UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13G

Under the Securities Exchange Act of 1934

(Amendment No. 2)*

| ATRenew

Inc. |

| (Name

of Issuer) |

| |

| Class A

ordinary shares, par value US$0.001 per share |

| (Title

of Class of Securities) |

| |

| 00138L108** |

| (CUSIP

Number) |

| |

| September 30,

2024 |

| (Date

of Event Which Requires Filing of this Statement) |

Check the appropriate box to designate the rule pursuant to which

this Schedule is filed:

| ¨ |

Rule 13d-1(b) |

| ¨ |

Rule 13d-1(c) |

| x |

Rule 13d-1(d) |

* The remainder of this cover page shall

be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any

subsequent amendment containing information which would alter the disclosures provided in a prior cover page.

** There is no CUSIP number assigned to the Class A

ordinary shares, par value US$0.001 per share (“Ordinary Shares”). CUSIP number 00138L108 has been assigned to the American

Depositary Shares (each an “ADS”) of ATRenew Inc. (the “Issuer”), which are quoted on the New York Stock Exchange

under the symbol “RERE.” Every three ADSs represents two Class A Ordinary Shares.

The information required in the remainder of

this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act

of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions

of the Act (however, see the Notes).

CUSIP No. 00138L108

| 1. |

Names

of Reporting Persons. |

| |

I.R.S. Identification Nos. of above persons

(entities only). |

| |

|

| |

TMT

General Partner Ltd. |

| 2. |

Check the Appropriate Box if a Member of

a Group (See Instructions) |

| |

|

(a) ¨ |

| |

|

(b) ¨ |

| 3. |

SEC Use Only |

| |

|

| 4. |

Citizenship or Place of Organization |

| |

|

| |

Cayman

Islands |

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With: |

5. |

Sole Voting Power |

| |

2 |

| 6. |

Shared Voting Power |

| |

0 |

| 7. |

Sole Dispositive Power |

| |

2 |

| 8. |

Shared Dispositive Power |

| |

0 |

| 9. |

Aggregate

Amount Beneficially Owned by Each Reporting Person |

| |

|

| |

2(1) |

| 10. |

Check if the Aggregate Amount in Row (9) Excludes

Certain Shares |

| |

|

| |

|

¨ |

| 11. |

Percent of Class Represented by Amount

in Row (9) |

| |

|

| |

0%(2) |

| 12. |

Type of Reporting Person (See Instructions) |

| |

|

| |

CO |

(1) Morningside China TMT Fund II, L.P.

and Morningside China TMT Top Up Fund, L.P. are the record owner of 1 Class A Ordinary Shares and the record owner of 1 Class A

Ordinary Share, respectively. Both Morningside China TMT Fund II, L.P. and Morningside China TMT Top Up Fund, L.P. are controlled by

their general partner, Morningside China TMT GP II, L.P., which, in turn, is controlled by its general partner, TMT General Partner Ltd.

TMT General Partner Ltd. is controlled by its board of directors which consists of three individuals, namely Jianming Shi, Qin Liu, and

Gerald Lokchung Chan. These directors have the voting and dispositive powers over the shares held by Morningside China TMT Fund II, L.P.

and Morningside China TMT Top Up Fund, L.P.

(2) The ownership percentage of the Reporting

Person is calculated based on a total of 87,795,879 Class A Ordinary Shares (excluding 2,084,384

Class A Ordinary Shares issued to depositary bank for the purpose of bulk issuance, 6,820,217 Class A Ordinary Shares underlying

ADSs repurchased by the Issuer and 5,420,246 treasury shares) as of February 29, 2024, as disclosed by the Issuer to the

Reporting Person.

CUSIP No. 00138L108

| 1. |

Names

of Reporting Persons. |

| |

I.R.S. Identification Nos. of above persons

(entities only). |

| |

|

| |

Morningside

China TMT GP II, L.P. |

| 2. |

Check the Appropriate Box if a Member of

a Group (See Instructions) |

| |

|

(a) ¨ |

| |

|

(b) ¨ |

| 3. |

SEC Use Only |

| |

|

| 4. |

Citizenship or Place of Organization |

| |

|

| |

Cayman

Islands |

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With: |

5. |

Sole Voting Power |

| |

2 |

| 6. |

Shared Voting Power |

| |

0 |

| 7. |

Sole Dispositive Power |

| |

2 |

| 8. |

Shared Dispositive Power |

| |

0 |

| 9. |

Aggregate

Amount Beneficially Owned by Each Reporting Person |

| |

|

| |

2(3) |

| 10. |

Check if the Aggregate Amount in Row (9) Excludes

Certain Shares |

| |

|

| |

|

¨ |

| 11. |

Percent of Class Represented by Amount

in Row (9) |

| |

|

| |

0%(4) |

| 12. |

Type of Reporting Person (See Instructions) |

| |

|

| |

PN |

(3) Morningside China TMT Fund II, L.P.

and Morningside China TMT Top Up Fund, L.P. are the record owner of 1 Class A Ordinary Shares and the record owner of 1 Class A

Ordinary Share, respectively. Both Morningside China TMT Fund II, L.P. and Morningside China TMT Top Up Fund, L.P. are controlled by

their general partner, Morningside China TMT GP II, L.P.

(4) The ownership percentage of the Reporting

Person is calculated based on a total of 87,795,879 Class A Ordinary Shares (excluding 2,084,384 Class A Ordinary Shares issued

to depositary bank for the purpose of bulk issuance, 6,820,217 Class A Ordinary Shares underlying ADSs repurchased by the Issuer

and 5,420,246 treasury shares) as of February 29, 2024, as disclosed by the Issuer

to the Reporting Person.

CUSIP No. 00138L108

| 1. |

Names

of Reporting Persons. |

| |

I.R.S. Identification Nos. of above persons

(entities only). |

| |

|

| |

Morningside

China TMT Fund II, L.P. |

| 2. |

Check the Appropriate Box if a Member of

a Group (See Instructions) |

| |

|

(a) ¨ |

| |

|

(b) ¨ |

| 3. |

SEC Use Only |

| |

|

| 4. |

Citizenship or Place of Organization |

| |

|

| |

Cayman

Islands |

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With: |

5. |

Sole Voting Power |

| |

1 |

| 6. |

Shared Voting Power |

| |

0 |

| 7. |

Sole Dispositive Power |

| |

1 |

| 8. |

Shared Dispositive Power |

| |

0 |

| 9. |

Aggregate

Amount Beneficially Owned by Each Reporting Person |

| |

|

| |

1 |

| 10. |

Check

if the Aggregate Amount in Row (9) Excludes Certain Shares

|

| |

|

¨ |

| 11. |

Percent

of Class Represented by Amount in Row (9) |

| |

|

| |

0%(5) |

| 12. |

Type

of Reporting Person (See Instructions) |

| |

|

| |

PN |

(5) The ownership percentage of the Reporting

Person is calculated based on a total of 87,795,879 Class A Ordinary Shares (excluding 2,084,384

Class A Ordinary Shares issued to depositary bank for the purpose of bulk issuance, 6,820,217 Class A Ordinary Shares underlying

ADSs repurchased by the Issuer and 5,420,246 treasury shares) as of February 29, 2024, as disclosed by the Issuer to the

Reporting Person.

CUSIP No. 00138L108

| 1. |

Names

of Reporting Persons. |

| |

I.R.S. Identification Nos. of above persons

(entities only). |

| |

|

| |

Morningside

China TMT Top Up Fund, L.P. |

| 2. |

Check the Appropriate Box if a Member of

a Group (See Instructions) |

| |

|

(a) ¨ |

| |

|

(b) ¨ |

| 3. |

SEC Use Only |

| |

|

| 4. |

Citizenship or Place of Organization |

| |

|

| |

Cayman

Islands |

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With: |

5. |

Sole Voting Power |

| |

1 |

| 6. |

Shared Voting Power |

| |

0 |

| 7. |

Sole Dispositive Power |

| |

1 |

| 8. |

Shared Dispositive Power |

| |

0 |

| 9. |

Aggregate Amount Beneficially Owned by

Each Reporting Person |

| |

|

| |

1 |

| 10. |

Check if the Aggregate Amount in Row (9) Excludes

Certain Shares |

| |

|

| |

|

¨ |

| 11. |

Percent of Class Represented by Amount

in Row (9) |

| |

|

| |

0%(6) |

| 12. |

Type of Reporting Person (See Instructions) |

| |

|

| |

PN |

(6) The ownership percentage of the Reporting

Person is calculated based on a total of 87,795,879 Class A Ordinary Shares (excluding 2,084,384

Class A Ordinary Shares issued to depositary bank for the purpose of bulk issuance, 6,820,217 Class A Ordinary Shares underlying

ADSs repurchased by the Issuer and 5,420,246 treasury shares) as of February 29, 2024, as disclosed by the Issuer to the

Reporting Person.

CUSIP No. 00138L108

| 1. |

Names

of Reporting Persons. |

| |

I.R.S. Identification Nos. of above persons

(entities only). |

| |

|

| |

Shanghai

Xingpan Investment Management Consulting Co., Ltd. |

| 2. |

Check the Appropriate Box if a Member of

a Group (See Instructions) |

| |

|

(a) ¨ |

| |

|

(b) ¨ |

| 3. |

SEC Use Only |

| |

|

| 4. |

Citizenship or Place of Organization |

| |

|

| |

People’s

Republic of China |

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With: |

5. |

Sole Voting Power |

| |

1 |

| 6. |

Shared Voting Power |

| |

0 |

| 7. |

Sole Dispositive Power |

| |

1 |

| 8. |

Shared Dispositive Power |

| |

0 |

| 9. |

Aggregate

Amount Beneficially Owned by Each Reporting Person |

| |

|

| |

1(7) |

| 10. |

Check if the Aggregate Amount in Row (9) Excludes

Certain Shares

|

| |

|

¨ |

| 11. |

Percent of Class Represented by Amount

in Row (9) |

| |

|

| |

0%(8) |

| 12. |

Type of Reporting Person (See Instructions) |

| |

|

| |

CO |

(7) Shanghai Chenxi Venture Capital Center

(Limited Partnership) is the record owner of 1 Class A Ordinary Shares. Shanghai Chenxi Venture Capital Center (Limited Partnership)

is controlled by Shanghai Xingpan Investment Management Consulting Co., Ltd., its fund manager. Shanghai Xingpan Investment Management

Consulting Co., Ltd. is controlled by an investment committee consisting of three individuals, namely Qin Liu, Jianming Shi and

Ye Yuan, who have the voting and dispositive powers over the shares held by Shanghai Chenxi Venture Capital Center (Limited Partnership).

(8) The ownership percentage of the Reporting

Person is calculated based on a total of 87,795,879 Class A Ordinary Shares (excluding 2,084,384

Class A Ordinary Shares issued to depositary bank for the purpose of bulk issuance, 6,820,217 Class A Ordinary Shares underlying

ADSs repurchased by the Issuer and 5,420,246 treasury shares) as of February 29, 2024, as disclosed by the Issuer to the

Reporting Person.

CUSIP No. 00138L108

| 1. |

Names

of Reporting Persons. |

| |

I.R.S. Identification Nos. of above persons

(entities only). |

| |

|

| |

Shanghai Chenxi

Venture Capital Center (Limited Partnership) |

| 2. |

Check the Appropriate Box if a Member of

a Group (See Instructions) |

| |

|

(a) ¨ |

| |

|

(b) ¨ |

| 3. |

SEC Use Only |

| |

|

| 4. |

Citizenship or Place of Organization |

| |

|

| |

People’s

Republic of China |

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With: |

5. |

Sole Voting Power |

| |

1 |

| 6. |

Shared Voting Power |

| |

0 |

| 7. |

Sole Dispositive Power |

| |

1 |

| 8. |

Shared Dispositive Power |

| |

0 |

| 9. |

Aggregate Amount Beneficially Owned by

Each Reporting Person |

| |

|

| |

1 |

| 10. |

Check if the Aggregate Amount in Row (9) Excludes

Certain Shares |

| |

|

| |

|

¨ |

| 11. |

Percent of Class Represented by Amount

in Row (9) |

| |

|

| |

0%(9) |

| 12. |

Type of Reporting Person (See Instructions) |

| |

|

| |

PN |

(9) The ownership percentage of the Reporting

Person is calculated based on a total of 87,795,879 Class A Ordinary Shares (excluding 2,084,384

Class A Ordinary Shares issued to depositary bank for the purpose of bulk issuance, 6,820,217 Class A Ordinary Shares underlying

ADSs repurchased by the Issuer and 5,420,246 treasury shares) as of February 29, 2024, as disclosed by the Issuer to the

Reporting Person.

Item 1.

ATRenew Inc.

| (b) |

Address of

Issuer's Principal Executive Offices: |

12th Floor, No. 6 Building,

433 Songhu Road

Shanghai, People’s Republic of China

Item 2.

| (a) |

Name of Person

Filing: |

I. TMT General Partner Ltd.

II. Morningside China TMT GP II, L.P.

III. Morningside China TMT Fund II, L.P.

IV. Morningside China TMT Top Up Fund,

L.P.

V. Shanghai Xingpan Investment Management

Consulting Co., Ltd.

VI. Shanghai Chenxi Venture Capital Center

(Limited Partnership)

| (b) |

Address of

Principal Business Office or, if none, Residence: |

I, II, III, & IV:

c/o Suite 905-6, 9th Floor

ICBC Tower, Three Garden Road

Hong Kong

V:

Room

681, District G, 6th Floor, Building 13,

No. 203, Wushebang Road, Qingpu District

Shanghai, People’s Republic of China

VI:

Room

693, District G, 6th Floor, Building 13,

No. 203, Wushebang Road, Qingpu District

Shanghai, People’s Republic of China

I. II. III. & IV:

Cayman Islands

V & VI:

People’s Republic of China

| (d) |

Title of Class of

Securities: |

Class A ordinary shares, par value

US$0.001 per share (“Ordinary Shares”)

There is no CUSIP number assigned to

the Class A Ordinary Shares. CUSIP number 00138L108 has been assigned to the American Depositary Shares (each an “ADS”)

of ATRenew Inc. (the “Issuer”), which are quoted on the New York Stock Exchange under the symbol “RERE.” Every

three ADSs represents two Class A Ordinary Shares.

| Item 3. |

If this

statement is filed pursuant to Rules 13d-1(b) or 13d-2(b) or (c), check whether the person filing is a: |

Not applicable

| (a) |

Amount beneficially

owned: |

The information required by Items

4(a) is set forth in Row 9 of the cover page for each Reporting Person and is incorporated herein by reference.

The information required by Items

4(a) is set forth in Row 11 of the cover page for each Reporting Person and is incorporated herein by reference.

| (c) |

Number of shares

as to which the person has: |

The information required by Items

4(c) is set forth in Rows 5-8 of the cover page for each Reporting Person and is incorporated herein by reference.

Morningside China TMT Fund II, L.P. and Morningside

China TMT Top Up Fund, L.P. are the record owner of 1 Class A Ordinary Shares and the record owner of 1 Class A Ordinary Share,

respectively. Both Morningside China TMT Fund II, L.P. and Morningside China TMT Top Up Fund, L.P. are controlled by their general partner,

Morningside China TMT GP II, L.P., which, in turn, is controlled by its general partner, TMT General Partner Ltd. TMT General Partner

Ltd. is controlled by its board of directors which consists of three individuals, namely Jianming Shi, Qin Liu, and Gerald Lokchung Chan.

These directors have the voting and dispositive powers over the shares held by Morningside China TMT Fund II, L.P. and Morningside China

TMT Top Up Fund, L.P.

Shanghai Chenxi Venture Capital Center (Limited

Partnership) is the record owner of 1 Class A Ordinary Shares. Shanghai Chenxi Venture Capital Center (Limited Partnership) is controlled

by Shanghai Xingpan Investment Management Consulting Co., Ltd., its fund manager. Shanghai Xingpan Investment Management Consulting

Co., Ltd. is controlled by an investment committee consisting of three individuals, namely Qin Liu, Jianming Shi and Ye Yuan, who

have the voting and dispositive powers over the shares held by Shanghai Chenxi Venture Capital Center (Limited Partnership).

| Item 5. |

Ownership of Five Percent

or Less of a Class |

If this statement is being filed to report the

fact that as of the date hereof the reporting person has ceased to be the beneficial owner of more than five percent of the class of

securities, check the following: x.

| Item 6. |

Ownership of More than

Five Percent on Behalf of Another Person |

Not applicable

| Item 7. |

Identification

and Classification of the Subsidiary Which Acquired the Security Being Reported on By the Parent Holding Company or Control Person |

Not Applicable

| Item 8. |

Identification

and Classification of Members of the Group |

Not applicable

| Item 9. |

Notice of

Dissolution of Group |

Not applicable

Not applicable

SIGNATURE

After reasonable inquiry and to the best of my

knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Date: November 7,

2024

| TMT General Partner Ltd. |

|

| By: |

/s/

LIU, Qin |

|

| |

Name: |

LIU, Qin |

|

| |

Title: |

Director |

|

| |

|

|

| Morningside China TMT GP II, L.P. |

|

| By: |

TMT General Partner Ltd., as its general

partner |

|

| By: |

/s/

LIU, Qin |

|

| |

Name: |

LIU, Qin |

|

| |

Title: |

Director |

|

| |

|

|

| Morningside China TMT Fund II, L.P. |

|

| By: |

Morningside China TMT GP II, L.P., as its

general partner |

|

| By: |

TMT General Partner Ltd., as its general

partner |

|

| By: |

/s/

LIU, Qin |

|

| |

Name: |

LIU, Qin |

|

| |

Title: |

Director |

|

| |

|

| Morningside China TMT Top Up Fund, L.P. |

|

| By: |

Morningside China TMT GP II, L.P., as its

general partner |

|

| By: |

TMT General Partner Ltd., as its general

partner |

|

| By: |

/s/

LIU, Qin |

|

| |

Name: |

LIU, Qin |

|

| |

Title: |

Director |

|

| |

|

|

|

| Shanghai Xingpan Investment Management

Consulting Co., Ltd. |

|

| By: |

/s/

LIU, Qin |

|

| |

Name: |

LIU, Qin |

|

| |

Title: |

Director |

|

| |

|

| Shanghai Chenxi Venture Capital Center

(Limited Partnership) |

|

| By: |

Shanghai Xingpan Investment Management Consulting Co., Ltd.,

as its Fund Manager |

|

| By: |

/s/

LIU, Qin |

|

| |

Name: |

LIU, Qin |

|

| |

Title: |

Director |

|

Exhibit Index

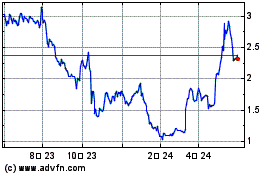

ATRenew (NYSE:RERE)

過去 株価チャート

から 10 2024 まで 11 2024

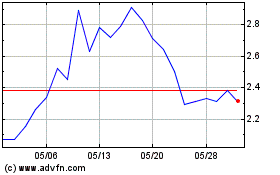

ATRenew (NYSE:RERE)

過去 株価チャート

から 11 2023 まで 11 2024