The Walt Disney Company Declares Cash Dividend of $1.00 Per Share

2024年12月5日 - 6:20AM

ビジネスワイヤ(英語)

The Walt Disney Company (NYSE: DIS) Board of Directors today

declared a cash dividend of $1.00 per share. This represents a 33%

increase over the $0.75 per share paid to shareholders during

fiscal year 2024.

The dividend will be paid in two installments of $0.50 per

share, according to the following record and payable dates:

Record Dates

Payable Dates

December 16, 2024

January 16, 2025

June 24, 2025

July 23, 2025

“It’s been a highly successful year for The Walt Disney Company,

stemming from the extensive strategic work across the company to

improve quality, innovation, efficiency, and value creation,” said

Robert A. Iger, Chief Executive Officer, The Walt Disney Company.

“With the company operating from a renewed position of strength, we

are pleased to increase the dividend for shareholders while

continuing to invest for the future and drive sustained growth

through Disney’s world-class portfolio of assets.”

About The Walt Disney Company

The Walt Disney Company, together with its subsidiaries and

affiliates, is a leading diversified international entertainment

and media enterprise that includes three business segments:

Entertainment, Sports, and Experiences. Disney is a Dow 30 company

and had annual revenue of $91.4 billion in its Fiscal Year

2024.

Forward-Looking Statements

Certain statements in this communication may constitute

“forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995, including statements

regarding our expectations, beliefs, financial prospects, impact of

strategic initiatives and other statements that are not historical

in nature. Any information that is not historical in nature is

subject to change. These statements are made on the basis of the

management’s views and assumptions regarding future events and

business performance as of the time the statements are made.

Management does not undertake any obligation to update these

statements.

Actual results may differ materially from those expressed or

implied. Such differences may result from actions taken by the

Company, including restructuring or strategic initiatives, our

execution of our business plans, our ability to quickly execute on

cost rationalization while preserving revenue, the discovery of

additional information or other business decisions, as well as from

developments beyond the Company’s control, including: the

occurrence of subsequent events; deterioration in domestic and

global economic conditions or a failure of conditions to improve as

anticipated; deterioration in or pressures from competitive

conditions, including competition to create or acquire content,

competition for talent and competition for advertising revenue;

consumer preferences and acceptance of our content, offerings,

pricing model and price increases, and corresponding subscriber

additions and churn, and the market for advertising sales on our

DTC streaming services and linear networks; health concerns and

their impact on our businesses and productions; international,

political or military developments; regulatory and legal

developments; technological developments; labor markets and

activities, including work stoppages; adverse weather conditions or

natural disasters; and availability of content. Such developments

may further affect entertainment, travel and leisure businesses

generally and may, among other things, affect (or further affect,

as applicable): our operations, business plans or profitability,

including direct-to-consumer profitability; demand for our products

and services; the performance of the Company’s content; our ability

to create or obtain desirable content at or under the value we

assign the content; the advertising market for programming;

taxation; and performance of some or all Company businesses either

directly or through their impact on those who distribute our

products.

Additional factors are set forth in the Company’s most recent

Annual Report on Form 10-K , including under the captions “Risk

Factors,” “Management’s Discussion and Analysis of Financial

Condition and Results of Operations,” and “Business,” and

subsequent filings with the Securities and Exchange Commission,

including, among others, quarterly reports on Form 10-Q.

The terms “Company,” “Disney,” “we,” and “our” are used above to

refer collectively to the parent company and the subsidiaries

through which our various businesses are actually conducted.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241204514675/en/

Carlos Gómez Investor Relations carlos.gomez@disney.com (818)

560-1933

David Jefferson Corporate Communications

david.j.jefferson@disney.com (818) 560-4832

Kelvin Liu Corporate Communications kelvin.liu@disney.com (818)

560-3117

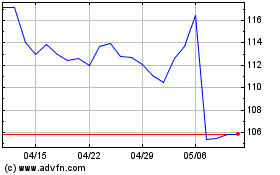

Walt Disney (NYSE:DIS)

過去 株価チャート

から 11 2024 まで 12 2024

Walt Disney (NYSE:DIS)

過去 株価チャート

から 12 2023 まで 12 2024