Molson Coors Beverage Company Announces Pricing of its Public Offering of Euro-Denominated Senior Notes

2024年5月23日 - 8:35AM

ビジネスワイヤ(英語)

Molson Coors Beverage Company (“Molson Coors” or the “Company”)

(NYSE: TAP, TAP.A, TAP 24; TSX: TPX.A, TPX.B) announced today that

it has priced its previously announced public offering (the

“Offering”) of €800,000,000 aggregate principal amount of its

3.800% Senior Notes due 2032 (the “Notes”). The Offering is

expected to close on or about May 29, 2024, subject to customary

closing conditions.

After deducting underwriting discounts and estimated Offering

expenses, Molson Coors expects to receive net proceeds from the

Offering of approximately €793.5 million. Molson Coors intends to

use the net proceeds of this Offering for general corporate

purposes including the repayment of the €800.0 million notes issued

on July 7, 2016 upon maturity in July 2024.

Citigroup Global Markets Limited, BofA Securities, Goldman Sachs

& Co. LLC, Bank of Montreal, London Branch, J.P. Morgan

Securities plc, RBC Europe Limited and Scotiabank (Ireland)

Designated Activity Company are acting as joint book-running

managers for the Offering.

The Offering is being made pursuant to an effective shelf

registration statement (including a prospectus) (File No.

333-277183) filed with the Securities and Exchange Commission

(“SEC”), which became effective upon filing. A preliminary

prospectus supplement related to the Offering was filed with the

SEC on May 22, 2024 and is available on the SEC’s website at

www.sec.gov. A final prospectus supplement related to the Offering

will be filed with the SEC. A copy of the prospectus and related

preliminary prospectus supplement for the offering may be obtained

by contacting: Citigroup Global Markets Limited by mail at

Citigroup Centre, Canada Square, Canary Wharf, London E14 5LB,

United Kingdom or by telephone at 1-800-831-9146; BofA Securities

by mail at 2 King Edward Street, London, EC1A 1HQ, United Kingdom

or by telephone at 1-800-294-1322; Goldman Sachs & Co. LLC by

mail at Prospectus Department, 200 West Street, New York, NY 10282,

by telephone at 1-866-471-2526, by facsimile at 212-902-9316 or by

email at Prospectus-ny@ny.email.gs.com.

This press release is for informational purposes only and does

not constitute an offer to sell, or a solicitation of an offer to

buy, any of the Notes or any other security, nor shall there be any

sale of the Notes or any other security in any state or

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of such state or other jurisdiction.

Overview of Molson Coors

For more than two centuries, Molson Coors Beverage Company has

been brewing beverages that unite people to celebrate all life’s

moments. From our core power brands Coors Light, Miller Lite, Coors

Banquet, Molson Canadian, Carling and Ožujsko to our above premium

brands including Madri, Staropramen, Blue Moon Belgian White and

Leinenkugel’s Summer Shandy, to our economy and value brands like

Miller High Life and Keystone, we produce many beloved and iconic

beer brands. While our Company's history is rooted in beer, we

offer a modern portfolio that expands beyond the beer aisle as

well, including flavored beverages like Vizzy Hard Seltzer, spirits

like Five Trail whiskey as well as non-alcoholic beverages.

Forward-Looking

Statements

This press release includes “forward-looking statements” within

the meaning of the U.S. federal securities laws. Such statements

include, without limitation, the Molson Coors’ plans and intentions

regarding the Offering and the use of proceeds from the Offering.

Such forward-looking statements are subject to certain risks,

uncertainties and assumptions, including, without limitation,

prevailing market conditions and other factors. Should one or more

of these risks or uncertainties materialize, or should underlying

assumptions prove incorrect, actual results may vary materially

from those expected. More information about potential risk factors

that could affect Molson Coors and its results is included in

Molson Coors’s filings with the SEC, including our most recent

Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q,

which are available at www.sec.gov. All forward-looking statements

in this press release are expressly qualified by such cautionary

statements and by reference to the underlying assumptions. You

should not place undue reliance on forward-looking statements,

which speak only as of the date they are made. Molson Coors does

not undertake to update forward-looking statements, whether as a

result of new information, future events or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240522341487/en/

News Media Rachel Dickens

(314) 452-9673 Investor

Relations Greg Tierney (414) 931-3303 Traci Mangini

(415) 308-0151

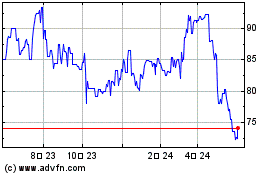

Molson Coors Canada (TSX:TPX.B)

過去 株価チャート

から 12 2024 まで 1 2025

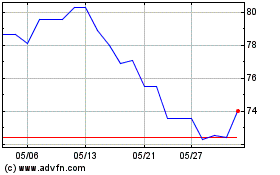

Molson Coors Canada (TSX:TPX.B)

過去 株価チャート

から 1 2024 まで 1 2025