0001088856false00010888562024-07-292024-07-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

July 29, 2024

Date of Report (date of earliest event reported)

Corcept Therapeutics Incorporated

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

Delaware | 000-50679 | 77-0487658 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

149 Commonwealth Drive, Menlo Park, CA 94025

(Address of Principal Executive Offices) (Zip Code)

(650) 327-3270

Registrant's telephone number, including area code

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.001 par value | CORT | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Item 2.02. Results of Operations and Financial Condition.

Item 7.01 Regulation FD Disclosure.

On July 29, 2024, Corcept Therapeutics Incorporated (the “Company”) issued a press release announcing its financial results for the quarter ended June 30, 2024 and a corporate update. The press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The information in this Item 2.02 and Item 7.01 and the information contained in the press release attached as Exhibit 99.1 shall not be deemed filed for purposes of Section 18 of the Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. The information in this Item 2.02 and Item 7.01 and the information contained in the press release attached as Exhibit 99.1 is not incorporated by reference into any filing with the U.S. Securities and Exchange Commission made by the Company, whether made before or after the date hereof, regardless of any general incorporation language in the filing unless specifically stated so therein.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

| | | | | |

| Exhibits No. | Description |

| 99.1 | | |

| 104.1 | | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | CORCEPT THERAPEUTICS INCORPORATED |

| | |

|

| Date: | July 29, 2024 | | By: | /s/ Atabak Mokari |

| | | | Name: Atabak Mokari |

| | | | Title: Chief Financial Officer |

EXHIBIT 99.1

CORCEPT THERAPEUTICS ANNOUNCES SECOND QUARTER FINANCIAL RESULTS

AND PROVIDES CORPORATE UPDATE

MENLO PARK, Calif., (July 29, 2024) – Corcept Therapeutics Incorporated (NASDAQ: CORT), a commercial-stage company engaged in the discovery and development of medications to treat severe endocrinologic, oncologic, metabolic and neurologic disorders by modulating the effects of the hormone cortisol, today reported its results for the quarter ended June 30, 2024.

Financial Results

•Revenue of $163.8 million, a 39 percent increase over the same period in 2023

•Increase in 2024 revenue guidance to $640 – $670 million, from $620 – $650 million

•Net income per common share of $0.32 (diluted), compared to $0.25 in second quarter 2023

•Cash and investments of $492.5 million as of June 30, 2024

“Once again, we had a record number of new Korlym® prescribers and a record number of patients receiving Korlym this quarter. Physicians are increasingly aware that hypercortisolism is much more prevalent than was previously assumed, so they are screening more patients for the disorder,” said Joseph K. Belanoff, MD, Corcept’s Chief Executive Officer. “From the launch of Korlym, we implemented a unique system of patient and physician support and have invested in multiple refinements over the past 12 years. Hypercortisolism is a complicated disease and the expertise we have developed is critical to the life-changing impact for patients who receive Korlym treatment.”

Corcept’s second quarter 2024 revenue was $163.8 million, compared to $117.7 million in the second quarter of 2023. Second quarter operating expenses were $128.2 million, compared to $88.1 million in the second quarter of 2023, due to increased spending on clinical trials and sales and marketing activities and to support the expansion of our commercial and clinical development teams. Net income was $35.5 million in the second quarter of 2024 compared to $27.5 million in the same period last year. Cash and investments were $492.5 million at June 30, 2024 compared to $451.0 million at March 31, 2024.

The company increased its 2024 revenue guidance to $640 – $670 million.

Clinical Development

“During the second quarter we presented the results from our GRACE and CATALYST trials. GRACE’s positive results are a welcome development for patients with hypercortisolism and constitute a significant step toward our new drug application for relacorilant, which we expect to submit in the fourth quarter. In addition, the results from the prevalence phase of our CATALYST study establish that hypercortisolism is a driving biological force in patients with diabetes refractory to treatment. We expect data from the treatment phase of the CATALYST study, as well as our other late-stage studies, GRADIENT, ROSELLA and DAZALS, by the end of this year,” added Dr. Belanoff.

Cushing’s Syndrome

•GRACE – Phase 3 trial of relacorilant in 152 patients with all etiologies of hypercortisolism – primary endpoint achieved in randomized withdrawal phase; open-label phase demonstrated clinically meaningful and statistically significant improvements in hypertension, hyperglycemia, weight, lean muscle mass, waist circumference, cognitive impairment and quality of life

•Relacorilant New Drug Application (NDA) – NDA submission for Cushing’s syndrome expected in the fourth quarter

•GRADIENT – Phase 3 trial of relacorilant in 137 patients with Cushing’s syndrome caused by adrenal adenomas – enrollment completed; results expected in the fourth quarter

•CATALYST – Phase 4 trial examining the prevalence of hypercortisolism in patients with difficult-to-control type 2 diabetes – in the first 1,055 patients enrolled, 24% were found to have hypercortisolism; 136 patients with hypercortisolism entered a randomized, double-blind, placebo-controlled study of Korlym – treatment phase results expected in the fourth quarter

“Relacorilant has demonstrated tremendous promise as a treatment for patients with Cushing’s syndrome. Patients in GRACE’s open-label phase experienced significant improvements across a broad range of clinically meaningful endpoints, without significant safety burden. In the randomized withdrawal phase, GRACE met its primary endpoint and demonstrated that patients who remained on relacorilant maintained these improvements while those who received placebo saw a significant worsening in their signs and symptoms of hypercortisolism,” said Bill Guyer, PharmD, Corcept’s Chief Development Officer.

“Our Phase 4 CATALYST trial is the largest and most rigorous study ever conducted to establish the prevalence of hypercortisolism in patients with difficult-to-control diabetes. The prevalence results from CATALYST confirm there are considerably more patients with Cushing's syndrome than was previously assumed. CATALYST is poised to become the landmark study that guides physicians toward expanded screening for hypercortisolism and will result in better health outcomes for many patients who are struggling today,” said Dr. Guyer.

Oncology

•ROSELLA – Pivotal Phase 3 trial of relacorilant plus nab-paclitaxel in 381 patients with platinum-resistant ovarian cancer – enrollment completed; results expected in the fourth quarter

•Open-label, Phase 1b trial of relacorilant plus pembrolizumab in 14 patients with advanced adrenal cancer with cortisol excess – improvement in Cushing’s syndrome signs and symptoms observed; no change in tumor progression

•Randomized, placebo-controlled, Phase 2 trial of relacorilant plus enzalutamide in patients with prostate cancer in collaboration with the University of Chicago – enrollment continues

“Relacorilant has the potential to become the standard of care for patients with platinum-resistant ovarian cancer. If our pivotal ROSELLA trial replicates the positive results from our large, controlled, Phase 2 study, it will constitute a major medical advance. We expect progression-free survival data, ROSELLA’s primary endpoint, by the end of this year,” said Dr. Guyer.

Amyotrophic Lateral Sclerosis (ALS)

•DAZALS – Randomized, double-blind, placebo-controlled, Phase 2 trial of dazucorilant in 249 patients with ALS – enrollment completed; results expected in the fourth quarter

“Dazucorilant showed great promise in an animal model of ALS – improving motor performance and reducing neuroinflammation and muscular atrophy. We expect data by the end of this year and are hopeful that the trial results will create a much-needed advance for patients with ALS,” said Dr. Guyer.

Metabolic Dysfunction-Associated Steatohepatitis (MASH)

•MONARCH – Randomized, double-blind, placebo-controlled, Phase 2b trial of miricorilant with a cohort of patients with biopsy-confirmed MASH and a second cohort of patients with presumed MASH based on non-invasive diagnostic tests – enrollment continues

“In our Phase 1b study, miricorilant reduced liver fat very rapidly, improved liver health and key metabolic and lipid measures, and was well-tolerated. We look forward to building on these promising results in our MONARCH study,” said Dr. Guyer. “Miricorilant has the potential to greatly benefit the millions of patients with MASH.”

Conference Call

We will hold a conference call on July 29, 2024, at 5:00 p.m. Eastern Time (2:00 p.m. Pacific Time). Participants must register in advance of the conference call by clicking here. Upon registering, each participant will receive a dial-in number and a unique access PIN. Each access PIN will accommodate one caller. Additionally, a listen-only webcast will be available by clicking here. A replay of the call will be available on the Investors / Events tab of Corcept.com.

About Corcept Therapeutics

For over 25 years, Corcept’s focus on cortisol modulation and its potential to treat patients with a wide variety of serious disorders has led to the discovery of more than 1,000 proprietary selective cortisol modulators. Corcept is conducting advanced clinical trials in patients with hypercortisolism, solid tumors, ALS and liver disease. In February 2012, the company introduced Korlym, the first medication approved by the U.S. Food and Drug Administration for the treatment of patients with Cushing’s syndrome. Corcept is headquartered in Menlo Park, California. For more information, visit Corcept.com.

Forward-Looking Statements

Statements in this press release, other than statements of historical fact, are forward-looking statements based on our current plans and expectations that are subject to risks and uncertainties that might cause our actual results to differ materially from those such statements express or imply. These risks and uncertainties include, but are not limited to, our ability to operate our business and generate sufficient revenue to fund our activities; the availability of competing treatments for hypercortisolism, including the potential for rapid uptake or discounted pricing of generic versions of Korlym; our ability to obtain acceptable prices and adequate insurance coverage and reimbursement for Korlym; risks related to the development of Korlym, relacorilant, dazucorilant, miricorilant and our other product candidates, including their clinical attributes, regulatory approvals, mandates, oversight and other requirements; the timing, cost and outcome of legal disputes and investigations; and the scope and protective power of our intellectual property. These and other risks are set forth in our SEC filings, which are available at our website and the SEC’s website.

In this press release, forward-looking statements include those concerning: favorable trends in medical practice, our continued revenue growth and 2024 revenue guidance, which may be adversely affected by changing technology, government pricing regulations and increased uptake or price reductions in competing medications, including generic versions of Korlym; the rates of screening and treatment for hypercortisolism; cortisol modulation’s potential to treat serious diseases; development of relacorilant as a treatment for Cushing’s syndrome and ovarian, adrenal and prostate cancer; the design, timing and expectations regarding our GRACE and GRADIENT trials; the timing and disposition of relacorilant’s NDA in Cushing’s syndrome, including any additional requirements, revisions or delays imposed by the FDA in course of its review; the design, timing and expectations regarding our CATALYST trial; the design, timing and expectations of our ROSELLA trial and the potential for relacorilant plus nab-paclitaxel to become a standard of care; the design, timing and expectations of our DAZALS trial of dazucorilant in patients with ALS; the design, timing and expectations of our MONARCH trial in patients with MASH; and the accrual and attributes of clinical data, as well as the timing of regulatory submissions with respect to, all of our development activities. We disclaim any intention or duty to update forward-looking statements made in this press release.

CORCEPT THERAPEUTICS INCORPORATED

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands)

| | | | | | | | | | | |

| June 30, 2024 | | December 31, 2023(1) |

| (Unaudited) | | |

| Assets | | | |

| Cash and investments | $ | 492,471 | | | $ | 425,397 | |

| Trade receivables, net of allowances | 53,837 | | | 41,123 | |

| Insurance recovery receivable related to Melucci litigation | — | | | 14,000 | |

| Inventory | 16,801 | | | 15,974 | |

| Operating lease right-of-use asset | 5,684 | | | 120 | |

| Deferred tax assets, net | 111,848 | | | 90,605 | |

| Other assets | 33,914 | | | 34,298 | |

| Total assets | $ | 714,555 | | | $ | 621,517 | |

| Liabilities and Stockholders’ Equity | | | |

| Accounts payable | $ | 19,484 | | | $ | 17,396 | |

| Accrued settlement related to Melucci litigation | — | | | 14,000 | |

| Operating lease liabilities | 5,669 | | | 151 | |

| Other liabilities | 93,159 | | | 83,265 | |

Stockholders’ equity | 596,243 | | | 506,705 | |

| Total liabilities and stockholders’ equity | $ | 714,555 | | | $ | 621,517 | |

| | | |

(1) Derived from audited financial statements at that date |

CORCEPT THERAPEUTICS INCORPORATED

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(In thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| June 30, | | June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Revenues | | | | | | | |

| Product revenue, net | $ | 163,796 | | | $ | 117,715 | | | $ | 310,604 | | | $ | 223,369 | |

| | | | | | | |

| Operating expenses | | | | | | | |

| Cost of sales | 2,524 | | | 1,574 | | | 5,059 | | | 2,960 | |

| Research and development | 58,745 | | | 43,277 | | | 117,251 | | | 84,128 | |

| Selling, general and administrative | 66,935 | | | 43,281 | | | 123,203 | | | 91,845 | |

| Total operating expenses | 128,204 | | | 88,132 | | | 245,513 | | | 178,933 | |

| Income from operations | 35,592 | | | 29,583 | | | 65,091 | | | 44,436 | |

| Interest and other income | 6,004 | | | 3,347 | | | 11,498 | | | 6,928 | |

| Income before income taxes | 41,596 | | | 32,930 | | | 76,589 | | | 51,364 | |

| Income tax expense | (6,108) | | | (5,402) | | | (13,339) | | | (7,957) | |

| Net income | $ | 35,488 | | | $ | 27,528 | | | $ | 63,250 | | | $ | 43,407 | |

| | | | | | | |

| Net income attributable to common stockholders | $ | 35,120 | | | $ | 27,356 | | | $ | 62,640 | | | $ | 43,173 | |

| | | | | | | |

| Basic net income per common share | $ | 0.34 | | | $ | 0.27 | | | $ | 0.61 | | | $ | 0.41 | |

| | | | | | | |

| Diluted net income per common share | $ | 0.32 | | | $ | 0.25 | | | $ | 0.57 | | | $ | 0.38 | |

| | | | | | | |

| Weighted-average shares outstanding used in computing net income per common share | | | | | | | |

| Basic | 103,118 | | | 101,964 | | | 102,954 | | | 104,908 | |

| Diluted | 111,244 | | | 109,590 | | | 110,550 | | | 112,492 | |

CONTACT:

Corcept Therapeutics

Investor Relations

ir@corcept.com

www.corcept.com

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

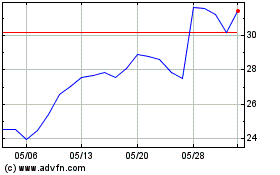

Corcept Therapeutics (NASDAQ:CORT)

過去 株価チャート

から 6 2024 まで 7 2024

Corcept Therapeutics (NASDAQ:CORT)

過去 株価チャート

から 7 2023 まで 7 2024