216 Airport DriveRochesterNew HampshireFALSE0000819793NYSE00008197932024-08-022024-08-020000819793ain:ClassACommonStockMember2024-08-022024-08-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report: August 2, 2024

(Date of earliest event reported)

| | | | | | | | |

| ALBANY INTERNATIONAL CORP. | |

| (Exact name of registrant as specified in its charter) | |

| | | | | | | | |

| Delaware | 1-10026 | 14-0462060 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S Employer Identification No.) |

| | | | | |

216 Airport Drive Rochester, New Hampshire | 03867 |

(Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code 603-330-5800

| | |

None |

(Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Class A Common Stock, $0.001 par value per share | | AIN | | The New York Stock Exchange (NYSE) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act 1933 (230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (240.12b-2 of this chapter).

☐ Emerging growth company

¨ If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On August 2, 2024, Albany International Corp. (“the Company”) announced that Christopher E. Stone had been appointed President of the Company’s AEC business segment, and elected an officer of the Company, effective August 12, 2024. Mr. Stone, the former Vice President and Chief Supply Chain officer of Lockheed Martin Corporation succeeds Gregory Harwell, who no longer serves in that position.

A copy of the Company’s press release, dated August 2, 2024, which sets forth other information required to be disclosed by this Item and is incorporated by reference herein, is attached as Exhibit 99.1.

A summary of Mr. Stone’s material terms of compensation is attached as Exhibit 99.2, which is incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits. The following exhibit is being furnished herewith:

99.1 Press release dated August 2, 2024.

99.2 Summary of Stone compensation terms.

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| |

| ALBANY INTERNATIONAL CORP. | |

| | | |

| By: | /s/ Robert D. Starr | |

| | | |

| Name: | Robert D. Starr | |

| Title: | Executive Vice President and Chief Financial Officer |

| | (Principal Financial Officer) |

Date: August 5, 2024

EXHIBIT INDEX

| | | | | |

Exhibit No. | Description |

| 99.1 | |

| 99.2 | |

| 104 | Inline XBRL cover page. |

Exhibit 99.1

NEWS RELEASE

Albany International Corp. Appoints Christopher E. Stone as President, Albany Engineered Composites

Rochester, New Hampshire, August 2, 2024 – Albany International Corp. (NYSE: AIN) announced today that its Board of Directors has appointed Christopher Stone as President, Albany Engineered Composites, Inc., and elected him an officer of the Company, effective August 12, 2024, to succeed Gregory Harwell, who no longer serves as President of Albany Engineered Composites, Inc.

Mr. Stone, 52, brings a deep knowledge of the A&D industry, and considerable broad experiences to his new role. He has held a wide range of leadership positions at public companies, with a focus in manufacturing and supply chain management, business operations, production control, logistics and organizational transformation. Most recently he served as Vice President & Chief Supply Chain Officer at Lockheed Martin Corporation from 2021 to 2024. Prior to joining Lockheed Martin, he was Vice President – Supply Chain & Material Management at Aerojet Rocketdyne from 2018 to 2021, and previously held various management positions at Textron companies, including Textron Marine & Land System and Bell Helicopter from 2005 to 2018. He is a former Aviation Officer with the United States Army with a Bachelor of Business Administration in Management from Gonzaga University and an MBA from Rice University.

Mr. Kleveland said “I am excited to have Chris join the Albany team and know he will bring a strong strategic capability to our growing business. At the same time, his experience and admirable results leading Operations and Supply Chain are critical to continue the competitive advantage AEC has in on time delivery of a quality product.”

Mr. Stone said “I am deeply honored to join the team at Albany Engineered Composites, renowned for their state-of-the-art technologies and exceptional execution in a market space that is critical to our industry. I am excited to meet our talented employees, learn the Albany business, and engage with our valued customers."

About Albany International Corp.

Albany International is a leading developer and manufacturer of engineered components, using advanced materials processing and automation capabilities, with two core businesses.

•Machine Clothing is the world’s leading producer of custom-designed, consumable belts essential for the manufacture of paper, paperboard, tissue and towel, pulp, non-wovens and a variety of other industrial applications.

•Albany Engineered Composites is a growing designer and manufacturer of advanced materials-based engineered components for demanding aerospace applications, supporting both commercial and military platforms.

Albany International is headquartered in Rochester, New Hampshire, operates 32 facilities in 14 countries, employs approximately 6,000 people worldwide, and is listed on the New York Stock Exchange (Symbol: AIN). Additional information about the Company and its products and services can be found at www.albint.com.

# # #

Investor / Media Contact:

JC Chetnani

603-330-5851

jc.chetnani@albint.com

Exhibit 99.2

Summary of Stone Compensation Terms

Position President, Albany Engineered Composites, effective August 12 (the “Effective Date”).

Term Employment at will. Employment may be terminated by Mr. Stone or the Company at any time.

Base Salary Initial base salary at the rate of $500,000 per year. Salary shall be subject to adjustment from time-to-time in the same manner as for other executive officers. Salaries of executive officers are customarily adjusted in April of each year.

Annual Bonus Mr. Stone will be granted an Annual Performance Period (“APP”) award for service performed in 2024 under the Company's 2023 Incentive Plan, to be determined and paid in cash during 2025. Under this award, he will be entitled to receive between 0% and 100% of a target award, equal to 70% of his base annual salary based on performance goal attainment during 2024. Mr. Stone will be eligible in 2025 and thereafter to participate in the 2025 APP award or any other annual executive bonus program, as the same may be adopted, amended, modified or terminated by the Company, in accordance with its terms.

Long-Term

Incentive Mr. Stone will be eligible, beginning in 2024, to receive a long-term incentive, which will be structured in two grants.

The first such grant will be a Multi-year Performance Period (“MPP”) award under the Company's 2023 Incentive Plan, to be determined and paid in shares of Company stock during early 2027. Under this award, Mr. Stone will be entitled to receive between 0% and 200% of a target award, based on performance goal attainment during the three-year performance period, and paid in shares of Company stock early in the year after the end of the three-year performance period. The target opportunity for the 2024 award would be a number of shares of Company stock equal to 60% of the Mr. Stone’s annual base salary at the time of grant.

The second grant will be a share-settled restricted stock unit award (“RSU Award”), also under the Company’s 2023 Incentive Plan. Under this award, he will be entitled to receive one-third of the award grant in each year in March 2025, 2026, and 2027. The award grant for the 2023 RSU Award would be a number of shares of Company stock equal to 60% of the Mr. Stone’s annual base salary at the time of grant.

Thereafter, Mr. Stone’s will be eligible to participate in any long-term executive incentive bonus program, as the same may be adopted, amended, modified or terminated by the Company, in accordance with its terms.

Sign-on

Bonus Mr. Stone will be granted a second share-settled restricted stock unit award (the “Sign-on RSU Award”), also under the Company’s 2023 Incentive Plan. Under this Sign-on RSU Award, Mr. Stone will be entitled to receive one-third of the award grant on the first, second and third anniversaries of the commencement of his employment. The award grant for the Sign-on RSU Award would be the number of shares of Company stock equaling $1.8 million using the fair value of the Company’s stock as of the commencement date.

Other

Benefits Mr. Stone will be eligible for two weeks paid vacation in 2024, then 4 weeks per year thereafter, unless the Company’s Vacation plan applicable to executive officer provides for a greater period. Mr. Stone will otherwise be eligible to participate in all of the Company’s employee benefit plans, policies and arrangements applicable to other executive officers generally, including, without limitation, relocation, 401(k), healthcare, vision, dental, life insurance and disability; in each case, as the same may exist from time to time.

Severance In the event that his employment is terminated by the Company without Cause, Mr. Stone shall be entitled to an amount equal to twice his Base Salary (or other annual cash incentive target) at the time of termination, payable over a period of 24 months. In addition, he shall be eligible for a bonus relating to the services he performs in the year in which his employment is terminated, calculated at the same time and in the same manner in which bonuses are awarded to similarly situated terminated, calculated at the same time and in the same manner in which bonuses are awarded to similarly situated employees under the then-current incentive plan.

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ain_ClassACommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

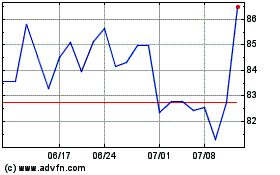

Albany (NYSE:AIN)

過去 株価チャート

から 7 2024 まで 8 2024

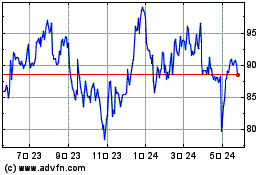

Albany (NYSE:AIN)

過去 株価チャート

から 8 2023 まで 8 2024