FDJ Announces the Successful Placement of Its Inaugural Bond Issue for €1.5 Billion to Refinance Kindred's Acquisition

2024年11月18日 - 3:30PM

ビジネスワイヤ(英語)

Regulatory News:

La Française des Jeux (FDJ) (Paris:FDJ), one of Europe's leading

betting and gaming operators, has announced that it has

successfully placed an inaugural three-tranche bond issue for an

amount of €1.5 billion maturing in 6 years, 9 years and 12

years:

- €500 million of bonds maturing on 21 November 2030, with an

annual coupon of 3.000%.

- €500 million of bonds maturing on 21 November 2033, with an

annual coupon of 3.375%.

- €500 million of bonds maturing on 21 November 2036, with an

annual coupon of 3.625%.

These new bonds will be rated Baa1 by Moody's in line with the

Group's long-term rating of Baa1 - stable outlook.

This is FDJ's first bond issue, with proceeds to be used to

refinance most of the €2 billion credit line implemented as part of

the Group's acquisition of Kindred.

This issue follows the Group's marketing campaign directed at

French and international bond investors. Final demand exceeded €7

billion, from more than two hundred top-tier investors on each

tranche, thus a transaction oversubscribed nearly 5 times,

reflecting their confidence in the Group's strategy and credit

profile.

BNP Paribas, Crédit Agricole CIB and Société Générale acted as

global coordinators for the transaction, alongside BofA Securities,

Crédit Industriel et Commercial, HSBC, Goldman Sachs Bank Europe SE

and Natixis as active bookrunners.

Furthermore, FDJ has finalised a €400 million syndicated loan

with top-tier French and international banks, which will be repaid

over 5 years. This financing is also intended to repay the bridging

loan which will be settled with Group’s cash.

About FDJ Group

FDJ Group is one of Europe's leading betting and gaming

operators, with a vast portfolio of iconic brands and a reputation

for technological excellence. With almost 6,000 employees and a

presence in around 15 regulated markets in Europe, the Group offers

a diversified, responsible range of games, both under exclusive

rights and open to competition: lottery games in France and

Ireland, via an extensive point-of-sale network and online; sports

betting at points of sale in France; and online games open to

competition (sports and horse-race betting, poker and online casino

games, in markets where these activities are authorised). The FDJ

Group has placed responsibility at the heart of its strategy and

promotes recreational betting. FDJ Group is listed on the regulated

market of Euronext Paris (Compartment A – FDJ.PA) and is part of

the SBF 120, Euronext 100, Euronext Vigeo 20, EN EZ ESG L 80, STOXX

Europe 600, MSCI Europe and FTSE Euro indices.

For more information, visit www.groupefdj.com

@FDJ FDJ @FDJ_official @FDJ

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241117572674/en/

Media Contact 01 41 10 33 82 |

servicedepresse@lfdj.com

Investor Relations Contact 01 41 04 19 74 |

invest@lfdj.com

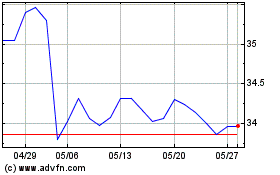

Francaise Des Jeux (EU:FDJ)

過去 株価チャート

から 12 2024 まで 1 2025

Francaise Des Jeux (EU:FDJ)

過去 株価チャート

から 1 2024 まで 1 2025