Is Chainlink (LINK) Sliding To $9? On-Chain Metrics Expose Weak Network Activity

2024年9月5日 - 3:30AM

NEWSBTC

Chainlink (LINK) is at a crucial level after a sharp 22% retrace

from recent local highs, sparking concern among investors and

analysts. The recent downturn is compounded by unsettling on-chain

data that suggests Chainlink’s network activity may weaken, adding

to the uncertainty surrounding the asset. This decline in activity,

coupled with broader market volatility, has heightened fears of

further losses. Related Reading: Chainlink (LINK) Could Drop

To $8 If It Loses Current Support: On-Chain Data Reveals If the

current bearish sentiment persists, LINK will likely test the next

significant demand level around the lower $9 mark. This level is

critical for determining the asset’s short-term future. A break

below could signal deeper declines, while a successful defense

might provide a foundation for recovery. Investors are closely

watching these developments, as the coming days will be pivotal for

Chainlink’s price direction and overall market sentiment. Chainlink

Driven By Low Network Activity Chainlink (LINK) has recently faced

significant selling pressure driven by more than just market

speculation. A decline in network activity also plays a crucial

role in the ongoing bearish trend. According to key data from

Santiment, the price-Daily Active Addresses (DAA) divergence

currently stands at -56.35%. This negative divergence suggests a

disconnect between Chainlink’s price and user engagement, signaling

potential trouble. The DAA metric is vital for understanding

whether network activity supports price movements. Generally, when

active addresses, which measure user participation on a blockchain,

increase with the price, it indicates strong underlying demand. It

can suggest that the cryptocurrency is poised for higher values. On

the other hand, if network activity rises while the price declines,

it often presents a buying opportunity, signaling that the market

may soon reverse. Related Reading: Can Avalanche (AVAX) Reclaim

$30? Top Analyst Predicts A Dip Before A Bounce However, the

current decrease in DAA for Chainlink paints a less optimistic

picture. This drop indicates that user engagement isn’t supporting

recent price action, a typically bearish factor. An increase in

network activity is essential for LINK to see any meaningful

consolidation and potential recovery. Without a corresponding rise

in DAA, the cryptocurrency may struggle to break free from its

current downtrend. Investors are closely monitoring this metric, as

a continued decline in network activity could lead to further

downward pressure on Chainlink’s price, possibly pushing it toward

lower support levels. LINK’s $9 Lifeline Chainlink (LINK) is

currently trading at $10.24, following a dip below the August 16

low of $9.92. LINK quickly recovered after briefly touching $9.84,

signaling demand at this level. However, despite this bounce, LINK

remains below the 4-hour 200 moving average (MA), a critical

technical indicator currently at $10.80. Analysts see this MA as a

key level, and a successful move above it could indicate a shift in

momentum, potentially pushing LINK toward the next resistance at

around $11.50. Conversely, if LINK fails to hold its current

position and slips further, a deeper correction could drag the

price to sub-$9 levels. This would signal continued bearish

pressure, with traders and investors closely monitoring the price.

LINK’s ability to reclaim the 200 MA or break below its recent lows

will be crucial in determining its next significant move. Related

Reading: Toncoin (TON) Price Action Signals 30% Crash After Losing

A Key Level Featured image from Dall-E, chart from TradingView

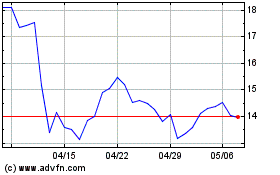

ChainLink Token (COIN:LINKUSD)

過去 株価チャート

から 3 2025 まで 4 2025

ChainLink Token (COIN:LINKUSD)

過去 株価チャート

から 4 2024 まで 4 2025