FALSEQ320240000789570--12-31http://fasb.org/us-gaap/2024#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2024#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2024#PropertyPlantAndEquipmentNethttp://fasb.org/us-gaap/2024#PropertyPlantAndEquipmentNethttp://fasb.org/us-gaap/2024#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2024#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2024#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2024#OtherLiabilitiesNoncurrentxbrli:sharesiso4217:USDiso4217:USDxbrli:sharesxbrli:puremgm:resortmgm:segmentiso4217:HKDiso4217:MOPiso4217:JPY00007895702024-01-012024-09-3000007895702024-10-2800007895702024-09-3000007895702023-12-310000789570us-gaap:CasinoMember2024-07-012024-09-300000789570us-gaap:CasinoMember2023-07-012023-09-300000789570us-gaap:CasinoMember2024-01-012024-09-300000789570us-gaap:CasinoMember2023-01-012023-09-300000789570us-gaap:OccupancyMember2024-07-012024-09-300000789570us-gaap:OccupancyMember2023-07-012023-09-300000789570us-gaap:OccupancyMember2024-01-012024-09-300000789570us-gaap:OccupancyMember2023-01-012023-09-300000789570us-gaap:FoodAndBeverageMember2024-07-012024-09-300000789570us-gaap:FoodAndBeverageMember2023-07-012023-09-300000789570us-gaap:FoodAndBeverageMember2024-01-012024-09-300000789570us-gaap:FoodAndBeverageMember2023-01-012023-09-300000789570mgm:EntertainmentRetailAndOtherMember2024-07-012024-09-300000789570mgm:EntertainmentRetailAndOtherMember2023-07-012023-09-300000789570mgm:EntertainmentRetailAndOtherMember2024-01-012024-09-300000789570mgm:EntertainmentRetailAndOtherMember2023-01-012023-09-300000789570mgm:ReimbursedCostsMember2024-07-012024-09-300000789570mgm:ReimbursedCostsMember2023-07-012023-09-300000789570mgm:ReimbursedCostsMember2024-01-012024-09-300000789570mgm:ReimbursedCostsMember2023-01-012023-09-3000007895702024-07-012024-09-3000007895702023-07-012023-09-3000007895702023-01-012023-09-3000007895702022-12-3100007895702023-09-300000789570mgm:GamingSubconcessionMembermgm:MGMGrandParadiseMember2024-01-012024-09-300000789570mgm:GamingSubconcessionMembermgm:MGMGrandParadiseMember2023-01-012023-09-300000789570us-gaap:CommonStockMember2024-06-300000789570us-gaap:AdditionalPaidInCapitalMember2024-06-300000789570us-gaap:RetainedEarningsMember2024-06-300000789570us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-06-300000789570us-gaap:ParentMember2024-06-300000789570us-gaap:NoncontrollingInterestMember2024-06-3000007895702024-06-300000789570us-gaap:RetainedEarningsMember2024-07-012024-09-300000789570us-gaap:ParentMember2024-07-012024-09-300000789570us-gaap:NoncontrollingInterestMember2024-07-012024-09-300000789570us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-07-012024-09-300000789570us-gaap:AdditionalPaidInCapitalMember2024-07-012024-09-300000789570us-gaap:CommonStockMember2024-07-012024-09-300000789570us-gaap:CommonStockMember2024-09-300000789570us-gaap:AdditionalPaidInCapitalMember2024-09-300000789570us-gaap:RetainedEarningsMember2024-09-300000789570us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-09-300000789570us-gaap:ParentMember2024-09-300000789570us-gaap:NoncontrollingInterestMember2024-09-300000789570us-gaap:CommonStockMember2023-12-310000789570us-gaap:AdditionalPaidInCapitalMember2023-12-310000789570us-gaap:RetainedEarningsMember2023-12-310000789570us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310000789570us-gaap:ParentMember2023-12-310000789570us-gaap:NoncontrollingInterestMember2023-12-310000789570us-gaap:RetainedEarningsMember2024-01-012024-09-300000789570us-gaap:ParentMember2024-01-012024-09-300000789570us-gaap:NoncontrollingInterestMember2024-01-012024-09-300000789570us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-09-300000789570us-gaap:AdditionalPaidInCapitalMember2024-01-012024-09-300000789570us-gaap:CommonStockMember2024-01-012024-09-300000789570us-gaap:CommonStockMember2023-06-300000789570us-gaap:AdditionalPaidInCapitalMember2023-06-300000789570us-gaap:RetainedEarningsMember2023-06-300000789570us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300000789570us-gaap:ParentMember2023-06-300000789570us-gaap:NoncontrollingInterestMember2023-06-3000007895702023-06-300000789570us-gaap:RetainedEarningsMember2023-07-012023-09-300000789570us-gaap:ParentMember2023-07-012023-09-300000789570us-gaap:NoncontrollingInterestMember2023-07-012023-09-300000789570us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-012023-09-300000789570us-gaap:AdditionalPaidInCapitalMember2023-07-012023-09-300000789570us-gaap:CommonStockMember2023-07-012023-09-300000789570us-gaap:CommonStockMember2023-09-300000789570us-gaap:AdditionalPaidInCapitalMember2023-09-300000789570us-gaap:RetainedEarningsMember2023-09-300000789570us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-300000789570us-gaap:ParentMember2023-09-300000789570us-gaap:NoncontrollingInterestMember2023-09-300000789570us-gaap:CommonStockMember2022-12-310000789570us-gaap:AdditionalPaidInCapitalMember2022-12-310000789570us-gaap:RetainedEarningsMember2022-12-310000789570us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310000789570us-gaap:ParentMember2022-12-310000789570us-gaap:NoncontrollingInterestMember2022-12-310000789570us-gaap:RetainedEarningsMember2023-01-012023-09-300000789570us-gaap:ParentMember2023-01-012023-09-300000789570us-gaap:NoncontrollingInterestMember2023-01-012023-09-300000789570us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-09-300000789570us-gaap:AdditionalPaidInCapitalMember2023-01-012023-09-300000789570us-gaap:CommonStockMember2023-01-012023-09-300000789570mgm:MGMChinaHoldingsLimitedMember2024-01-012024-09-300000789570mgm:EntainPLCMembermgm:BetMGMLLCMember2024-09-300000789570mgm:BetMGMLLCMember2024-09-300000789570country:JPmgm:OsakaIRKKMember2024-09-300000789570mgm:BellagioBREITVentureMember2024-09-300000789570us-gaap:ForeignExchangeForwardMember2024-09-300000789570us-gaap:ForeignExchangeForwardMember2023-12-310000789570us-gaap:ForeignExchangeForwardMember2024-07-012024-09-300000789570us-gaap:ForeignExchangeForwardMember2024-01-012024-09-300000789570us-gaap:FairValueInputsLevel1Memberus-gaap:CashAndCashEquivalentsMemberus-gaap:MoneyMarketFundsMember2024-09-300000789570us-gaap:FairValueInputsLevel1Memberus-gaap:CashAndCashEquivalentsMemberus-gaap:MoneyMarketFundsMember2023-12-310000789570us-gaap:CashAndCashEquivalentsMember2024-09-300000789570us-gaap:CashAndCashEquivalentsMember2023-12-310000789570us-gaap:FairValueInputsLevel1Memberus-gaap:ShortTermInvestmentsMemberus-gaap:USGovernmentDebtSecuritiesMember2024-09-300000789570us-gaap:FairValueInputsLevel1Memberus-gaap:ShortTermInvestmentsMemberus-gaap:USGovernmentDebtSecuritiesMember2023-12-310000789570us-gaap:FairValueInputsLevel2Memberus-gaap:ShortTermInvestmentsMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2024-09-300000789570us-gaap:FairValueInputsLevel2Memberus-gaap:ShortTermInvestmentsMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-12-310000789570us-gaap:FairValueInputsLevel2Memberus-gaap:ShortTermInvestmentsMemberus-gaap:CorporateBondSecuritiesMember2024-09-300000789570us-gaap:FairValueInputsLevel2Memberus-gaap:ShortTermInvestmentsMemberus-gaap:CorporateBondSecuritiesMember2023-12-310000789570us-gaap:FairValueInputsLevel2Memberus-gaap:ShortTermInvestmentsMemberus-gaap:AssetBackedSecuritiesMember2024-09-300000789570us-gaap:FairValueInputsLevel2Memberus-gaap:ShortTermInvestmentsMemberus-gaap:AssetBackedSecuritiesMember2023-12-310000789570us-gaap:ShortTermInvestmentsMember2024-09-300000789570us-gaap:ShortTermInvestmentsMember2023-12-310000789570mgm:MGMGrandParadiseSAMembermgm:June2022SubConcessionExtensionContractMember2023-12-310000789570mgm:MGMGrandParadiseSAMembermgm:June2022SubConcessionExtensionContractMember2024-09-300000789570mgm:CircusCircusLasVegasAndAdjacentLandMember2023-02-012023-02-280000789570mgm:OutstandingChipLiabilityMember2023-12-310000789570mgm:OutstandingChipLiabilityMember2022-12-310000789570mgm:LoyaltyProgramMember2023-12-310000789570mgm:LoyaltyProgramMember2022-12-310000789570mgm:CustomerAdvancesAndOtherMember2023-12-310000789570mgm:CustomerAdvancesAndOtherMember2022-12-310000789570mgm:OutstandingChipLiabilityMember2024-09-300000789570mgm:OutstandingChipLiabilityMember2023-09-300000789570mgm:LoyaltyProgramMember2024-09-300000789570mgm:LoyaltyProgramMember2023-09-300000789570mgm:CustomerAdvancesAndOtherMember2024-09-300000789570mgm:CustomerAdvancesAndOtherMember2023-09-300000789570mgm:OutstandingChipLiabilityMember2024-01-012024-09-300000789570mgm:OutstandingChipLiabilityMember2023-01-012023-09-300000789570mgm:LoyaltyProgramMember2024-01-012024-09-300000789570mgm:LoyaltyProgramMember2023-01-012023-09-300000789570mgm:CustomerAdvancesAndOtherMember2024-01-012024-09-300000789570mgm:CustomerAdvancesAndOtherMember2023-01-012023-09-300000789570mgm:FoodAndBeverageRevenueMember2024-07-012024-09-300000789570mgm:FoodAndBeverageRevenueMember2024-01-012024-09-300000789570mgm:EntertainmentRetailAndOtherRevenueMember2024-07-012024-09-300000789570mgm:EntertainmentRetailAndOtherRevenueMember2024-01-012024-09-300000789570mgm:FoodAndBeverageRevenueMember2023-07-012023-09-300000789570mgm:FoodAndBeverageRevenueMember2023-01-012023-09-300000789570mgm:EntertainmentRetailAndOtherRevenueMember2023-07-012023-09-300000789570mgm:EntertainmentRetailAndOtherRevenueMember2023-01-012023-09-300000789570mgm:MGMNationalHarborMember2023-01-012023-09-300000789570mgm:PushGamingMember2023-08-310000789570mgm:PushGamingMember2023-08-312023-08-310000789570mgm:GoldStrikeTunicaMemberus-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMembermgm:CNEGamingHoldingsLLCMember2023-02-152023-02-150000789570mgm:GoldStrikeTunicaMemberus-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMembermgm:CNEGamingHoldingsLLCMember2023-02-150000789570mgm:BetMGMLLCMember2023-12-310000789570mgm:BetMGMLLCMember2024-07-012024-09-300000789570mgm:BetMGMLLCMember2023-07-012023-09-300000789570mgm:BetMGMLLCMember2024-01-012024-09-300000789570mgm:BetMGMLLCMember2023-01-012023-09-300000789570mgm:OtherUnconsolidatedAffiliatesMember2024-07-012024-09-300000789570mgm:OtherUnconsolidatedAffiliatesMember2023-07-012023-09-300000789570mgm:OtherUnconsolidatedAffiliatesMember2024-01-012024-09-300000789570mgm:OtherUnconsolidatedAffiliatesMember2023-01-012023-09-300000789570mgm:MGMChinaCreditFacilityMember2024-09-300000789570mgm:MGMChinaCreditFacilityMember2023-12-310000789570mgm:MGMChinaSeniorNotesDue2024Member2024-09-300000789570mgm:MGMChinaSeniorNotesDue2024Member2023-12-310000789570mgm:SeniorNotes6.75Due2025Member2024-09-300000789570mgm:SeniorNotes6.75Due2025Member2023-12-310000789570mgm:SeniorNotes5.75Due2025Member2024-09-300000789570mgm:SeniorNotes5.75Due2025Member2023-12-310000789570mgm:MGMChinaSeniorNotesDue2025Member2024-09-300000789570mgm:MGMChinaSeniorNotesDue2025Member2023-12-310000789570mgm:MGMChinaSeniorNotesDue2026Member2024-09-300000789570mgm:MGMChinaSeniorNotesDue2026Member2023-12-310000789570mgm:SeniorNotesDue2026Member2024-09-300000789570mgm:SeniorNotesDue2026Member2023-12-310000789570mgm:SeniorNotesDue2027Member2024-09-300000789570mgm:SeniorNotesDue2027Member2023-12-310000789570mgm:MGMChinaSeniorNotesDue2027Member2024-09-300000789570mgm:MGMChinaSeniorNotesDue2027Member2023-12-310000789570mgm:SeniorNotesDue2028Member2024-09-300000789570mgm:SeniorNotesDue2028Member2023-12-310000789570mgm:SeniorNotesDue2029Member2024-09-300000789570mgm:SeniorNotesDue2029Member2023-12-310000789570mgm:MGMChinaSeniorNotesDue2031Member2024-09-300000789570mgm:MGMChinaSeniorNotesDue2031Member2023-12-310000789570mgm:SeniorNotesDue2032Member2024-09-300000789570mgm:SeniorNotesDue2032Member2023-12-310000789570mgm:DebenturesDue2036Member2024-09-300000789570mgm:DebenturesDue2036Member2023-12-310000789570mgm:SeniorSecuredCreditFacilityMemberus-gaap:LineOfCreditMember2024-02-290000789570mgm:SeniorSecuredCreditFacilityMemberus-gaap:LineOfCreditMember2024-09-300000789570mgm:MGMChinaCreditFacilityMembermgm:UnsecuredRevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2024-09-300000789570mgm:MGMChinaSecondRevolvingCreditFacilityMembermgm:UnsecuredRevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2024-09-300000789570mgm:MGMChinaSecondRevolvingCreditFacilityMembermgm:UnsecuredRevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2024-05-012024-05-310000789570mgm:MGMChinaSecondRevolvingCreditFacilityMembermgm:UnsecuredRevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2024-05-310000789570mgm:SeniorNotesDue2029Memberus-gaap:SeniorNotesMember2024-09-300000789570mgm:SeniorNotes5.75Due2025Memberus-gaap:SeniorNotesMemberus-gaap:SubsequentEventMember2024-10-012024-10-300000789570mgm:SeniorNotes5.75Due2025Memberus-gaap:SeniorNotesMemberus-gaap:SubsequentEventMember2024-10-300000789570mgm:SeniorNotesDue2032Memberus-gaap:SeniorNotesMember2024-04-300000789570mgm:SeniorNotes6.75Due2025Memberus-gaap:SeniorNotesMember2024-05-012024-05-310000789570mgm:SeniorNotes6.75Due2025Memberus-gaap:SeniorNotesMember2024-05-310000789570mgm:SeniorNotesSixPercentDueTwoThousandTwentyThreeMemberus-gaap:SeniorNotesMember2023-03-012023-03-310000789570mgm:SeniorNotesSixPercentDueTwoThousandTwentyThreeMemberus-gaap:SeniorNotesMember2023-03-310000789570mgm:MGMChinaSeniorNotesDue2031Memberus-gaap:SeniorNotesMember2024-06-300000789570mgm:MGMChinaSeniorNotesFivePointThreeSevenFiveDueTwoThousandTwentyFourMemberus-gaap:SeniorNotesMember2024-05-012024-05-310000789570mgm:MGMChinaSeniorNotesFivePointThreeSevenFiveDueTwoThousandTwentyFourMemberus-gaap:SeniorNotesMember2024-05-310000789570mgm:LeoVegasSeniorNotesMemberus-gaap:SeniorNotesMember2023-08-012023-08-310000789570mgm:MGMGrandParadiseSAMembercountry:MO2024-01-292024-01-290000789570mgm:BellagioMember2024-07-012024-09-300000789570mgm:BellagioMember2023-07-012023-09-300000789570mgm:BellagioMember2024-01-012024-09-300000789570mgm:BellagioMember2023-01-012023-09-300000789570mgm:BellagioLeaseMember2024-09-300000789570mgm:BellagioLeaseMember2023-12-310000789570mgm:MGMGrandParadiseSAMembermgm:January2023ConcessionsMember2023-01-310000789570mgm:MGMGrandParadiseSAMembermgm:January2023ConcessionsMember2024-09-300000789570mgm:MGMGrandParadiseSAMembermgm:January2023ConcessionsMember2023-01-012023-01-310000789570mgm:BlackstoneRealEstateIncomeTrustMember2024-09-300000789570mgm:MandalayBayAndMGMGrandLasVegasMember2024-09-300000789570country:JPmgm:OsakaIRKKMemberus-gaap:PerformanceGuaranteeMember2024-09-300000789570country:JPus-gaap:AssetPledgedAsCollateralMembermgm:OsakaIRKKMember2024-09-300000789570country:JPmgm:OsakaIRKKMember2024-07-012024-09-300000789570country:JPmgm:OsakaIRKKMember2024-01-012024-09-300000789570country:JPmgm:OsakaIRKKMember2023-07-012023-09-300000789570country:JPmgm:OsakaIRKKMember2023-01-012023-09-300000789570us-gaap:RevolvingCreditFacilityMember2024-09-300000789570mgm:SeniorCreditFacilityMember2024-09-300000789570mgm:ShareRepurchaseProgramMarch2022Memberus-gaap:CommonStockMember2022-03-310000789570mgm:ShareRepurchaseProgramFebruary2023Memberus-gaap:CommonStockMember2023-02-280000789570mgm:ShareRepurchaseProgramNovember2023Memberus-gaap:CommonStockMember2023-11-300000789570mgm:ShareRepurchaseProgramMemberus-gaap:CommonStockMember2023-07-012023-09-300000789570mgm:ShareRepurchaseProgramMemberus-gaap:CommonStockMember2023-01-012023-09-300000789570mgm:ShareRepurchaseProgramMemberus-gaap:CommonStockMember2024-07-012024-09-300000789570mgm:ShareRepurchaseProgramMemberus-gaap:CommonStockMember2024-01-012024-09-300000789570mgm:ShareRepurchaseProgramNovember2023Memberus-gaap:CommonStockMember2024-09-300000789570us-gaap:OperatingSegmentsMemberus-gaap:CasinoMembermgm:LasVegasStripResortsMember2024-07-012024-09-300000789570us-gaap:OperatingSegmentsMemberus-gaap:CasinoMembermgm:LasVegasStripResortsMember2023-07-012023-09-300000789570us-gaap:OperatingSegmentsMemberus-gaap:CasinoMembermgm:LasVegasStripResortsMember2024-01-012024-09-300000789570us-gaap:OperatingSegmentsMemberus-gaap:CasinoMembermgm:LasVegasStripResortsMember2023-01-012023-09-300000789570us-gaap:OperatingSegmentsMemberus-gaap:OccupancyMembermgm:LasVegasStripResortsMember2024-07-012024-09-300000789570us-gaap:OperatingSegmentsMemberus-gaap:OccupancyMembermgm:LasVegasStripResortsMember2023-07-012023-09-300000789570us-gaap:OperatingSegmentsMemberus-gaap:OccupancyMembermgm:LasVegasStripResortsMember2024-01-012024-09-300000789570us-gaap:OperatingSegmentsMemberus-gaap:OccupancyMembermgm:LasVegasStripResortsMember2023-01-012023-09-300000789570us-gaap:OperatingSegmentsMemberus-gaap:FoodAndBeverageMembermgm:LasVegasStripResortsMember2024-07-012024-09-300000789570us-gaap:OperatingSegmentsMemberus-gaap:FoodAndBeverageMembermgm:LasVegasStripResortsMember2023-07-012023-09-300000789570us-gaap:OperatingSegmentsMemberus-gaap:FoodAndBeverageMembermgm:LasVegasStripResortsMember2024-01-012024-09-300000789570us-gaap:OperatingSegmentsMemberus-gaap:FoodAndBeverageMembermgm:LasVegasStripResortsMember2023-01-012023-09-300000789570us-gaap:OperatingSegmentsMembermgm:EntertainmentRetailAndOtherMembermgm:LasVegasStripResortsMember2024-07-012024-09-300000789570us-gaap:OperatingSegmentsMembermgm:EntertainmentRetailAndOtherMembermgm:LasVegasStripResortsMember2023-07-012023-09-300000789570us-gaap:OperatingSegmentsMembermgm:EntertainmentRetailAndOtherMembermgm:LasVegasStripResortsMember2024-01-012024-09-300000789570us-gaap:OperatingSegmentsMembermgm:EntertainmentRetailAndOtherMembermgm:LasVegasStripResortsMember2023-01-012023-09-300000789570us-gaap:OperatingSegmentsMembermgm:LasVegasStripResortsMember2024-07-012024-09-300000789570us-gaap:OperatingSegmentsMembermgm:LasVegasStripResortsMember2023-07-012023-09-300000789570us-gaap:OperatingSegmentsMembermgm:LasVegasStripResortsMember2024-01-012024-09-300000789570us-gaap:OperatingSegmentsMembermgm:LasVegasStripResortsMember2023-01-012023-09-300000789570us-gaap:OperatingSegmentsMemberus-gaap:CasinoMembermgm:RegionalOperationsMember2024-07-012024-09-300000789570us-gaap:OperatingSegmentsMemberus-gaap:CasinoMembermgm:RegionalOperationsMember2023-07-012023-09-300000789570us-gaap:OperatingSegmentsMemberus-gaap:CasinoMembermgm:RegionalOperationsMember2024-01-012024-09-300000789570us-gaap:OperatingSegmentsMemberus-gaap:CasinoMembermgm:RegionalOperationsMember2023-01-012023-09-300000789570us-gaap:OperatingSegmentsMemberus-gaap:OccupancyMembermgm:RegionalOperationsMember2024-07-012024-09-300000789570us-gaap:OperatingSegmentsMemberus-gaap:OccupancyMembermgm:RegionalOperationsMember2023-07-012023-09-300000789570us-gaap:OperatingSegmentsMemberus-gaap:OccupancyMembermgm:RegionalOperationsMember2024-01-012024-09-300000789570us-gaap:OperatingSegmentsMemberus-gaap:OccupancyMembermgm:RegionalOperationsMember2023-01-012023-09-300000789570us-gaap:OperatingSegmentsMemberus-gaap:FoodAndBeverageMembermgm:RegionalOperationsMember2024-07-012024-09-300000789570us-gaap:OperatingSegmentsMemberus-gaap:FoodAndBeverageMembermgm:RegionalOperationsMember2023-07-012023-09-300000789570us-gaap:OperatingSegmentsMemberus-gaap:FoodAndBeverageMembermgm:RegionalOperationsMember2024-01-012024-09-300000789570us-gaap:OperatingSegmentsMemberus-gaap:FoodAndBeverageMembermgm:RegionalOperationsMember2023-01-012023-09-300000789570us-gaap:OperatingSegmentsMembermgm:EntertainmentRetailAndOtherAndReimbursedCostsMembermgm:RegionalOperationsMember2024-07-012024-09-300000789570us-gaap:OperatingSegmentsMembermgm:EntertainmentRetailAndOtherAndReimbursedCostsMembermgm:RegionalOperationsMember2023-07-012023-09-300000789570us-gaap:OperatingSegmentsMembermgm:EntertainmentRetailAndOtherAndReimbursedCostsMembermgm:RegionalOperationsMember2024-01-012024-09-300000789570us-gaap:OperatingSegmentsMembermgm:EntertainmentRetailAndOtherAndReimbursedCostsMembermgm:RegionalOperationsMember2023-01-012023-09-300000789570us-gaap:OperatingSegmentsMembermgm:RegionalOperationsMember2024-07-012024-09-300000789570us-gaap:OperatingSegmentsMembermgm:RegionalOperationsMember2023-07-012023-09-300000789570us-gaap:OperatingSegmentsMembermgm:RegionalOperationsMember2024-01-012024-09-300000789570us-gaap:OperatingSegmentsMembermgm:RegionalOperationsMember2023-01-012023-09-300000789570us-gaap:OperatingSegmentsMemberus-gaap:CasinoMembermgm:MGMChinaMember2024-07-012024-09-300000789570us-gaap:OperatingSegmentsMemberus-gaap:CasinoMembermgm:MGMChinaMember2023-07-012023-09-300000789570us-gaap:OperatingSegmentsMemberus-gaap:CasinoMembermgm:MGMChinaMember2024-01-012024-09-300000789570us-gaap:OperatingSegmentsMemberus-gaap:CasinoMembermgm:MGMChinaMember2023-01-012023-09-300000789570us-gaap:OperatingSegmentsMemberus-gaap:OccupancyMembermgm:MGMChinaMember2024-07-012024-09-300000789570us-gaap:OperatingSegmentsMemberus-gaap:OccupancyMembermgm:MGMChinaMember2023-07-012023-09-300000789570us-gaap:OperatingSegmentsMemberus-gaap:OccupancyMembermgm:MGMChinaMember2024-01-012024-09-300000789570us-gaap:OperatingSegmentsMemberus-gaap:OccupancyMembermgm:MGMChinaMember2023-01-012023-09-300000789570us-gaap:OperatingSegmentsMemberus-gaap:FoodAndBeverageMembermgm:MGMChinaMember2024-07-012024-09-300000789570us-gaap:OperatingSegmentsMemberus-gaap:FoodAndBeverageMembermgm:MGMChinaMember2023-07-012023-09-300000789570us-gaap:OperatingSegmentsMemberus-gaap:FoodAndBeverageMembermgm:MGMChinaMember2024-01-012024-09-300000789570us-gaap:OperatingSegmentsMemberus-gaap:FoodAndBeverageMembermgm:MGMChinaMember2023-01-012023-09-300000789570us-gaap:OperatingSegmentsMembermgm:EntertainmentRetailAndOtherMembermgm:MGMChinaMember2024-07-012024-09-300000789570us-gaap:OperatingSegmentsMembermgm:EntertainmentRetailAndOtherMembermgm:MGMChinaMember2023-07-012023-09-300000789570us-gaap:OperatingSegmentsMembermgm:EntertainmentRetailAndOtherMembermgm:MGMChinaMember2024-01-012024-09-300000789570us-gaap:OperatingSegmentsMembermgm:EntertainmentRetailAndOtherMembermgm:MGMChinaMember2023-01-012023-09-300000789570us-gaap:OperatingSegmentsMembermgm:MGMChinaMember2024-07-012024-09-300000789570us-gaap:OperatingSegmentsMembermgm:MGMChinaMember2023-07-012023-09-300000789570us-gaap:OperatingSegmentsMembermgm:MGMChinaMember2024-01-012024-09-300000789570us-gaap:OperatingSegmentsMembermgm:MGMChinaMember2023-01-012023-09-300000789570us-gaap:OperatingSegmentsMember2024-07-012024-09-300000789570us-gaap:OperatingSegmentsMember2023-07-012023-09-300000789570us-gaap:OperatingSegmentsMember2024-01-012024-09-300000789570us-gaap:OperatingSegmentsMember2023-01-012023-09-300000789570mgm:CorporateAndReconcilingItemsMember2024-07-012024-09-300000789570mgm:CorporateAndReconcilingItemsMember2023-07-012023-09-300000789570mgm:CorporateAndReconcilingItemsMember2024-01-012024-09-300000789570mgm:CorporateAndReconcilingItemsMember2023-01-012023-09-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2024

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File No. 001-10362

MGM Resorts International

(Exact name of registrant as specified in its charter)

| | | | | |

| Delaware | 88-0215232 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

3600 Las Vegas Boulevard South, Las Vegas, Nevada 89109

(Address of principal executive offices) (Zip Code)

(702) 693-7120

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

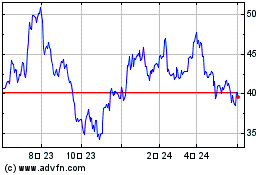

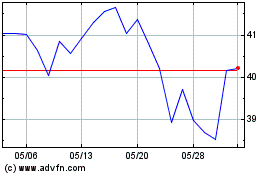

| Common stock (Par Value $0.01) | MGM | New York Stock Exchange (NYSE) |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☒ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| Emerging growth company | ☐ | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

| | | | | | | | |

| Class | | Outstanding at October 28, 2024 |

| Common Stock, $0.01 par value | | 297,740,481 shares |

MGM RESORTS INTERNATIONAL AND SUBSIDIARIES

FORM 10-Q

I N D E X

Part I. FINANCIAL INFORMATION

Item 1. Financial Statements

MGM RESORTS INTERNATIONAL AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(In thousands, except share data)

(Unaudited)

| | | | | | | | | | | |

| | September 30,

2024 | | December 31,

2023 |

| ASSETS |

| Current assets | | | |

| Cash and cash equivalents | $ | 2,950,592 | | | $ | 2,927,833 | |

| Accounts receivable, net | 964,741 | | | 929,135 | |

| Inventories | 144,843 | | | 141,678 | |

| Income tax receivable | 212,578 | | | 141,444 | |

| Prepaid expenses and other | 559,699 | | | 770,503 | |

| Total current assets | 4,832,453 | | | 4,910,593 | |

| | | |

| Property and equipment, net | 5,950,035 | | | 5,449,544 | |

| | | |

| Other assets | | | |

| Investments in and advances to unconsolidated affiliates | 414,161 | | | 240,803 | |

| Goodwill | 5,175,752 | | | 5,165,694 | |

| Other intangible assets, net | 1,776,503 | | | 1,724,582 | |

| Operating lease right-of-use assets, net | 23,658,647 | | | 24,027,465 | |

| Other long-term assets, net | 933,402 | | | 849,867 | |

| Total other assets | 31,958,465 | | | 32,008,411 | |

| $ | 42,740,953 | | | $ | 42,368,548 | |

| LIABILITIES AND STOCKHOLDERS' EQUITY |

| Current liabilities | | | |

| Accounts and construction payable | $ | 391,836 | | | $ | 461,718 | |

| Current portion of long-term debt | 675,000 | | | — | |

| Accrued interest on long-term debt | 112,403 | | | 60,173 | |

| Other accrued liabilities | 2,707,519 | | | 2,604,177 | |

| Total current liabilities | 3,886,758 | | | 3,126,068 | |

| | | |

| Deferred income taxes, net | 2,792,523 | | | 2,860,997 | |

| Long-term debt, net | 6,234,275 | | | 6,343,810 | |

| Operating lease liabilities | 25,092,217 | | | 25,127,464 | |

| Other long-term obligations | 880,296 | | | 542,708 | |

| Commitments and contingencies (Note 8) | | | |

| Redeemable noncontrolling interests | 33,343 | | | 33,356 | |

| Stockholders’ equity | | | |

Common stock, $0.01 par value: authorized 1,000,000,000 shares, issued and outstanding 296,886,350 and 326,550,141 shares | 2,969 | | | 3,266 | |

| Capital in excess of par value | — | | | — | |

| Retained earnings | 3,037,397 | | | 3,664,008 | |

| Accumulated other comprehensive income | 191,575 | | | 143,896 | |

| Total MGM Resorts International stockholders’ equity | 3,231,941 | | | 3,811,170 | |

| Noncontrolling interests | 589,600 | | | 522,975 | |

| Total stockholders’ equity | 3,821,541 | | | 4,334,145 | |

| $ | 42,740,953 | | | $ | 42,368,548 | |

The accompanying notes are an integral part of these consolidated financial statements.

MGM RESORTS INTERNATIONAL AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Revenues | | | | | | | |

| Casino | $ | 2,121,049 | | | $ | 2,050,584 | | | $ | 6,574,903 | | | $ | 5,884,394 | |

| Rooms | 883,564 | | | 827,091 | | | 2,738,963 | | | 2,490,902 | |

| Food and beverage | 755,322 | | | 698,261 | | | 2,326,863 | | | 2,163,628 | |

| Entertainment, retail and other | 411,326 | | | 385,691 | | | 1,217,322 | | | 1,215,980 | |

| Reimbursed costs | 11,877 | | | 11,556 | | | 35,932 | | | 33,782 | |

| 4,183,138 | | | 3,973,183 | | | 12,893,983 | | | 11,788,686 | |

| Expenses | | | | | | | |

| Casino | 1,205,286 | | | 1,056,487 | | | 3,698,885 | | | 3,073,122 | |

| Rooms | 286,658 | | | 260,905 | | | 838,915 | | | 751,319 | |

| Food and beverage | 563,521 | | | 530,145 | | | 1,693,031 | | | 1,579,561 | |

| Entertainment, retail and other | 247,817 | | | 238,403 | | | 732,386 | | | 740,403 | |

| Reimbursed costs | 11,877 | | | 11,556 | | | 35,932 | | | 33,782 | |

| General and administrative | 1,176,726 | | | 1,192,298 | | | 3,582,376 | | | 3,472,228 | |

| Corporate expense | 125,043 | | | 121,838 | | | 378,787 | | | 366,485 | |

| Preopening and start-up expenses | 519 | | | 68 | | | 2,469 | | | 356 | |

| Property transactions, net | 25,493 | | | 12,227 | | | 59,124 | | | (378,235) | |

| Depreciation and amortization | 233,330 | | | 201,827 | | | 621,868 | | | 608,831 | |

| 3,876,270 | | | 3,625,754 | | | 11,643,773 | | | 10,247,852 | |

| Income (loss) from unconsolidated affiliates | 7,989 | | | 22,507 | | | (51,319) | | | (68,681) | |

| Operating income | 314,857 | | | 369,936 | | | 1,198,891 | | | 1,472,153 | |

| Non-operating income (expense) | | | | | | | |

| Interest expense, net of amounts capitalized | (111,873) | | | (111,170) | | | (334,649) | | | (353,415) | |

| Non-operating items from unconsolidated affiliates | 417 | | | 438 | | | 2,043 | | | (1,187) | |

| Other, net | 93,333 | | | (34,879) | | | 45,096 | | | 35,121 | |

| (18,123) | | | (145,611) | | | (287,510) | | | (319,481) | |

| Income before income taxes | 296,734 | | | 224,325 | | | 911,381 | | | 1,152,672 | |

| Provision for income taxes | (52,570) | | | (12,440) | | | (84,689) | | | (217,360) | |

| Net income | 244,164 | | | 211,885 | | | 826,692 | | | 935,312 | |

| Less: Net income attributable to noncontrolling interests | (59,586) | | | (50,768) | | | (237,566) | | | (106,592) | |

| Net income attributable to MGM Resorts International | $ | 184,578 | | | $ | 161,117 | | | $ | 589,126 | | | $ | 828,720 | |

| Earnings per share | | | | | | | |

| Basic | $ | 0.61 | | | $ | 0.46 | | | $ | 1.90 | | | $ | 2.30 | |

| Diluted | $ | 0.61 | | | $ | 0.46 | | | $ | 1.88 | | | $ | 2.28 | |

| Weighted average common shares outstanding | | | | | | | |

| Basic | 300,499 | | | 347,345 | | | 310,688 | | | 360,732 | |

| Diluted | 303,479 | | | 351,390 | | | 313,852 | | | 364,847 | |

The accompanying notes are an integral part of these consolidated financial statements.

MGM RESORTS INTERNATIONAL AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(In thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Net income | $ | 244,164 | | | $ | 211,885 | | | $ | 826,692 | | | $ | 935,312 | |

| Other comprehensive income (loss), net of tax: | | | | | | | |

| Foreign currency translation | 156,968 | | | (30,386) | | | 50,700 | | | (36,475) | |

| Other | — | | | — | | | — | | | 871 | |

| Other comprehensive income (loss) | 156,968 | | | (30,386) | | | 50,700 | | | (35,604) | |

| Comprehensive income | 401,132 | | | 181,499 | | | 877,392 | | | 899,708 | |

| Less: Comprehensive income attributable to noncontrolling interests | (62,362) | | | (51,056) | | | (240,587) | | | (105,104) | |

| Comprehensive income attributable to MGM Resorts International | $ | 338,770 | | | $ | 130,443 | | | $ | 636,805 | | | $ | 794,604 | |

The accompanying notes are an integral part of these consolidated financial statements.

MGM RESORTS INTERNATIONAL AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

| | | | | | | | | | | |

| | Nine Months Ended September 30, |

| | 2024 | | 2023 |

| Cash flows from operating activities | | | |

| Net income | $ | 826,692 | | | $ | 935,312 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation and amortization | 621,868 | | | 608,831 | |

| Amortization of debt discounts and issuance costs | 20,396 | | | 20,846 | |

| Loss on early retirement of debt | 2,013 | | | — | |

| Provision for credit losses | 49,693 | | | 25,974 | |

| Stock-based compensation | 51,720 | | | 46,246 | |

| Foreign currency transaction loss | 28,303 | | | 26,302 | |

| Property transactions, net | 59,124 | | | (378,235) | |

| Noncash lease expense | 386,412 | | | 388,571 | |

| Other investment losses (gains) | (11,134) | | | 39,452 | |

| Loss from unconsolidated affiliates | 49,276 | | | 69,868 | |

| Distributions from unconsolidated affiliates | 12,390 | | | 8,838 | |

| Deferred income taxes | (68,942) | | | 11,828 | |

| Change in operating assets and liabilities: | | | |

| Accounts receivable | (40,244) | | | 5,296 | |

| Inventories | (3,029) | | | (9,766) | |

| Income taxes receivable and payable, net | (69,203) | | | (81,871) | |

| Prepaid expenses and other | (33,577) | | | (74,088) | |

| Accounts payable and accrued liabilities | (232,629) | | | 276,924 | |

| Other | 41,811 | | | 54,511 | |

| Net cash provided by operating activities | 1,690,940 | | | 1,974,839 | |

| Cash flows from investing activities | | | |

| Capital expenditures | (746,572) | | | (603,053) | |

| Dispositions of property and equipment | 3,472 | | | 6,133 | |

| Investments in unconsolidated affiliates | (182,078) | | | (144,452) | |

| Proceeds from sale of operating resorts | — | | | 460,392 | |

| Acquisitions, net of cash acquired | (113,882) | | | (122,058) | |

| Proceeds from repayment of principal on note receivable | — | | | 152,518 | |

| Distributions from unconsolidated affiliates | 1,762 | | | 6,792 | |

| Investments and other | 158,060 | | | (176,826) | |

| Net cash used in investing activities | (879,238) | | | (420,554) | |

| Cash flows from financing activities | | | |

| Net repayments under bank credit facilities - maturities of 90 days or less | (19,061) | | | (931,028) | |

| Issuance of long-term debt | 2,100,000 | | | — | |

| Repayment of long-term debt | (1,500,000) | | | (1,285,600) | |

| Debt issuance costs | (38,268) | | | (20,617) | |

| Distributions to noncontrolling interest owners | (103,569) | | | (169,093) | |

| Repurchases of common stock | (1,238,064) | | | (1,668,888) | |

| Other | 25,163 | | | (101,871) | |

| Net cash used in financing activities | (773,799) | | | (4,177,097) | |

| Effect of exchange rate on cash, cash equivalents, and restricted cash | (14,736) | | | (36,316) | |

| Change in cash and cash equivalents classified as assets held for sale | — | | | 25,938 | |

| Cash, cash equivalents, and restricted cash | | | |

| Net change for the period | 23,167 | | | (2,633,190) | |

| Balance, beginning of period | 3,014,896 | | | 6,036,388 | |

| Balance, end of period | $ | 3,038,063 | | | $ | 3,403,198 | |

| Supplemental cash flow disclosures | | | |

| Interest paid, net of amounts capitalized | $ | 262,023 | | | $ | 301,173 | |

Federal, state and foreign income taxes paid, net | 225,280 | | | 286,561 | |

Non-cash investing and financing activities | | | |

| MGM Grand Paradise gaming concession intangible asset | $ | — | | | $ | 226,083 | |

MGM Grand Paradise gaming concession payment obligation | — | | | 226,083 | |

The accompanying notes are an integral part of these consolidated financial statements.

MGM RESORTS INTERNATIONAL AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(In thousands)

(Unaudited) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Common Stock | | | | | | | | | | | | |

| Shares | | Par Value | | Capital in Excess of Par Value | | Retained Earnings | | Accumulated Other Comprehensive Income | | Total MGM Resorts International Stockholders’ Equity | | Noncontrolling Interests | | Total Stockholders’ Equity |

| Balances, July 1, 2024 | 304,965 | | | $ | 3,050 | | | $ | — | | | $ | 3,172,243 | | | $ | 37,383 | | | $ | 3,212,676 | | | $ | 601,469 | | | $ | 3,814,145 | |

| Net income | — | | | — | | | — | | | 184,578 | | | — | | | 184,578 | | | 59,499 | | | 244,077 | |

| Currency translation adjustment | — | | | — | | | — | | | — | | | 154,192 | | | 154,192 | | | 2,776 | | | 156,968 | |

| Stock-based compensation | — | | | — | | | 11,443 | | | — | | | — | | | 11,443 | | | 774 | | | 12,217 | |

| Issuance of common stock pursuant to stock-based compensation awards | 270 | | | 3 | | | (4,396) | | | — | | | — | | | (4,393) | | | — | | | (4,393) | |

| Distributions to noncontrolling interest owners | — | | | — | | | — | | | — | | | — | | | — | | | (84,424) | | | (84,424) | |

| Repurchases of common stock | (8,349) | | | (84) | | | (6,535) | | | (319,208) | | | — | | | (325,827) | | | — | | | (325,827) | |

| Adjustment of redeemable noncontrolling interest to redemption value | — | | | — | | | — | | | (216) | | | — | | | (216) | | | — | | | (216) | |

| Other | — | | | — | | | (512) | | | — | | | — | | | (512) | | | 9,506 | | | 8,994 | |

| Balances, September 30, 2024 | 296,886 | | | $ | 2,969 | | | $ | — | | | $ | 3,037,397 | | | $ | 191,575 | | | $ | 3,231,941 | | | $ | 589,600 | | | $ | 3,821,541 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Balances, January 1, 2024 | 326,550 | | | $ | 3,266 | | | $ | — | | | $ | 3,664,008 | | | $ | 143,896 | | | $ | 3,811,170 | | | $ | 522,975 | | | $ | 4,334,145 | |

| Net income | — | | | — | | | — | | | 589,126 | | | — | | | 589,126 | | | 237,171 | | | 826,297 | |

| Currency translation adjustment | — | | | — | | | — | | | — | | | 47,679 | | | 47,679 | | | 3,021 | | | 50,700 | |

| Stock-based compensation | — | | | — | | | 49,066 | | | — | | | — | | | 49,066 | | | 2,181 | | | 51,247 | |

| Issuance of common stock pursuant to stock-based compensation awards | 382 | | | 3 | | | (6,154) | | | — | | | — | | | (6,151) | | | — | | | (6,151) | |

| Distributions to noncontrolling interest owners | — | | | — | | | — | | | — | | | — | | | — | | | (178,713) | | | (178,713) | |

| | | | | | | | | | | | | | | |

| Repurchases of common stock | (30,046) | | | (300) | | | (34,066) | | | (1,215,752) | | | — | | | (1,250,118) | | | — | | | (1,250,118) | |

| Adjustment of redeemable noncontrolling interest to redemption value | — | | | — | | | — | | | 15 | | | — | | | 15 | | | — | | | 15 | |

| Other | — | | | — | | | (8,846) | | | — | | | — | | | (8,846) | | | 2,965 | | | (5,881) | |

| Balances, September 30, 2024 | 296,886 | | | $ | 2,969 | | | $ | — | | | $ | 3,037,397 | | | $ | 191,575 | | | $ | 3,231,941 | | | $ | 589,600 | | | $ | 3,821,541 | |

The accompanying notes are an integral part of these consolidated financial statements.

MGM RESORTS INTERNATIONAL AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(In thousands)

(Unaudited) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Common Stock | | | | | | | | | | | | |

| | Shares | | Par Value | | Capital in Excess of Par Value | | Retained Earnings | | Accumulated Other Comprehensive Income | | Total MGM Resorts International Stockholders’ Equity | | Noncontrolling Interests | | Total Stockholders’ Equity |

| Balances, July 1, 2023 | 352,790 | | | $ | 3,528 | | | $ | — | | | $ | 4,382,588 | | | $ | 30,057 | | | $ | 4,416,173 | | | $ | 419,194 | | | $ | 4,835,367 | |

| Net income | — | | | — | | | — | | | 161,117 | | | — | | | 161,117 | | | 50,625 | | | 211,742 | |

| Currency translation adjustment | — | | | — | | | — | | | — | | | (30,674) | | | (30,674) | | | 288 | | | (30,386) | |

| Stock-based compensation | — | | | — | | | 10,270 | | | — | | | — | | | 10,270 | | | 794 | | | 11,064 | |

| Issuance of common stock pursuant to stock-based compensation awards | 891 | | | 9 | | | (9,762) | | | (9,318) | | | — | | | (19,071) | | | — | | | (19,071) | |

| Distributions to noncontrolling interest owners | — | | | — | | | — | | | — | | | — | | | — | | | (7,476) | | | (7,476) | |

| Repurchases of common stock | (12,766) | | | (128) | | | — | | | (571,462) | | | — | | | (571,590) | | | — | | | (571,590) | |

| Adjustment of redeemable noncontrolling interest to redemption value | — | | | — | | | (34) | | | — | | | — | | | (34) | | | — | | | (34) | |

| Other | — | | | — | | | (474) | | | — | | | — | | | (474) | | | (362) | | | (836) | |

| Balances, September 30, 2023 | 340,915 | | | $ | 3,409 | | | $ | — | | | $ | 3,962,925 | | | $ | (617) | | | $ | 3,965,717 | | | $ | 463,063 | | | $ | 4,428,780 | |

| | | | | | | | | | | | | | | |

| Balances, January 1, 2023 | 379,088 | | | $ | 3,791 | | | $ | — | | | $ | 4,794,239 | | | $ | 33,499 | | | $ | 4,831,529 | | | $ | 378,594 | | | $ | 5,210,123 | |

| Net income | — | | | — | | | — | | | 828,720 | | | — | | | 828,720 | | | 106,111 | | | 934,831 | |

| Currency translation adjustment | — | | | — | | | — | | | — | | | (34,987) | | | (34,987) | | | (1,488) | | | (36,475) | |

| Stock-based compensation | — | | | — | | | 44,092 | | | — | | | — | | | 44,092 | | | 2,093 | | | 46,185 | |

| Issuance of common stock pursuant to stock-based compensation awards | 1,096 | | | 11 | | | (12,328) | | | (9,318) | | | — | | | (21,635) | | | — | | | (21,635) | |

| Distributions to noncontrolling interest owners | — | | | — | | | — | | | — | | | — | | | — | | | (21,566) | | | (21,566) | |

| Issuance of restricted stock units | — | | | — | | | 1,701 | | | — | | | — | | | 1,701 | | | — | | | 1,701 | |

| Repurchases of common stock | (39,269) | | | (393) | | | (33,688) | | | (1,650,716) | | | — | | | (1,684,797) | | | — | | | (1,684,797) | |

| Adjustment of redeemable noncontrolling interest to redemption value | — | | | — | | | 1,377 | | | — | | | — | | | 1,377 | | | — | | | 1,377 | |

| Other | — | | | — | | | (1,154) | | | — | | | 871 | | | (283) | | | (681) | | | (964) | |

| Balances, September 30, 2023 | 340,915 | | | $ | 3,409 | | | $ | — | | | $ | 3,962,925 | | | $ | (617) | | | $ | 3,965,717 | | | $ | 463,063 | | | $ | 4,428,780 | |

The accompanying notes are an integral part of these consolidated financial statements.

MGM RESORTS INTERNATIONAL AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

NOTE 1 — ORGANIZATION

Organization. MGM Resorts International, a Delaware corporation (together with its consolidated subsidiaries, unless otherwise indicated or unless the context requires otherwise, the “Company”) is a global gaming and entertainment company with domestic and international locations featuring hotels and casinos, convention, dining, and retail offerings, and sports betting and online gaming operations.

As of September 30, 2024, the Company’s domestic casino resorts include the following integrated casino, hotel and entertainment resorts in Las Vegas, Nevada: Aria (including Vdara), Bellagio, The Cosmopolitan of Las Vegas (“The Cosmopolitan”), MGM Grand Las Vegas (including The Signature), Mandalay Bay, Luxor, New York-New York, Park MGM, and Excalibur. The Company also operates MGM Grand Detroit in Detroit, Michigan, MGM National Harbor in Prince George’s County, Maryland, MGM Springfield in Springfield, Massachusetts, Borgata in Atlantic City, New Jersey, Empire City in Yonkers, New York, MGM Northfield Park in Northfield Park, Ohio, and Beau Rivage in Biloxi, Mississippi. Additionally, the Company operates The Park, a dining and entertainment district located between New York-New York and Park MGM. The Company leases the real estate assets of its domestic properties pursuant to triple-net lease agreements.

The Company has an approximate 56% controlling interest in MGM China Holdings Limited (together with its subsidiaries, “MGM China”), which owns MGM Grand Paradise, S.A. (“MGM Grand Paradise”). MGM Grand Paradise owns and operates MGM Macau and MGM Cotai, two integrated casino, hotel and entertainment resorts in Macau, as well as the related gaming concession and land concessions.

The Company also owns LV Lion Holding Limited (“LeoVegas”), a consolidated subsidiary that has global online gaming operations headquartered in Sweden and Malta. Additionally, the Company and its venture partner, Entain plc, each have a 50% ownership interest in BetMGM, LLC (“BetMGM”), an unconsolidated affiliate, which provides online sports betting and gaming in certain jurisdictions in North America. The Company also has a 50% ownership interest in Osaka IR KK, an unconsolidated affiliate, which plans to develop an integrated resort in Osaka, Japan.

Reportable segments. The Company has three reportable segments: Las Vegas Strip Resorts, Regional Operations and MGM China. See Note 11 for additional information about the Company’s segments.

NOTE 2 — BASIS OF PRESENTATION AND SIGNIFICANT ACCOUNTING POLICIES

Basis of presentation. As permitted by the rules and regulations of the Securities and Exchange Commission (“SEC”), certain information and footnote disclosures normally included in financial statements prepared in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”) have been condensed or omitted. These consolidated financial statements should be read in conjunction with the Company’s 2023 annual consolidated financial statements and notes thereto included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023.

In the opinion of management, the accompanying unaudited consolidated financial statements contain all adjustments, which include only normal recurring adjustments, necessary to present fairly the Company’s interim financial statements. The results for such periods are not necessarily indicative of the results to be expected for the full year.

Principles of consolidation. The Company evaluates entities for which control is achieved through means other than voting rights to determine if it is the primary beneficiary of a variable interest entity (“VIE”). The Company consolidates its investment in a VIE when it determines that it is its primary beneficiary. Bellagio BREIT Venture (the landlord of Bellagio, which is a venture in which the Company has a 5% ownership interest) and Osaka IR KK are VIEs in which the Company is not the primary beneficiary because it does not have power on its own to direct the activities that could potentially be significant to the ventures and, accordingly, does not consolidate the ventures. The Company may change its original assessment of a VIE upon subsequent events such as the modification of contractual arrangements that affect the characteristics or adequacy of the entity’s equity investments at risk and the disposition of all or a portion of an interest held by the primary beneficiary. The Company performs this analysis on an ongoing basis.

For entities determined not to be a VIE, the Company consolidates such entities in which the Company owns 100% of the equity. For entities in which the Company owns less than 100% of the equity interest, the Company consolidates the

entity under the voting interest model if it has a controlling financial interest based upon the terms of the respective entities’ ownership agreements, such as MGM China. For these entities, the Company records a noncontrolling interest in the consolidated balance sheets and all intercompany balances and transactions are eliminated in consolidation. If the entity does not qualify for consolidation under the voting interest model and the Company has significant influence over the operating and financial decisions of the entity, the Company generally accounts for the entity under the equity method, such as BetMGM, which does not qualify for consolidation as the Company has joint control, given the entity is structured with substantive participating rights whereby both owners participate in the decision making process, which prevents the Company from exerting a controlling financial interest in such entity, as defined in Accounting Standards Codification (“ASC”) 810. For entities over which the Company does not have significant influence, the Company accounts for its equity investment under ASC 321.

Reclassifications. Certain reclassifications have been made to conform the prior period presentation.

Fair value measurements. Fair value measurements affect the Company’s accounting and impairment assessments of its long-lived assets, investments in unconsolidated affiliates or equity interests, assets acquired, and liabilities assumed in an acquisition, and goodwill and other intangible assets. Fair value measurements also affect the Company’s accounting for certain of its financial assets and liabilities. Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date and is measured according to a hierarchy that includes: Level 1 inputs, such as quoted prices in an active market; Level 2 inputs, which are quoted prices for identical or comparable instruments or pricing using observable market data; or Level 3 inputs, which are unobservable inputs. The Company used the following inputs in its fair value measurements:

•Level 1 inputs when measuring its equity investments recorded at fair value;

•Level 2 inputs for its long-term debt fair value disclosures; See Note 5;

•Level 2 inputs for its derivatives, and

•Level 1 and Level 2 inputs for its debt investments.

Equity investments. Fair value is measured based upon trading prices on the applicable securities exchange for equity investments for which the Company has elected the fair value option of ASC 825 and equity investments accounted for under ASC 321 that have a readily determinable fair value. The fair value of these investments was $433 million and $435 million as of September 30, 2024 and December 31, 2023, respectively, and is reflected within “Other long-term assets, net” on the consolidated balance sheets. Gains and losses are recorded in “Other, net” in the statements of operations. For the three months ended September 30, 2024, the Company recorded a net gain on its equity investments of $48 million. For the nine months ended September 30, 2024, the Company recorded a net loss on its equity investments of $2 million. For the three and nine months ended September 30, 2023, the Company recorded a net loss on its equity investments of $57 million and $52 million, respectively.

Derivatives. The Company uses derivatives that are not designated for hedge accounting. The changes in fair value of these derivatives are recorded within “Other, net” in the statements of operations and within “Other” in operating activities in the statements of cash flows. The balance sheet classification of the derivatives in a current liability position are within “Other accrued liabilities,” a long-term liability position are within “Other long-term obligations,” a current asset position are within “Prepaid expenses and other,” and a long-term asset position are within “Other long-term assets, net.”

As of September 30, 2024, the Company has forward currency exchange contracts to manage its exposure to changes in foreign currency exchange rates. As of September 30, 2024, the fair value of derivatives classified as assets were $27 million, with $12 million in current assets and $15 million in long-term assets, and liabilities of $21 million, with $19 million in current liabilities and $2 million in long-term liabilities. As of December 31, 2023, the fair value of derivatives classified as assets were $10 million, with $1 million in current assets and $9 million in long-term assets, and liabilities of $17 million, with $8 million in current liabilities and $9 million in long-term liabilities.

For the three months ended September 30, 2024, the Company recorded a net gain on its derivatives of $87 million and for the nine months ended September 30, 2024, the Company recorded a net loss on its derivatives of $13 million.

Debt investments. The Company’s investments in debt securities are classified as trading securities and recorded at fair value. Gains and losses are recorded in “Other, net” in the statements of operations. Debt securities are considered cash equivalents if the criteria for such classification is met or otherwise classified as short-term investments within “Prepaid expenses and other” since the investment of cash is available for current operations.

The following table presents information regarding the Company’s debt investments:

| | | | | | | | | | | | | | |

| Fair value level | September 30, 2024 | | December 31, 2023 |

| (In thousands) |

Cash and cash equivalents: | | | | |

Money market funds | Level 1 | $ | 217,131 | | | $ | 18,828 | |

Cash and cash equivalents | | 217,131 | | | 18,828 | |

| Short-term investments: | | | | |

| U.S. government securities | Level 1 | 5,978 | | | 37,805 | |

| U.S. agency securities | Level 2 | — | | | 9,804 | |

| Corporate bonds | Level 2 | 189,242 | | | 364,926 | |

Asset-backed securities | Level 2 | 4,415 | | | 7,170 | |

Short-term investments | | 199,635 | | | 419,705 | |

Total debt investments | | $ | 416,766 | | | $ | 438,533 | |

Cash and cash equivalents. Cash and cash equivalents consist of cash and highly liquid investments with maturities of 90 days or less at the date of purchase. The fair value of cash and cash equivalents approximates carrying value because of the short maturity of those instruments (Level 1).

Restricted cash. MGM China’s pledged cash of $87 million for each of September 30, 2024 and December 31, 2023, securing the bank guarantees discussed in Note 8 is restricted in use and classified within “Other long-term assets, net.” Such amounts plus “Cash and cash equivalents” on the consolidated balance sheets equal “Cash, cash equivalents, and restricted cash” on the consolidated statements of cash flows as of September 30, 2024 and December 31, 2023.

Accounts receivable. As of September 30, 2024 and December 31, 2023, the loss reserve on accounts receivable was $145 million and $130 million, respectively.

Note receivable. In February 2023, the secured note receivable related to the sale of Circus Circus Las Vegas and the adjacent land was repaid, prior to maturity, for $170 million, which approximated its carrying value on the date of repayment.

Accounts payable. As of September 30, 2024 and December 31, 2023, the Company had accrued $90 million and $84 million, respectively, for purchases of property and equipment within “Accounts and construction payable” on the consolidated balance sheets.

Revenue recognition. Contract and Contract-Related Liabilities. There may be a difference between the timing of cash receipts from the customer and the recognition of revenue, resulting in a contract or contract-related liability. The Company generally has three types of liabilities related to contracts with customers: (1) outstanding chip liability, which represents the amounts owed in exchange for gaming chips held by a customer, (2) loyalty program obligations, which represents the deferred allocation of revenue relating to loyalty program incentives earned, and (3) customer advances and other, which is primarily funds deposited by customers before gaming play occurs (“casino front money”) and advance payments on goods and services yet to be provided, such as advance ticket sales and deposits on rooms and convention space or for unpaid wagers. These liabilities are generally expected to be recognized as revenue within one year of being purchased, earned, or deposited and are recorded within “Other accrued liabilities” on the consolidated balance sheets.

The following table summarizes the activity related to contract and contract-related liabilities:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Outstanding Chip Liability | | Loyalty Program | | Customer Advances and Other |

| | 2024 | | 2023 | | 2024 | | 2023 | | 2024 | | 2023 |

| | (In thousands) |

| Balance at January 1 | $ | 211,606 | | | $ | 185,669 | | | $ | 201,973 | | | $ | 183,602 | | | $ | 766,226 | | | $ | 816,376 | |

| Balance at September 30 | 171,502 | | | 185,615 | | | 213,330 | | | 204,333 | | | 795,489 | | | 847,572 | |

| Increase / (decrease) | $ | (40,104) | | | $ | (54) | | | $ | 11,357 | | | $ | 20,731 | | | $ | 29,263 | | | $ | 31,196 | |

The January 1, 2023 balances exclude liabilities related to assets held for sale related to Gold Strike Tunica.

Revenue by source. The Company presents the revenue earned disaggregated by the type or nature of the good or service (casino, room, food and beverage, and entertainment, retail and other) and by relevant geographic region within Note 11.

Leases. Refer to Note 7 for information regarding leases under which the Company is a lessee. The Company is a lessor under certain other lease arrangements. Lease revenues earned by the Company from third parties are classified within the line item corresponding to the type or nature of the tenant’s good or service. For the three and nine months ended September 30, 2024, lease revenues from third-party tenants include $21 million and $62 million recorded within food and beverage revenue, respectively and $28 million and $86 million recorded within entertainment, retail, and other revenue for the same such periods, respectively. For the three and nine months ended September 30, 2023, lease revenues from third-party tenants include $20 million and $57 million recorded within food and beverage revenue, respectively and $27 million and $86 million recorded within entertainment, retail, and other revenue for the same such periods, respectively. Lease revenues from the rental of hotel rooms are recorded as rooms revenues within the consolidated statements of operations.

Redeemable noncontrolling interest. Noncontrolling interests with redemption features, such as put rights, that are not exclusively in the Company’s control, are considered redeemable noncontrolling interests. Redeemable noncontrolling interests are presented outside of stockholders’ equity within the mezzanine section of the accompanying consolidated balance sheets. The interests are initially accounted for at fair value and subsequently adjusted to the greater of the redemption value and carrying value (initial fair value adjusted for attributed net income (loss) and distributions, as applicable). The Company records such adjustments to retained earnings, to the extent available, with any residual amount applied against capital in excess of par value.

During the nine months ended September 30, 2023, the Company purchased $138 million of interests from its redeemable noncontrolling interest parties.

NOTE 3 — ACQUISITIONS AND DIVESTITURES

Push Gaming acquisition. On August 31, 2023, LeoVegas acquired 86% of digital gaming developer, Push Gaming Holding Limited (“Push Gaming”) for total consideration of $146 million, which was allocated to $126 million of goodwill and $40 million of amortizable intangible assets.

Gold Strike Tunica. On February 15, 2023, the Company completed the sale of the operations of Gold Strike Tunica to CNE Gaming Holdings, LLC, a subsidiary of Cherokee Nation Business, for cash consideration of $450 million, or $474 million, net of purchase price adjustments and transaction costs. At closing, the master lease between the Company and VICI was amended to remove Gold Strike Tunica and to reflect a $40 million reduction in annual cash rent. The Company recognized a $399 million gain recorded within “Property transactions, net.” The gain reflects the net cash consideration less the net carrying value of the assets and liabilities derecognized of $75 million.

NOTE 4 — INVESTMENTS IN AND ADVANCES TO UNCONSOLIDATED AFFILIATES

Investments in and advances to unconsolidated affiliates were $414 million and $241 million as of September 30, 2024 and December 31, 2023, respectively. The Company’s share of losses of BetMGM in excess of its equity method investment balance is $44 million and $5 million as of September 30, 2024 and December 31, 2023, respectively.

The Company recorded its share of income (loss) from unconsolidated affiliates as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| | (In thousands) |

| Income (loss) from unconsolidated affiliates | $ | 7,989 | | | $ | 22,507 | | | $ | (51,319) | | | $ | (68,681) | |

| Non-operating items from unconsolidated affiliates | 417 | | | 438 | | | 2,043 | | | (1,187) | |

| | $ | 8,406 | | | $ | 22,945 | | | $ | (49,276) | | | $ | (69,868) | |

The following table summarizes information related to the Company’s share of operating income (loss) from unconsolidated affiliates:

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| | (In thousands) |

| BetMGM | $ | 3,211 | | | $ | 12,629 | | | $ | (67,781) | | | $ | (91,743) | |

| Other | 4,778 | | | 9,878 | | | 16,462 | | | 23,062 | |

| | $ | 7,989 | | | $ | 22,507 | | | $ | (51,319) | | | $ | (68,681) | |

NOTE 5 — LONG-TERM DEBT

Long-term debt consisted of the following:

| | | | | | | | | | | |

| | September 30,

2024 | | December 31,

2023 |

| | (In thousands) |

| MGM China first revolving credit facility | $ | 353,743 | | | $ | 371,300 | |

5.375% MGM China senior notes, due 2024 | — | | | 750,000 | |

6.75% senior notes, due 2025 | — | | | 750,000 | |

5.75% senior notes, due 2025 | 675,000 | | | 675,000 | |

5.25% MGM China senior notes, due 2025 | 500,000 | | | 500,000 | |

5.875% MGM China senior notes, due 2026 | 750,000 | | | 750,000 | |

4.625% senior notes, due 2026 | 400,000 | | | 400,000 | |

5.5% senior notes, due 2027 | 675,000 | | | 675,000 | |

4.75% MGM China senior notes, due 2027 | 750,000 | | | 750,000 | |

4.75% senior notes, due 2028 | 750,000 | | | 750,000 | |

6.125% senior notes, due 2029 | 850,000 | | | — | |

7.125% MGM China senior notes, due 2031 | 500,000 | | | — | |

6.5% senior notes, due 2032 | 750,000 | | | — | |

7% debentures, due 2036 | 552 | | | 552 | |

| | 6,954,295 | | | 6,371,852 | |

Less: Unamortized discounts and debt issuance costs, net | (45,020) | | | (28,042) | |

| 6,909,275 | | | 6,343,810 | |

Less: Current portion | (675,000) | | | — | |

| $ | 6,234,275 | | | $ | 6,343,810 | |

MGM China’s 5.25% senior notes due within one year of the September 30, 2024 balance sheet was classified as long-term as MGM China has both the intent and ability to refinance the notes on a long-term basis under its revolving credit facilities.

Senior secured credit facility. In February 2024, the Company amended its senior secured credit facility to increase the facility to $2.3 billion and extend the maturity date to February 2029. At September 30, 2024, no amounts were drawn.

The Company’s senior secured credit facility contains customary representations and warranties, events of default and positive and negative covenants. The Company was in compliance with its credit facility covenants at September 30, 2024.

MGM China first revolving credit facility. At September 30, 2024, the MGM China first revolving credit facility consisted of a HK$9.75 billion (approximately $1.3 billion) unsecured revolving credit facility, which matures in May 2026, and had a weighted average interest rate of 6.82%.

The MGM China first revolving credit facility contains customary representations and warranties, events of default, and positive, negative and financial covenants, including that MGM China maintains compliance with a maximum leverage ratio and a minimum interest coverage ratio. The financial covenants under the MGM China first revolving credit facility are waived through December 31, 2024 and become effective beginning on March 31, 2025. MGM China was in compliance with its applicable MGM China first revolving credit facility covenants at September 30, 2024.

MGM China second revolving credit facility. At September 30, 2024, the MGM China second revolving credit facility consisted of a HK$5.85 billion (approximately $753 million) unsecured revolving credit facility. The option to increase the amount of the facility was further exercised in May 2024, increasing the facility by HK$1.26 billion (approximately $161 million) to its full capacity of HK$5.85 billion. At September 30, 2024, no amounts were drawn on the MGM China second revolving credit facility.

The MGM China second revolving credit facility contains customary representations and warranties, events of default, and positive, negative and financial covenants, including that MGM China maintains compliance with a maximum leverage ratio and a minimum interest coverage ratio. The financial covenants under the MGM China second revolving credit facility are waived through December 31, 2024 and become effective beginning on March 31, 2025. MGM China was in compliance with its applicable MGM China second revolving credit facility covenants at September 30, 2024.

Senior notes. In September 2024, the Company issued $850 million in aggregate principal amount of 6.125% notes due 2029. The Company used the net proceeds from the offering to fund the early redemption of its $675 million in aggregate principal amount of 5.75% notes due 2025 at a redemption price of 100.607% in October 2024, with the remainder primarily used for general corporate purposes.

In April 2024, the Company issued $750 million in aggregate principal amount of 6.5% notes due 2032. The Company used the net proceeds from the offering to fund the early redemption of its $750 million in aggregate principal amount of 6.75% notes due 2025 in May 2024.

In March 2023, the Company repaid its $1.25 billion 6% notes due 2023 upon maturity.

MGM China senior notes. In June 2024, MGM China issued $500 million in aggregate principal amount of 7.125% notes due 2031.

In May 2024, MGM China repaid its $750 million in aggregate principal amount of 5.375% notes due 2024.

LeoVegas senior notes. In August 2023, LeoVegas repaid its outstanding senior unsecured notes totaling $36 million.

Fair value of long-term debt. The estimated fair value of the Company’s long-term debt was $6.9 billion and $6.3 billion at September 30, 2024 and December 31, 2023, respectively.

NOTE 6 — INCOME TAXES

For interim income tax reporting the Company estimates its annual effective tax rate and applies it to its year-to-date ordinary income. The tax effects of unusual or infrequently occurring items, including changes in judgment about valuation allowances and effects of changes in tax laws or rates, are reported in the interim period in which they occur. The Company’s effective income tax rate was 17.7% and 9.3% for the three and nine months ended September 30, 2024, respectively, compared to 5.5% and 18.9% for the three and nine months ended September 30, 2023, respectively.

On January 29, 2024, MGM Grand Paradise was granted an extension of its exemption from the Macau 12% complementary tax on gaming profits for the period of January 1, 2023 through December 31, 2027.

The Company recognizes deferred income tax assets, net of applicable reserves, related to net operating losses, tax credit carryforwards and certain temporary differences. The Company recognizes future tax benefits to the extent that realization of such benefit is more likely than not. Otherwise, a valuation allowance is applied.

NOTE 7 — LEASES

The Company leases real estate, land underlying certain of its properties, and various equipment under operating and, to a lesser extent, finance lease arrangements.

Other information. Components of lease costs and other information related to the Company’s leases are:

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| | (In thousands) |

Operating lease cost, primarily classified within “General and administrative”(1) | $ | 575,293 | | | $ | 575,112 | | | $ | 1,725,494 | | | $ | 1,731,572 | |

| | | | | | | |

| Finance lease costs | | | | | | | |

| Interest expense | $ | 8,891 | | | $ | 2,484 | | | $ | 27,701 | | | $ | 7,005 | |

| Amortization expense | 14,755 | | | 17,030 | | | 40,711 | | | 51,869 | |

| Total finance lease costs | $ | 23,646 | | | $ | 19,514 | | | $ | 68,412 | | | $ | 58,874 | |

(1)Operating lease cost includes $83 million for each of the three months ended September 30, 2024 and 2023 and $248 million for each of the nine months ended September 30, 2024 and 2023 related to the Bellagio lease, which is held with a related party.

| | | | | | | | | | | |

| | September 30,

2024 | | December 31,

2023 |

| (In thousands) |

| Operating leases | | | |

Operating lease ROU assets, net(1) | $ | 23,658,647 | | | $ | 24,027,465 | |

Operating lease liabilities - current, classified within “Other accrued liabilities” | $ | 88,364 | | | $ | 74,988 | |

Operating lease liabilities - long-term(2) | 25,092,217 | | | 25,127,464 | |

| Total operating lease liabilities | $ | 25,180,581 | | | $ | 25,202,452 | |

| | | |

| Finance leases | | | |

Finance lease ROU assets, net, classified within “Property and equipment, net” | $ | 320,200 | | | $ | 85,783 | |

Finance lease liabilities - current, classified within “Other accrued liabilities” | $ | 71,455 | | | $ | 9,166 | |

Finance lease liabilities - long-term, classified within “Other long-term obligations” | 259,464 | | | 85,391 | |

| Total finance lease liabilities | $ | 330,919 | | | $ | 94,557 | |

| | | |

| Weighted average remaining lease term (years) | | | |

| Operating leases | 25 | | 25 |

| Finance leases | 8 | | 22 |

| | | |

| Weighted average discount rate (%) | | | |

| Operating leases | 7 | | | 7 | |

| Finance leases | 6 | | | 6 | |

(1)As of September 30, 2024 and December 31, 2023, operating lease right-of-use assets, net included $3.4 billion and $3.5 billion related to the Bellagio lease, respectively.

(2)As of September 30, 2024 and December 31, 2023, operating lease liabilities – long-term included $3.8 billion related to the Bellagio lease. As of September 30, 2024, operating lease liabilities – current included $2 million related to the Bellagio lease.

| | | | | | | | | | | |

| | Nine Months Ended

September 30, |

| | 2024 | | 2023 |

| Cash paid for amounts included in the measurement of lease liabilities | (In thousands) |

| Operating cash outflows from operating leases | $ | 1,377,717 | | | $ | 1,350,828 | |

| Operating cash outflows from finance leases | 11,389 | | | 4,917 | |

Financing cash outflows from finance leases(1) | 38,745 | | | 53,211 | |

| | | |

| ROU assets obtained in exchange for new lease liabilities | | | |

| Operating leases | $ | 5,079 | | | $ | 12,347 | |

| Finance leases | 272,878 | | | 518 | |

(1)Included within “Other” within “Cash flows from financing activities” on the consolidated statements of cash flows.

Maturities of lease liabilities were as follows:

| | | | | | | | | | | |

| | Operating Leases | | Finance Leases |

| Year ending December 31, | (In thousands) |

| 2024 (excluding the nine months ended September 30, 2024) | $ | 459,142 | | | $ | 25,229 | |

| 2025 | 1,864,318 | | | 84,460 | |

| 2026 | 1,889,911 | | | 81,026 | |

| 2027 | 1,917,382 | | | 80,708 | |

| 2028 | 1,945,374 | | | 29,445 | |

| Thereafter | 48,944,154 | | | 128,248 | |

| Total future minimum lease payments | 57,020,281 | | | 429,116 | |

| Less: Amount of lease payments representing interest | (31,839,700) | | | (98,197) | |

| Present value of future minimum lease payments | 25,180,581 | | | 330,919 | |

| Less: Current portion | (88,364) | | | (71,455) | |

| Long-term portion of lease liabilities | $ | 25,092,217 | | | $ | 259,464 | |

NOTE 8 — COMMITMENTS AND CONTINGENCIES

Cybersecurity litigation, claims, and investigations. In September 2023, through unauthorized access to certain of its U.S. systems, third-party criminal actors accessed, for some of the Company’s customers, personal information (including name, contact information (such as phone number, email address and postal address), gender, date of birth and driver’s license numbers). For a limited number of customers, Social Security numbers and passport numbers were also accessed by the criminal actors. The Company has notified individuals impacted by this issue in accordance with federal and state law.

In connection with this cybersecurity issue, the Company became subject to consumer class actions in U.S. federal and state courts. These class actions assert a variety of common law and statutory claims based on allegations that the Company failed to use reasonable security procedures and practices to safeguard customers’ personal information, and seek monetary and statutory damages, injunctive relief and other related relief. In addition, the Company is the subject of investigations by state and federal regulators, which also could result in monetary fines and other relief. The Company cannot predict the timing or outcome of any of these potential matters, or whether the Company may be subject to additional legal proceedings, claims, regulatory inquiries, investigations, or enforcement actions. While the Company believes it is reasonably possible that it may incur losses associated with the above-described proceedings, it is not possible to estimate the amount of loss or range of loss, if any, that might result from adverse judgments, settlements, or other resolution given the preliminary stage of these proceedings. The Company has incurred, and expects to continue to incur, certain expenses related to the cybersecurity issue, including expenses to respond to, remediate, and investigate this matter. The full scope of the costs and related impacts of this issue, including the extent to which all of the costs will be offset by cybersecurity insurance, has not been determined.

Other litigation. The Company is a party to various other legal proceedings, most of which relate to routine matters incidental to its business. Management does not believe that the outcome of such proceedings will have a material adverse effect on the Company’s financial position, results of operations or cash flows.

MGM China bank guarantees. In connection with the issuance of the gaming concession in January 2023, bank guarantees were provided to the government of Macau in the amount of MOP 1 billion (approximately $125 million as of September 30, 2024) to warrant the fulfillment of labor liabilities and of damages or losses that may result if there is noncompliance with the concession. The guarantees expire 180 days after the end of the concession term. As of September 30, 2024, MOP 700 million of the bank guarantees (approximately $87 million as of September 30, 2024) were secured by pledged cash.

Shortfall guarantees. The Company provides shortfall guarantees of the $3.01 billion principal amount of indebtedness (and any interest accrued and unpaid thereon) of Bellagio BREIT Venture, the landlord of Bellagio, which matures in 2029, and of the $3.0 billion principal amount of indebtedness (and any interest accrued and unpaid thereon) of the landlords of Mandalay Bay and MGM Grand Las Vegas, which matures in 2032 and has an anticipated repayment date of March 2030. The terms of the shortfall guarantees provide that after the lenders have exhausted certain remedies to collect on the obligations under the indebtedness, the Company would then be responsible for any shortfall between the

value of the collateral, which is the real estate assets of the applicable property owned by the landlord, and the debt obligation. The guarantees are accounted for under ASC 460 at fair value; such value is immaterial.