Voxtur Announces Issuance of Shares to Settle Debt with a Former Executive

2024年6月12日 - 5:00AM

Voxtur Analytics Corp. (TSXV: VXTR; OTCQB: VXTRF)

(“

Voxtur” or the “

Company”), a

North American technology company creating a more transparent and

accessible real estate lending ecosystem, announces that it intends

to issue (the “

Issuance”) 987,487 common shares in

the capital of the Company (“

Common Shares”) at a

deemed price of US$0.0769 (C$0.1044) per share, to settle the

balance of a bonus owed to a former executive of the Company in the

amount of US$75,931 (C$103,130) (the “

Debt”).

The Issuance is considered to be a

shares-for-debt transaction pursuant to the policies of the TSX

Venture Exchange (the “TSXV”) and remains subject

to TSXV approval. The Common Shares to be issued pursuant to the

transaction will be subject to a hold period of four (4) months and

one (1) day from the date of issuance.

About Voxtur

Voxtur is a transformational real estate

technology company that is redefining industry standards in a

dynamic lending environment. The Company offers targeted data

analytics to simplify the multifaceted aspects of the lending

lifecycle for investors, lenders, government agencies and

servicers. Voxtur's proprietary data hub and workflow platforms

more accurately and efficiently value assets, originate and service

loans, and securitize portfolios. As an independent and transparent

mortgage technology provider, the Company offers primary and

secondary market solutions in the United States and Canada. For

more information, visit www.voxtur.com.

Neither TSXV nor its Regulation Services

Provider (as that term is defined in the policies of the TSXV)

accepts responsibility for the adequacy or accuracy of this

release.

Forward-Looking Information

This news release contains forward-looking

statements and forward-looking information (collectively,

“forward-looking information”). Any information

contained herein that is not based on historical facts may be

deemed to constitute forward-looking information within the meaning

of Canadian and United States securities laws. Forward-looking

information may be based on expectations, estimates and projections

as at the date of this news release, and may be identified by the

words “may”, “would”, “could”, “should”, “will”, “intend”, “plan”,

“anticipate”, “believe”, “estimate”, “expect” or similar

expressions. Forward-looking information may include, but is not

limited to: the completion of the Issuance; approval of the

Issuance by the TSXV; expectations for the effects of certain

milestones or the ability of the Company to successfully achieve

certain business objectives; the effects of unexpected costs,

liabilities or delays; success of software activities; regulatory

approval; the competition for skilled personnel; expectations for

other economic, business, environmental, regulatory and/or

competitive factors related to the Company, or the real estate

industry generally; anticipated future production costs; and other

events or conditions that may occur in the future. Investors are

cautioned that forward-looking information is not based on

historical facts but instead reflects estimates or projections

concerning future results or events based on the opinions,

assumptions and estimates of management considered reasonable at

the date the information is provided. Although the Company believes

that the expectations reflected in such forward-looking information

are reasonable, such information involves risks and uncertainties,

and undue reliance should not be placed on such information, as

unknown or unpredictable factors could have material adverse

effects on future results, performance, or achievements of the

Company. Among the key factors that could cause actual results to

differ materially from those projected in the forward-looking

information include but are not limited to: additional costs

related to acquisitions; ; integration of acquired businesses;

implementation of new products; changing global financial

conditions, especially in light of the COVID-19 global pandemic;

reliance on specific key employees and customers to maintain

business operations; competition within the Company's industry; a

risk in technological failure or failure to implement technological

upgrades in accordance with expected timelines; changing market

conditions; failure of governing agencies and regulatory bodies to

approve the use of products and services developed by the Company;

the Company’s dependence on maintaining intellectual property and

protecting newly developed intellectual property; operating losses

and negative cash flows; and currency fluctuations. Accordingly,

readers should not place undue reliance on forward-looking

information contained herein.

This forward-looking information is provided as

of the date of this news release and, accordingly, is subject to

change after such date. The Company does not assume any obligation

to update or revise this information to reflect new events or

circumstances except as required in accordance with applicable

laws.

Voxtur's common shares are traded on the TSX

Venture Exchange under the symbol VXTR and in the US on the OTCQB

under the symbol VXTRF.

Contact: Jordan RossChief Investment Officer

Tel: (416) 708-9764 jordan@voxtur.com

For media inquiries:

Jacob GaffneyTel: (817)

471-7627jacob@gaffneyaustin.com

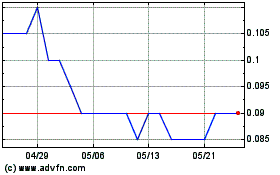

Voxtur Analytics (TSXV:VXTR)

過去 株価チャート

から 11 2024 まで 12 2024

Voxtur Analytics (TSXV:VXTR)

過去 株価チャート

から 12 2023 まで 12 2024