UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM SD

Specialized Disclosure Report

AZZ INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

TEXAS (State or Other Jurisdiction of Incorporation or Organization) | 1-12777 Commission File No. | 75-0948250 (I.R.S. Employer Identification Number) |

| | |

| One Museum Place, Suite 500 3100 West 7th Street Fort Worth, TX 76107 (Address of principal executive offices, including zip code) | |

Tara D. Mackey

Chief Legal Officer and Secretary

(817) 810-4973

(Name and telephone number, including area code, of the person to contact in connection with this report.)

Check the appropriate box to indicate the rule pursuant to which this form is being filed:

| | | | | |

| þ | Rule 13p-1 under the Securities Exchange Act (17 CFR 240.13p-1) for the reporting period from January 1 to December 31, 2022. |

| ☐ | Rule 13p-1 under the Securities Exchange Act (17 CFR 240.13p-1) for the fiscal year ended |

SECTION 1 – CONFLICT MINERALS DISCLOSURE

Item 1.01 Conflict Minerals Disclosure and Report

In accordance with Rule 13p-1 under the Securities Exchange Act of 1934, as amended, AZZ Inc. ("the Company", "our" or "we") conducted due diligence to assess whether "conflict minerals" (in the form of tin, tantalum, tungsten and gold) were necessary to the functionality or production of products we manufactured or contracted to manufacture in calendar year 2023 originated in the Democratic Republic of the Congo or an adjoining country (collectively, the "Covered Countries").

A copy of the Conflict Minerals Report for the calendar year ended December 31, 2023 is filed as Exhibit 1.01 hereto and is also publicly available on our internet website at www.azz.com.*

Item 1.02 Exhibit

AZZ Inc.’s Conflict Minerals Report for the year ended December 31, 2023 is filed as Exhibit 1.01 hereto.

SECTION 2 – RESOURCE EXTRACTION ISSUER DISCLOSURE

Item 2.01 Resource Extraction Issuer Disclosure and Report

Not applicable.

SECTION 3 - EXHIBITS

Item 3.01 Exhibits

The following exhibit is filed as part of this report:

| | | | | | | | |

| Exhibit No. | | Description |

| 1.01 | | |

____________

*The reference to AZZ’s website is provided for convenience only, and its contents are not incorporated by reference in to this Form SD or the Conflict Minerals Report. Both the Form SD and the Conflict Minerals Report are furnished to, but not filed with, the U.S. Securities and Exchange Commission.

SIGNATURES

Pursuant to the requirements of the Securities and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

AZZ Inc.

By: /s/ Tara D. Mackey

Tara D. Mackey

Chief Legal Officer and Secretary

Date: May 31, 2024

Exhibit 1.01

Conflict Minerals Report

For The Year Ended December 31, 2023

This Conflict Minerals Report (this “Report”) of AZZ Inc. (the "Company”, "our" or “we”) has been prepared pursuant to Rule 13p-1 and Form SD (“the Conflict Minerals Rule” or “the Rule”) promulgated under the Securities and Exchange Act of 1934, as amended, for the reporting period from January 1, 2023 to December 31, 2023.

Company Overview

The Company was established in 1956 and incorporated under the laws of the state of Texas. We are a provider of hot-dip galvanizing and coil coating solutions to a broad range of end-markets, predominantly in North America.

During calendar year 2023, we had two distinct operating segments: the Metal Coatings segment and the Precoat Metals segment. The Metal Coatings segment is a leading provider of metal finishing solutions for corrosion protection, including hot-dip galvanizing, spin galvanizing, powder coating, anodizing and plating to the North American steel fabrication and other industries. The Precoat Metals segment provides aesthetic and corrosion protective coatings and related value-added services for steel and aluminum coils, primarily serving the construction; appliance; heating, ventilation, and air conditioning (HVAC); container; transportation and other end markets in the United States

Certain statements herein about our expectations of future events or results constitute forward-looking statements for purposes of the safe harbor provisions of The Private Securities Litigation Reform Act of 1995. You can identify forward-looking statements by terminology such as "may," "could," "should," "expects," "plans," "will," "might," "would," "projects," "currently," "intends," "outlook," "forecasts," "targets," "anticipates," "believes," "estimates," "predicts," "potential," "continue," or the negative of these terms or other comparable terminology. Such forward-looking statements are based on currently available competitive, financial, and economic data and management’s views and assumptions regarding future events. Such forward-looking statements are inherently uncertain, and investors must recognize that actual results may differ from those expressed or implied in the forward-looking statements. Forward-looking statements speak only as of the date they are made and are subject to risks that could cause them to differ materially from actual results. Certain factors could affect the outcome of the matters described herein. This communication may contain forward-looking statements that involve risks and uncertainties including, but not limited to, changes in customer demand for our products and services, including demand by the construction markets, the industrial markets, and the metal coatings markets. We could also experience additional increases in labor costs, components and raw materials

including zinc and natural gas, which are used in our hot-dip galvanizing process; supply-chain vendor delays; customer requested delays of our products or services; delays in additional acquisition opportunities; an increase in our debt leverage and/or interest rates on our debt, of which a significant portion is tied to variable interest rates; availability of experienced management and employees to implement AZZ’s growth strategy; a downturn in market conditions in any industry relating to the products we inventory or sell or the services that we provide; economic volatility, including a prolonged economic downturn or macroeconomic conditions such as inflation or changes in the political stability in the United States and other foreign markets in which we operate; acts of war or terrorism inside the United States or abroad; and other changes in economic and financial conditions. AZZ has provided additional information regarding risks associated with the business, including in Part I, Item 1A. Risk Factors, in AZZ's Annual Report on Form 10-K for the fiscal year ended February 29, 2024, and other filings with the SEC, available for viewing on AZZ's website at www.azz.com and on the SEC's website at www.sec.gov. You are urged to consider these factors carefully when evaluating the forward-looking statements herein and are cautioned not to place undue reliance on such forward-looking statements, which are qualified in their entirety by this cautionary statement. These statements are based on information as of the date hereof and AZZ assumes no obligation to update any forward-looking statements, whether as a result of new information, future events, or otherwise.

The Conflict Minerals Rule

Rule 13p-1 was adopted by the SEC to implement reporting and disclosure requirements related to conflict minerals as directed by the Dodd-Frank Wall Street Reform Act of 2010 (“Dodd-Frank”). The Rule imposes certain reporting obligations on SEC registrants whose manufactured products contain conflict minerals that are necessary to their functionality or production. The term “conflict minerals” is defined in Section 13(p) as (A) cassiterite, columbite-tantalite (coltan), gold, wolframite, and their derivatives, as limited by the Rule, tin, tantalum, tungsten, and gold (“3TGs” or “conflict minerals”); or (B) any other mineral or its derivatives determined by the Secretary of State to be financing conflict in the Democratic Republic of Congo (“DRC”) or any adjoining country that shares an internationally recognized border with the DRC.

The Rule provides for a three-step disclosure process. The first step is to determine whether the Rule applies (i.e., a company must determine whether its manufactured products contain 3TG that subject it to the requirements of section 1502 of Dodd-Frank). The second step is to conduct a “reasonable country of origin inquiry” (“RCOI”) to determine whether any of the 3TG in its products originated in the Democratic Republic of Congo or an adjoining country (the “covered countries”) and are not from recycled or scrap sources. Following the RCOI process, if the company has reason to believe that the 3TG in its products may have originated in the covered countries and did not come from scrap or recycled sources, it must move on to the third step, which is to conduct due diligence in an attempt to establish whether the sourcing of the 3TG could have provided funding for armed groups in the

covered countries. Companies requiring due diligence must use a nationally or internationally recognized standard in order to meet their compliance and reporting obligations and file a Conflict Minerals Report (“CMR”) with the SEC that includes a description of those due diligence measures.

We remain committed to complying with the requirements of the Rule and upholding responsible sourcing practices. As such, the Company has put into place a due diligence program to address human rights issues and responsible practices across its supply chain.

Due Diligence Measures Performed

We are a downstream consumer of 3TGs – we do not purchase raw or smelted ores and our Company is several supply–chain layers removed from the mining and processing of 3TG metals. Accordingly, we relied heavily on our direct suppliers to complete our RCOI for calendar year 2023.

Our due diligence measures were designed to be in conformity with the criteria set forth in the internationally-recognized OECD Guidance, as set forth below.

Step 1: Establish and Maintain Strong Company Management Systems

We’ve taken the following measures to establish an internal management system to support supply- chain due diligence:

•Assembled an internal, cross-functional team to oversee the Company’s conflict minerals compliance program. The team reports to the Chief Legal Officer and includes representatives from the Company’s corporate team and our relevant business segments.

•Adopted a conflict minerals policy and posted the policy on the Company’s website.

•Documented the process the Company follows to collect information from direct suppliers regarding the use and origin of the 3TGs in its supply chain and made risk-based sourcing decisions based on that information.

•Communicated that the Company’s ethics hotline – AZZ Alertline (https://azz.alertline.com)

can be used to report concerns regarding compliance with the Rule.

Step 2: Identify and Assess Risks in Supply Chain

AZZ is a downstream consumer of 3TG – we do not purchase raw or smelted ores and are several supply-chain layers removed from the mining and processing of these metals. Accordingly, we relied on the participation of our direct suppliers to perform our reasonable country of origin inquiry for calendar year 2023.

The RCOI process consisted of several steps. First, we determined internally which products or components could possibly contain 3TGs based on a review of each segment’s product lines. Next, we identified the suppliers to those business units of products or components likely to contain 3TG and we surveyed those suppliers using the Conflict Minerals Reporting Template (“CMRT”) developed by the Electronic Industry Citizenship Coalition – Global eSustainability Initiative (“EICC/GeSI”). The CMRT is a standardized reporting template that facilitates the transfer of information through the supply chain regarding mineral country of origin and the smelters and refiners being utilized. We provided our suppliers instructions on how to complete the CMRT and asked them to return the completed template to the Company by a certain date.

The Company then reviewed the suppliers’ responses for completeness, followed-up on non-responses, and reported on the survey results to senior management.

suppliers and supports

Step 3: Design and implement a strategy to respond to identified risks

Based on the above due diligence, we concluded that conflict minerals are not contained in the products the Company manufactures or contracts to be manufactured. The top risk identified stems from suppliers whom did not respond to our request to submit a CMRT. The Company is continually improving our outreach and contact data in an effort to respond to this risk.

Step 4: Carry out an independent third-party audit of smelter/refiner due diligence practices

The Company supports the mission of CFSI’s Conflict-Free Smelter Program (“CFSP”), an

assessment scheme that facilitates independent third-party audits of smelters and refiners. As a

downstream consumer of conflict minerals, however, the Company is not required by the OECD

guidelines to directly audit the smelters/refiners in its supply chain.

The Company does not have a direct relationship with any 3TGs smelters or refiners and does not

perform or direct audits of these entities within its supply chain. Instead, the Company relies on third party audits of smelters and refiners conducted as part of the RMAP, which uses independent private

sector auditors to audit the source, including the mines of origin, and the chain of custody of the conflict minerals used by smelters and refiners that agree to participate in the program.

Step 5: Report annually on supply chain due diligence

The AZZ Conflict Minerals Policy Statement, Conflict Minerals Report, and the associated Form SD are all made available online at www.azz.com. The website (and information accessible through it) is not incorporated into this 2023 Conflict Minerals Report or the associated Form SD.

Results of Due Diligence

We received responses from approximately sixty-five percent (65%) of our surveyed suppliers (the “Respondents”). We reviewed the responses against criteria developed to determine which responses

required further engagement with the Respondents. These criteria included untimely or incomplete responses as well as inconsistencies within the data reported in the CMRT. The Respondents’ responses provided data at a company, user-defined or product level. Ninety-one percent (91%) of the Respondents’ responses provided representations that their products do not contain 3TGs. For the remaining nine percent (9%) of Respondents who indicated some of their products contained conflict minerals, we conducted further due diligence and determined the products procured by the company did not contain conflict minerals, the conflict minerals were not from covered countries and/or the conflict minerals were from scrap or recycled sources.

Due diligence is ongoing, and the information received continues to improve in quantity and quality. We cannot definitively determine whether any of the 3TGs reported by the suppliers were contained in materials supplied to us or validate that any of these smelters or refiners are actually in our supply chain. While many of the smelters and refiners in our supply chain have been verified to be conflict-free, we were unable to establish the conflict status on all of our products.

Continuous Risk Mitigation Efforts

The Company intends to continue to comply with the Rule on an annual basis and expand or narrow the scope of future due diligence efforts in light of any changes in its supply chain. The Company also intends to continuously implement steps that could improve the information gathered from its annual due diligence process, including taking actions designed to increase the response rate of its suppliers. Additionally, the Company intends to take the following steps to mitigate the risk that any 3TGs that may be contained in its products could benefit armed groups during the next reporting period:

•Continue to improve the number and quality of supplier responses through active supplier engagement;

•Endeavor to improve the number and quality of supplier responses through more active supplier engagement; and

•Continue to streamline the Company’s internal reporting processes.

As the Company has not elected to describe any of its products as “DRC conflict free,” this Report has not been subject to an independent private sector audit, consistent with the guidance provided by the SEC in its Statement on the Effect of the Recent Court of Appeals Decision on the Conflict Minerals Rule issued on April 29, 2014, the SEC’s Order Issuing Stay, dated May 2, 2014, and the SEC’s Updated Statement on the Effect of the Court of Appeals Decision on the Conflict Minerals Rule, dated April 7, 2017.

***

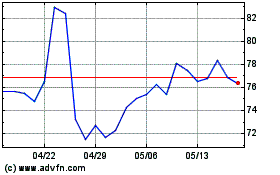

AZZ (NYSE:AZZ)

過去 株価チャート

から 5 2024 まで 6 2024

AZZ (NYSE:AZZ)

過去 株価チャート

から 6 2023 まで 6 2024