false

0001015383

0001015383

2024-08-08

2024-08-08

0001015383

POWW:CommonStock0.001ParValueMember

2024-08-08

2024-08-08

0001015383

POWW:Sec8.75SeriesCumulativeRedeemablePerpetualPreferredStock0.001ParValueMember

2024-08-08

2024-08-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): August 8, 2024

AMMO,

INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-13101 |

|

83-1950534 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

7681

E. Gray Rd.

Scottsdale,

Arizona 85260

(Address

of principal executive offices)

(480)

947-0001

(Registrant’s

telephone number, including area code)

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.001 par value |

|

POWW |

|

The

Nasdaq Stock Market LLC (Nasdaq Capital Market) |

| 8.75%

Series A Cumulative Redeemable Perpetual Preferred Stock, $0.001 par value |

|

POWWP |

|

The

Nasdaq Stock Market LLC (Nasdaq Capital Market) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.02 Results of Operations and Financial Condition.

On

August 8, 2024, Ammo, Inc. (the “Company”) reported its financial results for the fiscal

quarterly period ended June 30, 2024. A copy of the press release issued by the Company in this connection is furnished herewith

as Exhibit 99.1.

The

information in this Item in this Current Report on Form 8-K and Exhibit 99.1 attached hereto are being furnished and shall not be deemed

“filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject

to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or

the Exchange Act, regardless of any general incorporation language in such filing.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

AMMO,

INC. |

| |

|

|

| Dated:

August 8, 2024 |

By: |

/s/

Robert D. Wiley |

| |

|

Robert

D. Wiley |

| |

|

Chief

Financial Officer |

Exhibit

99.1

AMMO,

Inc. Reports First Quarter Fiscal Year 2025 Financial Results

SCOTTSDALE,

Ariz., August 8, 2024 (GLOBE NEWSWIRE) -- AMMO, Inc. (Nasdaq: POWW, POWWP) (“AMMO” or the “Company”),

the owner of GunBroker.com, the largest online marketplace serving the firearms and shooting sports industries, and a leading

vertically integrated producer of high-performance ammunition and components, today reported results for its first quarter of fiscal

2025, ended June 30, 2024.

First

Quarter Fiscal 2025 vs. First Quarter Fiscal 2024

| ● |

Net

Revenues of $31.0 million |

| ● |

Gross

profit margin of approximately 31.6% compared to 40.9% |

| ● |

Adjusted

EBITDA of $2.0 million compared to $6.6 million |

| ● |

Net

loss of ($7.1) million, compared to a net loss of ($1.1) million |

| ● |

Diluted

EPS of ($0.07), compared to ($0.02) |

| ● |

Adjusted

EPS of $0.01, compared to $0.05 |

GunBroker.com

“Marketplace” Metrics – First Quarter 2025

| ● |

Marketplace

revenue of approximately $12.3 million |

| ● |

New

user growth averaged approximately 25,000 per month |

| ● |

Average

take rate increased to 6.2% compared to 5.8% in Q1 FY 2024 |

Jared

Smith, AMMO’s CEO, commented “In our first quarter of fiscal 2025, we continued to make progress on the primary core initiatives

for each of our business units, transforming our ammunition plant to higher margin rifle and pistol production and transforming our marketplace

into an innovative ecommerce leader.

“We

have been building ammunition inventories to accelerate sales this fall for the launch of our new premium rifle hunting segments, and

we started delivering on our 12.7X108 cases under our contractual obligations to ZRO Delta. At GunBroker, we see take rates further increasing

in the quarters ahead as we push ahead with our Gearfire financing solution, and an anticipated increase in non-firearm accessory sales

as we monetize the algorithms and tune our cross-selling capabilities,” Mr. Smith concluded.

First

Quarter 2025 Results

We

ended the first quarter of our 2025 fiscal year with total revenues of approximately $31.0 million in comparison to $34.3 million in

the prior year quarter. Our ammunition segment made up $18.7 million of the total revenues and our marketplace segment generated the

remaining $12.3 million in revenues. The decrease in revenue was primarily related to a decrease in activity across both our reporting

segments, which we believe decreased as a result of the current macroeconomic environment impacting our industry as well as others.

Cost

of revenues was approximately $21.2 million for the quarter compared to $20.2 million in the comparable prior year quarter. Cost of revenues

for our marketplace segment was $1.8 million and our ammunition segment cost of revenues were $19.4 million.

This

resulted in a total gross margin for the quarter of $9.8 million or 31.6% compared to $14.0 million or 40.9% in the prior year period.

Our marketplace segment gross margin was $10.5 million or 85.6%. The gross margin for our ammunition segment was negative $0.7 million

or (4.0%).

The

increase in cost of revenues and decrease in gross profit margin was related to the shift in sales mix and production inefficiencies

in our ammunition segment in comparison to the prior year period.

Although

our margins decreased from the prior year period, the robust margins on GunBroker continue to hold strong, and while the margins in the

ammunition segment remained down as the plant ramp is still underway, we are beginning to see increased production throughput and expect

that we will see increased product marginality in future periods if we are able to continue with this trend.

There

was approximately $6.3 million of nonrecurring expenses in the quarter related to legal and professional fees, which we have included

as an addback to adjusted EBITDA. The $6.3 million of nonrecurring expenses also included a $3.2 million expense related to a contingency

stemming from litigation GunBroker was involved with prior to our acquisition. We expect to recover 2.9 million shares of common stock

as a result of this settlement, which will be cancelled and returned to our authorized but unissued share pool.

For

the quarter, we recorded Adjusted EBITDA of approximately $2.0 million, compared to prior year quarter Adjusted EBITDA of $6.6 million.

This

resulted in a loss per share of $0.07 for the quarter or Adjusted Net Income per Share of $0.01 in comparison to a loss per share of

$0.02 in the prior year quarter or Adjusted Net Income per Share of $0.05.

Looking

forward, we are continuing to focus on streamlining our manufacturing processes, which should improve product throughput and marginality.

For GunBroker, efforts to offer a flexible financing option to customers is well underway as well as our cross-selling solution which

provides our users with the ability to view and purchase compatible items when going through the checkout process. We expect these enhancements

will drive sales growth through better functionality and enhanced purchasing power of buyers.

Our

financial position remains strong given our net working capital position as we have reported $134.0 million in current assets including

$50.8 million of cash and cash equivalents along with $42.3 million of current liabilities. We believe this strong position will continue

to stimulate our transformation efforts.

We

repurchased approximately 580,000 shares of our common stock under our repurchase plan in the reported quarter, bringing us to just over

1.9 million total shares repurchased under the plan since December 2022.

Conference

Call

Management

will host a conference call at 5:00 PM ET today, August 8, 2024, to review financial results and provide an update on corporate developments.

Following management’s formal remarks there will be a question-and-answer session.

Participants

are asked to preregister for the call at the following link: https://dpregister.com/sreg/10190959/fd1589a7fa

Please

note that registered participants will receive their dial-in number upon registration and will dial directly into the call without delay.

Those without Internet access or who are unable to pre-register may dial in by calling 1-844-481-2698 (domestic) or 1-412-317-0655 (international).

Please

join at least 5-10 minutes prior to the scheduled start and follow the operator’s instructions. When requested, please ask for

“AMMO, Inc. First Quarter 2025 Conference Call.”

The

conference call will also be available through a live webcast at the following link: https://event.choruscall.com/mediaframe/webcast.html?webcastid=mju9ciSM,

which is also available through the Company’s website.

About

AMMO, Inc.

With

its corporate offices headquartered in Scottsdale, Arizona, AMMO designs and manufactures products for a variety of aptitudes, including

law enforcement, military, sport shooting and self-defense. The Company was founded in 2016 with a vision to change, innovate and invigorate

the complacent munitions industry. AMMO promotes branded munitions as well as its patented STREAK™ Visual Ammunition,

/stelTH/™ subsonic munitions, and specialty rounds for military use via government programs. For more information,

please visit: www.ammo-inc.com.

About

GunBroker.com

GunBroker.com

is the largest online marketplace dedicated to firearms, hunting, shooting and related products. Aside from merchandise bearing its logo,

GunBroker.com currently sells none of the items listed on its website. Third-party sellers list items on the site and Federal and state

laws govern the sale of firearms and other restricted items. Ownership policies and regulations are followed using licensed firearms

dealers as transfer agents. Launched in 1999, GunBroker.com is an informative, secure and safe way to buy and sell firearms, ammunition,

air guns, archery equipment, knives and swords, firearms accessories and hunting/shooting gear online. GunBroker.com promotes responsible

ownership of guns and firearms. For more information, please visit: www.gunbroker.com.

Forward

Looking Statements

This

document contains certain “forward-looking statements”. All statements other than statements of historical fact are “forward-looking

statements” for purposes of federal and state securities laws, including, but not limited to, any projections of earnings, revenue

or other financial items; any statements of the plans, strategies, goals and objectives of management for future operations; any statements

concerning proposed new products and services or developments thereof; any statements regarding future economic conditions or performance;

any statements or belief; and any statements of assumptions underlying any of the foregoing.

Forward

looking statements may include the words “may,” “could,” “estimate,” “intend,” “continue,”

“believe,” “expect” or “anticipate” or other similar words, or the negative thereof. These forward-looking

statements present our estimates and assumptions only as of the date of this report. Accordingly, readers are cautioned not to place

undue reliance on forward-looking statements, which speak only as of the dates on which they are made. We do not undertake to update

forward-looking statements to reflect the impact of circumstances or events that arise after the dates they are made. You should, however,

consult further disclosures and risk factors we include in Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, and Reports filed

on Form 8-K.

Investor

Contact:

CoreIR

Phone: (212) 655-0924

IR@ammo-inc.com

Source:

AMMO, Inc.

AMMO,

Inc.

CONDENSED

CONSOLIDATED BALANCE SHEETS

| | |

June 30, 2024 | | |

March 31, 2024 | |

| | |

(Unaudited) | | |

| |

| ASSETS | |

| | | |

| | |

| Current Assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 50,754,570 | | |

$ | 55,586,441 | |

| Accounts receivable, net | |

| 19,436,712 | | |

| 28,221,321 | |

| Due from related parties | |

| 4,800,000 | | |

| - | |

| Inventories | |

| 54,717,709 | | |

| 45,563,334 | |

| Prepaid expenses | |

| 4,244,197 | | |

| 2,154,170 | |

| Total Current Assets | |

| 133,953,188 | | |

| 131,525,266 | |

| | |

| | | |

| | |

| Equipment, net | |

| 57,998,933 | | |

| 58,082,040 | |

| | |

| | | |

| | |

| Other Assets: | |

| | | |

| | |

| Deposits | |

| 1,325,806 | | |

| 349,278 | |

| Patents, net | |

| 4,415,924 | | |

| 4,539,290 | |

| Other intangible assets, net | |

| 107,982,842 | | |

| 111,049,067 | |

| Goodwill | |

| 90,870,094 | | |

| 90,870,094 | |

| Right of use assets - operating leases | |

| 1,825,564 | | |

| 2,000,093 | |

| Deferred income tax asset | |

| 4,046,430 | | |

| 1,487,088 | |

| TOTAL ASSETS | |

$ | 402,418,781 | | |

$ | 399,902,216 | |

| | |

| | | |

| | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | |

| | | |

| | |

| Current Liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 22,678,651 | | |

$ | 23,156,495 | |

| Accrued liabilities | |

| 17,141,591 | | |

| 7,030,667 | |

| Current portion of operating lease liability | |

| 488,887 | | |

| 479,651 | |

| Current portion of construction note payable | |

| 276,616 | | |

| 273,459 | |

| Insurance premium note payable | |

| 1,680,594 | | |

| - | |

| Total Current Liabilities | |

| 42,266,339 | | |

| 30,940,272 | |

| | |

| | | |

| | |

| Long-term Liabilities: | |

| | | |

| | |

| Contingent consideration payable | |

| 39,852 | | |

| 59,838 | |

| Construction note payable, net of unamortized issuance costs | |

| 10,710,081 | | |

| 10,735,241 | |

| Operating lease liability, net of current portion | |

| 1,426,740 | | |

| 1,609,836 | |

| Total Liabilities | |

| 54,443,012 | | |

| 43,345,187 | |

| | |

| | | |

| | |

| Shareholders’ Equity: | |

| | | |

| | |

| Series A cumulative perpetual preferred Stock 8.75%, ($25.00 per share, $0.001 par value) 1,400,000 shares issued and outstanding as of June 30, 2024 and March 31, 2024, respectively | |

| 1,400 | | |

| 1,400 | |

| Common stock, $0.001 par value, 200,000,000 shares authorized 120,686,636 and 120,531,507 shares issued and 118,756,733 and 119,181,067 outstanding at June 30, 2024 and March 31, 2024, respectively | |

| 118,757 | | |

| 119,181 | |

| Additional paid-in capital | |

| 397,079,854 | | |

| 396,730,170 | |

| Accumulated deficit | |

| (45,455,985 | ) | |

| (37,620,566 | ) |

| Treasury Stock | |

| (3,768,257 | ) | |

| (2,673,156 | ) |

| Total Shareholders’ Equity | |

| 347,975,769 | | |

| 356,557,029 | |

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | |

$ | 402,418,781 | | |

$ | 399,902,216 | |

AMMO,

Inc.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| | |

For the Three Months Ended June 30, | |

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| Net Revenues | |

| | | |

| | |

| Ammunition sales(1) | |

$ | 13,359,554 | | |

$ | 14,106,029 | |

| Marketplace revenue | |

| 12,281,991 | | |

| 13,912,202 | |

| Casing sales | |

| 5,312,005 | | |

| 6,236,344 | |

| | |

| 30,953,550 | | |

| 34,254,575 | |

| | |

| | | |

| | |

| Cost of Revenues | |

| 21,164,428 | | |

| 20,230,035 | |

| Gross Profit | |

| 9,789,122 | | |

| 14,024,540 | |

| | |

| | | |

| | |

| Operating Expenses | |

| | | |

| | |

| Selling and marketing | |

| 298,613 | | |

| 295,581 | |

| Corporate general and administrative | |

| 11,323,078 | | |

| 7,947,563 | |

| Employee salaries and related expenses | |

| 4,462,101 | | |

| 4,116,280 | |

| Depreciation and amortization expense | |

| 3,381,669 | | |

| 3,344,043 | |

| Total operating expenses | |

| 19,465,461 | | |

| 15,703,467 | |

| Loss from Operations | |

| (9,676,339 | ) | |

| (1,678,927 | ) |

| | |

| | | |

| | |

| Other Income | |

| | | |

| | |

| Other income | |

| 252,232 | | |

| 692,951 | |

| Interest expense | |

| (196,522 | ) | |

| (204,201 | ) |

| Total other income | |

| 55,710 | | |

| 488,750 | |

| | |

| | | |

| | |

| Loss before Income Taxes | |

| (9,620,629 | ) | |

| (1,190,177 | ) |

| | |

| | | |

| | |

| Provision for Income Taxes | |

| (2,559,342 | ) | |

| (97,144 | ) |

| | |

| | | |

| | |

| Net Loss | |

| (7,061,287 | ) | |

| (1,093,033 | ) |

| | |

| | | |

| | |

| Preferred Stock Dividend | |

| (774,132 | ) | |

| (774,132 | ) |

| | |

| | | |

| | |

| Net Loss Attributable to Common Stock Shareholders | |

$ | (7,835,419 | ) | |

$ | (1,867,165 | ) |

| | |

| | | |

| | |

| Net Loss per share | |

| | | |

| | |

| Basic | |

$ | (0.07 | ) | |

$ | (0.02 | ) |

| Diluted | |

$ | (0.07 | ) | |

$ | (0.02 | ) |

| | |

| | | |

| | |

| Weighted average number of shares outstanding | |

| | | |

| | |

| Basic | |

| 119,105,502 | | |

| 117,713,805 | |

| Diluted | |

| 119,105,502 | | |

| 117,713,805 | |

| (1) |

Included

in revenue for the three months ended June 30, 2024 and 2023 are excise taxes of $1,303,603 and $1,175,796, respectively. |

AMMO,

Inc.

CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOW

(Unaudited)

| | |

For the Three Months Ended

June 30, | |

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| Cash flows from operating activities: | |

| | | |

| | |

| Net Loss | |

$ | (7,061,287 | ) | |

$ | (1,093,033 | ) |

| Adjustments to reconcile Net Loss to Net Cash provided by/(used in) operations: | |

| | | |

| | |

| Depreciation and amortization | |

| 4,692,556 | | |

| 4,620,087 | |

| Debt discount amortization | |

| 20,813 | | |

| 20,813 | |

| Employee stock awards | |

| 606,199 | | |

| 822,797 | |

| Stock grants | |

| 68,750 | | |

| 50,750 | |

| Common stock purchase options | |

| 41,055 | | |

| - | |

| Contingent consideration payable fair value | |

| (19,986 | ) | |

| (21,024 | ) |

| Allowance for doubtful accounts | |

| 87,689 | | |

| 909,717 | |

| Reduction in right of use asset | |

| 174,529 | | |

| 120,216 | |

| Deferred income taxes | |

| (2,559,342 | ) | |

| (97,144 | ) |

| Changes in Current Assets and Liabilities | |

| | | |

| | |

| Accounts receivable | |

| 8,696,920 | | |

| 7,088,437 | |

| Due from related parties | |

| (4,800,000 | ) | |

| - | |

| Inventories | |

| (9,154,375 | ) | |

| (1,579,836 | ) |

| Prepaid expenses | |

| 312,409 | | |

| 888,412 | |

| Deposits | |

| (976,528 | ) | |

| 2,964,365 | |

| Accounts payable | |

| (477,844 | ) | |

| (1,722,783 | ) |

| Accrued liabilities | |

| 9,974,813 | | |

| 152,021 | |

| Operating lease liability | |

| (173,860 | ) | |

| (127,704 | ) |

| Net cash provided by/(used in) operating activities | |

| (547,489 | ) | |

| 12,996,091 | |

| | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | |

| Purchase of equipment | |

| (1,419,857 | ) | |

| (1,313,939 | ) |

| Net cash used in investing activities | |

| (1,419,857 | ) | |

| (1,313,939 | ) |

| | |

| | | |

| | |

| Cash flow from financing activities: | |

| | | |

| | |

| Payments on insurance premium note payment | |

| (721,842 | ) | |

| (970,541 | ) |

| Payments on construction note payable | |

| (42,816 | ) | |

| (64,959 | ) |

| Proceeds from factoring liability | |

| - | | |

| 14,610,314 | |

| Payments on factoring liability | |

| - | | |

| (14,610,314 | ) |

| Payments on note payable - related party | |

| - | | |

| (180,850 | ) |

| Preferred stock dividends paid | |

| (638,021 | ) | |

| (638,038 | ) |

| Repurchase of common shares | |

| (366,164 | ) | |

| - | |

| Common stock repurchase plan | |

| (1,095,682 | ) | |

| (1,456,744 | ) |

| Net cash used in financing activities | |

| (2,864,525 | ) | |

| (3,311,132 | ) |

| | |

| | | |

| | |

| Net increase/(decrease) in cash | |

| (4,831,871 | ) | |

| 8,371,020 | |

| Cash, beginning of period | |

| 55,586,441 | | |

| 39,634,027 | |

| Cash, end of period | |

$ | 50,754,570 | | |

$ | 48,005,047 | |

(Continued)

AMMO,

Inc.

CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOW

(Unaudited)

| | |

For the Three Months Ended June 30, | |

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| Supplemental cash flow disclosures: | |

| | | |

| | |

| Cash paid during the period for: | |

| | | |

| | |

| Interest | |

$ | 196,552 | | |

$ | 184,385 | |

| Income taxes | |

$ | - | | |

$ | - | |

| | |

| | | |

| | |

| Non-cash investing and financing activities: | |

| | | |

| | |

| Insurance premium note payment | |

$ | 2,402,436 | | |

$ | 1,056,199 | |

| Dividends accumulated on preferred stock | |

$ | 136,111 | | |

$ | 136,094 | |

The

accompanying notes are an integral part of these condensed consolidated financial statements.

Non-GAAP

Financial Measures

We

analyze operational and financial data to evaluate our business, allocate our resources, and assess our performance. In addition to total

net sales, net loss, and other results under accounting principles generally accepted in the United States (“GAAP”), the

following information includes key operating metrics and non-GAAP financial measures we use to evaluate our business. We believe these

measures are useful for period-to-period comparisons of the Company. We have included these non-GAAP financial measures in this Current

Report on Form 8-K because they are key measures we use to evaluate our operational performance, produce future strategies for our operations,

and make strategic decisions, including those relating to operating expenses and the allocation of our resources. Accordingly, we believe

these measures provide useful information to investors and others in understanding and evaluating our operating results in the same manner

as our management and board of directors.

Reconciliation

of GAAP net loss to Adjusted EBITDA

Adjusted

EBITDA

| | |

For the Three Months Ended | |

| | |

30-Jun-24 | | |

30-Jun-23 | |

| | |

| | |

| |

| Reconciliation of GAAP net loss to Adjusted EBITDA | |

| | | |

| | |

| Net Loss | |

$ | (7,061,287 | ) | |

$ | (1,093,033 | ) |

| Provision for income taxes | |

| (2,559,342 | ) | |

| (97,144 | ) |

| Depreciation and amortization | |

| 4,692,556 | | |

| 4,620,087 | |

| Interest expense, net | |

| 196,522 | | |

| 204,201 | |

| Employee stock awards | |

| 606,199 | | |

| 822,797 | |

| Stock grants | |

| 68,750 | | |

| 50,750 | |

| Common stock purchase options | |

| 41,055 | | |

| - | |

| Other income, net | |

| (252,232 | ) | |

| (692,951 | ) |

| Contingent consideration fair value | |

| (19,986 | ) | |

| (21,024 | ) |

| Other nonrecurring expenses(1) | |

| 6,249,893 | | |

| 2,759,726 | |

| Adjusted EBITDA | |

$ | 1,962,128 | | |

$ | 6,553,409 | |

| |

1) |

For

the three months ended June 30, 2024 and 2023, other nonrecurring expenses consist of professional and legal fees that are nonrecurring

in nature. There were $3.2 million in expenses related to the settlement contingency included in other nonrecurring expenses for

the three months ended June 30, 2024. |

Reconciliation

of GAAP net income to Fully Diluted EPS

| | |

For the Three Months Ended | |

| | |

30-Jun-24 | | |

30-Jun-23 | |

| Reconciliation of GAAP net loss to Fully Diluted EPS | |

| | | |

| | | |

| | | |

| | |

| Net Loss | |

$ | (7,061,287 | ) | |

$ | (0.06 | ) | |

$ | (1,093,033 | ) | |

$ | (0.01 | ) |

| Depreciation and amortization | |

| 4,692,556 | | |

| 0.04 | | |

| 4,620,087 | | |

| 0.04 | |

| Interest expense, net | |

| 196,522 | | |

| - | | |

| 204,201 | | |

| - | |

| Employee stock awards | |

| 606,199 | | |

| 0.01 | | |

| 822,797 | | |

| 0.01 | |

| Stock grants | |

| 68,750 | | |

| - | | |

| 50,750 | | |

| - | |

| Contingent consideration fair value | |

| (19,986 | ) | |

| - | | |

| (21,024 | ) | |

| - | |

| Nonrecurring expenses | |

| 6,249,893 | | |

| 0.05 | | |

| 2,759,726 | | |

| 0.03 | |

| Tax effect(1) | |

| (3,154,317 | ) | |

| (0.03 | ) | |

| (2,009,764 | ) | |

| (0.02 | ) |

| Adjusted Net Income | |

$ | 1,578,330 | | |

$ | 0.01 | | |

$ | 5,333,740 | | |

$ | 0.05 | |

| |

(1) |

Tax

effects are estimated by applying the statutory rate to each applicable Non-GAAP adjustment. |

| | |

For the Three Months Ended

June 30, | |

| | |

2024 | | |

2023 | |

| Weighted average number of shares outstanding | |

| | | |

| | |

| Basic | |

| 119,105,502 | | |

| 117,713,805 | |

| Diluted | |

| 119,105,502 | | |

| 117,713,805 | |

v3.24.2.u1

Cover

|

Aug. 08, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 08, 2024

|

| Entity File Number |

001-13101

|

| Entity Registrant Name |

AMMO,

INC.

|

| Entity Central Index Key |

0001015383

|

| Entity Tax Identification Number |

83-1950534

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

7681

E. Gray Rd.

|

| Entity Address, City or Town |

Scottsdale

|

| Entity Address, State or Province |

AZ

|

| Entity Address, Postal Zip Code |

85260

|

| City Area Code |

(480)

|

| Local Phone Number |

947-0001

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock, $0.001 par value |

|

| Title of 12(b) Security |

Common

Stock, $0.001 par value

|

| Trading Symbol |

POWW

|

| Security Exchange Name |

NASDAQ

|

| 8.75% Series A Cumulative Redeemable Perpetual Preferred Stock, $0.001 par value |

|

| Title of 12(b) Security |

8.75%

Series A Cumulative Redeemable Perpetual Preferred Stock, $0.001 par value

|

| Trading Symbol |

POWWP

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=POWW_CommonStock0.001ParValueMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=POWW_Sec8.75SeriesCumulativeRedeemablePerpetualPreferredStock0.001ParValueMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

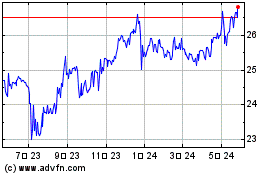

AMMO (NASDAQ:POWWP)

過去 株価チャート

から 10 2024 まで 11 2024

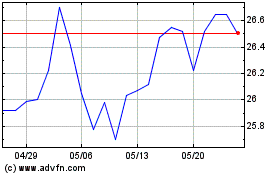

AMMO (NASDAQ:POWWP)

過去 株価チャート

から 11 2023 まで 11 2024