false

--03-31

2025

Q1

0000882291

0000882291

2024-04-01

2024-06-30

0000882291

2024-08-14

0000882291

2024-06-30

0000882291

2024-03-31

0000882291

2023-04-01

2023-06-30

0000882291

us-gaap:CommonStockMember

2024-03-31

0000882291

us-gaap:AdditionalPaidInCapitalMember

2024-03-31

0000882291

us-gaap:RetainedEarningsMember

2024-03-31

0000882291

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2024-03-31

0000882291

us-gaap:NoncontrollingInterestMember

2024-03-31

0000882291

us-gaap:CommonStockMember

2023-03-31

0000882291

us-gaap:AdditionalPaidInCapitalMember

2023-03-31

0000882291

us-gaap:RetainedEarningsMember

2023-03-31

0000882291

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-03-31

0000882291

us-gaap:NoncontrollingInterestMember

2023-03-31

0000882291

2023-03-31

0000882291

us-gaap:CommonStockMember

2024-04-01

2024-06-30

0000882291

us-gaap:AdditionalPaidInCapitalMember

2024-04-01

2024-06-30

0000882291

us-gaap:RetainedEarningsMember

2024-04-01

2024-06-30

0000882291

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2024-04-01

2024-06-30

0000882291

us-gaap:NoncontrollingInterestMember

2024-04-01

2024-06-30

0000882291

us-gaap:CommonStockMember

2023-04-01

2023-06-30

0000882291

us-gaap:AdditionalPaidInCapitalMember

2023-04-01

2023-06-30

0000882291

us-gaap:RetainedEarningsMember

2023-04-01

2023-06-30

0000882291

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-04-01

2023-06-30

0000882291

us-gaap:NoncontrollingInterestMember

2023-04-01

2023-06-30

0000882291

us-gaap:CommonStockMember

2024-06-30

0000882291

us-gaap:AdditionalPaidInCapitalMember

2024-06-30

0000882291

us-gaap:RetainedEarningsMember

2024-06-30

0000882291

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2024-06-30

0000882291

us-gaap:NoncontrollingInterestMember

2024-06-30

0000882291

us-gaap:CommonStockMember

2023-06-30

0000882291

us-gaap:AdditionalPaidInCapitalMember

2023-06-30

0000882291

us-gaap:RetainedEarningsMember

2023-06-30

0000882291

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-06-30

0000882291

us-gaap:NoncontrollingInterestMember

2023-06-30

0000882291

2023-06-30

0000882291

2023-10-03

2023-10-04

0000882291

us-gaap:LetterOfCreditMember

2024-06-30

0000882291

aemd:ATM2022AgreementMember

2022-03-24

0000882291

aemd:ATM2022AgreementMember

2024-04-01

2024-06-30

0000882291

aemd:ATM2022AgreementMember

2023-04-01

2023-06-30

0000882291

aemd:ATM2022AgreementMember

aemd:WainwrightMember

2023-04-01

2023-06-30

0000882291

aemd:May2024PublicOfferingMember

us-gaap:CommonStockMember

2024-05-16

2024-05-17

0000882291

aemd:May2024PublicOfferingMember

aemd:ClassAWarrantsMember

2024-05-17

0000882291

aemd:May2024PublicOfferingMember

aemd:ClassBWarrantsMember

2024-05-17

0000882291

aemd:May2024PublicOfferingMember

aemd:PrefundedWarrantsMember

2024-05-17

0000882291

aemd:May2024PublicOfferingMember

aemd:PlacementAgentMember

2024-05-16

2024-05-17

0000882291

aemd:May2024PublicOfferingMember

aemd:PlacementAgentWarrantsMember

2024-05-17

0000882291

aemd:May2024PublicOfferingMember

2024-05-16

2024-05-17

0000882291

aemd:May2024PublicOfferingMember

aemd:ClassAWarrantsMember

2024-06-01

2024-06-30

0000882291

aemd:May2024PublicOfferingMember

aemd:ClassBWarrantsMember

2024-06-01

2024-06-30

0000882291

aemd:May2024PublicOfferingMember

aemd:ClassAAndClassBWarrantsMember

2024-06-01

2024-06-30

0000882291

aemd:Director1Member

us-gaap:RestrictedStockUnitsRSUMember

2024-04-01

2024-06-30

0000882291

aemd:Director2Member

us-gaap:RestrictedStockUnitsRSUMember

2024-04-01

2024-06-30

0000882291

aemd:Director3Member

us-gaap:RestrictedStockUnitsRSUMember

2024-04-01

2024-06-30

0000882291

aemd:Director4Member

us-gaap:RestrictedStockUnitsRSUMember

2024-04-01

2024-06-30

0000882291

us-gaap:RestrictedStockUnitsRSUMember

2024-04-01

2024-06-30

0000882291

us-gaap:CommonStockMember

2024-04-01

2024-06-30

0000882291

aemd:NonEmployeeDirectorsMember

2024-06-30

0000882291

aemd:EmployeeMember

aemd:SeparationAgreementMember

2024-04-01

2024-06-30

0000882291

aemd:EmployeeMember

aemd:SeparationAgreementMember

2024-06-30

0000882291

srt:ChiefExecutiveOfficerMember

aemd:SeparationAgreementMember

2024-06-30

0000882291

aemd:AccruedBoardFeesMember

2024-06-30

0000882291

aemd:AccruedBoardFeesMember

2024-03-31

0000882291

aemd:AccruedVacationMember

2024-06-30

0000882291

aemd:AccruedVacationMember

2024-03-31

0000882291

aemd:AccruedSeparationExpensesMember

2024-06-30

0000882291

aemd:AccruedSeparationExpensesMember

2024-03-31

0000882291

aemd:StockBasedCompensationMember

2024-04-01

2024-06-30

0000882291

aemd:StockBasedCompensationMember

2023-04-01

2023-06-30

0000882291

us-gaap:RestrictedStockUnitsRSUMember

2023-04-01

2023-06-30

0000882291

us-gaap:StockOptionMember

2024-04-01

2024-06-30

0000882291

us-gaap:StockOptionMember

2024-06-30

0000882291

us-gaap:OptionMember

2024-03-31

0000882291

us-gaap:OptionMember

2024-04-01

2024-06-30

0000882291

us-gaap:OptionMember

2024-06-30

0000882291

us-gaap:OptionMember

aemd:ExercisePrice1Member

2024-06-30

0000882291

us-gaap:OptionMember

aemd:ExercisePrice1Member

2024-04-01

2024-06-30

0000882291

us-gaap:OptionMember

aemd:ExercisePrice2Member

2024-06-30

0000882291

us-gaap:OptionMember

aemd:ExercisePrice2Member

2024-04-01

2024-06-30

0000882291

us-gaap:RestrictedStockUnitsRSUMember

2024-03-31

0000882291

us-gaap:RestrictedStockUnitsRSUMember

2024-06-30

0000882291

us-gaap:OptionMember

2023-04-01

2023-06-30

0000882291

us-gaap:WarrantMember

2024-03-31

0000882291

us-gaap:WarrantMember

2024-04-01

2024-06-30

0000882291

us-gaap:WarrantMember

2024-06-30

0000882291

aemd:OfficeAndLaboratorySpaceMember

2024-04-01

2024-06-30

0000882291

aemd:ManufacturingSpaceMember

2024-04-01

2024-06-30

0000882291

aemd:ManufacturingSpaceMember

2024-06-30

0000882291

aemd:OfficeLabAndManufacturingLeasesMember

2024-06-30

0000882291

aemd:OfficeAndLaboratorySpaceMember

2024-06-30

0000882291

aemd:RestrictedCashMember

2024-06-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

☒ QUARTERLY

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2024

OR

☐ TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____to_____

COMMISSION FILE NUMBER 001-37487

Aethlon Medical, Inc.

(Exact name of registrant as specified in its

charter)

| nevada |

13-3632859 |

| (State or other jurisdiction

of incorporation or organization) |

(I.R.S. Employer Identification

No.) |

| |

|

| 11555 SORRENTO VALLEY ROAD, SUITE 203, SAN DIEGO, CA |

92121 |

| (Address of principal executive

offices) |

(Zip Code) |

(619) 941-0360

(Registrant’s telephone number, including

area code)

Securities registered pursuant to Section 12(b)

of the Act:

TITLE OF EACH CLASS

COMMON STOCK, $0.001 PAR VALUE |

TRADING SYMBOL

AEMD |

NAME OF EACH EXCHANGE ON WHICH REGISTERED

NASDAQ CAPITAL MARKET |

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12

months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant

has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405

of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes

☒ No ☐

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company”,

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated

Filer ☐ |

Accelerated Filer

☐ |

| Non-accelerated Filer ☒ |

Smaller reporting company ☒ |

| |

Emerging growth company ☐ |

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of August 14, 2024, the registrant had outstanding

13,937,327 shares of common stock, $0.001 par value.

TABLE OF CONTENTS

CAUTIONARY NOTICE REGARDING FORWARD LOOKING STATEMENTS

This Quarterly Report on Form 10-Q, or Quarterly

Report, contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended,

or Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, which are subject to the

safe harbor created by those sections.

We may, in some cases, use words such as “anticipate,”

“believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,”

“potential,” “predict,” “project,” “should,” “will,” “would”

or the negative of these terms, and similar expressions that convey uncertainty of future events or outcomes to identify these forward-looking

statements. Any statements contained herein that are not statements of historical facts may be deemed to be forward-looking statements

and are based upon our current expectations, beliefs, estimates and projections, and various assumptions, many of which, by their nature,

are inherently uncertain and beyond our control. Such statements, include, but are not limited to, statements contained in this Quarterly

Report relating to our business, business strategy, products and services we may offer in the future, the timing and results of future

clinical trials, and capital outlook, successful completion of our clinical trials, our ability to raise additional capital, our ability

to maintain our Nasdaq listing, U.S. Food and Drug Administration, or FDA, approval of our products candidates, our ability to comply

with changing government regulations, patent protection of our proprietary technology, product liability exposure, uncertainty of market

acceptance, competition, technological change, and other risk factors detailed herein and in other of our filings with the Securities

and Exchange Commission, or the SEC. Forward-looking statements are based on our current expectations and assumptions regarding our business,

the economy and other future conditions. Because forward looking statements relate to the future, they are subject to inherent uncertainties,

risks and changes in circumstances that are difficult to predict. Our actual results may differ materially from those contemplated by

the forward-looking statements. They are neither statement of historical fact nor guarantees of assurance of future performance. We caution

you therefore against relying on any of these forward-looking statements. Important factors that could cause actual results to differ

materially from those in the forward looking statements include, but are not limited to, a decline in general economic conditions nationally

and internationally, the ability to protect our intellectual property rights, competition from other providers and products, risks in

product development, inability to raise capital to fund continuing operations, changes in government regulation, and other factors (including

the risks contained in Item 1A of our most recent Annual Report on Form 10-K under the heading “Risk Factors”) relating to

our industry, our operations and results of operations and any businesses that may be acquired by us. Should one or more of these risks

or uncertainties materialize, or should the underlying assumptions prove incorrect, actual results may differ significantly from those

anticipated, believed, estimated, expected, intended or planned.

Factors or events that could cause our actual

results to differ may emerge from time to time, and it is not possible for us to predict all of them, nor can we assess the impact of

all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially

from those contained in any forward-looking statements we may make. Given these uncertainties, you should not place undue reliance on

these forward-looking statements. We cannot guarantee future results, levels of activity, performance or achievements. Except as required

by applicable law, we undertake no obligation to and do not intend to update any of the forward-looking statements to conform these statements

to actual results.

PART I. FINANCIAL INFORMATION

ITEM 1. CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

AETHLON MEDICAL, INC. AND SUBSIDIARY

CONDENSED CONSOLIDATED BALANCE SHEETS

| | |

| | |

| |

| | |

June 30,

2024 | | |

March 31,

2024 | |

| | |

(Unaudited) | | |

| |

| ASSETS | |

| | | |

| | |

| Current assets | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 9,072,379 | | |

$ | 5,441,978 | |

| Deferred Offering Cost | |

| – | | |

| 277,827 | |

| Prepaid expenses and other current assets | |

| 478,058 | | |

| 505,983 | |

| Total current assets | |

| 9,550,437 | | |

| 6,225,788 | |

| | |

| | | |

| | |

| Property and equipment, net | |

| 929,306 | | |

| 1,015,229 | |

| Operating lease right-of-use asset | |

| 813,900 | | |

| 883,054 | |

| Patents, net | |

| 963 | | |

| 1,100 | |

| Restricted cash | |

| 87,506 | | |

| 87,506 | |

| Deposits | |

| 33,305 | | |

| 33,305 | |

| Total assets | |

$ | 11,415,417 | | |

$ | 8,245,982 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Accounts payable | |

$ | 1,068,134 | | |

$ | 777,862 | |

| Due to related parties | |

| 732,518 | | |

| 546,434 | |

| Operating lease liability, current portion | |

| 296,093 | | |

| 290,565 | |

| Other current liabilities | |

| 32,203 | | |

| 215,038 | |

| Total current liabilities | |

| 2,128,948 | | |

| 1,829,899 | |

| | |

| | | |

| | |

| Operating lease liability, less current portion | |

| 573,852 | | |

| 649,751 | |

| Total liabilities | |

| 2,702,801 | | |

| 2,479,650 | |

| | |

| | | |

| | |

| Stockholders’ Equity | |

| | | |

| | |

| Common stock, par value $0.001 per share; 60,000,000 shares authorized as of June

30, 2024 and March 31, 2024; 13,937,327 and 2,629,725 shares issued and outstanding as of June 30, 2024 and March 31, 2024, respectively | |

| 13,937 | | |

| 2,629 | |

| Additional paid-in capital | |

| 165,844,620 | | |

| 160,337,371 | |

| Accumulated other comprehensive loss | |

| (7,773 | ) | |

| (6,940 | ) |

| Accumulated deficit | |

| (157,138,168 | ) | |

| (154,566,728 | ) |

| | |

| | | |

| | |

| Total stockholders’ equity | |

| 8,712,616 | | |

| 5,766,332 | |

| | |

| | | |

| | |

| Total liabilities and stockholders’ equity | |

$ | 11,415,417 | | |

$ | 8,245,982 | |

The accompanying notes are an integral part

of these condensed consolidated financial statements.

AETHLON MEDICAL, INC. AND SUBSIDIARY

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

For the Three Month Periods Ended June 30, 2024

and 2023

(Unaudited)

| | |

| | |

| |

| | |

Three Months

Ended

June 30,

2024 | | |

Three Months

Ended

June 30,

2023 | |

| | |

| | |

| |

| OPERATING EXPENSES | |

| | | |

| | |

| | |

| | | |

| | |

| Professional fees | |

$ | 614,082 | | |

$ | 976,638 | |

| Payroll and related expenses | |

| 1,254,802 | | |

| 1,123,239 | |

| General and administrative | |

| 751,974 | | |

| 1,308,283 | |

| Total operating expenses | |

| 2,620,858 | | |

| 3,408,160 | |

| OPERATING LOSS | |

| (2,620,858 | ) | |

| (3,408,160 | ) |

| | |

| | | |

| | |

| OTHER INCOME | |

| | | |

| | |

| Interest income | |

| 49,418 | | |

| 125,981 | |

| | |

| | | |

| | |

| NET LOSS | |

| (2,571,440 | ) | |

| (3,282,179 | ) |

| | |

| | | |

| | |

| NET LOSS ATTRIBUTABLE TO AETHLON MEDICAL, INC. | |

| (2,571,440 | ) | |

| (3,282,179 | ) |

| | |

| | | |

| | |

| OTHER COMPREHENSIVE LOSS | |

| (833 | ) | |

| (994 | ) |

| | |

| | | |

| | |

| COMPREHENSIVE LOSS | |

$ | (2,572,273 | ) | |

$ | (3,283,173 | ) |

| | |

| | | |

| | |

| Basic and diluted net loss per share attributable to common stockholders | |

$ | (0.34 | ) | |

$ | (1.35 | ) |

| | |

| | | |

| | |

| Weighted average number of common shares outstanding – basic and diluted | |

| 7,457,888 | | |

| 2,431,476 | |

The accompanying notes are an integral part

of these condensed consolidated financial statements.

AETHLON MEDICAL, INC. AND SUBSIDIARY

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’

EQUITY

For the Three Months Ended June 30, 2024 and 2023

(Unaudited)

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| | |

ATTRIBUTABLE TO AETHLON

MEDICAL, INC. | | |

| | |

| | |

| |

| | |

COMMON STOCK | | |

ADDITIONAL

PAID IN | | |

ACCUMULATED | | |

ACCUMULATED

COMPREHENSIVE | | |

NON-

CONTROLLING | | |

TOTAL | |

| | |

SHARES | | |

AMOUNT | | |

CAPITAL | | |

DEFICIT | | |

LOSS | | |

INTERESTS | | |

EQUITY | |

| BALANCE – MARCH

31, 2024 | |

| 2,629,725 | | |

$ | 2,629 | | |

$ | 160,337,371 | | |

$ | (154,566,728 | ) | |

$ | (6,940 | ) | |

$ | – | | |

$ | 5,766,332 | |

| Issuances of common stock for public

offering | |

| 8,100,000 | | |

| 8,100 | | |

| 3,531,807 | | |

| – | | |

| – | | |

| – | | |

| 3,539,907 | |

| Issuances of common stock for Class A and Class B warrant exercises | |

| 3,180,000 | | |

| 3,180 | | |

| 1,841,220 | | |

| – | | |

| – | | |

| – | | |

| 1,844,400 | |

| Issuance of common shares upon vesting

of restricted stock units and net stock option exercises | |

| 27,602 | | |

| 28 | | |

| (5,106 | ) | |

| – | | |

| – | | |

| – | | |

| (5,078 | ) |

| Stock-based compensation expense | |

| – | | |

| – | | |

| 139,328 | | |

| – | | |

| – | | |

| – | | |

| 139,328 | |

| Net loss | |

| – | | |

| – | | |

| – | | |

| (2,571,440 | ) | |

| – | | |

| – | | |

| (2,571,440 | ) |

| Other comprehensive

loss | |

| – | | |

| – | | |

| – | | |

| – | | |

| (833 | ) | |

| – | | |

| (833 | ) |

| BALANCE –

JUNE 30, 2024 | |

| 13,937,327 | | |

$ | 13,937 | | |

$ | 165,844,620 | | |

$ | (157,138,168 | ) | |

$ | (7,733 | ) | |

$ | – | | |

$ | 8,712,616 | |

| |

|

COMMON

STOCK |

|

|

ADDITIONAL

PAID IN |

|

|

ACCUMULATED |

|

|

ACCUMULATED

COMPREHENSIVE |

|

|

NON-

CONTROLLING |

|

|

TOTAL |

|

| |

|

SHARES |

|

|

AMOUNT |

|

|

CAPITAL |

|

|

DEFICIT |

|

|

LOSS |

|

|

INTERESTS |

|

|

EQUITY |

|

| BALANCE

– MARCH 31, 2023 |

|

|

2,299,259 |

|

|

$ |

2,299 |

|

|

$ |

157,426,606 |

|

|

$ |

(142,358,555 |

) |

|

$ |

(6,141 |

) |

|

$ |

– |

|

|

$ |

15,064,209 |

|

| Issuances

of common stock for cash under at the market program |

|

|

177,891 |

|

|

|

178 |

|

|

|

1,085,941 |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

1,086,119 |

|

| Issuance

of common shares upon vesting of restricted stock units and net stock option exercises |

|

|

6,397 |

|

|

|

7 |

|

|

|

(8,379 |

) |

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

(8,372 |

) |

| Stock-based

compensation expense |

|

|

– |

|

|

|

– |

|

|

|

250,114 |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

250,114 |

|

| Net

loss |

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

(3,282,179 |

) |

|

|

– |

|

|

|

– |

|

|

|

(3,282,179 |

) |

| Other

comprehensive loss |

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

(994 |

) |

|

|

– |

|

|

|

(994 |

) |

| BALANCE

– JUNE 30, 2023 |

|

|

2,483,547 |

|

|

$ |

2,484 |

|

|

$ |

158,754,282 |

|

|

$ |

(145,640,734 |

) |

|

$ |

(7,135 |

) |

|

$ |

– |

|

|

$ |

13,108,897 |

|

The accompanying notes are an integral part

of these condensed consolidated financial statements.

AETHLON MEDICAL, INC. AND SUBSIDIARY

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

For the Three Months Ended June 30, 2024 and 2023

(Unaudited)

| | |

| | |

| |

| | |

Three months

Ended

June 30, 2024 | | |

Three months

Ended

June 30, 2023 | |

| | |

| | |

| |

| Cash flows used in operating activities: | |

| | | |

| | |

| Net loss | |

$ | (2,571,440 | ) | |

$ | (3,282,179 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 86,060 | | |

| 90,325 | |

| Stock based compensation | |

| 139,328 | | |

| 250,114 | |

| Accretion of right-of-use operating lease asset | |

| (1,217 | ) | |

| 1,238 | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Prepaid expenses and other current assets | |

| 89,872 | | |

| 146,409 | |

| Accounts payable and other current liabilities | |

| 323,776 | | |

| 334,613 | |

| Deferred revenue | |

| – | | |

| – | |

| Due to related parties | |

| 186,084 | | |

| (22,907 | ) |

| Net cash used in operating activities | |

| (1,747,537 | ) | |

| (2,482,387 | ) |

| | |

| | | |

| | |

| Cash flows used in investing activities: | |

| | | |

| | |

| Purchases of property and equipment | |

| – | | |

| (230,383 | ) |

| Net cash used in investing activities | |

| – | | |

| (230,383 | ) |

| | |

| | | |

| | |

| Cash flows provided by financing activities: | |

| | | |

| | |

| Proceeds from the issuance of common stock, net | |

| 3,539,907 | | |

| 1,086,119 | |

| Proceeds from the issuance of common stock

upon Class A and Class B warrant exercises | |

| 1,844,400 | | |

| – | |

| Tax withholding payments or tax equivalent

payments for net share settlement of restricted stock units and net stock option expense | |

| (5,078 | ) | |

| (8,372 | ) |

| Net cash provided by financing activities | |

| 5,379,229 | | |

| 1,077,747 | |

| | |

| | | |

| | |

| Effect of exchange rate on changes on cash | |

| (1,290 | ) | |

| (186 | ) |

| | |

| | | |

| | |

| Net increase (decrease) in cash, cash equivalents and restricted cash | |

| 3,630,402 | | |

| (1,635,209 | ) |

| | |

| | | |

| | |

| Cash, cash equivalents and restricted cash at beginning of period | |

| 5,529,483 | | |

| 14,620,449 | |

| | |

| | | |

| | |

| Cash, cash equivalents and restricted cash at end of period | |

$ | 9,159,885 | | |

$ | 12,985,240 | |

| | |

| | | |

| | |

| Supplemental disclosures of cash flow information: | |

| | | |

| | |

| | |

| | | |

| | |

| Supplemental disclosures of non-cash investing and financing activities: | |

| | | |

| | |

| Par value of shares issued for vested restricted

stock units and net stock option exercise | |

$ | 28 | | |

$ | 64 | |

| | |

| | | |

| | |

| Reconciliation of cash, cash equivalents and restricted cash

to the condensed consolidated balance sheets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 9,072,379 | | |

$ | 12,897,734 | |

| Restricted cash | |

| 87,506 | | |

| 87,506 | |

| Cash, cash equivalents and restricted cash | |

$ | 9,159,885 | | |

$ | 12,985,240 | |

The accompanying notes are an integral part

of these condensed consolidated financial statements.

AETHLON MEDICAL, INC. AND SUBSIDIARY

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

June 30, 2024

1. NATURE OF BUSINESS AND BASIS OF PRESENTATION ORGANIZATION

Aethlon Medical, Inc., or Aethlon, the Company,

we or us, is a medical therapeutic company focused on developing the Hemopurifier, a clinical-stage immunotherapeutic device designed

to combat cancer and life-threatening viral infections and for use in organ transplantation. In human studies, 164 sessions with 38 patients,

the Hemopurifier was safely utilized and demonstrated the potential to remove life-threatening viruses. In pre-clinical studies, the

Hemopurifier has demonstrated the potential to remove harmful exosomes and exosomal particles from biological fluids, utilizing its proprietary

lectin-based technology. This action has potential applications in cancer, where exosomes and exosomal particles may promote immune suppression

and metastasis, and in life-threatening infectious diseases. The U.S. Food and Drug Administration, or FDA, has designated the Hemopurifier

as a “Breakthrough Device” for two independent indications:

| |

· |

the treatment of individuals

with advanced or metastatic cancer who are either unresponsive to or intolerant of standard of care therapy, and with cancer types

in which exosomes or exosomal particles have been shown to participate in the development or severity of the disease; and |

| |

· |

the treatment of life-threatening

viruses that are not addressed with approved therapies. |

We believe the Hemopurifier may be a substantial

advancement in the treatment of patients with advanced and metastatic cancer through its design to bind to and remove harmful exosomes

and exosomal particles that promote the growth and spread of tumors. In October 2022, we formed a wholly-owned subsidiary in Australia

to initially conduct oncology-related clinical research, then seek regulatory approval and commercialize our Hemopurifier in Australia.

We are currently working with our contract research organization, or CRO, on preparations to conduct a clinical trial in Australia in

patients with solid tumors, including head and neck cancer, and gastrointestinal cancers.

In January 2023, we entered into an agreement

with North American Science Associates, LLC, or NAMSA, a world leading medical technology CRO offering global end-to-end development

services, to oversee our planned clinical trials investigating the Hemopurifier for oncology indications. Pursuant to the agreement,

NAMSA agreed to manage our planned clinical trials of the Hemopurifier for patients in the United States and Australia with various types

of cancer tumors.

We recently completed an in vitro binding

study of relevant oncology targets, to provide pre-clinical evidence to support our trial design and translational endpoints. Our study

indicated positive results, providing evidence that our Hemopurifier removes extracellular vesicles, or EVs, from plasma.

This translational study provides pre-clinical evidence to support our planned phase 1 safety, feasibility and dose-finding clinical

trials of our Hemopurifier in patients with solid tumors who have stable or progressive disease during anti-PD-1 monotherapy treatment,

such as Keytruda® or Opdivo®. In addition to an interested initial trial site in India, we had three interested sites in Australia

that were awaiting our completion of this in vitro binding study. We added the data from this study to our Clinical Investigator

Brochure and submitted that brochure to the Ethics Committee of Royal Adelaide Hospital in Australia and in June 2024, we received approval

for our proposed phase 1 oncology trial from the Ethics Committee from Royal Adelaide Hospital. We are currently in the process of applying

to the Ethics Committees of the two additional interested clinical trial sites in Australia and the site in India.

We also believe that the Hemopurifier can be

part of the broad-spectrum treatment of life-threatening highly glycosylated, or carbohydrate coated, viruses that are not addressed

with an already approved treatment. In small-scale or early feasibility human studies, the Hemopurifier has been used in the past to

treat individuals infected with human immunodeficiency virus, or HIV, hepatitis-C and Ebola.

Additionally, in vitro, the

Hemopurifier has been demonstrated to capture H5N1 bird flu virus, H1N1 swine flu virus, Zika virus, Lassa virus, MERS-CoV,

cytomegalovirus, Epstein-Barr virus, Herpes simplex virus, Chikungunya virus, Dengue virus, West Nile virus, smallpox-related

viruses, Monkeypox virus and the reconstructed Spanish flu virus of 1918. In several cases, these studies were conducted in

collaboration with leading government or non-government research institutes.

On June 17, 2020, the FDA approved a supplement

to our open Investigational Device Exemption, or IDE, for the Hemopurifier in viral disease to allow for the testing of the Hemopurifier

in patients with SARS-CoV-2/COVID-19, or COVID-19, in a new feasibility study. That study was designed to enroll up to 40 subjects

at up to 20 centers in the United States. Subjects were to have established laboratory diagnosis of COVID-19, be admitted to an ICU and

have acute lung injury and/or severe or life-threatening disease, among other criteria. Endpoints for this study, in addition to safety,

included reduction in circulating virus, as well as clinical outcomes (NCT # 04595903). In January 2021, the Hemopurifier was used to

treat a viremic patient, under our emergency use approval, with a predicted risk of mortality of 80% and the Hemopurifier was able to

reduce the patient’s SARS-CoV-2 plasma viral load by 58.4%. In June 2022, the first patient in this study was enrolled and

completed the Hemopurifier treatment phase of the protocol. Due to the lack of COVID-19 patients in the ICUs of our trial sites, we terminated

this study in 2022. However, our IDE for this indication remains open, as we have an active COVID-19 trial in India and wish to preserve

the option of enrolling patients if the situation with COVID-19 changes.

Under Single Patient Emergency Use regulations,

Aethlon has treated two patients with COVID-19 with the Hemopurifier, in addition to the COVID-19 patient treated with our Hemopurifier

in our COVID-19 clinical trial discussed above.

In October 2022, we launched a wholly owned subsidiary

in Australia, formed to conduct clinical research, seek regulatory approval and commercialize our Hemopurifier in that country. The subsidiary

will initially focus on the planned oncology trials in Australia.

In August 2024, the Bellberry Human Research

Ethics Committee granted full ethics approval to the Pindara Private Hospital for a safety, feasibility and dose-finding clinical trial

of the Hemopurifier® in patients with solid tumors who have stable or progressive disease during anti-PD-1 monotherapy treatment

(AEMD-2022-06 Hemopurifier Study). The approval is valid for one year, until August 6, 2025. The trial will be conducted by Dr. Marco

Matos and his staff at the Pindara Private Hospital, located in Queensland, Australia.

In June 2024, the Human Research Ethics Committee

(HREC) of the Central Adelaide Local Health Network (CALHN) granted full ethics approval for the same safety, feasibility and dose-finding

clinical trial of the Hemopurifier in cancer patients with solid tumors who have stable or progressive disease during anti-PD-1 monotherapy

treatment, such as Keytruda® (pembrolizumab) or Opdivo® (nivolumab) (AEMD-2022-06 Hemopurifier Study). The approval is valid

for three years, until June 13, 2027. The trial will be conducted by Prof. Michael Brown and his staff at the Cancer Clinical Trials

Unit, CALHN, Royal Adelaide Hospital, located in Adelaide, Australia.

We also obtained ethics review board, or ERB,

approval from and entered into a clinical trial agreement with Medanta Medicity Hospital, a multi-specialty hospital in Delhi NCR, India,

for a COVID-19 clinical trial at that location.

In May 2023, we received ERB approval from the

MAMC, for a second site for our clinical trial in India to treat severe COVID-19. MAMC was established in 1958 and is located in New

Delhi, India. MAMC is affiliated with the University of Delhi and is operated by the Delhi government.

We now have two sites in India for this trial

with the Medanta Medicity Hospital and Maulana Azad Medical College, or MAMC. One patient has been treated to date; however, we have

been informed by our CRO that a new COVID-19 subvariant was detected in India recently. Our COVID-19 trial in India remains open in the

event that there are COVID-19 admissions to the ICUs at our sites in India.

Additionally, based on preclinical data with

acellular kidney perfusates, we believe that the Hemopurifier has potential applications in organ transplantation. We are investigating

whether the Hemopurifier, when incorporated into a machine perfusion organ preservation circuit, can remove harmful viruses, exosomes,

RNA molecules, cytokines, chemokines and other inflammatory molecules from recovered organs. We initially are focused on recovered kidneys

from deceased donors. We have previously demonstrated the removal of multiple viruses and exosomes and exosomal particles from buffer

solutions, in vitro, utilizing a scaled-down version of our Hemopurifier and believe this process could reduce transplantation

complications by improving graft function, reducing graft rejection, maintaining or improving organ viability prior to transplantation,

and potentially reducing the number of kidneys rejected for transplant.

Successful outcomes

of human trials will also be required by the regulatory agencies of certain foreign countries where we plan to market and sell the Hemopurifier.

Some of our patents may expire before FDA approval or approval in a foreign country, if any, is obtained. However, we believe that certain

patent applications and/or other patents issued to us more recently will help protect the proprietary nature of our Hemopurifier treatment

technology.

In addition to the foregoing, we are monitoring

closely the impact of inflation, recent bank failures and the war between Russia and Ukraine and the military conflicts in Israel and

the surrounding areas, as well as related political and economic responses and counter-responses by various global factors on our business.

Given the level of uncertainty regarding the duration and impact of these events on capital markets and the U.S. economy, we are unable

to assess the impact on our timelines and future access to capital. The full extent to which inflation, recent bank failures and the

ongoing military conflicts will impact our business, results of operations, financial condition, clinical trials and preclinical research

will depend on future developments, as well as the economic impact on national and international markets that are highly uncertain.

We incorporated in Nevada on March 10, 1999.

Our executive offices are located at 11555 Sorrento Valley Road, Suite 203, San Diego, California 92121. Our telephone number is (619)

941-0360. Our website address is www.aethlonmedical.com.

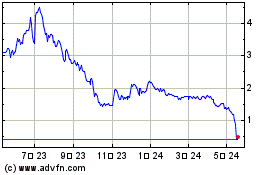

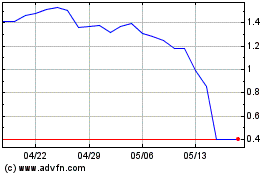

Our common stock is listed on the Nasdaq Capital Market under the

symbol “AEMD.”

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

During the three months ended June 30, 2024,

there were no changes to our significant accounting policies as described in our Annual Report on Form 10-K for the fiscal year ended

March 31, 2024.

REVERSE STOCK SPLIT

On October 4, 2023, we effected a 1-for-10 reverse

stock split of our then outstanding shares of common stock. Accordingly, each 10 shares of outstanding common stock then held by our

stockholders were combined into one share of common stock. Any fractional shares resulting from the reverse split were rounded up to

the next whole share. Authorized common stock remained at 60,000,000 shares following the stock split. The accompanying unaudited condensed

consolidated financial statements and accompanying notes have been retroactively revised to reflect such reverse stock split as if it

had occurred on April 1, 2023. All shares and per share amounts have been revised accordingly.

Basis of Presentation and Use of Estimates

Our accompanying unaudited condensed consolidated

financial statements have been prepared in accordance with U.S. generally accepted accounting principles, or GAAP, for interim financial

information and with the instructions to Form 10-Q and Article 8 of the Securities and Exchange Commission, or SEC, Regulation S-X. Accordingly,

they should be read in conjunction with the audited financial statements and notes thereto for the fiscal year ended March 31, 2024,

included in our Annual Report on Form 10-K filed with the SEC on June 27, 2024. The accompanying unaudited condensed consolidated financial

statements include the accounts of Aethlon Medical, Inc. and its wholly owned subsidiary, Aethlon Medical Australia Pty Ltd, as well

as its previously majority-owned subsidiary, Exosome Sciences, Inc., which dissolved in September 2022. All significant inter-company

transactions and balances have been eliminated in consolidation. The accompanying unaudited condensed consolidated financial statements,

taken as a whole, contain all adjustments that are of a normal recurring nature necessary to present fairly our operating results, cash

flows, and financial position as of and for the period ended June 30, 2024. Estimates were made relating to useful lives of fixed assets,

impairment of assets, share-based compensation expense and accruals for clinical trial and research and development expenses. Actual

results could differ materially from those estimates. The accompanying condensed consolidated balance sheet at March 31, 2024 has been

derived from the audited consolidated balance sheet at March 31, 2024, contained in the above referenced 10-K. The results of operations

for the three months ended June 30, 2024 are not necessarily indicative of the results to be expected for the full year or any future

interim periods.

Reclassifications

Certain prior year balances within the unaudited

condensed consolidated financial statements have been reclassified to conform to the current year presentation, including the impact

of the reverse stock split.

LIQUIDITY AND GOING CONCERN

Management expects existing cash as of June

30, 2024 to be sufficient to fund the Company’s operations for at least twelve months from the issuance date of these

condensed consolidated financial statements. In previous filings, we disclosed substantial doubt about our ability to continue as a

going concern due to recurring losses and negative cash flows. We have addressed these concerns by raising $5,379,229,

net, through the combination of an equity offering and warrant exercises, combined with our recent financial performance which has

shown a significant decrease in expenses and use of cash. For the three-month period ended June 30, 2024, expenses decreased by

approximately $787,000

compared to June 30, 2023, accompanied by an approximate $964,000

decrease in cash used in operating and investing activities. As a result of these actions, management believes that the substantial

doubt regarding our ability to continue as a going concern has been alleviated.

The accompanying unaudited condensed consolidated

financial statements have been prepared assuming that we will continue as a going concern, which contemplates, among other things, the

realization of assets and satisfaction of liabilities in the ordinary course of business.

Restricted Cash

To comply with the terms of our laboratory and

office lease and our lease for our manufacturing space (see Note 10), we caused our bank to issue two standby letters of credit, or L/Cs,

in the aggregate amount of $87,506 in favor of our landlord. The L/Cs are in lieu of a security deposit. In order to support the L/Cs,

we agreed to have our bank withdraw $87,506 from our operating accounts and to place that amount in a restricted certificate of deposit.

We have classified that amount as restricted cash, a long-term asset, on our balance sheet.

2. LOSS PER COMMON SHARE

Basic loss per share is computed by dividing

net loss by the weighted average number of common shares outstanding during the period of computation. Diluted loss per share is computed

similar to basic loss per share, except that the denominator is increased to include the number of additional dilutive common shares

that would have been outstanding if potential common shares had been issued, if such additional common shares were dilutive. Since we

had net losses for all periods presented, basic and diluted loss per share are the same, and additional potential common shares have

been excluded, as their effect would be antidilutive.

As of June 30, 2024 and 2023, an aggregate of

13,523,429 and 2,291,234 potential common shares, respectively, consisting of shares underlying outstanding stock options, warrants,

and restricted stock units were excluded, as their inclusion would be antidilutive.

3. RESEARCH AND DEVELOPMENT EXPENSES

Our research and development costs are expensed

as incurred. We incurred research and development expenses during the three-month periods ended June 30, 2024 and 2023, which are included

in various operating expense line items in the accompanying condensed consolidated statements of operations. Our research and development

expenses in those periods were as follows:

| Schedule of research and development

expenses | |

| | |

| |

| | |

June 30, | | |

June 30, | |

| | |

2024 | | |

2023 | |

| Three months ended | |

$ | 414,658 | | |

$ | 678,922 | |

4. RECENT ACCOUNTING PRONOUNCEMENTS

In November 2023, the Financial Accounting Standards

Board (“FASB”) issued ASU 2023-07 “Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures”

(“ASU 2023-07”). ASU 2023-07 intends to improve reportable segment disclosure requirements, enhance interim disclosure requirements

and provide new segment disclosure requirements for entities with a single reportable segment. ASU 2023-07 is effective for fiscal years

beginning after December 15, 2023, and for interim periods with fiscal years beginning after December 15, 2024. ASU 2023-07 is to be

adopted retrospectively to all prior periods presented. We are currently assessing the impact this guidance will have on our consolidated

financial statements; however, we do not expect a material impact.

In December 2023, the FASB issued Accounting

Standards Update 2023-09, Improvements to Income Tax Disclosures (“ASU 2023-09”), which requires enhanced annual disclosures

for specific categories in the rate reconciliation and income taxes paid disaggregated by federal, state and foreign taxes. ASU 2023-09

is effective for public business entities for annual periods beginning after December 15, 2024. The Company is evaluating if the adoption

of this new standard will have a material effect on our disclosures.

In June 2016, the FASB issued ASU No. 2016-13,

Financial Instruments-Credit Losses (Topic 326), Measurement of Credit Losses on Financial Instruments. The adoption of ASU No. 2016-13

for smaller reporting companies that did not previously early adopt was January 1, 2023. The Company maintained US Treasury bills with

maturities of less than three months and expects zero credit losses from these securities. As a result, the Company did not record an

allowance for expected credit losses.

5. EQUITY TRANSACTIONS IN THE THREE MONTHS ENDED JUNE 30, 2024

2022 At The Market Offering Agreement with H.C. Wainwright &

Co., LLC

On March 24, 2022, we entered into an At The

Market Offering Agreement, or the 2022 ATM Agreement, with H.C. Wainwright & Co., LLC, or Wainwright, which established an at-the-market

equity program pursuant to which we may offer and sell shares of our common stock from time to time, as set forth in the 2022 ATM Agreement.

The offering was registered under the Securities

Act of 1933, as amended, or the Securities Act, pursuant to our shelf registration statement on Form S-3 (Registration Statement No.

333-259909), as previously filed with the SEC and declared effective on October 21, 2021. We filed a prospectus supplement, dated March

24, 2022, with the SEC that provides for the sale of shares of our common stock having an aggregate offering price of up to $15,000,000,

or the 2022 ATM Shares.

Under the 2022 ATM Agreement, Wainwright may

sell the 2022 ATM Shares by any method permitted by law and deemed to be an “at the market offering” as defined in Rule 415

promulgated under the Securities Act, including sales made directly on the Nasdaq Capital Market, or on any other existing trading market

for the 2022 ATM Shares. In addition, under the 2022 ATM Agreement, Wainwright may sell the 2022 ATM Shares in privately negotiated transactions

with our consent and in block transactions. Under certain circumstances, we may instruct Wainwright not to sell the 2022 ATM Shares if

the sales cannot be effected at or above the price designated by us from time to time.

We are not obligated to make any sales of the

2022 ATM Shares under the 2022 ATM Agreement. The offering of the 2022 ATM Shares pursuant to the 2022 ATM Agreement will terminate upon

the termination of the 2022 ATM Agreement by Wainwright or us, as permitted therein.

The 2022 ATM Agreement contains customary representations,

warranties and agreements by us, and customary indemnification and contribution rights and obligations of the parties. We agreed to pay

Wainwright a placement fee of up to 3.0% of the aggregate gross proceeds from each sale of the 2022 ATM Shares. We also agreed to reimburse

Wainwright for certain specified expenses in connection with entering into the 2022 ATM Agreement.

During the three months ended June 30, 2024,

we did not raise proceeds under the 2022 ATM Agreement. During the three months ended June 30, 2023, we raised net proceeds of $1,086,119,

net of $27,999 in commissions to Wainwright and $5,846 in other offering expenses, through the sale of 177,890 shares of our common

stock at an average price of $6.11 per share under the 2022 ATM Agreement.

May 2024 Public Offering

On May 17, 2024, we closed a public offering pursuant

to which we sold an aggregate of: (i) 2,450,000 shares of our common stock and accompanying Class A warrants to purchase up to 2,450,000

shares of common stock and Class B warrants to purchase up to 2,450,000 shares of common stock, at a combined public offering price of

$0.58 per share and accompanying warrants; and (ii) in lieu of common stock, pre-funded warrants to purchase 5,650,000 shares of common

stock and accompanying Class A warrants to purchase up to 5,650,000 shares of common stock and Class B warrants to purchase up to 5,650,000

shares of common stock, at a combined public offering price of $0.579 per pre-funded warrant and accompanying warrants, which is equal

to the public offering price per share of common stock, and accompanying warrants less the $0.001 per share exercise price of each such

pre-funded warrant.

All pre-funded warrants issued in the offering were

exercised in the quarter ended June 30, 2024. The Class A and Class B warrants each have an exercise

price of $0.58 per share, are immediately exercisable, and, in the case of Class A warrants, will expire on May 17, 2029, and in the case

of Class B warrants, will expire on May 19, 2025. The exercise price of the Class A and Class B warrants is also subject to adjustment

for stock splits, reverse splits, and similar capital transactions as described in such warrants.

Maxim Group LLC (“Maxim”),

served as the exclusive placement agent in connection with the offering. We paid Maxim a cash fee of 6.5% of the aggregate gross proceeds

raised at the closing of the offering, and reimbursement of certain expenses and legal fees in the amount of $100,000. We also issued

to designees of Maxim warrants to purchase up to an aggregate of 324,000 shares of common stock (the “Placement Agent Warrants”).

The Placement Agent Warrants have an exercise price of $0.58 per share and have substantially the same terms as the Class A warrants,

except the Placement Agent Warrants are not subject to an exercise price reset, are non-exercisable until November 15, 2024, and will

expire on May 15, 2029.

The gross proceeds from

the offering, before deducting the placement agent’s fees and other offering expenses, were approximately $4.7 million. Net

proceeds, of the offering, after deducting the placement agent fees and expenses and other offering expenses payable by us, were are

approximately $3.5 million. In June 2024, and holders of Class A and Class B warrants exercised 300,000 shares and 2,880,000 shares,

respectively, for additional proceeds of $1,844,400.

The shares of Common Stock,

the Class A and Class B warrants, the pre-funded warrants and the Placement Agent Warrants described above and the underlying shares of

Common Stock were offered pursuant to a Registration Statement on Form S-1, as amended (File No. 333-278188) (the “Registration

Statement”), which was declared effective by the Securities and Exchange Commission (the “SEC”) on May 15, 2024.

Restricted Stock Unit Grants

On April 16, 2024, our Board of Directors

approved, pursuant to the terms of the Director Compensation Policy, the grant of the annual RSUs under the Director Compensation

Policy to each of the four non-employee directors of the Company then serving on the Board of Directors. The Director Compensation

Policy provides for a grant of stock options or $50,000 worth of RSUs at the beginning of each fiscal year for current non-employee

directors then serving on the Board of Directors, and for a grant of stock options or $75,000 worth of RSUs for a newly elected

non-employee director, with each RSU priced at the average of the closing prices for the five trading days preceding and including

the date of grant, or $1.52 per share for the RSUs granted in April 2024. As a result, in April 2024, the four eligible directors

were each granted 32,894

RSUs under the Company’s 2020 Equity Incentive Plan, as amended, or the 2020 Plan. The

RSUs are subject to vesting in four equal installments, with 25% of the restricted stock units vesting on each of June 30, 2024,

September 30, 2024, December 31, 2024, and March 31, 2025, subject in each case to the director’s Continuous Service (as

defined in the 2020 Plan), through such dates. Vesting will automatically terminate upon the director’s termination of

Continuous Service prior to any vesting date.

During the three-months ended June 30, 2024,

27,602

shares were issued upon settlement of 37,779

RSUs.

6. RELATED PARTY TRANSACTIONS

During the three months ended June 30, 2024,

we accrued unpaid fees of $68,250 owed to our non-employee directors.

As a result of entering

into a Separation Agreement effective July 1, 2024 with a former employee, we paid out accrued vacation of $9,688 in the three months

ended June 30, 2024. That accrued vacation was previously recorded in the due to related parties account. In addition, pursuant to the

terms of the Separation Agreement, we accrued $323,534 for salary and related expenses connected with the Separation Agreement. Accrued

separation expenses includes a balance of approximately $186,000 owed to our former Chief Executive Officer, as stipulated in his Separation

Agreement.

Amounts due to related parties were comprised

of the following items:

| Schedule of amounts due to related parties | |

| | |

| |

| | |

June 30,

2024 | | |

March 31,

2024 | |

| Accrued Board fees | |

$ | 68,250 | | |

$ | 68,250 | |

| Accrued vacation to all employees | |

| 154,816 | | |

| 167,973 | |

| Accrued separation expenses | |

| 509,452 | | |

| 310,211 | |

| Total due to related parties | |

$ | 732,518 | | |

$ | 546,434 | |

7. OTHER CURRENT LIABILITIES

Other current liabilities were comprised of the following items:

| Schedule of other current liabilities | |

| | |

| |

| | |

June 30, | | |

March 31, | |

| | |

2024 | | |

2024 | |

| Accrued professional fees | |

$ | 32,203 | | |

$ | 215,038 | |

| Total other current liabilities | |

$ | 32,203 | | |

$ | 215,038 | |

8. STOCK COMPENSATION

The following tables summarize share-based compensation

expenses relating to RSUs and stock options and the effect on basic and diluted loss per common share during the three month periods

ended June 30, 2024 and 2023:

| Schedule of share-based compensation

expenses | |

| | |

| |

| | |

June 30,

2024 | | |

June 30,

2023 | |

| Vesting of stock options and restricted stock units | |

$ | 139,328 | | |

$ | 250,114 | |

| Total stock-based compensation expense | |

$ | 139,328 | | |

$ | 250,114 | |

| | |

| | | |

| | |

| Weighted average number of common shares

outstanding – basic and diluted | |

| 7,457,888 | | |

| 2,431,476 | |

| | |

| | | |

| | |

| Basic and diluted loss per common share

attributable to stock-based compensation expense | |

$ | (0.10 | ) | |

$ | (0.16 | ) |

All of the stock-based compensation expense recorded

during the three months ended June 30, 2024 and 2023, an aggregate of $139,328 and $250,114, respectively, is included in payroll and

related expense in the accompanying condensed consolidated statements of operations. Stock-based compensation expense recorded during

each of the three months ended June 30, 2024 and 2023 represented an impact on basic and diluted loss per common share of $(0.02) and

$(0.16), respectively.

Stock Option Activity

We did not issue any stock options during the

three months ended June 30, 2024 and 2023.

Stock options outstanding that have vested as

of June 30, 2024 and stock options that are expected to vest subsequent to June 30, 2024 are as follows:

| Schedule of stock options outstanding | |

| | |

| | |

| |

| | |

Number of

Shares | | |

Weighted

Average

Exercise

Price | | |

Weighted

Average

Remaining

Contractual

Term in

Years | |

| Vested | |

| 61,977 | | |

$ | 17.37 | | |

| 6.81 | |

| Expected to vest | |

| 23,873 | | |

$ | 14.60 | | |

| 7.60 | |

| Total | |

| 85,850 | | |

| | | |

| | |

A summary of stock option activity during the

three months ended June 30, 2024 is presented below:

| Schedule of stock option activity | |

| | |

| | |

| |

| | |

Amount | | |

Range of

Exercise Price | | |

Weighted

Average

Exercise

Price | |

| Outstanding at beginning of year | |

| 86,466 | | |

$ | 6.90

– 25.20 | | |

$ | 22.40 | |

| Granted | |

| – | | |

$ | – | | |

$ | – | |

| Cancelled/Expired | |

| 616 | | |

$ | 14.10-1,425.00 | | |

$ | 206.34 | |

| Outstanding June 30, 2024 | |

| 85,850 | | |

$ | 6.90

– 25.20 | | |

$ | 16.60 | |

| Exercisable, June 30, 2024 | |

| 61,977 | | |

$ | | | |

$ | 17.37 | |

There were no stock option grants during the three months ended June 30, 2024 and 2023. There were 131,576

RSUs granted during the three months June 30, 2024. The weighted average grant date fair value of RSUs granted during the three

months ended June 30, 2024 was $1.52.

There were no

stock option exercises during the three months ended June 30, 2024 and 2023. On June 30, 2024, our outstanding stock options had no intrinsic value, since the closing share price on that date of $0.50

per share was below the exercise price of our outstanding stock options.

The table below summarizes nonvested stock options as of June 30,

2024 and changes during the three months ended June 30, 2024.

| Schedule of non vested stock options | |

| | |

| |

| | |

Shares | | |

Weighted Average Grant Date Fair Value | |

| Nonvested stock options at April 1, 2024 | |

| 28,653 | | |

$ | 1.44 | |

| Vested | |

| (4,780 | ) | |

$ | 1.62 | |

| Forfeited | |

| – | | |

| | |

| Nonvested stock options at June 30, 2024 | |

| 23,873 | | |

| | |

The detail of the options outstanding and exercisable as of June 30,

2024 is as follows:

| Schedule of options outstanding and exercisable |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Options

Outstanding |

|

|

|

Options

Exercisable |

|

| |

Exercise

Prices |

|

|

|

Number

Outstanding |

|

|

|

Weighted

Average

Remaining

Life (Years) |

|

|

|

Weighted

Average

Exercise

Price |

|

|

|

Number

Outstanding |

|

|

|

Weighted

Average

Exercise

Price |

|

| $ |

6.90 - 16.80 |

|

|

|

61,672 |

|

|

|

7.23 years |

|

|

$ |

13.23 |

|

|

|

41,326 |

|

|

$ |

13.46 |

|

| $ |

25.20 |

|

|

|

24,178 |

|

|

|

6.52 years |

|

|

$ |

25.20 |

|

|

|

20,651 |

|

|

$ |

25.20 |

|

| |

|

|

|

|

85,850 |

|

|

|

|

|

|

|

|

|

|

|

61,977 |

|

|

|

|

|

We recorded stock-based compensation expense

related to RSU issuances and to options granted totaling $139,328 and $250,114 for the three months ended June 30, 2024 and 2023, respectively.

These expenses were recorded as stock compensation included in payroll and related expenses in the accompanying consolidated statement

of operations for the three months ended June 30, 2024 and 2023.

The table below summarizes restricted stock units

as of June 30, 2024 and changes during the three months ended June 30, 2024.

| Schedule of restricted stock units restricted stock units | |

| |

| | |

Shares | |

| Nonvested RSUs at April 1, 2024 | |

| 4,885 | |

| Granted | |

| 131,576 | |

| Vested | |

| (27,602 | ) |

| Tax withholding payments or tax equivalent payments for net share settlement of

restricted stock units | |

| (10,177 | ) |

| Nonvested RSUs at June 31, 2024 | |

| 98,682 | |

Our total stock-based compensation for the three

months ended June 30, 2024 and 2023 included the following:

| Schedule of stock-based compensation | |

| | |

| |

| | |

Three Months Ended | |

| | |

June 30, 2024 | | |

June 30, 2023 | |

| Vesting of restricted stock units | |

$ | 68,750 | | |

$ | 37,500 | |

| Vesting of stock options | |

| 70,578 | | |

| 212,614 | |

| Total Stock-Based Compensation | |

$ | 139,328 | | |

$ | 250,114 | |

We review share-based compensation on a quarterly

basis for changes to the estimate of expected award forfeitures based on actual forfeiture experience. The cumulative effect of adjusting

the forfeiture rate for all expense amortization is recognized in the period the forfeiture estimate is changed. The effect of forfeiture

adjustments for the three months ended June 30, 2024 was insignificant.

On June 30, 2024, our outstanding stock options

had no intrinsic value since the closing price on that date of $0.50 per share was below the weighted average exercise price of our outstanding

stock options.

At June 30, 2024, there was approximately $310,674

of unrecognized compensation cost related to share-based payments, which is expected to be recognized over a weighted average period

of 1.45 years.

9. WARRANTS

During the three-months ended June 30, 2024,

we issued 16,524,000 warrants in connection with the May 17, 2024 public offering. We did not issue any warrants in the three-months

ended June 2023.

A summary of warrant activity during the three

months ended June 30, 2024 is presented below:

| Schedule of warrant activity | |

| | |

| | |

| |

| | |

Amount | | |

Range of

Exercise

Price | | |

Weighted

Average

Exercise

Price | |

| Warrants outstanding at March 31, 2024 | |

| 32,676 | | |

$ | 15.00

– 27.50 | | |

$ | 20.09 | |

| | |

| | | |

| | | |

| | |

| Granted | |

| 16,524,000 | | |

| 0.58 | | |

| 0.58 | |

| Exercised | |

| (3,180,000 | ) | |

$ | 0.58 | | |

$ | 0.58 | |

| Cancelled/Expired | |

| – | | |

$ | – | | |

$ | – | |

| Warrants outstanding at June 30, 2024 | |

| 13,376,676 | | |

$ | 0.58

– 27.50 | | |

$ | 0.63 | |

| Warrants exercisable at June 30, 2024 | |

| 13,376,676 | | |

$ | 0.58

– 27.50 | | |

$ | 0.63 | |

10. COMMITMENTS AND CONTINGENCIES

LEASE COMMITMENTS

Office, Lab and Manufacturing Space Leases

In December 2020, we entered into an agreement

to lease approximately 2,823 square feet of office space and 1,807 square feet of laboratory space located at 11555 Sorrento Valley Road,

Suite 203, San Diego, California 92121 and 11575 Sorrento Valley Road, Suite 200, San Diego, California 92121, respectively. The agreement

carries a term of 63 months and we took possession of the office space effective October 1, 2021. We took possession of the laboratory

space effective January 1, 2022. In October 2021, we entered into another lease for approximately 2,655 square feet of space to house

our manufacturing operations located at 11588 Sorrento Valley Road, San Diego, California 92121. The term is for 55 months and we took

possession of the manufacturing space in August 2022. The current monthly base rent under the office and laboratory component of the

lease is $14,158. The current monthly base rent under the manufacturing component of the lease is $12,452. Cash paid in the three months

ended June 30, 2024 for amounts included in the measurement of operating lease liabilities in operating cash flows was $79,830.

The office, lab and manufacturing leases are

coterminous with a remaining term of 33 months. The weighted average discount rate is 4.25%.

As of our June 30, 2024 balance sheet, we have

an operating lease right-of-use asset of $813,900 and operating lease liability of $869,945.

In addition, the lease agreements for the new

office, lab and manufacturing space required us to post a standby L/C in favor of the landlord in the aggregate amount of $87,506 in

lieu of a security deposit. We arranged for our bank to issue standby L/Cs for the new office and lab in the amounts of $46,726 in the

fiscal year ended March 31, 2021 and for the manufacturing space in the amount of $40,780 in the fiscal year ended March 31, 2022. We

transferred like amounts to a restricted certificate of deposit which secured the bank’s risk in issuing those L/Cs. We have classified

those restricted certificates of deposit on our balance sheet as restricted cash with a balance of $87,506.

Overall, our rent expense, which is included

in general and administrative expenses, approximated $102,000 and $105,000 for the three month periods ended June 30, 2024 and 2023,

respectively.

LEGAL MATTERS

We may be involved from time to time in various

claims, lawsuits, and/or disputes with third parties or breach of contract actions incidental to the normal course of our business operations.

We are currently not involved in any litigation or any pending legal proceedings.

11. SUBSEQUENT EVENTS

Management has evaluated events subsequent to

June 30, 2024 through the date that the accompanying consolidated financial statements were filed with the SEC for transactions and other

events which may require adjustment of and/or disclosure in such financial statements.

In August 2024, the Bellberry Human Research

Ethics Committee granted full ethics approval to the Pindara Private Hospital for a safety, feasibility and dose-finding clinical trial

of the Hemopurifier® in patients with solid tumors who have stable or progressive disease during anti-PD-1 monotherapy treatment

(AEMD-2022-06 Hemopurifier Study). The approval is valid for one year, until August 6, 2025. The trial will be conducted by Dr. Marco

Matos and his staff at the Pindara Private Hospital, located in Queensland, Australia.

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

The following discussion of our financial condition

and results of operations should be read in conjunction with, and is qualified in its entirety by, the condensed consolidated financial

statements and notes thereto included in Item 1 in this Quarterly Report on Form 10-Q. Some of the information contained in this discussion

and analysis or set forth elsewhere in this Quarterly Report, including information with respect to our plans and strategy for our business,

includes forward-looking statements that involve risks and uncertainties. For a complete discussion of forward-looking statements, see

the section above entitled “Cautionary Notice Regarding Forward Looking Statements.”

Overview

Aethlon Medical, Inc., or Aethlon, the Company,

we or us, is a medical therapeutic company focused on developing products to treat cancer and life-threatening infectious diseases. The

Aethlon Hemopurifier is a clinical-stage immunotherapeutic device designed to combat cancer and life-threatening viral infections. In

cancer, the Hemopurifier is designed to deplete the presence of circulating tumor-derived exosomes that promote immune suppression, seed

the spread of metastasis and inhibit the benefit of leading cancer therapies. The FDA has designated the Hemopurifier as a “Breakthrough

Device” for two independent indications:

| |

· |

the treatment of individuals

with advanced or metastatic cancer who are either unresponsive to or intolerant of standard of care therapy, and with cancer types

in which exosomes have been shown to participate in the development or severity of the disease; and |

| |

|

|

| |

· |

the treatment of life-threatening

viruses that are not addressed with approved therapies. |

We believe the Hemopurifier can be a substantial

advance in the treatment of patients with advanced and metastatic cancer through its design to bind to and remove harmful exosomes that

promote the growth and spread of tumors through multiple mechanisms. We are currently working with our contract research organization,

or CRO, on preparations to conduct a planned clinical trial in Australia in patients with solid tumors, including head and neck cancer,

gastrointestinal cancers and other cancers.

In January 2023, we entered into an agreement

with North American Science Associates, LLC, or NAMSA, a world leading MedTech CRO offering global end-to-end development services, to

oversee our planned clinical trials investigating the Hemopurifier for oncology indications. Pursuant to the agreement, NAMSA agreed

to manage our planned clinical trials of the Hemopurifier for patients in the United States and Australia with various types of cancer

tumors. We anticipate that the initial clinical trials will begin in Australia.

In August 2024, the Bellberry Human Research

Ethics Committee granted full ethics approval to the Pindara Private Hospital for a safety, feasibility and dose-finding clinical trial

of the Hemopurifier® in patients with solid tumors who have stable or progressive disease during anti-PD-1 monotherapy treatment

(AEMD-2022-06 Hemopurifier Study). The approval is valid for one year, until August 6, 2025. The trial will be conducted by Dr. Marco

Matos and his staff at the Pindara Private Hospital, located in Queensland, Australia.

In June 2024, the Human Research Ethics Committee

(HREC) of the Central Adelaide Local Health Network (CALHN) granted full ethics approval for the same safety, feasibility and dose-finding

clinical trial of the Hemopurifier in cancer patients with solid tumors who have stable or progressive disease during anti-PD-1 monotherapy

treatment, such as Keytruda® (pembrolizumab) or Opdivo® (nivolumab) (AEMD-2022-06 Hemopurifier Study). The approval is valid

for three years, until June 13, 2027. The trial will be conducted by Prof. Michael Brown and his staff at the Cancer Clinical Trials

Unit, CALHN, Royal Adelaide Hospital, located in Adelaide, Australia.

We also believe the Hemopurifier can be part

of the broad-spectrum treatment of life-threatening highly glycosylated, or carbohydrate coated, viruses that are not addressed with

an already approved treatment. In small-scale or early feasibility human studies, the Hemopurifier has been used in the past to treat

individuals infected with human immunodeficiency virus, or HIV, hepatitis-C and Ebola.

Additionally, in vitro, the Hemopurifier

has been demonstrated to capture Zika virus, Lassa virus, MERS-CoV, cytomegalovirus, Epstein-Barr virus, Herpes simplex virus, Chikungunya

virus, Dengue virus, West Nile virus, smallpox-related viruses, H1N1 swine flu virus, H5N1 bird flu virus, Monkeypox virus and the reconstructed

Spanish flu virus of 1918. In several cases, these studies were conducted in collaboration with leading government or non-government

research institutes.

On June 17, 2020, the FDA approved a supplement

to our open Investigational Device Exemption, or IDE, for the Hemopurifier in viral disease to allow for the testing of the Hemopurifier

in patients with SARS-CoV-2/COVID-19, or COVID-19, in a New Feasibility Study. That study was designed to enroll up to 40 subjects at

up to 20 centers in the United States. Subjects were to have established laboratory diagnosis of COVID-19, be admitted to an intensive

care unit, or ICU, and have acute lung injury and/or severe or life-threatening disease, among other criteria. Endpoints for this study,

in addition to safety, included reduction in circulating virus as well as clinical outcomes (NCT # 04595903). In June 2022, the first