| |

SEC

FILE NUMBER |

| |

001-13101 |

| |

|

| |

CUSIP

NUMBER |

| |

Common

Stock: 00175J107 |

| |

Preferred

Stock: 00175J206 |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

12b-25

NOTIFICATION

OF LATE FILING

| (Check

One): |

|

☐

Form 10-K ☐ Form 20-F ☐ Form 11-K

☒

Form 10-Q ☐ Form 10-D ☐ Form N-CEN ☐ Form N-CSR |

| |

|

| |

|

For

Period Ended: September 30, 2024 |

| |

|

| |

|

☐

Transition Report on Form 10-K |

| |

|

| |

|

☐

Transition Report on Form 20-F |

| |

|

| |

|

☐

Transition Report on Form 11-K |

| |

|

| |

|

☐

Transition Report on Form 10-Q |

| |

|

| |

|

For

the Transition Period Ended: |

| Nothing

in this Form shall be construed to imply that the Commission has verified any information contained herein. |

If

the notification relates to a portion of the filing checked above, identify the Item(s) to which the notification relates: Not Applicable.

PART

I — REGISTRANT INFORMATION

AMMO,

INC.

Full

Name of Registrant

N/A

Former

Name if Applicable

7681

E. Gray Rd.

Address

of Principal Executive Office (Street and Number)

Scottsdale,

Arizona 85260

City,

State and Zip Code

PART

II — RULES 12b-25(b) AND (c)

If

the subject report could not be filed without unreasonable effort or expense and the registrant seeks relief pursuant to Rule 12b-25(b),

the following should be completed. (Check box if appropriate)

| ☐ |

|

(a) |

The

reasons described in reasonable detail in Part III of this Form could not be eliminated without

unreasonable effort or expense;

|

| |

(b) |

The

subject annual report, semi-annual report, transition report on Form 10-K, Form 20-F, Form

11-K, Form N-CEN or Form N-CSR, or portion thereof, will be filed on or before the fifteenth

calendar day following the prescribed due date; or the subject quarterly report or transition

report on Form 10-Q or subject distribution report on Form 10-D, or portion thereof, will

be filed on or before the fifth calendar day following the prescribed due date; and

|

| |

(c) |

The

accountant’s statement or other exhibit required by Rule 12b-25(c) has been attached if applicable. |

PART

III — NARRATIVE

State

below in reasonable detail why Forms 10-K, 20-F, 11-K, 10-Q, 10-D, N-CEN, N-CSR, or the transition report or portion thereof, could not

be filed within the prescribed time period.

This

Form 12b-25 (Notification of Late Filing) is filed by Ammo, Inc. (the “Company”) with respect to its Quarterly Report on

Form 10-Q for the fiscal quarter ended September 30, 2024 (the “Quarterly Report”) pursuant to Rule 12b-25 under the Securities

Exchange Act of 1934, as amended (the “Exchange Act”).

As

previously disclosed in the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission (the “Commission”)

on October 3, 2024, on September 27, 2024, the Company received a communication from its independent registered public accounting firm,

Pannell Kerr Forster of Texas, P.C. (“PKF”), in which PKF requested that the Company take action to disclose that the following

historical financial statements and auditors’ reports previously reported by the Company should no longer be relied upon:

| |

● |

financial

statements as of and for the year ended March 31, 2024, as well as all interim periods within such year, including the auditors’

report on the financial statements and the auditors’ report on internal controls; |

| |

|

|

| |

● |

financial

statements as of and for the year ended March 31, 2023, as well as all interim periods within such year, including the auditors’

report on the financial statements and the auditors’ report on internal controls; |

| |

|

|

| |

● |

financial

statements as of and for the year ended March 31, 2022, as well as all interim periods within such year, including the auditors’

report on the financial statements; and |

| |

|

|

| |

● |

financial

statements as of and for the year ended March 31, 2021, including the auditors’ report on the financial statements (collectively

the “Affected Periods”). |

As

previously disclosed in the Company’s Current Report on Form 8-K filed with the Commission on September 24, 2024, based in part

on information provided by PKF, a Special Committee of the Board of Directors of the Company retained a law firm to conduct an independent

investigation (the “Investigation”) focused on fiscal years 2020 through 2023. The scope of the Investigation includes, among

other things, an assessment of whether the Company and its management control persons at the time (i) accurately disclosed all executive

officers, members of management, and potential related party transactions in fiscal years 2020 through 2023, (ii) properly characterized

certain fees paid for investor relations and legal services as reductions of proceeds from capital raises rather than period expenses

in fiscal years 2021 and 2022 and (iii) appropriately valued unrestricted stock awards to officers, directors, employees and others in

fiscal years 2020 through 2022 (collectively, the “Investigation Issues”).

Furthermore,

as previously disclosed, the Company’s management concluded that in light of the Investigation Issues, a material weakness existed

in the Company’s internal control over financial reporting during the Affected Periods and that the Company’s disclosure

controls and procedures were not effective. To address this material weakness, management has devoted, and plans to continue to devote,

significant effort and resources to the remediation and improvement of Company’s internal control over financial reporting. Specifically,

the Company is, among other things, identifying deficiency exposure, evaluating its control environment, testing operating effectiveness,

assessing tests of design, addressing segregation of duties, evaluating management review controls and procedures, and developing and

implementing remediation plans.

The

Company’s current management team is committed to remediating the material weakness, addressing the Investigation Issues, and promoting

a culture of transparency and open communication within the Company. Nonetheless, the Company has determined that it is unable to file

the Quarterly Report by the prescribed due date without unreasonable effort or expense because the Investigation is still ongoing. While

the Company intends to file the Quarterly Report as soon as practicable, it does not expect to file the Quarterly Report within the 5-day

extension period provided by Rule 12b-25 under the Exchange Act. Counsel for the Special Committee of the Board of Directors intends

to complete the Investigation as soon as practicable.

Cautionary

Note Regarding Forward-Looking Statements

This

Form 12b-25 contains forward-looking statements within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation

Reform Act of 1995, which statements are subject to considerable risks and uncertainties. These forward-looking statements include statements

regarding the expected timing of the filing of the Quarterly Report, the timing of the completion of the Investigation and the Company’s

ability to effectively remediate material weaknesses relating to internal controls over financial reporting. Forward-looking statements

include all statements that are not solely historical facts and can be identified by terms such as “believe,” “anticipate,”

“could,” “estimate,” “expect,” “may,” “will,” “should,” or similar

expressions. Investors are cautioned not to place undue reliance on these forward-looking statements, which are subject to numerous risks

and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements, including

the risks and uncertainties addressed under the heading “Risk Factors” and elsewhere in the Company’s Annual Report

on Form 10-K for the fiscal year ended March 31, 2024, the Quarterly Report on Form 10-Q for the fiscal quarter ended June 30, 2024,

and the other filings the Company makes with the Commission from time to time. These forward-looking statements speak only as of the

date of this Form 12b-25, and the Company undertakes no obligation to update these forward-looking statements to reflect events or circumstances

occurring after the date hereof.

PART

IV — OTHER INFORMATION

| (1) |

Name

and telephone number of person to contact in regard to this notification: |

| |

|

|

|

| |

Jordan

Christensen |

|

(480) |

|

947-0001 |

| |

(Name) |

|

(Area

code) |

|

(Telephone

Number) |

| |

|

| (2) |

Have

all other periodic reports required under Section 13 or 15(d) of the Securities Exchange

Act of 1934 or Section 30 of the Investment Company Act of 1940 during the preceding 12 months

or for such shorter period that the registrant was required to file such report(s) been filed?

If the answer is no, identify report(s).

☒

Yes ☐ No |

| |

|

| (3) |

Is

it anticipated that any significant change in results of operations from the corresponding period for the last fiscal year will be

reflected by the earnings statements to be included in the subject report or portion thereof? ☒ Yes ☐ No |

| |

|

| |

If

so, attach an explanation of the anticipated change, both narratively and quantitatively, and, if appropriate, state the reasons

why a reasonable estimate of the results cannot be made. |

Given

that the Investigation is ongoing and the financial statements for the Affected Periods should no longer be relied upon, the Company

is unable to make a reasonable estimate of any changes in results of operations in its financial statements until after the Investigation

is complete. For additional information, see the discussion above in Part III.

AMMO,

INC.

(Name

of Registrant as Specified in Charter)

has

caused this notification to be signed on its behalf by the undersigned hereunto duly authorized.

| Date:

November 13, 2024 |

By: |

/s/

Jared R. Smith |

| |

|

Jared

R. Smith |

| |

|

Chief

Executive Officer |

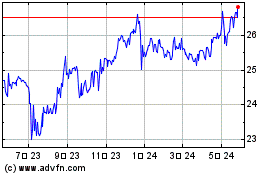

AMMO (NASDAQ:POWWP)

過去 株価チャート

から 12 2024 まで 12 2024

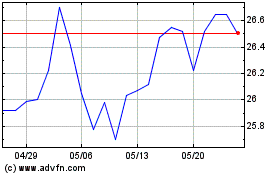

AMMO (NASDAQ:POWWP)

過去 株価チャート

から 12 2023 まで 12 2024