Dogecoin Buy Signal Hints At Upside As Funding Rate Keeps Rising

2024年10月15日 - 2:00AM

NEWSBTC

Dogecoin tests a critical liquidity area of around $0.112 after

days of choppy price action. While the broader crypto market, led

by Bitcoin, is experiencing a notable rise from yearly lows, driven

by positive economic data and improving sentiment, Dogecoin has yet

to catch up. Other altcoins and meme coins have surged, but DOGE

remains in consolidation. Related Reading: Analyst Forecasts XRP

Bullish Breakout – A 1,000% Opportunity? Analysts and investors are

closely watching for a signal that could confirm a further uptrend

for Dogecoin. The funding rate indicates rising demand, which could

support a potential price increase. Top analyst and investor Ali

has shared an intriguing buy signal for DOGE, suggesting that gains

may be on the horizon. As the market sentiment shifts, traders

closely monitor whether Dogecoin will follow the broader crypto

trend and break out of its current range in the coming days.

Dogecoin Price Is Set To Rise Dogecoin is currently at a crucial

level that will determine its price action, as DOGE has struggled

to hold above this area since early August. Speculation around

DOGE’s performance in the coming months is optimistic, yet Dogecoin

must catch up with the gains other meme coins deliver to

investors. Prominent analyst Ali has shared a technical chart

on X, showing a buy signal for Dogecoin on the 4-hour price chart.

This signal is significant because it appears in a shorter

timeframe and often indicates a larger trend shift in the daily

timeframe, suggesting a potential upside in the coming days. If

this signal plays out, it could begin a stronger upward movement

for DOGE. Supporting this optimistic outlook, key data from

Coinglass reveals that the OI-weighted funding rate for Dogecoin is

rising. A positive funding rate in cryptocurrency markets indicates

that the price of perpetual futures contracts is higher than the

spot price of the underlying asset. This means long positions are

becoming more dominant, and long traders pay short traders a

positive funding rate. This dynamic reflects increased demand for

DOGE and hints at potential gains ahead. Related Reading: Solana

Prepares For A 20% Rally – Can SOL Reclaim $176? If Dogecoin can

maintain strength above this critical level, it may finally follow

the broader market’s uptrend. However, Dogecoin risks further

consolidation or a potential drop if it fails to break above and

sustain higher levels. For now, investors are watching closely,

waiting for a confirmed move that could lead to significant gains

for DOGE. DOGE Testing Supply: Breakout Soon? Dogecoin (DOGE)

currently trades at $0.112 after several days of sideways trading

below the daily 200 exponential moving average (EMA), which sits at

$0.116. This level has acted as a key resistance, and breaking

above DOGE must gain momentum. If the price manages to recover the

1D 200 EMA and push past the $0.13 mark, it could signal the start

of a significant rally for Dogecoin. Such a move would likely

reignite investor interest and attract new buying demand,

potentially driving higher prices. However, if Dogecoin fails to

hold above the $0.11 level and continues to struggle with the 1D

200 EMA, a deeper correction could be on the horizon. In that

scenario, DOGE may retrace to lower demand areas around $0.09,

where buyers might step in to prevent further downside. Related

Reading: Active Dogecoin Addresses Reach Highest Level In 8 Months

– Is DOGE About To Rally? For now, Dogecoin’s price action remains

in a tight range, and traders are watching closely to see if it can

reclaim these critical levels or if a larger pullback is in store.

The next few days will be essential in determining the future

direction of DOGE’s price. Featured image from Dall-E, chart from

TradingView

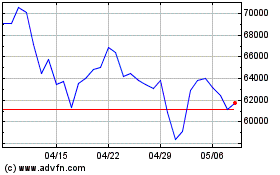

Bitcoin (COIN:BTCUSD)

過去 株価チャート

から 10 2024 まで 11 2024

Bitcoin (COIN:BTCUSD)

過去 株価チャート

から 11 2023 まで 11 2024