UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULES 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

Dated

July 29, 2024

Commission

File Number: 001-10086

VODAFONE GROUP

PUBLIC LIMITED COMPANY

(Translation

of registrant’s name into English)

VODAFONE

HOUSE, THE CONNECTION, NEWBURY, BERKSHIRE, RG14 2FN,

ENGLAND

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form

20-F ✓

Form 40-F _

This

Report on Form 6-K contains a Stock Exchange Announcement dated 29

July 2024 entitled ‘VODAFONE LAUNCHES CAPPED TENDER

OFFERS’.

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN OR INTO, OR TO ANY

PERSON RESIDENT AND/OR LOCATED IN, ANY JURISDICTION WHERE SUCH

RELEASE, PUBLICATION OR DISTRIBUTION IS UNLAWFUL

THIS ANNOUNCEMENT RELATES TO THE DISCLOSURE OF INFORMATION THAT

QUALIFIED OR MAY HAVE QUALIFIED AS INSIDE INFORMATION WITHIN THE

MEANING OF (A) ARTICLE 7(1) OF UK MAR IN SO FAR AS IT RELATES TO

NOTES ISSUED BY VODAFONE (EACH AS DEFINED BELOW) AND (B) ARTICLE

7(1) OF MAR IN SO FAR AS IT RELATES TO NOTES ISSUED BY VIFD (EACH

AS DEFINED HEREIN)

VODAFONE GROUP PUBLIC LIMITED COMPANY LAUNCHES CAPPED TENDER OFFERS

FOR CERTAIN U.S. DOLLAR AND EURO DENOMINATED NOTES DUE 2028 TO

2031

(Newbury,

Berkshire - England) - July 29, 2024 - Vodafone Group Plc

("Vodafone" or the "Company") announces the launch of its offers to

purchase for cash in concurrent, but separate offers the

outstanding notes of the series described in the table below (the

"Notes") in three separate pools (each, a "Pool" and, together, the

"Pools") with an aggregate principal amount for (i) the series of

Notes within Pool 1 of up to €660,000,000, (ii) the series of

Notes within Pool 2 of up to €400,000,000 and (iii) the Notes

within Pool 3 of up to €290,000,000, and in the case of the

Pool 1 Notes and Pool 2 Notes, based on the respective order of

priority (each an "Acceptance Priority Level" and together, the

"Acceptance Priority Levels"), as applicable, for such series

within such Pool, as set forth in the table below. Each offer to

purchase each series of Notes is referred to herein as an "Offer"

and the offers to purchase the Notes as the "Offers." The Offers

are subject to the terms of, and conditions set out in, the offer

to purchase dated July 29, 2024 (the "Offer to Purchase"),

including the Financing Condition (as defined herein)

|

Title of Security

|

|

Principal Amount Outstanding

|

|

CUSIP/ISIN /Common Code

|

|

Acceptance PriorityLevel

|

|

Early Tender Premium(2)

|

|

Reference Security

|

|

Bloomberg Reference Page/Screen

|

|

Fixed Spread(basis points)

|

|

|

Pool 1 Notes - Offers subject to the Pool 1 Maximum Tender Amount

of €660,000,000(1)

|

|

|

4.375%

Notes due May 2028 (the "2028 Notes")

|

|

$900,504,000

|

|

92857WBK5

/ US92857WBK53 /N/A

|

|

1

|

|

$50

|

|

4.375%

U.S. Treasury due July 15, 2027

|

|

FIT1

|

|

30

|

|

|

3.25%

Notes due March 2029 with a First Par Call Date of December 2, 2028

(the "March 2029 Notes")(3)

|

|

€650,000,000

|

|

N/A

/XS2560495462 /1256049546

|

|

2

|

|

€50

|

|

March

2029 Notes Interpolated Mid-Swap Rate

|

|

IRSB EU

<GO>(5)

|

|

15

|

|

|

Pool 2 Notes - Offers subject to the Pool 2 Maximum Tender Amount

of €400,000,000(1)

|

|

|

1.875%

Notes due November 2029 (the "November 2029 Notes")

|

|

€750,000,000

|

|

N/A

/XS1721422068 /172142206

|

|

1

|

|

€50

|

|

November

2029 Notes Interpolated Mid-Swap Rate

|

|

IRSB EU

<GO>(5)

|

|

15

|

|

|

7.875%

Notes due February 2030 (the "2030 Notes")(4)

|

|

$744,400,000(4)

|

|

92857TAH0

/US92857TAH05 /N/A

|

|

2

|

|

$50

|

|

4.25%

U.S. Treasury due June 30, 2029

|

|

FIT1

|

|

55

|

|

|

Pool 3 Notes - Offers subject to the Pool 3 Maximum Tender Amount

of €290,000,000(1)

|

|

|

1.60%

Notes due July 2031 (the "2031 Notes")

|

|

€1,150,000,000

|

|

N/A

/XS1463101680 /146310168

|

|

N/A

|

|

€50

|

|

2031

Notes Interpolated Mid-Swap Rate

|

|

IRSB EU

<GO>(5)

|

|

30

|

|

|

Notes:

|

|

|

(1)

To determine whether the applicable Pool Maximum Tender Amount has

been reached, where required, we will convert the applicable

aggregate principal amount with respect to the Dollar Notes (as

defined herein) validly tendered into Euro using a conversion rate

of $1:€0.9204, which was the exchange rate as of 10:00 a.m.

(New York City time) on July 26, 2024 as displayed on the BFIX

screen on Bloomberg. Pool Maximum Tender Amounts represent the

maximum aggregate principal amount that may be purchased among the

relevant series of Notes within the relevant Pool. Pool Maximum

Tender Amounts may be increased or decreased at the Company's sole

and absolute discretion.

|

|

(2)

Per $1,000 or €1,000, as applicable, principal amount of

Notes validly tendered and not validly withdrawn at or prior to the

Early Tender Time and accepted for purchase. For the avoidance

of doubt, the Early Tender Premium is already included within the

Total Consideration (which, in the case of the Notes, will be

calculated using the Fixed Spread over the relevant Reference Yield

as described herein), and is not in addition to the Total

Consideration.

|

|

(3)

Issued by Vodafone International Financing DAC ("VIFD"), an

indirectly wholly owned subsidiary of the Company. The terms and

conditions of the March 2029 Notes provide for an optional call at

par (together with any Accrued Interest (as defined herein) up to

(but excluding) the redemption date) at the VIFD's option on any

date from (and including) December 2, 2028 ("First Par Call Date")

to (but excluding) March 2, 2029.

(4)

Only the 2030 Notes issued pursuant to the CUSIP/ISIN shown are

subject to the relevant Offer. The principal amount outstanding

shows only amounts held under the relevant CUSIP/ISIN.

(5)

Pricing Source: BGN.

|

The

Notes denominated in U.S. Dollars are referred to herein as "Dollar

Notes," and the Notes denominated in Euro are referred to herein as

"Euro Notes." Capitalised terms not otherwise defined in this

announcement have the same meaning as assigned to them in the Offer

to Purchase.

Holders

are advised to read carefully the Offer to Purchase for full

details of, and information on the procedures for participating in,

the Offers. All documentation relating to the Offers, including the

Offer to Purchase, together with any updates, are available at the

following website:

https://deals.is.kroll.com/vodafone.

All

Notes accepted in the Offers will be cancelled and retired by the

Company.

Purpose of the Offers

The

Offers and the issuance of the New Notes (as defined herein) are

being undertaken to, among other things, proactively manage the

Company's outstanding debt portfolio.

Financing Condition

VIFD,

an indirect wholly owned subsidiary of the Company, has today, July

29, 2024, announced its intention to issue new euro-denominated

notes to be wholly and unconditionally and irrevocably guaranteed

by the Company (the "New Notes"). Whether the Company will accept

for purchase any Notes validly tendered in the Offers and complete

the Offers is subject, without limitation, to the successful

completion (in the sole and absolute discretion of the Company) of

the issue of the New Notes (the "Financing

Condition").

Consideration for the Notes

Upon

the terms and subject to the conditions set forth in the Offer to

Purchase, including the Financing Condition, Holders of Notes that

are validly tendered and not validly withdrawn at or prior to the

Early Tender Time and accepted for purchase will receive the

applicable Total Consideration. The Total Consideration payable for

a series of Notes will be a price per $1,000 or €1,000

principal amount of such series of Notes that, as regards the

Dollar Notes and the Euro Notes, shall be equal to an amount,

calculated in accordance with the respective formulas described in

Schedules A-1 or A-2 of the Offer to Purchase, as applicable, that

would reflect, as of the Early Settlement Date, a yield to the

maturity date or First Par Call Date, as applicable, of each series

of Notes equal to the sum of (a) the Reference Yield of the

applicable Reference Security, determined at the Price

Determination Date plus (b) the applicable Fixed Spread, minus

Accrued Interest. The Reference Yield will be calculated in

accordance with standard market practice (rounded to 3 decimal

points) and will correspond to:

●

for the Dollar Notes, the bid-side price of the applicable

Reference Security as displayed on the applicable reference

page/screen (the "Reference Page") set forth in table above;

and

●

for the Euro Notes, the applicable Interpolated Mid-Swap Rate (as

defined in the Offer to Purchase),

each as

of the Price Determination Date.

If the

Dealer Managers determine that the relevant Reference Page is not

operational or is displaying inaccurate information at that time,

the bid-side price of the Reference Security or the applicable

Interpolated Mid-Swap Rate, as applicable, determined at or around

the Price Determination Date shall be determined by such other

means as the Company, in consultation with the Dealer Managers, may

consider to be appropriate under the circumstances.

For the

avoidance of doubt, the Early Tender Premium is already included

within the Total Consideration (which, in the case of all Notes,

will be calculated using the Fixed Spread over the relevant

Reference Yield), and is not in addition to the Total

Consideration. Holders who validly tender their Notes after the

Early Tender Time but at or prior to the Expiration Date, and whose

Notes are accepted for purchase, will receive only the applicable

Late Tender Offer Consideration, which is the applicable Total

Consideration less the applicable Early Tender

Premium.

In

respect of each series of Notes except for the March 2029 Notes,

the Total Consideration shall in all cases be calculated with

reference to the maturity date of such series of Notes. With

respect to the March 2029 Notes, if the sum of (i) the March 2029

Notes Interpolated Mid-Swap Rate to Par Call plus (ii) the Fixed

Spread applicable to the March 2029 Notes, is less than the

contractual annual rate of interest for the March 2029 Notes, then

the Total Consideration shall be calculated with reference to the

First Par Call Date of such Notes, assuming such series of Notes

were repaid in full on the First Par Call Date and in such case the

"March 2029 Notes Interpolated Mid-Swap Rate" shall be the March

2029 Notes Interpolated Mid-Swap Rate to Par Call. With respect to

the March 2029 Notes, if the sum of (i) the March 2029 Notes

Interpolated Mid-Swap Rate to Par Call plus (ii) the Fixed Spread

applicable to the March 2029 Notes, is greater than or equal to the

contractual annual rate of interest for the March 2029 Notes, then

the Total Consideration shall be calculated with reference to the

maturity date of such Notes and in such case the "March 2029 Notes

Interpolated Mid-Swap Rate" shall be the March 2029 Notes

Interpolated Mid-Swap Rate to Maturity.

Vodafone

will issue a press release specifying the applicable consideration

for each series of Notes as soon as reasonably practicable after

the determination thereof by the Dealer Managers.

Accrued Interest

In

addition to the applicable Total Consideration or applicable Late

Tender Offer Consideration, each Holder whose Notes are tendered

and accepted for purchase will receive accrued and unpaid interest

on the principal amount of Notes from, and including, the most

recent interest payment date prior to the applicable Settlement

Date up to, but not including, the applicable Settlement Date,

rounded to the nearest cent ("Accrued Interest"). Accrued Interest

will be paid in cash. All Notes accepted in the Offers will be

cancelled and retired by Vodafone.

Pool Maximum Tender Amount; Acceptance Priority Levels and

Proration

The

amount of each series of Notes in the relevant Pool that is

purchased is subject to the relevant Pool Maximum Tender Amount.

Tendered Pool 1 Notes with an aggregate principal amount of up to

€660,000,000 will be accepted in Pool 1; tendered Pool 2

Notes with an aggregate principal amount of up to

€400,000,000 will be accepted in Pool 2; and tendered Pool 3

Notes with an aggregate principal amount of up to

€290,000,000 will be accepted in Pool 3. The Company reserves

the right to increase or decrease any Pool Maximum Tender Amount.

To determine whether the relevant Pool Maximum Tender Amount has

been reached, the aggregate principal amount of the Dollar Notes

validly tendered will be converted into Euro using a conversion

rate of $1:€0.9204, which was the exchange rate as of 10:00

a.m. (New York City time) on July 26, 2024 as displayed on the BFIX

screen on Bloomberg.

Subject

to the Pool Maximum Tender Amounts, the Pool 1 Notes and Pool 2

Notes will be purchased in accordance with the Acceptance Priority

Levels (in numerical priority order) set forth in the table above.

With respect to the Pool 1 Notes, the 2028 Notes are designated as

the first, or higher, Acceptance Priority Level and the March 2029

Notes are designated as the second, or lower, Acceptance Priority

Level. With respect to the Pool 2 Notes, the November 2029 Notes

are designated as the first, or higher, Acceptance Priority Level,

and the 2030 Notes are designated as the second, or lower,

Acceptance Priority Level.

Subject

to the Pool Maximum Tender Amounts, all Pool 1 Notes and Pool 2

Notes tendered at or prior to the Early Tender Time having a higher

Acceptance Priority Level within the relevant Pool will be accepted

before any tendered Pool 1 Notes or Pool 2 Notes of a series within

such Pool having a lower Acceptance Priority Level are accepted,

and all Notes within such Pool tendered following the Early Tender

Time but at or prior to the Expiration Date having a higher

Acceptance Priority Level will be accepted before any Pool 1 Notes

or Pool 2 Notes within such Pool tendered following the Early

Tender Time having a lower Acceptance Priority Level are accepted

in the relevant Offer. If the relevant Pool Maximum Tender Amount

is not reached as of the Early Tender Time, Notes within a relevant

Pool tendered at or prior to the Early Tender Time will be accepted

for purchase in priority to Notes within such Pool tendered

following the Early Tender Time even if such Notes tendered

following the Early Tender Time have a higher Acceptance Priority

Level than Notes within such Pool tendered at or prior to the Early

Tender Time.

Notes

of a series within a relevant Pool may be subject to proration if

the aggregate principal amount of the Notes of such series validly

tendered would cause the relevant Pool Maximum Tender Amount to be

exceeded. Furthermore, if a Pool Maximum Tender Amount is reached

as of the Early Tender Time, Holders who validly tender Notes

within the relevant Pool following the Early Tender Time but at or

prior to the Expiration Date will not have any of their Notes

within such Pool accepted for purchase unless the relevant Pool

Maximum Tender Amount is increased in the sole and absolute

discretion of the Company.

Key Dates and Times, Offer Period and Results

Holders

of the Notes should note the following dates and times relating to

the Offers:

|

Date

|

|

Calendar Date

|

|

Commencement

Date

...............................................................................

|

|

July

29, 2024.

|

|

Early

Tender

Time

..............................................................................

|

|

5:00

p.m., New York City time, on August 9, 2024, unless extended or

earlier terminated by the Company in its sole and absolute

discretion, subject to applicable law.

|

|

Withdrawal

Deadline

|

|

5:00

p.m., New York City time, on August 9, 2024, unless extended or

earlier terminated by the Company in its sole and absolute

discretion, subject to applicable law.

|

|

Early

Results Announcement

Date

..............................................................................

|

|

The

first business day after the Early Tender Time, which is expected

to be August 12, 2024

|

|

Price

Determination

Date

..............................................................................

|

|

10:00

a.m., New York City time, on August 12, 2024.

|

|

Early

Settlement

Date

..............................................................................

|

|

In

respect of all Notes validly tendered and not validly withdrawn at

or prior to the Early Tender Time and accepted for purchase, the

Company expects to make payment on the third business day after the

Early Tender Time, August 14, 2024.

|

|

Expiration

Date

..............................................................................

|

|

5:00

p.m., New York City time, on August 26, 2024, unless extended or

earlier terminated by the Company in its sole and absolute

discretion, subject to applicable law.

|

|

Final

Tender Results Announcement

Date.............................................................................

|

|

The

first business day after the Expiration Date, which is expected to

be August 27, 2024.

|

|

Final

Settlement

Date

............................................................................

|

|

In

respect of the Notes that are validly tendered after the Early

Tender Time and at or prior to the Expiration Date and accepted for

purchase, the Company expects the Final Settlement Date to occur on

the second business day after the Expiration Date, August 28,

2024.

|

|

|

|

|

Holders of Notes are advised to check with any intermediary through

which they hold Notes as to when such intermediary would need to

receive instructions from a beneficial owner in order for that

beneficial owner to be able to participate in, or withdraw their

instruction to participate in, the Offers before the deadlines

specified in the Offer to Purchase. The deadlines set by any such

intermediary and the applicable Clearing System for participation

in the Offers may be earlier than the relevant deadlines specified

above.

The

acceptance of Notes for purchase is conditional on the satisfaction

of the conditions of the Offers as provided in "The Terms of the

Offers-Conditions to the Offers" in the Offer to Purchase,

including the Financing Condition.

The

Company has retained Merrill Lynch International and NatWest

Markets Plc as Dealer Managers and Kroll Issuer Services Limited as

Information and Tender Agent (the "Information and Tender Agent")

for the purposes of the Offers.

Questions

regarding procedures for tendering Notes may be directed to the

Information and Tender Agent at +44 20 7704 0880 or by email to

vodafone@is.kroll.com, Attention: Owen Morris. Questions regarding

the Offers may be directed to Merrill Lynch International at +1

(888) 292-0070 (toll free), +1 (980) 387-3907 or +44 207 996 5420

(in London) or by email to DG.LM-EMEA@bofa.com and to NatWest

Markets Plc at +1 (800) 231-5830 (toll free) or + 44 20 7678 5222

(in London) or by email to

liabilitymanagement@natwestmarkets.com.

This

announcement is for informational purposes only and does not

constitute an offer to buy, or a solicitation of an offer to sell,

any security. No offer, solicitation, or sale will be made in any

jurisdiction in which such an offer, solicitation, or sale would be

unlawful. The Offers are only being made pursuant to the Offer to

Purchase. Holders of the Notes are urged to carefully read the

Offer to Purchase before making any decision with respect to the

Offers.

This

announcement does not constitute or form a part of any offer or

solicitation to purchase or subscribe for, or otherwise invest in,

New Notes in the United States.

The New

Notes are not being, and will not be, offered or sold in the United

States. Nothing in this announcement constitutes an offer to sell

or the solicitation of an offer to buy the New Notes in the United

States or any other jurisdiction. Securities may not be offered,

sold or delivered in the United States absent registration under,

or an exemption from the registration requirements of, the United

States Securities Act of 1933, as amended (the "Securities Act").

The New Notes have not been, and will not be, registered under the

Securities Act or the securities laws of any state or other

jurisdiction of the United States and may not be offered, sold or

delivered, directly or indirectly, within the United States or to,

or for the account or benefit of, U.S. persons (as defined in

Regulation S under the Securities Act).

This

announcement is being made by each of Vodafone Group Plc and

Vodafone International Financing DAC and contains information that

qualified or may have qualified as inside information for the

purposes of (a) Article 7(1) of the Market Abuse Regulation (EU)

596/2014 ("MAR") as it forms part of domestic law in the United

Kingdom by virtue of the European Union (Withdrawal) Act 2018 (the

"EUWA") ("UK MAR") in so far as it relates to Notes issued by

Vodafone and (b) Article 7 of MAR in so far as it relates to Notes

issued by VIFD, encompassing information relating to the Offers

described above. For the purposes of (a) in respect of Vodafone, UK

MAR and Article 2 of Commission Implementing Regulation (EU)

2016/1055 as it forms part of domestic law in the United Kingdom by

virtue of the EUWA, and (b) in respect of VIFD, MAR and Article 2

of Commission Implementing Regulation (EU) 2016/1055, this

announcement is made by Maaike de Bie, Group General Counsel and

Company Secretary of Vodafone.

Offer and Distribution Restrictions

Italy

None of

the Offers, this announcement, the Offer to Purchase or any other

documents or materials relating to the Offers have been or will be

submitted to the clearance procedures of the Commissione Nazionale

per le Società e la Borsa ("CONSOB") pursuant to Italian laws

and regulations. Each Offer is being carried out in the Republic of

Italy ("Italy") as an exempt offer pursuant to article 101-bis,

paragraph 3-bis of the Legislative Decree No. 58 of February 24,

1998, as amended (the "Financial Services Act") and article 35-bis,

paragraph 4 of CONSOB Regulation No. 11971 of May 14, 1999, as

amended. Holders or beneficial owners of the Notes that are

resident or located in Italy can tender Notes for purchase in the

Offers through authorised persons (such as investment firms, banks

or financial intermediaries permitted to conduct such activities in

Italy in accordance with the Financial Services Act, CONSOB

Regulation No. 20307 of February 15, 2018, as amended from time to

time, and Legislative Decree No. 385 of September 1, 1993, as

amended) and in compliance with any other applicable laws and

regulations and with any requirements imposed by CONSOB or any

other Italian authority.

Each

intermediary must comply with the applicable laws and regulations

concerning information duties vis-à-vis its clients in

connection with the Notes and/or the Offers.

United Kingdom

The

communication of this announcement and the Offer to Purchase and

any other documents or materials relating to the Offers is not

being made by and such documents and/or materials have not been

approved by an "authorised person" for the purposes of section 21

of the Financial Services and Markets Act 2000 ("FSMA 2000").

Accordingly, such documents and/or materials are not being

distributed to, and must not be passed on to, the general public in

the United Kingdom. The communication of such documents and/or

materials is exempt from the restriction on financial promotions

under section 21(1) of the FSMA on the basis that it is only

directed at and may only be communicated to: (1) persons who are

outside of the United Kingdom; (2) investment professionals falling

within the definition contained in Article 19(5) of the Financial

Services and Markets Act 2000 (Financial Promotion) Order 2005 (the

"Financial Promotion Order"); (3) those persons who are existing

members or creditors of the Company or other persons falling within

Article 43(2) of the Financial Promotion Order; or (4) any other

persons to whom such documents and/or materials may lawfully be

communicated in accordance with the Financial Promotion Order (all

such persons together referred to as "relevant persons"). This

announcement, the Offer to Purchase and any other documents or

materials relating to the Offers are only available to relevant

persons. Any person who is not a relevant person should not act or

rely on this document or any of its contents.

France

The

Offers are not being made, directly or indirectly, and none of this

announcement, the Offer to Purchase or any other document or

material relating to the Offers has been or shall be distributed,

to the public in the Republic of France other than to qualified

investors as defined in Article 2(e) of the Regulation (EU)

2017/1129 (the "Prospectus Regulation"). None of this announcement,

the Offer to Purchase or any other document or materials relating

to the Offers have been or will be submitted for clearance to nor

approved by the Autorité

des Marchés Financiers.

Belgium

Neither

this announcement, the Offer to Purchase nor any other brochure,

documents or materials relating to the Offers has been, or will be,

submitted or notified to, or approved or recognized by, the Belgian

Financial Services and Markets Authority ("Autorité des services et marchés

financiers"/"Autoriteit voor Financiële Diensten en

Markten"). In Belgium, the Offers do not constitute a public

offering within the meaning of Articles 3, §1, 1° and 6,

§1 of the Belgian Law of April 1, 2007 on public takeover bids

("loi relative aux offres

publiques d'acquisition"/"wet op de openbare

overnamebiedingen"), as amended or replaced from time to

time. Accordingly, the Offers may not be, and are not being

advertised, and this announcement, the Offer to Purchase, as well

as any brochure, or any other material or document relating thereto

(including any memorandum, information circular, brochure or any

similar document) may not, have not and will not be distributed or

made available, directly or indirectly, to any person located

and/or resident within Belgium, other than to "qualified investors"

("investisseurs

qualifiés"/"qekwalificeerde belegge"), within the

meaning of Article 2(e) of the Prospectus Regulation acting on

their own account. Insofar as Belgium is concerned, the Offers are

made only to qualified investors, as this term is defined above.

Accordingly, the information contained in this announcement, the

Offer to Purchase or in any brochure or any other document or

material relating thereto may not be used for any other purpose or

disclosed or distributed to any other person in

Belgium.

General

This

announcement does not constitute an offer to buy or the

solicitation of an offer to sell Notes (and tenders of Notes in the

Offers will not be accepted from Holders) in any circumstances in

which such offer or solicitation or acceptance is unlawful. In

those jurisdictions where the securities, blue sky or other laws

require the Offers to be made by a licensed broker or dealer and

any Dealer Manager or any of the Dealer Managers' affiliates is

such a licensed broker or dealer in any such jurisdiction, the

Offers shall be deemed to be made by such Dealer Manager or such

Dealer Manager's affiliate, as the case may be, on behalf of the

Company in such jurisdiction.

Each

tendering Holder participating in the Offers will be deemed to give

certain representations in respect of the jurisdictions referred to

above and generally as set out in the section titled "Description

of the Offers-Procedures for Tendering Notes-Other Matters" in the

Offer to Purchase. Any tender of Notes for purchase pursuant to the

Offers from a Holder that is unable to make these representations

will not be accepted. Each of the Company, the Dealer Managers and

the Information and Tender Agent reserves the right, in its sole

and absolute discretion, to investigate, in relation to any tender

of Notes for purchase pursuant to the Offers, whether any such

representation given by a Holder is correct and, if such

investigation is undertaken and as a result the Company determines

(for any reason) that such representation is not correct, such

tender shall not be accepted.

Forward-Looking Information

This

announcement contains certain forward-looking statements which

reflect the Company's intent, beliefs or current expectations about

the future and can be recognised by the use of words such as

"expects," "will," "anticipate," or words of similar meaning. These

forward-looking statements are not guarantees of any future

performance and are necessarily estimates reflecting the best

judgment of the senior management of the Company and involve a

number of risks and uncertainties that could cause actual results

to differ materially from those suggested by the forward-looking

statements. As a consequence, these forward-looking statements

should be considered in light of various important factors that

could cause actual results to differ materially from estimates or

projections contained in the forward-looking statements, which

include, without limitation, the risk factors set forth in the

Offer to Purchase. The Company cannot guarantee that any

forward-looking statement will be realised, although it believes it

has been prudent in its plans and assumptions. Achievement of

future results is subject to risks, uncertainties and assumptions

that may prove to be inaccurate. Should known or unknown risks or

uncertainties materialise, or should underlying assumptions prove

inaccurate, actual results could vary materially from those

anticipated, estimated or projected. The Company undertakes no

obligation to update publicly or release any revisions to these

forward-looking statements to reflect events or circumstances or to

reflect the occurrence of unanticipated events, except as required

by applicable law.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorised.

|

|

VODAFONE

GROUP

|

|

|

PUBLIC

LIMITED COMPANY

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

Date:

July 29, 2024

|

By: /s/ M D B

|

|

|

Name: Maaike de Bie

|

|

|

Title: Group General Counsel and Company Secretary

|

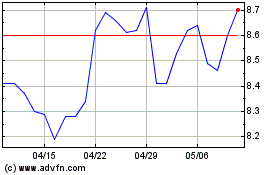

Vodafone (NASDAQ:VOD)

過去 株価チャート

から 6 2024 まで 7 2024

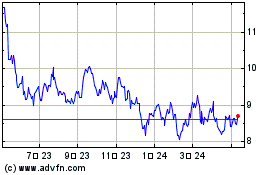

Vodafone (NASDAQ:VOD)

過去 株価チャート

から 7 2023 まで 7 2024