Barnes Shareholders to Receive $47.50 Per Share in Cash

Barnes Group Inc. (NYSE: B) (“Barnes” or “the Company”), a

global provider of highly engineered products, differentiated

industrial technologies and innovative solutions, announced today

that it has entered into a definitive agreement to be acquired by

funds managed by affiliates of Apollo Global Management, Inc.

(NYSE: APO) (“Apollo”) (the “Apollo Funds”) in an all-cash

transaction that values Barnes at an enterprise value of

approximately $3.6 billion.

The agreement provides that Barnes shareholders will receive

$47.50 per share in cash. The per share purchase price represents a

premium of approximately 22% over Barnes’ undisturbed closing share

price on June 25, 2024, and a premium of approximately 28% over the

volume weighted average price (VWAP) of Barnes common stock for the

90 days ending June 25, 2024.

“We are pleased to reach this agreement with Apollo Funds, which

delivers immediate and certain cash value to our shareholders and

positions Barnes to continue meeting and exceeding our customers’

needs for aerospace and industrial products, systems and

solutions,” said Richard J. Hipple, Chairman of the Board of

Directors. “The Board and management team carefully reviewed a

range of potential opportunities and determined that this

transaction with Apollo Funds maximizes value for our shareholders

and is in the best interest of all stakeholders. The Board also

recognizes the Barnes family, who founded the Company 167 years ago

and continue to contribute to building the Company’s rich history

through six generations of steadfast and profound leadership.”

“Over the past several quarters, Barnes has made tremendous

strides to unlock the Company’s full potential by investing in our

business, reshaping our portfolio, innovating our platforms and

strengthening our financial performance,” said Thomas J. Hook,

President and Chief Executive Officer of Barnes. “Apollo has a

35-year track record of investing in companies like Barnes that

have leading businesses, strong teams and solid performance, and

helping to position them for long-term, sustainable growth. Under

Apollo Funds ownership, we aim to accelerate our transformation,

enhance our capabilities, broaden our product offerings and create

new opportunities for growth and innovation. We look forward to

working with the Apollo team as we continue to execute on our

transformation strategy and capture the opportunities this

transaction will create for Barnes, our employees, our

shareholders, our customers, our suppliers and all

stakeholders.”

“We are thrilled to partner with the talented team at Barnes,

which has a tremendous heritage of building leading businesses with

strong customer relationships in the aerospace and industrial

sectors,” said Antoine Munfakh, Partner at Apollo. “We see

opportunities to further invest in and grow Barnes’ businesses,

which are positioned to benefit from long-term aerospace demand

trends, as well as the need for high performance components and

solutions for a range of end-markets. We applaud the Barnes team

for the progress it has made with its transformation plan, and we

believe this plan can be accelerated in a private company setting.

We look forward to drawing on Apollo’s significant industry

experience and value-added capabilities to support Barnes as it

executes against its transformation and growth plans.”

Transaction Details

The transaction is expected to close before the end of Q1 2025

and is subject to customary closing conditions, including approval

by Barnes shareholders and receipt of required regulatory

approvals. The Barnes Board of Directors unanimously approved the

definitive agreement and recommends that Barnes shareholders vote

in favor of the transaction.

Upon completion of the transaction, Barnes will be delisted from

the New York Stock Exchange and become a privately held company.

Barnes will continue to operate under the Barnes Group name and

brand.

Third Quarter 2024 Earnings and Update on Guidance

Barnes’ third quarter earnings release will be issued on October

25, 2024, before the market opens, as previously announced. In

light of the announced transaction with Apollo Funds, Barnes will

not be conducting its third quarter 2024 conference call and

webcast. In addition, Barnes is suspending its financial guidance

for the full year 2024 as a result of the pending transaction.

Advisors

Goldman Sachs & Co. LLC and Jefferies LLC are serving as

financial advisors and Wachtell, Lipton, Rosen & Katz is

serving as legal counsel to Barnes. Latham & Watkins LLP and

Paul, Weiss, Rifkind, Wharton & Garrison LLP are serving as

legal counsel to Apollo Funds.

Additional Information About the Merger and Where to Find

It

This communication relates to the proposed transaction involving

Barnes Group. In connection with the proposed transaction, Barnes

Group will file relevant materials with the U.S. Securities and

Exchange Commission (the “SEC”), including Barnes Group’s proxy

statement on Schedule 14A (the “Proxy Statement”). This

communication is not a substitute for the Proxy Statement or any

other document that Barnes Group may file with the SEC or send to

its shareholders in connection with the proposed transaction.

BEFORE MAKING ANY VOTING DECISION, SHAREHOLDERS OF BARNES GROUP ARE

URGED TO READ ALL RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE

SEC, INCLUDING THE PROXY STATEMENT, WHEN THEY BECOME AVAILABLE

BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED

TRANSACTION. Investors and security holders will be able to obtain

the documents (when available) free of charge at the SEC’s website,

www.sec.gov, or by visiting Barnes Group’s investor relations

website, https://ir.onebarnes.com/home/default.aspx.

Participants in the Solicitation

Barnes and certain of its directors, executive officers and

employees may be deemed to be participants in the solicitation of

proxies in respect of the proposed transaction. Information

regarding Barnes’ directors and executive officers is available in

Barnes’ proxy statement for the 2024 annual meeting of

stockholders, which was filed with the SEC on March 29, 2024 (the

“Annual Meeting Proxy Statement”). Please refer to the sections

captioned “Director Compensation,” “Executive Compensation,” and

“Stock Ownership” in the Annual Meeting Proxy Statement. To the

extent holdings of such participants in Barnes’ securities have

changed since the amounts described in the Annual Meeting Proxy

Statement, such changes have been reflected on Initial Statements

of Beneficial Ownership on Form 3 or Statements of Change in

Ownership on Form 4 filed with the SEC: Form 4, filed by Elijah

Kent Barnes on May 6, 2024; Form 4, filed by Jakki L. Haussler on

May 6, 2024; Form 4, filed Richard J. Hipple on May 6, 2024; Form

4, filed by Daphne E. Jones on May 6, 2024; Form 4, filed by Neal

J. Keating on May 6, 2024; Form 4, filed by Hans-Peter Männer on

May 6, 2024; Form 4, filed by Anthony V. Nicolosi on May 6, 2024;

Form 4, filed by JoAnna Sohovich on May 6, 2024; Form 4, filed by

Adam J. Katz on May 6, 2024; Form 4, filed by Julie K. Streich on

July 22, 2024; Form 4, filed by Dawn N. Edwards on July 22, 2024;

Form 4, filed by Marian Acker on July 22, 2024; Form 4, filed by

Elijah Kent Barnes on August 5, 2024; Form 4, filed by Marian Acker

on August 13, 2024; Form 4, filed by Dawn N. Edwards on August 13,

2024; Form 4, filed by Thomas J. Hook on August 13, 2024; Form 4,

filed by Jay B. Knoll on August 13, 2024; Form 4, filed by Ian M.

Reason on August 13, 2024; Form 4, filed by Julie K. Streich on

August 13, 2024; and Form 3, filed by Troy W. Ingianni on September

20, 2024. Other information regarding the participants in the proxy

solicitation and a description of their direct and indirect

interests, by security holdings or otherwise, will be contained in

the Proxy Statement and other relevant materials to be filed with

the SEC in connection with the proposed transaction when they

become available. Free copies of the Proxy Statement and such other

materials may be obtained as described in the preceding

paragraph.

Forward-Looking Statements

This release contains forward-looking statements as defined in

the Private Securities Litigation Reform Act of 1995, including,

without limitation, statements regarding our ESG goals,

commitments, and strategies. Forward-looking statements often

contain words such as “anticipate,” “believe,” “expect,” “plan,”

“estimate,” “project,” “continue,” “will,” “should,” “may,” and

similar terms. These forward-looking statements do not constitute

guarantees of future performance and are subject to a variety of

risks and uncertainties that may cause actual results to differ

materially from any future results expressed or implied by the

forward-looking statements. In addition, we have based some of

these forward-looking statements on assumptions about future events

that may prove to be inaccurate. Such factors, risks and

uncertainties include: (1) the occurrence of any event, change or

other circumstances that could give rise to the termination of the

merger agreement between the parties to the proposed transaction or

extend the anticipated timetable for completion of the proposed

transaction; (2) the failure to obtain approval of the proposed

transaction from the Company’s shareholders; (3) the failure to

obtain certain required regulatory approvals or the failure to

satisfy any of the other closing conditions to the completion of

the proposed transaction within the expected timeframes or at all;

(4) risks related to disruption of management’s attention from the

Company’s ongoing business operations due to the proposed

transaction; (5) the effect of the announcement of the proposed

transaction on the ability of the Company to retain and hire key

personnel and maintain relationships with its customers, suppliers

and others with whom it does business, or on its operating results

and business generally; (6) the ability of the Company to meet

expectations regarding the timing and completion of the

transaction; (7) the impacts resulting from the conflict in

Ukraine, the Middle East or any other geopolitical tensions; and

(8) the impacts of the any pandemics, epidemics or infectious

disease outbreaks

For additional information and detailed discussion of these

risks, uncertainties, and other potential factors that could affect

our business and performance and cause actual results or outcomes

to differ materially from the results, performance or achievements

addressed in our forward-looking statements is included in our

other filings with the SEC, including in the “Risk Factors” and

“Management’s Discussion and Analysis of Financial Condition and

Results of Operations” sections of our most recently filed periodic

reports on Form 10-K and Form 10-Q and subsequent filings. The

Company assumes no obligation to update its forward-looking

statements, which speak as of their respective dates, whether as a

result of new information, future events, or otherwise.

About BARNES

Barnes Group Inc. (NYSE: B) leverages world-class manufacturing

capabilities and market-leading engineering to develop advanced

processes, automation solutions, and applied technologies for

industries ranging from aerospace and medical & personal care

to mobility and packaging. With a celebrated legacy of pioneering

excellence, Barnes delivers exceptional value to customers through

advanced manufacturing capabilities and cutting-edge industrial

technologies. Barnes Aerospace specializes in the production and

servicing of intricate fabricated and precision-machined components

for both commercial and military turbine engines, nacelles, and

airframes. Barnes Industrial excels in advancing the processing,

control, and sustainability of engineered plastics and delivering

innovative, custom-tailored solutions for industrial automation and

metal forming applications. Established in 1857 and headquartered

in Bristol, Connecticut, USA, the Company has manufacturing and

support operations around the globe. For more information, visit

please visit www.onebarnes.com.

About Apollo

Apollo is a high-growth, global alternative asset manager. In

our asset management business, we seek to provide our clients

excess return at every point along the risk-reward spectrum from

investment grade to private equity with a focus on three investing

strategies: yield, hybrid, and equity. For more than three decades,

our investing expertise across our fully integrated platform has

served the financial return needs of our clients and provided

businesses with innovative capital solutions for growth. Through

Athene, our retirement services business, we specialize in helping

clients achieve financial security by providing a suite of

retirement savings products and acting as a solutions provider to

institutions. Our patient, creative, and knowledgeable approach to

investing aligns our clients, businesses we invest in, our

employees, and the communities we impact, to expand opportunity and

achieve positive outcomes. As of June 30, 2024, Apollo had

approximately $696 billion of assets under management. To learn

more, please visit www.apollo.com.

Category: General

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241006270417/en/

Barnes Contact Media and Investors William Pitts

Vice President Investor Relations 860-973-2144

wpitts@onebarnes.com

Apollo Contacts Noah Gunn Global Head of Investor

Relations Apollo Global Management, Inc. (212) 822-0540

IR@apollo.com

Joanna Rose Global Head of Corporate Communications Apollo

Global Management, Inc. (212) 822-0491

Communications@apollo.com

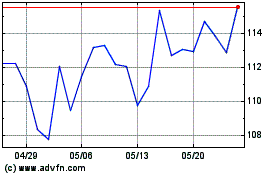

Apollo Global Management (NYSE:APO)

過去 株価チャート

から 11 2024 まで 12 2024

Apollo Global Management (NYSE:APO)

過去 株価チャート

から 12 2023 まで 12 2024