| SECURITIES AND EXCHANGE COMMISSION |

|

| Washington, D.C. 20549 |

|

| |

|

| SCHEDULE 13D |

| |

| Under the Securities Exchange Act of 1934 |

| |

|

Southwest Airlines

Co. |

| (Name of Issuer) |

| |

|

Common Stock,

par value $1.00 per share |

| (Title of Class of Securities) |

| |

|

844741108 |

| (CUSIP Number) |

| |

|

Elliott Investment Management,

L.P.

360 S. Rosemary Ave, 18th Floor

West Palm Beach, FL 33401

with a copy to:

Eleazer Klein, Esq.

Adriana Schwartz, Esq.

Schulte Roth & Zabel LLP

919 Third Avenue

New York, New York 10022

(212) 756-2000 |

| (Name, Address and Telephone Number of Person |

| Authorized to Receive Notices and Communications) |

| |

|

July 29,

2024 |

| (Date of Event Which Requires Filing of This Statement) |

| |

If the filing person has previously filed a statement on Schedule 13G to

report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e), Rule 13d-1(f) or

Rule 13d-1(g), check the following box. ¨

(Page 1 of 8 Pages)

______________________________

* The remainder of this cover page shall be filled out for a reporting

person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing

information which would alter disclosures provided in a prior cover page.

The information required on the remainder of

this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (the

“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions

of the Act (however, see the Notes).

| CUSIP No. 844741108 | Schedule 13D | Page 2 of 8 Pages |

| 1 |

NAME OF REPORTING PERSON

Elliott Investment Management L.P. |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ¨

(b) ¨ |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

OO |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH: |

7 |

SOLE VOTING POWER

41,948,500 (1) |

| 8 |

SHARED VOTING POWER

-0- |

| 9 |

SOLE DISPOSITIVE POWER

41,948,500

(1) |

| 10 |

SHARED DISPOSITIVE POWER

-0- |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

41,948,500 (1) |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

7.0% |

| 14 |

TYPE OF REPORTING PERSON

PN, IA |

| |

|

|

|

|

(1) Includes 18,648,500 shares of Common Stock underlying the Physical

Derivative Agreements (as defined in Item 6 of this Schedule 13D).

| CUSIP No. 844741108 | Schedule 13D | Page 3 of 8 Pages |

| Item 1. |

SECURITY AND ISSUER |

| This statement relates to the common stock, par value $1.00 per share (the “Common Stock”), of Southwest Airlines Co., a Texas corporation (the “Issuer”). The Issuer’s principal executive offices are located at P.O. Box 36611, Dallas, Texas 75235-1611. |

| Item 2. |

IDENTITY AND BACKGROUND |

| (a)-(c)

This statement is being filed by Elliott Investment Management L.P., a Delaware limited partnership (“EIM” or the

“Reporting Person”), the investment manager of Elliott Associates, L.P., a Delaware limited partnership

(“Elliott”) and Elliott International, L.P., a Cayman Islands limited partnership (“Elliott

International”, and together with Elliott, the “Elliott Funds”), with respect to the shares of Common

Stock held by the Elliott Funds and/or their respective subsidiaries. Elliott Investment Management GP LLC, a Delaware

limited liability company (“EIM GP”), is the sole general partner of EIM. Paul E. Singer

(“Singer”) is the sole managing member of EIM GP. |

| |

| EIM |

| |

| The business address of EIM is 360 S. Rosemary Ave, 18th Floor, West Palm Beach, FL 33401. |

| |

| The principal

business of EIM is to act as investment manager for the Elliott Funds. |

| |

| The name, business address, and present principal occupation or employment of the general partner of EIM is as follows: |

| NAME |

ADDRESS |

OCCUPATION |

| |

|

|

| Elliott Investment Management GP LLC |

360 S. Rosemary Ave, 18th Floor, West Palm Beach,

FL 33401 |

General partner of EIM |

| EIM GP |

| |

| The business address of EIM GP is 360 S. Rosemary Ave, 18th Floor, West Palm Beach, FL 33401. |

| |

| The principal business of EIM GP is serving as a general partner of EIM. |

| |

| The name, business address, and present principal occupation or employment of the managing member of EIM GP is as follows: |

| NAME |

ADDRESS |

OCCUPATION |

| |

|

|

| Paul E. Singer |

360 S. Rosemary Ave, 18th Floor, West Palm Beach, FL 33401 |

Sole managing member of EIM GP |

| Singer’s business address is 360 S. Rosemary Ave, 18th Floor, West Palm Beach, FL 33401. |

| |

| Singer’s principal business is to serve as the sole managing member of EIM GP. |

| CUSIP No. 844741108 | Schedule 13D | Page 4 of 8 Pages |

| (d) and (e) During the last five years, none of the persons or entities listed above has been (i) convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors); or (ii) a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws. |

| (f) See Items 2(a)-(c) above. Singer is a citizen of the United States of America. |

| Item 3. |

SOURCE AND AMOUNT OF FUNDS OR OTHER CONSIDERATION |

| Item 4 of the Schedule 13D is incorporated herein by reference. |

|

The aggregate cost of the shares of Common Stock

directly held by the Elliott Funds is approximately $626,859,790. The aggregate purchase price of

the Physical Derivative Agreements reported herein is approximately $502,716,516.

|

| |

| The Reporting Person may

effect purchases of the shares of Common Stock through margin accounts maintained for the Elliott Funds with prime brokers, which

extend margin credit as and when required to open or carry positions in their margin accounts, subject to applicable federal margin

regulations, stock exchange rules and such firms’ credit policies. Positions in the shares of Common Stock may be held in margin

accounts and may be pledged as collateral security for the repayment of debit balances in such accounts. Since other securities may

be held in such margin accounts, it may not be possible to determine the amounts, if any, of margin used to purchase the shares of

Common Stock. |

| Item 4. |

PURPOSE OF TRANSACTION |

| The

Reporting Person believes the securities of the Issuer are undervalued and represent an attractive investment opportunity. The

Reporting Person believes that the Issuer requires fundamental changes throughout its business to evolve its strategy and improve

its performance. The Reporting Person believes the Issuer can achieve this by (1) reconstituting its board of directors

(the “Board”), (2) enhancing its leadership team, including through the identification of a new CEO and a new

independent Board Chair, and (3) thereafter, undergoing a comprehensive business review to develop and execute a new strategy to

restore the Issuer to industry-leading performance. On each of June 10, 2024 and July 8, 2024, the Reporting Person sent

a letter to the Board, which are attached hereto as Exhibit 99.1 and Exhibit 99.2, respectively (the “Board

Letters”), detailing its views with respect to the foregoing. Representatives of the Reporting Person also met

with the Issuer’s CEO, Executive Chairman and members of its Board at the Issuer’s headquarters to convey the views included

in the Board Letters. |

| The

Reporting Person will continue to seek to engage in a dialogue with the Board and/or management about the matters set forth in the

Board Letters and other strategic opportunities to maximize shareholder value. The Reporting Person may also seek to

communicate with shareholders and other third parties about such matters. In particular, the Reporting Person has

identified and had discussions with a number of highly qualified former airline executives, industry leaders and other qualified

persons with relevant experience who are eager to serve on the Board, and intends to provide shareholders with an opportunity to

elect new highly qualified Board members, whether by requesting that the Issuer call a special meeting of shareholders

or at an annual meeting of shareholders. |

| The

Reporting Person may consider, explore and/or develop plans and/or make proposals (whether preliminary or final) with respect to,

among other things, potential changes in the Issuer’s operations, management, organizational documents, composition of the Board

(including, without limitation, proposing or nominating director candidates to the Board, whether at an annual or special meeting of

shareholders), ownership, capital or corporate structure, strategic transactions, capital allocation policy, strategy and

plans. The Reporting Person intends to communicate with the Issuer’s management and Board about, and may enter into

negotiations and agreements with them regarding, the foregoing and a broad range of operational and strategic matters and to

communicate with other shareholders or third parties, including potential director and management candidates, regarding

the Issuer. The Reporting Person may exchange information with any such persons pursuant to appropriate confidentiality or

similar agreements. The Reporting Person may change its intentions with respect to any and all matters referred to in this Item

4. It may also take steps to explore and prepare for various plans and actions, and propose transactions, before forming

an intention to engage in such plans or actions or proceed with such transactions. |

| CUSIP No. 844741108 | Schedule 13D | Page 5 of 8 Pages |

| The Reporting Person intends to review its investment in the Issuer on a continuing basis and depending upon various factors, including without limitation, the Issuer’s financial position and strategic direction, the outcome of any discussions or matters referenced above, overall market conditions, other investment opportunities available to the Reporting Person, and the availability of securities of the Issuer at prices that would make the purchase or sale of such securities desirable, the Reporting Person may endeavor (i) to increase or decrease its position in the Issuer through, among other things, the purchase or sale of securities of the Issuer, including through transactions involving the Common Stock and/or other equity, debt, notes, other securities, or derivative or other instruments that are based upon or relate to the value of securities of the Issuer in the open market or in private transactions, including through a trading plan created under Rule 10b5-1(c) or otherwise, on such terms and at such times as the Reporting Person may deem advisable and/or (ii) to enter into transactions that increase or hedge their economic exposure to the Common Stock without affecting their beneficial ownership of the Common Stock. In addition, the Reporting Person may, at any time and from time to time, (i) review or reconsider its position and/or change its purpose and/or formulate plans or proposals with respect thereto and (ii) consider or propose one or more of the actions described in subparagraphs (a) - (j) of Item 4 of Schedule 13D. |

| Item 5. |

INTEREST IN SECURITIES OF THE ISSUER |

| (a)

See rows (11) and (13) of the cover page to this Schedule 13D for the aggregate number of shares of Common Stock and percentage of shares

of Common Stock beneficially owned by the Reporting Person. The aggregate percentage of shares of Common Stock reported beneficially

owned by the Reporting Person is based upon 599,157,019 shares of Common Stock outstanding

as of July 25, 2024, as disclosed in the Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2024, filed by the Issuer

with the Securities and Exchange Commission on July 29, 2024. |

| (b) See rows (7) through (10) of the cover page to this Schedule 13D for the shares of Common Stock as to which the Reporting Person has the sole or shared power to vote or direct the vote and sole or shared power to dispose or to direct the disposition. |

| (c) The transactions in the shares of Common Stock effected by EIM during the past sixty (60) days, which were all in the open market, are set forth on Schedule 1 attached hereto. |

| (d) No persons other than the Elliott Funds and/or their respective subsidiaries and EIM have the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, the shares of Common Stock beneficially owned by EIM. |

| CUSIP No. 844741108 | Schedule 13D | Page 6 of 8 Pages |

| Item 6. |

CONTRACTS, ARRANGEMENTS, UNDERSTANDINGS OR RELATIONSHIPS WITH RESPECT TO SECURITIES OF THE ISSUER |

The Elliott Funds have entered into notional principal

amount derivative agreements (the “Cash Derivative Agreements”) in the form of cash settled swaps with respect to an

aggregate of 23,976,000 shares of Common Stock of the Issuer (collectively representing economic exposure comparable to 4.0% of the

shares of Common Stock of the Issuer). The Cash Derivative Agreements provide the Elliott Funds with economic results that are comparable

to the economic results of ownership but do not provide them or the Reporting Person with the power to vote or direct the voting or dispose

of or direct the disposition of the shares that are referenced in the Cash Derivative Agreements (such shares, the “Subject Shares”).

The Reporting Person disclaims beneficial ownership in the Subject Shares. The counterparties to the Cash Derivative Agreements are unaffiliated

third party financial institutions.

The Elliott Funds have entered into notional principal

amount derivative agreements in the form of physically settled swaps (the “Physical Derivative Agreements”) with respect

to an aggregate of 18,648,500 shares of Common Stock, which the Reporting Person may be deemed to beneficially own. Collectively, the

Physical Derivative Agreements held by the Elliott Funds represent economic exposure comparable to an interest in approximately 3.1%

of the shares of Common Stock. The counterparties to the Physical Derivative Agreements are unaffiliated third party financial institutions.

The Reporting Person has combined economic exposure in the Issuer of approximately

11.0% of the shares of Common Stock outstanding.

Except as set forth

herein, there are no contracts, arrangements, understandings or relationships (legal or otherwise) among the persons named in Item 2

hereof and between such persons and any person with respect to any securities of the Issuer, including any class of the Issuer’s

securities used as a reference security, in connection with any of the following: call options, put options, security-based swaps or

any other derivative securities, transfer or voting of any of the securities, finder’s fees, joint ventures, loan

or option arrangements, guarantees of profits, division of profits or loss, or the giving or withholding of proxies.

| Exhibit 99.1: |

Letter to the Issuer’s Board, dated June 10, 2024. |

| Exhibit 99.2: |

Letter

to the Issuer’s Board, dated July 8, 2024. |

| CUSIP No. 844741108 | Schedule 13D | Page 7 of 8 Pages |

SIGNATURES

After reasonable inquiry

and to the best of its knowledge and belief, the undersigned certifies that the information set forth in this statement is true, complete

and correct.

DATE: August 5, 2024

| Elliott Investment Management L.P. |

|

|

| |

|

|

| /s/ Elliot Greenberg |

|

|

| Name: Elliot Greenberg |

|

|

| Title: Vice President |

|

|

| CUSIP No. 844741108 | Schedule 13D | Page 8 of 8 Pages |

SCHEDULE 1

Transactions in the Shares of Common Stock of the

Issuer by the Reporting Person During the Past Sixty (60) Days

The following table sets forth all transactions in the shares of Common

Stock reported herein effected during the past sixty (60) days by the Reporting Person. Except as noted below, all such transactions were

effected by the Reporting Person in the open market through brokers and the price per share excludes commissions. Where a price range

is provided in the column titled “Price Range ($)”, the price reported in the column titled “Price Per Share ($)”

is a weighted average price. These shares of Common Stock were sold or purchased in multiple transactions at prices between the price

ranges indicated in the column titled “Price Range ($)”. The Reporting Person will undertake to provide to the staff of the

SEC, upon request, full information regarding the shares of Common Stock sold or purchased at each separate price.

| Trade Date |

Shares Purchased (Sold) |

Price Per Share ($) |

Price Range ($) |

| 7/11/2024 |

1,050,000 |

26.94 |

26.60-27.09 |

| 7/12/2024 |

700,000 |

27.47 |

26.98-27.79 |

| 7/15/2024 |

750,000 |

27.70 |

27.24-27.87 |

| 7/16/2024 |

600,000 |

28.58 |

28.35-28.83 |

| 7/16/2024 |

400,000 |

28.71 |

28.35-28.83 |

| 7/17/2024 |

500,000 |

28.32 |

28.22-28.55 |

| 7/17/2024 |

400,000 |

28.34 |

28.22-28.55 |

| 7/18/2024 |

500,000 |

27.91 |

27.34-28.56 |

| 7/29/2024 |

1,600,000 |

26.44 |

26.15-27.03 |

| 7/30/2024 |

2,250,000 |

27.08 |

26.40-27.36 |

| 7/31/2024 |

2,500,000 |

27.29 |

26.90-27.79 |

| 8/1/2024 |

2,050,000 |

26.38 |

26.03-26.88 |

| 8/2/2024 |

2,250,000 |

25.19 |

24.89-25.75 |

| 8/5/2024 |

1,750,000 |

24.05 |

23.60-24.47 |

EXHIBIT 99.1

June 10, 2024

The Board of Directors

Southwest Airlines Co.

2702 Love Field Drive

Dallas, Texas 75235

Dear Members of the Board:

We are writing to you on behalf of funds managed by

Elliott Investment Management L.P. (together with such funds, “Elliott” or “we”). Elliott has made an investment

of approximately $1.9 billion in Southwest Airlines (“Southwest” or the “Company”), representing an approximately

11% economic interest and making us one of the largest investors in the Company.

Southwest is a legendary airline with a proud history.

Since starting service in 1971, Southwest revolutionized the airline industry with an innovative business model built on operational excellence

and a commitment to providing customers with a low-cost alternative to the legacy airlines. This winning strategy generated decades of

success and allowed Southwest to become the premier U.S. domestic airline, with 47 consecutive years of profitability in a highly competitive

and challenging industry. Along the way, Southwest became a beloved brand among customers and a motivating career opportunity for its

employees.

Today, however, poor execution and leadership’s

stubborn unwillingness to evolve the Company’s strategy have led to deeply disappointing results for shareholders, employees and

customers alike. Southwest’s share price has declined by more than 50% in the past three years and has now fallen below the levels

at which it traded in March 2020, during the depths of the COVID-related travel shutdowns. And while the U.S. airline industry is seeing

record revenues and peer airlines are enjoying very strong profitability, Southwest’s 2024 EBITDAR is expected to be nearly 50%

lower than 2018 levels. In addition to negative returns for shareholders, this disappointing financial performance has cost each frontline

employee tens of thousands of dollars on average in the form of reduced employee profit-sharing and declines in the value of Southwest

stock held by employee retirement plans.

After 18 months of intensive research, we are convinced

that Southwest represents the most compelling airline turnaround opportunity in the last two decades. The significant investment we

have made reflects our conviction that, with the right leadership, Southwest can regain its status as an industry-leading airline. In

this letter and the appended presentation, we lay out our perspectives on how Southwest can reclaim its status and achieve the success

that Southwest’s shareholders, employees and customers deserve.

Southwest Today

Southwest’s rigid commitment to an approach

developed decades ago has inhibited its ability to compete in the modern airline industry; this ethos pervades the entire business with

outdated software, a dated monetization strategy and antiquated operational processes. This failure to modernize is vividly underscored

by the December 2022 operational meltdown that was caused by the Company’s outdated technology, which led to Southwest stranding

over two million customers over the holidays.

Southwest’s Executive Chairman and its CEO,

who have spent a combined 74 years at the Company, have presided over a period of severe underperformance, and they have demonstrated

that they are not up to the task of modernizing Southwest. Since his appointment, Southwest CEO Bob Jordan has delivered unacceptable

financial and operational performance quarter after quarter, resulting in seven negative guidance revisions in the last 17 months. Operational

metrics are pointing in the wrong direction: Southwest’s unit costs – a core priority for a low-cost carrier – have

ballooned, while unit revenues have lagged peers. Even as the Company’s performance has deteriorated, Jordan has demonstrated a

surprising level of complacency, describing each quarter as “great” or “strong” while the earnings outlook continues

to fall. Despite the management team’s assertions that it is “absolutely committed” to bringing per-unit costs under

control, management guided costs meaningfully higher for 2024 and revised cost guidance upward again in April.

Southwest’s Board has failed to hold management

accountable for poor execution and has been unable to catalyze (or permit) the necessary strategic evolution. Instead, the Board has reinforced

an insular culture and outdated thinking in the face of indisputable evidence that change is required. The Board includes no directors

with external airline experience, and a majority of the independent directors were recruited by Executive Chairman Gary Kelly. This Board

has in turn selected a management team that, of the eight most senior executives, includes only one executive with experience at another

airline; the rest have worked at Southwest for an average of over 25 years. The mandate from the Board has been clear: Keep doing things

the way they have always been done.

The lack of accountability is best reflected in the

Company’s response to the December 2022 operational meltdown. In a clear display of poor leadership, CEO Bob Jordan declined to

testify in front of Congress after the meltdown, despite attending a company rally just 40 miles away in Baltimore the prior day. No senior

executives were terminated for their role in the meltdown. Most concerning, and in blatant disregard for the affected customers and employees,

the Board nearly doubled the compensation of all key executives in the year after the incident.

We believe that new leadership is required at Southwest.

While Southwest has a proud history, that history is not an argument for supporting poor leadership and sticking with a strategy that

no longer succeeds in the modern airline industry. Rather, Southwest’s legacy necessitates evolution and change to regain

industry leadership for its customers, employees and shareholders. As one of Southwest’s largest investors, we are committed to

delivering the necessary leadership changes to achieve this goal.

A Stronger Southwest

In the accompanying presentation, “Stronger

Southwest,” we outline our views on the challenges the Company faces today and our recommendations to drive improved performance,

which we summarize below:

| (1) | Enhance the Board of Directors: The Board should be reconstituted

with new, truly independent directors from outside of Southwest who have best-in-class expertise in airlines, customer experience and

technology. |

| (2) | Upgrade Leadership: Southwest must bring in new leadership

from outside of the Company to improve operational execution and lead the evolution of Southwest’s strategy. |

| (3) | Undertake a Comprehensive Business Review: Southwest should

form a new management and Board-level committee to evaluate all available opportunities to rapidly restore the Company’s performance

to best-in-class standards. This review would modernize Southwest’s strategy and operations with a focus on increased customer choice,

improved cost execution and updating outdated IT systems, among other opportunities, and it should leverage the fresh perspectives of

the new directors to help formulate the optimal go-forward plan for Southwest. |

By executing on the Stronger Southwest plan, we believe

the Company can return to its rightful position as an industry leader, including generating best-in-class margins and compelling returns

for its shareholders. We believe Southwest’s stock can achieve $49 per share within 12 months, representing a highly attractive

77% return during the period. For the Company’s frontline employees who have a meaningful economic stake in Southwest’s

success, we estimate the plan would result in approximately $8 billion of incremental long-term value from additional profit-sharing payouts

and appreciation of employee-owned stock.

The Stronger Southwest plan puts the Company on a

path to more sustainable performance that will better serve customers, employees and shareholders. The plan modernizes Southwest’s

approach to ensure that its offering is aligned with customer preferences. It upgrades leadership to improve execution. It drives the

efficiency required to continue offering low fares. And it facilitates the necessary investments to run the reliable operation that customers

and employees expect.

Next Steps

Southwest became a leading airline by innovating and

executing. Today, Southwest’s failure to execute and evolve has led to deteriorating performance, and the Company simply is not

living up to its legacy of efficiency and top-tier results. Nevertheless, we are convinced the issues the Company currently faces are

addressable with the right leadership and a comprehensive, unbiased evaluation of the available opportunities.

We look forward to collaborating with Southwest to

restore accountability and best-in-class financial performance for the benefit of the Company’s employees, customers and shareholders.

To that end, we will make ourselves available for a meeting with you at your earliest convenience to discuss these issues in greater detail

and to align on the changes that Southwest needs in order to deliver on its significant potential.

| Sincerely, |

|

| |

|

|

|

| John Pike |

Bobby Xu |

| Partner |

Portfolio Manager |

EXHIBIT 99.2

July 8, 2024

The Board of Directors

Southwest Airlines Co.

2702 Love Field Drive

Dallas, Texas 75235

Dear Members of the Board,

We write to you again on behalf of Elliott Associates,

L.P. and Elliott International, L.P. (together, with its affiliates, “Elliott” or “we”). The purpose of today’s

letter is to summarize the feedback we have received and the key events that have occurred since the publication last month of our letter

and presentation on the urgent need for leadership change at Southwest Airlines (“Southwest” or the “Company”).

Since publishing our views on June 10, we’ve

had the opportunity to engage with shareholders, equity research analysts, industry executives and current and former employees. Many

new institutions and individuals have reached out to us, providing us with new sources of insight and information, and this trend is continuing.

The feedback has been overwhelmingly consistent with our perspective that the Company’s performance is unacceptable and that leadership

change is required to return Southwest to its once-leading position in the industry.

The actions of Southwest’s Board and management

team since we published our views have only solidified the case for leadership change:

| · | On June 26, Southwest announced significantly reduced unit revenue guidance

for the second quarter, continuing its disappointing trend of industry-lagging revenue performance (which appears to have become a habit).

This announcement marked the eighth guidance reduction in the last 18 months. |

| · | On July 3, this Board put its own self-interest ahead of the Company’s

by pursuing the entrenchment strategy of adopting an antiquated and shareholder-unfriendly “poison pill” to prevent Elliott

from increasing its stake above 12.5%. |

| · | And today, the Board announced that it had appointed a handpicked new director

in a clear attempt to entrench itself and the current management team, thereby expanding the size of the current Board to 15 members.

Among the criteria for selecting this new director was clearly that he would be supportive of Southwest’s current leadership and

status-quo approach, as he noted in the announcement that he was “look[ing] forward to supporting the Company’s strategic

direction.” |

These actions – and in particular the adoption

of the “poison pill” – demonstrate how profoundly out of touch Southwest’s Board has become with shareholder sentiment

and with the reality of the situation. Contrary to the Company’s statements, Elliott is not seeking control of Southwest. Quite

simply, we are seeking to strengthen oversight, upgrade management and improve Company performance. Preventing shareholders who do not

support the Company’s failed leadership and oversight from purchasing additional stock reflects exceptionally poor governance and

underscores the immediate need for accountability at Southwest. This is the worst kind of governance – a shield for failure and

a sword for nothing except the fees of advisers who propose these anti-shareholder devices.

In light of these actions, we have become increasingly

concerned by the “self-help” half-measures that the Board appears to be contemplating and adopting, none of which will do

anything to allay the lost credibility of Southwest’s management. Elliott does not make calls for leadership change lightly or without

regard to potential consequences. In this instance, given the long record of falling short and the deep loss of confidence in Southwest’s

leadership among shareholders and other constituents, it is simply untenable for the same Board and management team to continue to lead

Southwest.

Shareholder Feedback

Supports Leadership Change

The feedback we have received since releasing our

materials on June 10 underscores a profound lack of confidence in Southwest’s leadership, strategy and performance, and has reinforced

our conclusion that Board and leadership change is necessary to put Southwest on the right path.

Since the release of our letter, we have spoken with

numerous shareholders representing a significant percentage of Southwest’s shareholder base. While these conversations have been

confidential, we can characterize the sentiments expressed by these shareholders as being overwhelmingly supportive of leadership change.

This was well illustrated by the public support for our campaign offered by Southwest shareholder Artisan Partners on June 12, when it

called on the Board to “reconstitute itself and upgrade the Company’s leadership such that it can objectively assess the best

path forward for Southwest’s shareholders, employees, and customers. We believe this process needs to commence immediately.”

Other conversations echoed the feedback we received

in the shareholder survey we commissioned before publishing our views. Below, we have included a representative sample of perspectives

shared by some of Southwest’s largest investors as part of the survey, with such sentiments having been confirmed in our most recent

discussions:

“The CEO is a headwind to a turnaround.

Firing him is the tailwind.” – Top 10 Active Shareholder

“I would rate them as the worst-performing

management team in the airlines. This was a Company that has destroyed more value based on their own inaction than anyone else in the

industry. They need to go.” – Top 10 Active Shareholder

“They need a new look across the board

and you are only going to get that with [a CEO] who is not from Southwest… This is a classic example of where a disruptor stayed

in the original model as the industry passed them by and now they have a problem.” – Top 10 Active Shareholder

“I have zero confidence this team can

get this right and certainly not in the timeframe that is needed. I rarely call for wholesale change at a company, but that is what is

needed here.” – Top 10 Active Shareholder

“Having the current CEO drive the process

for a new strategy is not a good idea. I think that means we get glacial change and even if they say they are going to become SpaceX there

is still going to be a fairly material overhang in the stock because of skepticism about the execution. This is a good time for the change.”

– Top 10 Active Shareholder

“Would you ever see anyone issue a press

release that says ‘35 year veteran of the company to drive significant strategic, operational and financial turnaround,’ which

is what you would have to believe is possible if you think that Bob Jordan is the right CEO. You need a really different leader to right

the ship.” – Top 10 Active Shareholder

“I don’t think this is the right

CEO to lead the company and I would view his removal positively… Is this the leader you think is able to lead the company into the

transformational change that is needed? I don’t think so and I am not sure other investors do either. I would be surprised if they

did.” – Top 10 Active Shareholder

“So it is really [the CEO] has not done

a good job running the company and what they have in front of them is considerably different than the job he came into, so this really

is a natural time for a leadership succession. The Street would be widely supportive of a change.” – Top 10 Active

Shareholder (emphasis added)

In short, shareholders are demanding change now, and

Elliott remains committed to providing them with a clear choice between continued industry-lagging performance under an incumbent leadership

team that has repeatedly failed to deliver on its promises, versus fundamental leadership change involving new and proven airline industry

executives capable of returning Southwest to its rightful place as an industry leader.

Other Constituents

Have Also Expressed Deep Concerns with Southwest’s Leadership

In addition to hearing from shareholders, we have

received feedback on our views both publicly and privately from some of Southwest’s employees. For an illustrative example of the

feedback we’ve heard, consider the sentiments expressed by SWAPA’s leadership on July 1:

“We see the numbers, not just every

quarter when we have the board meeting here, but we know where the trajectory has been. Then actually when we meet with Bob Jordan

and Andrew Watterson, we bring these concerns up… We have years of disdain from leadership, and that’s how labor has

been treated… I mentioned the word disdain before and I’m going to say it again because that’s the only way that

really we can describe how labor has been treated and SWAPA and our data-driven analysis has been treated. It’s been

disregarded. And here we are with an activist investor basically saying everything we’ve said… Right now we just

can’t [get behind the Company] because we’re again disdained and there’s very little concern right now at the

C-suite, you know, outside of their jobs. There’s not a concern for the employees. And that’s something we can never

forget and really won’t.” – SWAPA Leadership, The SWAPA Number Podcast (July 1)

In addition to this sort of public commentary, we

have also received a deluge of unsolicited private expressions of support from individuals representing themselves as current and former

employees of Southwest – many of whom were in strong agreement with our analysis of the Company’s recent performance and our

calls for change:

“I’m a retired Southwest Captain

and I couldn’t agree with you more on the next steps for Southwest… When I started at Southwest in 1997, it was ‘us

against the world!’ Now it’s every man for himself as our famous culture is dying a slow, painful death. I believe it can

be fixed, and I’m hoping you and your group can make it happen.” – Former Employee

“Not only do I have a vested interest

in the success of the company (my SWA stock has lost over half of its value) but I have spent 50% of my life flying and working for a

company that was once the envy of every other airline operating in the world. Without any doubt I agree that a new leadership team is

needed.” – Current Employee

“As a SWA employee of more than 23 years,

I am in complete agreement with your analysis. I have been screaming this for 15 years.” – Current Employee

“I am a former 21 year employee retiree

and stock holder of SWA who completely agrees with your perspective of current senior management at SWA. [Bob Jordan] has driven the airline

into the ground. Thank you for taking a bold stance and insisting on making some changes.” – Former Employee

This candid feedback is only a small sample of what

we have received so far. We believe sentiment regarding Southwest’s Board and management is particularly negative among these constituents

because, in their view, Southwest’s leadership has ignored their feedback for years and stood idly by as the Company’s performance

deteriorated.

The Path Forward

While it appears that the Company is now finally

considering certain piecemeal changes in the face of public pressure from Elliott, it is crucial that the Board understand that Southwest’s

leadership has already lost the trust of its shareholders. Following years of complacency and – to paraphrase the Company’s

own words in announcing its latest failure to meet guidance – a total inability to adapt to the complexity of the current airline

operating environment, shareholders simply do not believe this Board and management team are capable of devising and executing a bold

new plan to turn around Southwest.

In fact, one of the biggest risks we see to Southwest

in the short term would be the announcement by the Board of a package of half-measures with the objective of further entrenching itself

and avoiding more fundamental change – such as, for example, replacing the current CEO without running a comprehensive search process.

Such unilateral measures, developed hurriedly and lacking the buy-in of shareholders, are the very definition of “short-term thinking”

and will inevitably lead to worse performance over time.

Simply put, investors do not want to see a new plan

from the same leadership team whose record at the Company has been one of failure. They want new leaders who will bring outside perspectives

and proven expertise to the task of preserving all that was great about Southwest while charting a higher-performing future for the airline.

We are calling on the Board to collaborate on the

following changes to strengthen oversight and select the best new CEO to lead the Company into the future:

| 1. | Board Changes: Elliott has identified a number of highly qualified

former airline executives and other industry leaders with relevant experience who are eager to serve on Southwest’s Board. These

individuals are independent from Elliott and have a demonstrated track record of value creation in their former roles. We believe each

would be highly additive to the Board, and unlike the individual added to the Board today, their appointment would not be conditioned

on support for the status-quo leadership and plan. Rather, they would join the Board with an open mind and would evaluate the business

and its leadership without any preconceived commitments or allegiances. The Company should immediately begin the process of working with

us to reconstitute the Board to include these leaders. We believe shareholders will strongly agree that these individuals’ expertise

stands in stark contrast to the existing Board’s demonstrated lack of independence and relevant experience, which has resulted in

years of deteriorating performance with no accountability for management. Additionally, as we have conveyed to you, we believe the role

of Executive Chairman should be retired and Southwest should appoint an independent chair from outside the Company. |

| 2. | Upgraded Leadership: The Company should immediately announce

a CEO transition and select an interim CEO who can earn the trust of investors. This person could be one of the newly appointed Board

members. Following a reconstitution of the Board, Southwest should form a CEO search committee composed of both new and existing directors

to lead a search for the best candidate to become Southwest’s next CEO. We believe the new CEO should be sourced from external

candidates and possess relevant airline or other transportation industry experience, strong operational capabilities and a demonstrated

track record. |

| 3. | Comprehensive Business Review: Following a Board refresh and

the appointment of a highly qualified and credible new CEO, Southwest would be well positioned to develop and execute a new strategy to restore

the airline to industry-leading performance. This comprehensive business review should be led by a new Board-level Business Review Committee.

We believe that fresh perspectives, operational excellence and an openness to evaluating all options are imperative to Southwest’s

future success. |

As one of the Southwest’s largest investors,

Elliott is focused on the sustainable, long-term success of the Company. This Board, however, refuses to hold itself and the management

team accountable for the long-term value destruction endured by Southwest’s shareholders. Indeed, the “poison pill”

announced on July 3 indicates that this Board feels it needs protection from the Company’s owners, rather than to earn their

support. It is tantamount to an admission of failure.

Entrenchment maneuvers by the Board like this “poison

pill” and the unilateral appointment of a new director handpicked by the Company’s incumbent leaders to support the status

quo will not be effective in the face of the deep shareholder frustration that exists today. We are open to collaborating with the Board

on a path forward consistent with the framework outlined above, but absent alignment, we intend to move expeditiously to give shareholders

a direct say on the necessary leadership changes.

We are committed to realizing the substantial opportunity

of improving Southwest’s performance with an updated strategy guided by accomplished, best-in-class industry executives and leaders.

Based on the feedback we have received to date, we believe our fellow shareholders will be equally committed to supporting that new direction.

We will make ourselves available at your earliest convenience for further discussions.

| Sincerely, |

|

| |

|

|

|

| John Pike |

Bobby Xu |

| Partner |

Portfolio Manager |

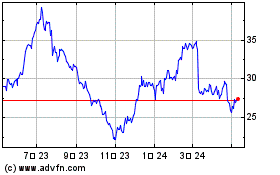

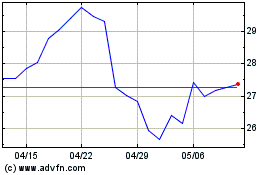

Southwest Airlines (NYSE:LUV)

過去 株価チャート

から 7 2024 まで 8 2024

Southwest Airlines (NYSE:LUV)

過去 株価チャート

から 8 2023 まで 8 2024