Bitcoin Price Forecast: Trump Win Could Boost BTC To $125,000, Standard Chartered

2024年9月13日 - 7:30AM

NEWSBTC

Geoff Kendrick, the Head of Crypto Research at Standard Chartered

Bank, has put forth bullish predictions regarding the Bitcoin price

trajectory in the event of the 2024 US presidential election.

Bitcoin Price Predictions Soar According to a CNBC report, Kendrick

posits that a potential re-election of Donald Trump could propel

Bitcoin to a staggering $125,000 mark. However, he also indicates

that Bitcoin is poised to reach new all-time highs regardless of

the election outcome, with an anticipated value of $75,000 if Vice

President Kamala Harris secures the presidency. Elaborating on the

election’s implications on the cryptocurrency landscape, Kendrick

highlights that while the political scenario will undoubtedly

influence the Bitcoin market, the perceived risks associated with a

Harris presidency might be exaggerated. Related Reading:

Challenges Mount For Bitcoin Miners As Difficulty Surges To Record

High According to Kendrick’s analysis, the Bitcoin price is

projected to conclude 2024 at record highs under either election

scenario, nearing the $125,000 threshold under a Trump victory or

hovering around $75,000 in a Harris administration. In the

wake of a potential Harris win. However, an initial price dip could

occur, Kendrick asserts that market participants would likely view

such declines as buying opportunities, given the expectation of

continued regulatory advancements. Contrary to industry

apprehensions regarding Harris potentially adopting a stringent

stance towards Bitcoin, Kendrick contends that her administration

would likely exhibit a more favorable outlook towards digital

assets than a potential second term under President Biden.

Moreover, Standard Chartered remains optimistic about the Bitcoin

price future, maintaining a bullish stance by forecasting a surge

to $200,000 by the conclusion of 2025, irrespective of the election

outcome this year. Potential Q4 Rally For BTC Evaluating the

current state of the Bitcoin market, crypto analyst Daan Crypto

Trades shed light on BTC’s historical performance trends in

September. Despite the general observation that Bitcoin tends

to face challenges in September, Daan assesses that whether at the

beginning of a bullish trend, in the later stages of previous

market cycles, or even in a bearish phase, September typically

marks a local bottom followed by a subsequent up move in the fourth

quarter. Recently, Bitcoin encountered two significant downturns,

notably on August 5, when it dropped nearly 25%, causing the price

to plummet to as low as $49,000. Subsequently, another

retracement occurred on September 6, pushing the price to $52,000.

However, amidst these fluctuations, Bitcoin has shown resilience by

trading at $58,360, indicating strong support along the macro

uptrend line. Related Reading: Shiba Inu Accumulation: Whales Pull

Out $4 Million From Exchanges, Can SHIB Recover? Moreover, Daan

Crypto Trades emphasizes that a considerable portion of BTC’s

liquidity remains at higher levels. This observation aligns with

the price effectively clearing out historical levels from

approximately the past six months during the sharp decline

witnessed in early August. Highlighting a pivotal level to monitor,

the analyst underscores the significance of surpassing the $65,000

mark. Breaking this level would signify the formation of a local

higher high, potentially paving the way towards targeting the

liquidity at $70,000. Featured image from DALL-E, chart from

TradingView.com

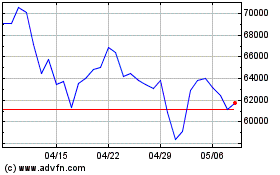

Bitcoin (COIN:BTCUSD)

過去 株価チャート

から 10 2024 まで 11 2024

Bitcoin (COIN:BTCUSD)

過去 株価チャート

から 11 2023 まで 11 2024