million, respectively, related to Corporate.

(2) Restructuring costs for the three months ended June 30, 2024 and 2023 include $1 million and $4 million, respectively, related to our North American LTL segment, $3 million and $1 million, respectively, related to our European Transportation segment, and $1 million and $5 million, respectively, related to Corporate. Restructuring costs for the six months ended June 30, 2024 and 2023 include $2 million and $10 million, respectively, related to our North American LTL segment, $11 million and $8 million, respectively, related to our European Transportation segment, and $1 million and $16 million, respectively, related to Corporate. See Note 4— Restructuring Charges for further information on our restructuring actions.

3. Revenue Recognition

Disaggregation of Revenues

Our revenue disaggregated by geographic area based on sales office location was as follows: | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, 2024 |

| (In millions) | | North American LTL | | European Transportation | | | | Total |

| Revenue | | | | | | | | |

| United States | | $ | 1,244 | | | $ | — | | | | | $ | 1,244 | |

| North America (excluding United States) | | 28 | | | — | | | | | 28 | |

| France | | — | | | 331 | | | | | 331 | |

| United Kingdom | | — | | | 254 | | | | | 254 | |

| Europe (excluding France and United Kingdom) | | — | | | 222 | | | | | 222 | |

| | | | | | | | |

| Total | | $ | 1,272 | | | $ | 808 | | | | | $ | 2,079 | |

| | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, 2023 |

| (In millions) | | North American LTL | | European Transportation | | | | Total |

| Revenue | | | | | | | | |

| United States | | $ | 1,112 | | | $ | — | | | | | $ | 1,112 | |

| North America (excluding United States) | | 24 | | | — | | | | | 24 | |

| France | | — | | | 331 | | | | | 331 | |

| United Kingdom | | — | | | 226 | | | | | 226 | |

| Europe (excluding France and United Kingdom) | | — | | | 224 | | | | | 224 | |

| | | | | | | | |

| Total | | $ | 1,136 | | | $ | 781 | | | | | $ | 1,917 | |

| | | | | | | | | | | | | | | | | | | | | | |

| | Six Months Ended June 30, 2024 |

| (In millions) | | North American LTL | | European Transportation | | | | Total |

| Revenue | | | | | | | | |

| United States | | $ | 2,438 | | | $ | — | | | | | $ | 2,438 | |

| North America (excluding United States) | | 55 | | | — | | | | | 55 | |

| France | | — | | | 664 | | | | | 664 | |

| United Kingdom | | — | | | 497 | | | | | 497 | |

| Europe (excluding France and United Kingdom) | | — | | | 443 | | | | | 443 | |

| | | | | | | | |

| Total | | $ | 2,493 | | | $ | 1,605 | | | | | $ | 4,097 | |

| | | | | | | | | | | | | | | | | | | | | | |

| | Six Months Ended June 30, 2023 |

| (In millions) | | North American LTL | | European Transportation | | | | Total |

| Revenue | | | | | | | | |

| United States | | $ | 2,209 | | | $ | — | | | | | $ | 2,209 | |

| North America (excluding United States) | | 47 | | | — | | | | | 47 | |

| France | | — | | | 671 | | | | | 671 | |

| United Kingdom | | — | | | 450 | | | | | 450 | |

| Europe (excluding France and United Kingdom) | | — | | | 447 | | | | | 447 | |

| | | | | | | | |

| Total | | $ | 2,256 | | | $ | 1,568 | | | | | $ | 3,824 | |

4. Restructuring Charges

We engage in restructuring actions as part of our ongoing efforts to best use our resources and infrastructure. These actions generally include severance and facility-related costs, including impairment of lease assets, as well as contract termination costs, and are intended to improve our efficiency and profitability.

Our restructuring-related activity was as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Six Months Ended June 30, 2024 | |

| (In millions) | | Reserve Balance

as of

December 31, 2023 | | Charges Incurred | | Payments | | | | Foreign Exchange and Other | | Reserve Balance

as of

June 30, 2024 |

| Severance | | | | | | | | | | | | |

| North American LTL | | $ | 2 | | | $ | — | | | $ | (2) | | | | | $ | 1 | | | $ | 2 | |

| European Transportation | | 1 | | | 10 | | | (8) | | | | | — | | | 2 | |

| Corporate | | 8 | | | 1 | | | (6) | | | | | (1) | | | 3 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Total | | $ | 11 | | | $ | 11 | | | $ | (16) | | | | | $ | — | | | $ | 7 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

In addition to the severance charges noted in the table above, we recorded non-cash charges in our North American LTL and European Transportation segments of $2 million and $1 million, respectively, during the first six months of 2024.

We expect that the majority of the cash outlays related to the severance charges incurred in the first six months of 2024 will be completed within 12 months.

5. Derivative Instruments

In the normal course of business, we are exposed to risks arising from business operations and economic factors, including fluctuations in interest rates and foreign currencies. We use derivative instruments to manage the volatility related to these exposures. The objective of these derivative instruments is to reduce fluctuations in our earnings and cash flows associated with changes in foreign currency exchange rates and interest rates. These financial instruments are not used for trading or other speculative purposes. Historically, we have not incurred, and do not expect to incur in the future, any losses as a result of counterparty default.

The fair value of our derivative instruments and the related notional amounts were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | June 30, 2024 |

| | | | Derivative Assets | | Derivative Liabilities |

| (In millions) | | Notional Amount | | Balance Sheet Caption | | Fair Value | | Balance Sheet Caption | | Fair Value |

| Derivatives designated as hedges | | | | | | | | | | |

| Cross-currency swap agreements | | $ | 249 | | | Other current assets | | $ | — | | | Other current liabilities | | $ | (7) | |

| Cross-currency swap agreements | | 403 | | | Other long-term assets | | — | | | Other long-term liabilities | | (8) | |

| Interest rate swaps | | 550 | | | Other current assets | | 1 | | | Other current liabilities | | — | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Total | | | | | | $ | 1 | | | | | $ | (15) | |

| | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | December 31, 2023 |

| | | | Derivative Assets | | Derivative Liabilities |

| (In millions) | | Notional Amount | | Balance Sheet Caption | | Fair Value | | Balance Sheet Caption | | Fair Value |

| Derivatives designated as hedges | | | | | | | | | | |

| Cross-currency swap agreements | | $ | 652 | | | Other current assets | | $ | — | | | Other current liabilities | | $ | (34) | |

| | | | | | | | | | |

| Interest rate swaps | | 350 | | | Other current assets | | — | | | Other current liabilities | | (2) | |

| Interest rate swaps | | 200 | | | Other long-term assets | | — | | | Other long-term liabilities | | — | |

| Total | | | | | | $ | — | | | | | $ | (36) | |

The derivatives are classified as Level 2 within the fair value hierarchy. The derivatives are valued using inputs other than quoted prices, such as foreign exchange rates and yield curves.

The effect of derivative and nonderivative instruments designated as hedges on our Condensed Consolidated Statements of Income was as follows: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Amount of Gain (Loss) Recognized in Other Comprehensive Income (Loss) on Derivatives | | Amount of Gain Reclassified from AOCI into Net Income | | Amount of Gain Recognized in Income on Derivative (Amount Excluded from Effectiveness Testing) |

| | Three Months Ended June 30, |

| (In millions) | | 2024 | | 2023 | | 2024 | | 2023 | | 2024 | | 2023 |

| Derivatives designated as cash flow hedges | | | | | | | | | | | | |

| | | | | | | | | | | | |

| Interest rate swaps | | $ | — | | | $ | 1 | | | $ | — | | | $ | 1 | | | $ | — | | | $ | — | |

| Derivatives designated as net investment hedges | | | | | | | | | | | | |

| Cross-currency swap agreements | | 5 | | | (3) | | | — | | | — | | | 2 | | | 2 | |

| Total | | $ | 5 | | | $ | (2) | | | $ | — | | | $ | 1 | | | $ | 2 | | | $ | 2 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Amount of Gain (Loss) Recognized in Other Comprehensive Income (Loss) on Derivatives | | Amount of Gain Reclassified from AOCI into Net Income | | Amount of Gain Recognized in Income on Derivative (Amount Excluded from Effectiveness Testing) |

| | Six Months Ended June 30, |

| (In millions) | | 2024 | | 2023 | | 2024 | | 2023 | | 2024 | | 2023 |

| Derivatives designated as cash flow hedges | | | | | | | | | | | | |

| | | | | | | | | | | | |

| Interest rate swaps | | $ | 2 | | | $ | 2 | | | $ | 1 | | | $ | 1 | | | $ | — | | | $ | — | |

| Derivatives designated as net investment hedges | | | | | | | | | | | | |

| Cross-currency swap agreements | | 18 | | | (13) | | | — | | | — | | | 5 | | | 4 | |

| Total | | $ | 21 | | | $ | (11) | | | $ | 1 | | | $ | 1 | | | $ | 5 | | | $ | 4 | |

Cross-Currency Swap Agreements

We enter into cross-currency swap agreements to manage the foreign currency exchange risk related to our international operations by effectively converting our fixed-rate USD-denominated debt, including the associated interest payments, to fixed-rate, euro (“EUR”)-denominated debt. The risk management objective of these transactions is to manage foreign currency risk relating to net investments in subsidiaries denominated in foreign currencies and reduce the variability in the functional currency equivalent cash flows of this debt.

During the term of the swap contracts, we will receive interest on a quarterly basis from the counterparties based on USD fixed interest rates, and we will pay interest, also on a quarterly basis, to the counterparties based on EUR

fixed interest rates. At maturity, we will repay the original principal amount in EUR and receive the principal amount in USD. These agreements expire at various dates through 2027.

We designated these cross-currency swaps as qualifying hedging instruments and account for them as net investment hedges. We apply the simplified method of assessing the effectiveness of our net investment hedging relationships. Under this method, for each reporting period, the change in the fair value of the cross-currency swaps is initially recognized in Accumulated other comprehensive income (“AOCI”). The change in the fair value due to foreign exchange remains in AOCI and the initial component excluded from effectiveness testing will initially remain in AOCI and then will be reclassified from AOCI to Interest expense each period in a systematic manner. Cash flows related to the periodic exchange of interest payments for these net investment hedges are included in Cash flows from operating activities of continuing operations on our Condensed Consolidated Statements of Cash Flows.

Interest Rate Hedging

We execute short-term interest rate swaps to mitigate variability in forecasted interest payments on our Senior Secured Term Loan Credit Agreement (the “Term Loan Credit Agreement”). The interest rate swaps convert floating-rate interest payments into fixed rate interest payments. We designated the interest rate swaps as qualifying hedging instruments and account for these derivatives as cash flow hedges. The outstanding interest rate swaps mature on various dates in 2024 and 2025.

We record gains and losses resulting from fair value adjustments to the designated portion of interest rate swaps in AOCI and reclassify them to Interest expense on the dates that interest payments accrue. Cash flows related to the interest rate swaps are included in Cash flows from operating activities of continuing operations on our Condensed Consolidated Statements of Cash Flows.

6. Debt

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | June 30, 2024 | | December 31, 2023 |

| (In millions) | | Principal Balance | | Carrying Value | | Principal Balance | | Carrying Value |

| | | | | | | | |

| Term loan facility | | $ | 1,100 | | | $ | 1,088 | | | $ | 1,100 | | | $ | 1,087 | |

| | | | | | | | |

6.25% senior secured notes due 2028 | | 830 | | | 822 | | | 830 | | | 822 | |

7.125% senior notes due 2031 | | 450 | | | 445 | | | 450 | | | 445 | |

7.125% senior notes due 2032 | | 585 | | | 576 | | | 585 | | | 575 | |

6.70% senior debentures due 2034 | | 300 | | | 223 | | | 300 | | | 221 | |

| | | | | | | | |

| Finance leases, asset financing and other | | 240 | | | 240 | | | 254 | | | 254 | |

| Total debt | | 3,505 | | | 3,394 | | | 3,519 | | | 3,404 | |

| Short-term borrowings and current maturities of long-term debt | | 64 | | | 64 | | | 69 | | | 69 | |

| Long-term debt | | $ | 3,441 | | | $ | 3,330 | | | $ | 3,450 | | | $ | 3,335 | |

The fair value of our debt and classification in the fair value hierarchy was as follows:

| | | | | | | | | | | | | | | | | | | | |

| (In millions) | | Fair Value | | Level 1 | | Level 2 |

| June 30, 2024 | | $ | 3,546 | | | $ | 2,214 | | | $ | 1,333 | |

| December 31, 2023 | | 3,583 | | | 2,235 | | | 1,348 | |

We valued Level 1 debt using quoted prices in active markets. We valued Level 2 debt using bid evaluation pricing models or quoted prices of securities with similar characteristics.

ABL Facility

As of June 30, 2024, our borrowing base was $587 million and our availability under our Second Amended and Restated Revolving Credit Agreement, as amended (the “ABL Facility”) was $586 million after considering outstanding letters of credit of less than $1 million. As of June 30, 2024, we were in compliance with the ABL Facility’s financial covenants.

Letters of Credit Facility

As of June 30, 2024, we had issued $137 million in aggregate face amount of letters of credit under our $200 million uncommitted secured evergreen letter of credit facility.

Term Loan Facility

In 2015, we entered into a Term Loan Credit Agreement that provided for a single borrowing of $1.6 billion, which was subsequently amended to increase the principal balance to $2.0 billion and to extend the maturity date to February 2025 (the “Existing Term Loan Facility”).

In the second quarter of 2023, we amended the Term Loan Credit Agreement to obtain $700 million of new term loans (the “New Term Loan Facility”) having substantially similar terms as the Existing Term Loan Facility, except with respect to maturity date, issue price, interest rate, prepayment premiums in connection with certain voluntary prepayments and certain other provisions. The New Term Loan Facility was issued at 99.5% of the face amount and will mature in May 2028.

In the same period, we used net proceeds from the New Term Loan Facility, the Senior Secured Notes due 2028 (as defined below) and the Senior Notes due 2031 (as defined below), together with cash on hand, to repay $2.0 billion of outstanding principal under the Existing Term Loan Facility and to pay related fees, expenses and accrued interest. We recorded a debt extinguishment loss of $23 million in the second quarter 2023 due to this repayment.

In the fourth quarter of 2023, we entered into an incremental amendment to the Term Loan Credit Agreement to obtain $400 million of incremental term loans (the “Incremental Term Loans”). The Incremental Term Loans are a new tranche of loans under the Term Loan Credit Agreement and will mature in February 2031.

The applicable interest rate for the two tranches of the term loan facility approximated 7.34% as of June 30, 2024.

Senior Notes Due 2028 and 2031

In the second quarter of 2023, we completed private placements of $830 million aggregate principal amount of senior secured notes due 2028 (the “Senior Secured Notes due 2028”) and $450 million aggregate principal amount of senior notes due 2031 (the “Senior Notes due 2031”). The Senior Secured Notes due 2028 mature in June 2028 and bear interest at a rate of 6.25% per annum. The Senior Notes due 2031 mature in June 2031 and bear interest at a rate of 7.125% per annum. Interest is payable semi-annually in cash in arrears and commenced December 1, 2023. These notes were issued at par and were used to repay our Existing Term Loan Facility as described above.

7. Income Taxes

During the second quarter of 2024, the Company executed a legal entity reorganization in our European Transportation business that resulted in a one-time tax benefit of $41 million in the second quarter of 2024.

8. Earnings (Loss) per Share

The computations of basic and diluted earnings per share were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended June 30, | | Six Months Ended June 30, |

| (In millions, except per share data) | | 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Net income from continuing operations | | $ | 150 | | | $ | 31 | | | $ | 217 | | | $ | 48 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Net income (loss) from discontinued operations | | — | | | 2 | | | — | | | (1) | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Net income | | $ | 150 | | | $ | 33 | | | $ | 217 | | | $ | 47 | |

| | | | | | | | | |

| Basic weighted-average common shares | | 116 | | | 116 | | | 116 | | | 116 | |

| Dilutive effect of stock-based awards | | 4 | | | 2 | | | 4 | | | 1 | |

| Diluted weighted-average common shares | | 120 | | | 118 | | | 120 | | | 117 | |

| | | | | | | | | |

| Basic earnings from continuing operations per share | | $ | 1.29 | | | $ | 0.27 | | | $ | 1.87 | | | $ | 0.42 | |

| Basic earnings (loss) from discontinued operations per share | | — | | | 0.01 | | | — | | | (0.01) | |

| Basic earnings per share | | $ | 1.29 | | | $ | 0.28 | | | $ | 1.87 | | | $ | 0.41 | |

| | | | | | | | | |

| | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | |

| | | | | | | | | |

| | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | |

| | | | | | | | | |

| Diluted earnings from continuing operations per share | | $ | 1.25 | | | $ | 0.27 | | | $ | 1.81 | | | $ | 0.41 | |

| Diluted earnings (loss) from discontinued operations per share | | — | | | 0.01 | | | — | | | (0.01) | |

| Diluted earnings per share | | $ | 1.25 | | | $ | 0.28 | | | $ | 1.81 | | | $ | 0.40 | |

| | | | | | | | | |

| | | | | | | | |

9. Commitments and Contingencies

We are involved, and expect to continue to be involved, in numerous proceedings arising out of the conduct of our business. These proceedings may include claims for property damage or personal injury incurred in connection with the transportation of freight, environmental liability, commercial disputes, insurance coverage disputes and employment-related claims, including claims involving asserted breaches of employee restrictive covenants.

We establish accruals for specific legal proceedings when it is considered probable that a loss has been incurred and the amount of the loss can be reasonably estimated. We review and adjust, as appropriate, accruals for loss contingencies at least quarterly and as additional information becomes available. If a loss is not both probable and reasonably estimable, or if an exposure to loss exists in excess of the amount accrued, we assess whether there is at least a reasonable possibility that a loss, or additional loss, may have been incurred. If there is a reasonable possibility that a loss, or additional loss, may have been incurred, we disclose the estimate of the possible loss or range of loss if it is material and an estimate can be made, or disclose that such an estimate cannot be made. The determination as to whether a loss can reasonably be considered to be possible or probable is based on our assessment, together with legal counsel, regarding the ultimate outcome of the matter.

We believe that we have adequately accrued for the potential impact of loss contingencies that are probable and reasonably estimable. We do not believe that the ultimate resolution of any matters to which we are presently a party will have a material adverse effect on our results of operations, financial condition or cash flows. However, the results of these matters cannot be predicted with certainty, and an unfavorable resolution of one or more of these matters could have a material adverse effect on our financial condition, results of operations or cash flows. Legal costs incurred related to these matters are expensed as incurred.

We carry liability and excess umbrella insurance policies that we deem sufficient to cover potential legal claims arising in the normal course of conducting our operations as a transportation company. In the event we are required to satisfy a legal claim outside the scope of the coverage provided by insurance, our financial condition, results of operations or cash flows could be negatively impacted.

Insurance Contribution Litigation

In April 2012, Allianz Global Risks US Insurance Company sued eighteen insurance companies in a case captioned Allianz Global Risks US Ins. Co. v. ACE Property & Casualty Ins. Co., et al., Multnomah County Circuit Court (Case No. 1204-04552). Allianz Global Risks US Ins. Co. (“Allianz”) sought contribution on environmental and product liability claims that Allianz agreed to defend and indemnify on behalf of its insured, Daimler Trucks North America (“DTNA”). Defendants had insured Freightliner’s assets, which DTNA acquired in 1981. Con-way, Freightliner’s former parent company, intervened. We acquired Con-way in 2015. Con-way and Freightliner had self-insured under fronting agreements with defendant insurers ACE, Westport, and General. Under those agreements, Con-way agreed to indemnify the fronting carriers for damages assessed under the fronting policies. Con-way’s captive insurer, Centron, was also a named defendant. After a seven-week jury trial in 2014, the jury found that Con-way and the fronting insurers never intended that the insurers defend or indemnify any claims against Freightliner. In June 2015, Allianz appealed to the Oregon Court of Appeals. In May 2019, the Oregon Court of Appeals upheld the jury verdict. In September 2019, Allianz appealed to the Oregon Supreme Court. In March 2021, the Oregon Supreme Court reversed the jury verdict, holding that it was an error to allow the jury to decide how the parties intended the fronting policies to operate, and also holding that the trial court improperly instructed the jury concerning one of the pollution exclusions at issue. In July 2021, the matter was remanded to the trial court for further proceedings consistent with the Oregon Supreme Court’s decision. In June 2023, the trial court decided the parties’ cross-motions for summary judgment, leaving open the pollution exclusion and allocation issues. The trial on the pollution exclusion issue is scheduled to take place in the fall of 2024, and the trial on allocation of defense costs among the applicable insurance policies is to take place in early 2025. We have accrued an immaterial amount for the potential exposure associated with ultimate allocation to the relevant policies; however, any losses that may arise in connection with the fronting policies issued by defendant insurers ACE, Westport, and General are not reasonably estimable at this time.

California Environmental Matters

In August 2022, the Company received a letter from the San Bernardino County District Attorney’s Office (the “County”), written in cooperation with certain other California District Attorneys and the Los Angeles City Attorney, notifying the Company of an investigation into alleged violations with respect to underground storage tanks, hazardous materials, and hazardous waste in California, and offering a meeting. Following meetings between the Company and County attorneys and the Los Angeles City Attorney and an assessment of the allegations and the underlying facts, the Company engaged in negotiations with the County and Los Angeles City Attorneys to address settlement of the alleged violations. The Company previously accrued for this matter, and it was resolved for $7.9 million in April 2024.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Cautionary Statement Regarding Forward-Looking Statements