Form SC 13D/A - General statement of acquisition of beneficial ownership: [Amend]

2024年2月21日 - 11:24AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 4)

APOLLO

GLOBAL MANAGEMENT, InC. |

| (Name of Issuer) |

| |

Common

stock, par value $0.00001 per share |

| (Title of Class of Securities) |

| |

03769M

106 |

| (CUSIP Number) |

| |

c/o

Elysium Management LLC

445 Park Avenue, Suite 1401

New York, NY 10022

(646) 589-8607

|

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications) |

| |

February 16, 2024 |

| (Date of Event which Requires Filing of this Statement) |

If the filing person has previously filed a statement on Schedule

13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e),

240.13d-1(f) or 240.13d-1(g), check the following box. ☐

Note: Schedules filed in paper format shall include a signed original

and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies are to be sent.

*The remainder of this cover page shall be filled out for a reporting

person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing

information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall

not be deemed to be “filed” for the purpose of section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see

the Notes).

|

CUSIP No. 03769M 106 |

SCHEDULE 13D |

Page 2

of 5 |

| 1 |

NAME OF REPORTING PERSON

Socrates Trust |

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ☐

(b) ☒ |

| 3 |

SEC USE ONLY

|

|

| 4 |

SOURCE OF FUNDS

OO |

|

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS

2(d) or 2(e)

|

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

New York |

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

7 |

SOLE VOTING POWER

32,643,280 |

| 8 |

SHARED VOTING POWER

-0- |

| 9 |

SOLE DISPOSITIVE POWER

32,643,280 |

| 10 |

SHARED DISPOSITIVE POWER

-0- |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

32,643,280 |

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

5.8% (1) |

|

| 14 |

TYPE OF REPORTING PERSON

OO |

|

| (1) | Based

on 567,555,284 shares of common stock, par value $0.00001 per share, of Apollo Global Management,

Inc. (the “Issuer”) issued and outstanding as of November 3, 2023, as reported in the Issuer’s Quarterly

Report on Form 10-Q filed on November 7, 2023. |

|

CUSIP No. 03769M 106 |

SCHEDULE 13D |

Page 3

of 5 |

Item 1. Security and Issuer.

This Amendment No. 4 amends and supplements the

Schedule 13D (this “Schedule 13D”) filed with the Securities and Exchange Commission (the “Commission”)

by the Socrates Trust, formerly known as the Heritage Trust u/a/d 11/12/2018, a trust organized under the laws of New York and established

for the benefit of the family of Mr. Leon D. Black (the trustees of which are Messrs. John J. Hannan, Richard Ressler and Barry J. Cohen)

(the “Socrates Trust” or the “Reporting Person”), relating to the shares of the common

stock, par value $0.00001 per share (“Common Stock”), of Apollo

Global Management, Inc., a Delaware corporation (the “Issuer”) on January 11, 2022, as amended by Amendment

No. 1 thereto, filed on March 3, 2022, and Amendment No. 2 thereto, filed on May 27, 2022 and Amendment No. 3 thereto, filed on September

21, 2022 (as so amended, the “Schedule 13D”). This Amendment No. 4 is being filed to reflect recent transactions

and to update the disclosure in Item 6. The Schedule 13D is hereby amended as follows:

Item 2. Identity and Background.

No material change.

Item 3. Source and Amount of Funds or Other Consideration.

No material change.

Item 4. Purpose

of Transaction.

No material change.

Item 5. Interest in Securities of the Issuer.

Reference to percentage ownership of the Common Stock

in this Schedule 13D are based on 567,555,284

shares of Common Stock, issued and outstanding as

of November 3, 2023, as reported in the Issuer’s Quarterly Report on Form 10-Q filed on November 7, 2023.

(a) and (b)

As of the date of this Schedule 13D, the Socrates

Trust may be deemed to be the beneficial owner of 32,643,280 shares of Common Stock (approximately 5.8% of the Common Stock), which it

holds directly. The Socrates Trust may be deemed to have sole voting and sole dispositive power with respect to such shares.

By virtue of the agreements made pursuant to

the Stockholders Agreement, the parties thereto, including the Reporting Person, may be deemed to be acting as a group for purposes of

Rule 13d-3 under the Exchange Act. According to public filings, the parties to the Stockholders Agreement, as a group, beneficially own

an aggregate of 152,841,675 shares of Common Stock (approximately 26.9% of the Common Stock). The Reporting Person disclaims beneficial

ownership of any securities owned by such other parties. Only the shares of Common Stock beneficially owned by the Reporting Person are

the subject of this Schedule 13D. For a description of the relationship between the Reporting Person and the other parties to the Stockholders

Agreement, see Item 4.

(c) On

December 15, 2023, Leon D. Black delivered 6,000,000 shares to the Socrates Trust in partial satisfaction of previously contracted outstanding

debt obligations.

(d) Not applicable.

|

CUSIP No. 03769M 106 |

SCHEDULE 13D |

Page 4

of 5 |

(e) Not

applicable.

Item 6. Contracts, Arrangements, Understandings

or Relationships with Respect to Securities of the Issuer.

As of the date of this Amendment No. 4, a total

of 31,643,280 shares of Common Stock beneficially owned by the Reporting Person are held in one or more margin or collateral accounts

subject to standard margin loan or stock security arrangements. The Reporting Person does not have any current intention to sell any

of such shares.

Item 7. Material to be

Filed as Exhibits.

None.

|

CUSIP No. 03769M 106 |

SCHEDULE 13D |

Page 5

of 5 |

SIGNATURE

After reasonable inquiry and to the best of my knowledge

and belief, I certify that the information set forth in this statement is true, complete and correct.

Date: February 20, 2024

| |

SOCRATES

TRUST

|

|

| |

|

|

|

| |

By: |

/s/ Barry J. Cohen |

|

| |

|

Name: Barry J. Cohen |

|

| |

|

Title: Attorney-in-Fact |

|

Attention. Intentional misstatements or omissions of fact constitute Federal

criminal violations (see 18 U.S.C. 1001).

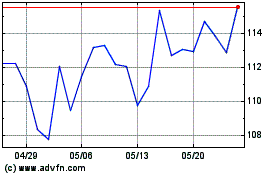

Apollo Global Management (NYSE:APO)

過去 株価チャート

から 12 2024 まで 1 2025

Apollo Global Management (NYSE:APO)

過去 株価チャート

から 1 2024 まで 1 2025