Form NT 10-Q - Notification of inability to timely file Form 10-Q or 10-QSB

2024年2月16日 - 7:05AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

12b-25

NOTIFICATION

OF LATE FILING

| (Check

one): |

|

☐

Form 10-K ☐ Form 20-F ☐ Form 11-K ☒ Form 10-Q ☐ Form 10-D ☐ Form N-CEN ☐ Form N-CSR |

| |

|

|

| |

|

For

Period Ended: |

December

31, 2023 |

| |

|

|

| |

|

☐

Transition Report on Form 10-K |

| |

|

|

| |

|

☐

Transition Report on Form 20-F |

| |

|

|

| |

|

☐

Transition Report on Form 11-K |

| |

|

|

| |

|

☐

Transition Report on Form 10-Q |

| |

|

|

| |

|

For

the Transition Period Ended: |

If

the notification relates to a portion of the filing checked above, identify the Item(s) to which the notification relates:

PART

I — REGISTRANT INFORMATION

| ESPORTS

ENTERTAINMENT GROUP, INC. |

| Full

Name of Registrant |

| |

| Former

Name if Applicable |

| Block

6, Triq Paceville |

| Address

of Principal Executive Office (Street and Number) |

| St.

Julians, Malta, STJ 3109 |

| City,

State and Zip Code |

PART

II — RULES 12b-25(b) AND (c)

If

the subject report could not be filed without unreasonable effort or expense and the registrant seeks relief pursuant to Rule 12b-25(b),

the following should be completed. (Check box if appropriate)

| ☒ |

|

(a) |

The

reason described in reasonable detail in Part III of this form could not be eliminated without unreasonable effort or expense; |

| |

|

|

| |

(b) |

The

subject annual report, semi-annual report, transition report on Form 10-K, Form 20-F, Form 11-K, Form N-CEN or Form N-CSR, or portion

thereof, will be filed on or before the fifteenth calendar day following the prescribed due date; or the subject quarterly report

of transition report on Form 10-Q or subject distribution report on Form 10-D, or portion thereof will be filed on or before the

fifth calendar day following the prescribed due date; and |

| |

|

|

| |

(c) |

The

accountant’s statement or other exhibit required by Rule 12b-25(c) has been attached if applicable. |

PART

III — NARRATIVE

State

below in reasonable detail the reasons why Forms 10-K, 20-F, 11-K, 10-Q, 10-D, N-CEN, N-CSR, or the transition report or portion thereof,

could not be filed within the prescribed time period.

ESPORTS ENTERTAINMENT GROUP, INC. (the “Registrant”)

was unable, without unreasonable effort or expense, to file its Quarterly Report on Form 10-Q for the period ended December 31, 2023 (the

“Quarterly Report”) by the deadline of February 14, 2024, the filing date applicable to non-accelerated filers. The delay

experienced by the Registrant in completing its unaudited condensed consolidated financial statements and other disclosures in the Quarterly

Report is due to challenges the Registrant has been facing, which led to its recent decision and announcement to delist is securities

from the Nasdaq Capital Markets (“Nasdaq”). As a result, the Registrant is continuing to compile the required unaudited financial

information to complete the Quarterly Report for the period ended December 31, 2023, to identify, evaluate and incorporate the effects

of steps the Company has taken to delist and reposition its strategy, and its ongoing cost-saving activities.

PART

IV — OTHER INFORMATION

| (1) |

Name

and telephone number of person to contact in regard to this notification |

| |

Michael

Villani |

|

(356) |

|

2713

1276 |

| |

(Name) |

|

(Area

Code) |

|

(Telephone

Number) |

| (2) |

Have all other

periodic reports required under Section 13 or 15(d) of the Securities Exchange Act of 1934 or Section 30 of the Investment Company

Act of 1940 during the preceding 12 months or for such shorter period that the registrant was required to file such report(s) been

filed? If answer is no, identify report(s). |

| |

Yes ☒ No ☐ |

| |

|

| (3) |

Is it anticipated that

any significant change in results of operations from the corresponding period for the last fiscal year will be reflected by the earnings

statements to be included in the subject report or portion thereof? |

| |

Yes ☒ No ☐ |

| |

|

| |

If so, attach an explanation

of the anticipated change, both narratively and quantitatively, and, if appropriate, state the reasons why a reasonable estimate

of the results cannot be made. |

| |

|

| |

The

following table provides preliminary summary unaudited financial information based on a compilation of financial results that is

currently available. It is not a comprehensive statement of the Registrant’s financial results and is subject to change and

may be further updated for the impacts of recent events that includes a delisting from Nasdaq to OTCMarkets, a repositioning of its

strategy, and its ongoing cost-saving activities. The Registrant made a decision to withdraw from Nasdaq as it is unable to maintain

Nasdaq’s required minimum stockholders’ equity of $2,500,000 (“Equity Rule”) for listed companies. At the

time of this filing the Company is under a Nasdaq Panel Monitor and is not in compliance with the Equity Rule. The delisting

of the Registrant’s securities from Nasdaq could continue to negatively impact the Registrant and holders of its securities,

including the willingness of investors to hold the Registrant’s securities due to the possibility of resulting decreases in

the prices, liquidity and trading of the Registrant’s securities; limited availability of price quotations; reduced news and

analyst coverage; and reduced ability to raise capital and complete potentially accretive acquisitions. Delisting may also adversely

impact the perception of the Registrant’s financial condition, and cause reputational harm with investors, its employees and

parties conducting business with the Registrant. The Registrant has carefully weighed these factors against the significant obstacles

it faces in maintaining compliance with the Equity Rule and in appropriately addressing the significant obligations of its outstanding

preferred stock as a Nasdaq-listed company.

The

preliminary unaudited financial information below includes ranges rather than specific amounts as financial statement closing procedures

for the three and six months ended December 31, 2023, are not yet complete. These estimates should not be viewed as a substitute

for the Registrant’s completed unaudited financial statements prepared in accordance with generally accepted accounting principles

in the United States, or GAAP. The results for the three and six months ended December 31, 2023, are expected to be fundamentally

different from the same period in the prior year.

|

| |

The

preliminary estimated results below are not necessarily indicative of the results to be expected for any future period. See the sections

titled “Cautionary Statements Regarding Forward-Looking Information” and “Risk Factors”, including, those

on material weaknesses in internal control of financial reporting, income taxes, and information technology general controls which

remain unremediated, in our filings with the SEC, for additional information regarding factors that could result in differences between

the preliminary estimated ranges of certain of our unaudited financial data presented below and the actual unaudited financial data

we will report for the three and six months ended December 31, 2023. While the Registrant continues

efforts to remediate the material weaknesses, management cannot provide assurance as to when such remediation will conclude,

nor can management be certain of whether additional actions will be required or the costs of any such actions may cause further delays.

Our independent registered public accountants have not audited, reviewed, compiled or performed any procedures with respect

to this financial information. Accordingly, our independent registered public accountants do not express an opinion or provide any

form of assurance with respect thereto. |

| |

|

| |

The

preliminary unaudited estimated ranges for net revenues, operating expenses, other income (expense), net and net loss for the three

and six months ended December 31, 2023 and 2022 follow: |

| | |

Three Months Ended

December 31, 2023

Estimated (Unaudited) | | |

Six Months Ended

December 31, 2023

Estimated (Unaudited) | |

| | |

Low | | |

High | | |

Low | | |

High | |

| Net Revenue (1) | |

$ | 2,500,000 | | |

$ | 2,600,000 | | |

$ | 5,200,000 | | |

$ | 5,300,000 | |

| Operating expenses(2) | |

$ | (5,800,000 | ) | |

$ | (6,300,000 | ) | |

$ | (13,500,000 | ) | |

$ | (14,000,000 | ) |

| Total other income (expense), net(3) | |

$ | (500,000 | ) | |

$ | (1,000,000 | ) | |

$ | (500,000 | ) | |

$ | (1,000,000 | ) |

| Net loss (4) | |

$ | (3,800,000 | ) | |

$ | (4,700,000 | ) | |

$ | (8,800,000 | ) | |

$ | (9,700,000 | ) |

| |

(1) |

Net

revenue is expected to have decreased significantly, as result of: (i) the sale of the Bethard iGaming business and Spanish iGaming

operations and (ii) the previous closing and liquidation and deconsolidation of the Argyll iGaming operations, which have impacted

the three months and six months ended December 31, 2023, when compared to the three months and six months ended December 31, 2022,

respectively. For the prior three and six months period ended December 31, 2022, net revenue was $6.4 million and $16.0 million,

respectively. |

| |

|

|

| |

(2) |

Operating

expenses have also significantly reduced as a result of the sale and liquidations of the businesses noted above and other cost reductions.

For the prior three and six months ended December 31, 2022, operating expenses was $(27.9) million and $(43.6) million, respectively. |

| |

|

|

| |

(3) |

Other

income (expense), net included a $8.6 million gain on the elimination of a derivative liability, a $5.0 million gain on change

in fair value of warrant liability, offset by $(4.4) million in net other expense for interest, fair value of contingent consideration

and other non-operating income in the six month period ending December 31, 2022 compared to $(0.3) million loss driven by the expense

on the derivative liability for the six month period ended December 31, 2023. For the prior three and six months ended December 31,

2022, total other income (expense), net was $7.4 million and $9.3 million, respectively. |

| |

|

|

| |

(4) |

The

Net loss amount is preliminary, and exclude the effects, if any, that result from the evaluation of the recoverability of the Registrant’s

goodwill and intangible assets, a final determination of the derivative liability related to its Series C and Series D Convertible

Preferred Stock, and other potential charges for the three months and six months ended December 31, 2023. For the prior three and

six months ended December 31, 2022, and net loss was $(14.1) million and $(18.3) million, respectively.

Total

preliminary stockholders’ deficit, excluding the effects, if any, that result

from the evaluation of the recoverability of the Registrant’s goodwill and intangible assets, a final determination of the

derivative liability related to its Series C and Series D Convertible Preferred Stock, and other potential charges for the three

months and six months ended December 31, 2023, at December 31, 2023, is expected to be approximately

$(1.6) million, which is below the minimum equity required by Nasdaq under its Equity Rule. The decrease from $4.8 million

stockholders equity as of June 30, 2023, is driven by continued losses of the Registrant,

the reclass of the Series C Convertible Preferred Stock to mezzanine equity of approximately $3.5 million driven by limited availability

of unissued common stock, offset by proceeds from the Registrant’s “at the market” equity offering program

(“ATM”) sales of approximately $5.2 million, net of approximately $0.2 million in issuance costs. Subsequent

to December 31, 2023, and the holder of the Series D Convertible Preferred Stock redeemed approximately $2.6 million of these proceeds

as part of the ATM agreement. The total preliminary stockholders’ deficit is subject to materially change upon the completion

of the unaudited condensed consolidated financial statements for the three and six months ended December 31, 2023 and 2022. |

Liquidity

The

Registrant has an accumulated deficit and it has a history of recurring losses from operations and recurring negative cash flows from

operations. At December 31, 2023, the Registrant had approximately $1.1 million of available

cash on-hand. The amount of available cash on hand on February 14, 2024, one business day preceding this filing, was approximately $0.3

million.

The

Registrant’s current liquidity as well as future market and economic conditions may be deemed outside the control of the Registrant

as it relates to obtaining financing and generating future profits. A delisting to the OTCMarkets is expected to also impact the

Registrant’s ability to raise funds in the future and impact the Registrant’s

securities by reducing the willingness of investors to hold our securities because of expected

decreases in the prices, liquidity and trading of our securities, and the limited availability of price quotations and news and analyst

coverage. The Registrant’s additional financing sources are expected to be

directly from investors or through future offerings, where the amount of the offering has not yet been determined.

ESPORTS

ENTERTAINMENT GROUP, INC.

(Name

of Registrant as Specified in Charter)

has

caused this notification to be signed on its behalf by the undersigned hereunto duly authorized.

| Date:

February 15, 2024 |

By: |

/s/

Michael Villani |

| |

Name:

|

Michael

Villani |

| |

Title: |

Chief

Financial Officer |

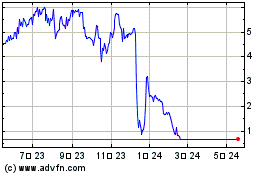

Esports Entertainment (NASDAQ:GMBLP)

過去 株価チャート

から 4 2024 まで 5 2024

Esports Entertainment (NASDAQ:GMBLP)

過去 株価チャート

から 5 2023 まで 5 2024