Artemis Gold Inc. (TSX-V: ARTG) ("

Artemis" or the

"

Company") is pleased to announce that it has

entered into an agreement with a syndicate of underwriters co-led

by National Bank Financial and BMO Capital Markets (collectively,

the "

Underwriters") under which the Underwriters

have agreed to buy on bought deal basis 16,394,000 common shares

(the "

Common Shares"), at a price of $6.10 per

Common Share (the “

Offering Price”) for gross

proceeds of approximately $100,003,400 (the "

Bought Deal

Offering").

The Company is also undertaking a non-brokered

private placement (the “Non-Brokered Offering” and

together with the Bought Deal Offering, the

“Offering”) whereby up to 9,200,000 Common Shares

will be issued to insiders of the Company and to a president’s

list, at the Offering Price, for gross proceeds of up to

$56,120,000.

The Common Shares issuable under the Bought Deal

Offering will be offered pursuant to a prospectus supplement (the

“Supplement”) to the Company's base shelf

prospectus dated January 12, 2021. The terms of the Bought Deal

Offering will be described in the Supplement which will be filed

with the securities regulators in each of the provinces and

territories of Canada, other than Québec, and the Common Shares may

also be offered by way of private placement in the United

States.

In respect of the Bought Deal Offering, the

Company has granted the Underwriters an option, exercisable at the

Offering Price for a period of 30 days following the closing of the

Offering, to purchase up to an additional 15% of the Bought Deal

Offering to cover over-allotments, if any.

The Bought Deal Offering is expected to close on

May 19, 2021 and the Non-Brokered Offering is expected to close on

or before May 31, 2021. The closing of the Offering is subject to

certain conditions, including but not limited to, the Company

receiving the approval of the TSX Venture Exchange.

The net proceeds of the Offering will be used to

make its final cash acquisition payment to New Gold Inc. pursuant

to an Asset Purchase Agreement dated June 9, 2020 between Artemis

and New Gold Inc., fund permitting and development costs for the

Company’s Blackwater Gold Project and for general corporate

purposes.

The Common Shares offered have not been

registered under the U.S. Securities Act of 1933, as amended, and

may not be offered or sold in the United States absent registration

or an applicable exemption from the registration requirements. This

press release shall not constitute an offer to sell or the

solicitation of an offer to buy nor shall there be any sale of the

Common Shares in any jurisdiction in which such offer, solicitation

or sale would be unlawful.

ARTEMIS GOLD INC.On behalf of the Board of

Directors

“Steven Dean”Chairman and Chief Executive

Officer

For further information: Chris Batalha, CFO

and Corporate Secretary, +1 (604) 558-1107.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

Cautionary Note Regarding

Forward-Looking Information

This news release contains certain "forward

looking statements" and certain "forward-looking information" as

defined under applicable Canadian and U.S. securities laws

(together, “forward-looking statements”).

Forward-looking statements can generally be identified by the use

of forward-looking terminology such as "may", "will", "expect",

"intend", "estimate", "anticipate", "believe", "continue", "plans",

"potential" or similar terminology. Forward-looking statements in

this news release include, but are not limited to, statements and

information related to the closing of the Offering, the ability of

the Company to satisfy the conditions and close the Offering; the

terms of the Offering, including the size of the Offering, and

ability of the Company to complete the Offering; the use of

proceeds from the Offering; and other statements regarding future

plans, expectations, guidance, projections, objectives, estimates

and forecasts, as well as statements as to management's

expectations with respect to such matters.

Forward-looking statements and information are

not historical facts and are made as of the date of this news

release. These forward-looking statements involve numerous risks

and uncertainties and actual results may vary. Important factors

that may cause actual results to vary include without limitation,

risks related to the ability of the Company to satisfy the

conditions of the Offering and close the Offering; the ability of

the Company to accomplish its plans and objectives with respect to

the Blackwater Gold Project within the expected timing or at all;

the timing and receipt of certain approvals, changes in commodity

and power prices, changes in interest and currency exchange rates,

risks inherent in exploration estimates and results, timing and

success, inaccurate geological and metallurgical assumptions

(including with respect to the size, grade and recoverability of

mineral reserves and resources), changes in development or mining

plans due to changes in logistical, technical or other factors,

unanticipated operational difficulties (including failure of plant,

equipment or processes to operate in accordance with

specifications, cost escalation, unavailability of materials,

equipment and third party contractors, delays in the receipt of

government approvals, industrial disturbances or other job action,

and unanticipated events related to health, safety and

environmental matters), political risk, social unrest, and changes

in general economic conditions or conditions in the financial

markets. In making the forward-looking statements in this news

release, the Company has applied several material assumptions,

including without limitation, the assumptions that: (1) the Company

will be able to complete the Offering on the expected timing; (2)

the Company will be able to obtain all necessary approvals required

in connection with the Offering; (3) market fundamentals will

result in sustained mineral demand and prices; (4) the receipt of

any necessary approvals and consents in connection with the

development of any properties; (5) the availability of financing on

suitable terms for the development, construction and continued

operation of any mineral properties; and (6) sustained commodity

prices such that any properties put into operation remain

economically viable. The actual results or performance by the

Company could differ materially from those expressed in, or implied

by, any forward-looking statements relating to those matters.

Accordingly, no assurances can be given that any of the events

anticipated by the forward-looking statements will transpire or

occur, or if any of them do so, what impact they will have on the

Offering, results of operations or financial condition of the

Company. Except as required by law, the Company is under no

obligation, and expressly disclaim any obligation, to update, alter

or otherwise revise any forward-looking statement, whether written

or oral, that may be made from time to time, whether as a result of

new information, future events or otherwise, except as may be

required under applicable securities laws.

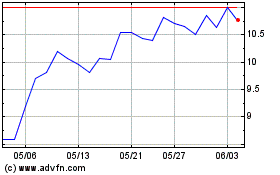

Artemis Gold (TSXV:ARTG)

過去 株価チャート

から 11 2024 まで 12 2024

Artemis Gold (TSXV:ARTG)

過去 株価チャート

から 12 2023 まで 12 2024