- Data Vault’s CEO to join today’s Q3 2024

conference call to discuss its commercialization strategy –

WiSA Technologies, Inc. (NASDAQ: WISA), which is in a definitive

agreement to acquire AI, blockchain and Data Web 3.0 IP assets of

Data Vault Holdings, Inc.® (“Data Vault”) to form a data technology

& licensing company leveraging IP & proprietary HPC

software, today filed a Preliminary Proxy Statement for its Annual

Meeting, which included information regarding its planned

acquisition of Data Vault’s ADIO® and Data Vault assets (the “Asset

Purchase”). In its Q3 2024 conference call and presentation today

at 8:00 am PT / 11:00 am ET, Data Vault’s CEO Nate Bradley will

also be joining to discuss recent news and the commercialization

strategy.

The Asset Purchase Agreement

On September 4, 2024, as amended on November 14, 2024, WiSA

Technologies executed a $210 million Definitive Agreement to

purchase assets, including High-Performance Computing (HPC)

software and acoustic technologies IP, from Data Vault, to create a

licensing and technology company with an extensive patent portfolio

serving multiple industry and government entities in

bioengineering, energy, education, finance & fintech,

healthcare, sports entertainment, consumer, restaurants,

automotive, and more. The $210 million purchase price consists of

40 million shares of WiSA common stock to be issued at $5 per share

plus a $10 million 3-year Note, along with a 3% royalty on

applicable product revenues.

Nathaniel T. Bradley, CEO and co-founder of Data Vault, said,

“Data Vault continues to execute on our strategic initiatives to

monetize our technologies with partners, licensees, and direct

customers in large addressable markets. We’ve made strong inroads

into the entertainment and events market, where we’ve demonstrated

capabilities across multiple venues, including concerts, MMA,

boxing, golf and sports entertainment arenas, which we expect to

substantially monetize in 2025. We look forward to building a

well-capitalized public company in combination with WiSA

Technologies and unlocking shareholder value for all our

investors.”

“The Data Vault transaction continues to move forward, and on

November 15, 2024, we filed the preliminary proxy for WiSA

stockholders to vote on the planned asset acquisition, which will

create a larger, more dynamic entity with broad reach in multiple,

rapidly growing markets,” said Brett Moyer, CEO of WiSA. “Data

Vault’s substantial IP portfolio significantly amplifies our

spatial audio technology and adds powerful HPC assets.”

Data Vault’s Recent Operating Highlights

- Received three new patents and one new allowance from the

United States Patent Office and related International publication

of its now patented innovations.

- Launched DVHolo, its hologram product suite, powered by ADIO

and developed in partnership with HYPERVSN, renowned for its

innovative holographic solutions that provide an immersive,

real-time 3D experience that is both visually compelling and

commercially potent.

- Partnered with CLEAR, the security identity platform, to power

CLEAR’s Know Your Customer (KYC) solution.

- Launched VerifyU in collaboration with Arizona State University

and its Luminosity Lab. The VerifyU platform provides secure,

real-time blockchain-based academic credential verification, a key

solution for students, educational institutions, and employers who

rely on trustworthy and efficient methods to confirm

qualifications.

- Presented at the New York Scientific Data Summit 2024. Hosted

by Brookhaven National Laboratory on September 16-17, 2024,

Datavault addressed key advancements in Digital Twin technologies

impacting various sectors, and in particular bioenergy.

Stockholders’ Meeting

The Company has filed a Preliminary Proxy on November 15, 2024

for its Annual Meeting of Stockholders (the “Annual Meeting”) to be

held in December 2024. Stockholders will have an opportunity to

vote at the Annual Meeting to approve the Asset Purchase of

Datavault and Adio assets. If approved by stockholders, WiSA

expects that the Asset Purchase will close shortly after the Annual

Meeting, subject to satisfaction of customary closing

conditions.

WiSA Technologies Investor Conference Call

Management will host its third quarter 2024 results conference

call at 8:00 am PT / 11:00 am ET, on Friday, November 15, 2024.

The conference call will be available through a live webcast

found here:

Webcast | Third Quarter 2024 Results

Those without internet access or who wish to dial in may call:

1-833-366-1124 (domestic), or 1-412-317-0702 (international). All

callers should dial in approximately 10 minutes prior to the

scheduled start time and ask to be joined into the WiSA

Technologies call.

A webcast replay of the call will be available approximately one

hour after the end of the call and will be available for 90 days,

at the above webcast link. A telephonic replay of the call will be

available through November 22, 2024, and may be accessed by calling

1- 877-344-7529 (domestic) or 1- 412-317-0088 (international) or

Canada (toll free) 855-669-9658 and using access code 4877124.

A presentation of the Q3 2024 results will be accessible on

Friday, November 15, 2024, under the “Investors” section of WiSA

Technologies’ website.

About Data Vault Holdings, Inc.

Data Vault Holdings Inc. is a technology holding company that

provides a proprietary, cloud-based platform for the delivery of

blockchain objects. Data Vault Holdings Inc. provides businesses

with the tools to monetize data assets securely over its

Information Data Exchange® (IDE). The company is in the process of

finalizing the consolidation of its affiliates Data Donate

Technologies, Inc., ADIO LLC, and Datavault Inc. as wholly owned

subsidiaries under one corporate structure. Learn more about Data

Vault Holdings Inc. here.

LEGAL DISCLAIMER

Forward-Looking Statements

This press release of WiSA Technologies, Inc. (NASDAQ: WISA)

(the “Company”, “us”, “our” or “WiSA”) contains forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended (the “Securities Act”), and Section 21E of the

Securities Exchange Act of 1934, as amended. These forward-looking

statements, include, among others, the Company’s and Data Vault

Holdings, Inc.’s (“Datavault”) expectations with respect to the

proposed asset purchase (the “Asset Purchase) between them,

including statements regarding the benefits of the Asset Purchase,

the anticipated timing of the Asset Purchase, the implied valuation

of Datavault, the products offered by Datavault and the markets in

which it operates, and the Company’s and Datavault’s projected

future results and market opportunities, as well as information

with respect to WiSA’s future operating results and business

strategy. Readers are cautioned not to place undue reliance on

these forward-looking statements. Actual results may differ

materially from those indicated by these forward-looking statements

as a result of a variety of factors, including, but are not limited

to: (i) risks and uncertainties impacting WiSA’s business

including, risks related to its current liquidity position and the

need to obtain additional financing to support ongoing operations,

WiSA’s ability to continue as a going concern, WiSA’s ability to

maintain the listing of its common stock on Nasdaq, WiSA’s ability

to predict the timing of design wins entering production and the

potential future revenue associated with design wins, WiSA’s

ability to predict its rate of growth, WiSA’s ability to predict

customer demand for existing and future products and to secure

adequate manufacturing capacity, consumer demand conditions

affecting WiSA’s customers’ end markets, WiSA’s ability to hire,

retain and motivate employees, the effects of competition on WiSA’s

business, including price competition, technological, regulatory

and legal developments, developments in the economy and financial

markets, and potential harm caused by software defects, computer

viruses and development delays, (ii) risks related to the Asset

Purchase, including WiSA’s ability to close the Asset Purchase in a

timely manner or at all, or on the terms anticipated, whether due

to WiSA’s ability to satisfy the applicable closing conditions and

secure stockholder approval from WiSA stockholders or otherwise, as

well as risks related to WiSA’s ability to realize some or all of

the anticipated benefits from the Asset Purchase, (iii) any risks

that may adversely affect the business, financial condition and

results of operations of Datavault, including but not limited to

cybersecurity risks, the potential for AI design and usage errors,

risks related to regulatory compliance and costs, potential harm

caused by data privacy breaches, digital business interruption and

geopolitical risks, and (iv) other risks as set forth from time to

time in WiSA’s filings with the U.S. Securities and Exchange

Commission (the “SEC”). The information in this press release is as

of the date hereof and neither the Company nor Datavault undertakes

any obligation to update such information unless required to do so

by law. The reader is cautioned not to place under reliance on

forward looking statements. Neither the Company nor Datavault gives

any assurance that either the Company or Datavault will achieve its

expectations.

This press release shall not constitute an offer to sell, or the

solicitation of an offer to buy, nor will there be any sale of

these securities in any state or other jurisdiction in which such

offer, solicitation or sale would be unlawful prior to the

registration or qualification under the securities laws of such

state or jurisdiction. No offering of securities shall be made

except by means of a prospectus meeting the requirements of Section

10 of the Securities Act, or an exemption therefrom.

Additional Information and Where to Find It

In connection with the proposed Asset Purchase, WiSA intends to

file with the SEC a definitive proxy statement. The definitive

proxy statement for WiSA (if and when available) will be mailed to

stockholders of WiSA. WISA STOCKHOLDERS ARE URGED TO READ THE PROXY

STATEMENT AND OTHER DOCUMENTS THAT MAY BE FILED WITH THE SEC

CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE

BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED

ASSET PURCHASE.

WiSA stockholders will be able to obtain free copies of these

documents (if and when available) and other documents containing

important information about WiSA and Data Vault, once such

documents are filed with the SEC, through the website maintained by

the SEC at http://www.sec.gov. Copies of the documents filed with

the SEC will also be made available free of charge by contacting

WiSA using the contact information below.

Participants in the Solicitation

WISA and its directors, executive officers and other members of

its management and employees may be deemed to be participants in

the solicitation of proxies from WiSA’s stockholders in connection

with the Asset Purchase. Stockholders are urged to carefully read

the proxy statement regarding the Asset Purchase when it becomes

available, because it will contain important information.

Information regarding the persons who may, under the rules of the

SEC, be deemed participants in the solicitation of WiSA’s

stockholders in connection with the Asset Purchase will be set

forth in the proxy statement when it is filed with the SEC.

Information about WiSA’s executive officers and directors will be

set forth in the proxy statement relating to the Asset Purchase

when it becomes available. You can obtain free copies of these and

other documents containing relevant information at the SEC’s web

site at www.sec.gov or by directing a request to the address or

phone number set forth below.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241115120021/en/

For further information, please contact: WiSA Technologies, Inc.

15268 NW Greenbrier Pkwy Beaverton, OR 97006 (408) 627-4716

Investors Contact for WiSA Technologies and Data Vault

Holdings: David Barnard, Alliance Advisors Investor Relations,

415-433-3777, wisa@lhai.com

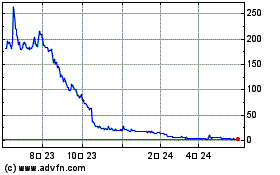

WiSA Technologies (NASDAQ:WISA)

過去 株価チャート

から 11 2024 まで 12 2024

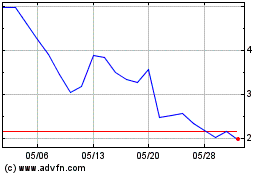

WiSA Technologies (NASDAQ:WISA)

過去 株価チャート

から 12 2023 まで 12 2024