Alpha Modus, Corp. (“Alpha Modus” or the “Company”), a technology

company with a core focus on artificial intelligence in retail, is

pleased to announce that the Company has retained the services of

Christopher E. Hanba of Dickinson Wright PLLC, a leading global law

firm, for his legal expertise, technical industry knowledge, and

deep experience with enforcing intellectual property rights.

Christopher Hanba has almost 20 years of

experience in intellectual property litigation, particularly within

the technology sector. Mr. Hanba acts as lead counsel on patent,

trademark, copyright, and trade secret misappropriation litigation

matters. In addition, he regularly appears before the federal

courts and the International Trade Commission and is well-versed to

efficiently manage litigation processes with demonstrable results.

Mr. Hanba is also known as a thought leader on evolving technology

and the impact on intellectual property, including artificial

intelligence. Most recently he was a featured presenter on the

topic of Intellectual Property Infringement Risks Due to the Use of

AI Tools, at the Seminar for Legal Risks and Start-up Strategies

Planning with the Advent of Artificial Intelligence.

On January 16, 2024, Alpha Modus initiated a

patent infringement action against The Kroger Company alleging

patent infringement of several Alpha Modus patents pertaining to

the Company’s ‘571 patent portfolio encompassing retail marketing

and advertising data-driven technologies to enhance consumers’

in-store experience at the point of decision.

About Alpha Modus

Alpha Modus engages in creating, developing and

licensing data-driven technologies to enhance consumers’ in-store

digital experience at the point of decision. The company was

founded in 2014 and is headquartered in Cornelius, North Carolina.

For additional information, please visit alphamodus.com. Effective

as of October 13, 2023, Alpha Modus entered into a business

combination agreement (the “BCA”) with Insight Acquisition Corp.

(“Insight”), pursuant to which Alpha Modus would be acquired by

Insight (the “Business Combination”). The closing of the proposed

Business Combination is subject to a number of conditions, as set

out in the BCA, including but not limited to approval of the

transaction by Insight’s stockholders and Alpha Modus’

stockholders, the SEC declaring Insight’s registration statement on

Form S-4 effective and other customary closing conditions.

About Insight Acquisition Corp.

Insight Acquisition Corp. (NASDAQ: INAQ) is a

special purpose acquisition company formed solely to effect a

merger, capital stock exchange, asset acquisition, stock purchase,

reorganization or similar business combination with one or more

businesses. Insight Acquisition Corp. is sponsored by Insight

Acquisition Sponsor LLC. For additional information, please visit

insightacqcorp.com.

Important Information About the Proposed

Business Combination and Where to Find It

In connection with the proposed Business

Combination, Insight and Alpha Modus have filed with the SEC a

registration statement on Form S-4, which includes Insight’s proxy

statement on Schedule 14A, and which registration statement has not

yet been declared effective by the SEC. The Company’s stockholders

and other interested persons are advised to read, when available,

the definitive proxy statement and documents incorporated by

reference therein filed in connection with the proposed Business

Combination, as these materials will contain important information

about Insight and Alpha Modus, and the proposed Business

Combination. Promptly after filing its definitive proxy statement

relating to the proposed Business Combination with the SEC, Insight

will mail the definitive proxy statement and a proxy card to each

Insight stockholder entitled to vote at the special meeting on the

Business Combination and the other proposals. Insight stockholders

will also be able to obtain copies of the preliminary proxy

statement, the definitive proxy statement, and other relevant

materials filed with the SEC that will be incorporated by reference

therein, without charge, once available, at the SEC’s website

at www.sec.gov or upon written request to Insight Acquisition

Corp. at 333 East 91st Street, #33AB New York, NY 10024.

Participants in the

Solicitation

Insight and its directors and executive officers

may be deemed participants in the solicitation of proxies from

Insight’s stockholders with respect to the Business Combination. A

list of the names of those directors and executive officers and a

description of their interests in Insight will be included in the

proxy statement for the proposed Business Combination and be

available at www.sec.gov. Additional information regarding the

interests of such participants will be contained in the proxy

statement for the proposed Business Combination when available.

Information about Insight’s directors and executive officers and

their ownership of Insight’s common stock is set forth in the

Company’s final prospectus, as filed with the SEC on September 7,

2021, or supplemented by any Form 3 or Form 4 filed with the SEC

since the date of such filing. Other information regarding the

interests of the participants in the proxy solicitation will be

included in the proxy statement pertaining to the proposed Business

Combination when it becomes available. These documents can be

obtained free of charge from the sources indicated above.

Alpha Modus and its directors and executive

officers may also be deemed to be participants in the solicitation

of proxies from the stockholders of the Company in connection with

the proposed Business Combination. A list of the names of such

directors and executive officers and information regarding their

interests in the proposed Business Combination will be included in

the proxy statement for the proposed Business Combination.

No Offer or Solicitation

This press release shall not constitute a

solicitation of a proxy, consent, or authorization with respect to

any securities or in respect of the proposed Business Combination.

This press release shall also not constitute an offer to sell or

the solicitation of an offer to buy any securities, nor shall there

be any sale of securities in any states or jurisdictions in which

such offer, solicitation, or sale would be unlawful prior to

registration or qualification under the securities laws of any such

jurisdiction. No offering of securities shall be made except by

means of a prospectus meeting the requirements of Section 10 of the

Securities Act of 1933, as amended, or an exemption therefrom.

Forward-Looking Statements

This press release includes “forward-looking

statements” within the meaning of the “safe harbor” provisions of

the United States Private Securities Litigation Reform Act of 1995.

Insight’s and Alpha Modus’ actual results may differ from their

expectations, estimates, and projections and, consequently, you

should not rely on these forward-looking statements as predictions

of future events. Words such as “expect,” “estimate,” “project,”

“budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,”

“will,” “could,” “should,” “believes,” “predicts,” “potential,”

“continue,” and similar expressions (or the negative versions of

such words or expressions) are intended to identify such

forward-looking statements, but are not the exclusive means of

identifying these statements. These forward-looking statements

include, without limitation, Insight’s and Alpha Modus’

expectations with respect to future performance and anticipated

financial impacts of the proposed Business Combination, the

satisfaction of the closing conditions to the proposed Business

Combination, and the timing of the completion of the proposed

Business Combination.

These forward-looking statements involve

significant risks and uncertainties that could cause the actual

results to differ materially from those discussed in the

forward-looking statements. Most of these factors are outside

Insight’s and Alpha Modus’ control and are difficult to predict.

Factors that may cause such differences include, but are not

limited to: (1) the occurrence of any event, change, or other

circumstances that could give rise to the termination of the

business combination agreement between Insight and Alpha Modus (the

“BCA”); (2) the outcome of any legal proceedings that may be

instituted against Insight and Alpha Modus following the

announcement of the BCA and the transactions contemplated therein;

(3) the inability to complete the proposed the proposed Business

Combination, including due to failure to obtain approval of the

stockholders of Insight and Alpha Modus, certain regulatory

approvals, or satisfy other conditions to closing in the BCA; (4)

the occurrence of any event, change, or other circumstance that

could give rise to the termination of the BCA or could otherwise

cause the transaction to fail to close; (5) the impact of COVID-19

pandemic on Alpha Modus’ business and/or the ability of the parties

to complete the proposed Business Combination; (6) the inability to

obtain the listing of the combined company’s common stock on the

Nasdaq Stock Market following the proposed Business Combination;

(7) the risk that the proposed Business Combination disrupts

current plans and operations as a result of the announcement and

consummation of the proposed Business Combination; (8) the ability

to recognize the anticipated benefits of the proposed Business

Combination, which may be affected by, among other things,

competition, the ability of Alpha Modus to grow and manage growth

profitably, and retain its key employees; (9) costs related to the

proposed Business Combination; (10) changes in applicable laws or

regulations; (11) the possibility that Insight and Alpha Modus may

be adversely affected by other economic, business, and/or

competitive factors; (12) risks relating to the uncertainty of the

projected financial information with respect to Alpha Modus; (13)

risks related to the organic and inorganic growth of Alpha Modus’

business and the timing of expected business milestones; (14) the

amount of redemption requests made by Insight’s stockholders; and

(15) other risks and uncertainties indicated from time to time in

the final prospectus of Insight for its initial public offering and

the registration statement on Form S-4, including the proxy

statement relating to the proposed Business Combination, including

those enumerated under “Risk Factors” therein, and in Insight’s

other filings with the SEC. Insight cautions that the foregoing

list of factors is not exclusive. Insight and Alpha Modus caution

readers not to place undue reliance upon any forward-looking

statements, which speak only as of the date made. Insight and Alpha

Modus do not undertake or accept any obligation or undertaking to

release publicly any updates or revisions to any forward-looking

statements to reflect any change in their expectations or any

change in events, conditions, or circumstances on which any such

statement is based.

Contacts:

Alpha Modus Shannon DevineMZ

Group+1(203) 741-8841shannon.devine@mzgroup.us

Insight Acquisition Corp.Cody SlachGateway

Group+1(949) 574-3860 INAQ@gateway-grp.com

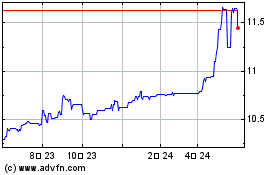

Insight Acquisition (NASDAQ:INAQ)

過去 株価チャート

から 11 2024 まで 12 2024

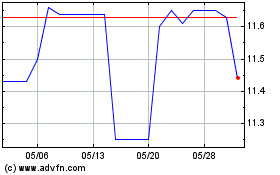

Insight Acquisition (NASDAQ:INAQ)

過去 株価チャート

から 12 2023 まで 12 2024