0000874501FALSE00008745012024-08-062024-08-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): August 6, 2024

| | |

| Ambac Financial Group, Inc. |

| (Exact name of Registrant as specified in its charter) |

| | | | | | | | | | | | | | |

| Delaware | | 1-10777 | | 13-3621676 |

| (State of incorporation) | | (Commission

file number) | | (I.R.S. employer

identification no.) |

| | | | | | | | | | | |

| One World Trade Center | New York | NY | 10007 |

| (Address of principal executive offices) |

| | | | | | | | | | | |

| (212) | 658-7470 | |

| (Registrant's telephone number, including area code) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☒ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act

(17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

(17 CFR 240.13e-4c)) |

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common stock, par value $0.01 per share | | AMBC | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 under the Securities Act (17 CFR 230.405) or Rule 12b-2 under the Exchange Act (17 CFR 240.12b-2).

| | | | | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to |

| Section 13(a) of the Exchange Act. | ☐ | |

Item 7.01. Regulation FD Disclosure.

On August 6, 2024, Ambac’s management hosted an earnings call. A transcript of the call is attached as Exhibit 99.1 hereto and is hereby incorporated by reference.

The information furnished pursuant to this Item 7.01, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities under that Section and shall not be deemed to be incorporated by reference into any filing of the Company under the Securities Act or the Exchange Act.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits. The following exhibit is filed as part of this Current Report on Form 8-K:

EXHIBIT INDEX

| | | | | | | | |

| Exhibit | | |

| Number | | Exhibit Description |

| 99.1 | | |

| 101.INS | | XBRL Instance Document - the instance document does not appear in the interactive Data File because its XBRL tags are embedded within the Inline XBRL document. |

| 101.SCH | | XBRL Taxonomy Extension Schema Document. |

| 101.CAL | | XBRL Taxonomy Extension Calculation Linkbase Document. |

| 101.LAB | | XBRL Taxonomy Extension Label Linkbase Document. |

| 101.PRE | | XBRL Taxonomy Extension Presentation Linkbase Document. |

| 101.DEF | | XBRL Taxonomy Extension Definition Linkbase Document. |

| 104 | | Cover Page Interactive Data File - The cover page interactive data file does not appear in the Interactive Data File because its XBRL tags or embedded within the Inline XBRL document |

* Certain schedules and other similar attachments to such agreement have been omitted pursuant to Item 601(a)(5) of Regulation S-K. The Company will furnish a copy of such omitted documents to the SEC upon request.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | |

| | | Ambac Financial Group, Inc. |

| | | (Registrant) |

| | | | | |

| Dated: | August 6, 2024 | | By: | | /s/ Stephen M. Ksenak |

| | | | | Stephen M. Ksenak |

| | | | | Senior Managing Director, General Counsel

and Assistant Secretary |

Exhibit 99.1

Filed by Ambac Financial Group, Inc.

pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: Ambac Financial Group, Inc.

Commission File No.: 1-10777

Date: August 6,2024

| | |

Ambac Financial Group, Inc. – Second Quarter 2024 Earnings Call, August 6, 2024

|

Forward-Looking Statements

In this presentation, we have included statements that may constitute “forward-looking statements” within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Words such as “estimate,” “project,” “plan,” “believe,” “anticipate,” “intend,” “planned,” “potential” and similar expressions, or future or conditional verbs such as “will,” “should,” “would,” “could,” and “may,” or the negative of those expressions or verbs, identify forward-looking statements. We caution readers that these statements are not guarantees of future performance. Forward-looking statements are not historical facts but instead represent only our beliefs regarding future events, which may by their nature be inherently uncertain and some of which may be outside our control. These statements may relate to plans and objectives with respect to the future, among other things which may change. We are alerting you to the possibility that our actual results may differ, possibly materially, from the expected objectives or anticipated results that may be suggested, expressed or implied by these forward-looking statements. Important factors that could cause our results to differ, possibly materially, from those indicated in the forward-looking statements include, among others, those discussed under “Risk Factors” in our most recent SEC filed quarterly or annual report.

Any or all of management’s forward-looking statements here or in other publications may turn out to be incorrect and are based on management’s current belief or opinions. Ambac Financial Group’s (“AFG”) and its subsidiaries’ (collectively, “Ambac” or the “Company”) actual results may vary materially, and there are no guarantees about the performance of Ambac’s securities. Among events, risks, uncertainties or factors that could cause actual results to differ materially are: (1) the high degree of volatility in the price of AFG’s common stock; (2) uncertainty concerning the Company’s ability to achieve value for holders of its securities, whether from Ambac Assurance Corporation (“AAC”) and its subsidiaries or from the specialty property and casualty insurance business, the insurance distribution business, or related businesses; (3) inadequacy of reserves established for losses and loss expenses and the possibility that changes in loss reserves may result in further volatility of earnings or financial results; (4) potential for rehabilitation proceedings or other regulatory intervention or restrictions against AAC; (5) credit risk throughout Ambac’s business, including but not limited to credit risk related to insured residential mortgage-backed securities, student loan and other asset securitizations, public finance obligations (including risks associated with Chapter 9 and other restructuring proceedings), issuers of securities in our investment portfolios, and exposures to reinsurers; (6) our inability to effectively reduce insured financial guarantee exposures or achieve recoveries or investment objectives; (7) AAC’s inability to generate the significant amount of cash needed to service its debt and financial obligations, and its inability to refinance its indebtedness; (8) AAC’s substantial indebtedness could adversely affect the Company’s financial condition and operating flexibility; (9) Ambac may not be able to obtain financing, refinance its outstanding indebtedness, or raise capital on acceptable terms or at all due to its substantial indebtedness and financial condition; (10) greater than expected underwriting losses in the Company’s specialty property and casualty insurance business; (11) failure of specialty insurance program partners to properly market, underwrite or administer policies; (12) inability to obtain reinsurance coverage on expected terms; (13) loss of key relationships for production of business in specialty property and casualty and insurance distribution businesses or the inability to secure such additional relationships to produce expected results; (14) the impact of catastrophic public health, environmental or natural events, or global or regional conflicts; (15) credit risks related to large single risks, risk concentrations and correlated risks; (16) risks associated with adverse selection as Ambac’s financial guarantee insurance portfolio runs off; (17) the risk that Ambac’s risk management policies and practices do not anticipate certain risks and/or the magnitude of potential for loss; (18) restrictive covenants in agreements and instruments that impair Ambac’s ability to pursue or achieve its business strategies; (19) adverse effects on operating results or the Company’s financial position resulting from measures taken to reduce financial guarantee risks in its insured portfolio; (20) disagreements or disputes with Ambac's insurance regulators; (21) loss of control rights in transactions for which we provide financial guarantee insurance; (22) inability

1

ViaVid has made considerable efforts to provide an accurate transcription. There may be material errors, omissions, or inaccuracies in the reporting of the substance of the conference call. This transcript is being made available for information purposes only.

1-888-562-0262 1-604-929-1352 www.viavid.com

| | |

Ambac Financial Group, Inc. – Second Quarter 2024 Earnings Call, August 6, 2024

|

to realize expected recoveries of financial guarantee losses; (23) risks attendant to the change in composition of securities in Ambac’s investment portfolio; (24) adverse impacts from changes in prevailing interest rates; (25) events or circumstances that result in the impairment of our intangible assets and/or goodwill that was recorded in connection with Ambac’s acquisitions; (26) factors that may negatively influence the amount of installment premiums paid to Ambac; (27) the risk of litigation, regulatory inquiries, investigations, claims or proceedings, and the risk of adverse outcomes in connection therewith; (28) the Company’s ability to adapt to the rapid pace of regulatory change; (29) actions of stakeholders whose interests are not aligned with broader interests of Ambac's stockholders; (30) system security risks, data protection breaches and cyber attacks; (31) regulatory oversight of Ambac Assurance UK Limited (“Ambac UK”) and applicable regulatory restrictions may adversely affect our ability to realize value from Ambac UK or the amount of value we ultimately realize; (32) failures in services or products provided by third parties; (33) political developments that disrupt the economies where the Company has insured exposures; (34) our inability to attract and retain qualified executives, senior managers and other employees, or the loss of such personnel; (35) fluctuations in foreign currency exchange rates; (36) failure to realize our business expansion plans or failure of such plans to create value; (37) greater competition for our specialty property and casualty insurance business and/or our insurance distribution business; (38) loss or lowering of the AM Best rating for our property and casualty insurance company subsidiaries; (39) disintermediation within the insurance industry or greater competition from technology-based insurance solutions or non-traditional insurance markets; (40) changes in law or in the functioning of the healthcare market that impair the business model of our accident and health managing general underwriter; (41) failure to consummate the proposed sale of all of the common stock of AAC and the transactions contemplated by the related stock purchase agreement (the “Sale Transactions”) in a timely manner or at all; (42) potential litigation relating to the proposed Sale Transactions; (43) disruptions from the proposed Sale Transactions that may harm Ambac’s business, including current plans and operations; (44) potential adverse reactions or changes to business relationships resulting from the announcement or completion of the proposed Sale Transactions; (45) difficulties in integrating acquired businesses into our business; and (46) other risks and uncertainties that have not been identified at this time.

C O R P O R A T E P A R T I C I P A N T S

Charles Sebaski, Head of Investor Relations

Claude LeBlanc, President and Chief Executive Officer

David Trick, Executive Vice President, Chief Financial Officer and Treasurer

C O N F E R E N C E C A L L P A R T I C I P A N T S

Giuliano Bologna, Compass Point

Deepak Sarpangal, Repertoire Partners

2

ViaVid has made considerable efforts to provide an accurate transcription. There may be material errors, omissions, or inaccuracies in the reporting of the substance of the conference call. This transcript is being made available for information purposes only.

1-888-562-0262 1-604-929-1352 www.viavid.com

| | |

Ambac Financial Group, Inc. – Second Quarter 2024 Earnings Call, August 6, 2024

|

P R E S E N T A T I O N

Operator

Greetings, and welcome to the Ambac Financial Group, Inc. Second Quarter 2024 Earnings Call.

At this time, all participants are in a listen-only mode. A brief question-and-answer session will follow the formal presentation. If anyone should require Operator assistance during the conference, please press star, zero on your telephone keypad.

As a reminder, this conference is being recorded.

It is now my pleasure to turn the call over to Charles Sebaski, Head of Investor Relations. Please go ahead, sir.

Charles Sebaski

Thank you.

Good morning, and welcome to Ambac's second quarter 2024 call to discuss financial results.

Speaking today will be Claude LeBlanc, President and CEO; and David Trick, Chief Financial Officer. They will discuss the financial results of our business and the current market environment, and after prepared remarks, we'll take your questions. For those of you following along on the webcast, during prepared remarks, we'll be highlighting some slides from the investor presentation, which can be located on our website.

Our call today includes forward-looking statements. The Company cautions investors that any forward-looking statements involve risks and uncertainties and is not a guarantee of future performance. Actual results may differ materially from those expressed or implied in the forward-looking statements due to a variety of factors. Those factors are described under Forward-Looking Statements in our earnings press release, our most recent 10-Q and 10-K filed with the SEC. We do not undertake any obligation to update forward-looking statements.

Also, in our prepared remarks or responses to questions, we may mention some non-GAAP financial measures. Reconciliation to those non-GAAP measures are included in our recent earnings press release, operating supplement, and other materials available on the investor section of our website, ambac.com.

I would now like to turn the call over to Mr. Claude LeBlanc.

Claude LeBlanc

Thank you, Chuck, and welcome to everyone joining today's call.

<#>

ViaVid has made considerable efforts to provide an accurate transcription. There may be material errors, omissions, or inaccuracies in the reporting of the substance of the conference call. This transcript is being made available for information purposes only.

1-888-562-0262 1-604-929-1352 www.viavid.com

| | |

Ambac Financial Group, Inc. – Second Quarter 2024 Earnings Call, August 6, 2024

|

Our reported results for the second quarter were favorable compared to the prior year. We generated a net loss of just under $1 million, adjusted net income of $8 million, and consolidated EBITDA of $27 million. David will discuss our financial results in detail shortly.

Today, I would like to provide an update on the two strategic announcements we made earlier in the quarter.

In June, we announced an agreement to sell our Legacy Financial Guarantee business to Oaktree Capital Management for $420 million. This was the culmination of several years of targeted efforts to optimize the portfolio, maximize recoveries, and progress the business towards a steady-state runoff in preparation for a strategic review. The Oaktree bid was the best value to shareholders, measured on a notional, time, and risk adjusted basis. The sale price achieved was consistent with or above a range of estimated values that we evaluate. The sale of AAC is expected to close during the fourth quarter of 2024, although the ultimate timing will be subject to approvals outside of our control.

Upon the close of the sale, we will implement a share repurchase program of up to $50 million to be initiated in the first three months of closing depending on market conditions. In making this decision, Management and the Board took into consideration our anticipated year-end liquidity and capital position and our go-forward capital needs and obligations, amongst other considerations. Following the execution of the share repurchase program, we will evaluate authorizing additional capital return activities measured against other capital deployment opportunities and based on market conditions.

Last week, we also announced the closing of the Beat Capital acquisition. I would like to take this opportunity to officially welcome John Cavanagh and his partners and the entire Beat team to the Ambac family. In Beat, we have found an organization with a similar culture and values. Both Cirrata and Beat employ a partnership model to aligned interests. The combination offers significant potential for revenue, capital, and expense synergies which we believe will allow us to achieve superior returns and create long-term value for our shareholders. The Cirrata/Beat combination establishes us as a leading insurance distribution platform with exceptional global growth opportunities through both organic and inorganic means. We believe the combined breadth and depth of our capacity relationships, distribution channels, and a highly desirable operational environment makes us a premier destination for top MGA talent.

Our distribution businesses are primarily focused on specialty and E&S lines where specialization and flexibility of rate and form have led this segment to outperform the growth of the broader P&C markets. On a combined basis, Ambac’s Specialty P&C businesses are now expected to generate approximately $1.4 billion of premium on a pro forma basis for 2024, essentially doubling the size of our P&C platform. The combined Cirrata/Beat insurance distribution platform now comprises 16 MGAs, up from five, as of the end of the second quarter.

As we seek to accelerate our premium and margin growth, our combined platform is uniquely positioned to continue to attract what we believe to be best-in-class talent, as well as top MGAs. Together, we are better positioned to leverage our key differentiated offerings for the benefit of our MGA partners, which include, first, aligned risk capital. Unlike the majority of our insurance distribution peers, we can accelerate the launch and support the development and growth of our distribution businesses. Our Lloyd’s Syndicates and capital light carriers enable us to align interests with our capacity providers and gives us

1

ViaVid has made considerable efforts to provide an accurate transcription. There may be material errors, omissions, or inaccuracies in the reporting of the substance of the conference call. This transcript is being made available for information purposes only.

1-888-562-0262 1-604-929-1352 www.viavid.com

| | |

Ambac Financial Group, Inc. – Second Quarter 2024 Earnings Call, August 6, 2024

|

the ability to incubate and launch distribution ventures more rapidly. This distinct market advantage positions us for strong future growth. Second, as a public company, we offer key risk and oversight controls that benefit our businesses, as well as our key stakeholders, and lastly, business agility supported by our extensive technology-focused shared service offering.

Turning now to our second quarter results, excluding our Beat business.

Our consolidated Specialty P&C insurance platform continued to generate strong production with over $165 million in premium, a 75% increase over last year. Our insurance distribution business placed over $53 million of premium, up 31% over the prior year. This was supported by the ongoing benefit of organic growth initiatives and the addition of Riverton to the platform last August.

We also announced the launch of Tara Hill in the second quarter, an MGA focused on management and professional alliance.

Going forward, we believe Cirrata’s business profile and mix will be meaningfully and positively impacted by the Beat acquisition. We look forward to providing investors with more details on the combined business in the coming months.

Everspan had strong growth in the quarter, generating gross written premium of $111 million, which is up 109% over last year, and produced a combined ratio of 109.4%, improving from the 112.7% last year as the portfolio continues to scale and diversify. This quarter, the underwriting results were impacted by increased loss frequency in commercial auto. As we indicated in prior quarters, we continue to take a cautious approach to reserving and expect some near-term volatility as Everspan’s portfolio scales and diversifies across programs and lines of business.

Consistent with our focus on disciplined underwriting, we discontinued the subject commercial auto program this quarter. We believe rates are keeping up or exceeding loss cost trends for all of our other programs. At the same time, Everspan maintains a strong pipeline of program opportunities which we believe will further our goals to diversify the portfolio, support growth, reduce our combined ratios, and deliver strong future ROEs.

I will now turn the call over to David discuss our financial results for the quarter. David?

David Trick

Thank you, Claude, and good morning, everyone.

For the second quarter of 2024, Ambac generated a net loss of just under $1 million or $0.02 per diluted share, improving from a net loss of $13 million or $0.29 per diluted share in the second quarter of 2023.

Adjusted net income increased to $8 million or $0.18 per diluted share for the quarter compared to adjusted net income of $3 million or $0.07 per diluted share in the second quarter of 2023.

Our results for the second quarter of 2024 were impacted by several items, including $5 million of net gains from minority strategic investments in Insurtech-related businesses, $12 million of net gains from

2

ViaVid has made considerable efforts to provide an accurate transcription. There may be material errors, omissions, or inaccuracies in the reporting of the substance of the conference call. This transcript is being made available for information purposes only.

1-888-562-0262 1-604-929-1352 www.viavid.com

| | |

Ambac Financial Group, Inc. – Second Quarter 2024 Earnings Call, August 6, 2024

|

the termination of a retiree benefit plan, and approximately $16 million of legal and advisor expenses related to the acquisition of Beat and the sale of AAC. In addition, during the second quarter, we continued to experience significant growth in our Specialty P&C businesses.

Cirrata premiums placed grew 31% to over $53 million from $41 million in the second quarter of 2023, driven by the acquisition of Riverton and 11% organic growth. Gross commissions were $13 million, up 32% compared to the second quarter of 2023. Revenue benefited both from the acquisition of Riverton and 12% organic growth.

EBITDA was $2.4 million, $2 million after a minority non-controlling interest for the second quarter of 2023, up 47% and 54% from the $1.6 million, $1.3 million after minority non-controlling interest, respectively, produced in the second quarter of 2023. The resulting gross EBITDA margin was 18.1% this quarter compared to 16.3% in the second quarter of 2023. This margin expansion was largely driven by organic growth, including an A&H policy renewal which shifted to the second quarter of 2024, would have been the third quarter.

We expect Cirrata’s earnings and margin profile to be positively impacted in the third quarter by the inclusion of two months of Beat’s results, with the closing of the acquisition effective July 31.

Everspan’s net premiums written in the quarter of $32 million were up 254% over the prior-year period based on a retention rate of approximately 29% of gross written premium at $111 million. This compared to a 17% retention rate of gross premium written of $53 million last year. As was the case last quarter, both the growth in net premiums and higher retention levels stem mostly from workers compensation and nonstandard auto programs written in the back half of 2023 as assumed reinsurance.

Earned premiums and program fees were $27 million and $3 million, up 248% and 60%, respectively, from the second quarter of 2023. The loss ratio of 85.1% in the second quarter of 2024 was up from 73.7% in the second quarter of 2023. Year-to-date, the loss ratio was 80.5% compared to 70.4% last year. The second quarter loss ratio included 6.9 percentage points of prior accident year developments, mainly driven by increased frequency in commercial auto. This elevated commercial auto frequency also led to 4.2 percentage points of catch up from the first quarter of this year. The 2024 accident year loss ratio, including both prior-period development and inter-period catch up, was 73.9% compared to 69.5% in the second quarter of 2023.

One of the ways Everspan manages exposure is through sliding-scale commissions, which is recorded against acquisition cost and linked to loss performance. For the second quarter of 2024, sliding-scale commissions produced a benefit of 5.6% compared to a 4.2% benefit last year. The expense ratio was 24.3% in the second quarter of 2024, down from 39% in the prior-year quarter, benefiting from the overall growth at Everspan. In addition, the expense ratio benefited this quarter from the increase in sliding-scale commissions of 140 basis points noted earlier. The resulting combined ratio for the second quarter was 109.4%, an improvement of 330 basis points from the respective prior-year period. The year-to-date combined ratio of 104% is down meaningfully from 117.1% last year-to-date.

Everspan’s combined ratios overall are continuing to trend downward as the business grows and diversifies, and as noted by Claude, we have taken decisive action to contain the losses in commercial auto. Excluding commercial auto, Everspan produced a loss ratio for the quarter of 68.7%. For the

3

ViaVid has made considerable efforts to provide an accurate transcription. There may be material errors, omissions, or inaccuracies in the reporting of the substance of the conference call. This transcript is being made available for information purposes only.

1-888-562-0262 1-604-929-1352 www.viavid.com

| | |

Ambac Financial Group, Inc. – Second Quarter 2024 Earnings Call, August 6, 2024

|

quarter, Everspan experienced just over a $1 million protect loss compared to a roughly breakeven result for the second quarter of 2023.

For the second quarter, the Legacy Financial Guarantee segment generated net income of $11 million versus a net loss of $9 million in the prior-year period. The year-over-year improvement was primarily driven by higher discount rates and a one-time gain related to determination of a benefit plan.

Consolidated investment income for the second quarter was $36 million compared to $35 million in the second quarter of 2023. The improvement stemmed from higher average yields on fixed income securities which increased 60 basis points over the same period.

Consolidated loss and loss adjustment expenses were $18 million in the second quarter of 2024 compared to $7 million in the second quarter of 2023. Everspan losses grew by $17 million compared to the prior year to $23 million.

Legacy Financial Guarantee produced a net benefit of $5 million, favorably impacted by higher discount rates versus lower discount rates in the prior year and favorable credit developments.

Shareholders equity of $1.37 billion or $30.25 per share at June 30, 2024 compared to $30.19 at March 31, 2024. The net loss in the quarter was more than offset by a $4 million unrealized gain on available for sale investments.

Adjusted book value of $1.32 billion or $29.23 per share at June 30, 2024 was up 1% from $29.03 per share at March 31, 2024.

At June 30, 2024, AFG on a standalone basis, excluding investments and subsidiaries, had cash investments and debt receivables of approximately $202 million or $4.47 per share.

I will now turn the call back to Claude for some closing remarks.

Claude LeBlanc

Thank you, David.

This quarter represents an inflection point for Ambac, as we made significant progress on all key strategic priorities: first, completing the transformation of Ambac to a pure play Specialty P&C company by entering into an agreement to sell our Legacy Financial Guarantee business to Oaktree Capital; second, establishing a leading insurance distribution business through the combination of Beat and Cirrata.

The execution of these strategic priorities is not an endpoint, but the beginning of our future. We have strong conviction that Ambac’s go-forward business strategy provides tremendous opportunity to create additional value for our shareholders through continued growth of our insurance distribution business, which has been materially advanced by the recent acquisition of Beat Capital Partners and positions us as a leading pure play Specialty P&C business.

4

ViaVid has made considerable efforts to provide an accurate transcription. There may be material errors, omissions, or inaccuracies in the reporting of the substance of the conference call. This transcript is being made available for information purposes only.

1-888-562-0262 1-604-929-1352 www.viavid.com

| | |

Ambac Financial Group, Inc. – Second Quarter 2024 Earnings Call, August 6, 2024

|

Our focus remains on maximizing long-term shareholder value, which we are committed to doing by growing our Specialty P&C businesses, as well as through prudent capital allocation. I look forward to updating you on our progress in the coming quarters.

Operator, please open the call for questions.

Operator

Thank you. We will now be conducting a question-and-answer session. If you would like to ask a question, please press star, one on your telephone keypad. A confirmation tone will indicate your line is in the question queue. You may press star, two if you would like to remove your question from the queue. We ask analysts to limit themselves to one question and a follow-up so that others may have an opportunity to ask questions. For participants using speaker equipment, it may be necessary to pick up your handset before pressing the star keys. One moment, please, while we poll for questions.

Our first question comes from Giuliano Bologna with Compass Point. Please proceed with your question.

Giuliano Bologna

Good morning. Maybe to kick off, one of the notes in the presentation highlights that there’s some potential obligations to fund minority interests at the MGAs and it could range from $250 million to $370 million. I’m curious about potential timing of that, and if you could maybe accelerate some of those or internalize some of the minority interest before those obligations are along the way?

David Trick

Hi, Giuliano. Thanks for the question. Yes, so those obligations relate primarily to the puts and the calls that we have with the MGAs that are currently part of the Cirrata family, as well as now with the acquisition of Beat. Typically, when we partner up with these MGAs, we acquire about 80% on average, 60% to 80% on average of MGAs and the remaining minority interest of 20% to 40%, we enter into put call arrangements. We’re coming to a point where, on some of our earlier acquisitions, we’re in the put call period for our first acquisition, and others will be coming at a regular cadence at this point, including with Beat, which our first put call would be in 2026. We can’t really accelerate them, but we are in a point in time in our evolution at Cirrata that these puts and calls will be coming, in the case of the call, exercisable, and the put, which would be more the obligation, could be put to us, and so we do anticipate over the next couple of years, that we’ll be exercising some of those calls and/or responding to some of those puts, which ultimately would be funded by cash on the balance sheet, as well as potentially some external financing.

Giuliano Bologna

That’s very helpful. Then, sorry, different topic, there’s a discussion about $50 million share repurchase authorization. I’m curious about two different aspects around that. The first one is if there’s any ability to accelerate any of that before the potential sale of AAC closes, and then the second one is $50 million is not necessarily immaterial to your market cap and you still have the 5% ownership limitation in place. I’m

5

ViaVid has made considerable efforts to provide an accurate transcription. There may be material errors, omissions, or inaccuracies in the reporting of the substance of the conference call. This transcript is being made available for information purposes only.

1-888-562-0262 1-604-929-1352 www.viavid.com

| | |

Ambac Financial Group, Inc. – Second Quarter 2024 Earnings Call, August 6, 2024

|

curious if there’s any way to lift the 5% cap or there’s any interest in lifting the 5% cap or how you could work around that, get to a $50 million carry purchase program executed?

Claude LeBlanc

Hey, Giuliano, the $50 million is a plan that we have indicated we will initiate immediately post close of the AAC transaction. We do have some additional capital available between now and close, but we’ve earmarked that for other business purposes and just prudent capital management. We’re going to wait until we close the AAC transaction to officially launch into that. You’re right, it is on a larger side, if you will, in terms of buybacks relative to our market cap. Although, as we’ve indicated, we believe that our share trading values are below our view of the value of Company, and we believe that that gap we hope will reduce between now and the closing of the transaction, potentially in connection with the close of the transaction, but we do have strong conviction to deploy the full $50 million if market conditions are appropriate depending on where stock price is.

As it relates to the 5% limitation, while that is something that we’ll keep a close eye on as we progress, we have developed a plan to mitigate the risk of that, but we won’t be using that as a hard line. In the event that there was potentially some shift, that’s something that we’ll be prepared to deal with, although we’re not looking to create shift that would in any way jeopardize the NOLs.

Giuliano Bologna

That’s helpful. Thank you, and then just thinking about, obviously, there are a few moving parts between now and the closing of the AAC transaction in terms of holdco liquidity moving around, but I’m curious, when you think about further out, I’m curious how you think about holdco leverage and how much leverage you might be willing to use at the holding company level to fund additional growth opportunities, and/or just different investments for the rest of the platform?

David Trick

Sure, Giuliano, so we are not afraid of leverage. Certainly, we could use leverage if it makes economic sense. We’re going to leverage the Company whether it’s because of puts and calls or other acquisition opportunities. It’s going to measured against what the profile of those investments and acquisitions are to make sure that we have the right leverage for the balance sheet, protect the balance sheet, because at the end of the day, that’s our primary goal is to grow the business in a responsible way and protect the balance sheet and optimize the financial flexibility. But as a normal course company and growing company now, leverage makes a lot of sense and it’s one of the ways in which we can optimize our course of capital and the efficiency of our balance sheet. I think over longer term, a normalized level of leverage could be in the range of two to four times EBITDA that may peek up at a certain point in time depending on short-term transactions, but as a normal cost, that seems to be the level of leverage that would make sense for us over the long-term.

Giuliano Bologna

That’s very helpful. I appreciate the time, and I will jump back in the queue.

6

ViaVid has made considerable efforts to provide an accurate transcription. There may be material errors, omissions, or inaccuracies in the reporting of the substance of the conference call. This transcript is being made available for information purposes only.

1-888-562-0262 1-604-929-1352 www.viavid.com

| | |

Ambac Financial Group, Inc. – Second Quarter 2024 Earnings Call, August 6, 2024

|

David Trick

Sure.

Operator

Our next question comes from Deepak Sarpangal with Repertoire Partners. Please proceed with your question.

Deepak Sarpangal

Thank you. Good morning, Claude, David, and Chuck. One quick follow-up first, just given the first question from Giuliano on the put call potential obligations or opportunity. On Slide 15, you had listed this $250 million to $370 million over the next five years. How much of that relates to Beat versus how much of it relates to the previous acquisitions?

David Trick

Certainly, the relative value, if you will, will shift depending on the performance of each of the businesses, and these are typically structured in a way that’s a result of a multiple of future EBITDA, so giving that range gives effect to a few things, so ultimately, the larger portion of that is related to Beat. The smaller portion of it, at current expectations of performance, is related to the existing MGAs.

Deepak Sarpangal

Yes, and maybe this touches on the comment David just made about the Company being in a stronger position, and ultimately, the most efficient balance sheet, including a certain amount of leverage, but in the range that you gave for $250 million to $370 million, you previously said that those multiples should be similar to what you paid for Beat, so let’s call it roughly 16 times EBITDA. If I take $250 million and $370 million and divide it by 16, we’re talking about probably an incremental $15 million to $23 million of EBITDA that you can acquire, but tell me if my math is incorrect, but what that looks like to me is that effectively, because I know some of these are contingent on performance, that in those scenarios, you’re talking about roughly doubling your EBITDA, at least as it relates to something like Beat, correct?

David Trick

There’s two components of that. First of all, the existing MGAs, we have set schedules in terms of what the multiples are, and there’s certainly a range there of multiples we could pay for the minority interest, but I don’t believe any of those touch $16 million. I think the range on those is anywhere from $10 million to $14 million, let’s say, and then of course, as it relates to Beat, we have acquired 60%, so the opportunity to acquire additional 40% nearly comes close to doubling, of course, the available EBITDA there, but also, in the Beat structure, you may recall, Beat owns a number of MGAs in which they own a majority stake, 60% to 70%, and we also have negotiated for the ability to acquire those minority interests or a portion of those minority interests in the actual MGAs at a discount to that multiple that you mentioned.

7

ViaVid has made considerable efforts to provide an accurate transcription. There may be material errors, omissions, or inaccuracies in the reporting of the substance of the conference call. This transcript is being made available for information purposes only.

1-888-562-0262 1-604-929-1352 www.viavid.com

| | |

Ambac Financial Group, Inc. – Second Quarter 2024 Earnings Call, August 6, 2024

|

Deepak Sarpangal

Okay. Yes, so I think the point being that given that effectively there’s likely some EBITDA growth involved in that, and with David’s comment that you do have both access to and a willingness to borrow prudently when it makes sense, that some portion of that incremental EBITDA would effectively increase your cash available from debt financing, so some of that would further reduce the amount of reserve that you might need, and I think there’s a lot of interesting information on this Slide 15.

One clarification I wanted to make is that in your current plan, which I understand is conservative and prudent, you’ve got the initial $50 million share repurchase plan, and as Claude referenced, you’ll be able to consider and evaluate additional capital returns beyond that measured against other opportunities. It looks here that you also have a $50 million cash reserve and that you are assuming the repayment of the bridge and co-investment, but even after all of that, at the bottom of this slide, there’s almost $200 million of excess cash available to both grow the business, as well as for additional capital returns. Is that correct?

David Trick

That’s correct..

Deepak Sarpangal

Got it, and so in the event that you were able to utilize some debt financing, once you repay the bridge, that could be well over $200 million and still leave you with a $50 million cash reserve, so really liking the position that we should be in as we approach the close of this deal, and then I thought it might be helpful to get a better sense of clarification, because it was a really interesting comment that Claude made about—first of all, appreciate a lot of work that would have gone into the merger proxy. There’s a lot of information there. You’ve got the initial share repurchase program and it is depending on market conditions, so obviously, there’s all kinds of things that could happen, especially by that point, but you have the flexibility both to adjust that in either direction, including, as you referenced, if the stock price is in a position where it remains substantially dislocated from fair value, you have the ability to do a significant amount more than that $50 million, correct?

Claude LeBlanc

That is correct.

Deepak Sarpangal

Just for the avoidance of doubt, because we certainly have a view that there’s been a lot of very favorable progress and development with the Company, and we appreciate your stewardship of that. Without predicting the future, based on how things currently stand today, at anything near—if hypothetically we were at today’s stock price around the close of the deal, would you agree or disagree that the overwhelmingly attractive use of capital would be to take advantage of that and to create accretion and benefit from this wide disconnect in your share price from fair value?

8

ViaVid has made considerable efforts to provide an accurate transcription. There may be material errors, omissions, or inaccuracies in the reporting of the substance of the conference call. This transcript is being made available for information purposes only.

1-888-562-0262 1-604-929-1352 www.viavid.com

| | |

Ambac Financial Group, Inc. – Second Quarter 2024 Earnings Call, August 6, 2024

|

Claude LeBlanc

Yes, certainly, at these levels, and I think we’re closer to certainly the numbers that we were before the announcement than where we are today, there’s tremendous return value, so we have strong conviction into that range, and we will always continue to balance it against other opportunities that we’re looking at. But I think we’re now looking at this from a much longer-term perspective on growth and value creation than simply the events of the sale of the purchase. We have very strong conviction around our growth prospects for this combined Cirrata/Beat platform going forward, and we are also going to be very active in working with the investor community to ensure that our message is getting out there on our growth opportunities going forward, so we will keep those considerations in balance, but given where the stock price is today, there’s no question that we have strong conviction in purchasing our stock at these levels, and we’ll do that for so long as there’s opportunities to do that.

Deepak Sarpangal

That’s great. No, look, we think that the growth opportunities are really exciting, and again, we think that the market hasn’t really come around to fully appreciating that, and so hopefully we can take advantage of both of those situations; the inorganic growth opportunity, the organic growth investments, and buying ourselves at a very large discount and effectively buying down the price of our already attractive acquisitions.

One quick clarification as well technicality, which is on the transaction costs, I think there was a footnote on Slide 22, if I’m not mistaken, that the Q2 non-compensation expense included the cost related to the transactions totaling $15.6 million. How much of the transaction expenses have already been expensed versus remain to be expensed, and then how much of the transaction expenses have already been paid versus still need to be paid?

David Trick

I didn’t hear the latter part of that, but...

Deepak Sarpangal

I was curious how much of it was already expensed, because I know in the merger proxy, I think it was like $22 million total including the past two years, but there was $6 million contingent on the close of the AAC sale, and some of it may have already been expensed in the P&L, so what’s both the amount that’s been approved or expensed and then what’s the amount that has actually been dispersed, if you will, or remaining? Yes.

David Trick

The amounts in the first quarter were primarily accrued expenses. What’s to come is really banking fees related to the investment bankers on each of the transactions, so there’s additional expenses to come, and there’s some, of course, variability in some of the legal expenses. I would say a significant portion of the expenses have been accrued, but there is some additional expenses that will be incurred in the third quarter as it relates to Beat, and then assuming a close in the fourth quarter of the AAC transaction, fourth quarter for the AAC transaction.

9

ViaVid has made considerable efforts to provide an accurate transcription. There may be material errors, omissions, or inaccuracies in the reporting of the substance of the conference call. This transcript is being made available for information purposes only.

1-888-562-0262 1-604-929-1352 www.viavid.com

| | |

Ambac Financial Group, Inc. – Second Quarter 2024 Earnings Call, August 6, 2024

|

Deepak Sarpangal

Okay. That sounds great. Well, I’ll get back in the queue if I have any other questions, but congratulations on closing the Beat deal, and look forward to closing the AAC transaction as well and continuing to advance our various strategic priorities. Thanks so much.

Claude LeBlanc

Thanks, Deepak.

Operator

There are no further questions at this time. This concludes today’s teleconference. We thank you for participating. You may disconnect your lines at this time.

Where to Find Additional Information

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. This communication may be deemed to be solicitation material in respect of the proposed sale of AAC to Oaktree Capital Management by AFG (the “proposed transaction”). In connection with the proposed transaction, AFG has filed a preliminary proxy statement with the SEC. When completed, a definitive proxy statement and a form of proxy will be mailed to the stockholders of AFG. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING THE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders may obtain free copies of the proxy statement (when available) and other documents filed by AFG with the SEC at http://www.sec.gov. Free copies of the proxy statement and AFG’s other filings with the SEC may also be obtained from AFG. Free copies of documents filed with the SEC by AFG will be made available free of charge on AFG’s investor relations website at https://ambac.com/investor-relations/investor-overview/default.aspx.

Participants in the Solicitation

AFG and certain of its directors and executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information about the directors and executive officers of AFG is set forth in its definitive proxy statement, which was filed with the SEC on April 26, 2024. Investors may obtain additional information regarding the interests of such participants by reading the proxy statement and other relevant materials regarding the proposed transaction when they become available.

10

ViaVid has made considerable efforts to provide an accurate transcription. There may be material errors, omissions, or inaccuracies in the reporting of the substance of the conference call. This transcript is being made available for information purposes only.

1-888-562-0262 1-604-929-1352 www.viavid.com

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

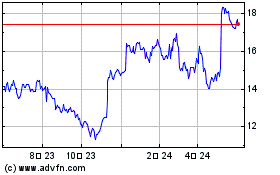

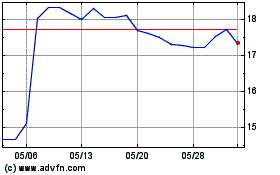

Ambac Financial (NYSE:AMBC)

過去 株価チャート

から 9 2024 まで 10 2024

Ambac Financial (NYSE:AMBC)

過去 株価チャート

から 10 2023 まで 10 2024