UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a‑6(e)(2))

☐ Definitive Proxy Statement

☒ Definitive Additional Materials

☐ Soliciting Material under §240.14a‑12

| | |

| WESTERN ASSET MORTGAGE CAPITAL CORPORATION |

| (Name of Registrant as Specified In Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check all boxes that apply):

☒ No fee required

☐ Fee paid previously with preliminary materials

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(l) and 0-11

SUPPLEMENT TO JOINT PROXY STATEMENT/PROSPECTUS FOR

THE SPECIAL MEETINGS OF STOCKHOLDERS OF WESTERN ASSET MORTGAGE CAPITAL CORPORATION AND AG MORTGAGE INVESTMENT TRUST, INC.

TO BE HELD NOVEMBER 7, 2023

As previously disclosed, on August 8, 2023, Western Asset Mortgage Capital Corporation, a Delaware corporation (“WMC”), entered into an Agreement and Plan of Merger (the “Merger Agreement”) with AG Mortgage Investment Trust, Inc., a Maryland corporation (“MITT”), AGMIT Merger Sub, LLC, a Delaware limited liability company and wholly owned subsidiary of MITT (“Merger Sub”), and, solely for the limited purposes set forth in the Merger Agreement, AG REIT Management, LLC, a Delaware limited liability company. Pursuant to, and subject to the terms and conditions set forth in, the Merger Agreement, WMC will merge with and into Merger Sub, with Merger Sub surviving (the “Merger”).

In connection with the Merger, MITT filed a registration statement on Form S-4 (333-274319) (as amended, the “Registration Statement”) with the U.S. Securities and Exchange Commission (the “SEC”). On September 29, 2023, the Registration Statement was declared effective by the SEC. Subsequently, on September 29, 2023, WMC and MITT filed a joint proxy statement/prospectus with respect to the special meetings of stockholders of WMC and MITT, which was initially mailed to WMC stockholders and MITT stockholders on or about October 3, 2023 (the “joint proxy statement/prospectus”).

Since the filing of the joint proxy statement/prospectus, two purported holders of WMC common stock filed complaints against WMC and the members of the WMC board of directors (the “WMC Board”) in court. The two complaints are captioned as follows: Eric Sabatini v. Western Asset Mortgage Capital Corporation, et al. (Complaint - United States District Court for the District of Delaware, Case No. 1:23-cv-01151) (filed October 13, 2023) (the “Sabatini Lawsuit”); and Paul Parshall v. Western Asset Mortgage Capital Corporation, et al. (Complaint – United States District Court for the District of Delaware, Case No. 1:23-cv-01143) (filed October 12, 2023) (the “Parshall Lawsuit” and together with the Sabatini Lawsuit, the “Stockholder Litigation”). In addition to the Stockholder Litigation, ten purported holders of WMC common stock and two purported holders of MITT common stock have delivered demand letters alleging deficiencies similar to the Stockholder Litigation in the disclosures in the Registration Statement and/or the joint proxy statement/prospectus, as applicable, in violation of Sections 14(a) and 20(a) of the Securities Exchange Act of 1934 and Rule 14a-9 thereunder (such letters, the “Demand Letters” and collectively with the Stockholder Litigation, the “Litigation Matters”).

WMC and MITT believe that the claims asserted in the Litigation Matters are without merit and that no additional disclosures were or are required under applicable law. However, in order to moot certain of plaintiffs’ disclosure claims in the Litigation Matters, avoid the risk of the Litigation Matters delaying or adversely affecting the Merger and minimize the costs, risks and uncertainties inherent in litigation, and without admitting any liability or wrongdoing, WMC and MITT have determined to voluntarily make the following supplemental disclosures to the joint proxy statement/prospectus, as described in this supplement (this “Supplement”). Nothing in this Supplement shall be deemed an admission of the legal necessity or materiality under applicable laws of any of the disclosures set forth herein.

These supplemental disclosures will not change the merger consideration to be paid to WMC stockholders in connection with the Merger or the timing of the special meeting of WMC stockholders (the “WMC Special Meeting”) to be held on November 7, 2023, at 9:00 a.m., Pacific Time, or the timing of the special meeting of MITT stockholders (the “MITT Special Meeting”) to be held on November 7, 2023, at 10:00 a.m., Eastern Time. The WMC Board continues to unanimously recommend that the WMC stockholders vote “FOR” the proposals to be voted on at the WMC Special Meeting described in the joint proxy statement/prospectus. The MITT Board continues to unanimously recommend that MITT stockholders vote “FOR” the proposals to be voted on at the MITT Special Meeting described in the joint proxy statement/prospectus.

* * * * *

SUPPLEMENTAL DISCLOSURES TO JOINT PROXY STATEMENT/PROSPECTUS

This Supplement should be read in conjunction with the disclosures contained in the joint proxy statement/prospectus, which in turn should be read in its entirety, along with periodic reports and other information WMC and MITT file with the SEC. To the extent that information herein differs from or updates information contained in the joint proxy statement/prospectus, the information contained herein supersedes the information contained in the joint

proxy statement/prospectus. All page references are to the joint proxy statement/prospectus and terms used below, unless otherwise defined, shall have the meanings ascribed to such terms in the joint proxy statement/prospectus. New text within restated language from the joint proxy statement/prospectus is indicated in bold, underlined text (e.g., bold, underlined text) and removed language within the restated language from the joint proxy statement/prospectus is indicated in strikethrough text (e.g., strikethrough text), as applicable. The information contained herein speaks only as of October 26, 2023 unless the information indicates another date applies.

The section of the joint proxy statement/prospectus entitled “The Merger—Background of the Merger” is amended and supplemented as follows:

1.The following supplemental disclosure replaces in its entirety the second full paragraph on page 96 of the joint proxy statement/prospectus:

As part of the strategic review process, between August 4, 2022 and September 8, 2022, JMP engaged in conversations with a total of 43 parties (including MITT and Terra Property Trust, Inc. (“TPT”)) who were contacted by JMP or responded to WMC’s announcement of the strategic review process, including other mortgage REITs, asset managers and private equity firms, to inform them of the process and to solicit their interest in a possible transaction with WMC. A total of 25 of the parties chose to execute confidentiality agreements and received access to WMC’s data room. Each of the confidentiality agreements included a standstill provision with customary fall away events, including upon WMC’s entry into a definitive written agreement relating to a sale of WMC, and none precluded such parties from making confidential offers to WMC. The 25 parties were also provided with a process letter requesting the submission of non-binding transaction proposals by September 10, 2022.

2.The following supplemental disclosure replaces in its entirety the second full paragraph on page 98 of the joint proxy statement/prospectus:

On January 27, 2023, following the expiration of the exclusivity period with Party A, at the direction of the WMC Board, JMP initiated outreach to a select group of mortgage REITs and real estate focused asset managers who had previously been active in the process or contacted JMP during the exclusivity period with Party A to discuss their interest in reengaging in discussions regarding a transaction with WMC. JMP contacted five parties who had previously engaged in prior discussions with WMC, including TPT and MITT, as well as two new parties who had contacted JMP during the exclusivity period with Party A. Of the contacted parties, three opted not to engage. MITT, TPT and, after executing confidentiality agreements, two other parties contacted were granted access to the data room between February 13, 2023 and February 21, 2023. Following this, two additional parties contacted JMP expressing interest in the process and were granted access to the data room the week of March 13, 2023 after executing confidentiality agreements. Each of the confidentiality agreements that were entered into included a standstill provision with customary fall away events, including upon WMC’s entry into a definitive written agreement relating to a sale of WMC, and neither precluded such parties from making confidential offers to WMC.

3.The following supplemental disclosure replaces in its entirety the fourth full paragraph on page 105 of the joint proxy statement/prospectus:

Over the following weeks, WMC and TPT continued to make progress on preparing a registration statement and cooperating in pursuit of the transactions contemplated by the TPT Merger Agreement. During the same period, representatives of WMC and MITT continued to negotiate the transaction documents related to the MITT Competing Proposal and conducted their respective due diligence as permitted under the terms of the TPT Merger Agreement. Negotiations included discussions of the exchange ratio, termination fees, transaction expense calculations and expense reimbursements in the event of a party’s failure to obtain stockholder approval. Negotiations did not involve discussions of post-transaction employment for any member of WMC management. Throughout this period, representatives of Skadden continued to provide notice to TPT and TPT’s outside counsel and with copies of draft transaction documents between WMC and MITT in accordance with WMC’s obligations under the TPT Merger Agreement.

The section of the joint proxy statement/prospectus entitled “The Merger—Opinion of MITT’s Financial Advisor” is hereby amended and supplemented as follows:

1.The following supplemental disclosure replaces in its entirety the nine bullet points under the heading “Public Companies Analyses” on page 124 of the joint proxy statement/prospectus:

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | 2023E Dividend Yield | Price/Tangible Book Value |

| Company Name | Ticker | 8/3/23 Stock Price | Implied Market Cap ($M) | Current Quarter Annualized | Projection / Analyst Mean | TBV / Share | Price / TBV |

New York Mortgage Trust, Inc.(1) | NYMT | $ | 9.07 | $ | 915 | 13.2% | 15.9% | $ | 12.44 | 0.73x |

| Ellington Financial Inc. | EFC | 13.08 | 910 | 13.8% | 13.8% | 15.05 | 0.87x |

| Redwood Trust, Inc. | RWT | 7.35 | 854 | 8.7% | 9.7% | 8.87 | 0.83x |

Dynex Capital, Inc.(1) | DX | 12.60 | 703 | 12.4% | 12.4% | 14.20 | 0.89x |

Invesco Mortgage Capital Inc.(1) | IVR | 11.31 | 487 | 14.1% | 14.1% | 11.98 | 0.94x |

Orchid Island Capital, Inc.(1) | ORC | 10.05 | 457 | 19.1% | 18.7% | 11.16 | 0.90x |

| Angel Oak Mortgage REIT, Inc. | AOMR | 9.02 | 232 | 14.2% | 14.2% | 9.80 | 0.92x |

Great Ajax Corp.(1)(2) | AJX | 6.13 | 144 | 13.1% | 12.6% | 11.86 | 0.52x |

Arlington Asset Investment Corp.(3) | AAIC | 2.75 | 78 | NM | NA | 6.47 | 0.43x |

_____________

Note: Balance sheet data as of March 31, 2023 unless otherwise noted.

(1) Balance sheet data as of June 30, 2023.

(2) AJX stock price and related metrics reflect the company’s unaffected stock price (June 30, 2023) on the trading day before announcement of its acquisition by EFC.

(3) AAIC stock price and related metrics reflect the company’s unaffected stock price (May 26, 2023) on the trading day before announcement of its acquisition by EFC.

2.The following supplemental disclosure replaces in its entirety the table under the heading “Precedent Transactions Analysis” on page 126 of the joint proxy statement/prospectus:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Buyer | | Seller | | Announce Date | | Announced Equity Deal Value ($M) | | Announced Deal Value Per Share | | Book Value per Share | | Deal Value to Book Value Mult. |

| Ellington Financial Inc. | | Great Ajax Corp. | | 7/3/23 | | $ | 172,500 | | $ | 7.33 | | $ | 12.58 | | 0.58x |

| Ellington Financial Inc. | | Arlington Asset Investment Corp. | | 5/30/23 | | 154,000 | | 4.77 | | 5.62(1) | | 0.85x(1) |

| Ready Capital Corporation | | Broadmark Realty Capital Inc. | | 2/27/23 | | 787,000 | | 5.90 | | 6.96 | | 0.85x |

| Ready Capital Corporation | | Anworth Mortgage Asset Corporation | | 12/7/20 | | 302,000 | | 2.94 | | 3.04 | | 0.97x |

| Ready Capital Corporation | | Owens Realty Mortgage, Inc. | | 11/7/18 | | 182,600 | | 21.53 | | 22.54 | | 0.96x |

| Annaly Capital Management Inc. | | MTGE Investment Corp. | | 5/2/18 | | 900,000 | | 19.65 | | 19.65 | | 1.00x |

| Two Harbors Investment Corp. | | CYS Investments Inc. | | 4/26/18 | | 1,163,656 | | 7.79 | | 7.41 | | 1.05x |

| Annaly Capital Management Inc. | | Hatteras Financial Corp. | | 4/11/16 | | 1,500,000 | | 15.85 | | 18.60 | | 0.85x |

| ARMOUR Residential REIT, Inc. | | JAVELIN Mortgage Investment Corp. | | 3/2/16 | | 85,203 | | 7.18(2) | | 8.25(2) | | 0.87x |

| Apollo Commercial Real Estate Finance, Inc. | | Apollo Residential Mortgage, Inc. | | 2/26/16 | | 468,500 | | 14.59 | | 16.40 | | 0.89x |

_____________

(1) The fully diluted book value of $5.62 per share of AAIC common stock reflects 4.280 million additional shares of AAIC common stock not included in AAIC’s reported book value as of March 31, 2023, consisting of (i) outstanding shares of unvested AAIC common stock and (ii) outstanding unvested performance share units convertible into shares of AAIC common stock, in each case that will vest and be issued in connection with the completion of the merger.

(2) Represents final cash tender offer price of second-step merger and implied book value per share based on quoted 0.87x multiple in merger press release.

3.The following supplemental disclosure is added as a new paragraph under the heading “Dividend Discount Analyses” following the table setting forth the “WMC Implied Per Share Equity Value Reference Range” on page 128 of the joint proxy statement/prospectus:

The following tables describe the discount rate calculation for MITT common stock and WMC common stock, respectively, as prepared by Piper Sandler. In its normal course of business, Piper Sandler employs the Kroll Cost of Capital Navigator in determining an appropriate discount rate. The discount rate equals the sum of the risk-free rate, the equity risk premium, the size premium and the industry premium.

| | | | | | | | | | | |

| Calculation of MITT Discount Rate |

| Risk-free rate | | 3.50% |

| Equity risk premium | | 5.50% |

| Size Premium | | 3.40% |

| Industry Premium | | 3.30% |

| Calculated discount rate | | 15.70% |

| | | | | | | | | | | |

| Calculation of WMC Discount Rate |

| Risk-free rate | | 3.50% |

| Equity risk premium | | 5.50% |

| Size Premium | | 7.83% |

| Industry Premium | | 3.30% |

| Calculated discount rate | | 20.13% |

The section of the joint proxy statement/prospectus entitled “The Merger—Opinion of WMC’s Financial Advisor” is hereby amended and supplemented as follows:

1.The following supplemental disclosure replaces in its entirety the table under the heading “Selected Precedent M&A Transaction Analysis” on page 133 of the joint proxy statement/prospectus:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| Announcement Date | | Buyer | | Target | | | Equity Value | Price/BV |

| 7/3/23 | | Ellington Financial Inc. | | Great Ajax Corp. | | | $172,000,000 | 0.59x |

| 5/30/23 | | Ellington Financial Inc. | | Arlington Asset Investment Corp. | | | $154,000,000 | 0.74x |

| 2/27/23 | | Ready Capital Corporation | | Broadmark Realty Capital Inc. | | | $787,000,000 | 0.85x |

2.The following supplemental disclosure replaces in its entirety the second full paragraph under the heading “Dividend Discount Analysis” on page 134 of the joint proxy statement/prospectus:

Using discount rates ranging from 18.55% to 22.55%, based on the cost of equity (based on the capital asset pricing model), BTIG calculated (i) a range of implied present values of the projected dividends per share WMC was forecasted to distribute from the third quarter of calendar year 2023 through calendar year 2025 and (ii) ranges of implied present values of implied terminal values per share for WMC using two methodologies, one based on price-to-book value multiples and the other based on dividend yields. The implied terminal values per share were derived by (a) applying a range of price-to-book value multiples of 0.50x to 0.70x, based on the average price/book value multiple of the four selected publicly traded hybrid/credit mortgage REITs with market capitalizations of less than $250,000, to WMC’s estimated book value as of December 31, 2025 of $18.54 and (b) applying a range of dividend yields of 10.8% to 14.8%, based on the average dividend yield of the four selected publicly traded hybrid/credit mortgage REITs with market capitalizations of less than $250,000,000, to WMC’s estimated annualized dividend per share for the fourth quarter of calendar year 2025 of $1.40. For example, the implied terminal value BTIG calculated based on the price-to-book value multiple of 0.60x was $11.12 and the implied terminal value BTIG calculated based on the dividend yield of 12.8% was $10.96. Using a discount rate equal to 20.55%, BTIG calculated the present value of the foregoing implied terminal values to be $6.97 and $6.87, respectively, and the present value of dividends per share to be equal to $2.73. These calculations resulted in the following ranges of implied equity values per share of WMC Common Stock:

The section of the joint proxy statement/prospectus entitled “The Merger” is amended and supplemented as follows:

1.The following supplemental disclosure is added as a new section under the heading “The Merger” following the last paragraph on page 135 of the joint proxy statement/prospectus:

JMP Financial Advisor

Pursuant to an engagement letter by and between JMP and WMC, dated as of January 23, 2021 and as amended on June 9, 2022, JMP is entitled to or has received from WMC: (i) a $100,000 retainer fee, which was payable upon execution of the engagement letter (the “Retainer Fee”), (ii) a $500,000 opinion fee, which was payable upon delivery by JMP of its opinion to WMC in connection with the TPT transaction (the “Opinion Fee”), (iii) a $1,750,000 success fee (against which 100% of the Retainer Fee and the Opinion Fee will be credited), payable upon consummation of the Merger (the “Success Fee”) and (iv) in the event the Merger is not consummated, a fee equal to 25% of any “termination”, “break-up”, “topping” or other similar fee that WMC receives, less any previously paid Retainer Fee or Opinion Fee (the “Break-Up Fee”). Any Break-Up Fee payable to JMP shall be credited against any Success Fee that may be subsequently payable to JMP pursuant to the engagement letter.

In the past two years, JMP acted as an underwriter for a convertible note offering for WMC in September 2021.

The section of the joint proxy statement/prospectus entitled “The Merger—Certain WMC Unaudited Prospective Financial Information” is hereby amended and supplemented as follows:

1.The following supplemental disclosure replaces in its entirety the table under the heading “Certain WMC Unaudited Prospective Financial Information” on page 142 of the joint proxy statement/prospectus:

| | | | | | | | | | | | | | |

| | 2023E | 2024E | 2025E |

| Earnings Per Share | $2.33 | $1.70 | $1.67 |

| Dividends Per Share | $0.35 | $0.35 | $0.35 |

| Economic Book Value Per Share(1) | $17.98 | $18.27 | $18.54 |

| Net interest income Other Income (loss), net Total Operating Expenses Income tax provision (benefit) Net income (loss) | $15,597,372 13,627,054 (15,112,731) (25,000) $14,086,695 | $19,550,086 5,186,232 (14,366,989) (50,000) $10,319,329 | $19,477,199 5,486,232 (14,797,998) (75,000) $10,090,433 |

_____________

(1) Economic Book Value is a non-GAAP financial measure of WMC’s financial position on an unconsolidated basis. WMC owns certain securities that represent a controlling variable interest, which under GAAP requires consolidation; however, WMC’s economic exposure to these variable interests is limited to the fair value of the individual investments. Economic Book Value is calculated by taking the GAAP book value and 1) adding the fair value of the retained interest or acquired security of the VIEs held by WMC and 2) removing the asset and liabilities associated with each of consolidated trusts (CSMC USA, Arroyo 2019-2, Arroyo 2020-1, Arroyo 2022-1, and Arroyo 2022-2). Management considers that Economic Book Value provides investors with a useful supplemental measure to evaluate WMC’s financial position as it reflects the actual financial interest of these investments irrespective of the variable interest consolidation model applied for GAAP reporting purposes. Economic Book Value does not represent and should not be considered as a substitute for Stockholders’ Equity, as determined in accordance with GAAP, and WMC’s calculation of this measure may not be comparable to similarly titled measures reported by other companies.

Important Additional Information and Where to Find It

In connection with the proposed Merger, MITT has filed the Registration Statement with the SEC, which was declared effective by the SEC on September 29, 2023. The Registration Statement includes the joint proxy statement/prospectus. The joint proxy statement/prospectus contains important information about MITT, WMC, the proposed Merger and related matters. MITT and WMC may file with the SEC other documents regarding the Merger. The definitive joint proxy statement/prospectus has been sent to the stockholders of MITT and WMC, and contains important information about MITT, WMC, the proposed Merger and related matters. This communication is not a substitute for any proxy statement, registration statement, tender or exchange offer statement, prospectus or other document MITT or WMC has filed or may file with the SEC in connection with the proposed Merger and related matters. INVESTORS AND SECURITY HOLDERS ARE ADVISED TO READ THE REGISTRATION STATEMENT ON FORM S-4 AND THE RELATED JOINT PROXY STATEMENT/PROSPECTUS (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) AND OTHER RELEVANT DOCUMENTS THAT ARE FILED OR MAY BE FILED BY MITT AND WMC WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT MITT, WMC AND THE PROPOSED MERGER. Investors and security holders may obtain copies of these documents free of charge through the website maintained by the SEC at www.sec.gov. Copies of the documents filed by MITT with the SEC are also available free of charge on MITT’s website at www.agmit.com. Copies of the documents filed by WMC with the SEC are also available free of charge on WMC’s website at www.westernassetmcc.com.

Participants in the Solicitation Relating to the Merger

MITT, WMC and certain of their respective directors and executive officers and certain other affiliates of MITT and WMC may be deemed to be participants in the solicitation of proxies from the common stockholders of WMC and MITT in respect of the proposed Merger. Information regarding WMC and its directors and executive officers and their ownership of common stock of WMC can be found in WMC’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, filed with the SEC on March 13, 2023, and in its definitive proxy statement relating to its 2023 annual meeting of stockholders, filed with the SEC on May 2, 2023. Information regarding MITT and its directors and executive officers and their ownership of common stock of MITT can be found in MITT’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, filed with the SEC on February 27, 2023, and in its definitive proxy statement relating to its 2023 annual meeting of stockholders, filed with the SEC on March 22, 2023. Additional information regarding the interests of such participants in the Merger is included in the joint proxy statement/prospectus and other relevant documents relating to the proposed Merger filed with the SEC. These documents are available free of charge on the SEC’s website and from MITT or WMC, as applicable, using the sources indicated above.

No Offer or Solicitation

This communication and the information contained herein shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended (the “Securities Act”). This communication may be deemed to be solicitation material in respect of the proposed Merger.

Forward-Looking Statements

This document contains certain “forward-looking” statements within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended. MITT and WMC intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995 and include this statement for purposes of complying with the safe harbor provisions. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “will,” “should,” “may,” “projects,” “could,” “estimates” or variations of such words and other similar expressions are intended to identify such forward-looking statements, which generally are not historical in nature, but not all forward-looking statements include such identifying words. Forward-looking statements regarding MITT and WMC include, but are not limited to, statements related to the proposed Merger, including the anticipated timing, benefits and financial and operational impact thereof; other statements of management’s belief, intentions or goals; and other statements that are not historical facts. These forward-looking statements are based on each of the companies’ current plans, objectives, estimates, expectations and intentions and inherently involve significant risks and uncertainties. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of these risks and uncertainties, which include, without limitation, risks and uncertainties associated with: MITT’s and WMC’s ability to complete the proposed Merger on the proposed terms or on the anticipated timeline, or at all, including risks and uncertainties related to securing the necessary stockholder approval from WMC’s and MITT’s respective stockholders and satisfaction of other closing conditions

to consummate the proposed Merger; the occurrence of any event, change or other circumstance that could give rise to the termination of the Merger Agreement; risks related to diverting the attention of MITT and WMC management from ongoing business operations; failure to realize the expected benefits of the proposed Merger; significant transaction costs and/or unknown or inestimable liabilities; the risk of stockholder litigation in connection with the proposed Merger, including resulting expense or delay; the risk that MITT’s and WMC’s respective businesses will not be integrated successfully or that such integration may be more difficult, time-consuming or costly than expected; and effects relating to the announcement of the proposed Merger or any further announcements or the consummation of the proposed Merger on the market price of MITT’s or WMC’s common stock. Additional risks and uncertainties related to MITT’s and WMC’s business are included under the headings “Forward-Looking Statements” and “Risk Factors” in MITT’s and WMC’s Annual Report on Form 10-K for the year ended December 31, 2022, MITT’s and WMC’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2023, the joint proxy statement/prospectus and in other reports and documents filed by either company with the SEC from time to time. Moreover, other risks and uncertainties of which MITT or WMC are not currently aware may also affect each of the companies’ forward-looking statements and may cause actual results and the timing of events to differ materially from those anticipated. The forward-looking statements made in this communication are made only as of the date hereof or as of the dates indicated in the forward-looking statements, even if they are subsequently made available by MITT or WMC on their respective websites or otherwise. Neither MITT nor WMC undertakes any obligation to update or supplement any forward-looking statements to reflect actual results, new information, future events, changes in its expectations or other circumstances that exist after the date as of which the forward-looking statements were made, except as required by law.

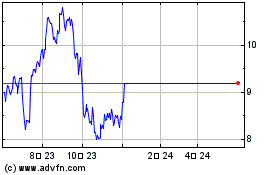

Western Asset Mortgage C... (NYSE:WMC)

過去 株価チャート

から 11 2024 まで 12 2024

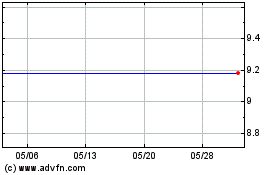

Western Asset Mortgage C... (NYSE:WMC)

過去 株価チャート

から 12 2023 まで 12 2024