Intuitive Machines, Inc. (Nasdaq: LUNR, “Intuitive Machines,” or

the “Company”), a leading space exploration, infrastructure, and

services company, today announced its financial results for the

second quarter ended June 30, 2024.

Intuitive Machines CEO Steve Altemus said, “The landmark

accomplishments achieved up to and during the second quarter were

significant milestones that extend our competitive advantage in

providing delivery, data transmission, and autonomous operations,

the three pillars of space commercialization.”

“For our second mission, we made considerable progress

continuing with assembly, integration, and testing of our lander,

including successful flight engine qualification. We also completed

the system requirements review for our lunar terrain vehicle. This

milestone validated Intuitive Machines’ lunar terrain vehicle and

heavy cargo class lander design. Intuitive Machines is unique among

the competitors in the LTV bidding pool as we are the only

competing prime contractor with demonstrated experience delivering

to, transmitting data from, and autonomously operating on the

surface of the Moon.”

Mr. Altemus continued, “Our continued operational excellence,

along with our detailed roadmap for the rest of the year, gives us

the confidence to raise the low end of our revenue outlook. On the

cash side, we are now debt free and expect to have more runway with

sufficient cash today to fund operations for the next 12 months as

we execute on our growth trajectory.”

2024 Outlook

- Expect full-year 2024 revenue of

$210 - $240 million, resulting in 2.6x - 3x prior year sales

- Q2 ending cash balance expected to

be sufficient to fund operations through the next 12 months

- Continue to add cash reserves based

on projected wins and planned operations to execute growth

trajectory

- Backlog expansion driven by key

upcoming awards; Near Space Network Services (NSNS), the next

Commercial Lunar Payload Services (CLPS) award, among others

- Expected shipment of the mission two

completed lander to the launch site in the fourth quarter with the

launch window extending through the first quarter of 2025

Second Quarter 2024 Financial

Highlights

- Contracted backlog of $213.0 million

as of the end of the second quarter

- Second quarter 2024 revenue of $41.4 million, an increase of

130% year-over-year, driven primarily by the OMES, LTVS, and JETSON

low power nuclear satellite projects. Revenue also includes the

impact of changes in estimates associated with NASA CLPS contract

modifications. Prior period revenue was $18.0 million

- Second quarter 2024 operating loss

of $(28.2) million, driven primarily by the completion of the IM-1

mission and the noncash impact of changes in estimates associated

with NASA CLPS contract modifications versus $(13.2) million in the

prior year period

- Ending cash balance of $31.6 million as of the end of the

second quarter and is expected to be sufficient to fund operations

through the next 12 months. This includes $21.5M of cash outflow in

the quarter for launch provider payments for IM-1, IM-2, and IM-3;

majority of launch provider payments now behind us

Conference Call Information

Intuitive Machines will host a conference call today,

August 13, 2024, at 8:30 am Eastern Time to discuss these

results. A link to the live webcast of the earnings conference call

will be made available on the investors portion of the Intuitive

Machines’ website at https://investors.intuitivemachines.com.

Following the conference call, a webcast replay will be

available through the same link on the investors portion of the

Intuitive Machines’ website at

https://investors.intuitivemachines.com.

Key Business Metrics and Non-GAAP

Financial Measures

In addition to the GAAP financial measures set forth in this

press release, the Company has included certain financial measures

that have not been prepared in accordance with generally accepted

accounting principles (“GAAP”) and constitute “non-GAAP financial

measures” as defined by the SEC. This includes adjusted EBITDA

(“Adjusted EBITDA”).

Adjusted EBITDA is a key performance measure that

our management team uses to assess the Company’s operating

performance and is calculated as net income (loss) excluding

results from non-operating sources including interest income,

interest expense, gain on extinguishing of debt, share-based

compensation, change in fair value instruments, gain or loss on

issuance of securities, other income/expense, depreciation, and

provision for income taxes. Intuitive Machines has included

Adjusted EBITDA because we believe it is helpful in highlighting

trends in the Company’s operating results and because it is

frequently used by analysts, investors, and other interested

parties to evaluate companies in our industry.

Adjusted EBITDA has limitations as an analytical measure, and

investors should not consider it in isolation or as a substitute

for analysis of the Company’s results as reported under GAAP. Other

companies, including companies in Intuitive Machines’ industry, may

calculate Adjusted EBITDA differently, which reduces its usefulness

as a comparative measure. Because of these limitations, you should

consider Adjusted EBITDA alongside other financial performance

measures, including various cash flow metrics, net income (loss)

and our other GAAP results. A reconciliation of

Adjusted EBITDA to the most directly comparable GAAP financial

measure is included below under the heading “Reconciliation of GAAP

to Non-GAAP Financial Measure.”

We define free cash flow as net cash (used in) provided by

operating activities less purchases of property and equipment. We

believe that free cash flow is a meaningful indicator of liquidity

that provides information to management and investors about the

amount of cash generated from operations that, after purchases of

property and equipment, can be used for strategic initiatives,

including continuous investment in our business and strengthening

our balance sheet. Free Cash Flow has limitations as a liquidity

measure, and you should not consider it in isolation or as a

substitute for analysis of our cash flows as reported under GAAP.

Some of these limitations are: Free Cash Flow is not a measure

calculated in accordance with GAAP and should not be considered in

isolation from, or as a substitute for financial information

prepared in accordance with GAAP; Free Cash Flow may not be

comparable to similarly titled metrics of other companies due to

differences among methods of calculation; and Free Cash Flow may be

affected in the near to medium term by the timing of capital

investments, fluctuations in our growth and the effect of such

fluctuations on working capital and changes in our cash conversion

cycle. A reconciliation of Free Cash Flow to the most

directly comparable GAAP financial measure is included below under

the heading “Reconciliation of GAAP to Non-GAAP Financial

Measure.”

The Company has also included contracted backlog, which is

defined as the total estimate of the revenue the Company expects to

realize in the future as a result of performing work on awarded

contracts, less the amount of revenue the Company has previously

recognized. Intuitive Machines monitors its backlog because we

believe it is a forward-looking indicator of potential sales which

can be helpful to investors in evaluating the performance of its

business and identifying trends over time.

About Intuitive Machines

Intuitive Machines is a diversified space exploration,

infrastructure, and services company focused on fundamentally

disrupting lunar access economics. In 2024, Intuitive Machines

became the first commercial company to land and operate on the

lunar surface, validating its ability to provide the three service

pillars required to commercialize a celestial body: delivery, data

& communications, and autonomous operations in space. The

Company empowers its customers to achieve their ambitious visions

and commercial goals in space through seamless collaboration with

its robust service pillars. For more information, please visit

intuitivemachines.com.

Forward-Looking Statements

This press release includes “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995, as amended. These statements that do not relate to matters of

historical fact should be considered forward looking. These

forward-looking statements generally are identified by the words

such as “anticipate,” “believe,” “continue,” “could,” “estimate,”

“expect,” “intend,” “may,” “might,” “plan,” “possible,”

“potential,” “predict,” “project,” “should,” “strive,” “would,”

“strategy,” “outlook,” the negative of these words or other similar

expressions, but the absence of these words does not mean that a

statement is not forward-looking. These forward-looking statements

include but are not limited to statements regarding: our

expectations and plans relating to our lunar missions, including

the expected timing of launch and our progress in preparation

thereof; our expectations with respect to, among other things,

demand for our product portfolio, our submission of bids for

contracts including NSNS and CP-22; our expectations regarding

revenue for government contracts awarded to us; our operations, our

financial performance and our industry; our business strategy,

business plan, and plans to drive long-term sustainable shareholder

value; information under “2024 Outlook,” including our expectations

on revenue generation and cash. These forward-looking statements

reflect the Company’s predictions, projections, or expectations

based upon currently available information and data. Our actual

results, performance or achievements may differ materially from

those expressed or implied by the forward-looking statements, and

you are cautioned not to place undue reliance on these forward

looking statements. The following important factors and

uncertainties, among others, could cause actual outcomes or results

to differ materially from those indicated by the forward-looking

statements in this press release: our reliance upon the efforts of

our Board and key personnel to be successful; our limited operating

history; our failure to manage our growth effectively; competition

from existing or new companies; unsatisfactory safety performance

of our spaceflight systems or security incidents at our facilities;

failure of the market for commercial spaceflight to achieve the

growth potential we expect; any delayed launches, launch failures,

failure of our satellites or lunar landers to reach their planned

orbital locations, significant increases in the costs related to

launches of satellites and lunar landers, and insufficient capacity

available from satellite and lunar lander launch providers; our

customer concentration; risks associated with commercial

spaceflight, including any accident on launch or during the journey

into space; risks associated with the handling, production and

disposition of potentially explosive and ignitable energetic

materials and other dangerous chemicals in our operations; our

reliance on a limited number of suppliers for certain materials and

supplied components; failure of our products to operate in the

expected manner or defects in our products; counterparty risks on

contracts entered into with our customers and failure of our prime

contractors to maintain their relationships with their

counterparties and fulfill their contractual obligations; failure

to successfully defend protest from other bidders for government

contracts; failure to comply with various laws and regulations

relating to various aspects of our business and any changes in the

funding levels of various governmental entities with which we do

business; our failure to protect the confidentiality of our trade

secrets, and unpatented know how; our failure to comply with the

terms of third-party open source software our systems utilize; our

ability to maintain an effective system of internal control over

financial reporting, and to address and remediate material

weaknesses in our internal control over financial reporting; the

U.S. government’s budget deficit and the national debt, as well as

any inability of the U.S. government to complete its budget process

for any government fiscal year, and our dependence on U.S.

government contracts and funding by the government for the

government contracts; our failure to comply with U.S. export and

import control laws and regulations and U.S. economic sanctions and

trade control laws and regulations; uncertain global macro-economic

and political conditions and rising inflation; our history of

losses and failure to achieve profitability and our need for

substantial additional capital to fund our operations; the fact

that our financial results may fluctuate significantly from quarter

to quarter; our holding company status; the risk that our business

and operations could be significantly affected if it becomes

subject to any litigation, including securities litigation or

stockholder activism; our public securities’ potential liquidity

and trading; and other public filings and press releases other

factors detailed under the section titled Part I, Item 1A. Risk

Factors of our Annual Report on Form 10-K for the fiscal year ended

December 31, 2023 filed with the Securities and Exchange Commission

(the “SEC”), the section titled Part I, Item 2, Management’s

Discussion and Analysis of Financial Condition and Results of

Operations and the section titled Part II. Item 1A. “Risk Factors”

in our most recently filed Quarterly Report on Form 10-Q, and in

our subsequent filings with the SEC, which are accessible on the

SEC's website at www.sec.gov.

These forward-looking statements are based on information

available as of the date of this press release and current

expectations, forecasts, and assumptions, and involve a number of

judgments, risks, and uncertainties. Accordingly, forward-looking

statements should not be relied upon as representing our views as

of any subsequent date, and we do not undertake any obligation to

update forward-looking statements to reflect events or

circumstances after the date they were made, whether as a result of

new information, future events, or otherwise, except as may be

required under applicable securities laws.

Contacts

For investor inquiries:investors@intuitivemachines.com

For media inquiries:press@intuitivemachines.com

| |

|

INTUITIVE MACHINES, INC.Condensed

Consolidated Balance Sheets(In

thousands)(Unaudited) |

| |

| |

June 30,2024 |

|

December 31,2023 |

| ASSETS |

|

|

|

| Current

assets |

|

|

|

|

Cash and cash equivalents |

$ |

31,631 |

|

|

$ |

4,498 |

|

|

Restricted cash |

|

2,042 |

|

|

|

62 |

|

|

Trade accounts receivable, net |

|

38,262 |

|

|

|

16,881 |

|

|

Contract assets |

|

7,324 |

|

|

|

6,489 |

|

|

Prepaid and other current assets |

|

3,852 |

|

|

|

3,681 |

|

|

Total current assets |

|

83,111 |

|

|

|

31,611 |

|

| Property and equipment,

net |

|

21,305 |

|

|

|

18,349 |

|

| Operating lease right-of-use

assets |

|

35,577 |

|

|

|

35,853 |

|

| Finance lease right-of-use

assets |

|

128 |

|

|

|

95 |

|

|

Total assets |

$ |

140,121 |

|

|

$ |

85,908 |

|

| LIABILITIES, MEZZANINE

EQUITY AND SHAREHOLDERS’ DEFICIT |

|

|

|

| Current

liabilities |

|

|

|

|

Accounts payable and accrued expenses |

|

23,917 |

|

|

$ |

16,771 |

|

|

Accounts payable - affiliated companies |

|

5,749 |

|

|

|

3,493 |

|

|

Current maturities of long-term debt |

|

3,000 |

|

|

|

8,000 |

|

|

Contract liabilities, current |

|

40,550 |

|

|

|

45,511 |

|

|

Operating lease liabilities, current |

|

3,025 |

|

|

|

4,833 |

|

|

Finance lease liabilities, current |

|

36 |

|

|

|

25 |

|

|

Other current liabilities |

|

8,733 |

|

|

|

4,747 |

|

|

Total current liabilities |

|

85,010 |

|

|

|

83,380 |

|

| Contract liabilities,

non-current |

|

3,316 |

|

|

|

— |

|

| Operating lease liabilities,

non-current |

|

31,293 |

|

|

|

30,550 |

|

| Finance lease liabilities,

non-current |

|

84 |

|

|

|

67 |

|

| Earn-out liabilities |

|

14,520 |

|

|

|

14,032 |

|

| Warrant liabilities |

|

16,109 |

|

|

|

11,294 |

|

| Other long-term

liabilities |

|

158 |

|

|

|

4 |

|

|

Total liabilities |

|

150,490 |

|

|

|

139,327 |

|

| Commitments and

contingencies |

|

|

|

| MEZZANINE

EQUITY |

|

|

|

| Series A preferred stock

subject to possible redemption |

|

5,698 |

|

|

|

28,201 |

|

| Redeemable noncontrolling

interests |

|

218,160 |

|

|

|

181,662 |

|

| SHAREHOLDERS’

DEFICIT |

|

|

|

|

Class A common stock |

|

6 |

|

|

|

2 |

|

| Class B common stock |

|

— |

|

|

|

— |

|

| Class C common stock |

|

7 |

|

|

|

7 |

|

| Treasury Stock |

|

(12,825 |

) |

|

|

(12,825 |

) |

| Paid-in capital |

|

— |

|

|

|

— |

|

| Accumulated deficit |

|

(222,203 |

) |

|

|

(250,466 |

) |

|

Total shareholders’ deficit attributable to the

Company |

|

(235,015 |

) |

|

|

(263,282 |

) |

| Noncontrolling interests |

|

788 |

|

|

|

— |

|

|

Total shareholders’ deficit |

|

(234,227 |

) |

|

|

(263,282 |

) |

|

Total liabilities, mezzanine equity and shareholders’

deficit |

$ |

140,121 |

|

|

$ |

85,908 |

|

| |

|

INTUITIVE MACHINES, INC.Condensed

Consolidated Statements of Operations(In

thousands)(Unaudited) |

| |

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Revenue |

$ |

41,408 |

|

|

$ |

17,993 |

|

|

$ |

114,476 |

|

|

$ |

36,229 |

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

Cost of revenue (excluding depreciation) |

|

57,102 |

|

|

|

22,481 |

|

|

|

118,013 |

|

|

|

45,607 |

|

|

Depreciation |

|

423 |

|

|

|

319 |

|

|

|

837 |

|

|

|

615 |

|

|

General and administrative expense (excluding depreciation) |

|

12,057 |

|

|

|

8,376 |

|

|

|

29,200 |

|

|

|

17,153 |

|

|

Total operating expenses |

|

69,582 |

|

|

|

31,176 |

|

|

|

148,050 |

|

|

|

63,375 |

|

| Operating

loss |

|

(28,174 |

) |

|

|

(13,183 |

) |

|

|

(33,574 |

) |

|

|

(27,146 |

) |

| Other income

(expense), net: |

|

|

|

|

|

|

|

|

Interest income (expense), net |

|

20 |

|

|

|

(274 |

) |

|

|

— |

|

|

|

(553 |

) |

|

Change in fair value of earn-out liabilities |

|

22,109 |

|

|

|

28,756 |

|

|

|

(488 |

) |

|

|

25,030 |

|

|

Change in fair value of warrant liabilities |

|

21,009 |

|

|

|

— |

|

|

|

(2,955 |

) |

|

|

— |

|

|

Change in fair value of SAFE Agreements |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(2,353 |

) |

|

Gain (loss) on issuance of securities |

|

596 |

|

|

|

— |

|

|

|

(68,080 |

) |

|

|

— |

|

|

Other income (expense), net |

|

421 |

|

|

|

(50 |

) |

|

|

422 |

|

|

|

39 |

|

|

Total other income (expense), net |

|

44,155 |

|

|

|

28,432 |

|

|

|

(71,101 |

) |

|

|

22,163 |

|

| Income (loss) before

income taxes |

|

15,981 |

|

|

|

15,249 |

|

|

|

(104,675 |

) |

|

|

(4,983 |

) |

| Income tax benefit |

|

— |

|

|

|

3,528 |

|

|

|

— |

|

|

|

313 |

|

| Net income (loss) |

|

15,981 |

|

|

|

18,777 |

|

|

|

(104,675 |

) |

|

|

(4,670 |

) |

|

Net loss attributable to Intuitive Machines, LLC prior to the

Business Combination |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(5,751 |

) |

| Net income (loss)

(post Business Combination) |

|

15,981 |

|

|

|

18,777 |

|

|

|

(104,675 |

) |

|

|

1,081 |

|

|

Net loss attributable to redeemable noncontrolling interest |

|

(3,088 |

) |

|

|

(10,744 |

) |

|

|

(26,379 |

) |

|

|

(19,080 |

) |

|

Net income attributable to noncontrolling interest |

|

789 |

|

|

|

— |

|

|

|

1,761 |

|

|

|

— |

|

| Net income (loss)

attributable to the Company |

|

18,280 |

|

|

|

29,521 |

|

|

|

(80,057 |

) |

|

|

20,161 |

|

|

Less: Preferred dividends |

|

(137 |

) |

|

|

(655 |

) |

|

|

(608 |

) |

|

|

(983 |

) |

| Net income (loss)

attributable to Class A common shareholders |

$ |

18,143 |

|

|

$ |

28,866 |

|

|

$ |

(80,665 |

) |

|

$ |

19,178 |

|

|

|

|

INTUITIVE MACHINES, INC.Condensed

Consolidated Statements of Cash Flows(In

thousands)(Unaudited) |

|

|

|

|

Six Months Ended June 30, |

|

|

|

2024 |

|

|

|

2023 |

|

| Cash flows from

operating activities: |

|

|

|

|

Net loss |

$ |

(104,675 |

) |

|

$ |

(4,670 |

) |

|

Adjustments to reconcile net loss to net cash used in operating

activities: |

|

|

|

|

Depreciation |

|

837 |

|

|

|

615 |

|

|

Bad debt expense |

|

440 |

|

|

|

124 |

|

|

Share-based compensation expense |

|

5,895 |

|

|

|

1,192 |

|

|

Change in fair value of SAFE Agreements |

|

— |

|

|

|

2,353 |

|

|

Change in fair value of earn-out liabilities |

|

488 |

|

|

|

(25,030 |

) |

|

Change in fair value of warrant liabilities |

|

2,955 |

|

|

|

— |

|

|

Loss on issuance of securities |

|

68,080 |

|

|

|

— |

|

|

Other |

|

154 |

|

|

|

18 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

Trade accounts receivable, net |

|

(21,821 |

) |

|

|

(1,091 |

) |

|

Contract assets |

|

(834 |

) |

|

|

2,272 |

|

|

Prepaid expenses |

|

(172 |

) |

|

|

(2,154 |

) |

|

Other assets, net |

|

244 |

|

|

|

358 |

|

|

Accounts payable and accrued expenses |

|

7,145 |

|

|

|

13,373 |

|

|

Accounts payable – affiliated companies |

|

2,257 |

|

|

|

559 |

|

|

Contract liabilities – current and long-term |

|

(1,644 |

) |

|

|

(18,190 |

) |

|

Other liabilities |

|

2,949 |

|

|

|

14,497 |

|

|

Net cash used in operating activities |

|

(37,702 |

) |

|

|

(15,774 |

) |

| Cash flows from

investing activities: |

|

|

|

|

Purchase of property and equipment |

|

(3,793 |

) |

|

|

(20,200 |

) |

|

Net cash used in investing activities |

|

(3,793 |

) |

|

|

(20,200 |

) |

| Cash flows from

financing activities: |

|

|

|

|

Proceeds from Business Combination |

|

— |

|

|

|

8,055 |

|

|

Proceeds from issuance of Series A Preferred Stock |

|

— |

|

|

|

26,000 |

|

|

Transaction costs |

|

(437 |

) |

|

|

(9,371 |

) |

|

Proceeds from borrowings |

|

10,000 |

|

|

|

— |

|

|

Repayment of loans |

|

(15,000 |

) |

|

|

— |

|

|

Proceeds from issuance of securities |

|

27,481 |

|

|

|

— |

|

|

Member distributions |

|

— |

|

|

|

(4,263 |

) |

|

Stock option exercises |

|

300 |

|

|

|

22 |

|

|

Payment of withholding taxes from share-based awards |

|

(2,123 |

) |

|

|

— |

|

|

Forward purchase agreement termination |

|

— |

|

|

|

12,730 |

|

|

Warrants exercised |

|

51,360 |

|

|

|

16,124 |

|

|

Distribution to noncontrolling interests |

|

(973 |

) |

|

|

— |

|

|

Net cash provided by financing activities |

|

70,608 |

|

|

|

49,297 |

|

| Net increase in cash,

cash equivalents and restricted cash |

|

29,113 |

|

|

|

13,323 |

|

| Cash, cash equivalents and

restricted cash at beginning of the period |

|

4,560 |

|

|

|

25,826 |

|

| Cash, cash equivalents and

restricted cash at end of the period |

|

33,673 |

|

|

|

39,149 |

|

| Less: restricted cash |

|

2,042 |

|

|

|

62 |

|

| Cash and cash equivalents at

end of the period |

$ |

31,631 |

|

|

$ |

39,087 |

|

| |

|

INTUITIVE MACHINES, INC.Reconciliation of

GAAP to Non-GAAP Financial Measure |

| |

Adjusted EBITDA

The following table presents a reconciliation of

net loss, the most directly comparable financial measure presented

in accordance with GAAP, to Adjusted EBITDA.

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

(in thousands) |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Net income (loss) |

$ |

15,981 |

|

|

$ |

18,777 |

|

|

$ |

(104,675 |

) |

|

$ |

(4,670 |

) |

| Adjusted to exclude the

following: |

|

|

|

|

|

|

|

|

Taxes |

|

— |

|

|

|

(3,528 |

) |

|

|

— |

|

|

|

(313 |

) |

|

Depreciation |

|

423 |

|

|

|

319 |

|

|

|

837 |

|

|

|

615 |

|

|

Interest (income) expense, net |

|

(20 |

) |

|

|

274 |

|

|

|

— |

|

|

|

553 |

|

|

Share-based compensation expense |

|

1,969 |

|

|

|

985 |

|

|

|

5,895 |

|

|

|

1,192 |

|

|

Change in fair value of earn-out liabilities |

|

(22,109 |

) |

|

|

(28,756 |

) |

|

|

488 |

|

|

|

(25,030 |

) |

|

Change in fair value of warrant liabilities |

|

(21,009 |

) |

|

|

— |

|

|

|

2,955 |

|

|

|

— |

|

|

Change in fair value of SAFE Agreements |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2,353 |

|

|

(Gain) loss on issuance of securities |

|

(596 |

) |

|

|

— |

|

|

|

68,080 |

|

|

|

— |

|

|

Other expense (income), net |

|

(421 |

) |

|

|

50 |

|

|

|

(422 |

) |

|

|

(39 |

) |

| Adjusted EBITDA |

$ |

(25,782 |

) |

|

$ |

(11,879 |

) |

|

$ |

(26,842 |

) |

|

$ |

(25,339 |

) |

Free Cash Flow

We define free cash flow as net cash (used in)

provided by operating activities less purchases of property and

equipment. We believe that free cash flow is a meaningful indicator

of liquidity that provides information to management and investors

about the amount of cash generated from operations that, after

purchases of property and equipment, can be used for strategic

initiatives, including continuous investment in our business and

strengthening our balance sheet.

Free Cash Flow has limitations as a liquidity

measure, and you should not consider it in isolation or as a

substitute for analysis of our cash flows as reported under GAAP.

Some of these limitations are:

- Free Cash Flow is

not a measure calculated in accordance with GAAP and should not be

considered in isolation from, or as a substitute for financial

information prepared in accordance with GAAP.

- Free Cash Flow may

not be comparable to similarly titled metrics of other companies

due to differences among methods of calculation.

- Free Cash Flow may

be affected in the near to medium term by the timing of capital

investments, fluctuations in our growth and the effect of such

fluctuations on working capital and changes in our cash conversion

cycle.

The following table presents a reconciliation of

net cash used in operating activities, the most directly comparable

financial measure presented in accordance with GAAP, to free cash

flow:

| |

Six Months Ended June 30, |

|

(in thousands) |

2024 |

|

|

2023 |

|

|

Net cash used in operating activities |

(37,702 |

) |

|

(15,774 |

) |

| Purchases of property and

equipment |

(3,793 |

) |

|

(20,200 |

) |

| Free cash flow |

(41,495 |

) |

|

(35,974 |

) |

Backlog

The following table presents our backlog as of

the periods indicated:

|

(in thousands) |

|

June 30, 2024 |

|

December 31, 2023 |

|

Backlog |

|

$ |

212,980 |

|

|

$ |

268,566 |

|

Backlog decreased by $55.6 million as of

June 30, 2024 compared to December 31, 2023, primarily

due to continued performance on existing contracts of $114.5

million and decreases related to contract value adjustments of

$10.7 million primarily related to various certain fixed price

contracts and task order adjustments on the OMES III contract. The

decrease was partially offset by $69.6 million in new awards

primarily associated with the Lunar Terrain Vehicle Services design

project, a new commercial payload contract on the IM-3 mission,

task order modification to the IM-2 CLPS contract and an unapproved

task order modification to the IM-3 CLPS contract.

This press release was published by a CLEAR® Verified

individual.

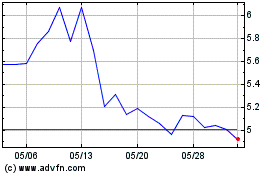

Intuitive Machines (NASDAQ:LUNR)

過去 株価チャート

から 11 2024 まで 12 2024

Intuitive Machines (NASDAQ:LUNR)

過去 株価チャート

から 12 2023 まで 12 2024