UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 11-K

(Mark one)

x ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2023

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number 1-39686

| | |

A.Full title of the plan and the address of the plan, if different from that of the issuer named below: |

|

AIR 401(k) Retirement Plan |

|

B.Name of issuer of the securities held pursuant to the plan and the address of its principal executive office: |

Apartment Income REIT Corp.

4582 South Ulster Street, Suite 1700

Denver, Colorado 80237

Financial Statements and Schedules

AIR 401(k) Retirement Plan

December 31, 2023, and 2022, and Year Ended December 31, 2023

Index to Financial Statements

| | | | | |

| |

| |

| Financial Statements: | |

| |

| |

| |

| |

| Supplemental Schedules: | |

| |

| |

| |

| |

| |

| NOTE: All other supplemental schedules required by Section 2520.103-10 of the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974 have been omitted because they are not applicable. | |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Plan Participants and Plan Administrator of AIR 401(k) Retirement Plan

Opinion on the Financial Statements

We have audited the accompanying statements of net assets available for benefits of AIR 401(k) Retirement Plan (the "Plan") as of December 31, 2023 and 2022, the related statement of changes in net assets available for benefits for the year ended December 31, 2023, and the related notes (collectively referred to as the "financial statements"). In our opinion, the financial statements present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2023 and 2022, and the changes in net assets available for benefits for the year ended December 31, 2023, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Plan's management. Our responsibility is to express an opinion on the Plan's financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Report on Supplemental Schedules

The supplemental schedule of assets (held at end of year) as of December 31, 2023, and the schedule of delinquent participant contributions for the year ended December 31, 2023 have been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The supplemental schedules are the responsibility of the Plan's management. Our audit procedures included determining whether the supplemental schedules reconcile to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental schedules. In forming our opinion on the supplemental schedules, we evaluated whether the supplemental schedules, including their form and content, are presented in compliance with the Department of Labor's Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, such schedules are fairly stated, in all material respects, in relation to the financial statements as a whole.

Denver, Colorado

June 13, 2024

We have served as the auditor of the Plan since 2021.

AIR 401(k) Retirement Plan

Statements of Net Assets Available for Benefits

| | | | | | | | | | | |

| December 31, |

| 2023 | | 2022 |

| ASSETS | | | |

| Investments, at fair value (Note 3) | $ | 103,507,865 | | | $ | 90,323,927 | |

| Notes receivable from participants | 1,068,495 | | | 1,093,131 | |

| Contributions receivable | 174,221 | | | 42,202 | |

| Total assets | 104,750,581 | | | 91,459,260 | |

| | | |

| LIABILITIES | | | |

| Excess contributions payable | — | | | 1,099 | |

| Net assets available for benefits | $ | 104,750,581 | | | $ | 91,458,161 | |

See accompanying notes to financial statements.

4

AIR 401(k) Retirement Plan

Statement of Changes in Net Assets Available for Benefits

For the Year Ended December 31, 2023

| | | | | |

| Contributions: | |

| Participants | $ | 4,296,649 | |

| Employer | 1,300,688 | |

| Rollovers | 565,352 | |

| Total contributions | 6,162,689 | |

| |

| Investment income: | |

| Interest and dividend income | 2,517,089 | |

| Interest income on notes receivable from participants | 75,149 | |

| Net appreciation in fair value of investments | 16,271,538 | |

| Total investment income | 18,863,776 | |

| |

| Deductions: | |

| Payments and expenses: | |

| Benefit payments | 11,663,256 | |

| Administrative expenses | 70,789 | |

| Total deductions | 11,734,045 | |

| |

| |

| |

| |

| |

| Net increase in net assets available for benefits | 13,292,420 | |

| Net assets available for benefits at the beginning of the year | 91,458,161 | |

| Net assets available for benefits at the end of the year | $ | 104,750,581 | |

See accompanying notes to financial statements.

5

AIR 401(k) Retirement Plan

Notes to Financial Statements

As of December 31, 2022 and 2023, and for the Year Ended December 31, 2023

Note 1 — Description of the Plan

General

The following description of the AIR 401(k) Retirement Plan (the “Plan”) provides only general information. Participants should refer to the Plan document and Summary Plan Description for a more complete description of the Plan’s provisions.

The Plan is a multiple employer plan sponsored by Apartment Income REIT Corp. (“AIR”). The Plan is a defined contribution plan covering all employees of AIR and their subsidiaries who have completed 30 days of service and are age 18 or older, except certain employees covered by collective bargaining agreements who are not eligible to participate in the Plan, unless such collective bargaining agreement provides for the inclusion of such employees as participants in the Plan. Fidelity Management Trust Company (“Fidelity”) serves as the Plan’s trustee and provides certain administrative services to the Plan. The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended (“ERISA”).

Contributions

Each year, participants may contribute to the Plan, on a pretax basis, up to 50% of their eligible compensation, or $22,500 for 2023, whichever is less. Participants who have attained age 50 before the end of the Plan year are eligible to make additional catch-up contributions up to $7,500 for 2023. Participants may also contribute amounts representing distributions from other qualified defined benefit, defined contribution plans and individual retirement accounts (rollovers).

Each participating employer may make matching contributions to the Plan at its discretion. For 2023, AIR’s matching contribution equaled 25% of participant contributions to the extent of the first 4% of the participant’s eligible compensation. Each participating employer may also make an additional discretionary lump sum contribution to all eligible employees following the Plan’s year-end based on the employer’s achievement of its corporate goals. Employer cash contributions totaled $1,300,688 for the Plan year ended December 31, 2023, which consisted of matching contributions. Of these contributions, $1,168,669 had been received by the Plan on December 31, 2023, and $174,221 were included in contributions receivable as of December 31, 2023. All contributions are subject to certain limitations of the Internal Revenue Code (the “Code”). See Note 4 for the discretionary lump sum contribution made subsequent to year end.

Participants direct their contributions and any allocated employer matching or other discretionary employer contributions into the various investment options offered by the Plan and may change their investment options on a daily basis. As of December 31, 2023, the Plan provided various mutual funds, a common collective fund, and AIR stock funds in which participants were able to choose to invest. During 2023, participants had the ability to choose to invest in AIR common shares. Effective December 30, 2022, the Plan froze the ability to direct future contributions or money movement into Aimco stock. The Plan liquidated all Aimco stock investments during the year ended December 31, 2023.

Participant Accounts

Each participant’s account is credited with the participant’s contributions, and the employer matching and discretionary contributions, and allocations of plan earnings, and is charged with an allocation of administrative expenses. Plan earnings are allocated based on the participant’s share of net earnings or losses of their respective elected investment options. Allocations of administrative expenses are a fixed dollar amount per participant or per transaction type. The benefit to which a participant is entitled is the participant’s vested account balance at the time of distribution. Participants may direct the investment of their contributions and any discretionary contributions into various investment options offered by the Plan and may change investments and transfer amounts between funds daily.

Vesting

Participants are immediately vested in their voluntary contributions plus actual earnings and losses thereon. Employer contributions are fully vested for those employees who have attained three years of service or will vest after an

employee completes three years of service. Employer contributions also fully vest in the event that a participant reaches normal retirement age, or age 65, during their employment with a participating employer, regardless of whether the participant has attained three years of service.

Notes Receivable from Participants

Participants may borrow funds from their own account. Loans are permitted in amounts not to exceed the lesser of $50,000, reduced by the highest outstanding loan balance for the preceding year, or 50% of the value of the vested interest in the participant’s account. Two loans may be outstanding at any time.

Payment of Benefits

On termination of service or upon death, disability, or retirement, a participant (or the participant’s beneficiary) may elect to receive a distribution equal to the vested value of their account, which will be paid out as soon as administratively possible. In-service withdrawals are available in certain limited circumstances, as defined by the Plan.

Forfeited Accounts

Upon termination of employment, participants forfeit their non-vested balances. As of December 31, 2023 and 2022, forfeited accounts totaled $56,640 and $121,976, respectively. These accounts will be used to pay Plan administrative expenses and reduce future employer contributions. In 2023, employer contributions were funded with $43,315 from forfeited accounts.

Plan Termination

Although AIR has not expressed any intent to do so, it has the right under the Plan to terminate the Plan subject to the provisions of ERISA. In the event of termination of the Plan, each participant will become fully vested and will receive a total distribution of their account.

Note 2 — Summary of Significant Accounting Policies

Basis of Accounting

The accompanying financial statements have been prepared in accordance with U.S. generally accepted accounting principles (“GAAP”).

Investments and Investment Income

The Plan’s investments are measured at fair value. Fair value of a financial instrument is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. See Note 3 for further discussion and disclosures related to fair value measurements.

Purchases and sales of securities are recorded on a trade-date basis. Interest income is recorded on an accrual basis. Dividends are recorded on the ex-dividend date. Net appreciation or depreciation in fair value of investments includes the Plan’s realized gains and losses on investments that were both bought and sold during the year as well as unrealized appreciation or depreciation of the investments held at year end.

Excess Contribution Payable

Plan is required to return contributions received during the Plan year in excess of the IRC limits. Excess contributions due to participants as of December 31, 2023 and 2022 were $0 and $1,099, respectively.

Payment of Benefits

Benefit payments to participants are recorded upon distribution. There were no participants, who elected to withdraw from the Plan, but had not yet been paid as of December 31, 2023.

Notes Receivable from Participants

Notes receivable from participants represent participant loans, all of which are secured by vested account balances of borrowing participants and are recorded at their outstanding principal balances plus accrued but unpaid interest. Interest income on notes receivable from participants is recorded when it is earned and is included in interest income on notes receivable from participants on the statement of changes in net assets available for benefits. Related fees are recorded as administrative expenses and are expensed when they are incurred. No allowance for credit losses has been recorded as of December 31, 2023 or 2022. If a participant ceases to make loan repayments and the plan administrator deems the participant loan to be a distribution, the participant loan balance is reduced, and a taxable deemed distribution is recorded. As of December 31, 2023, participant loans have maturities through 2035 at interest rates ranging from 5.25% to 10.25%.

Risks and Uncertainties

The Plan invests in various investment securities. Investment securities are exposed to various risks such as: interest rate, market, and credit risks. The Plan’s exposure to credit loss in the event of nonperformance of investments is limited to the carrying value of such instruments. Due to the level of risk associated with certain investment securities, it is at least reasonably possible that changes in the values of investment securities will occur in the near term and that such changes could materially affect participants’ account balances and the amounts reported in the statements of net assets available for benefits.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates that affect the amounts reported in the financial statements, accompanying notes, and supplemental schedule. Actual results could differ from those estimates.

Income Tax Status

The underlying volume submitter plan has received an advisory letter from the Internal Revenue Service (“IRS”) dated June 30, 2020, stating that the form of the plan is qualified under Section 401 of the Internal Revenue Code (“the Code”) and, therefore, the related trust is tax-exempt. The plan administrator has determined that it is eligible to, and has chosen to, rely on the current IRS volume submitter advisory letter. Once qualified, the Plan is required to operate in conformity with the Code to maintain its qualified status. The plan administrator believes the Plan is being operated in compliance with the applicable requirements of the Code and, therefore, believes the Plan is qualified and the related trust is tax-exempt.

GAAP requires plan management to evaluate tax positions taken by the Plan and recognize a tax liability if the Plan has taken an uncertain position that more likely than not would not be sustained upon examination by the IRS. Plan management has analyzed the tax positions taken by the Plan, and has concluded that there are no uncertain positions taken or expected to be taken. The Plan is subject to routine audits by taxing jurisdictions; however, there are currently no audits for any tax periods in progress.

Plan Expenses

The Plan’s administrative expenses are paid by either the Plan or the participating employers, as provided by the Plan’s provisions. Administrative expenses paid by the Plan include recordkeeping and trustee fees. The Plan may fund administrative expenses with forfeited balances of terminated participants’ accounts. Any administrative expenses not paid by the Plan will be paid by the participating employers and are excluded from these financial statements. During the year ended December 31, 2023, forfeited balances of terminated participants’ accounts totaling $70,789 were used to pay administrative expenses. Expenses relating to purchases, sales, or transfers of the Plan’s investments are charged to the particular investment fund to which the expenses relate and are included in net appreciation in fair value of investments on the statement of changes in net assets available for benefits.

The Plan has a revenue-sharing agreement whereby certain investments return a portion of the investment fees to participants who hold investments in these funds generating credits. For the year ended December 31, 2023, revenue credits of $92,613 were applied to individual participant accounts that invested in the funds generating the revenue credit.

Related Party Transactions and Party-in-Interest Transactions

Certain Plan investments in mutual funds and a common collective trust are managed by Fidelity Management Trust Company, which also serves as the trustee of the Plan and, therefore, Plan transactions involving these mutual funds and the common collective trust qualify as party-in-interest transactions under ERISA and the Code. Additionally, a portion of the Plan’s assets is invested in funds managed by Vanguard, which is a beneficial owner of AIR common stock and held more than 10% of AIR's common stock outstanding during the year ended December 31, 2023. Because of its holdings in AIR common stock, Plan transactions involving Vanguard-managed funds qualify as party-in-interest transactions. A portion of the Plan’s assets are also invested in AIR common stock. Plan transactions involving AIR common stock qualify as party-in-interest transactions. All of these transactions are exempt from the prohibited transactions rules under ERISA.

Certain plan investments are shares of AIR common stock, as further detailed in Note 3. During the year ended December 31, 2023, purchases of AIR shares by the Plan totaled $230,288, sales of AIR shares by the Plan totaled $3,564, and the Plan recorded dividend income from AIR shares of $129,257. During the year ended December 31, 2023, purchases of Aimco shares by the Plan totaled $0, sales of Aimco shares by the Plan totaled $612,089, and the Plan recorded dividend income from Aimco shares of $0.

The Plan also issues loans to participants, which are secured by the vested balances in the participants’ accounts.

Note 3 — Fair Value Measurements and Investments

The Plan’s investments are held in trust by Fidelity Trust Management Company. In accordance with GAAP, the Plan measures investments at fair value. The valuation methodologies used to measure the fair values of common stock, money market funds, common collective fund, and mutual funds use a market approach with quoted market prices from active markets, which are classified within Level 1 of the fair value hierarchy defined by GAAP. Investments measured at fair value on a recurring basis consisted of the following investments:

| | | | | | | | | | | | | | | | | | | | | | | |

| December 31, 2023 | | December 31, 2022 |

| Level 1 | | Total | | Level 1 | | Total |

| AIR common stock (1) | $ | 2,639,742 | | | $ | 2,639,742 | | | $ | 2,320,304 | | | $ | 2,320,304 | |

| Money market fund held by AIR Stock Fund | 801 | | | 801 | | | 693 | | | 693 | |

| Aimco common stock (2) | — | | | — | | | 591,130 | | | 591,130 | |

| Money market fund held by Aimco Stock Fund | — | | | — | | | 951 | | | 951 | |

| Mutual funds | 97,989,212 | | | 97,989,212 | | | 83,658,449 | | | 83,658,449 | |

| Common collective trust fund (3) | — | | | 2,878,110 | | | — | | | 3,752,400 | |

| Total investments measured at fair value | $ | 100,629,755 | | | $ | 103,507,865 | | | $ | 86,571,527 | | | $ | 90,323,927 | |

(1)The fair value of AIR common stock is based on the closing price per the New York Stock Exchange. As of December 31, 2023 and 2022, this fund held 76,008 shares and 67,628 shares of AIR common stock, respectively, with a cost basis of $2,907,294 and $2,634,562, respectively.

(2)The fair value of Aimco common stock is based on the closing price per the New York Stock Exchange. As of December 31, 2023 and 2022, this fund held 0 shares and 83,024 shares of Aimco common stock, respectively with a cost basis of $0 and $2,173,501, respectively.

(3)The fair value of the common collective trust fund is measured using the net asset value (“NAV”) practical expedient and is not categorized in the fair value hierarchy. The fair value amounts presented in these tables are intended to permit reconciliation of the fair value hierarchy to the amounts presented in the Statements of Net Assets Available for Benefits.

The Fidelity Managed Income Portfolio (“MIP”) Fund is a common collective trust fund designed to deliver safety and stability by preserving principal and accumulating earnings. This fund is primarily invested in guaranteed investment contracts and synthetic investment contracts. Participant-directed redemptions have no restrictions; however, the Plan is required to provide a one-year redemption notice to liquidate its entire share in the fund. Investments in the Fidelity MIP Fund are recorded at fair value, using the NAV practical expedient. The fair value of the Fidelity MIP Fund has been estimated based on the fund’s NAV provided by Fidelity, which is based on the contract value of the underlying investment contracts held by the fund. As of December 31, 2023, there were no unfunded commitments in the MIP Fund.

The AIR Stock Fund is a stock fund that operates similarly to a mutual fund, in that it is composed of stock, and a small percentage of cash or another short-term interest-bearing vehicle. The inclusion of cash provides liquid assets to allow for the daily processing of transfers, loans, and withdrawals. The value of the stock fund is based on the value of the underlying common stock, as participants cannot directly invest their account balances in the associated short-term interest-bearing vehicle. The individual assets of a stock fund are considered separately as individual investments for accounting, auditing, and financial statement reporting purposes.

Mutual funds are valued at the daily closing price as reported by the fund. Mutual funds held by the Plan are open-ended mutual funds that are registered with the Securities and Exchange Commission. These funds are required to publish their daily net asset value and to transact at that price. The mutual funds held by the Plan are deemed to be actively traded.

Note 4 — Subsequent Events

In February 2024, AIR made a discretionary lump sum contribution totaling $928,711, or $1,267 per eligible employee, based on the achievement of AIR’s 2023 corporate goals. All AIR employees eligible for the Plan as of December 31, 2023, received the contribution. This contribution will be reflected in the Plan’s 2024 financial statements.

On April 7, 2024, AIR entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Apex Purchaser LLC (“Buyer 1”), Aries Purchaser LLC (“Buyer 2”), Astro Purchaser LLC (“Buyer 3”), and Astro Merger Sub, Inc. (“Merger Sub”), which are affiliates of Blackstone Real Estate Partners X (“Blackstone”). Pursuant to the terms and subject to the conditions set forth in the Merger Agreement, upon the closing of the transactions contemplated by the Merger Agreement, Merger Sub will merge with and into the Company (the “Merger”) and each share of the Company’s Class A common stock (“Company Common Stock”) (other than those held by the Company or any of its subsidiaries, or by Buyer 1, Buyer 2, Buyer 3 or Merger Sub (the “Cancelled Shares”)) that is issued and outstanding immediately prior to the Merger will be automatically canceled and converted into the right to receive an amount in cash equal to $39.12 (the “Common Stock Merger Consideration”), without interest. Additionally, substantially concurrently with the consummation of the Merger, the Company shall effect the redemption of, or make an irrevocable deposit pursuant to the terms of the Class A preferred stock, $0.01 par value per share, of the Company (“Company Preferred Stock”) in respect to the amount required to redeem, all outstanding shares of the Company Preferred Stock at a redemption price payable in cash, by or on behalf of the Company, in an amount equal to $100,000 per share of Company Preferred Stock plus accumulated, accrued and unpaid dividends thereon (“Preferred Stock Redemption Payment”) and from and after the consummation of the Merger, the Company Preferred Stock shall no longer be outstanding and all rights of the holders thereof will terminate, except for the right to receive the Preferred Stock Redemption Payment.

The Merger was unanimously approved by the Company’s Board of Directors and is expected to close in the third quarter of 2024, subject to approval by the Company’s stockholders and other customary closing conditions. Pursuant to the terms of the Merger Agreement, the Company may not pay dividends, including its quarterly dividend, effective immediately except as necessary to preserve its tax status as a real estate investment trust, and any such dividends would result in an offsetting decrease to the Common Stock Merger Consideration. Subject to and upon consummation of the Merger, the Company’s Class A common stock will no longer be listed on the New York Stock Exchange.

The issued and outstanding equity interests of the AIR Operating Partnership, including the Partnership Common Units, each class of Partnership Preferred Units, Partnership LTIP Units and Class I High Performance Partnership Units (each as defined in the Merger Agreement), will be unaffected by the Merger and will remain issued and outstanding and will continue to have the rights and privileges set forth in the Partnership LPA (as defined in the Merger Agreement). At or prior to the consummation of the Merger, the Partnership LPA will be amended by AIR-GP, Inc. (the “General Partner”) in substantially the form attached to the Merger Agreement (the “LPA Amendment”) to provide that, following the closing, (i) the AIR Operating Partnership will pay cash to those of holders of Partnership Units (as defined in the Merger Agreement) who elect to redeem their Partnership Units in accordance with the terms of the Partnership LPA (and will not exercise its right to pay for such redeemed Partnership Units in shares of Company Common Stock), (ii) any Partnership Units redeemed on the Closing Date (as defined in the Merger Agreement) or within ten (10) days thereafter will be valued at an amount equal to the Common Stock Merger Consideration minus the aggregate amount of all distributions per Partnership Common Unit declared or paid to the holders of Partnership Common Units during the period commencing on the Closing Date and ending on the date a notice of redemption is received and (iii) any Partnership Units redeemed after the tenth (10th) day following the Closing Date will be valued by the General Partner in good faith on the basis of such information as it considers, in its reasonable judgment, as appropriate.

Subsequent events were evaluated through June 13, 2024, the date the financial statements were issued.

AIR 401(k) Retirement Plan

Schedule H, Line 4i – Schedule of Assets (Held at End of Year)

December 31, 2023

EIN: 84- 1299717

Plan Number: 001

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (a) | | (b) Identity of Issue, Borrower, Lessor or Similar Party | | (c) Description of Investment | | (d) Cost** | | (e) Current Value |

| | Common stock: | | | | | | | | |

| * | | AIR Stock Fund | | 76,008 | | shares | | | | $ | 2,640,543 | |

| | | | | | | | | | |

| | Mutual Funds: | | | | | | | | |

| * | | Fidelity 500 Index Fund | | 100,063 | | shares | | | | 16,559,457 | |

| * | | Fidelity Extended Market Index Fund | | 7,695 | | shares | | | | 600,660 | |

| * | | Fidelity Freedom 2010 Fund | | 40,344 | | shares | | | | 546,251 | |

| * | | Fidelity Freedom 2015 Fund | | 2,159 | | shares | | | | 23,963 | |

| * | | Fidelity Freedom 2020 Fund | | 146,919 | | shares | | | | 2,049,522 | |

| * | | Fidelity Freedom 2025 Fund | | 14,514 | | shares | | | | 189,122 | |

| * | | Fidelity Freedom 2030 Fund | | 515,287 | | shares | | | | 8,497,079 | |

| * | | Fidelity Freedom 2035 Fund | | 28,485 | | shares | | | | 411,890 | |

| * | | Fidelity Freedom 2040 Fund | | 797,095 | | shares | | | | 8,313,705 | |

| * | | Fidelity Freedom 2045 Fund | | 71,671 | | shares | | | | 860,774 | |

| * | | Fidelity Freedom 2050 Fund | | 556,752 | | shares | | | | 6,781,238 | |

| * | | Fidelity Freedom 2055 Fund | | 30,340 | | shares | | | | 428,096 | |

| * | | Fidelity Freedom 2060 Fund | | 137,611 | | shares | | | | 1,786,185 | |

| * | | Fidelity Freedom 2065 Fund | | 11,680 | | shares | | | | 139,226 | |

| * | | Fidelity Freedom Income Fund | | 45,978 | | shares | | | | 478,636 | |

| * | | Fidelity Growth Company Fund | | 927,880 | | shares | | | | 20,830,904 | |

| * | | Fidelity Low-Priced Stock Fund | | 227,663 | | shares | | | | 3,426,327 | |

| * | | Fidelity Real Estate Fund | | 30,136 | | shares | | | | 1,160,254 | |

| * | | Fidelity Total International Index Fund | | 122,529 | | shares | | | | 1,611,256 | |

| * | | Fidelity U.S. Bond Index Fund | | 141,626 | | shares | | | | 1,477,163 | |

| * | | Vanguard Explorer Fund | | 49,948 | | shares | | | | 5,156,081 | |

| * | | Vanguard Total International Bond Index Fund | | 15,908 | | shares | | | | 313,704 | |

| * | | Vanguard Treasury Money Market | | 3,299,522 | | shares | | | | 3,299,522 | |

| | American Beacon Small Cap Value Fund | | 53,665 | | shares | | | | 1,338,406 | |

| | American Funds EuroPacific Growth Fund | | 49,361 | | shares | | | | 2,700,042 | |

| | Dodge and Cox Fund | | 22,432 | | shares | | | | 5,463,480 | |

| | H&W High Yield Fund | | 39,695 | | shares | | | | 417,192 | |

| | MetWest Total Return Bond Fund | | 241,134 | | shares | | | | 2,078,571 | |

| | Pacific Investment Management Company Real Return Fund | | 104,736 | | shares | | | | 1,050,506 | |

| | | | | | | | | | |

| | Common Collective Trust Fund: | | | | | | | | |

| * | | Fidelity Managed Income Portfolio Fund | | 2,878,110 | | shares | | | | 2,878,110 | |

| | | | | | | | | | |

| * | | Participant loans: 5.25% to 10.25% interest rate, with various maturities through 2035 | | | | | | | | 1,068,495 | |

| | | | | | | | | | $ | 104,576,360 | |

*Indicates a party-in-interest to the Plan.

**Cost information is not applicable because all the investments are participant-directed.

See Accompanying Report of Independent Registered Public Accounting Firm.

AIR 401(k) Retirement Plan

Schedule H, Line 4a – Schedule of Delinquent Participant Contributions

For the Year Ended December 31, 2023

EIN: 84- 1299717

Plan Number: 001

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Participant Contributions Transferred Late to the Plan | | Total That Constitute Nonexempt Prohibited Transactions | | Total Fully Corrected under VFCP and PTE

2002-51 |

| Contributions Not

Corrected | | Contributions Corrected Outside

VFCP | | Contributions Pending Correction

in VFCP | |

| Check here if late participant loan contributions are included | X | | | | | | | |

| 2022 participant contribution transferred late to the Plan | | $ | — | | | $ | — | | | $ | — | | | $ | 1,580 | |

See Accompanying Report of Independent Registered Public Accounting Firm.

SIGNATURES

Pursuant to the requirements of the Securities and Exchange Act of 1934, the Plan Administrator has duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Date: June 13, 2024 | |

| AIR 401(k) Retirement Plan |

| | |

| | |

| By: | /s/ Elizabeth Harmon |

| | |

| Elizabeth Harmon |

| Vice President, Human Resources |

| | |

| By: | /s/ Lauren Deliefde |

| | |

| Lauren Deliefde |

| Vice President, Operations |

| | |

| By: | /s/ Paul Beldin |

| | |

| Paul Beldin |

| Executive Vice President and Chief Financial Officer |

EXHIBIT INDEX

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We consent to the incorporation by reference in Registration Statement No. 333-251343 of Apartment Income REIT Corp. pertaining to the AIR 401(k) Retirement Plan and Registration Statements No. 333-207828 and No. 333-57617 of Apartment Investment and Management Company pertaining to the AIR 401(k) Retirement Plan, on Form S-8 of our report dated June 13, 2024, relating to the financial statements of AIR 401(k) Retirement Plan appearing in this Annual Report on Form 11-K of AIR 401(k) Retirement Plan for the year ended December 31, 2023.

Denver, Colorado

June 13, 2024

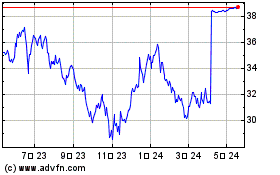

Apartment Income REIT (NYSE:AIRC)

過去 株価チャート

から 10 2024 まで 11 2024

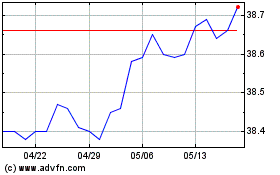

Apartment Income REIT (NYSE:AIRC)

過去 株価チャート

から 11 2023 まで 11 2024