TIDMPEEL

RNS Number : 9886C

Peel Hunt Limited

16 June 2023

The following amendments have been made to the 'Full-Year

Results' announcement released on 16 June 2023 at 7:00 under RNS No

9193C.

-- In the Unaudited Illustrative Statement of Comprehensive

Income table, Dividend for Year ended 31 March 2023 should have

read 'Nil' and not '(1,322)'

All other details remain unchanged.

The full amended text is shown below.

Peel Hunt Limited

Full-Year Results

For the year ended 31 March 2023

Strategic progress in challenging markets

Peel Hunt Limited ("Peel Hunt" or the "Company") together with

its subsidiaries (the "Group") today announces audited results for

the year ended 31 March 2023 ("FY23").

The full-year results for the Group consolidate Peel Hunt

LLP, a limited liability partnership which, up until the IPO

of the Company on 29 September 2021, had a corporate member

and individual members. Profits derived from the partnership

during the year ended 31 March 2022 ('FY22') were allocated

between the members. Profits attributable to the corporate

member were retained within the Group and subject to corporation

tax; profits attributable to individual members (prior to

the IPO) comprised the non-controlling interests, with those

members bearing tax liabilities personally. Following the

IPO, individual members became employees of Peel Hunt LLP

with all future earnings attributable to the Group.

For reference, an unaudited illustrative consolidated statement

of comprehensive income for FY22 is also presented as a prior

year comparative. This statement illustrates the impact that

the reorganisation of the Group's corporate structure, and

the IPO, would have had on the consolidated statement of comprehensive

income had it taken place on or before 31 March 2021. This

illustrative statement retains the actual revenue results

in FY22 and considers the addition of all former members of

Peel Hunt LLP being remunerated as employees along with related

National Insurance contributions and pension costs on an ongoing

basis. The statement has also been adjusted to remove the

impact of one-off costs relating to the IPO, and tax-related

prior year items arising in FY22. Partnership profits that

were allocated to the former individual members in FY22, or

non-controlling interests, are attributed to the Group in

full and are shown as if subject to corporation tax.

Steven Fine, Chief Executive Officer, said:

"The challenges faced by the financial services sector in the

past 12 months have been well documented, with the impact on market

activity and investor sentiment felt across the industry. This can

be seen in our FY23 results.

Despite this backdrop, we have continued to deliver on the

strategic priorities of the organisation, adding FTSE 350 mandates,

building-out our Private Capital Markets capability and

strengthening our M&A/Advisory business. We are also pleased to

be relaunching REX as RetailBook alongside a number of our peers,

and to have received regulatory approval for our EU platform.

Real credit for all of this goes to our people, who have shown

incredible tenacity, working together to stay focused on what

matters most: looking after our clients. I'd like to thank them for

their hard work and continued enthusiasm for our future.

Our distinctive culture and continued technology leadership have

been integral to navigating this turbulence and will remain core to

the long-term future of the firm. Our diversified business model

and cost discipline have helped us maintain a strong balance sheet,

which in turn has allowed us to invest selectively to strengthen

our platform. We remain confident that we will be ready and

well-positioned to capitalise when market activity normalises."

Highlights

-- Revenue and profitability impacted by unusually low capital

markets activity throughout FY23

o Revenue of GBP82.3m (FY22: GBP131.0m) and loss before tax

(LBT) of GBP(1.5)m (FY22: profit before tax (PBT) GBP41.2m)

o Actions taken to rationalise costs, partially mitigating

inflationary cost pressures

-- Business division performance

o Investment Banking revenues were GBP23.4m (FY22: GBP57.9m), 19

new retained corporate clients, including seven in the FTSE 350. We

currently act for 40 FTSE 350 clients, an increase of 37.9% over

the last five years

o Execution Services revenues remain higher than pre-pandemic

levels at GBP33.8m but down year-on-year due to lower market

volumes (FY22: GBP46.1m). Market leading position retained with a

13.3% share of LSE volumes

o A resilient performance in Research and Distribution with

revenues of GBP25.1m (FY22: GBP26.9m) despite the drop in market

activity. Further strengthened our market leading mid-cap North

American and Continental European distribution capabilities, and

continued to build our institutional client base

-- Strategic progress

o Further built out our Private Capital Markets capability and

strengthened our M&A/Advisory business

o Our retail capital markets technology platform REX to relaunch

as RetailBook, a standalone business that will operate

independently of Peel Hunt. Collaboration agreements in place with

Hargreaves Lansdown, Jefferies, Numis and Rothschild & Co

o Regulatory approval received for Peel Hunt Europe to open our

Copenhagen office which is expected to be operational over the

summer

-- Our strong balance sheet allowed us to take advantage of

market dislocation to make selective and targeted investment in

talent in line with the strategy

o Net assets of GBP93.1m and cash balances of GBP27.4m

o Capital base comfortably in excess of minimum regulatory

requirements

-- Well positioned for when market conditions improve with c

onsiderable operational leverage in the business

Outlook

Whilst the macro-economic backdrop may remain challenging for

some time, we have seen a gradual improvement in our M&A

pipeline since the start of FY24, with UK mid-cap valuations

remaining attractive, and are seeing tentative signs of a pick-up

in capital markets activity. We will continue to progress our

strategic priorities whilst prudently managing the business through

this period of downturn. As consolidation amongst UK-focused

investment banking and financial advisory businesses accelerates,

we remain confident that our consistent model of delivering a

joined-up and agile service, providing our clients with trusted and

impartial advice, will position us well to take advantage of

opportunities that may arise.

Key statistics

Financial highlights 2023 2022 Change

-------------------------------- ------------- ------------ --------

Revenue GBP82.3m GBP131.0m (37.2)%

-------------------------------- ------------- ------------ --------

(Loss)/Profit before tax

(1) LBT GBP(1.5)m PBT GBP41.2m (103.6)%

-------------------------------- ------------- ------------ --------

Basic EPS (2) (1.1)p 15.4p (107.1)%

-------------------------------- ------------- ------------ --------

Dividend - 3.1p (100)%

-------------------------------- ------------- ------------ --------

Compensation ratio (3) 58.6% 47.1% 11.5ppts

-------------------------------- ------------- ------------ --------

Operating highlights

-------------------------------- ------------- ------------ --------

Cash GBP27.4m GBP76.7m (64.3)%

-------------------------------- ------------- ------------ --------

Net assets GBP93.1m GBP100.1m (7.0)%

-------------------------------- ------------- ------------ --------

Corporate clients 155 162 (4.3)%

-------------------------------- ------------- ------------ --------

Average market cap of clients GBP690.5m GBP 683.7m 1.0%

-------------------------------- ------------- ------------ --------

Notes:

(1) Illustrative PBT in FY22 was GBP33.1m

(2) Illustrative Basic EPS in FY22 was GBP21.1p

(3) Illustrative Compensation ratio (using illustrative staff

costs) in FY22 was 46.3%.

For further information, please contact:

Peel Hunt : via MHP

Steven Fine, CEO

Sunil Dhall, CFOO

MHP (Financial PR): +44 (0)20 3128 8540

Tim Rowntree

Charlie Barker

Robert Collett-Creedy

peelhunt@mhpgroup.com

Grant Thornton UK LLP (Nominated Adviser) : +44 (0)20 7728

2942

Colin Aaronson

Samuel Littler

Keefe, Bruyette & Woods (Corporate Broker) : +44 (0) 20 7710

7600

Alistair McKay

Alberto Moreno Blasco

Fred Walsh

Akshman Ori

Notes to editors

Peel Hunt is a leading specialist in UK investment banking. Our

purpose is to guide and nurture people through the evolution of

business. We achieve this through a proven, joined-up approach that

consistently delivers value to UK corporates, global institutions

and trading counterparties alike.

Forward-looking statements

This announcement contains forward-looking statements.

Forward-looking statements sometimes use words such as 'may',

'will', 'could', 'seek', 'continue', 'aim', 'anticipate', 'target',

'project', 'expect', 'estimate', 'intend', 'plan', 'goal',

'believe', 'achieve' or other words of similar meaning. Past

performance is no guide to future performance and any

forward-looking statements and forecasts are based on current

expectations and assumptions but relate to events and depend upon

circumstances in the future and you should not place reliance on

them. These statements and forecasts are subject to various risks

and uncertainties and there are a number of factors that could

cause actual results or developments to differ materially from

those expressed or implied by forward-looking statements and

forecasts.

The forward-looking statements contained in this document speak

only as of the date of this announcement and (except as required by

applicable regulations or by law) Peel Hunt does not undertake to

publicly update or review any forward-looking statements, whether

as a result of new information, future events or otherwise.

Nothing in this announcement constitutes or should be construed

as constituting a profit forecast.

No offer of securities

The information, statements and opinions contained in this

announcement do not constitute or form part of, and should not be

construed as, any public offer under any applicable legislation, or

an offer, or solicitation of an offer, to buy or sell any

securities or financial instruments in any jurisdiction, or any

advice or recommendation with respect to any securities or

financial instruments.

BUSINESS REVIEW

Market review

During FY23 we have seen an extraordinary level of market

turmoil, driven by different economic and geopolitical events. The

ongoing war on European soil combined with the fallout from the UK

Government's disastrous mini-budget have contributed to rapidly

rising interest rates, which are now at their highest level for 14

years. This, together with the biggest bank failures since 2008,

has weighed heavily on investor confidence and market volumes in

the UK.

Overall, during the financial year, the FTSE 250 declined 10.6%

and the AIM All-Share 22.3%, although both have staged recoveries

in the second half, from October lows. Nevertheless, capital

markets activity levels have remained exceptionally low throughout

the period and the IPO market has been effectively closed.

Divisional review: Investment Banking

This has been a difficult year for the UK's equity markets, with

very low volumes of activity, particularly around primary issuance.

As a result, Investment Banking revenues in FY23 were down at

GBP23.4m, compared with GBP57.9m in FY22. Overall, we acted on 27

Equity Capital Markets (ECM) transactions over FY23, versus 46 in

FY22. Nonetheless, we worked on a number of successful secondary

fundraising transactions with a total value of GBP829.6m, acted on

a number of high-profile public M&A transactions, and continued

to develop our retail capital markets profile on our own

transactions as well as on third-party transactions, through the

use of REX.

We have always stayed close to our clients and invested

selectively in our business during economic downturns. This year

has been no different. The quality and consistency of our team and

the services they provide, alongside our absolute commitment to

being a trusted adviser to our clients, have helped us win 19 new

retained corporate clients.

A key element of our refined strategy is to evolve the quality

and profitability of our corporate client base, focusing on mid-cap

and growth companies ahead of absolute client numbers. In the

period we added seven FTSE 350 clients. Notwithstanding the drop in

the FTSE 250 over FY23, the average market capitalisation of our

retained corporate clients was GBP690.5m (FY22: GBP684m). Overall,

we ended the year with 155 corporate clients (FY22: 162), including

39 in the FTSE 350, and our income from retainers increased to

GBP8.8m. What sits behind these numbers is the quality and

relevance of the relationships we're developing, and our long-term

approach of supporting our clients through the evolution of

business.

Towards the end of Q4, we saw some pick-up in market activity,

with a number of new mandates and pipeline deals with a higher

M&A weighting. However, it is too early to say what will happen

in practice, and execution risk remains amplified.

A period of sustained subdued capital market activity has given

us the opportunity to spend time focusing internally on building

the business in line with our strategic priorities. Expanding

Investment Banking as part of the joined-up service we offer

clients includes strengthening our capabilities in M&A, Private

Capital Markets, and Debt Advisory. We are really pleased to have

made some key strategic hires in these areas. A particularly

important development is our increasing focus on Private Capital

Markets. We've long been known for our expertise in Equity Capital

Markets, but our services are equally relevant to private

companies.

We're also investing in people at the very start of their

finance career, launching our first graduate scheme, which has

given us the opportunity to target a more diverse pool of

candidates. The scheme has already proved popular, with more than

1,000 applications for four places. Our graduates will join us

later in 2023 and will spend their first 12 months rotating through

a series of roles to help them experience our joined-up

approach.

Technology is one of our firm-wide strategic priorities, and

it's particularly relevant in Investment Banking, where our ability

to digitalise makes life easier, simpler, faster and more efficient

for our clients and ourselves. Our proprietary retail platform,

REX, is an excellent example of this. This year, REX was mandated

on 12 completed transactions of which eight were non-Peel Hunt

deals. We're now taking steps to spin off REX into a standalone

business, RetailBook, which will help expand retail participation

in capital markets.

Meanwhile, our ability to use technology to interrogate data in

a more meaningful way is evolving. The bespoke digital tools and

dashboards developed by our in-house team are adding value to our

Investment Banking service, helping us share emerging trends and

themes with clients more quickly, and speeding up decision-making.

What's also important is how we're embedding digital thinking

within our team. Not everyone needs to be able to create

technology, but we all need to understand what technology can help

us achieve and how it can add value to our clients.

Divisional review: Execution Services

Execution Services had a respectable year despite the extremely

challenging economic climate, generating revenue of GBP33.8m (FY22:

GBP46.1m). Crucially, we retained a leading market position with a

13.3% share of LSE volume, ahead of our pre-pandemic market

share.

Systematic Trading and Investment Trusts performed in-line with

expectations. Fixed Income has outperformed given the greater

trading opportunities in fixed income securities this year. The

capital and funding we've applied to the trading business has

yielded positive returns in difficult markets.

We have not completely avoided the market turbulence, with lower

trading volumes, particularly in small-cap and AIM stocks, but the

revenue we have generated has contributed to the resilience of the

firm overall. This is thanks, in large part, to the experience that

we have built up in our team over several years, and our proactive

approach to diversifying our revenue across a growing number of

trading strategies. From this, we can access incremental,

differentiated pools of liquidity for our clients and

counterparties.

As a result, we've been able to keep demonstrating our ability

to deliver positive returns from low-risk market making across the

cycle. Despite market volatility during the period, our traders

have maintained good risk management discipline, operating within

their risk limits.

Technology is an essential part of our trading capabilities and

risk controls. Thanks to the investments we've made over more than

a decade, our proprietary tools and platforms have helped us retain

a high market share of retail trading and continue building our

overall UK trading volumes. Today, technology is genuinely a

differentiator for our business. But ours is also an increasingly

competitive space, so we have continued to invest in our

proprietary trading intelligence tool, Peel Hunt Automated Trading

(PHAT), to make it more efficient and ensure we continue to provide

fast access to liquidity for our customers and clients. We're

always innovating and giving our traders better tools to manage

risk and trade efficiently.

Divisional review: Research & Distribution

Research & Distribution has had another stable, resilient

year, despite the challenges in the macroeconomic landscape.

Revenue from research payments and execution commissions was down

6.9% to GBP25.1m (FY22: GBP27.0m), reflecting the quality of our

research offering, broad and deep institutional relationships, and

aligned core trading focused on driving liquidity and facilitating

client business in difficult markets.

Although market volumes fell, we saw momentum in new account

openings in both formal research agreements and trading accounts.

We also continued to expand our offering to a wider universe of

hedge funds, sovereign wealth funds, overseas funds and family

offices and private capital market investors. As well as opening up

new commission opportunities, this has further strengthened our ECM

distribution platform.

Today, we have 1,243 relationships with clients who value our

top-rated research, an increase from 1,235 in FY22. Annual sales

interactions this year reached 17,340 (FY22: 16,372).

The experience and consistency of our research, distribution and

core trading teams has always helped us win new corporate clients

and IPO mandates, and these qualities became even more important

this year as we stepped forward to help our clients navigate

challenging markets.

As well as retaining our number one research ranking in the

Institutional Investor's UK Mid and Small-cap survey for the sixth

consecutive year, a record five of our analysts ranked individually

in the top 10 across all sectors. Meanwhile, our US and Continental

European sales teams were also ranked number one for the second

year running.

One of our strategic priorities is to expand our distribution

footprint in the UK and internationally. This will ensure our

corporate clients have in-depth access to all relevant pools of

capital as we become an increasingly key partner for new

institutional clients. We have now received regulatory approval for

our new Copenhagen office, which will allow us to reinstate our

unrestricted, pre-Brexit access to EU institutions.

Meanwhile, our differentiated, low-touch institutional

electronic execution product, developed in conjunction with our

technology team, continues to build momentum. Having completed the

build out, we are now onboarding clients. Our low-touch product is

an increasingly important part of delivering best execution for our

clients.

Technology has also been a big theme for our research team, as

we completed work to roll out our new centralised Research

database. It's already helping us be more efficient, giving our

research analysts new tools to interrogate data and produce more

in-depth reports. We're very much at the start of this process,

exploring the tremendous potential the database has to generate

deeper insights, more quickly, to share with our clients. We also

continued to develop our new portal for investors.

However, perhaps the most exciting development for our digital

approach this year was having a specialist developer embed

themselves in the research team. As a result, we have already

introduced some bespoke, data-led products and are quickly

harnessing the power of artificial intelligence to help our

research and sales teams produce superior content for our clients.

This connection between frontline work across the firm will help

ensure that our accelerating technology investments keep our

clients' needs front and centre, bolstering our role as a trusted

adviser.

Current trading and outlook

The challenging market conditions seen throughout FY23 have

continued into FY24, although we have seen a gradual improvement in

our pipeline since the start of FY24, especially in M&A, and

there are tentative signs of a pick-up in capital markets activity.

Through the remainder of this period of downturn, we will continue

to prudently manage the business, make strategic progress and

position the business for when market activity normalises. The

stability of our platform, our one-firm, joined-up approach and

consistent impartial advice, mean that we are well positioned to

take advantage of opportunities with our clients as market

conditions improve.

FINANCIAL REVIEW

Revenue performance

Our revenue performance was in line with revised market

expectations, albeit down relative to the prior year, influenced by

uncertainty in the global markets, high inflation and rising

interest rates. Nevertheless, our strategy of combining advice,

research, distribution and market share in trading volumes, allied

to our sector specialist approach, remains in demand and will put

us in a good position as market conditions normalise.

Continued targeted investment in our operating divisions, both

in technology and our people, remains important to the long-term

growth of the business.

Revenue comprises the following:

FY23 FY22 %

GBP000 GBP000 change

Investment Banking revenue 23,411 57,948 (59.6)%

------- -------- --------

Research payments and execution

commission(1) 25,116 26,986 (6.9)%

------- -------- --------

Execution Services revenue(1) 33,810 46,112 (26.7)%

------- -------- --------

Total revenue for the year 82,337 131,046 (37.2)%

------- -------- --------

Notes:

(1) We have reclassified GBP3.5m from Research payments and

Execution commission to Execution services revenue to better match

how the business is managed. The effect of the reclassification is

immaterial in the current year.

Revenue for the year was GBP82.3m (FY22: GBP131.0m). Investment

Banking revenue was affected by the uncertain global economic

environment and extreme lows in capital markets activity throughout

FY23. Execution Services revenue remained higher than pre-pandemic

levels, although down year-on-year due to lower market volumes.

Research & Distribution revenue remained resilient, with

research payments and institutional commissions largely consistent

with the previous year, notwithstanding the drop in market

activity.

Investment Banking performance

FY23 FY22 %

GBP000 GBP000 change

Investment Banking fees 14,622 49,643 (70.5)%

-------- ------- --------

Investment Banking retainers 8,789 8,305 5.8%

-------- ------- --------

Total Investment Banking revenue 23,411 57,948 (59.6)%

-------- ------- --------

This year has been a challenging period for UK equity capital

markets with transaction activity at an all-time low, particularly

in terms of primary equity issuance. The downturn has suppressed

client activity and stalled IPO mandates. As a result, our revenue

for the year was down to GBP23.4m, compared with GBP57.9m in

FY22.

During the year we added 19 new retained corporate clients

(including seven in the FTSE 350). At the end of FY23 we had 155

corporate clients (FY22: 162), with an average market

capitalisation of approximately GBP690.5m, including 39 in the FTSE

350. Having added a further FTSE 350 client since the start of

FY24, we now act for 40 FTSE 350 clients.

We have continued to strengthen our private capital markets

capabilities, enabling us to act for both public and private

companies alike. We have also continued to invest in our advisory

business, where we act as retained financial adviser on M&A

transactions.

We continue to receive new mandate enquiries and we have a

number of pipeline deals that we expect to execute when market

conditions permit.

Execution Services performance

FY23 FY22 %

GBP000 GBP000 change

Execution Services revenue 33,810 46,112 (26.7)%

-------- ------- --------

Execution Services revenue was down 26.7% to GBP33.8m, although

our volumes and LSE market share remained above pre-pandemic

levels.

Our Execution Services revenue is diversified across a growing

number of trading strategies as we obtain access to incremental,

differentiated pools of liquidity, extending our ability to provide

liquidity to our clients and counterparties. We continued to

demonstrate our ability to deliver positive returns from low-risk

market making across the cycle, and our traders have maintained

good risk management discipline, operating well within their risk

limits.

During the financial year the FTSE 250 and AIM All-Share

declined 10.6% and 22.3% respectively, and trading volumes remained

much lower across the market as a whole. Despite this backdrop, a

number of our trading books have performed well versus market

drawdowns.

Research & Distribution performance

FY23 FY22 %

GBP000 GBP000 change

Research payments and execution

commission 25,116 26,986 (6.9)%

-------- ------- --------

Research & Distribution returned a resilient revenue

performance of GBP25.1m, representing a 6.9% reduction, compared to

FY22. The effect of reduced market volumes was somewhat offset by

momentum in new account openings, across both formal research

agreements and trading accounts. We expanded our offering to a

wider universe of hedge funds, sovereign wealth funds, overseas

funds and family offices, which have opened up new commission

opportunities.

Our differentiated, low-touch institutional electronic execution

product continues to build momentum, with the technical build-out

now complete and client onboarding ongoing.

Costs and people

FY23 FY22 %

GBP000 GBP000 change

Illustrative staff costs(1) 48,252 60,680 (20.5)%

-------- ------- ---------

Illustrative non-staff costs(1) 34,125 35,665 (4.3)%

-------- ------- ---------

Total illustrative administration

costs(1) 82,377 96,345 (14.5)%

-------- ------- ---------

Illustrative compensation ratio(1) 58.6% 46.3% 12.3ppts

-------- ------- ---------

Actual staff costs(2) 48,252 41,465 16.4%

-------- ------- ---------

Actual non-staff costs 34,125 36,852 (7.4)%

-------- ------- ---------

Total actual administration costs 82,377 78,317 5.2%

-------- ------- ---------

Actual compensation ratio 58.6% 47.1% 11.5ppts

-------- ------- ---------

Period-end headcount 310 309 0.0%

-------- ------- ---------

Average headcount 316 299 5.7%

-------- ------- ---------

Notes:

(1) FY23 are actual financial results; FY22 are illustrative

financial results as outlined in the Unaudited Illustrative

Statement of Comprehensive Income below.

(2) Actual staff costs in FY22 include variable remuneration

costs for employees but not for members

Despite the challenging markets, we are confident in our

strategy, and have continued with our programme of targeted

investment in our strategic priorities.

Actual staff costs in FY23 were higher than FY22, partly due to

the increase in headcount, and partly due to the change in

compensation structure between the periods. In H1 FY22, all former

members of Peel Hunt LLP were remunerated as employees, with

additional National Insurance contributions and pension costs.

Also, at the start of FY22, the firm rebalanced the compensation of

staff between fixed and variable pay. This brought fixed

compensation in line with peer firms in an extremely competitive

market for talent and also prepared us to meet the Investment Firm

Prudential Regulation ('IFPR') remuneration requirements. IFPR

requires that a proportion of variable compensation for certain

staff members must now be paid in shares and deferred over multiple

years.

Illustrative staff costs (including variable remuneration) in

FY23 were lower than FY22, reflecting the reduction in revenue and

the associated reduction in variable remuneration expense. However,

reduced revenue has resulted in an increased illustrative

compensation ratio compared with FY22.

Actual non-staff costs decreased in FY23 largely due to the

corresponding period in FY22 including the costs associated with

the IPO. However, FY23 additional costs related to increased audit

and corporate governance requirements alongside increased interest

rates and inflationary increases, particularly on our large

technology contracts and our continued investment in technology

capabilities. Illustrative non-staff costs are largely consistent

with FY22.

Since the end of FY23, we have taken action to rationalise costs

and we will continue to carefully monitor expenditure in the

context of prevailing market activity/conditions, whilst remaining

focused on our strategic priorities.

Responsible business

Our commitments to diversity and sustainability are shaped by

our board-level ESG Committee. During the period, we have

determined four areas of focus which are important to our

stakeholders and which Peel Hunt can positively impact. These

are:

i. Diversity, equity and inclusion

ii. Carbon reduction

iii. Governance and integrity: We are working to ensure that

sustainability is formally embedded within our risk appetite and

decision-making processes

iv. Building our sustainability capabilities and products: We

want to help our investment bankers and research analysts enhance

their sustainability knowledge so that they can better serve our

clients.

In the spirit of creating measurable steps for delivery, we have

set important targets to reduce our carbon footprint and increase

gender diversity. These include a target of women comprising at

least 40% of employees by 2035, as well as setting targets to

become carbon neutral by 2025, and reach net zero by 2040.

Balance sheet

The Group's net asset position as at 31 March 2023 was GBP93.1m

(31 March 2022: GBP100.1m), representing a decrease of 7.0% from

compared with last year, due to the previous year's dividend

payment, the EBT's acquisition of ordinary shares in the Group to

meet future employee share plan obligations and the loss in the

current financial year.

We have a strong balance sheet following the IPO, and as at 31

March 2023 we maintained GBP101.7m of liquid assets, comprising

cash and settled securities (mainly equities and some government

bonds), which can provide funding to the business at short

notice.

Capital and liquidity

The business maintained a good cash balance at the year-end of

GBP27.4m, having decreased from GBP76.7m as at 31 March 2022. This

is largely due to the settlement of amounts attributable to the

period before the IPO, in addition to investment in the trading

book and payment of the dividend in July 2022. We have now

completed all non-recurring payments due in relation to the period

before the IPO.

Strong liquidity management and controls have remained a focus

during the year, to ensure the resilience of our business. Scenario

and stress testing have always been part of our regular liquidity

and capital analysis, providing clear actions that can be

implemented in severe scenarios.

We continue to operate well in excess of our minimum regulatory

capital requirements with an Own Funds cover over net assets of

555% at the end of FY23, compared to 558% at the end of FY22. The

slight decrease has been due to the reduction in net assets since

FY22 offset by a reduction in risk exposures during FY23.

We repaid long-term debt of GBP6.0m during the year leaving

GBP21.0m of principal outstanding as at 31 March 2023, and we

continue to have access to a GBP30.0m revolving credit facility

('RCF'), which was renewed during the year. Since the year end we

have accelerated repayments of GBP6m further reducing the principal

outstanding to GBP15m as shown in Note 9 to the condensed

consolidated financial statements.

Dividend

The Board is not proposing a dividend for the year.

Unaudited Illustrative Statement of Comprehensive Income

The unaudited illustrative statement of comprehensive income,

set out below, has been prepared for the comparative period to

illustrate the impact that the reorganisation of the Group's

corporate structure, and the IPO, would have had on the

consolidated statement of comprehensive income had it taken place

on or before 31 March 2021. FY23 are actual results whilst FY22 is

prepared on an illustrative basis.

Year ended Year ended

31 March 2023 31 March

2022

Continuing activities Notes GBP'000 GBP'000

------------------------------- ------ -------------- -----------

Revenue 82,337 131,046

Administrative expenses (1) (82,377) (96,345)

(Loss)/profit from operations (40) 34,701

Finance income 692 15

Finance expenses (2,320) (1,664)

Other income 180 56

(Loss)/profit before tax (1,488) 33,108

Tax (2) 166 (7,566)

(Loss)/profit after tax (1,322) 25,542

Dividend (3) - (10,217)

Retained (loss)/profit

for the period (1,322) 15,325

Illustrative performance

metrics

------------------------------- ------ -------------- -----------

Compensation ratio 58.6% 46.3%

Non-staff cost ratio 43.2% 28.4%

(Loss)/profit before tax

margin (1.8)% 25.3%

Notes to the Unaudited Illustrative Statement of Comprehensive

Income

1. Administrative expenses - in FY22 these include the impact of

changes to the compensation structure of the Group, including the

former members of Peel Hunt LLP being remunerated as employees plus

the resulting additional National Insurance contributions and

pension costs. In addition, FY22 excludes one-off costs of GBP4.1m

(GBP1.2m of staff costs relating to the reorganisation of the

Group's corporate structure, and GBP2.9m of non-staff costs

relating to the IPO).

2. Tax - the corporation tax in FY22 includes the effect of the

Group being subject to corporation tax at the standard rate (19%)

on additional profits.

3. Dividend - the dividend in FY22 includes the targeted basic

dividend pay-out ratio of the Group (40%), applied to the profit

after tax for the period.

Reconciliation of Illustrative to Actual Consolidated

Comprehensive Income for FY22 (1)

The impact of Notes (1) to (3) in the unaudited illustrative

statement of comprehensive income on FY22 is summarised below:

Administrative

expenses (2)

Actual Include: Exclude: Exclude: Include: Include: Illustrative

financials revised one-off one-off additional illustrative financials

- FY22 compensation expenses tax charge corporation 40% dividend - FY22

model (3) in respect tax

of prior

years

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Profit before

tax for the

period 41,228 (12,193) 4,073 33,108

---------------- ------------ -------------- ---------- ------------ ------------- -------------- -------------

Tax (5,280) 1,559 (3,845) (7,566)

Profit after

tax 35,948 (12,193) 4,073 1,559 (3,845) 25,542

---------------- ------------ -------------- ---------- ------------ ------------- -------------- -------------

Dividend (10,217) (10,217)

Retained profit

for the period 15,325

---------------- ------------ -------------- ---------- ------------ ------------- -------------- -------------

(1) There is no reconciliation for FY23 as the results remain

the same as the actual financial results.

(2) Administration expenses includes members' remuneration

charged as an expense; this is presented separately from the actual

administration expenses shown in the consolidated statement of

comprehensive income within the financial statements.

(3) Includes National Insurance, pension costs and variable

remuneration related to former members of Peel Hunt LLP.

CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Consolidated Statement of Comprehensive Income

Audited for the year ended 31 March 2023

Year ended Year ended

31 March 31 March

2023 2022

Continuing activities Note GBP'000 GBP'000

-------------------------------- ----- ----------- -----------

Revenue 2 82,337 131,046

Administrative expenses 3 (82,377) (78,317)

(Loss)/profit from operations (40) 52,729

Finance income 4 692 15

Finance expense 4 (2,320) (1,664)

Other income 180 56

-------------------------------- -----

(Loss)/profit before members'

remuneration and tax (1,488) 51,136

Members' remuneration charged

as an expense 3 - (9,908)

(Loss)/profit before tax for

the year (1,488) 41,228

Tax 5 166 (5,280)

(Loss)/profit for the year (1,322) 35,948

Other comprehensive income for

the year - 27

Total comprehensive (expense)

income for the year (1,322) 35,975

-------------------------------- ----- ----------- -----------

Attributable to:

Owners of the Company (1,322) 10,954

Non-controlling interests 6 - 24,994

-------------------------------- ----- ----------- -----------

(Loss)/profit for the year (1,322) 35,948

-------------------------------- ----- ----------- -----------

Attributable to:

Owners of the Company (1,322) 10,981

Non-controlling interests 6 - 24,994

-------------------------------- ----- ----------- -----------

Total comprehensive (expense)

income for the year (1,322) 35,975

-------------------------------- ----- ----------- -----------

(Loss)/earnings per share - attributable

to owners of the Company:

Basic 8 (1.1p) 15.4p

Diluted 8 (1.1p) 15.4p

Consolidated Statement of Financial Position

Audited as at 31 March 2023

As at 31 March As at 31 March

2023 2022

GBP'000 GBP'000

------------------------------- --------------- ---------------

ASSETS

Non-current assets

Property, plant and equipment 8,092 9,341

Intangible assets 1,152 110

Right-of-use assets 15,889 18,219

Deferred tax asset 273 259

Total non-current assets 25,406 27,929

-------------------------------- --------------- ---------------

Current assets

Securities held for trading 54,144 50,341

Market and client debtors 471,504 559,485

Trade and other debtors 15,546 13,200

Cash and cash equivalents 27,410 76,719

-------------------------------- --------------- ---------------

Total current assets 568,604 699,745

-------------------------------- --------------- ---------------

LIABILITIES

Current liabilities

Securities held for trading (32,062) (32,705)

Market and client creditors (421,953) (505,475)

Amounts due to members - (21,837)

Trade and other creditors (4,214) (16,790)

Long-term loan (6,000) (6,000)

Lease liabilities (2,867) (2,544)

Provisions (576) (540)

-------------------------------- --------------- ---------------

Total current liabilities (467,672) (585,891)

-------------------------------- --------------- ---------------

Net current assets 100,932 113,854

-------------------------------- --------------- ---------------

Non-current liabilities

Long-term loan (15,000) (21,000)

Lease liabilities (18,192) (20,649)

Total non-current liabilities (33,192) (41,649)

-------------------------------- --------------- ---------------

Net assets 93,146 100,134

-------------------------------- --------------- ---------------

Consolidated Statement of Financial Position

Audited as at 31 March 2023

As at 31 March As at 31 March

2023 2022

GBP'000 GBP'000

------------------------ --------------- ---------------

EQUITY

Ordinary share capital 40,099 40,099

Other reserves 53,047 60,035

Total equity 93,146 100,134

------------------------- --------------- ---------------

Consolidated Statement of Changes in Equity

Audited for the year ended 31 March 2023

Ordinary Other Total Equity

share Own shares reserves

capital held by

the

Company

Group GBP'000 GBP'000 GBP'000 GBP'000

---------------------------- --------- ------------- -------------------- -------------------

Balance at 1 April

2021 99 (14) 48,285 48,370

Profit for the year - - 10,954 10,954

Other comprehensive

income - - 27 27

Total comprehensive

income - - 10,981 10,981

Transactions with

owners

New shares issued

during the year 40,000 - (2,513) 37,487

(including cost of

issuance)

Gain on option exercise - - 730 730

Sale of Company shares - 14 2,552 2,566

Balance at 31 March

2022 40,099 - 60,035 100,134

----------------------------- --------- ------------- -------------------- -------------------

Loss for the year - - (1,322) (1,322)

Other comprehensive - - - -

income

Total comprehensive

expense - - (1,322) (1,322)

Transactions with

owners

Equity-settled share-based

payments reserve - - 647 647

Purchase of Company

shares - - (2,581) (2,581)

Dividends paid - - (3,732) (3,732)

----------------------------- --------- ------------- -------------------- -------------------

Balance at 31 March

2023 40,099 - 53,047 93,146

----------------------------- --------- ------------- -------------------- -------------------

Consolidated Statement of Cash Flows

Audited for the year ended 31 March 2023

Year ended Year ended

31 March 2023 31 March 2022

Note GBP'000 GBP'000

--------------------------------------- ----- --------------- ---------------

Net cash used in operations 9 (30,899) (68,074)

--------------------------------------- ----- --------------- ---------------

Cash flows from investing activities

Purchase of tangible assets (511) (1,346)

Purchase of intangible assets (1,087) (6)

Disposal of equity investments

not held for trading - 47

Net cash used in investing activities (1,598) (1,305)

--------------------------------------- ----- --------------- ---------------

Cash flows from financing activities

Interest paid (1,382) (732)

Dividends paid (3,732) -

Lease liability payments (3,117) (316)

Proceeds from share issuance - 40,000

(Purchase)/sale of Company shares (2,581) 2,566

Proceeds from option exercise - 730

Share issuance expenses - (2,513)

(Repayment of)/increase in long-term

loan (6,000) 3,000

Net cash (used in)/ generated

from financing activities (16,812) 42,735

--------------------------------------- ----- --------------- ---------------

Net decrease in cash and cash

equivalents (49,309) (26,644)

Cash and cash equivalents at start

of period 76,719 103,363

--------------------------------------- ----- --------------- ---------------

Cash and cash equivalents at

end of period 27,410 76,719

--------------------------------------- ----- --------------- ---------------

NOTES TO THE FINANCIAL STATEMENTS

1. Basis of preparation

Peel Hunt Limited (the Company) (until 21 September 2021, PH

Capital Limited) is a non-cellular company limited by shares having

listed its shares for trading on the Alternative Investment Market

(AIM), a market operated by The London Stock Exchange, on 29

September 2021. The Company is registered in Guernsey. Its

registered office is Ground Floor, Dorey Court, Admiral Park, St

Peter Port, Guernsey GY1 2HT. The consolidated financial statements

of the Company comprises the Company and its subsidiaries, together

referred to as the Group.

The financial information is presented in pounds sterling and

all values are rounded to the nearest thousand (GBP'000), except

where indicated otherwise.

The financial information has been prepared on the historical

cost basis, except for derivatives, financial assets and

liabilities which are valued at fair value through profit and loss

(FVTPL) and fair value through other comprehensive income (FVTOCI).

Historical cost is generally based on the fair value of the

consideration given in exchange for the assets.

Going concern

The Group's principal activities are Investment Banking,

Research & Distribution and Execution Services in UK mid-cap

and growth companies to institutional clients, wealth managers and

private client brokers.

The Directors have assessed the Group's projected business

activities and available financial resources together with a

detailed cash flow forecast for the next 18 months from the date

these financial statements were approved. The Directors have used

base case and severe but plausible scenarios to perform the going

concern assessment.

The base scenario assumes:

-- Long-term sustainable growth of the Group as approved by the

Board in the Group's five-year business plan, including continued

growth in corporate clients

-- Increased interest rates, as well as inflationary pressures on all cost categories

-- Continued strategic investment in the Group, particularly in

relation to technology and execution services

The severe but plausible downside scenario assumes:

-- Worsening of the economic climate from the current historic

low levels, continuing to keep capital market activity low and

trading volumes reduced

-- An operational event occurs reducing profitability and cash

-- Management continue to rationalise costs where possible

The results of the scenario analysis consider the impact on

profitability, cash, liquid assets, regulatory capital and covenant

requirements. The severe but plausible downside scenario also

includes active management of the Group's liquid assets in order to

ensure the Group's ability to repay its long-term loans as

required, which would remove any potential covenant constraints. In

view of the Group's available financial resources, the Directors

believe that the Group is well placed to manage its business risks

successfully.

The Directors are satisfied that the Group has adequate

resources to continue in operational existence for a period of at

least 12 months from the date these financial statements are

approved and for the foreseeable future. The Group has a strong

focus on working capital management to ensure the payment of the

Group's liabilities as they fall due. There is also a focus on

monitoring the regulatory capital resource and requirements of Peel

Hunt LLP and the UK regulatory group to ensure that all regulatory

capital and liquidity requirements and covenant requirements are

met.

Accordingly, the Directors continue to adopt the going concern

basis in preparing the financial statements for the year ended 31

March 2023.

The new standards or amendments to IFRS that became effective

and were adopted by the Group during the year had no material

effect on the financial statements.

2. Revenue

Year ended Year ended

31 Mar 2023 31 Mar 2022

GBP'000 GBP'000

Restated

--------------------------------------- ------------- -------------

Research payments and execution

commission 25,116 26,986

Execution Services revenue 33,810 46,112

Investment Banking fees and retainers 23,411 57,948

---------------------------------------- ------------- -------------

Total revenue for the period 82,337 131,046

======================================== ============= =============

We have reclassified GBP3.5m from Research payments and

Execution commission to Execution services revenue in the prior

year to better match how the business is managed. The effect of the

reclassification is immaterial in the current year.

3. Staff costs

Year ended Year ended

31 Mar 2023 31 Mar 2022

-------------------------------------

GBP'000 GBP'000

------------------------------------- ------------- -------------

Wages and salaries 39,946 33,179

Social security costs 5,597 6,051

Pensions costs 2,623 1,473

Other costs 86 762

-------------------------------------- ------------- -------------

Total staff costs for the period 48,252 41,465

Members' remuneration charged as an

expense - 9,908

Total staff costs and members'

remuneration charged as an expense

for the period 48,252 51,373

====================================== ============= =============

The average number of employees and members of the Group during

the period has increased to 316 (31 March 2022: 299).

4. Net finance expense

Year ended Year ended

31 Mar 2023 31 Mar 2022

------------------------------------

GBP'000 GBP'000

------------------------------------ ------------- -------------

Finance income

Bank interest received 692 15

Finance expense

Bank interest paid (52) (72)

Interest on lease liabilities (938) (934)

Interest accrued on long-term

loan (1,330) (658)

-------------------------------------

Finance expense for the period (2,320) (1,664)

------------------------------------- ------------- -------------

Net finance expense for the period (1,628) (1,649)

===================================== ============= =============

5. Tax charge

The Group tax charge in the year ended 31 March 2023 includes a

credit of GBP0.2m relating to tax charges in respect of prior

years.

6. Non-controlling interest

The non-controlling interest in the prior year relates to the

former individual members of Peel Hunt LLP; these amounts are

included in amounts due to members on the Consolidated Statement of

Financial Position.

7. Statement of Financial Position items

(a) Property, plant and equipment

Property, plant and equipment is stated at cost less accumulated

depreciation and impairment losses. Depreciation is charged to the

income statement on a straight-line basis over the estimated useful

economic lives of each item.

(b) Intangible assets

Intangible assets represent internally generated intangible

assets, computer software and sports debentures. Amortisation is

charged to the income statement on a straight-line basis over the

estimated useful economic lives of each item. Internally generated

intangible assets are amortised over three years, computer software

is amortised over five years and sports debentures are amortised

over the life of the ticket rights.

Internally generated intangible assets comprises capitalised

development costs for certain technology developments for key

projects in the Group. The expenditure incurred in the research

phase of these internal projects is expensed. Intangible assets are

recognised from the development phase if and only if certain

specific criteria are met in order to demonstrate the asset will

generate probable future economic benefits and that its costs can

be reliably measured. Amortisation begins when the asset is

available for use.

(c) Right-of-use asset and lease liabilities

The right-of-use asset and lease liabilities (current and

non-current) represent the two property leases that the Group

currently uses for its offices in London and New York.

(d) Market and client debtors and creditors

The market and client debtor and creditor balances represent

unsettled sold securities transactions and unsettled purchased

securities transactions, which are recognised on a trade date

basis. The majority of open bargains were settled in the ordinary

course of business (trade date plus two days). Market and client

debtor and creditor balances in these financial statements include

agreed counterparty netting of GBP11.9m (31 March 2022:

GBP17.4m).

(e) Financial instruments

Financial assets and financial liabilities are recognised in the

statement of financial position when the Group becomes a party to

the contractual provisions of the financial instrument. The type of

financial instruments held by the Group at 31 March 2023 and 31

March 2022 are consistent with those held at prior year end. The

majority of financial instruments are classified as 'Level 1', with

quoted prices in active markets.

(f) Stock borrowing collateral

The Group enters into stock borrowing agreements with a number

of institutions on a collateralised basis. Under such agreements,

securities are purchased with a commitment to return them at a

future date and price. The securities purchased are not recognised

on the statement of financial position. The cash advanced is

recorded on the statement of financial position as cash collateral

within trade and other debtors, the value of which is not

significantly different from the value of the securities purchased.

The total value of cash collateral held on the statement of

financial position is GBP2.4m (31 March 2022: GBP2.8m).

(g) Long-term loans

During the year the Group repaid GBP6m of the outstanding Senior

Facilities Agreement. The balance outstanding at year end is GBP21m

(31 March 2022: GBP27m).

8. (Loss)/earnings per share

Year ended Year ended

31 March 2023 31 March 2022

------------------------------------- =============== ================

Basic weighted average number

of ordinary shares in issue during

the year 119,197,519 71,231,123

Dilutive effect of share option

grants 1,605,000 259,971

====================================== =============== ================

Diluted weighted average number

of ordinary shares in issue during

the year 120,802,519 71,491,093

====================================== =============== ================

Basic (loss)/earnings per share is calculated on total

comprehensive (loss)/income for the year, attributable to the

owners of the Company, of GBP(1.3m) (31 March 2022: GBP11.0m) and

119,197,519 (31 March 2022: 71,231,123) ordinary shares, being the

weighted average number of ordinary shares in issue during the

year. Diluted earnings per share is calculated after adjusting for

the number of options expected to be exercised from the share

option grants.

The Company has 1,605,000 (31 March 2022: 259,971) of dilutive

equity instruments outstanding as at 31 March 2023.

9. Post balance sheet event

Since the year end the Company has accelerated GBP6m of

principal repayments of the Senior Facilities Agreement (SFA) (see

Note 7(g) - Long-term loans), reducing the outstanding balance to

GBP15m. As a result, GBP3m of scheduled principal repayments in

each of September 2023 and March 2024 are no longer due. The

accelerated repayments are estimated to save approximately GBP0.3m

of interest expense throughout the year ending 31 March 2024. The

available Revolving Credit Facility (RCF) remains at GBP30m and the

interest rates applicable to both the SFA and RCF remain unchanged.

Alongside the accelerated repayments, the Company has negotiated a

temporary reduction in its interest cover covenant up to, and

including, 31 December 2023.

10. Reconciliation of (loss)/profit before tax to cash from operating activities

Year ended Year ended

31 March 2023 31 March 2022

----------------------------------------

GBP'000 GBP'000

---------------------------------------- ----------------------------------- ------------------------------------

(Loss)/profit before tax for

the period (1,488) 41,228

Adjustments for:

Depreciation and amortisation 4, 251 4,154

Impairment loss on loans and receivables 277 244

Fair value gain on sale of securities

not held for trading _ 27

Increase in provisions 37 109

Foreign exchange movement on deferred

tax asset - (8)

Equity settled share-based payments 647 -

- IFRS 2 charge

Revaluation of Right-of-use asset

and Lease liability (71) (52)

Net finance costs 1,628 1,649

Change in working capital:

Increase in net securities held for

trading (4,446) (4,068)

Decrease in net market and client

debtors 4,458 12,373

Increase in trade and other debtors (2,339) (4,017)

Decrease in net amounts due to

members (21,837) (116,565)

(Decrease)/increase in trade and other

creditors (12,572) 3,001

----------------------------------------- ----------------------------------- ------------------------------------

Cash used in operations (31,455) (61,925)

----------------------------------------- ----------------------------------- ------------------------------------

Interest received 692 15

Corporation tax paid (136) (6,164)

Net cash used in operations (30,899) (68,074)

========================================= =================================== ====================================

END

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR GZGMVRVGGFZG

(END) Dow Jones Newswires

June 16, 2023 04:05 ET (08:05 GMT)

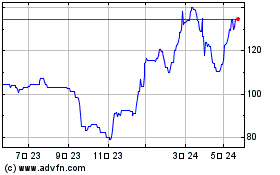

Peel Hunt (LSE:PEEL)

過去 株価チャート

から 4 2024 まで 5 2024

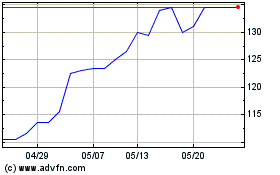

Peel Hunt (LSE:PEEL)

過去 株価チャート

から 5 2023 まで 5 2024