0001614806false00016148062023-11-022023-11-020001614806us-gaap:CommonStockMember2023-11-022023-11-020001614806ajx:ConvertibleSeniorNotesMember2023-11-022023-11-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 2, 2023

GREAT AJAX CORP.

(Exact name of registrant as specified in charter)

| | | | | | | | | | | | | | |

Maryland | | 001-36844 | | 46-5211870 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

13190 SW 68th Parkway

Suite 110

Tigard, OR 97223

(Address of principal executive offices)

Registrant’s telephone number, including area code:

503-505-5670

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbols | | Name of each exchange on which registered |

| Common stock, par value $0.01 per share | | AJX | | New York Stock Exchange |

| 7.25% Convertible Senior Notes due 2024 | | AJXA | | New York Stock Exchange |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨ | | | | | |

| Item 2.02. | Results of Operations and Financial Condition |

On November 2, 2023, Great Ajax Corp., a Maryland corporation (the “Company”), issued a press release regarding its financial results for the third quarter ended September 30, 2023 (the “Press Release”). A copy of the Press Release is attached hereto as Exhibit 99.1 and is available on the Company’s website.

The information provided in Item 2.02 of this report, including Exhibit 99.1, shall be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended.

| | | | | |

Item 7.01. | Regulation FD Disclosure |

On November 2, 2023, the Company will hold an investor conference call and webcast to discuss financial results for the third quarter ended September 30, 2023, including the Press Release and other matters relating to the Company.

The Company has also made available on its website presentation materials containing certain additional information relating to the Company and its financial results for the third quarter ended September 30, 2023 (the “Presentation Materials”). The Presentation Materials are furnished herewith as Exhibit 99.2, and are incorporated by reference in this Item 7.01. All information in Exhibit 99.2 is presented as of the particular date or dates referenced therein, and the Company does not undertake any obligation to, and disclaims any duty to, update any of the information provided.

The information provided in Item 7.01 of this report, including Exhibit 99.2, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall the information or Exhibit 99.2 be deemed incorporated by reference in any filings under the Securities Act of 1933, as amended.

| | | | | |

| Item 9.01. | Financial Statements and Exhibits |

| | | | | | | | |

Exhibit | | Description |

| 99.1 | | Press Release dated November 2, 2023 |

| 99.2 | | November 2023 Presentation Materials |

| 104 | | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document |

EXHIBIT INDEX

| | | | | | | | |

Exhibit | | Description |

| 99.1 | | |

| 99.2 | | |

| 104 | | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | |

| GREAT AJAX CORP. |

| | |

| By: | /s/ Mary Doyle |

| Name: | Mary Doyle |

| Title: | Chief Financial Officer |

Dated: November 2, 2023

Exhibit 99.1

GREAT AJAX CORP. ANNOUNCES RESULTS FOR THE QUARTER

ENDED SEPTEMBER 30, 2023; PROVIDES STRATEGIC UPDATE

Third Quarter Highlights

•Interest income of $17.9 million; net interest income of $3.0 million

•Net loss attributable to common stockholders of $(6.1) million

•Operating loss of $(2.3) million

•Earnings per share ("EPS") per basic common share was a loss of $(0.25)

•Operating loss per basic common share of $(0.09)

•Taxable loss of $(0.06) per share attributable to common stockholders after payment of dividends on our preferred stock

•Book value per common share of $11.07 at September 30, 2023

•Formed two joint ventures that acquired $325.3 million in unpaid principal balance ("UPB") of mortgage loans from pre-existing joint ventures with collateral values of $718.7 million and retained $57.9 million of the varying classes of the related debt securities and beneficial interests issued by the joint venture to end the quarter with $309.2 million of investments in debt securities and beneficial interests

•Collected total cash of $39.5 million from loan payments, sales of real estate owned ("REO") properties and collections from investments in debt securities and beneficial interests

•Held $63.9 million of cash and cash equivalents at September 30, 2023; average daily cash balance for the quarter was $53.2 million

•As of September 30, 2023, approximately 81.2% of our portfolio (based on UPB at the time of acquisition) made at least 12 out of the last 12 payments

New York, NY—November 2, 2023 —Great Ajax Corp. (NYSE: AJX), a Maryland corporation that is a real estate investment trust ("REIT"), announces its results of operations for the quarter ended September 30, 2023. We focus primarily on acquiring, investing in and managing a portfolio of re-performing mortgage loans ("RPLs") and non-performing loans ("NPLs") secured by single-family residences and commercial properties. In addition to our continued focus on RPLs and NPLs, we also originate and acquire small-balance commercial loans ("SBC loans") secured by multi-family retail/residential and mixed use properties.

Selected Financial Results (Unaudited)

($ in thousands except per share amounts) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the three months ended |

| | September 30, 2023 | | June 30, 2023 | | March 31, 2023 | | December 31, 2022 | | September 30, 2022 |

Loan interest income(1) | | $ | 12,696 | | | $ | 12,929 | | | $ | 13,281 | | | $ | 13,520 | | | $ | 14,864 | |

Earnings from debt securities and beneficial interests(2) | | $ | 4,218 | | | $ | 4,480 | | | $ | 4,569 | | | $ | 4,562 | | | $ | 4,613 | |

| Other interest income | | $ | 965 | | | $ | 931 | | | $ | 606 | | | $ | 367 | | | $ | 544 | |

| Interest expense | | $ | (14,838) | | | $ | (15,039) | | | $ | (14,925) | | | $ | (14,482) | | | $ | (11,369) | |

| Net interest income | | $ | 3,041 | | | $ | 3,301 | | | $ | 3,531 | | | $ | 3,967 | | | $ | 8,652 | |

| Net (increase)/decrease in the net present value of expected credit losses | | $ | (330) | | | $ | 2,866 | | | $ | 621 | | | $ | 1,152 | | | $ | 1,935 | |

| Other income/(loss), loss from equity method investments and loss on joint venture refinancing on beneficial interests | | $ | (1,658) | | | $ | (8,581) | | | $ | (3,612) | | | $ | (3,744) | | | $ | (65) | |

Total revenue/(loss), net(1,3) | | $ | 1,053 | | | $ | (2,414) | | | $ | 540 | | | $ | 1,375 | | | $ | 10,522 | |

Consolidated net loss(1) | | $ | (5,517) | | | $ | (11,462) | | | $ | (7,364) | | | $ | (6,283) | | | $ | (9,503) | |

| Net loss per basic share | | $ | (0.25) | | | $ | (0.51) | | | $ | (0.34) | | | $ | (0.30) | | | $ | (0.71) | |

Average equity(1,4) | | $ | 316,814 | | | $ | 324,089 | | | $ | 337,206 | | | $ | 343,112 | | | $ | 399,610 | |

Average total assets(1) | | $ | 1,384,285 | | | $ | 1,424,524 | | | $ | 1,463,529 | | | $ | 1,509,738 | | | $ | 1,559,584 | |

Average daily cash balance | | $ | 53,211 | | | $ | 43,609 | | | $ | 50,916 | | | $ | 47,196 | | | $ | 62,334 | |

Average carrying value of RPLs(1) | | $ | 892,367 | | | $ | 886,072 | | | $ | 882,018 | | | $ | 883,254 | | | $ | 897,947 | |

Average carrying value of NPLs(1) | | $ | 50,439 | | | $ | 68,459 | | | $ | 86,494 | | | $ | 99,160 | | | $ | 100,827 | |

Average carrying value of SBC loans | | $ | 8,349 | | | $ | 10,876 | | | $ | 12,159 | | | $ | 14,275 | | | $ | 15,546 | |

| Average carrying value of debt securities and beneficial interests | | $ | 346,601 | | | $ | 382,502 | | | $ | 401,240 | | | $ | 427,471 | | | $ | 435,849 | |

Average asset backed debt balance(1) | | $ | 834,507 | | | $ | 870,595 | | | $ | 897,279 | | | $ | 933,695 | | | $ | 987,394 | |

____________________________________________________________

(1)Reflects the impact of consolidating the assets, liabilities and non-controlling interests of Ajax Mortgage Loan Trust 2017-D, which is 50% owned by third-party institutional investors.

(2)Interest income on investment in debt securities and beneficial interests issued by our joint ventures is net of servicing fees.

(3)Total revenue includes net interest income, loss from equity method investments, loss on joint venture refinancing on beneficial interests and other income/loss.

(4)Average equity includes the effect of an aggregate of $34.6 million of preferred stock for the three months ended September 30, 2023, June 30, 2023, March 31, 2023, December 31, 2022 and September 30, 2022.

For the quarter ended September 30, 2023, we had a GAAP consolidated net loss attributable to common stockholders of $(6.1) million or $(0.25) per common share after preferred dividends. Operating loss, a non-GAAP financial measure that adjusts GAAP earnings by removing gains and losses as well as certain other non-core income and expenses and preferred dividends, was $(2.3) million or $(0.09) per common share. We consider Operating loss/income to provide a useful measure for comparing the results of our ongoing operations over multiple quarters. For a reconciliation of Operating loss to consolidated net loss available to common stockholders, please refer to Appendix B.

Our net interest income for the quarter ended September 30, 2023, excluding any adjustment for expected credit losses was $3.0 million, a decrease of $0.3 million over the prior quarter. Gross interest income decreased $0.5 million as a result of slightly lower average balances on our mortgage, debt security and beneficial interest portfolios. Our interest expense for the quarter ended September 30, 2023 decreased $0.2 million compared to the prior quarter primarily as a result of a decrease in our average balance of interest bearing debt. Interest earning assets declined $54.3 million during the quarter ended September 30, 2023.

We generally acquire loans at a discount and record an allowance for expected credit losses at acquisition. We update the allowance quarterly based on actual cash flow results and changing cash flow expectations in accordance with the current expected credit losses accounting standard, otherwise known as CECL. During the quarter ended September 30, 2023, we

recorded $0.3 million of expense due to a net increase in expected credit losses resulting from decreases in the present value of expected cash flows.

On July 11, 2023, we sold an unrated Class A senior bond in one of our joint ventures and recognized a loss of $0.4 million. The $0.4 million loss was already reflected in our book value calculation through AOCI at September 30, 2023. Accordingly, the loss was a reclassification from unrealized loss in accumulated other comprehensive income ("AOCI") to realized loss in the Statement of Operations.

On July 24, 2023, we formed Ajax Mortgage Loan Trust 2023-B ("2023-B") and Ajax Mortgage Loan Trust 2023-C ("2023-C"), with an institutional accredited investor, by refinancing eight joint ventures and recorded an $8.8 million non-cash impairment on our Investments in beneficial interests during the second quarter of 2023 based on estimated liquidated proceeds from the sale of the underlying collateral. We recorded an incremental loss of $1.3 million during the third quarter to reflect final pricing agreed to by the majority beneficial interest holders in July 2023. We retained $21.8 million or 20.0% of varying classes of debt securities and beneficial interests in 2023-B and $36.1 million or 20.0% of varying classes of the agency rated and unrated debt securities and beneficial interests in 2023-C. 2023-B acquired 571 RPLs and NPLs with UPB of $121.7 million and an aggregate property value of $255.0 million. The senior securities represent 75.0% of the UPB of the underlying mortgage loans and carry a 4.25% coupon. 2023-C acquired 1,171 RPLs and NPLs with UPB of $203.6 million and an aggregate property value of $463.7 million. The AAA through A rated securities issued by 2023-C represent 72.4% of the UPB of the underlying mortgage loans and carry a weighted average coupon of 3.45%. Based on the structure of the transactions, we do not consolidate 2023-B and 2023-C under U.S. GAAP.

Gaea Real Estate Corp ("Gaea") internalized its manager on September 1, 2023 and paid a contract termination fee. We recorded a loss from our investments in affiliates of $0.6 million for the quarter ended September 30, 2023 compared to a loss of $0.3 million for the quarter ended June 30, 2023 due to a pass through of higher losses on our equity method investment, as a result of a one-time management fee termination expense recorded by Gaea. Gaea generally records a GAAP loss due to the depreciation expense of the real estate assets in its portfolio and the contract termination fee increased the GAAP loss.

Our GAAP expenses decreased on a quarter over quarter basis by $2.2 million primarily due to a $0.5 million decrease in other expense due to less impairment on our REO, discussed further below. Additionally our amortization of put option liability decreased by $1.3 million as we reached the initial put option liability and are now accruing a non-compounding fixed rate on the outstanding balance.

We recorded $0.2 million in impairment on our REO held-for-sale portfolio in other expense for the quarter ended September 30, 2023. We sold seven properties in the third quarter and recorded a net gain of $0.1 million in other income. Four properties were added to REO held-for-sale through foreclosures.

For the quarter ended March 31, 2023, we transferred certain securities from AFS to HTM in compliance with the European Union risk retention requirement, which was a non-cash transaction and recorded at fair value. On the date of transfer, AOCI included unrealized losses of $10.9 million for these securities. This amount will be amortized out of AOCI over the remaining life of the respective securities, and has no net impact to interest income. For the quarter ended September 30, 2023, this amortization resulted in a recapture of book value of $0.9 million through the recovery of AOCI compared to $1.1 million for the quarter ended June 30, 2023.

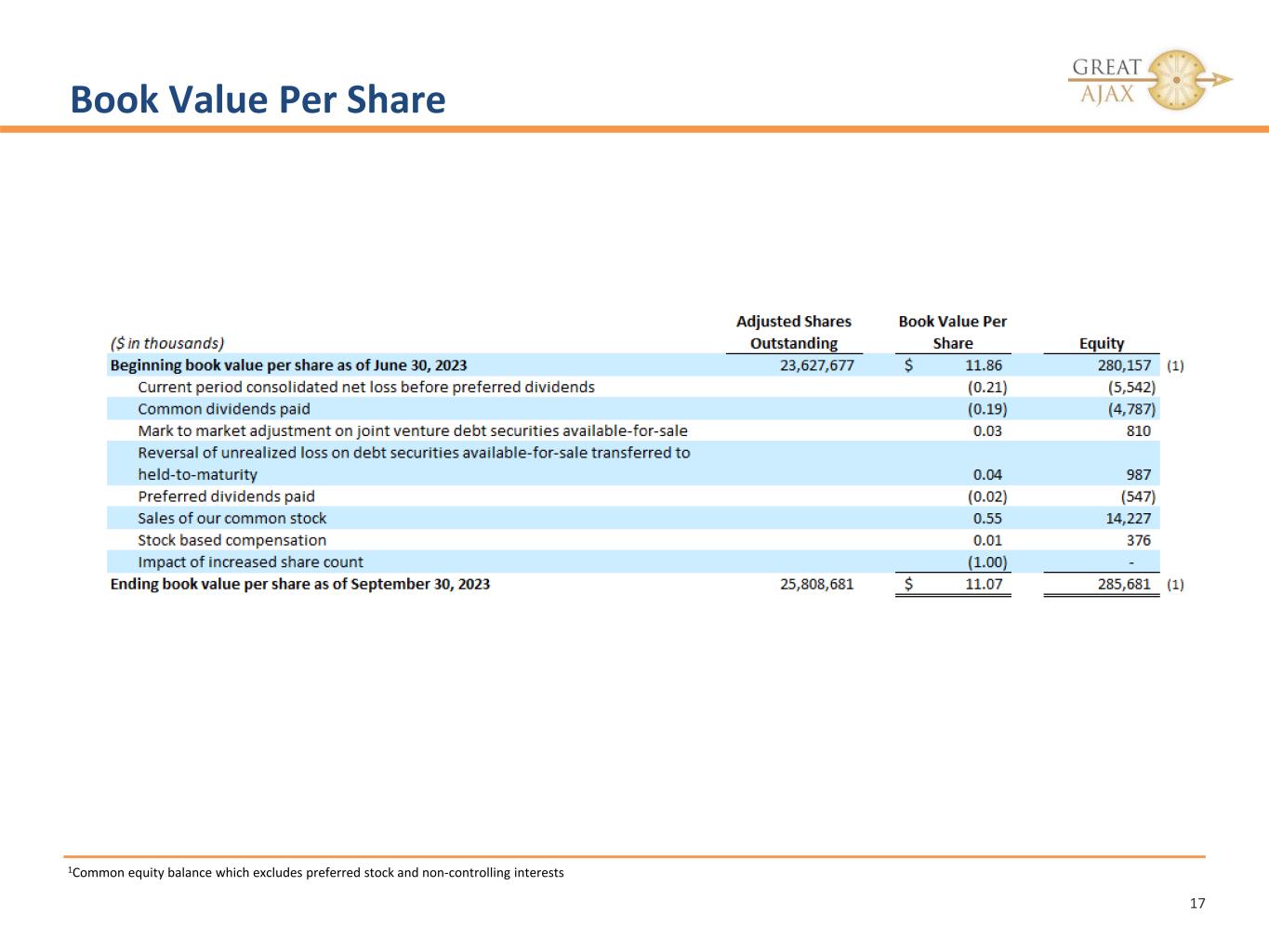

We ended the quarter with a GAAP book value of $11.07 per common share, compared to a book value per common share of $11.86 for the quarter ended June 30, 2023. The decrease in book value is driven primarily by the increase in the number of our outstanding common share count due to shares issued during the quarter, our GAAP loss for the quarter and dividends paid, partially offset by the recovery of a portion of the mark to market loss in debt securities recorded on the balance sheet through AOCI, and the $0.9 million amortization of the unrealized loss on debt securities transferred to HTM.

Our taxable loss for the quarter ended September 30, 2023 was $(0.06) per share of net income available to common stockholders, compared to $(0.02) per share of taxable net income available to common stockholders for the quarter ended June 30, 2023. Additionally, we recorded income tax benefit of $0.1 million comprised primarily of state and local income taxes.

We collected $39.5 million of cash during the third quarter as a result of loan payments, loan payoffs, sales of REO, and cash collections on our securities portfolio to end the quarter with $63.9 million in cash and cash equivalents.

We purchased one RPL with UPB of $0.2 million at 25.8% of property value and 80.5% of UPB and one NPL with UPB of $0.2 million at 60.7% of property value and 93.7% of UPB. These loans were acquired and included on our consolidated balance sheet for a weighted average of 56 days of the quarter.

The following table provides an overview of our portfolio at September 30, 2023 ($ in thousands):

| | | | | | | | | | | | | | | | | | | | |

| No. of loans | | 5,102 | | | Weighted average coupon | | 4.48 | % |

Total UPB(1) | | $ | 972,765 | | | Weighted average LTV(5) | | 54.7 | % |

| Interest-bearing balance | | $ | 890,104 | | | Weighted average remaining term (months) | | 290 | |

Deferred balance(2) | | $ | 82,661 | | | No. of first liens | | 5,056 | |

Market value of collateral(3) | | $ | 2,123,778 | | | No. of second liens | | 46 | |

Current purchase price/total UPB | | 81.6 | % | | No. of REO held-for-sale | | 25 | |

| Current purchase price/market value of collateral | | 41.8 | % | | Market value of REO held-for-sale(6) | | $ | 4,515 | |

| RPLs | | 89.2 | % | | Carrying value of debt securities and beneficial interests in trusts | | $ | 320,130 | |

| NPLs | | 10.0 | % | | Loans with 12 for 12 payments as an approximate percentage of acquisition UPB(7) | | 81.2 | % |

SBC loans(4) | | 0.8 | % | | Loans with 24 for 24 payments as an approximate percentage of acquisition UPB(8) | | 77.2 | % |

____________________________________________________________

(1)Our loan portfolio consists of fixed rate (60.2% of UPB), ARM (6.4% of UPB) and Hybrid ARM (33.4% of UPB) mortgage loans.

(2)Amounts that have been deferred in connection with a loan modification on which interest does not accrue. These amounts generally become payable at maturity.

(3)As of the reporting date.

(4)SBC loans includes both purchased and originated loans.

(5)UPB as of September 30, 2023 divided by market value of collateral and weighted by the UPB of the loan.

(6)Market value of other REO is the estimated expected gross proceeds from the sale of the REO less estimated costs to sell, including repayment of servicer advances.

(7)Loans that have made at least 12 of the last 12 payments, or for which the full dollar amount to cover at least 12 payments has been made in the last 12 months.

(8)Loans that have made at least 24 of the last 24 payments, or for which the full dollar amount to cover at least 24 payments has been made in the last 24 months.

Recent Events

As we previously announced on October 20, 2023, we and Ellington Financial Inc. (“Ellington Financial”) mutually terminated our merger agreement with Ellington Financial. The termination was approved by both companies’ boards of directors after careful consideration of the proposed merger and the progress made towards completing the transaction. In connection with the termination, Ellington Financial paid us $16.0 million, $5.0 million of which was paid in cash, and $11.0 million of which was paid in cash as consideration for approximately 1,666,666 shares of our common stock. The common stock was purchased at $6.60 per share. The purchase price was determined based on the merger exchange ratio. Ellington Financial holds approximately 6.1% of our stock. An affiliate of Ellington Financial’s external manager owned 273,983 shares of our common stock as of June 30, 2023. Ellington Financial remains one of our securitization joint venture partners.

As we discussed when we announced the now terminated transaction, our board regularly evaluates and considers our strategic direction, our objectives and our succession plans, as well as our ongoing business, all with a view to maximizing long-term value for our stockholders. This evaluation and consideration led to our entry into the merger agreement with Ellington Financial. Following termination of the agreement, the board engaged Piper Sandler & Co. as our financial adviser to assist us with a thorough evaluation of strategic alternatives, including, but not limited to, other strategic transactions, potential capital injections involving us and/or our affiliates, other monetization opportunities involving us and/or our affiliates, specific asset sales, or other opportunities. No assurance can be given that this process will culminate in a successful transaction, nor can we provide any guidance regarding the timing of this process or any possible transaction(s) that might result given that the board must undertake a thorough review of available alternatives. We do not intend to comment further on the review of strategic alternatives until we determine disclosure is necessary or advisable.

This year, to date, we have distributed $0.65 per share in dividends. Today our board declared a cash dividend of $0.11 per share to be paid on November 30, 2023 to stockholders of record as of November 15, 2023. We reduced the dividend per share amount in order to focus on book value and maximizing stockholder value overall.

Conference Call

Great Ajax Corp. will host a conference call at 5:00 p.m. EST on Thursday, November 2, 2023 to review our financial results for the quarter and discuss other updates. A live Webcast of the conference call will be accessible from the Quarterly Reports section of our website www.greatajax.com. An archive of the Webcast will be available for 90 days.

About Great Ajax Corp.

Great Ajax Corp. is a Maryland corporation that is a REIT, that focuses primarily on acquiring, investing in and managing RPLs and NPLs secured by single-family residences and commercial properties. In addition to our continued focus on RPLs and NPLs, we also originate and acquire SBC loans secured by multi-family retail/residential and mixed use properties. We are externally managed by Thetis Asset Management LLC, an affiliated entity. Our mortgage loans and other real estate assets are serviced by Gregory Funding LLC, an affiliated entity. We have elected to be taxed as a REIT under the Internal Revenue Code.

Forward-Looking Statements

This press release contains certain forward-looking statements. Words such as “believes,” “intends,” “expects,” “projects,” “anticipates,” and “future” or similar expressions are intended to identify forward-looking statements. These forward-looking statements are subject to the inherent uncertainties in predicting future results and conditions, many of which are beyond our control, including, without limitation and the risk factors and other matters set forth in our Annual Report on Form 10-K for the period ended December 31, 2022 filed with the Securities and Exchange Commission (the “SEC”) on March 3, 2023, when filed with the SEC and our Quarterly Report on Form 10-Q for the period ended September 30, 2023. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by law.

| | | | | |

| CONTACT: | Lawrence Mendelsohn |

| | Chief Executive Officer |

| | Or |

| | Mary Doyle |

| | Chief Financial Officer |

| | Mary.Doyle@aspencapital.com |

| | 503-444-4224 |

GREAT AJAX CORP. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(Dollars in thousands except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended |

| | September 30, 2023 | | June 30, 2023 | | March 31, 2023 | | December 31, 2022 |

| | (Unaudited) | | (Unaudited) | | (Unaudited) | | (Unaudited) |

| INCOME | | | | | | | | |

| Interest income | | $ | 17,879 | | | $ | 18,340 | | | $ | 18,456 | | | $ | 18,449 | |

| Interest expense | | (14,838) | | | (15,039) | | | (14,925) | | | (14,482) | |

| Net interest income | | 3,041 | | | 3,301 | | | 3,531 | | | 3,967 | |

| Net (increase)/decrease in the net present value of expected credit losses | | (330) | | | 2,866 | | | 621 | | | 1,152 | |

| Net interest income after the impact of changes in the net present value of expected credit losses | | 2,711 | | | 6,167 | | | 4,152 | | | 5,119 | |

| | | | | | | | |

| Loss from equity method investments | | (628) | | | (265) | | | (98) | | | (349) | |

| Loss on joint venture refinancing on beneficial interests | | (1,215) | | | (8,814) | | | (995) | | | — | |

| Other income/(loss) | | 185 | | | 498 | | | (2,519) | | | (3,395) | |

| Total revenue/(loss), net | | 1,053 | | | (2,414) | | | 540 | | | 1,375 | |

| | | | | | | | |

| EXPENSE | | | | | | | | |

| Related party expense - loan servicing fees | | 1,809 | | | 1,827 | | | 1,860 | | | 1,911 | |

| Related party expense - management fee | | 1,940 | | | 2,001 | | | 1,828 | | | 1,722 | |

| Professional fees | | 611 | | | 989 | | | 934 | | | 621 | |

| Fair value adjustment on put option liability | | 540 | | | 1,839 | | | 1,622 | | | 1,431 | |

| Other expense | | 1,754 | | | 2,211 | | | 1,614 | | | 1,741 | |

| Total expense | | 6,654 | | | 8,867 | | | 7,858 | | | 7,426 | |

| Loss/(gain) on debt extinguishment | | 16 | | | — | | | (47) | | | — | |

| Loss before provision for income taxes | | (5,617) | | | (11,281) | | | (7,271) | | | (6,051) | |

| Provision for income taxes (benefit) | | (100) | | | 181 | | | 93 | | | 232 | |

| Consolidated net loss | | (5,517) | | | (11,462) | | | (7,364) | | | (6,283) | |

| Less: consolidated net income attributable to non-controlling interests | | 25 | | | 24 | | | 30 | | | 5 | |

| Consolidated net loss attributable to the Company | | (5,542) | | | (11,486) | | | (7,394) | | | (6,288) | |

| Less: dividends on preferred stock | | 547 | | | 548 | | | 547 | | | 547 | |

| Consolidated net loss attributable to common stockholders | | $ | (6,089) | | | $ | (12,034) | | | $ | (7,941) | | | $ | (6,835) | |

| Basic loss per common share | | $ | (0.25) | | | $ | (0.51) | | | $ | (0.34) | | | $ | (0.30) | |

| Diluted loss per common share | | $ | (0.25) | | | $ | (0.51) | | | $ | (0.34) | | | $ | (0.30) | |

| | | | | | | | |

| Weighted average shares – basic | | 24,001,702 | | | 23,250,725 | | | 22,920,943 | | | 22,778,652 | |

| Weighted average shares – diluted | | 24,244,147 | | | 23,565,351 | | | 22,920,943 | | | 22,778,652 | |

GREAT AJAX CORP. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(Dollars in thousands except per share amounts)

| | | | | | | | | | | | | | |

| | September 30, 2023 | | December 31, 2022 |

| ASSETS | | (Unaudited) | | |

| Cash and cash equivalents | | $ | 63,910 | | | $ | 47,845 | |

Mortgage loans held-for-investment, net(1,2) | | 939,080 | | | 989,084 | |

Real estate owned properties, net(3) | | 4,040 | | | 6,333 | |

Investments in securities available-for-sale(4) | | 131,037 | | | 257,062 | |

Investments in securities held-to-maturity(5) | | 61,189 | | | — | |

Investments in beneficial interests(6) | | 116,954 | | | 134,552 | |

| Receivable from servicer | | 9,673 | | | 7,450 | |

| Investments in affiliates | | 29,132 | | | 30,185 | |

| Prepaid expenses and other assets | | 19,519 | | | 11,915 | |

| Total assets | | $ | 1,374,534 | | | $ | 1,484,426 | |

| | | | |

| LIABILITIES AND EQUITY | | | | |

| Liabilities: | | | | |

Secured borrowings, net(1,7) | | $ | 424,651 | | | $ | 467,205 | |

| Borrowings under repurchase transactions | | 392,024 | | | 445,855 | |

Convertible senior notes, net(7) | | 103,516 | | | 104,256 | |

Notes payable, net(7) | | 106,629 | | | 106,046 | |

| Management fee payable | | 1,938 | | | 1,720 | |

| Put option liability | | 16,155 | | | 12,153 | |

| Accrued expenses and other liabilities | | 7,270 | | | 9,726 | |

| Total liabilities | | 1,052,183 | | | 1,146,961 | |

| | | | |

| Equity: | | | | |

| Preferred stock $0.01 par value, 25,000,000 shares authorized | | | | |

| Series A 7.25% Fixed-to-Floating Rate Cumulative Redeemable, $25.00 liquidation preference per share, 424,949 shares issued and outstanding at both September 30, 2023 and December 31, 2022 | | 9,411 | | | 9,411 | |

| Series B 5.00% Fixed-to-Floating Rate Cumulative Redeemable, $25.00 liquidation preference per share, 1,135,590 shares issued and outstanding at both September 30, 2023 and December 31, 2022 | | 25,143 | | | 25,143 | |

| Common stock $0.01 par value; 125,000,000 shares authorized, 25,808,681 shares issued and outstanding at September 30, 2023 and 23,130,956 shares issued and outstanding at December 31, 2022 | | 268 | | | 241 | |

| Additional paid-in capital | | 340,861 | | | 322,439 | |

| Treasury stock | | (9,557) | | | (9,532) | |

| Retained (deficit)/earnings | | (28,158) | | | 13,275 | |

| Accumulated other comprehensive loss | | (17,733) | | | (25,649) | |

| Equity attributable to stockholders | | 320,235 | | | 335,328 | |

Non-controlling interests(8) | | 2,116 | | | 2,137 | |

| Total equity | | 322,351 | | | 337,465 | |

| Total liabilities and equity | | $ | 1,374,534 | | | $ | 1,484,426 | |

____________________________________________________________

(1)Mortgage loans held-for-investment, net include $638.4 million and $675.8 million of loans at September 30, 2023 and December 31, 2022, respectively, transferred to securitization trusts that are variable interest entities (“VIEs”); these loans can only be used to settle obligations of the VIEs. Secured borrowings consist of notes issued by VIEs that can only be settled with the assets and cash flows of the VIEs. The creditors do not have recourse to the primary beneficiary (Great Ajax Corp.). Mortgage loans held-for-investment, net include $7.4 million and $6.1 million of allowance for expected credit losses at September 30, 2023 and December 31, 2022, respectively.

(2)As of both September 30, 2023 and December 31, 2022, balances for Mortgage loans held-for-investment, net include $0.6 million from a 50.0% owned joint venture, which we consolidate under U.S. GAAP.

(3)Real estate owned properties, net, are presented net of valuation allowances of $1.4 million and $0.7 million at September 30, 2023 and December 31, 2022, respectively.

(4)Investments in securities AFS are presented at fair value. As of September 30, 2023, Investments in securities AFS include an amortized cost basis of $142.0 million and a net unrealized loss of $11.0 million. As of December 31, 2022, Investments in securities AFS include an amortized cost basis of $282.7 million and net unrealized loss of $25.6 million.

(5)On January 1, 2023, we transferred certain of our Investments in securities AFS to HTM due to European risk retention regulations. As of September 30, 2023, Investments in securities HTM includes an allowance for expected credit losses of zero and remaining discount of $6.8 million related to the unamortized unrealized loss in AOCI.

(6)Investments in beneficial interests includes allowance for expected credit losses of zero at both September 30, 2023 and December 31, 2022.

(7)Secured borrowings, net are presented net of deferred issuance costs of $3.5 million at September 30, 2023 and $4.7 million at December 31, 2022. Convertible senior notes, net are presented net of deferred issuance costs of zero and $0.3 million at September 30, 2023 and December 31, 2022, respectively. Notes payable, net are presented net of deferred issuance costs and discount of $3.4 million at September 30, 2023 and $4.0 million at December 31, 2022.

(8)As of September 30, 2023, non-controlling interests includes $1.0 million from a 50.0% owned joint venture, $1.0 million from a 53.1% owned subsidiary and $0.1 million from a 99.9% owned subsidiary which the Company consolidates. As of December 31, 2022, non-controlling interests includes $1.0 million from a 50.0% owned joint venture, $1.1 million from a 53.1% owned subsidiary and $0.1 million from a 99.9% owned subsidiary which we consolidate under U.S. GAAP.

Appendix A - Earnings per share

The following table sets forth the components of basic and diluted EPS ($ in thousands, except per share):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended |

| | September 30, 2023 | | June 30, 2023 | | March 31, 2023 | | December 31, 2022 |

| | Income

(Numerator) | | Shares

(Denominator) | | Per Share

Amount | | Income

(Numerator) | | Shares

(Denominator) | | Per Share

Amount | | Income

(Numerator) | | Shares

(Denominator) | | Per Share

Amount | | Income

(Numerator) | | Shares

(Denominator) | | Per Share

Amount |

| | (Unaudited) | | (Unaudited) | | (Unaudited) | | (Unaudited) |

| Basic EPS | | | | | | | | | | | | | | | | | | | | | | | | |

| Consolidated net loss attributable to common stockholders | | $ | (6,089) | | | 24,001,702 | | | | | $ | (12,034) | | | 23,250,725 | | | | | $ | (7,941) | | | 22,920,943 | | | | | $ | (6,835) | | | 22,778,652 | | | |

| Allocation of loss to participating restricted shares | | 62 | | | — | | | | | 161 | | | — | | | | | 111 | | | — | | | | | 97 | | | — | | | |

| Consolidated net loss attributable to unrestricted common stockholders | | $ | (6,027) | | | 24,001,702 | | | $ | (0.25) | | | $ | (11,873) | | | 23,250,725 | | | $ | (0.51) | | | $ | (7,830) | | | 22,920,943 | | | $ | (0.34) | | | $ | (6,738) | | | 22,778,652 | | | $ | (0.30) | |

Effect of dilutive securities(1) | | | | | | | | | | | | | | | | | | | | | | | | |

Restricted stock grants and director fee shares(2) | | (62) | | | 242,445 | | | | | (161) | | | 314,626 | | | | | — | | | — | | | | | — | | | — | | | |

Amortization of put option(3) | | — | | | — | | | | | — | | | — | | | | | — | | | — | | | | | — | | | — | | | |

| Diluted EPS | | | | | | | | | | | | | | | | | | | | | | | | |

| Consolidated net loss attributable to common stockholders and dilutive securities | | $ | (6,089) | | | 24,244,147 | | | $ | (0.25) | | | $ | (12,034) | | | 23,565,351 | | | $ | (0.51) | | | $ | (7,830) | | | 22,920,943 | | | $ | (0.34) | | | $ | (6,738) | | | 22,778,652 | | | $ | (0.30) | |

____________________________________________________________(1)Our outstanding warrants and the effect of the interest expense and assumed conversion of shares from convertible notes would have an anti-dilutive effect on diluted earnings per share for all periods shown and have not been included in the calculation.

(2)The effect of restricted stock grants and manager and director fee shares on our diluted EPS calculation for the three months ended March 31, 2023 and December 31, 2022 would have been anti-dilutive and has been removed from the calculation.

(3)The effect of the amortization of put option on our diluted EPS calculation for all periods shown would have been anti-dilutive and has been removed from the calculation.

Appendix B - Reconciliation of Operating loss to Consolidated net loss available to common stockholders

(Dollars in thousands except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended |

| | September 30, 2023 | | June 30, 2023 | | March 31, 2023 | | December 31, 2022 |

| | (Unaudited) | | (Unaudited) | | (Unaudited) | | (Unaudited) |

| INCOME | | | | | | | | |

| Interest income | | $ | 17,879 | | | $ | 18,340 | | | $ | 18,456 | | | $ | 18,449 | |

| Interest expense | | (14,838) | | | (15,039) | | | (14,925) | | | (14,482) | |

| Net interest income | | 3,041 | | | 3,301 | | | 3,531 | | | 3,967 | |

| | | | | | | | |

| Other income | | 558 | | | 498 | | | 455 | | | 479 | |

| Total revenue, net | | 3,599 | | | 3,799 | | | 3,986 | | | 4,446 | |

| | | | | | | | |

| EXPENSE | | | | | | | | |

| Related party expense - loan servicing fees | | 1,809 | | | 1,827 | | | 1,860 | | | 1,911 | |

| Related party expense - management fees | | 1,940 | | | 2,001 | | | 1,828 | | | 1,722 | |

| Professional fees | | 611 | | | 989 | | | 934 | | | 621 | |

| Other expense | | 1,505 | | | 1,526 | | | 1,503 | | | 1,443 | |

| Total expense | | 5,865 | | | 6,343 | | | 6,125 | | | 5,697 | |

| Consolidated operating loss | | $ | (2,266) | | | $ | (2,544) | | | $ | (2,139) | | | $ | (1,251) | |

| Basic operating loss per common share | | $ | (0.09) | | | $ | (0.11) | | | $ | (0.09) | | | $ | (0.05) | |

| Diluted operating loss per common share | | $ | (0.09) | | | $ | (0.11) | | | $ | (0.09) | | | $ | (0.05) | |

| | | | | | | | |

| Reconciliation to GAAP net loss | | | | | | | | |

| | | | | | | | |

| Consolidated operating loss | | $ | (2,266) | | | $ | (2,544) | | | $ | (2,139) | | | $ | (1,251) | |

| | | | | | | | |

| Mark to market loss on joint venture refinancing | | (1,215) | | | (8,814) | | | (995) | | | — | |

| Realized loss on sale of securities | | (373) | | | — | | | (2,974) | | | (3,836) | |

| Net (increase)/decrease in the net present value of expected credit losses | | (330) | | | 2,866 | | | 621 | | | 1,152 | |

| Fair value adjustment on put option liability | | (540) | | | (1,839) | | | (1,622) | | | (1,431) | |

| Other adjustments | | (893) | | | (950) | | | (162) | | | (685) | |

| Loss before provision for income taxes | | (5,617) | | | (11,281) | | | (7,271) | | | (6,051) | |

| Provision for income taxes (benefit) | | (100) | | | 181 | | | 93 | | | 232 | |

| Consolidated net income attributable to non-controlling interest | | (25) | | | (24) | | | (30) | | | (5) | |

| Consolidated net loss attributable to the Company | | (5,542) | | | (11,486) | | | (7,394) | | | (6,288) | |

| Dividends on preferred stock | | (547) | | | (548) | | | (547) | | | (547) | |

| Consolidated net loss attributable to common stockholders | | $ | (6,089) | | | $ | (12,034) | | | $ | (7,941) | | | $ | (6,835) | |

| Basic loss per common share | | $ | (0.25) | | | $ | (0.51) | | | $ | (0.34) | | | $ | (0.30) | |

| Diluted loss per common share | | $ | (0.25) | | | $ | (0.51) | | | $ | (0.34) | | | $ | (0.30) | |

Third Quarter Investor Presentation November 2, 2023

Safe Harbor Disclosure 2 We make forward-looking statements in this presentation that are subject to risks and uncertainties. These forward-looking statements include information about possible or future results of our business, financial condition, liquidity, results of operations, cash flow and plans and objectives. When we use the words “believe,” “expect,” “anticipate,” “estimate,” “plan,” “continue,” “intend,” “should,” “may” or similar expressions, we intend to identify forward-looking statements. Statements regarding the following subjects, among others, may be forward-looking: market trends in our industry, interest rates, real estate values, the financing markets or the general economy or the demand for and availability of residential and small-balance commercial real estate loans; our business and investment strategy; our projected operating results; actions and initiatives of the U.S. government and changes to U.S. government policies and the execution and impact of these actions, initiatives and policies; the state of the U.S. economy generally or in specific geographic regions; economic trends and economic recoveries; our ability to obtain and maintain financing arrangements; changes in the value of our mortgage portfolio; changes to our portfolio of properties; impact of and changes in governmental regulations, tax law and rates, accounting guidance and similar matters; our ability to satisfy the real estate investment trust qualification requirements for U.S. federal income tax purposes; availability of qualified personnel; estimates relating to our ability to make distributions to our stockholders in the future; general volatility of the capital markets and the market price of our shares of common stock; the degree and nature of our competition; and the prospect of any future strategic transactions. The forward-looking statements included in this presentation are based on our current beliefs, assumptions and expectations of our future performance. Forward-looking statements are not predictions of future events. Our beliefs, assumptions and expectations can change as a result of many possible events or factors, not all of which are currently known to us or reasonably expected to occur at this time. If a change in our beliefs, assumptions or expectations occurs, our business, financial condition, liquidity and results of operations may vary materially from the forward-looking statements included in this presentation. Forward-looking statements are subject to risks and uncertainties, including, among other things, those described under Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2022, which can be accessed through the link to our Securities and Exchange Commission ("SEC") filings on our website (www.greatajax.com) or at the SEC's website (www.sec.gov). Other risks, uncertainties and factors that could cause actual results to differ materially from the forward-looking statements included in this presentation may be described from time to time in reports we file with the SEC. Any forward-looking statement speaks only as of the date on which it is made. New risks and uncertainties arise over time, and it is not possible for us to predict those events or how they may affect us. Except as required by law, we are not obligated to, and do not intend to, update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Unless stated otherwise, financial information included in this presentation is as of September 30, 2023. Past performance is neither indicative nor a guarantee of future results.

Business Overview 3 Leverage longstanding relationships to acquire mortgage loans through privately negotiated transactions from a diverse group of customers and in joint venture investments with third-party institutional investors – Acquisitions made in 383 transactions since inception. Two transactions closed in Q3 2023 Use our manager’s proprietary analytics to price each mortgage pool on an asset-by-asset basis – We own 19.8% of our manager Our affiliated servicer services the loans asset-by-asset and borrower-by-borrower – We own 9.6% and hold warrants to purchase up to an additional 12% of our affiliated servicer – Analytics and processes of our manager and servicer enable us to broaden our reach through joint ventures with third-party institutional investors As of September 30, 2023, we own a 22.0% equity interest in Gaea Real Estate Corp. (“GAEA”), an equity REIT that invests in multifamily properties with a focus on property appreciation and triple net lease veterinary clinics – GAEA internalized its manager on September 1, 2023

Key Financial Results – Quarter Ended September 30, 2023 4 Interest income of $17.9 million; net interest income of $3.0 million Net loss attributable to common stockholders of $(6.1) million Operating loss of $(2.3) million Earnings per share ("EPS") per basic common share was a loss of $(0.25) Operating loss per basic common share of $(0.09)1 Taxable loss of $(0.06) per share attributable to common stockholders after payment of dividends on our preferred stock Book value per common share of $11.07 at September 30, 2023 Formed two joint ventures that acquired $325.3 million in unpaid principal balance ("UPB") of mortgage loans from pre- existing joint ventures with collateral values of $718.7 million and retained $57.9 million of the varying classes of the related debt securities and beneficial interests issued by the joint ventures to end the quarter with $309.2 million of investments in debt securities and beneficial interests Collected total cash of $39.5 million from loan payments, sales of real estate owned ("REO") properties and collections from investments in debt securities and beneficial interests Held $63.9 million of cash and cash equivalents at September 30, 2023; average daily cash balance for the quarter was $53.2 million As of September 30, 2023, approximately 81.2% of our portfolio (based on UPB at the time of acquisition) made at least 12 out of the last 12 payments 1 Operating income, a non-GAAP financial measure which adjusts GAAP earnings by removing unrealized gains and losses as well as certain other non-core expenses and preferred dividends. We consider Operating income to provide a useful measure for comparing the results of our ongoing operations over multiple quarters.

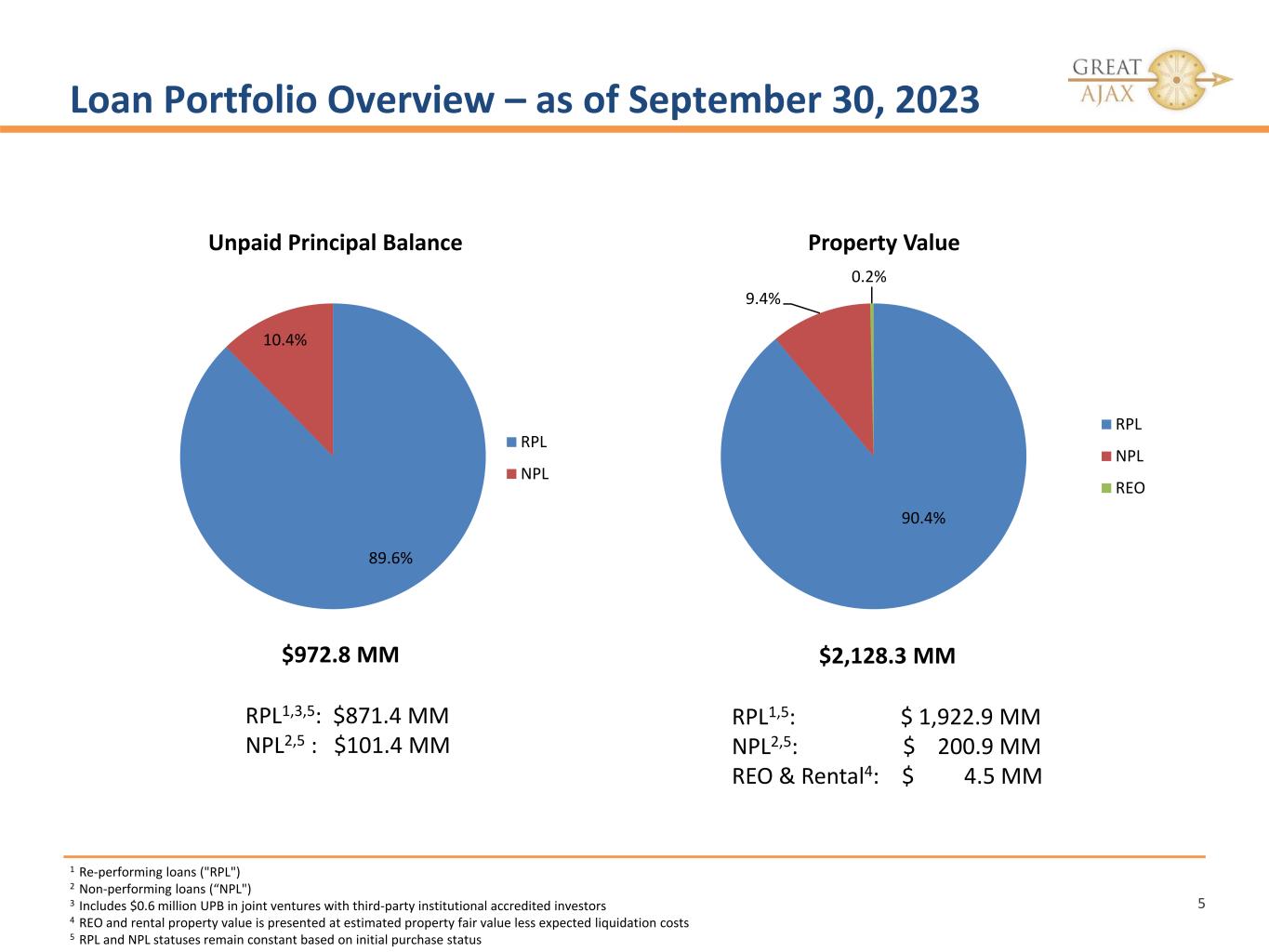

Loan Portfolio Overview – as of September 30, 2023 5 $972.8 MM RPL1,3,5: $871.4 MM NPL2,5 : $101.4 MM $2,128.3 MM RPL1,5: $ 1,922.9 MM NPL2,5: $ 200.9 MM REO & Rental4: $ 4.5 MM 1 Re-performing loans ("RPL") 2 Non-performing loans (“NPL") 3 Includes $0.6 million UPB in joint ventures with third-party institutional accredited investors 4 REO and rental property value is presented at estimated property fair value less expected liquidation costs 5 RPL and NPL statuses remain constant based on initial purchase status 89.6% 10.4% Unpaid Principal Balance RPL NPL 90.4% 9.4% 0.2% Property Value RPL NPL REO

Loan Portfolio Growth 6 RPL UPB includes $9.9 million of SBC loans, which are performing loans RPL status stays constant based on initial purchase status $1,257 $1,161 $939 $933 $871 $1,770 $1,845 $1,719 $2,014 $1,923 $1,094 $1,024 $831 $835 $796 0 500 1,000 1,500 2,000 2,500 9/30/2019 9/30/2020 9/30/2021 9/30/2022 9/30/2023 M ill io ns Re-performing Loans UPB Property Value Price

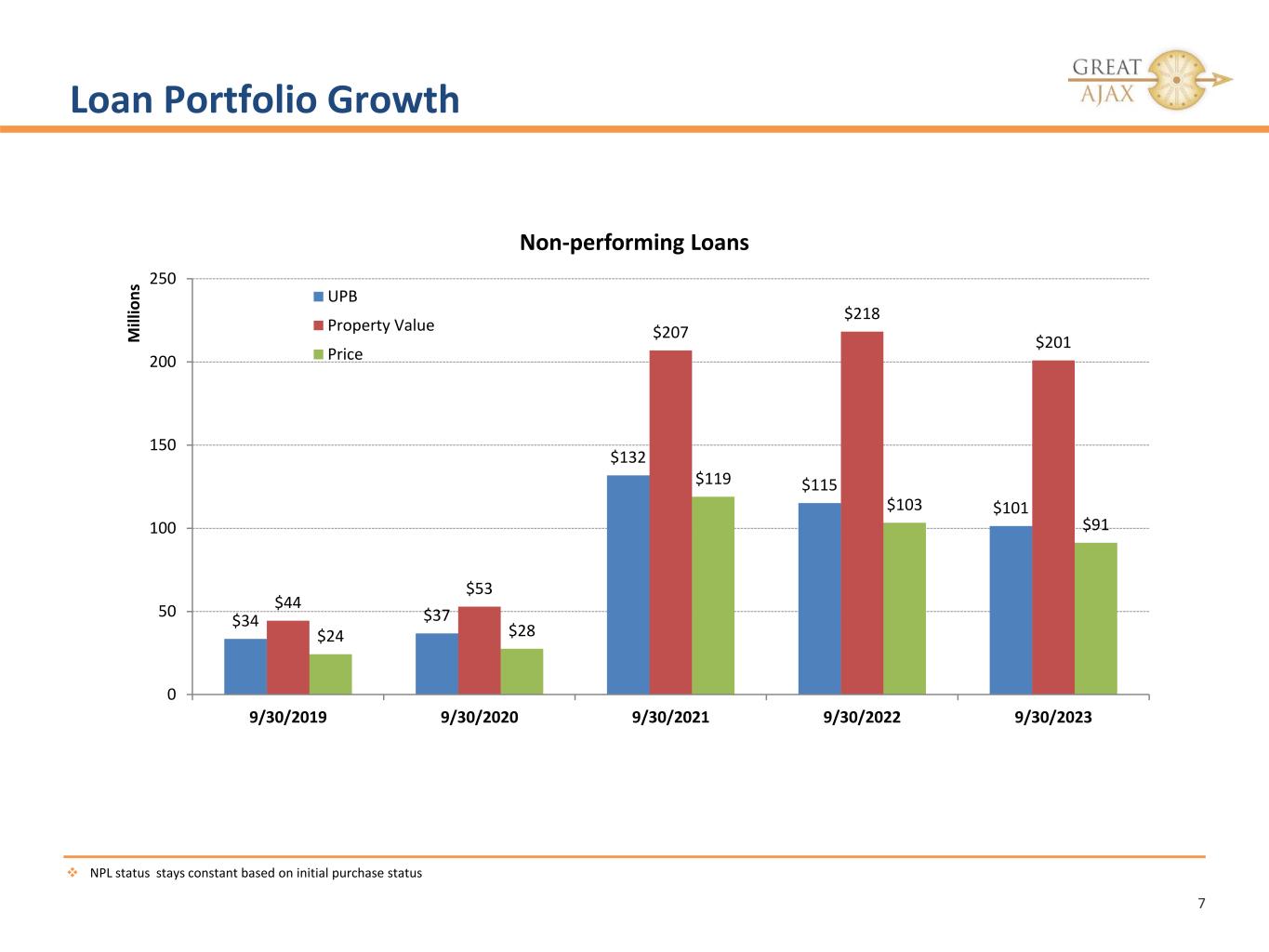

Loan Portfolio Growth 7 NPL status stays constant based on initial purchase status $34 $37 $132 $115 $101 $44 $53 $207 $218 $201 $24 $28 $119 $103 $91 0 50 100 150 200 250 9/30/2019 9/30/2020 9/30/2021 9/30/2022 9/30/2023 M ill io ns Non-performing Loans UPB Property Value Price

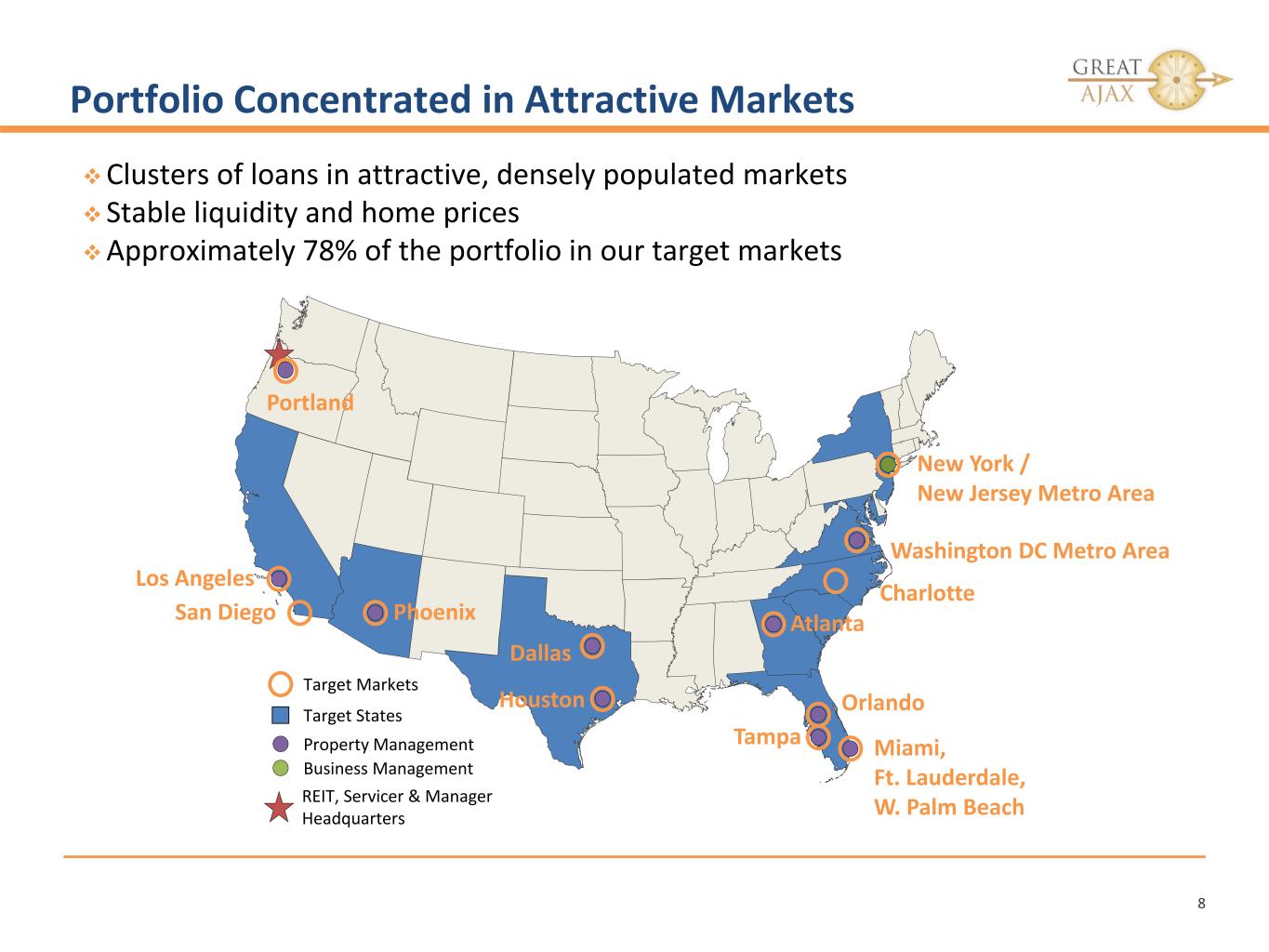

Portfolio Concentrated in Attractive Markets 8 Clusters of loans in attractive, densely populated markets Stable liquidity and home prices Approximately 78% of the portfolio in our target markets Target States Target Markets Los Angeles San Diego Dallas Portland Phoenix Washington DC Metro Area Atlanta Orlando Tampa Miami, Ft. Lauderdale, W. Palm Beach New York / New Jersey Metro Area REIT, Servicer & Manager Headquarters Property Management Business Management Houston Charlotte

Portfolio Migration 9 24 for 24: Loans that have made at least 24 of the last 24 payments, or for which the full dollar amount to cover at least 24 payments has been made in the last 24 months 12 for 12: Loans that have made at least 12 of the last 12 payments, or for which the full dollar amount to cover at least 12 payments has been made in the last 12 months 7 for 7: Loans that have made at least 7 of the last 7 payments, or for which the full dollar amount to cover at least 7 payments has been made in the last 7 months NPL: <1 full payment in the last three months

Financial Metrics 10 1Includes the impact of the credit loss expense 2Interest income on debt securities is net of servicing fee 3Includes the impact of the net (increase)/decrease in the net present value of expected credit losses on mortgage loans 4Excludes the impact of convertible and unsecured debt

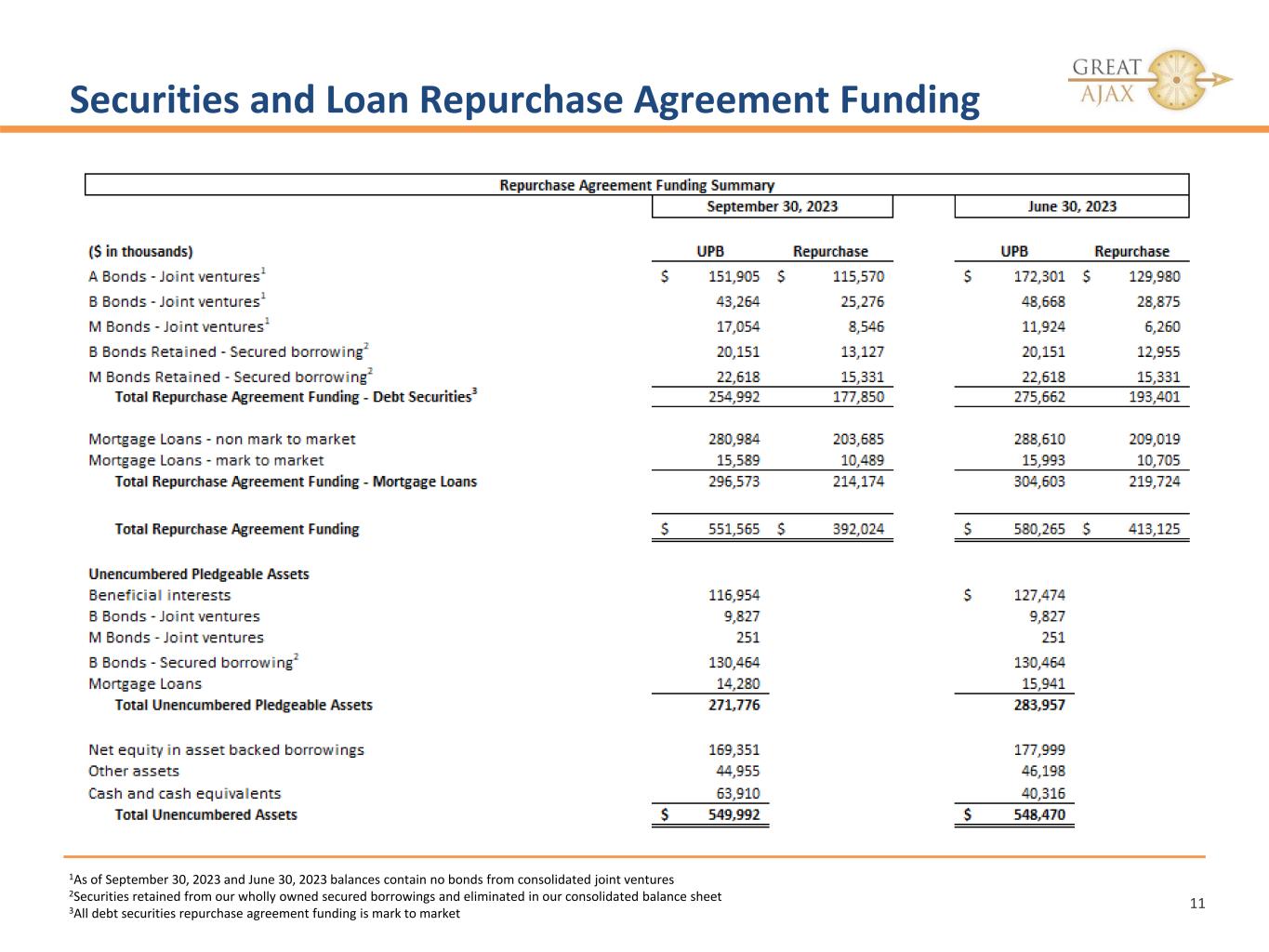

Securities and Loan Repurchase Agreement Funding 11 1As of September 30, 2023 and June 30, 2023 balances contain no bonds from consolidated joint ventures 2Securities retained from our wholly owned secured borrowings and eliminated in our consolidated balance sheet 3All debt securities repurchase agreement funding is mark to market

Recent Developments 12 As announced, in late October, we and Ellington Financial Inc. (“Ellington Financial”) mutually terminated our merger agreement. The termination was approved by both companies’ boards of directors after careful consideration of the proposed merger and the progress made towards completing the transaction. The details of the $16 million termination payment are disclosed in our press release. Ellington Financial holds approximately 6.1% of our stock. An affiliate of Ellington Financial’s external manager owned 273,983 shares of our common stock as of June 30, 2023. Ellington Financial remains one of our securitization joint venture partners. As disclosed in our earnings press release, our Board of Directors regularly evaluates and considers our strategic direction, our objectives and our succession plans, as well as our ongoing business, all with a view to maximizing long-term value for our stockholders. This evaluation and consideration led to our entry into the merger agreement with Ellington Financial. Following termination of the merger agreement, the board engaged a financial adviser to assist us with a thorough evaluation of strategic alternatives. We do not intend to comment further on this process until disclosure is necessary or advisable. This year, to date, we have distributed $0.65 per share in dividends. Today, our Board of Directors declared a cash dividend of $0.11 per share to be paid on November 30, 2023 to stockholders of record as of November 15, 2023. We reduced the dividend per share amount in order to focus on book value and maximizing stockholder value overall.

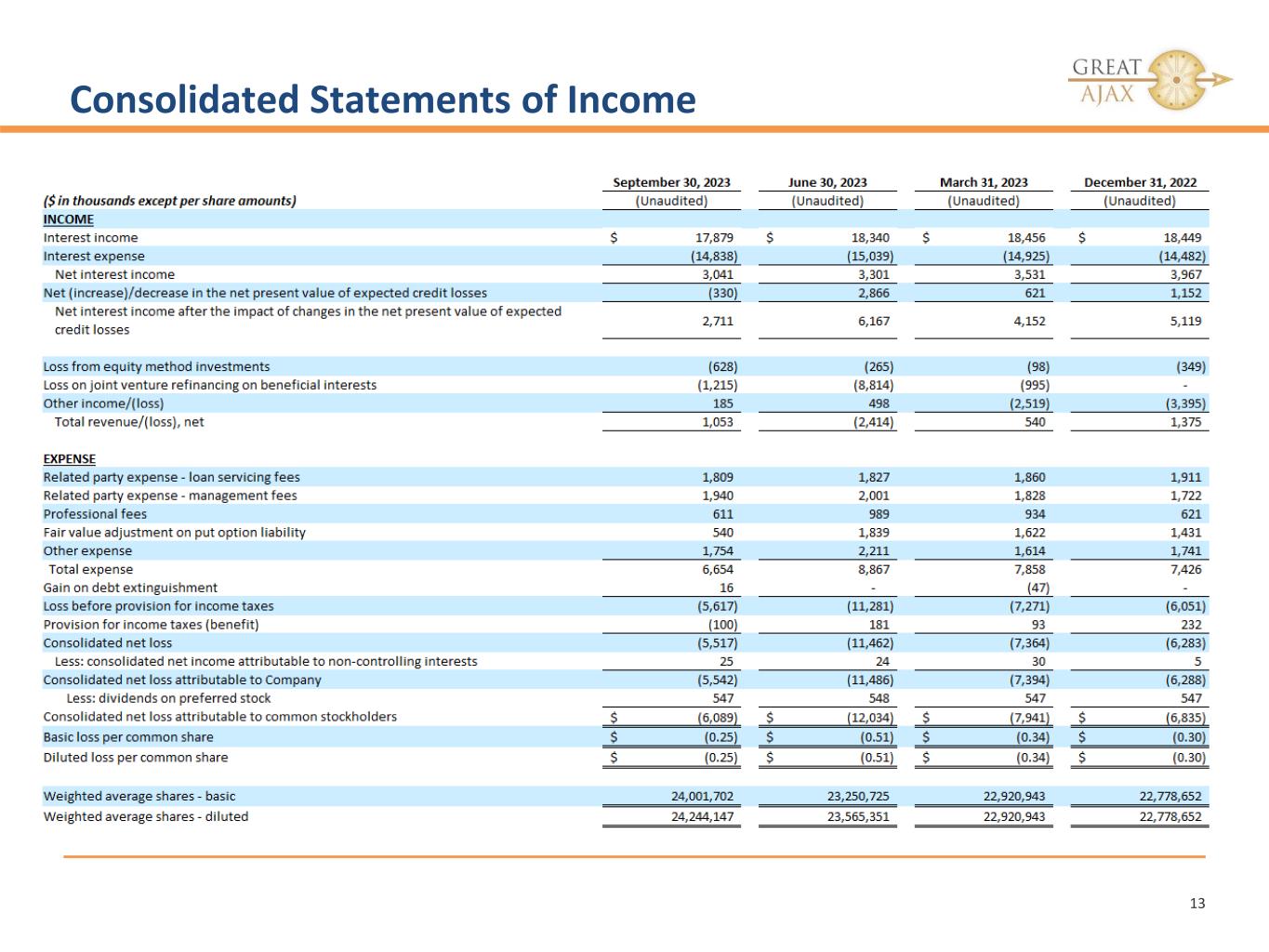

Consolidated Statements of Income 13

Consolidated Balance Sheets 14

Consolidated Balance Sheets Notes 15 1. Mortgage loans held-for-investment, net include $638.4 million and $675.8 million of loans at September 30, 2023 and December 31, 2022, respectively, transferred to securitization trusts that are variable interest entities (“VIEs”); these loans can only be used to settle obligations of the VIEs. Secured borrowings consist of notes issued by VIEs that can only be settled with the assets and cash flows of the VIEs. The creditors do not have recourse to the primary beneficiary (Great Ajax Corp.). Mortgage loans held-for-investment, net include $7.4 million and $6.1 million of allowance for expected credit losses at September 30, 2023 and December 31, 2022, respectively. 2. As of both September 30, 2023 and December 31, 2022, balances for Mortgage loans held-for-investment, net include $0.6 million from a 50.0% owned joint venture, which we consolidate under U.S. Generally Accepted Accounting Principles ("U.S. GAAP"). 3. Real estate owned properties, net, are presented net of valuation allowances of $1.4 million and $0.7 million at September 30, 2023 and December 31, 2022, respectively. 4. Investments in securities available-for-sale (“AFS”) are presented at fair value. As of September 30, 2023, Investments in securities AFS include an amortized cost basis of $142.0 million and a net unrealized loss of $11.0 million. As of December 31, 2022, Investments in securities AFS include an amortized cost basis of $282.7 million and net unrealized loss of $25.6 million. 5. On January 1, 2023, we transferred certain of our Investments in securities AFS to HTM due to European risk retention regulations. Investments in securities HTM includes an allowance for expected credit losses of zero and remaining discount of $6.8 million related to the unamortized unrealized loss in AOCI from transfer at September 30, 2023. 6. Investments in beneficial interests includes allowance for expected credit losses of zero at both September 30, 2023 and December 31, 2022. 7. Secured borrowings, net are presented net of deferred issuance costs of $3.5 million at September 30, 2023 and $4.7 million at December 31, 2022. Convertible senior notes, net are presented net of deferred issuance costs of zero and $0.3 million at September 30, 2023 and December 31, 2022, respectively. Notes payable, net are presented net of deferred issuance costs and discount of $3.4 million at September 30, 2023 and $4.0 million at December 31, 2022. 8. $25.00 liquidation preference per share, 424,949 shares issued and outstanding at both September 30, 2023 and December 31, 2022. 9. $25.00 liquidation preference per share, 1,135,590 shares issued and outstanding at both September 30, 2023 December 31, 2022. 10. 125,000,000 shares authorized, 25,808,681 shares issued and outstanding at September 30, 2023 and 23,130,956 shares issued and outstanding at December 31, 2022. 11. As of September 30, 2023, non-controlling interests includes $1.0 million from a 50.0% owned joint venture, $1.0 million from a 53.1% owned subsidiary and $0.1 million from a 99.9% owned subsidiary. As of December 31, 2022, non-controlling interests includes $1.0 million from a 50.0% owned joint venture, $1.1 million from a 53.1% owned subsidiary and $0.1 million from a 99.9% owned subsidiary which we consolidate under U.S. GAAP.

Consolidated Operating Income 16

Book Value Per Share 17 1Common equity balance which excludes preferred stock and non-controlling interests

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ajx_ConvertibleSeniorNotesMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

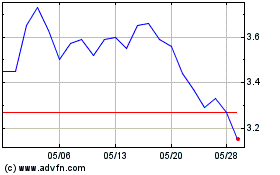

Great Ajax (NYSE:AJX)

過去 株価チャート

から 11 2024 まで 12 2024

Great Ajax (NYSE:AJX)

過去 株価チャート

から 12 2023 まで 12 2024