MakerDAO Initiates Massive $600 Million DAI Investment In USDe And sUSDe

2024年4月3日 - 6:00AM

NEWSBTC

Decentralized Finance (DeFi) protocol MakerDAO is considering

allocating 600 million DAI stablecoins to the USDe and staked USDe

(sUSDe) protocols through the DeFi lending platform Morpho Labs.

The proposed allocation aims to improve risk management and

maximize user incentives in the DeFi landscape. MakerDAO Sets

Maximum 600 Million DAI Allocation The Spark DAI Vault, launched in

2023 as a lending platform, experienced strong demand soon after

its launch, according to MakerDAO’s announcement on the protocol’s

governance forum. Related Reading: Tether Buys 8,888 Bitcoin

For $618 Million, But Why Is Price Down? Given the desire to keep

liquidity risk at an acceptable level, MakerDAO proposes a greater

allocation of DAI to the USDe pools, which can be immediately

redeemed via Ethena (ENA), a synthetic dollar protocol developed on

the Ethereum blockchain. This reallocation also allows Ethena

to retain a larger revenue share for their insurance fund,

potentially improving the overall risk profile of MakerDAO’s Ethena

allocation. Furthermore, MakerDAO recommends focusing future

allocations on the 86% and 91.5% Loan-To-Liquidity-Value (LLTV)

pools, which have shown “higher efficiency” regarding borrow rates

and user demand. While lower LLTV pools, such as the 77% and 94.5%

pools, will continue to receive allocations, they will be

proportionally lower than the two primary pools. To mitigate

potential insolvency risks and ensure a favorable risk-reward

ratio, MakerDAO limits the total allocation to 600 million DAI.

However, the Dividend Debt Mechanism (DDM) line parameter is set at

1 billion DAI to provide flexibility for future increases if

constraints change. In addition, MakerDAO recommends marginally

increasing the funds deployed in the 77% and 94.5% pools to 10

million DAI each to ensure sufficient pool size for “efficient

management of positions” and the calibration of interest rate

models. The recently unveiled Ethena points program for Season 2

introduces a $500 million cap on total eligible collateral for

incentives on Morpho. If demand for DAI borrowing through the vault

declines after this threshold is reached, the protocol states that

Multisig can reduce allocations below $600 million to maintain a

balanced supply/demand dynamic and align with expected collateral

returns. MKR Surges To Near Three-Year High MakerDAO’s native

token, MKR, hit a nearly three-year high of $4,074 on Sunday, which

is 40% below its current all-time high (ATH) of $6,292 in May 2023.

The token has pulled back nearly 2% and is currently trading at

$3,717. It is consolidating above its next support level of $3,640.

Despite the retracement, MKR still boasts significant gains over

longer time frames. It has posted a 25% gain over the past fourteen

days and an impressive 80% gain over the past thirty days.

Related Reading: Solana Price Could Explode By 80% If This Happens:

Crypto Analyst Demand for MKR tokens is evident as trading volume

has increased to $274,659,607 over the past 24 hours, a substantial

40% increase from just one day ago, according to CoinGecko data. In

addition, MKR’s market capitalization has seen a remarkable

increase of nearly 100% over the past month. Starting in

March with a market cap of $1.8 billion, as of the most recent

update on April 2nd, the market cap stands at $3.46 billion. This

significant increase underscores the high level of interest in the

MakerDAO protocol and its native token. Featured image from

Shutterstock, chart from TradingView.com

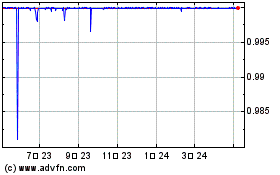

Dai Stablecoin (COIN:DAIUSD)

過去 株価チャート

から 3 2025 まで 4 2025

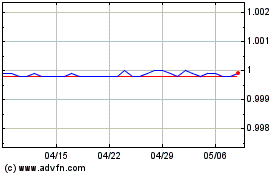

Dai Stablecoin (COIN:DAIUSD)

過去 株価チャート

から 4 2024 まで 4 2025