Following today’s joint announcement with Nouveau Monde Graphite

Inc. (NYSE: NMG) (TSX-V: NOU) titled: “Nouveau Monde and Mason

Graphite Announce Strategic Investment and Conditional Option and

Joint Venture Agreement on Lac Guéret Project”, Mason Graphite Inc.

(“

Mason Graphite” or the “Company") (TSX-V: LLG)

(OTCQX: MGPHF) is pleased to provide a corporate update on its

subsidiary, Black Swan Graphene Inc. (“

Black Swan

Graphene”). Highlights include:

- The completion

of the subscription receipt financing pursuant to its listing

process (the “RTO Transaction”) with Dragonfly

Capital Corp., for gross proceeds of approximately $7.0 million,

which was upsized from $5.0 million due to high demand, providing

for a pro forma valuation of Mason Graphite’s investment in Black

Swan Graphene of approximately $17.7 million;

- The execution of

a multi-year Master Distributorship Agreement with Gerdau Grafeno

Ltda (“Gerdau Graphene”), a wholly owned

subsidiary of Gerdau S. A. focused on the development of chemical

additives, mineral additives and masterbatches with graphene, which

will buy products from Black Swan Graphene in order to market,

promote and resell in the Americas Region;

- The execution of

a non-binding letter of intent with Nouveau Monde Graphite Inc.,

whereby Black Swan Graphene would agree to establish graphene

production capacity within Nouveau Monde’s graphite processing

plant, which has a design throughput of 3.5 tonnes of ore per hour

(tph), the equivalent nameplate production capacity of

approximately 1,000 tonnes of graphite concentrate per annum, using

NMG’s ore grading an average of 4.5% graphitic carbon, in

Saint-Michel-des-Saints, Québec, Canada, in order to create a

fully-integrated producing facility from graphite ore, through

graphite concentrate, and to graphene finished products. This

proposed agreement falls within the proposed joint venture to be

formed between Mason Graphite and Nouveau Monde; see the joint

press release issued by Mason Graphite and Nouveau Monde;

- The execution of

a binding collaboration agreement with a key equipment supplier,

which includes commercial details and minimum commitments for the

procurement of long-lead items required for large scale production

of graphene;

- The grant by the

Chinese Authorities of a Certificate of Invention Patent to Black

Swan Graphene for apparatus and method for bulk production of

atomically thin 2-dimentional materials including graphene,

increasing the portfolio of patents and patent applications to 20

in 9 countries;

- The execution of

a Membership Agreement with the Graphene Engineering Innovation

Center (“GEIC”) of the University of Manchester, a

world-class centre which promotes, assists and carries out applied

research, commercialisation, and manufacture of graphene.

- The launch of a

new website which includes a Corporate Video, which is expected to

be used in different industry events, and to support general

awareness of Black Swan Graphene: www.blackswangraphene.com;

- The appointment

of Mr. Michael Edwards as Black Swan Graphene’s Chief Operating

Officer (“COO”). Mr. Edwards joins Black Swan Graphene from Thomas

Swan & Co. Ltd., where he was the head of the Advanced

Materials Division, where the company’s graphene processing

technology was originally developed;

- The appointment

of Mr. Henri Wilhelm, as Black Swan Graphene’s Vice-President

Technology. Mr. Wilhelm has more than 15 years of experience in

R&D and development of graphite-based products for energy

storage applications, including with Imerys Graphite & Carbon

and SGL; and

- The appointment

of Mr. Aidan Sullivan, as Black Swan Graphene’s Vice-President

Strategic Initiatives; Mr. Sullivan has more than 15 years of

corporate experience and brings to Black Swan Graphene a vast

network of international relationships.

Simon Marcotte, President and Chief Executive

Officer of Black Swan Graphene, stated: “We couldn’t be more

excited to see Black Swan Graphene progress so rapidly since its

inception and the investment made by Mason Graphite in latter half

of 2021. The idea that we now have a clear path towards commercial

production and a distribution partner is a testament of how

burgeoning the graphene industry has become. I would also like to

welcome Michael, Henri and Aiden to Black Swan.”

Master Distributorship Agreement with

Gerdau Graphene

Gerdau Graphene will collaborate with Black Swan

Graphene in order to introduce graphene products and accelerate the

adoption of graphene in different industrial applications in the

Americas market, including concrete and polymers where Gerdau

Graphene will serve as a value-add distributor, working with its

customers in the integration of the graphene products, and support

the development of existing and new applications. Black Swan

Graphene will support Gerdau Graphene with its know-how, product

optimization and dispersion capabilities in different materials and

polymer matrixes, as well as commercialization capacity.

Mr. Alexandre de Toledo Corrêa, General Manager

for Gerdau Graphene, commented: “We are very excited about the

growing opportunities of the graphene industry in the Americas. We

are proud to establish this partnership with Black Swan Graphene

which has demonstrated good product quality and availability, as

well as know-how and technical expertise on graphene

development.”

Completion of a $7 Million Subscription

Receipt Financing

Due to high demand, the subscription receipt

financing recently announced was upsized from $5 million to

approximately $7 million. This capital is in addition to the cash

currently held by Black Graphene of approximately $4.4 million.

Assuming the closing of the RTO Transaction and the exchange of the

subscription receipts for common shares of Black Swan Graphene,

Black Swan Graphene is expected to have approximately $11.4 million

in cash, which is sufficient to accomplish its business objectives

beyond the next 24 months. Based on the value of the RTO

Transaction, the shares of Black Swan Graphene owned by Mason

Graphite have a pro forma valuation of approximately $17.7

million.

Non-Binding Letter of Intent with

Nouveau Monde Graphite

Nouveau Monde and Black Swan Graphene have

entered into a non-binding letter of intent, whereby Black Swan

Graphene would establish its graphene processing technology in

Nouveau Monde’s graphite concentrate production facility, resulting

in a fully integrated production supply chain from graphite ore in

the ground, through graphite concentrate, and to graphene finished

products. This facility also has laboratory, process control, and

quality assurance capabilities, which Black Swan Graphene will be

able to share and benefit from for its own commercialization and

distribution.

In September 2018, Nouveau Monde commissioned

its graphite concentrate production facility in

Saint-Michael-des-Saints, Québec, Canada, which has a nameplate

production capacity of approximately 1,000 tonnes of graphite

concentrate per annum which is the key feedstock for the graphene

processing technology of Black Swan Graphene. Nouveau Monde has

invested approximately $30 million in this facility thus far.

Binding Collaboration Agreement with a

Key Equipment Supplier

Black Swan Graphene has executed a Collaboration

Agreement with a key European equipment manufacturer, which

includes commercial details and minimum commitments for the

procurement of key items necessary for large scale graphene

manufacturing based on the graphene processing technology of Black

Swan. The agreement also establishes parameters restricting the

apparatus manufacturer from selling such equipment for the purpose

of graphene and 2-D materials production.

Grant of a Certificate of Invention

Patent by the Chinese Authorities

After examination of this invention application,

in accordance with the Patent Law of the People’s Republic of

China, the authorities have decided to grant a patent and issue a

certificate (certificate number: 4904683; Announcement No.:

CN108137328B) to the invention and register the same in the patent

rolls. The term of this patent is twenty years from the application

date. This increases Black Swan Graphene’s patent portfolio to 20

patents and patent applications in 9 countries, namely the United

Kingdom, the United States, Canada, Germany, Italy, Spain, France

Sweden and China.

Membership agreement with the Graphene

Engineering Innovation Center

Black Swan Graphene will now have a formal

presence at the Graphene Engineering Innovation Center (“GEIC”).

The GEIC specialises in the rapid development and scale-up of

graphene and other 2D materials applications. It is an industry-led

innovation centre, designed to work in collaboration with industry

partners to create, test and optimise new concepts for delivery to

market, along with the processes required for scale up and supply

chain integration. With a dedicated team of experienced Application

Managers, Application Specialists, Technicians and the Business

Engagement team, the GEIC can react as quickly as industry

requires. The tier-2 membership model allows us to work on short

feasibility projects, through to a long-term strategic partnership

with multiple projects in different application areas.

About Mason Graphite

Inc.

Mason Graphite is a Canadian corporation focused

on the production and transformation of natural graphite. Its

strategy includes the development of value-added products, notably

for green technologies like transport electrification. The Company

also owns 100% of the rights to the Lac Guéret graphite deposit,

one of the richest in the world. The Company is also the largest

shareholder of Black Swan Graphene.

About Black Swan Graphene

Inc.

Black Swan Graphene is a Canadian private

company focusing on the large-scale production and

commercialization of patented high-performance and low-cost

graphene products aimed at several industrial sectors, including

concrete, polymers, Li-ion batteries, and others, which are

expected to require large volumes of graphene and, in turn, require

large volumes of graphite. Black Swan Graphene aims to leverage the

low cost and green hydroelectricity of the Province of Québec as

well as the proximity of the eventual production sites of Mason

Graphite in order to establish a fully integrated supply chain,

reduce overall costs, and accelerate the deployment of graphene

usage.

About Gerdau Graphene

Gerdau Graphene is wholly owned subsidiary of

Gerdau S. A., one of the largest steel producers in the Americas.

In 2021, Gerdau Graphene was launched as a company focused on the

production, development and commercialization of chemical

additives, mineral additives, and masterbatches enhanced with

graphene. The company is based in Brazil and operates in the

American continent, generating key value for its customers by

capturing properties from carbon nanomaterials and incorporating

them in commercial solutions of scale.

About Nouveau Monde Graphite

Inc.

Nouveau Monde is striving to become a key

contributor to the sustainable energy revolution. The company is

working toward developing a fully integrated source of

carbon-neutral battery anode material in Quebec, Canada, for the

growing lithium-ion and fuel cell markets. With low-cost operations

and enviable environmental, social and governance (ESG) standards,

Nouveau Monde aspires to become a strategic supplier to the world's

leading battery and automobile manufacturers, providing

high-performing and reliable advanced materials while promoting

sustainability and supply chain traceability. Nouveau Monde is

listed on the NYSE under the symbol “NMG” and on the TSX Venture

Exchange under the symbol “NOU”.

About Dragonfly Capital

Corp.

Dragonfly Capital Corp. is a Capital Pool

Company as defined by the policies of the TSX Venture Exchange. The

Company’s principal business activity is to identify and evaluate

opportunities for acquisition of assets or business. The Company is

headquartered in Vancouver, British Columbia.

For more

information: www.masongraphite.com

Mason Graphite Inc. on behalf of the Board of

Directors:

“Peter Damouni”, Executive Director

Mason Graphite Inc.

Paul Hardy at info@masongraphite.com or +1 514

289-3580

Head Office: 3030, boulevard Le Carrefour, Suite

600, Laval, Québec, Canada, H7T 2P5

Cautionary Statements

This press release contains “forward-looking

information” within the meaning of Canadian securities legislation.

All information contained herein that is not clearly historical in

nature may constitute forward-looking information. Generally, such

forward-looking information can be identified by the use of

forward-looking terminology such as “plans”, “expects” or “does not

expect”, “is expected”, “budget”, “scheduled”, “estimates”,

“forecasts”, “intends”, “anticipates” or “does not anticipate”, or

“believes”, or variations of such words and phrases or state that

certain actions, events or results “may”, “could”, “would”, “might”

or “will be taken”, “occur” or “be achieved”. Forward-looking

information is subject to known and unknown risks, uncertainties

and other factors that may cause the actual results, level of

activity, performance or achievements of the Company to be

materially different from those expressed or implied by such

forward-looking information, including but not limited to: (i)

volatile stock price; (ii) the general global markets and economic

conditions; (iii) the possibility of write-downs and impairments;

(iv) the risk associated with exploration, development and

operations of mineral deposits; (v) the risk associated with

establishing title to mineral properties and assets; (vi) the risks

associated with entering into joint ventures; (vii) fluctuations in

commodity prices; (viii) the risks associated with uninsurable

risks arising during the course of exploration, development and

production; (ix) competition faced by the resulting issuer in

securing experienced personnel and financing; (x) access to

adequate infrastructure to support mining, processing, development

and exploration activities; (xi) the risks associated with changes

in the mining regulatory regime governing the resulting issuer;

(xii) the risks associated with the various environmental

regulations the resulting issuer is subject to; (xiii) risks

related to regulatory and permitting delays; (xiv) risks related to

potential conflicts of interest; (xv) the reliance on key

personnel; (xvi) liquidity risks; (xvii) the risk of potential

dilution through the issuance of common shares; (xviii) the Company

does not anticipate declaring dividends in the near term; (xix) the

risk of litigation; (xx) risk management, (xxi) risks related to

the RTO Transaction, including that the RTO Transaction may not be

completed as contemplated, (xxii) risks related to the holding of

the shares of Black Swan Graphene and the pro forma valuation

assigned to such shares, including that such shares may be subject

to the general business risks of the company and volatility, and

(xxiii) risks related to the non-binding nature of the letter of

intent between Black Swan Graphene and Nouveau Monde, including

that such letter of intent may not result in a definitive

agreement.

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

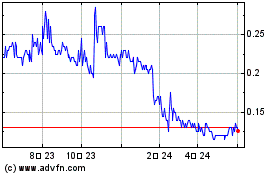

Mason Resources (TSXV:LLG)

過去 株価チャート

から 10 2024 まで 11 2024

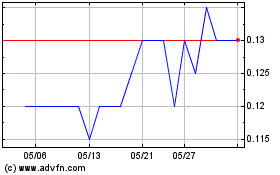

Mason Resources (TSXV:LLG)

過去 株価チャート

から 11 2023 まで 11 2024